Deep Dive: Who Killed the Vitality of Telegram Mini Games?

TechFlow Selected TechFlow Selected

Deep Dive: Who Killed the Vitality of Telegram Mini Games?

Telegram's mini-program applications are currently facing challenges in two areas: commercialization and content.

By: Shijun

Recently, data from Telegram bots and Miniapps have shown a clear downward trend.

There was a time when Clicker games sparked explosive growth, making Telegram Miniapps the focal point of the blockchain space.

Yet beneath this prosperity lurked a crisis.

The TON Foundation's development strategy leaned too heavily on Clicker games. While this brought rapid user and data growth in the short term, it also planted the seeds for ecological imbalance.

As user novelty faded, the homogeneity and lack of depth in Clicker games became increasingly evident, triggering a backlash across the entire ecosystem.

Now that the tide has receded, it’s crucial to reflect deeply on the strategic missteps of the TON Foundation and seek new narratives capable of guiding the next phase of TON's ecosystem development.

We sourced BOT statistics from Telegram Apps Center, TON App, and The Open League (see appendix).

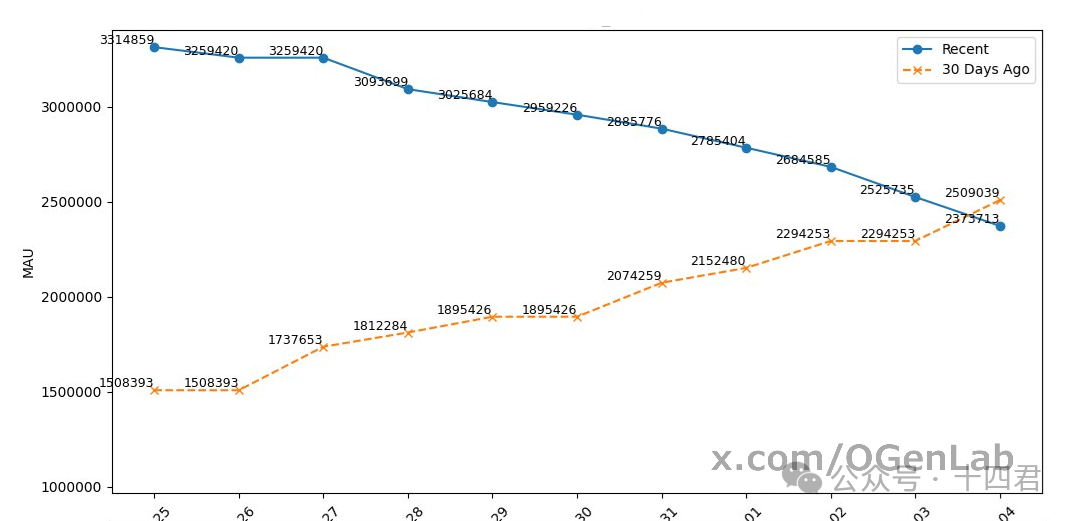

1. The Sharp Decline in MAU Is Unstoppable

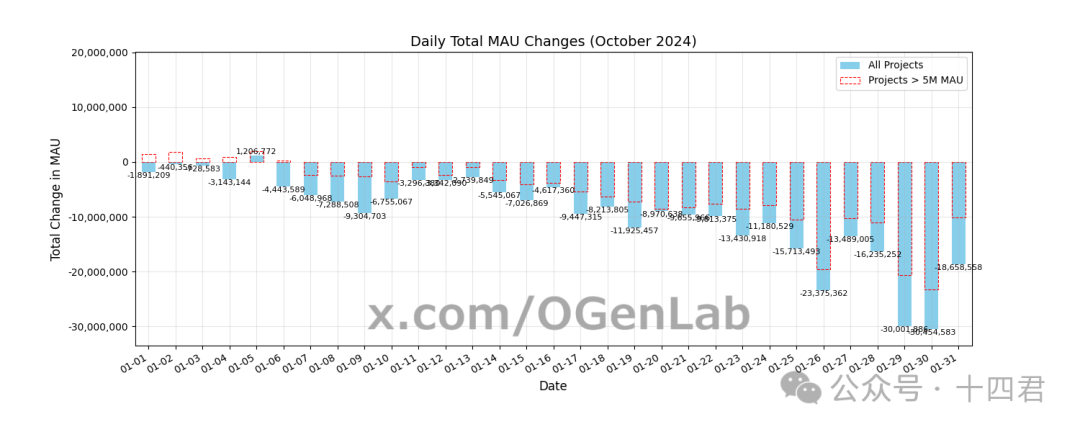

Over the past month, OGenLab continuously monitored 820 Telegram projects.

From October 1 to October 31, although cumulative Monthly Active Users (MAU) reached 879,922,503 due to non-deduplicated data,

this massive figure masks a worrying sharp decline.

In just one month, MAU dropped by 295,971,112 (non-deduplicated), representing a 33% decrease.

This significant drop reveals rapidly declining user engagement, reflecting unprecedented challenges facing the entire ecosystem.

Through daily data analysis, OGenLab found that this decline is accelerating.

Initially, large-scale projects with over 5 million users experienced relatively slow MAU declines, appearing stable.

However, over time, their rate of decline accelerated, eventually leading the downturn in later stages and exerting a deeper impact on overall MAU reduction.

This indicates even top-tier projects with massive user bases cannot withstand the wave of user attrition, exposing deep-rooted issues within the ecosystem that demand urgent resolution.

2. Structural Shifts Behind Project Performance Trends

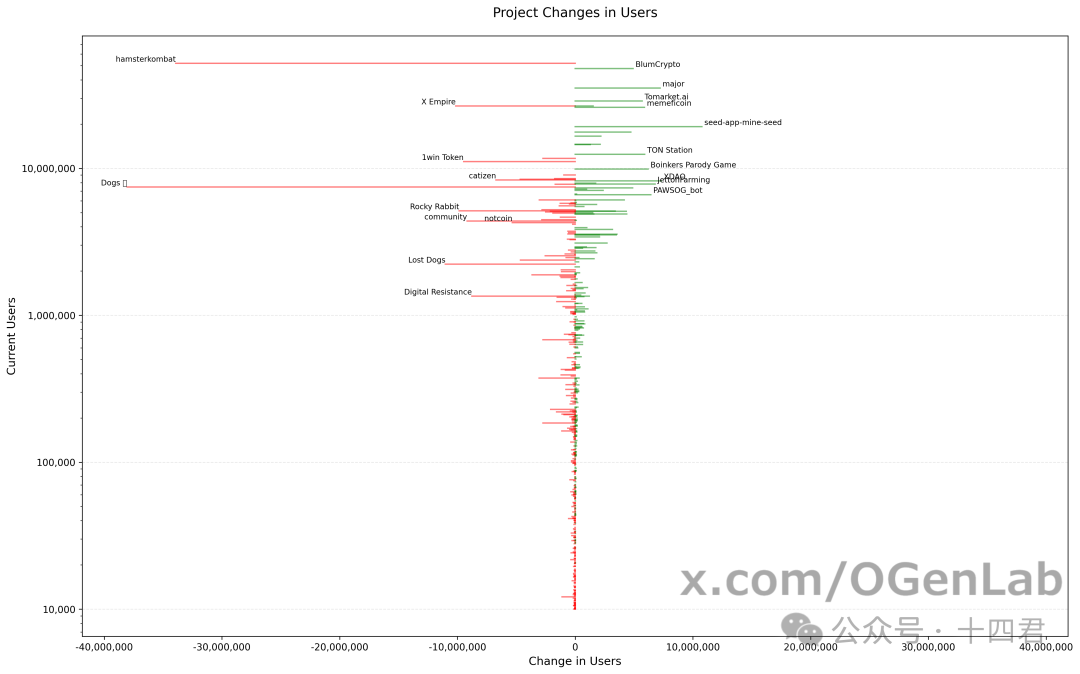

Among the 820 projects monitored by OGenLab, 249 increased while 491 declined in October.

Bar chart analysis clearly shows that established, high-profile projects—such as Hamster, Dogs, and Catizen, which have already launched tokens—experienced the most significant drops.

These once-thriving flagship projects are now grappling with substantial decreases in user activity and engagement, signaling weakening momentum and fading user interest.

Meanwhile, some emerging projects achieved positive growth, injecting new vitality into the market.

However, both in number and magnitude, these gains fall far short of offsetting losses from declining legacy projects.

Even among projects with fewer than 1 million users, more declined than grew.

This suggests that even at the mid- and small-scale level, the overall trend remains bearish, with insufficient new forces to reverse the downward trajectory.

This highlights structural flaws within the TON ecosystem: waning appeal of older projects and inadequate growth momentum among newer ones. The ecosystem urgently needs fresh stimuli and direction.

How to maintain user stickiness while delivering more innovative and valuable applications has become an immediate challenge for both the foundation and developers.

3. Migration Across Project Tiers and Downgrading of User Demand

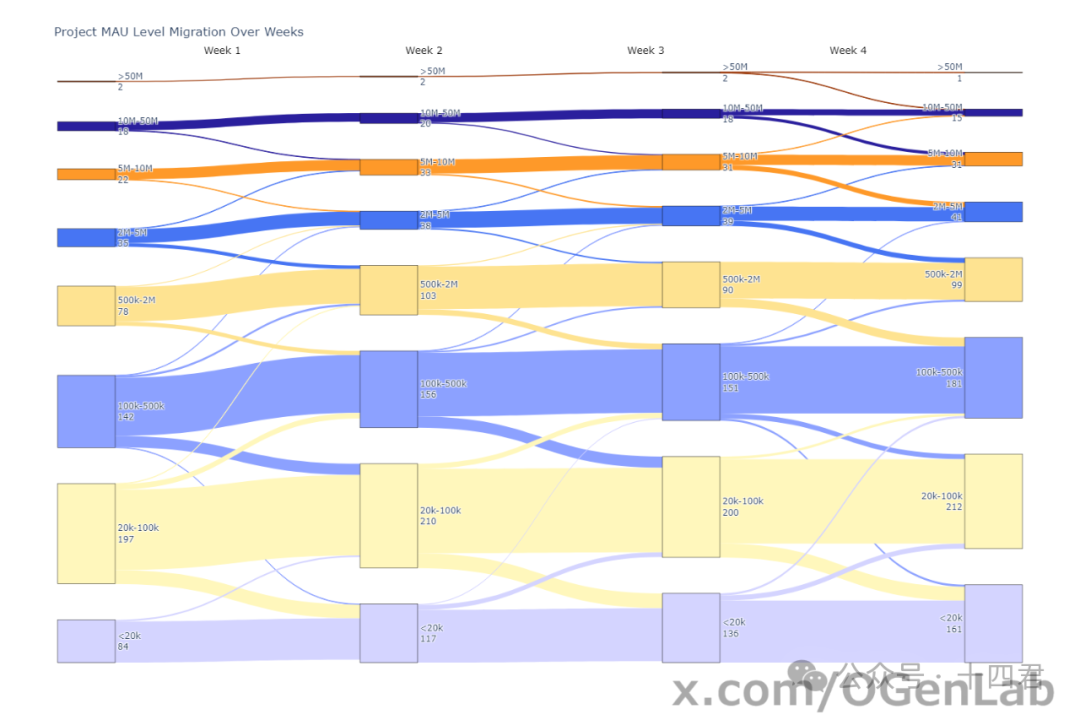

To gain deeper insights into ecosystem dynamics, OGenLab categorized the 820 monitored projects by Monthly Active Users (MAU) into tiers: >50M, 10M–50M, 5M–10M, 2M–5M, 500K–2M, 100K–500K, 20K–100K, and <20K.

Observing shifts across these tiers in October revealed notable trends.

3.1. High-Tier Projects Moving Downward

>50M MAU tier:

Number of projects: decreased from 2 in Week 1 to 1 in Week 4.

Movement: One project dropped from >50M to 10M–50M between Week 3 and Week 4.

10M–50M MAU tier:

Number of projects: declined from 18 in Week 1 to 15 in Week 4.

Movements:

-

One project downgraded to 5M–10M between Week 1 and Week 2;

-

Two projects downgraded to 5M–10M between Week 2 and Week 3;

-

Six projects downgraded to 5M–10M between Week 3 and Week 4.

5M–10M MAU tier:

Number of projects: increased from 22 in Week 1 to 31 in Week 4.

Movement: Inflows from higher tiers; simultaneously, some projects further downgraded to 2M–5M tier.

A clear pattern emerges: top-tier projects are sliding down.

The number of projects exceeding 50 million users dropped from 2 to 1, indicating a significant decline in user engagement among flagship apps.

This trend reduces the count of high-tier projects while increasing mid-tier counts, reflecting a top-down contraction of the ecosystem.

3.2. Noticeable Downgrade Among Mid-Tier Projects

2M–5M MAU tier:

Number of projects: rose from 35 in Week 1 to 41 in Week 4, but growth was slow.

Movement: Ten projects downgraded from 5M–10M tier; ten others further downgraded to 500K–2M tier.

500K–2M MAU tier:

Number of projects: increased from 78 in Week 1 to 99 in Week 4.

Movement: Numerous downgrades from higher tiers; some projects further downgraded to 100K–500K tier.

Mid-sized projects were not spared from declining engagement.

Their growing numbers stemmed mainly from downgrades rather than organic growth, indicating mounting pressure to retain users and evident user attrition.

3.3. Surge in Small-Scale Projects

100K–500K MAU tier:

-

Number of projects: increased from 142 in Week 1 to 181 in Week 4.

-

Movement: Many downgraded from 500K–2M and 2M–5M tiers; some further dropped to 20K–100K and <20K tiers.

20K–100K MAU and <20K MAU tiers:

-

Number of projects: significantly increased. The <20K tier grew from 84 to 161 projects.

-

Movement: Many downgraded from higher tiers, especially 100K–500K. Some saw internal declines, causing a surge in the lowest-tier projects.

The rise in small-scale projects does not signal ecosystem vitality—it reflects widespread project deterioration.

Projects across all tiers face declining engagement. New entries fail to compensate for user losses, leaving the ecosystem starved of fresh blood.

Data clearly reveals a comprehensive downward shift in project scale across the TON ecosystem.

From elite to minor projects, none are immune to declining activity.

This trend underscores insufficient user retention and lack of innovation, calling for new strategies and narratives to stimulate growth and rebuild user trust.

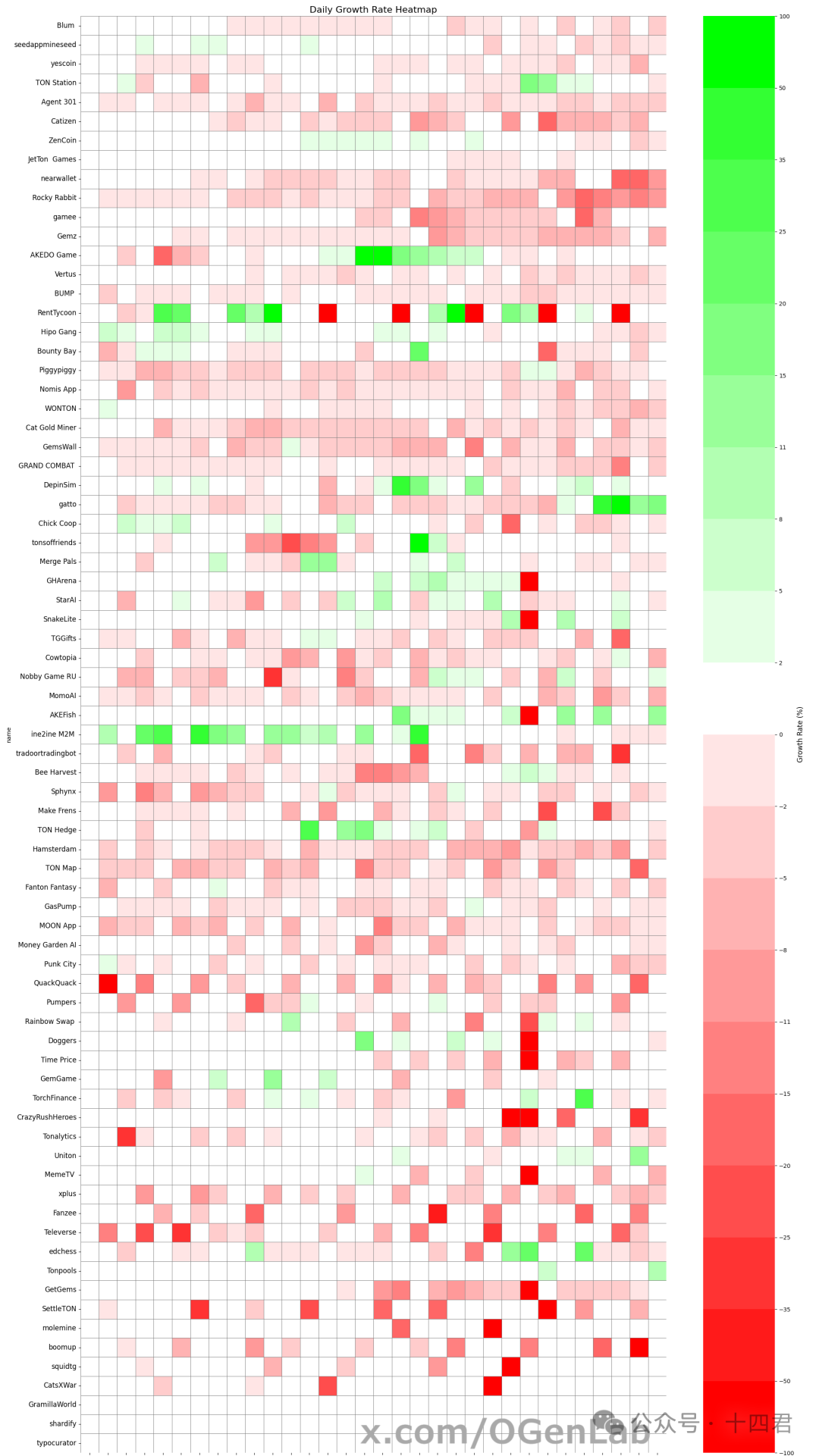

4. Challenges and Bright Spots Within OpenLeague Projects

When examining development across TON ecosystem projects, we focused on OpenLeague. Despite its market recognition and user base, it still suffers from user decline—sometimes even more severely than others.

Additionally, the project landscape is mixed, with inconsistent quality.

Nevertheless, a few standout projects offer hope for the broader ecosystem.

More Pronounced User Decline

Data analysis of OpenLeague shows:

-

Declining overall engagement: Compared to other projects, OpenLeague experienced sharper user drops and continuous active user loss, possibly due to insufficient innovation and user participation mechanisms.

-

Increased competition: In the competitive gaming sector, OpenLeague faces fiercer rivalry. The emergence of new projects diverts users, shrinking its market share.

Inconsistent Project Quality

-

Mixed-quality ecosystem: Sub-projects and events within OpenLeague vary widely in quality. Some lack clear positioning or high-quality content, failing to attract or retain users.

-

Poor user experience: Design and functional shortcomings in certain projects lead to subpar user experiences, accelerating churn.

Noteworthy Bright Spots

Despite numerous challenges, a few projects stand out, such as "AKEDO Game" and "RentTycoon," which showed strong green (growth) signals and sustained upward momentum on certain days.

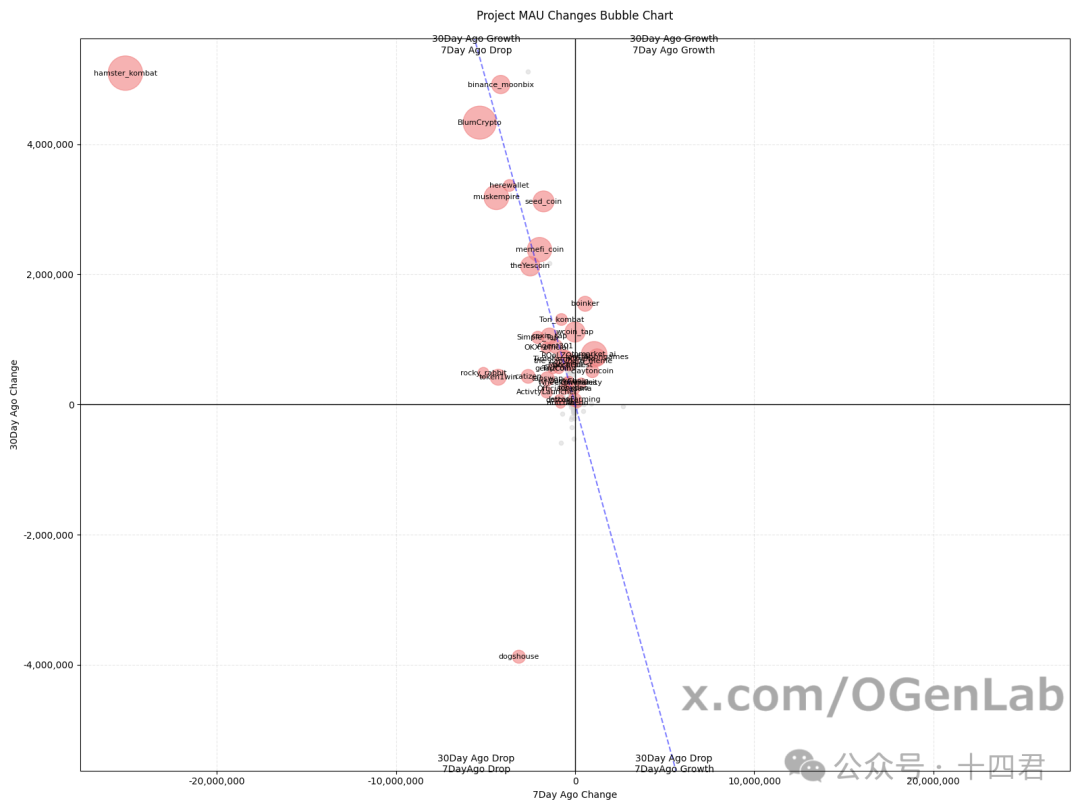

5. When a Whale Falls, Does Life Bloom—or Does It All Go to Zero?

To better understand project user dynamics, we analyzed changes between two weekly periods: one month ago (September 24–30) and the most recent week (October 25–31).

-

On one hand, this helps track monthly trends;

-

On the other, since official data reports Monthly Active Users (MAU), if the sum of trend slopes from these two periods approaches zero, the project may be inflating metrics without real new user acquisition.

Analysis Method

We defined the following metrics for the two 7-day periods:

M1 (user change from September 24–30): Calculated as the effective user count (non-empty and >10) on the last day minus that on the first day.

M2 (user change from October 25–31): Similarly, M2 equals the effective user count on the final day minus that on the initial day.

We also plotted a 2D coordinate system with M1 on the x-axis and M2 on the y-axis, adding a reference line x = -y for analysis support.

Quadrant Interpretation

By plotting project data points, we can assess user trends based on quadrant location.

First Quadrant (M1>0, M2>0)

Meaning: The project gained users in both the earlier and recent weeks.

Interpretation: These projects likely possess sustained growth momentum, with steadily improving engagement—worthy of attention.

Second Quadrant (M1<0, M2>0)

Meaning: Users declined 30 days ago but recently increased.

Interpretation: If located to the right of x=-y, the project is reversing course and may hold potential.

If to the left, growth fails to offset prior losses, suggesting instability.

Third Quadrant (M1<0, M2<0)

Meaning: User numbers fell in both periods.

Interpretation: Clear downward trend, persistently low engagement, high risk of termination.

Fourth Quadrant (M1>0, M2<0)

Meaning: Growth occurred 30 days ago, but recent decline.

Interpretation: If left of x=-y, the recent drop exceeds previous gains—users may spiral downward, raising red flags.

Suspected Metric-Inflating Projects

Projects near the origin or along x=-y, where M1 + M2 ≈ 0, show little real growth and likely inflate metrics, with minimal genuine new users.

Potential Projects

Those in the second quadrant and to the right of x=-y, despite prior declines, show clear recent recovery—worth monitoring.

Risky Projects

In the third quadrant: persistent user loss; survival and improvement strategies need evaluation.

Projects to Watch

In the fourth quadrant and left of x=-y: sharp recent declines suggest ongoing user erosion.

In summary:

-

Growth Projects (first and second quadrants) deserve close attention—they show sustained growth or rebound potential.

-

Declining Projects (third and fourth quadrants) require root-cause analysis and timely strategic adjustments to recover users.

-

Suspected Inflated-Metrics Projects need stricter data monitoring to ensure authenticity and safeguard ecosystem health.

6. Summary

Currently, Telegram mini-apps face unprecedented difficulties centered on two key areas: monetization and content.

Monetization:

Current models rely primarily on selling traffic and token listings—essentially monetizing user volume.

However, today’s challenge lies here: exchanges and listing platforms have already purchased initial traffic, so newly acquired traffic holds less appeal.

Meanwhile, games generate vast amounts of tokens without concrete use cases or consumption mechanisms.

Players’ only option after earning tokens is to sell them immediately, causing projects to collapse shortly after listing.

Content:

Most top games today revolve around clickers and viral tasks, lacking gameplay depth.

Over time, users develop a fixed stereotype of Telegram games, attracting mostly “Earn-to-Sell” players.

To reverse this, truly engaging games must be developed—a complete rebuild—to restore user trust. The next shining star in Telegram’s sky should be a masterpiece that genuinely moves people.

We sincerely hope to see fresh content ideas and new monetization models that breathe life into these games, guiding users toward a real gaming experience.

OGenLab is a passionate game studio standing at the forefront of emerging trends, chasing infinite possibilities of the future.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News