In-depth Analysis of Usual Money: Beware the Retail Liquidity Honey Pot—USD0++ with a 4-Year Lock-up Period

TechFlow Selected TechFlow Selected

In-depth Analysis of Usual Money: Beware the Retail Liquidity Honey Pot—USD0++ with a 4-Year Lock-up Period

For retail investors with smaller capital, USD0++ is akin to a liquidity honeypot, requiring a cautious approach when participating.

Author: @Web3Mario

Summary: This week I continued studying Telegram API documentation—admittedly, the documentation style of Telegram-related projects leaves much to be desired; it has a distinct "Russian hardcore" flavor. In my spare time, I chatted with friends and came across an interesting stablecoin project that’s recently gained some traction: Usual Money. As I’ve always maintained a research interest in stablecoin projects, I immediately spent some time digging into it. Here are some insights I’d like to share, hoping they help you approach or participate in this project more cautiously. Overall, I believe Usual Money's core innovation lies in its tokenomics design—by using profits from interest-bearing collateral as value backing for its governance token $Usual, and by wrapping a 4-year bond product called USD0++ to reduce USD0 liquidity, thereby securing a relatively stable profit stream. However, for retail users with smaller capital, USD0++ essentially functions as a liquidity honeypot, and participation should be approached with caution.

Analyzing Usual Money’s Mechanism and Core Value Proposition

Since launching its points campaign last month, several PR-style articles have introduced Usual Money within Chinese-speaking internet communities. Interested readers can explore those independently. Here, I’ll briefly recap and add some additional context. Many introductory articles mention that Usual Money was founded by a former French politician, leading me initially to picture an older figure nearing the end of a political career, leveraging influence to secure a lucrative post-political venture. In reality, the founder is quite young—Pierre Person, born January 22, 1989—who served as a member of France’s National Assembly for Paris’s 6th district from 2017 to 2022. His political career centered around serving as an election strategist and political ally to President Emmanuel Macron. A member of the Socialist Party, he sits on the left side of the political spectrum and championed bills related to LGBT healthcare and cannabis legalization—basically fitting the archetype of a “woke left-wing elite.”

Given his background, his transition from politics to business this year makes sense. Macron’s Renaissance Party (centrist) lost the 2024 National Assembly elections to the left-wing coalition “New Popular Front,” and narrowly edged out the far-right National Rally in third place. This reflects a broader trend of political polarization across Western nations. As a key establishment figure and close Macron ally, Pierre Person’s decision to pivot careers at this moment seems quite prudent.

I include this background to help clarify what the founder stands to gain from this project—which directly influences how much effort and resources he’s likely to commit. Back to Usual Money: it’s a stablecoin protocol whose mechanism revolves around three tokens. First, USD0 is a stablecoin pegged 1:1 to RWA (real-world asset) reserves. Second, USD0++ is a tradable certificate representing a 4-year USD0 bond. Third, Usual is the governance token.

We can categorize current stablecoin projects along their evolutionary paths into three main types:

l High-efficiency transaction medium: Projects like USDT and USDC—fiat-backed stablecoins whose primary value lies in bridging real-world assets with on-chain ecosystems. Their development focus is creating deeper liquidity to improve user experience and adoption;

l Censorship resistance: Projects like DAI and FRAX—decentralized, crypto-collateralized stablecoins primarily valued for offering privacy-conscious capital a way to store value and hedge risks under censorship-resistant conditions. Their focus is enhancing protocol stability while maintaining decentralization, with stronger resilience against bank runs;

l Yield-generating, low-volatility financial product receipts: Projects like USDe, which package delta-neutral, low-risk yield products into stablecoin-like instruments. Their main value proposition is capturing yield while minimizing principal volatility. Development focuses on identifying more high-return, low-risk investment portfolios.

In practice, these attributes often blend, but most projects emphasize one primary innovation. Usual Money belongs to the third category. Its core selling point is generating yield through USD0. Let’s examine how this works. Evaluating any stablecoin project typically involves two dimensions: stability and growth potential. Products like USD0 usually exhibit strong growth potential but somewhat weaker stability.

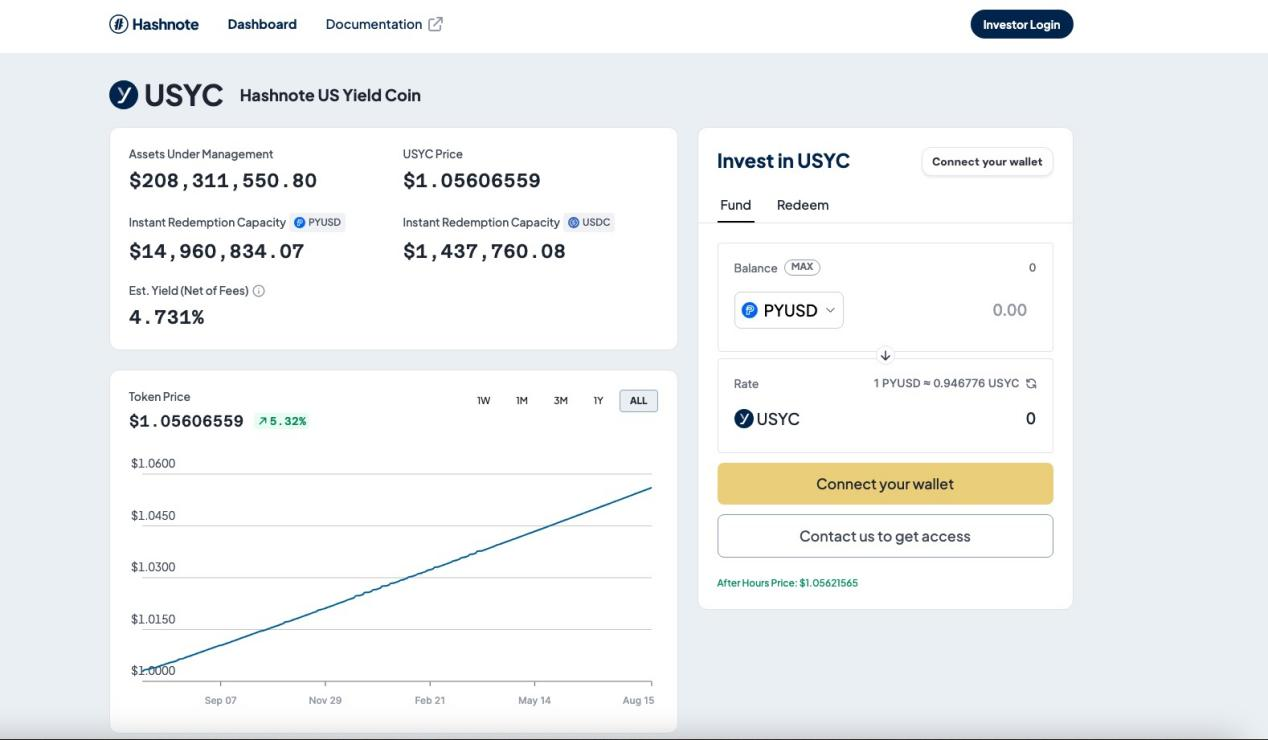

On stability, USD0 adopts the now-common 100% reserve model rather than over-collateralization—similar to Fei, the current version of FRAX, and Grypscope. Simply put, when you deposit funds, the protocol mints an equivalent amount of stablecoins, and your funds become 100% reserved as backing. USD0 differentiates itself by selecting specific types of reserve assets: a basket of RWAs, specifically short-term U.S. Treasury bonds and overnight reverse repurchase agreements. In its early stage, USD0 accepts only one such asset: USYC issued by Hashnote, an on-chain RWA compliant with these criteria. Users can mint USD0 1:1 with USYC, or use USDC (which an agent converts into USYC).

This approach offers two advantages:

l It generates a genuine yield source for the protocol while keeping risk extremely low;

l It aggregates demand to provide liquidity for nascent RWA assets.

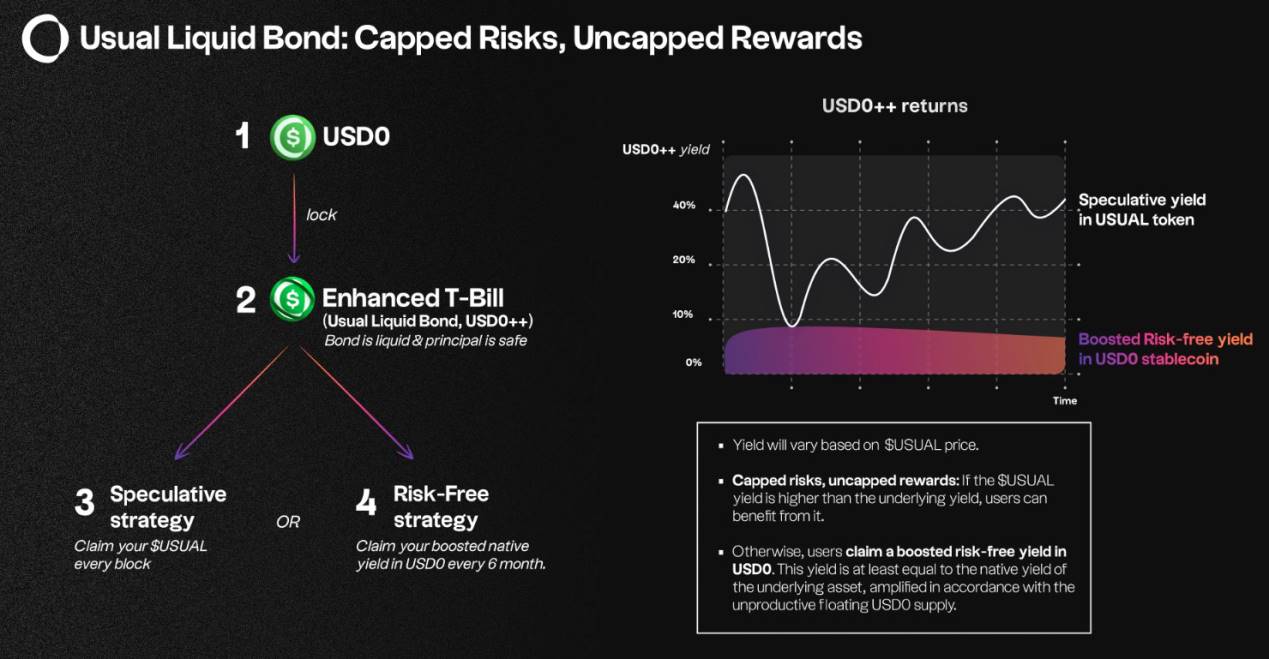

The first benefit is shared by most similar projects—even USDT and USDC operate this way. Thus, Usual Money’s true innovation lies in how it distributes the generated yield, via USD0++, a 4-year tradable bond for USD0. Importantly, simply holding USD0 yields nothing; only converting USD0 into USD0++, which locks funds for four years, enables yield capture—similar in concept to Ethena. However, users may sell USD0++ on secondary markets during the term to access liquidity earlier via discounting.

Notably, USD0++’s yield sourcing and distribution are worth clarifying. First, each user’s yield corresponds solely to the RWA returns from their deposited assets—not a pro-rata share of total protocol-wide earnings. Second, Usual Money offers two yield collection options: (1) Hold USD0++ and receive daily rewards in $Usual tokens at the prevailing RWA yield rate; or (2) Lock USD0++ for six months, after which you can claim either USD0 or $Usual equivalent to all accrued yield. However, if you unlock early, you forfeit all yield earned during the lockup period.

To illustrate, suppose the average APY of Usual Money’s RWA reserves is 4.5%. You deposit $100 worth of USD0 and convert it into USD0++. You then have two choices:

l If you hold without locking, you earn ~$0.0123 per day ($100 × 4.5% ÷ 365) in $Usual tokens. If $Usual appreciates, your effective yield increases; if it depreciates, your yield decreases—this is what they call “USD0++ Alpha Yield.”

l Alternatively, you can lock for six months. Assuming the APY remains constant, after six months you could claim $2.214 in USD0 or an equivalent value in $Usual tokens. This eliminates exposure to $Usual price volatility during the period—what they brand as Base Interest Guarantee (BIG).

This implies that only the RWA yield corresponding to USD0++ locked for six months will be fully distributed, and even then, only at approximately the underlying RWA’s market-average yield. All other RWA-generated yields will instead be retained by the protocol as value backing for the $Usual token. While exact mechanisms linking these reserves to $Usual remain unclear pending further disclosures, buybacks or treasury accumulation are likely methods.

Stakeholder Incentives in Usual Money—and Why It’s a Liquidity Honeypot Designed for Retail

Having understood Usual Money’s mechanism, let’s analyze the stakeholders involved and their respective incentives. We can broadly identify six roles: VCs/investors, RWA issuers, KOLs, whales, the project team, and retail users.

For VCs or investors, the central incentive is the value of the $Usual token. The quality of Usual Money’s backers and funding scale suggests strong confidence in the mechanism’s ability to support $Usual’s value. This bodes well for motivating investor engagement. Strong endorsements can drive wider participation in the USD0 protocol—and especially conversions into USD0++—which would significantly bolster price stability. Hence, you’re likely to see supportive voices from affiliated figures across social media.

For RWA issuers, Usual Money serves as a compelling liquidity solution. Frankly, adoption of RWA tokens remains low because real-world asset yields typically lag behind those expected in Web3, making them less attractive to crypto capital. But by integrating with Usual Money, user attention shifts from the RWA itself to the potential alpha yield—drawing in capital that seamlessly flows into RWA demand without users even realizing it. This indirectly boosts RWA liquidity and demand, so issuers are naturally inclined to support the project.

For KOLs, motivations depend on whether they're buyers or sellers. Given the referral commission structure in Usual Money’s points campaign, KOLs seeking quick gains will likely publish favorable posts followed by their referral codes.

For whale users, capital advantages mean they’re likely to capture a significant portion of $Usual token incentives—especially considering that 90% of the token supply appears allocated to the community. As analyzed earlier, USD0++ has a 4-year maturity, exposing participants to substantial discount rate volatility. Whales, however, can exploit a unique feature called Parity Arbitrage Right (PAR). Essentially, if USD0++ prices deviate significantly in secondary markets, the DAO may decide to unlock some positions early to restore liquidity. Naturally, whales wield disproportionate influence here. When they deem it necessary, they can invoke PAR to reduce discount rates—or effectively lower trading slippage.

This mechanism is also valuable for the project team: the unlocking process creates arbitrage opportunities, and the resulting trading fees flow into the project treasury. Therefore, maintaining a certain level of discount rate benefits the team financially—but directly translates into higher exit costs for retail users.

Finally, retail users are the only vulnerable and passive party in this ecosystem. Choosing to participate in USD0++ means committing to a 4-year lockup. In bond markets, longer durations demand higher risk premiums—but USD0++ offers yields comparable only to short-term U.S. Treasuries. That is, retail bears higher risk yet receives the lowest possible return. Moreover, unlike whales, retail lacks governance power in the DAO to advocate for early unlocks, meaning they must absorb larger discount costs upon exiting. Since these costs constitute a key revenue stream for the project, there’s little incentive for the team to protect retail interests.

Compounding this, the Federal Reserve has entered a rate-cutting cycle. With yields declining, the capital efficiency of retail funds in USD0++ will shrink further. At the same time, falling rates push bond prices up—meaning RWA appreciation benefits accrue to $Usual holders as upside, bypassing retail entirely. Thus, I see this as an elegant liquidity trap meticulously crafted by elites for retail investors. Participation demands extreme caution. For small-capital users, allocating modestly to $Usual itself might prove far more profitable than chasing USD0++ yields.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News