Usual Introduces a New Paradigm for Stablecoin Yields: 90% to the Community, a Truly User-Driven Stablecoin Protocol

TechFlow Selected TechFlow Selected

Usual Introduces a New Paradigm for Stablecoin Yields: 90% to the Community, a Truly User-Driven Stablecoin Protocol

Unlike utility tokens with low circulation and high FDV, Usual's token economics focus more on community distribution.

Author: Ignas | DeFi

Translation: TechFlow

The stablecoin market has surpassed $100 billion, yet the majority of this value is controlled by centralized giants like Tether and Circle, leaving ordinary users unable to benefit.

In this market cycle, we've seen the rise of Ethena, and now Usual has entered the competition.

Usual is a decentralized, transparent, and community-driven stablecoin protocol.

Usual has launched USD0, a fiat-backed stablecoin collateralized by ultra-short-term U.S. Treasury bonds.

Recently, they partnered with Ethena to allow users to use USDtb as collateral for minting USD0.

In addition, the protocol offers a 1:1 swap mechanism between USDtb, USD0, and sUSDe.

Usual has also introduced USD0++, a liquid staking token that generates yield from staked USD0.

Users can earn daily returns through USD0++, either in the form of $USUAL tokens or risk-free USD0.

The current annualized yield reaches as high as 80%.

$USUAL introduces innovation in tokenomics:

-

It represents ownership of 100% of the protocol’s revenue.

-

Holders have governance rights over the treasury and protocol decisions.

-

Holders also share in future growth dividends of the protocol.

Unlike utility tokens with low circulation and high fully diluted valuations (FDV), Usual emphasizes community-centric token distribution:

-

90% of $USUAL will be allocated to the community, including users, liquidity providers, and contributors.

-

Only 10% is allocated to insiders (team and investors).

-

$USUAL holders will control the treasury and major protocol decisions.

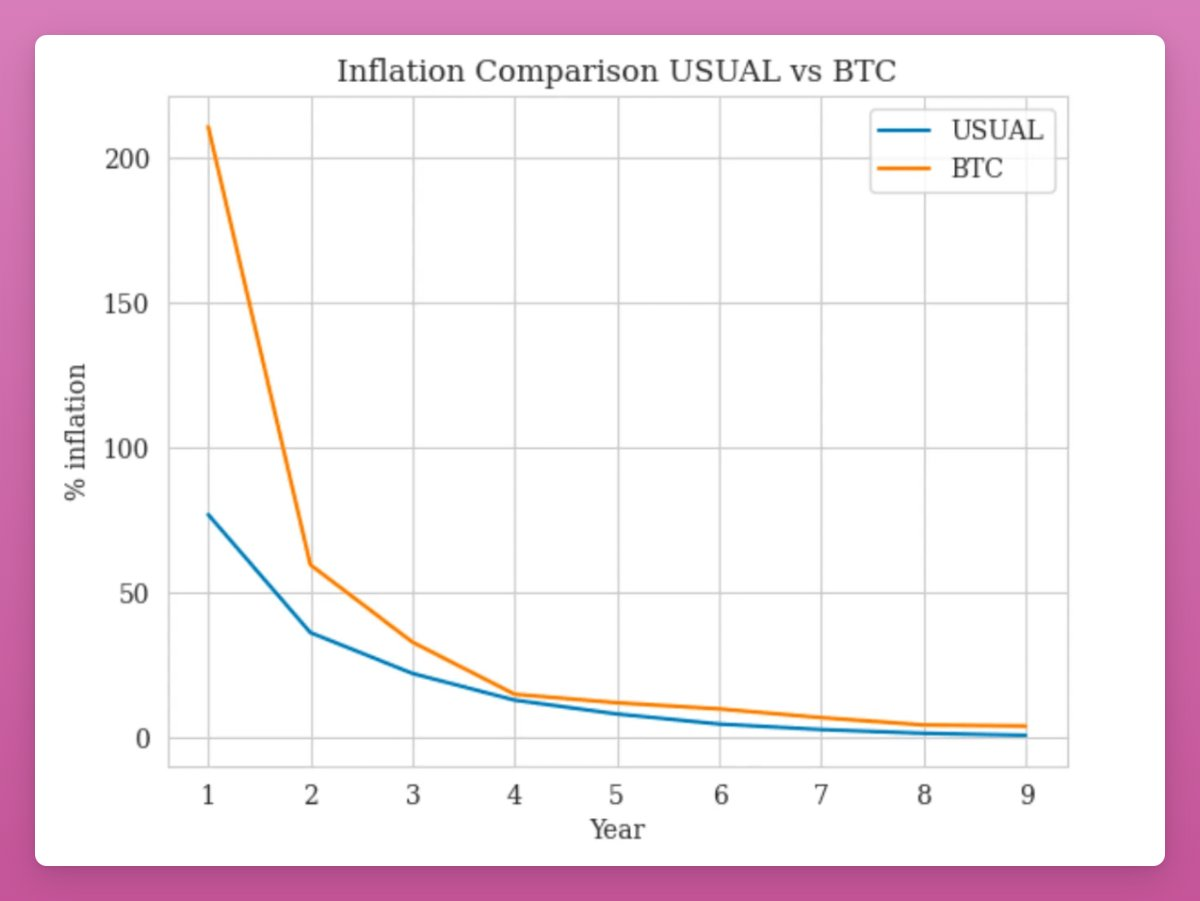

The issuance of $USUAL is dynamic and directly tied to the protocol's actual revenue.

New $USUAL tokens are minted and distributed daily based on the protocol's income.

As the total value locked (TVL) in USD0++ grows, the emission rate of $USUAL gradually slows down.

Although official documentation claims the token is not inflationary, $USUAL is effectively inflationary.

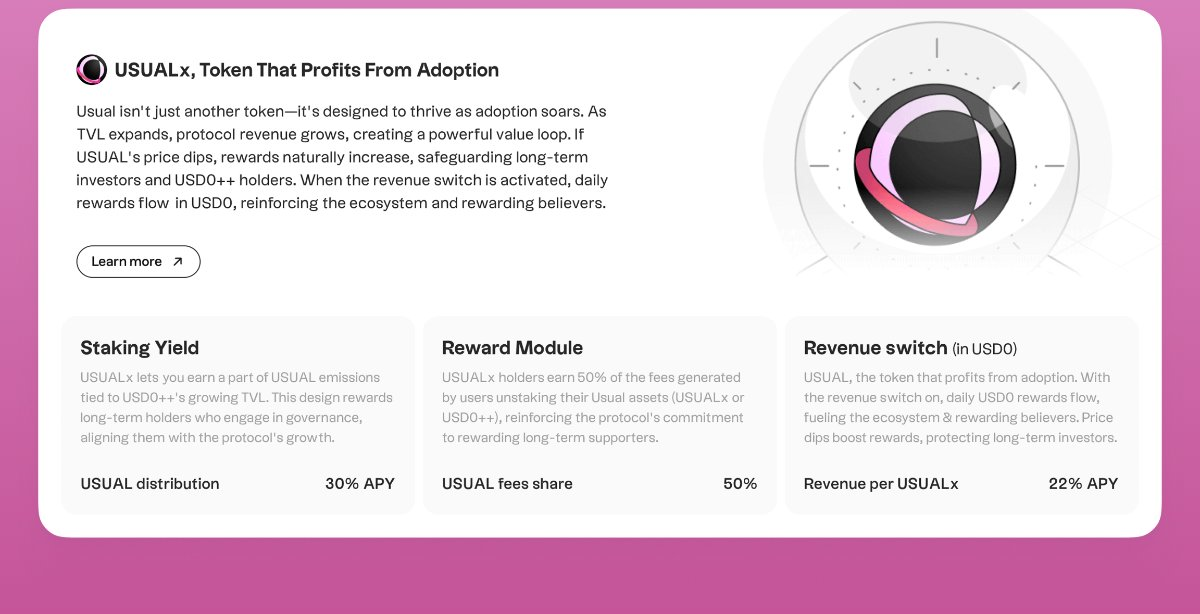

The solution is to stake $USUAL into USUALx, which earns 10% of the daily total $USUAL issuance.

If unstaking occurs, a 10% penalty is applied, with half of it rewarded to other USUALx stakers.

The current annualized yield reaches up to 1737%.

The largest distribution of $USUAL occurred during the initial airdrop phase (which I completely missed).

Over time, the token emission rate will continue to slow, giving early participants a significant advantage—timing matters, and growth in TVL is key.

The longer one waits, the more pronounced the dilution effect becomes.

The good news is that the partnership with Ethena could significantly accelerate TVL growth.

Disclaimer: I received no compensation for writing this article!

However, it's exciting to see innovative projects like Ethena and Usual challenging USDT and USDC. These traditional stablecoin giants do not share profits with users, while new entrants are changing that paradigm.

Now, we have two promising alternatives to watch and potentially invest in as the stablecoin market continues to grow.

If I made any factual errors, please feel free to point them out!

I'm still researching this protocol and, as always, documenting my understanding while learning!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News