Tether Earns $2.5 Billion in Q3 on Gold and U.S. Treasuries, Reaching Record Highs in Total Assets and Shareholders' Equity

TechFlow Selected TechFlow Selected

Tether Earns $2.5 Billion in Q3 on Gold and U.S. Treasuries, Reaching Record Highs in Total Assets and Shareholders' Equity

USDT's circulating supply has grown by $27.8 billion year-to-date, reaching nearly $120 billion, an increase of 30%, with growth in scale almost equivalent to the total market capitalization of its competitor USDC.

By James, BlockTempo

Tether, the issuer of the US dollar-pegged stablecoin USDT, today released its Q3 2024 reserve report audited by BDO, one of the world’s top five independent public accounting firms. The report revealed a quarterly net profit of $2.5 billion, with cumulative profits reaching $7.7 billion in the first nine months of the year. Shareholders’ equity rose to $14.2 billion and total assets hit $134.4 billion, both record highs.

Tether attributed its $2.5 billion in Q3 net profit primarily to strong performance from its gold holdings, which generated approximately $1.1 billion in unrealized gains, while the remaining $1.3 billion in profit came from yields on U.S. Treasury securities.

One key highlight of the quarter was the continued demand for stablecoins, driving USDT's circulating supply up by $27.8 billion year-to-date to nearly $120 billion—an increase of 30%. This growth alone is nearly equivalent to the entire market capitalization of its main competitor, USDC.

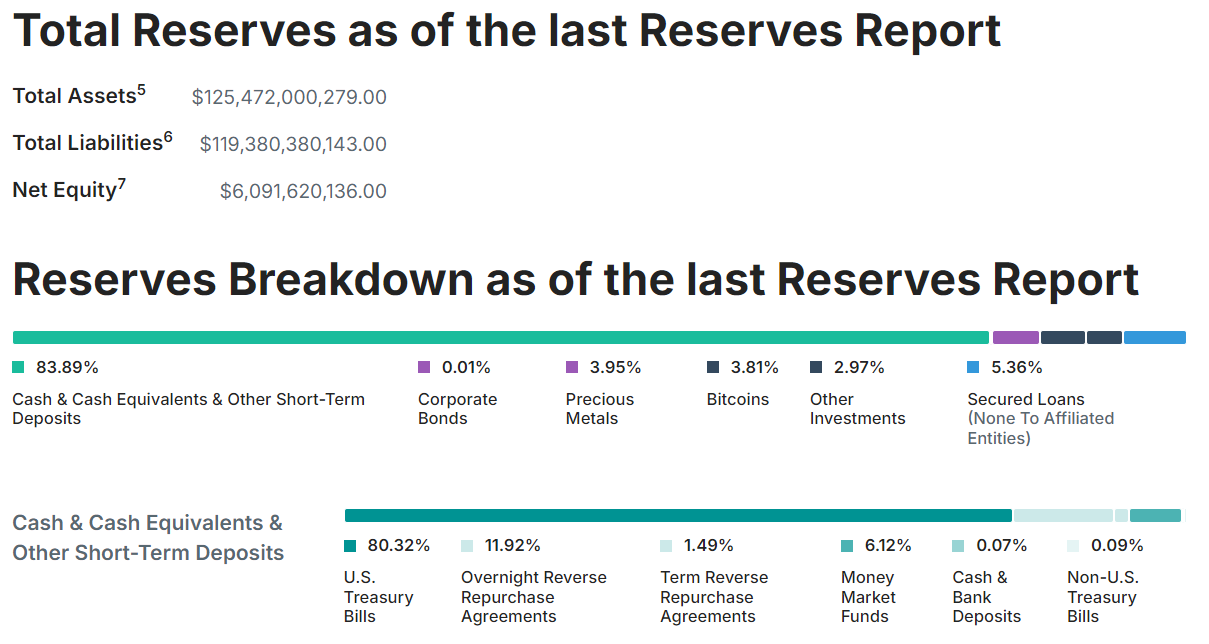

Tether Reserve Overview

In terms of reserves, as of Q3, Tether held $125.5 billion in reserve assets against $119.4 billion in liabilities, resulting in over $6 billion in excess reserves. The non-annualized growth rate of reserves over the past nine months reached 15%.

Tether currently holds more than $105 billion in cash and cash equivalents, including direct and indirect holdings of U.S. Treasuries totaling $102.5 billion, making it one of the top 18 holders of U.S. Treasuries globally—ranking ahead of countries such as Germany, Australia, and the United Arab Emirates.

During Q3, Tether also increased its holdings of Bitcoin and gold, with their values reaching $4.8 billion and $5.0 billion respectively.

Strategic Investments Reach $7.7 Billion

In addition, reflecting Tether’s long-term vision, the net asset value of its proprietary investment arm, Tether Investments, has grown to $7.7 billion, up from $6.2 billion in the previous quarter. The division has made strategic investments across key sectors including renewable energy, Bitcoin mining, AI, telecommunications, and education, and currently holds 7,100 Bitcoins.

Tether CEO Paolo Ardoino stated that the company’s strong Q3 performance underscores its unwavering commitment to transparency, liquidity, and responsible risk management. Reaching a stablecoin market cap milestone of $120 billion and holding $102.5 billion in U.S. Treasuries highlights Tether’s unmatched financial strength:

“By expanding our reserve buffer to over $6 billion and maintaining focus on strategic investments, Tether is once again setting the standard for stability in finance.”

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News