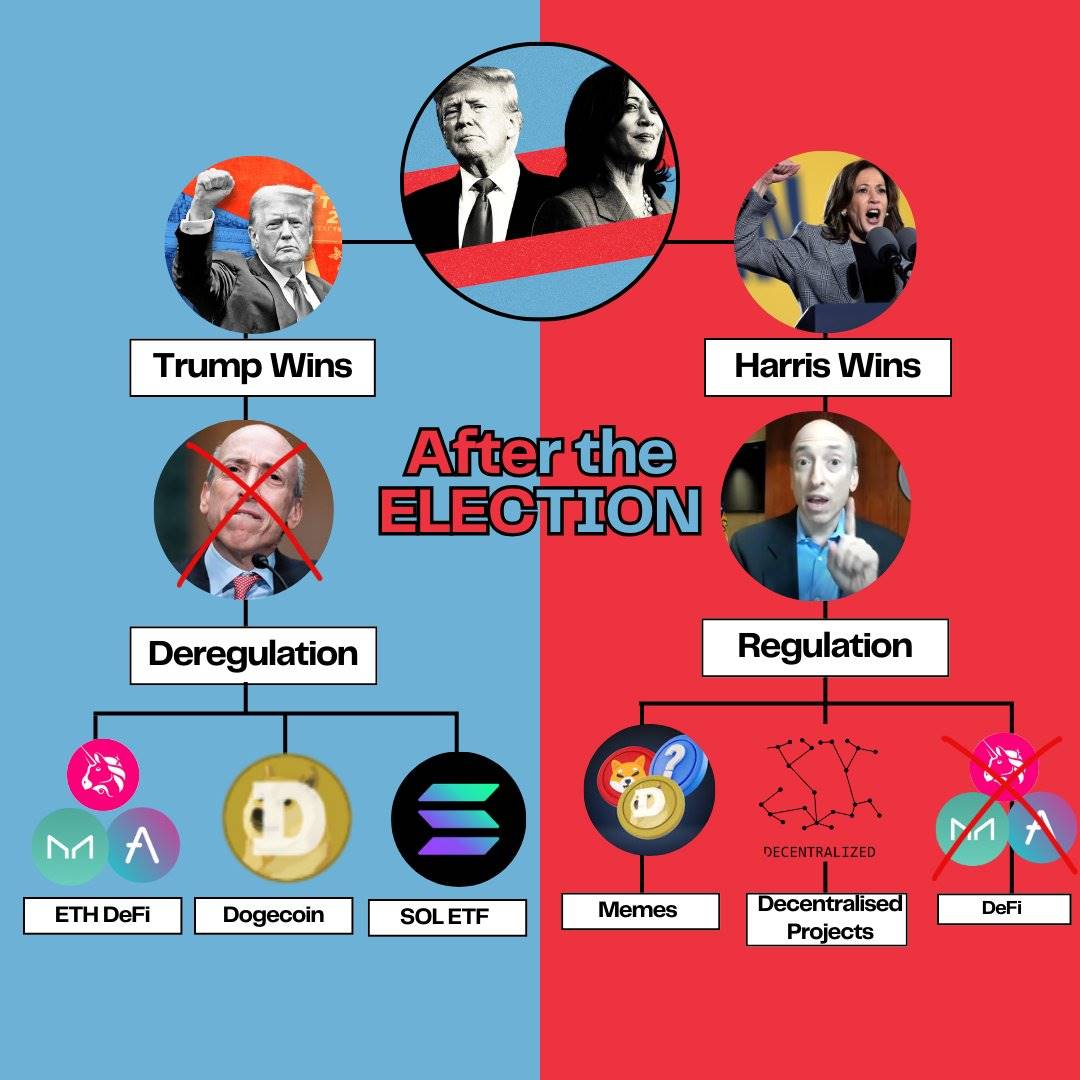

Trump vs Harris: Analyzing Crypto Investment Strategies Under Different Election Outcomes

TechFlow Selected TechFlow Selected

Trump vs Harris: Analyzing Crypto Investment Strategies Under Different Election Outcomes

ICOs may regain popularity, and controls on over-the-counter transactions may become stricter, or they may even be banned.

Author: Crypto Stream

Translation: TechFlow

Altcoin holders are worried about the U.S. election.

However, not all altcoins will become worthless.

Below are my thoughts on which altcoins might survive—or even rise—after the election.

In this article, I’ll explore:

-

The potential impact of a Trump victory

-

The potential impact of a Harris victory

-

Short- and long-term investment strategies for each outcome

A brief note on market trends:

Major events often spark new market trends, and the U.S. election is exactly such an event.

Depending on the election results, the market may form a new consensus around which altcoins have potential.

Therefore, I believe we may be witnessing the peak of the current Meme trend—market attention could soon shift elsewhere.

If Trump Wins:

Trump favors reduced regulation.

Who benefits?

Mainly large institutions in the U.S.: major funds seeking investments and key cryptocurrency projects headquartered in the United States.

Most of these projects are concentrated in Ethereum’s decentralized finance (DeFi) space.

Under looser regulations, DeFi projects on Ethereum may explore revenue-sharing models and other growth strategies. Large funds may view Ethereum DeFi as the most attractive investment area, such as $AAVE, $UNI, and $MAKER.

Other potentially beneficial projects include:

-

$DOGE – because Elon Musk wants to launch an ETF

-

$SOL – has potential for ETF approval

-

XRP, LTC, and more ETF-related projects

If Harris Wins:

Harris’ policies may bring stricter regulations, posing years of challenges for altcoins. However, not all altcoins would be classified as securities. Some projects may qualify as digital commodities under the FIT 21 framework. For example, $QUIL is one such project (disclaimer: I hold $QUIL, but mention it due to its decentralized nature—there are certainly others).

Meme coins may also benefit, depending on their issuance method and initial distribution. Be cautious if your meme coin had OTC deals or a presale phase. Possible surviving meme coins include: $WIF, $DOGE (after initial sell-off), and other well-distributed tokens.

Other potential industry shifts may include:

-

ICOs may regain popularity

-

Stricter controls—or even bans—on OTC transactions

-

Ethereum could see a price increase

-

The market may place greater emphasis on fairly launched projects

More trading strategy suggestions:

-

Go long or short $DOGE (depending on whether Trump or Harris wins)

-

Go long SOL (if Trump wins)

-

Go long UNI and AAVE (if Trump wins)

-

Go long BTC and short altcoins (if Harris wins)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News