Sui surges, but don't forget it has a twin brother—Aptos

TechFlow Selected TechFlow Selected

Sui surges, but don't forget it has a twin brother—Aptos

If Sui and Aptos are to survive longer in this market, they need to promote the widespread adoption of the Move language.

On October 14, not long ago, the SUI token closed above $2.30, setting a new all-time high and entering the top 20 by market capitalization, with its upward momentum continuing—its two-day gain exceeded 30% at that time.

While the broader cryptocurrency market remained in sideways consolidation alongside Bitcoin, SUI surged nearly 300% from $0.75 to its historical peak, making it the best-performing layer-1 blockchain token from the beginning of 2024 to date.

People can't help but wonder: could Sui surpass performance-focused giants like Solana and Ton?

However, such comparisons are not particularly meaningful. In the previous Crypto-Value article, I mentioned that when comparing blockchain projects, beyond whether they prioritize performance or stability, another key factor is their "age".

Whether Ethereum, Cardano, Solana, or Ton, they have all gone through at least one full bull-and-bear cycle. But Sui only launched its mainnet in 2023—it's still very much a "teenager".

That said, there’s Aptos, which shares a similar origin story, making it a more valid point of comparison.

The goal of this Crypto-Value column is to evaluate projects from the perspective of an angel investor or VC, rigorously analyzing investment strategies across six dimensions: due diligence, fundamentals, competition, valuation, technical analysis, and founders.

Due Diligence: Shared Origins, Divergent Paths

Sui and Aptos are often described as coming from the “same team” because their core developers originated from Meta’s (formerly Facebook) defunct cryptocurrency project, Diem.

Due to regulatory pressure, Meta eventually abandoned Diem. However, some key engineers left the company to found independent ventures—Sui and Aptos—aiming to realize the original technological vision behind Diem.

In addition, both Sui and Aptos use Move, the programming language originally developed by Meta for the Diem project. As the whitepaper describes: "Resources cannot be copied or implicitly discarded—they can only move between program storage locations," hence the name "Move."

What sets Move apart from other languages like Solidity used on Ethereum lies in how it handles resources—a concept rooted in linear logic, a branch of mathematical logic.

In linear logic, propositions are treated as fundamental resources that can only be used once. This mechanism aims to maximize security without increasing transaction complexity, thereby reducing gas fees.

In short, the Move language offers a safer and more flexible environment for smart contract development, especially advantageous for asset management and high-frequency transactions.

Most importantly, both Sui and Aptos share extremely similar design philosophies with Solana in areas such as parallel processing, consensus optimization, proof-of-stake (PoS), and storage efficiency—all aimed at solving the performance bottlenecks of traditional blockchains (what I refer to as "stable chains").

This is why the market often compares these two "teenagers" with one "middle-aged man." The advantage, however, is that teenagers can learn from the path already traveled by adults, potentially replicating Solana’s explosive growth trajectory.

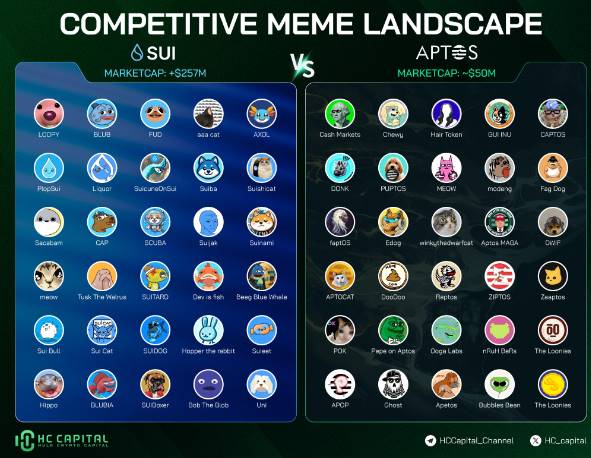

Indeed, Sui has already started doing so. After Solana achieved remarkable growth during the bear market via the memecoin sector, Sui’s ecosystem has also seen a rise in memecoins.

If you're a memecoin speculator or enthusiast, I highly recommend getting early exposure to leading dog coins, frog coins, and others within the Sui and Aptos ecosystems (see image below).

Back to our analysis: while Sui and Aptos appear largely aligned in technical design, they differ significantly in implementation approaches and scale, allowing investors to achieve diversification benefits by holding both.

Specifically, Aptos closely follows the textbook-style architecture outlined in the original Diem whitepaper. In contrast, Sui adopts a slightly different object model centered around an "object"-based storage system, meaning nearly everything on the blockchain—including addresses and transactions—is visible as an object.

Sui explicitly defines whether objects are owned, shared, mutable, or immutable—something Aptos does not do. Furthermore, Sui’s ownership API is cleaner than Aptos’, offering greater clarity in blockchain design.

Moreover, Aptos achieves parallelization by dynamically detecting dependencies and using BlockSTM (a derivative of the HotStuff consensus protocol) to schedule task execution (image above).

Sui takes innovation further by implementing Narwhal and Tusk as its consensus mechanism—an asynchronous DAG (Directed Acyclic Graph)-based mempool enabling parallelization at the execution layer (image below).

This protocol is asynchronous, meaning it is resilient against DoS (Denial-of-Service) attacks. On the surface, this gives Sui a slight edge over Aptos in terms of security.

That said, I believe security innovations in performance-focused chains may not be worth overemphasizing, since their decentralization becomes questionable as node counts decrease.

The so-called security is centralized in nature and lacks revolutionary impact—which explains their relatively high probability of network outages, as we’ve seen with Solana and Ton.

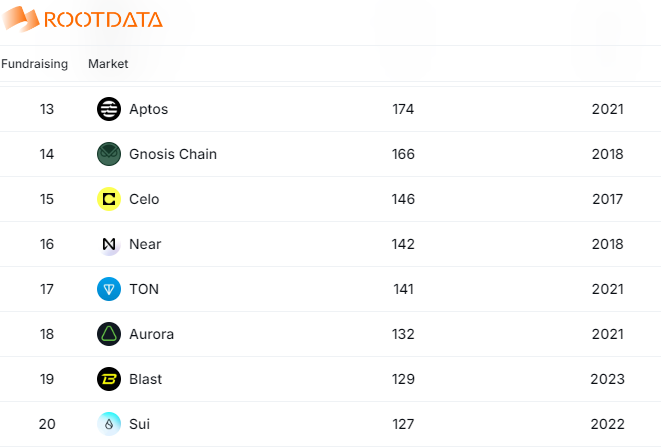

Finally, regarding scale, Aptos enjoys a first-mover advantage, having launched slightly earlier than Sui in terms of both timeline and mainnet availability. Consequently, its ecosystem and participant base are naturally larger and better validated.

Specifically, Aptos shows higher activity on GitHub, with more code commits and contributors, indicating a larger developer community.

Additionally, the Aptos ecosystem hosts over 170 active projects, compared to around 120 on Sui (image above). An earlier-matured ecosystem typically means capturing favorable market positioning and more partnership opportunities.

We’ll pause here on background, technology, and current status comparisons, and now examine how their “youthful promise” has impacted their native token prices.

First, let’s look at SUI (image above). Like most VC-backed tokens, it experienced a significant post-launch correction. But as the first half of this year saw a “pseudo bull market” (driven by Bitcoin and Ethereum ETF approvals), the price rapidly rose above both market cap and TVL, before correcting back below the market cap line.

Shortly after, possibly due to coordinated buying or extreme undervaluation, the token price, market cap, and TVL surged simultaneously. Today, the three curves are tightly intertwined, though the price curve remains slightly below the other two.

Overall, this rally appears justified—not driven solely by price speculation—and historically, when these three lines converge, another surge often follows.

Next, APT (image above). Unlike SUI, APT had already seen a strong run-up before the “pseudo bull market,” with its price closely tracking both market cap and TVL—only now showing a clear uptick in TVL.

Currently, the price curve lags far behind the other two. Notably, TVL is now the highest—suggesting APT may be significantly undervalued.

Fundamentals: Stable Token Supply

In terms of tokenomics, compared to the well-established ADA discussed previously, both SUI and APT are quite complex—but I’ll simplify them as much as possible.

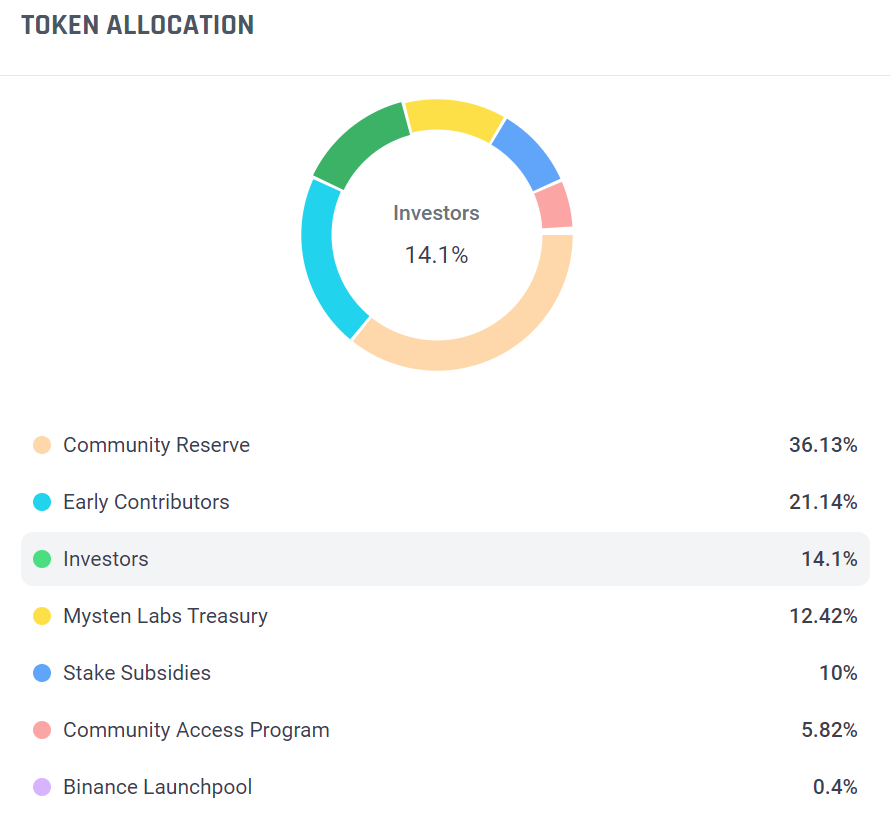

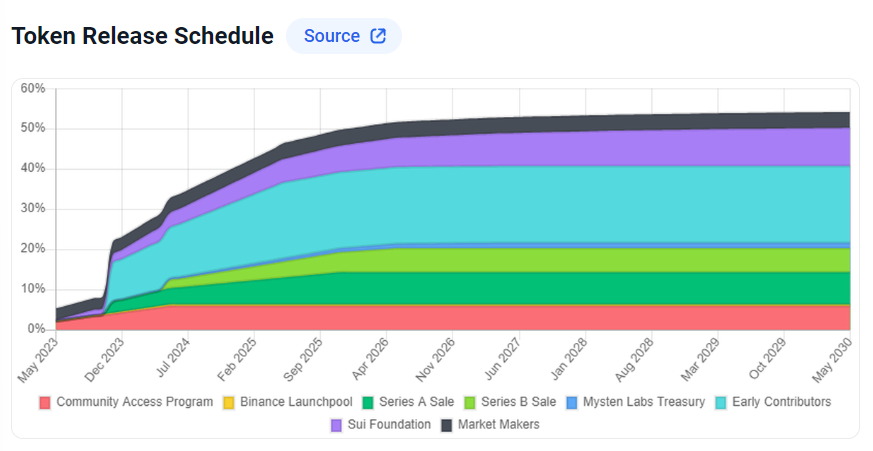

First, SUI’s token distribution is overly complicated, involving numerous stakeholders (image below). This isn’t ideal, as the greater the number of parties involved, the higher the future uncertainty.

Since SUI is a VC-backed token, early investors and team members haven’t yet exited. They will inevitably try to pump the price, so examining the proportion allocated to early investors is particularly insightful.

Investors hold 14.1%, early contributors 21.14%, and the lab itself holds 12.42%. Combined, these groups account for 47.66%—nearly half—who could potentially dump tokens later, creating a “rug-pull” effect.

Good news: investing before the bull market allows us to anticipate aggressive price pumping during the cycle. But we must also exit alongside these insiders when the project becomes excessively overvalued.

Another predictable factor is the token unlock schedule. All allocations for SUI will unlock linearly through 2025, resulting in relatively stable supply inflation.

SUI has a fixed total supply of 10,000,000,000, with a current circulating supply of 2,845,750,695 (28.46%). This is slightly lower than the planned 35%, likely due to additional lock-up rules applied even after official unlocks—for example, for team, early investors, or community funds.

We can estimate the gap using a multiplier of approximately 0.813 for predicting 2025 circulation.

According to the plan, SUI’s circulation should reach about 45% by 2025. Applying the 0.813 adjustment gives us 36.585%. Multiplying by total supply yields an estimated 2025 circulating supply of ~3.7 billion.

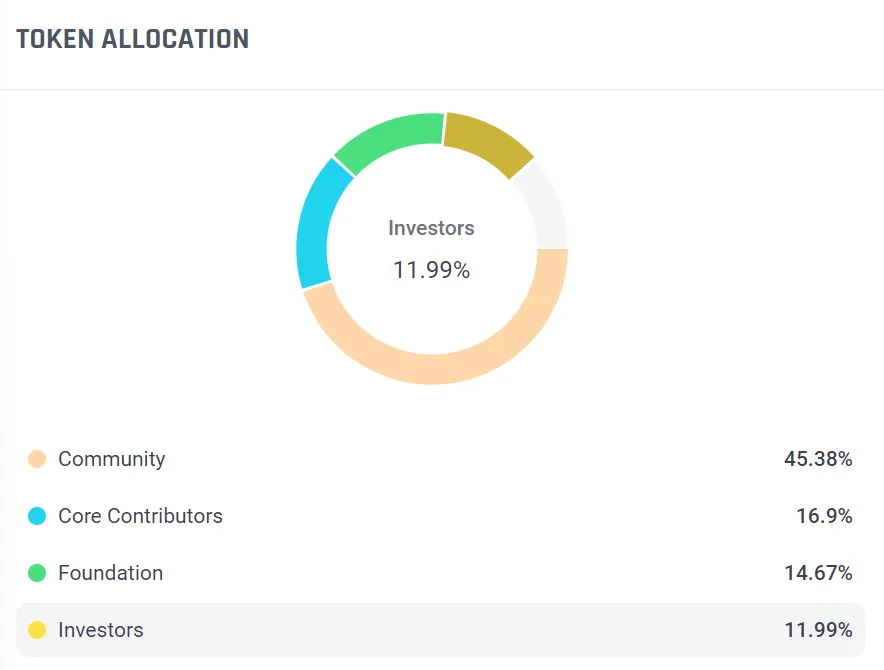

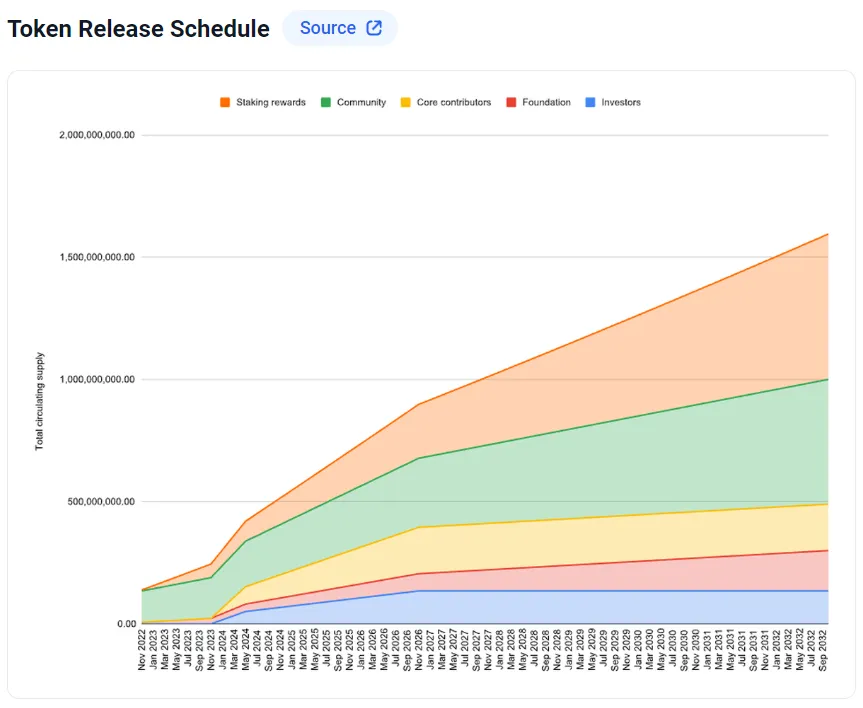

Turning to APT, both token distribution and unlock schedules are much simpler. The only notable difference is that APT has no hard cap—it’s infinitely issuable, unlike SUI’s fixed supply.

For investors planning to exit during this bull run, this distinction makes little difference, as both will be inflating in 2025.

But for long-term holders, SUI’s fixed supply may be more attractive due to its scarcity guarantee.

APT’s allocation includes 11.99% to investors, 14.67% to the team, and 16.9% to core contributors—totaling 43.56%, again nearly half.

Now let’s calculate APT’s 2025 circulating supply. According to the unlock schedule (image below), APT’s circulation at the start of 2025 should be 550 million—currently at 519,059,281, closely matching expectations.

By end of 2025, the target is 750 million. Taking the average gives us ~650 million. Therefore, Aptos’ average unlocked supply in 2025 is projected to be 650 million.

Competition: Supplemental Due Diligence Data

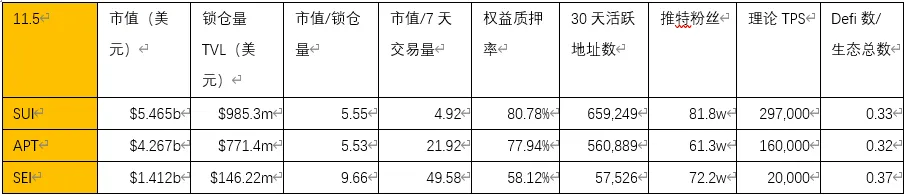

For a fairer comparison, I’ve added another contender—Sei, another 2023-launched layer-1 project still in its "teen years".

Honestly, aside from having more Twitter followers than Aptos, Sei doesn’t compare favorably with either.

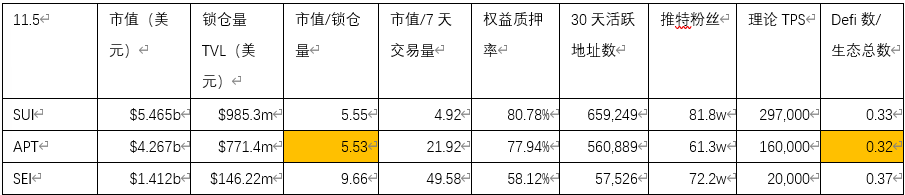

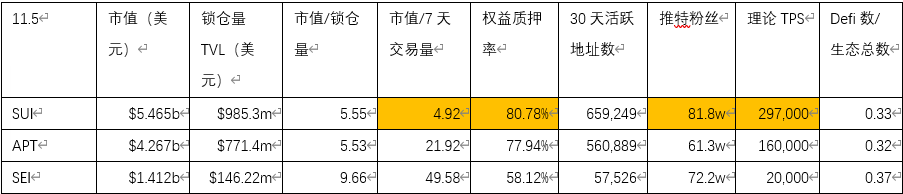

Aptos edges out Sui in two metrics: market cap-to-staked ratio and DeFi count-to-total ecosystem projects (image above), suggesting stronger user engagement, stickiness, and ecosystem diversity.

Sui, on the other hand, seems to have entered its “adolescence”—outpacing Aptos across nearly all data points and indices (image below).

Valuation: Analogous to SOL’s History

Since both SUI and APT are approaching their first full bull market cycle, their growth during the upswing will likely be explosive. Top-down valuation methods may underestimate potential, so we’ll use a bottom-up approach this time.

A reference for top-down valuation can be found in the previous ADA research analysis. If interested, readers can apply that method independently.

As usual, each valuation strategy includes conservative, fair, and aggressive scenarios—readers can choose based on risk appetite or blend them.

Let’s first review Solana’s performance during its initial bull run. In 2021, SOL rose from $25 to ~$250—a tenfold increase (image below).

But for early adopters who bought near $1, the gain was around 250x.

If SUI mirrors SOL’s breakout phase, a conservative estimate would be a 10x market cap increase (already starting from ~$2 price level and elevated market cap), projecting SUI’s market cap at ~$5.5 billion.

A fair estimate would be 50x (~$22 billion), and aggressively, 200x (~$110 billion).

Based on the previously calculated 2025 circulating supply of ~3.7 billion SUI, these correspond to price targets of $1.49 (conservative), $5.95 (fair), and $29.73 (aggressive) (image below).

Under conservative assumptions, SUI’s current price (~$2) already exceeds the target—raising questions about whether now is an optimal entry point.

Similarly for APT: conservatively, a 10x market cap increase brings it to $4.3 billion; fairly, 50x to $21.5 billion; aggressively, 200x to $86 billion.

With an estimated 2025 circulating supply of ~650 million APT, this translates to price targets of $6.62 (conservative), $33.08 (fair), and $132.31 (aggressive) (image below).

Again, under conservative estimates, APT appears currently overvalued. Thus, both tokens hold upside potential primarily within the context of a full bull market.

Technical Analysis: What’s the Best Entry Price Recently?

Now, as angel investors, we’ve decided to back both projects! But ideally, we’d want to enter at a “good price,” right?

So let’s dive into micro-level technical analysis to identify the most cost-effective entry points recently.

For SUI, despite recent weakening momentum, it hasn’t broken out of its reasonable uptrend channel. Prices continue testing support levels, making $1.82 a solid entry point (image below).

However, with U.S. election results imminent tomorrow, a sharp drop remains possible—an aggressive support level sits at $1.03.

But if you believe a major bull market will begin immediately post-election, then now is the time to buy.

APT’s recent trend isn’t as strong as SUI’s—it has already broken below its stable ascending channel (image below). I previously entered at $9.36 near the lower boundary and was too early.

Fortunately, a rebound occurred at the next support level, filling part of my limit order. Buying near $8.30 now would offer excellent value.

The Two Founders

Finally, let’s look at the founders. Evan Cheng (center above) is co-founder and CEO of Mysten Labs—the team behind Sui—while Mo Shaikh (left below) is co-founder and CEO of Aptos Labs.

Both Evan Cheng and Mo Shaikh worked together at Meta on the Diem and Novi projects, focusing on different roles. Evan led technical architecture and Move language development, while Mo focused on strategy and market expansion.

They jointly aimed to build Diem into a globally accessible digital payment system. However, due to regulatory pressure, Meta ultimately shut down the project—prompting both to pursue independent visions for blockchain infrastructure.

Though now leading separate companies and projects, they share a similar vision for advancing blockchain infrastructure—both aiming for high throughput, low latency, and scalable decentralized applications.

In the crypto industry, Sui and Aptos are frequently compared due to their shared origins and similar tech foundations. The “coopetition” between their founders has become a popular narrative in the space.

And where there’s narrative, there’s momentum—and potential price appreciation, right?

In summary, both Sui and Aptos are poised to benefit in this bull market, with Sui already showing signs of momentum. If you’re a value investor positioning for the next cycle, investing in both projects is a no-brainer.

Beyond tokens and projects, technically inclined readers should also explore the advantages and long-term viability of the Move language.

Because for Sui and Aptos to survive and thrive long-term, Move must gain widespread adoption and recognition.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News