Polymarket prediction market 2024 "presidential mystery": What happens if Trump loses the election?

TechFlow Selected TechFlow Selected

Polymarket prediction market 2024 "presidential mystery": What happens if Trump loses the election?

After the dispute period, the market should resolve to "Trump loses."

Author: Zaddycoin

Translation: TechFlow

Do your own research—this is just personal opinion and does not constitute financial advice.

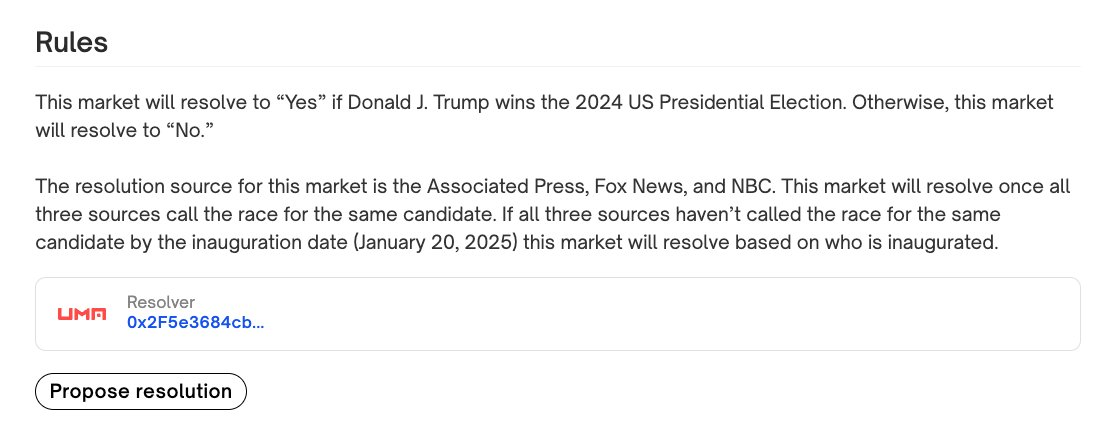

If Trump is reported as losing the election by @AP, @Foxnews, and @NBCNews according to market rules, I predict the U.S. Presidential Election market on @Polymarket will undergo two "disputes," during which retail traders may suffer losses by chasing the possibility of a market reversal.

In other words, if the market rules Trump a loser, it could face two disputes, and retail traders might go all-in hoping the outcome can be overturned—think of it like aHail Mary pass.

But remember, you're not Tom Brady... If Trump loses, expect TRUMPYES holders to fight hard—possibly even harder than supporters of HARRISYES. However, rules are rules, and @Polymarket has reminded everyone what the consequences would be should this scenario unfold.

Market Rules

Polymarket 2024 Presidential Election Winner

Let me explain.

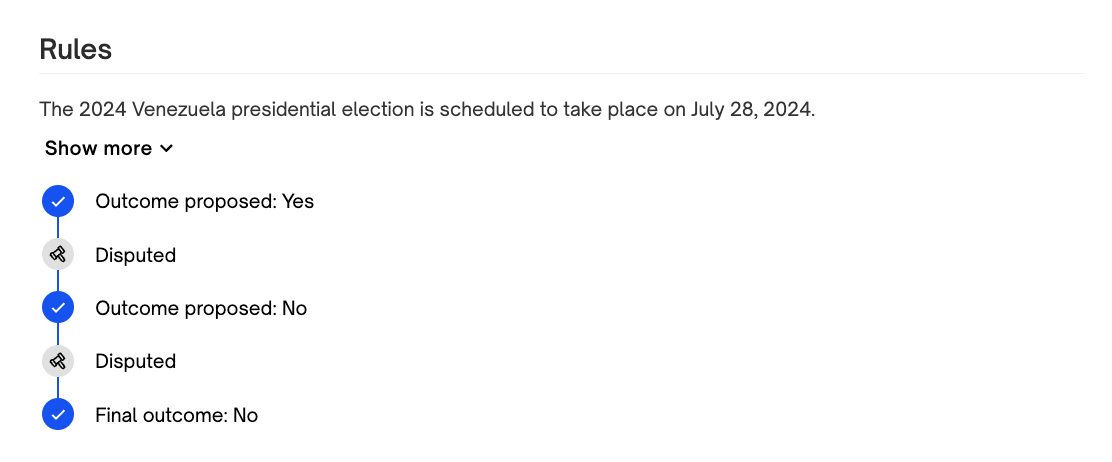

Dispute Mechanism

Anyone can dispute the market resolution roughly within one day after it's resolved, by staking $750 on @UMAprotocol. This amount is relatively small for platform liquidity. Traders can dispute the market twice before final settlement.

Here’s an example of a doubly disputed and ultimately overturned market. (These examples show what disputed markets look like.)

Given that the rules require confirmation from all these news outlets, and based on Polymarket’s historical precedents with disputed markets, I expect the market to enter a double-dispute phase, with $UMA token holders (UMA voters) ultimately ruling the outcome as “Trump loses.”

False Arbitrage Opportunities

During this period, I anticipate the emergence of apparent arbitrage opportunities targeting investors seeking 100x returns from a potential market reversal (e.g., betting on TRUMPYES at 1% odds, hoping for a 100x payout if the result flips). During disputes, the market typically resets TRUMPYES pricing to 1% and TRUMPNO to 99%. As more participants invest hoping for 100x gains, market volatility may expand—creating short-term arbitrage-like dynamics.

To be honest, these resemble slot machines in prediction markets.

Some might say, “There’s a 100x chance—I’ll put in a little,” while others may confidently deploy large sums. Ah well…

Rather than gamble on that 100x long shot, I’d allocate funds to the 99% side, since post-dispute, the market should resolve as “Trump loses.”

Note: Actual arbitrage opportunities may be minimal, as “100x bettors” alone cannot shift the market significantly.

In the RFK market, after resolution, YES dropped to 96% during Friday trading. During the dispute window, experienced investors familiar with Polymarket’s dispute mechanics were able to secure a nearly risk-free 6% arbitrage gain.

How to Know When the Time Is Right?

If @AP, @Foxnews, and @NBCNews declare Trump defeated in the election, my prediction may come true.

Imagine if @FoxNews, due to its support for Trump, refuses to call a winner—that would be fascinating.

I’m not sure there's historical precedent for such a situation, but if it happens, it would certainly be interesting.

My sympathies go to @Polymarket, because if any of these hypothetical outcomes materialize, it could create an extremely complex situation involving substantial amounts of capital. Again, these are merely speculative thoughts based on a combination of variables—please consider them as such. I’d also love to hear thoughts from @Domahhhh, @hosseeb, and others.

Let the games begin.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News