Analysis of the Impact of Trump's Presidency on Cryptocurrencies: Growth of U.S. Cryptocurrency Holders and Regulatory Trends

TechFlow Selected TechFlow Selected

Analysis of the Impact of Trump's Presidency on Cryptocurrencies: Growth of U.S. Cryptocurrency Holders and Regulatory Trends

Trump's re-election as president and his proactive support for cryptocurrencies could become a key catalyst for the development of the U.S. crypto market, thereby having a profound impact on the global crypto market.

By Beosin

On November 6, Donald Trump won the U.S. presidential election. Benefiting from his favorable stance toward the cryptocurrency industry, BTC repeatedly hit new all-time highs, approaching the $90,000 mark. Trump's return to power has sparked market attention on financial policies, particularly regarding the crypto sector.

On November 13, according to TheVerge, President-elect Donald Trump appointed Elon Musk and Vivek Ramaswamy to lead the Department of Government Efficiency (DOGE)—paving the way for his administration to "reduce government bureaucracy, cut excessive regulations, eliminate wasteful spending, and restructure federal agencies."

As stated in a post on Truth Social, this department will operate in some capacity "outside of government" while collaborating with the White House and the Office of Management and Budget. The statement indicated that Musk and Ramaswamy must complete their mission by July 4, 2026.

Image source: Elon Musk’s X account

Trump's re-election and his active support for cryptocurrencies could become a key catalyst for the development of the U.S. crypto market, thereby exerting profound influence on the global crypto landscape. This shift may not only transform the regulatory environment for the crypto industry but also help attract institutional capital and innovative talent, positioning the United States as a leader in the global crypto economy.

1. Continuous Growth of U.S. Cryptocurrency Holders

Over recent years, the number of cryptocurrency holders in the United States has significantly increased. According to market research data, more than 20% of American adults owned some form of digital asset in 2023, especially mainstream cryptocurrencies such as Bitcoin and Ethereum. This growth trend has been driven by multiple factors including economic uncertainty, fiat currency inflation, and the gradual penetration of blockchain technology into the financial sector. Market optimism following Trump's return may further boost holder numbers in the short term.

Cryptocurrency ownership extends beyond retail investors, increasingly attracting participation from institutional investors. Banks, hedge funds, pension funds, and other institutions are gradually entering cryptocurrency asset management, diversifying the overall market participants. Moreover, institutional involvement positively impacts market stability and liquidity, promoting further standardization within the crypto market.

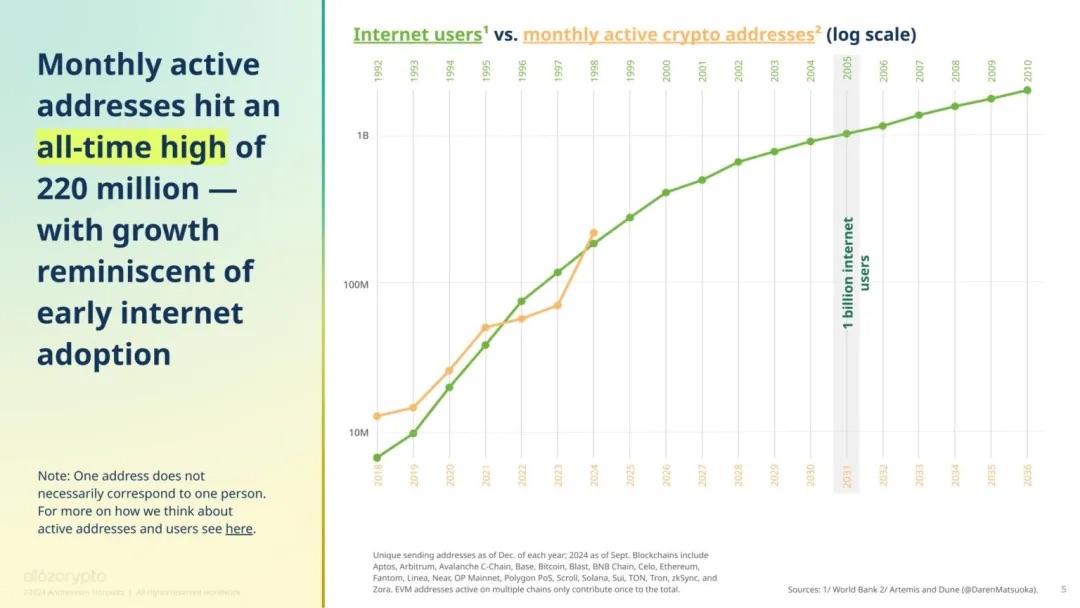

Data shows that in September, 220 million addresses interacted with blockchains at least once—a figure that has more than tripled since the end of 2023.

Image source: https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/

The surge in active addresses is largely attributed to Solana, which had approximately 100 million active addresses. This is followed by NEAR (31 million), Coinbase’s popular L2 network Base (22 million), Tron (14 million), and Bitcoin (11 million). Among EVM-compatible chains, BNB Chain by Binance ranks second after Base with 10 million active addresses, followed by Ethereum (6 million).

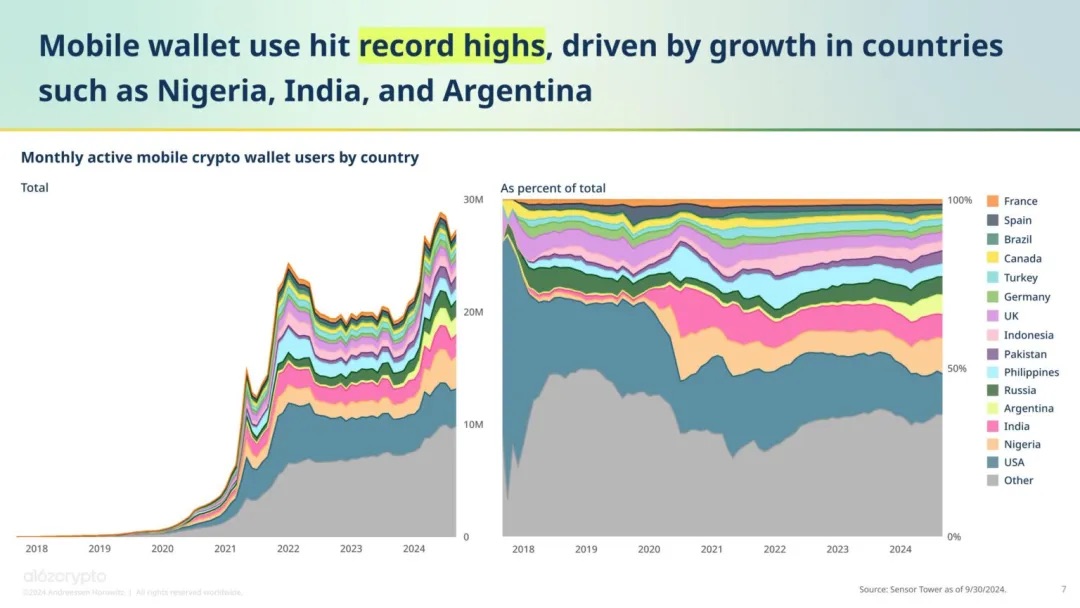

Meanwhile, in June 2024, monthly active users of mobile crypto wallets reached a record high of 29 million. Although the U.S. accounts for the largest share—12%—of monthly mobile wallet users, its proportion within the global user base has declined in recent years due to increasing global adoption of cryptocurrencies and an expanding number of projects geo-fencing out U.S. users to achieve regulatory compliance.

Image source: https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/

2. Regulatory Policy Shifts Under the Trump Administration

In 2022, the collapse of exchange FTX prompted the Biden administration to intensify crackdowns on the crypto industry, sparking discontent among executives and investors. Since then, federal regulators have focused on combating fraud, taxing crypto investment gains, and attempting to classify more digital tokens as securities to strengthen oversight.

Thus, the U.S. Securities and Exchange Commission (SEC) became the primary regulatory body. Its chair, Gary Gensler, launched major lawsuits against large platforms such as Coinbase, Ripple, and Binance, accusing them of violating investor protection rules. All companies have denied these allegations.

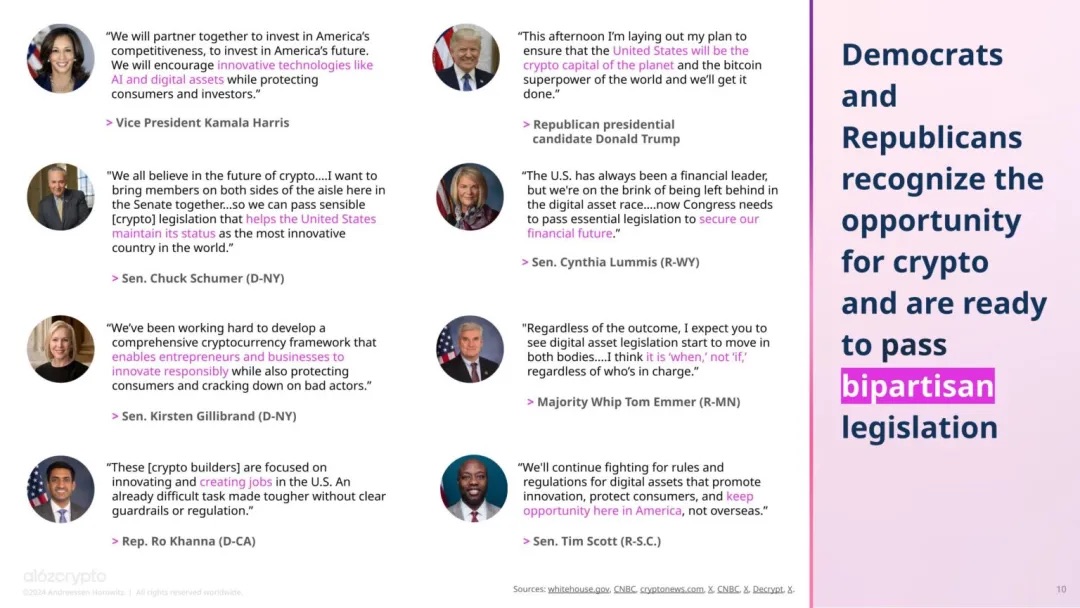

Prior to the election, many politicians anticipated growing momentum for bipartisan crypto legislation. An increasing number of policymakers and political figures have adopted positive attitudes toward cryptocurrencies.

Image source: https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/

This year, the industry spurred additional significant policy initiatives. At the federal level, the House passed the Financial Innovation and Technology for the 21st Century Act (FIT21) with bipartisan support—208 Republicans and 71 Democrats voted in favor. The bill awaits Senate review and approval and could provide much-needed regulatory clarity for crypto entrepreneurs.

Equally meaningful, at the state level, Wyoming enacted the Decentralized Autonomous Nonprofit Association (DUNA) Act, granting legal recognition to decentralized autonomous organizations (DAOs) and allowing blockchain networks to operate legally without compromising decentralization.

Image source: https://a16zcrypto.com/posts/article/state-of-crypto-report-2024/

At the 2024 Bitcoin Conference in Nashville, Trump pledged to establish a committee composed of industry experts and implement pro-crypto policies. He also promised to include Bitcoin in the “national strategic reserve” and fire SEC Chair Gary Gensler. These commitments reignited strong reactions after his victory.

Cameron Winklevoss passionately wrote on social media: “Imagine if the crypto industry no longer had to spend billions fighting the SEC, but instead invested that money into the future of money—what incredible things we could achieve in the next four years. Amazing things are coming.”

3. Anti-Money Laundering (AML) Remains Critical in the Crypto Market

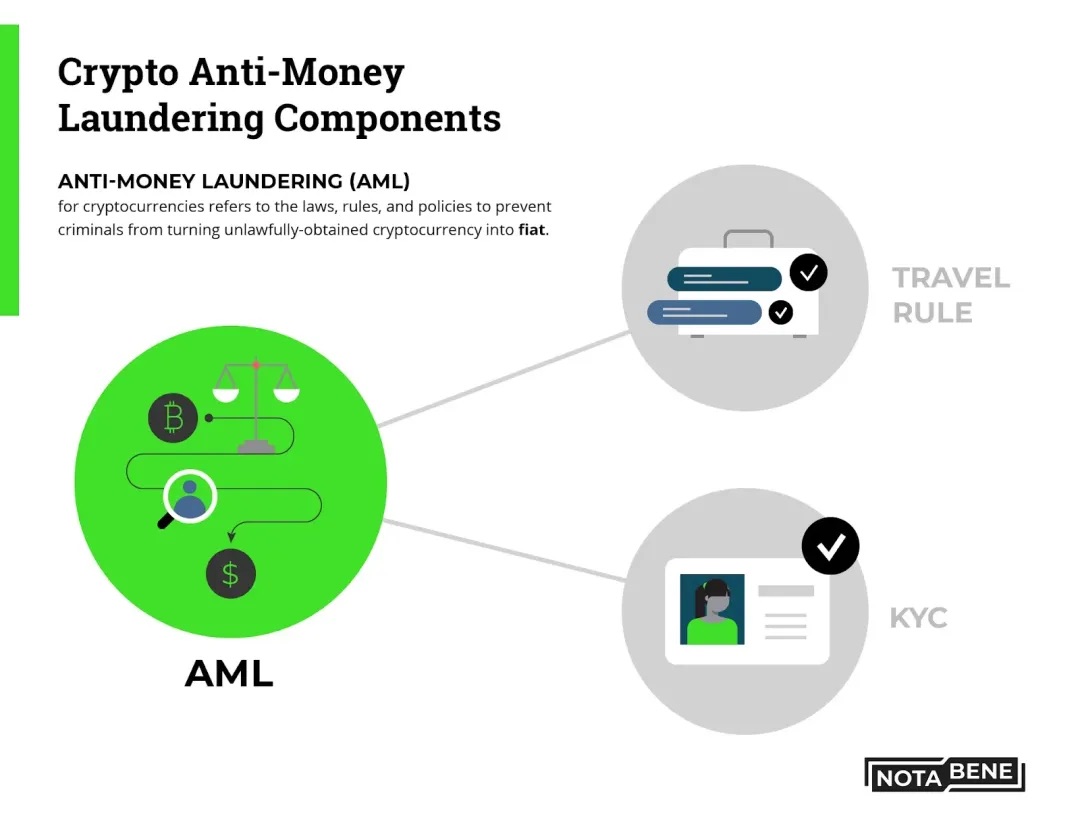

Anti-money laundering (AML) remains crucial in the cryptocurrency market. The decentralized and often anonymous nature of cryptocurrencies provides convenient avenues for illicit actors to launder money. As the number of market holders grows—especially with institutional involvement—AML requirements become increasingly important. The Trump administration may adopt stricter AML policies in the future to curb illegal activities.

In 2014, FATF issued anti-money laundering guidelines for cryptocurrencies, prompting swift action by policymakers in FATF member countries. The U.S. Financial Crimes Enforcement Network (FinCEN), the European Commission, and dozens of other regulatory bodies have incorporated most of FATF’s crypto-related AML recommendations into law.

Responsibility then falls upon cryptocurrency exchanges, stablecoin issuers, and certain DeFi protocols and NFT markets (depending on jurisdiction), which FATF defines collectively as Virtual Asset Service Providers (VASPs). Going forward, VASP compliance officers must enforce mandatory KYC checks and regularly monitor suspicious activity to prevent transactions linked to money laundering or terrorist financing.

In addition, VASPs must report suspicious activities to relevant regulatory authorities, who analyze fund flows and use various tools—including blockchain analytics—to trace illicit activities back to real-world identities.

Image source: https://notabene.id/crypto-travel-rule-101/aml-crypto

In recent years, the U.S. Department of the Treasury has introduced several measures strengthening AML regulations for cryptocurrencies. The Trump administration is likely to continue along this policy path, expectedly maintaining or even enhancing AML compliance scrutiny over crypto exchanges. For example, exchanges might face stricter identity verification requirements and be obligated to submit more detailed transaction records to ensure full compliance. Under such policies, U.S.-based crypto exchanges are expected to place greater emphasis on user verification, with AML-compliant projects gaining stronger market recognition.

While tighter AML policies may exert short-term pressure on market liquidity, in the long run they enhance transparency and trustworthiness, paving the way for deeper institutional participation. As regulatory frameworks solidify, compliant exchanges and projects are likely to gain significant competitive advantages in the marketplace.

4. Potential Market Impacts of Trump’s Policies

With Trump returning to the presidency, his supportive stance toward cryptocurrencies could profoundly shape the future market. Below are potential impacts across key areas:

(1) Shift in Regulatory Environment

Trump has pledged to dismiss current SEC Chair Gary Gensler and replace him with a regulator who "understands crypto." Such a change implies a potentially more relaxed and friendly regulatory environment for the U.S. crypto industry. Currently, the U.S. crypto sector faces high compliance burdens. If regulations become more open, it would reduce corporate compliance costs, attract more crypto projects to develop in the U.S., and drive increased capital and talent inflows into the American crypto market—thereby boosting the nation’s competitiveness in the crypto industry.

(2) Boost in Crypto Investment Sentiment

Trump’s public endorsement of Bitcoin and cryptocurrencies—expressing his desire for the U.S. to become a “cryptocurrency superpower”—greatly encourages investor sentiment. In confident, supportive policy environments, investors and businesses are generally more willing to invest in and innovate around digital assets. Trump’s position could spark bullish sentiment, driving capital inflows into the crypto market and generating positive price momentum for major assets like Bitcoin, possibly triggering a new bull cycle.

(3) Repatriation of Bitcoin Mining and Related Industries

Trump’s vision of “Bitcoin made in America” suggests he may push to bring Bitcoin mining operations back to the U.S., reducing reliance on other nations—particularly major mining hubs like China. Coupled with more lenient energy policies and tax incentives, U.S. mining infrastructure could rapidly expand, positioning the country as one of the world leaders in Bitcoin hash rate. As mining activity increases, upstream sectors such as mining hardware and power infrastructure stand to benefit, stimulating job creation and technological innovation.

(4) Accelerated Crypto Adoption by Traditional Financial Institutions

If Trump implements crypto-friendly policies, traditional financial institutions such as banks and funds may accelerate their entry into the crypto space. Institutional participation brings greater liquidity, enhances market maturity, and improves the legitimacy and credibility of crypto assets. Increased institutional presence can deepen markets, reduce volatility, and attract broader mainstream adoption of crypto investments and services.

(5) Shifting Global Competitive Landscape of the Crypto Industry

If Trump integrates the crypto industry into national economic strategy, the U.S.’s policy direction could influence other countries’ stances. Should the U.S. emerge as a “Bitcoin superpower,” other nations may feel compelled to expedite their own crypto policy development to avoid falling behind in the global crypto economy. This international competition could catalyze global regulatory reforms, accelerating the pace of development across the cryptocurrency and blockchain industries.

Conclusion

The direction of financial markets under a Trump-led administration will directly impact the regulatory environment for the cryptocurrency market. With steady growth in the number of crypto holders, demand for regulation and compliance continues to rise. This article aims to analyze the potential impact of the Trump administration on the U.S. cryptocurrency market, particularly changes in regulatory intensity and anti-money laundering measures.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News