After the Americanization of encryption, the era of free city-states comes to an end

TechFlow Selected TechFlow Selected

After the Americanization of encryption, the era of free city-states comes to an end

The process of crypto Americanization has already begun in practice—not through decentralization, but by intervening at the political center.

By: Zuo Ye

If you're amazed by Trump's victory, revisiting the story of Alexander will calm us down, rather than wallow in sorrow over the decline of Athenian democracy.

In 338 BC, Alexander the Great defeated the coalition of Greek city-states at the Battle of Chaeronea, then went on to conquer much of the known world, initiating a widespread Hellenization process. For instance, the Gandhara region—under his influence—developed exquisite Buddhist sculpture art, which later profoundly influenced Chinese grotto statue art. The world circles endlessly, yet remains interconnected and evolving.

Crypto-Americanization, Law in Motion

Today, Trump dominates across five dimensions: party (Republican), public opinion (Musk), executive, legislative, and judicial. Over the next two years, it will be his solo performance. The crypto industry’s generous sponsorship totaling $135 million in various elections is certain to yield enormous returns under Trump.

In contrast, what path should city-states like Dubai, Singapore, and Hong Kong take? Global regulatory storms targeting cryptocurrency exchanges began in 2022 with issues around high leverage and taxation, peaked after the FTX collapse, and eventually concluded with CZ’s three-act drama: paying fines, serving prison time, and being banned from the industry.

-

Binance chose global arbitrage—moving from mainland China to Japan, Singapore, France, and finally the UAE. Wherever I find peace, there is my home.

-

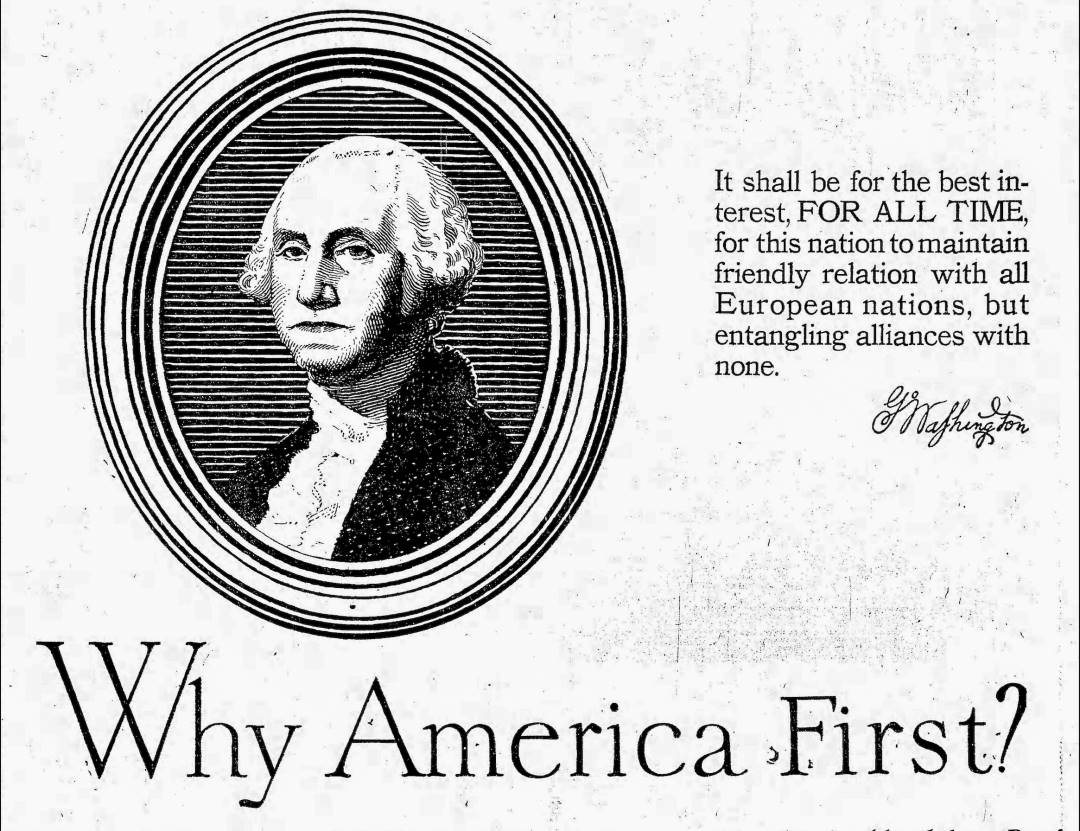

Coinbase adopted proactive engagement—starting with hiring Chris Lehane for lobbying, then supporting pro-crypto candidates through FairShake PAC. What doesn’t kill me makes me stronger.

Image caption: Coinbase lobbying expenses

Source: https://www.opensecrets.org

But Trump’s return does not mark the end of chaos, nor the birth of new order.

Rome wasn't built in a day. Shortly after the FTX collapse in 2022, the crypto industry began actively rescuing itself. Top players like Coinbase, A16Z, and Ripple started taking initiative then. As shown in the chart above, 2022 was actually the peak year for spending.

From the perspective of America’s political structure, cryptocurrencies are nearing full legalization—not just specific sectors such as exchanges, stablecoins, public chains, or token issuance, but more importantly, the underlying regulatory and legal frameworks have largely taken shape.

-

Congress – FIT21 Act

-

Regulation – Shift from SEC to CFTC

-

Executive Branch – Trump plans to treat Bitcoin as strategic reserve, avoid issuing CBDC, and pardon Silk Road’s founder

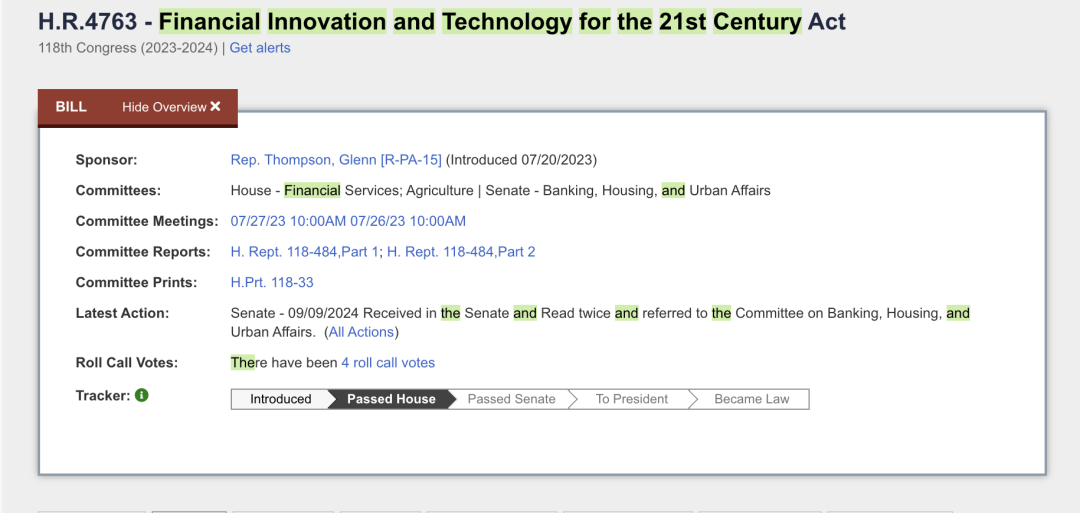

Image caption: FIT21 Act

Source: https://www.congress.gov

The FIT21 Act (Financial Innovation and Technology for the 21st Century Act) serves as the overarching framework for these changes. It passed the House in May; given Trump-Republican dominance in the Senate, its enactment into law is not far off.

Under the FIT21 framework, digital assets and digital commodities are clearly distinguished, defining jurisdictional boundaries between the SEC and CFTC:

-

Digital assets fall under SEC jurisdiction;

-

Digital commodities fall under CFTC jurisdiction.

For example, ETH is essential for maintaining Ethereum’s operation and clearly has utility value—it should be classified as a "digital commodity," a view even SEC Chair Gary Gensler agrees with.

In contrast, tokens issued primarily for fundraising (IXO), where holders and issuers care only about expected price gains without contributing real value to the blockchain or product, would be defined as digital assets under SEC oversight—effectively treated as securities.

Additional compliance requirements apply to stablecoins and intermediaries. But once SEC and CFTC roles are clarified, token issuance becomes legally grounded. Projects proving actual use and value can escape Gary Gensler’s "harassment," while market mechanisms naturally filter out scams.

Though Gary Gensler openly opposes this bill, one thing is certain: his tenure is nearing an end. Trump has announced he’ll fire him on Day One.

In Trump’s view, Bitcoin—or crypto more broadly—is a potential solution, at least partial, to the debt crisis. More broadly, he will politically legitimize crypto at the U.S. national level—an endorsement reciprocated by crypto’s early support for him.

We can set a key observation point: If large-scale crypto advertising reemerges in mainstream politics (rare among Trump supporters so far), and exchanges regain space in American political discourse, crypto-Americanization will be complete.

City-States Can’t Arbitrage, No Room Between Giants

"The夹子" are part of Ethereum, like barnacles on a turtle—so accepted as part of the ecosystem that few imagine an ecosystem without parasites.

Consider these three groups of countries or regions:

-

Cayman Islands, British Virgin Islands

-

Dubai, Singapore, Hong Kong

-

Vietnam, Morocco, Mexico

If you’re active in venture capital, crypto, or overseas expansion circles, you’ll recognize their common role: they serve as cross-chain bridges between East and West. After the Russia-Ukraine war broke out, elites from both sides met in Dubai, as if distant bloodshed had no bearing on their capital flows.

But with Trump’s targeted return, everything changes—through deglobalization, entangling interactions worldwide. Untangling complex global ties requires interdependence to ensure coordinated action.

Among Dubai, Singapore, and Hong Kong, crypto can be reduced to two categories: exchanges and stablecoins. The exchange battle is mostly over. Hong Kong is left with compliant exchanges like Hashkey and OSL, while Dubai hosts Binance, OKX, Bybit, and others unable to obtain Hong Kong licenses.

Dubai: Middle Eastern Peace Hotel

When the SEC aggressively pursued Ripple, Ripple declared it would move operations to Dubai to undermine U.S. global competitiveness—a tactic repeatedly used by firms like Coinbase and A16Z. The ultimate victor earns the right to reset the agenda.

Dubai focuses on exchange businesses, regulating under VASP (Virtual Asset Service Providers). Unlike the SEC-CFTC split, Dubai created a bespoke regulatory regime for crypto. But don’t take it too seriously—FTX once held this license, quietly revoked only after its collapse, proving no one can regulate a black box.

More interestingly, USDT has entered oil trading, recently completing a $45 million oil trade financing deal. Note: this isn’t direct buyer-seller settlement via USDT, but a novel application beyond traditional crypto trades—worth encouraging.

Tether also cooperated with local firms to issue an AED (UAE Dirham)-pegged stablecoin per UAE Central Bank rules, built on TON. Telegram relocated to Dubai after fleeing Russia, and the UAE Central Bank introduced specific stablecoin regulations, legitimizing bold moves. Get on board first, pay later—if it brings profit, all is welcome.

Yet this isn’t as rosy as it sounds. Despite appearances, Dubai/UAE remains subordinate to Western powers. CZ resides in the UAE but voluntarily traveled to the U.S. to settle his case—even though the U.S. has no extradition treaty with the UAE.

Similarly, Telegram founder Nikolai Durov holds multiple citizenships including UAE, yet was arrested in France. These cases show Dubai may offer shelter, but its power is limited. Ultimately, strength lies within oneself.

Singapore: A Comfort Zone for Chinese

Compared to Dubai’s exoticism, Singapore—just eight hours south of Beijing—is closer to Shenzhen and Fujian. Over 200 years of “Nanyang” migration have built a vast overseas Chinese-speaking community. After FBI investigations, Justin Sun fled to Singapore—near China, far from the U.S.—though we could also say: compared to Dubai, Singapore better suits those seeking livelihood near the mainland.

After FTX collapsed, Temasek (a major investor) conducted internal reviews, leading to more cautious government policies toward crypto. Yet this didn’t stop the grandeur of Token2049 or the惊艳 PayFi concept at Solana Break Point.

Moreover, DBS (Singapore’s largest bank) hasn’t abandoned crypto. Most notably, it launched USDG (Global Dollar)—managed by DBS as dollar custodian, issued by Paxos (former issuer of BUSD). Paxos obtained MAS’s (Monetary Authority of Singapore) MPI (Major Payment Institution) license back in 2022—shared by Alibaba and Coinbase.

This USDG launch marks a key step under MAS’s 2023 stablecoin regulatory framework. Locally compliant dollar-backed stablecoins won’t challenge USDT yet, but they point toward the future.

Overall, Dubai and Singapore are interchangeable alternatives—neither clearly superior. But regarding comfort for Chinese communities, Dubai’s 300,000 cannot compare to Singapore’s multi-million population.

Hong Kong: The Dilemma of True Compliance

Hong Kong differs significantly from Singapore and Dubai due to the long-standing history of HKEX. Yet with weak domestic tech stocks and declining overseas appeal, Hong Kong’s crypto policies struggle to advance boldly.

Despite swiftly approving BTC/ETH spot ETFs following the U.S., their scale and trading volume pale in comparison to American counterparts.

Image caption: Hong Kong BTC Spot ETF Data

Source:

https://sosovalue.com/zh/assets/etf/hk-btc-spot

As for exchange policy, Hong Kong enforces "true compliance"—requiring licensed exchanges to exclude mainland Chinese customers. Naturally, most exchanges prioritize profit over compliance. They remain in gray zones long-term. Marx already answered: when profits are high enough, capitalists won’t mind hanging themselves. Here, Hayek triumphs.

On stablecoins, Hong Kong’s approach involves partnering with big corporations like JD.com. However, despite compliance capability, current market structures prevent them from creating new use cases—leaving them unable to make meaningful moves.

Welcome to the New Era

Comparing the policies of these three jurisdictions, globally operable exchange compliance remains unachievable. Fragmented liquidity is unacceptable for any enterprise. Hence Hashkey Global, Coinbase Global, and others emerge—after all, compliance alone can’t put food on the table. Business is business.

Neoliberal globalization since the 1980s is ending. Regionalization will dominate—like Singapore’s regional stablecoins, Dubai’s local compliance licenses, and Hong Kong’s non-mainland-user exchanges. All are walking the talk.

But in Trump’s plan, it’s not just China that will be targeted—he will equally spread hostility toward all non-U.S. economies. "America First" knows no sentimentality; under MAGA, there are no shared values.

In Trump’s vision, a 15% corporate tax rate is essential economic reform—the very incentive Ireland uses to attract U.S. capital into Europe. During his first term, powerful corporate lobbying blocked global implementation. Now, he says, it’s time to end that.

If everyone faces the same rate, clearly America holds the advantage, Trump argues.

In sum, competition among major powers will return to hard capabilities—industry, high-tech prowess. Space for small giants to maneuver will shrink dramatically. They may even turn against each other. In this era of shrinking pie, competition will be brutal. Cryptocurrency remains one of the few truly global industries—and thus, a vital symbol connecting the world.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News