When bonds decouple as usual, RWA stablecoins face the test of volatility

TechFlow Selected TechFlow Selected

When bonds decouple as usual, RWA stablecoins face the test of volatility

Can RWA withstand the test of volatility?

Author: Pzai, Foresight News

RWA-backed stablecoins have recently become a major narrative, bringing fresh momentum to the stablecoin sector by leveraging the natural growth of off-chain assets and opening up substantial imaginative space for investors. Among them, representative project Usual has gained market favor, rapidly accumulating over $1.6 billion in TVL. However, the project is currently facing certain challenges.

On January 9, its liquid staking token USD0++ was heavily sold off following an announcement from Usual. Meanwhile, within the broader RWA stablecoin ecosystem, several projects are experiencing varying degrees of de-pegging, reflecting a shift in market sentiment. This article analyzes this phenomenon.

Mechanism Changes

USD0++ is a liquid staking token (LST) with a 4-year staking period, akin to a "4-year bond." For every USD0 staked, Usual mints new USUAL tokens in a deflationary manner and distributes them as rewards to users. In Usual’s latest announcement, USD0++ will transition to a floor-price redemption mechanism with conditional exit options:

-

Conditional Exit: 1:1 redemption, but requires forfeiting part of the USUAL yield. This plan is set to launch next week.

-

Unconditional Exit: Redeem at a floor price (currently set at $0.87), which will gradually converge back to $1 over time.

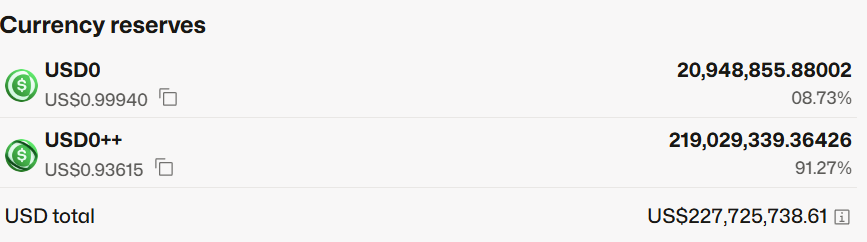

In the context of volatile crypto markets—where liquidity fluctuates significantly (for example, RWA's underlying assets such as U.S. Treasuries have recently traded at discounts)—the implementation of this new mechanism dampened investor expectations. The USD0/USD0++ Curve pool was swiftly dumped by investors, resulting in a pool imbalance of 91.27%/8.73%. The APY in Morpho’s USD0++/USD0 lending pool also surged to 78.82%. Prior to the announcement, USD0++ had consistently traded at a premium to USD0, likely due to Binance’s pre-trading phase offering an early exemption option allowing 1:1 redemptions, maximizing airdrop yields for users before protocol launch. After the mechanism clarification, investors began shifting back to more liquid native assets.

This event has impacted USD0++ holders to some extent. However, most USD0++ holders were primarily incentivized by USUAL rewards, tend to hold long-term, and price volatility has not yet breached the floor price, indicating that the sell-off reflects panic rather than fundamental collapse.

Partly affected by this incident, USUAL dropped to $0.684 at the time of writing, down 2.29% in 24 hours.

Gradual Volatility

From a mechanistic perspective, USUAL may in the future implement a process to re-anchor USD0++ yields through burning USUAL tokens—boosting token price and yield while attracting liquidity back into the system. During the liquidity acquisition phase for RWA stablecoins, the role of token incentives is self-evident. Usual’s model specifically uses USUAL tokens to reward the entire stablecoin holder ecosystem, maintaining peg stability under conditions of steady yield generation. In volatile markets, however, investors often require greater liquidity to support their positions, further amplifying fluctuations in USD0++.

Beyond Usual, another RWA stablecoin, Anzen USDz, has also experienced prolonged de-pegging. Since October 16 last year, it has been subjected to sustained selling pressure—possibly due to airdrop-related dumping—and once fell below $0.90, eroding potential investor returns. Although the Anzen protocol offers functionality similar to USD0++, its overall staking scale remains below 10%, limiting its ability to absorb sell-side pressure. Moreover, its single pool liquidity stands at only $3.2 million, far less than the nearly $100 million in liquidity available in USD0’s Curve pool.

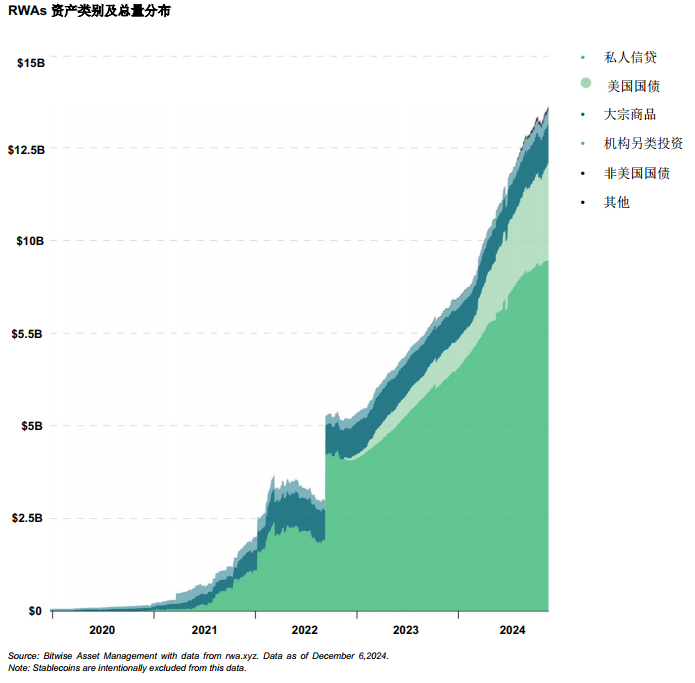

From a business model standpoint, RWA stablecoins face numerous challenges, including how to balance token issuance with sustainable liquidity growth, and how to ensure real yield generation keeps pace with on-chain developments. According to Bitwise analysis, most RWA assets consist of U.S. Treasuries. This concentration makes stablecoins vulnerable to shocks affecting Treasury valuations, raising important questions about how protocols can build resilience through mechanism design or reserve diversification.

For stablecoin projects, there appears to be a recurrence of the “farm, sell, exit” cycle seen during DeFi Summer. While high-yield token incentives can attract significant users and capital in the short term, this model fails to address long-term value creation for the protocol. Instead, it often leads to persistent downward pressure on token prices due to heavy selling, ultimately undermining user confidence and the healthy development of the ecosystem.

To break this cycle, project teams must focus on long-term ecosystem building—developing innovative products, refining governance mechanisms, and enhancing community engagement—to gradually establish a diversified and sustainable stablecoin ecosystem, rather than relying solely on short-term incentives. Only through such efforts can stablecoin projects truly escape the “farm, sell, exit” trap, deliver tangible real yields and robust liquidity backing to users, and stand out in a fiercely competitive market for long-term success.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News