Mastering the Movement DeFi Ecosystem in One Article (2)|Advanced Edition

TechFlow Selected TechFlow Selected

Mastering the Movement DeFi Ecosystem in One Article (2)|Advanced Edition

The Movement ecosystem has welcomed a wave of new DeFi beginners, and our goal is to help these newcomers grasp the fundamentals of DeFi. This is also the second advanced installment in our series on different DeFi strategies within Movement.

Author: Movement Official Chinese

Yesterday, we introduced a beginner's guide to the Movement DeFi ecosystem. Today, let’s continue following Torab @torabyou for an advanced-level walkthrough.

This is part two of our series on different DeFi strategies within Movement. Do we still need to remind you this isn’t investment advice? Come on, if you know, you know. If you're a seasoned DeFi user, this might feel a bit basic—feel free to move on. But if you’re new, welcome aboard. Let’s dive in.

Projects covered today: @fraxfinance, @AnzenFinance, @BTClayer2 , @Lombard_Finance, @meridian_money , @LayerBankFi,

@canopyxyz, @StableJack_xyz, @zerufinance, @YuzuDEX.

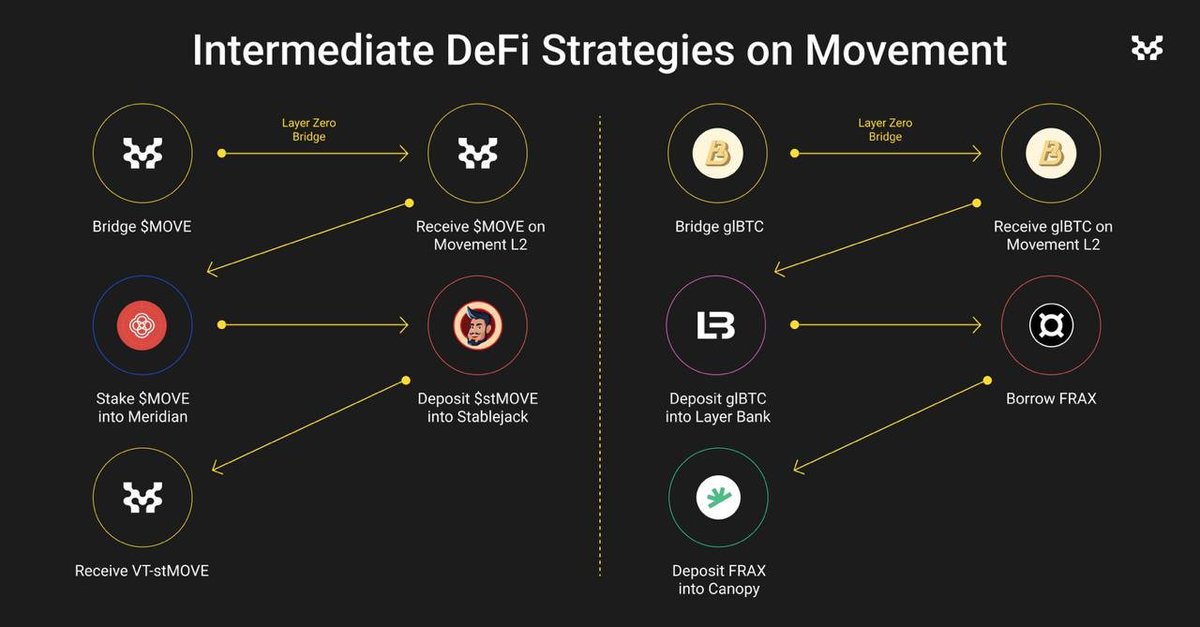

🟡Strategy One

Use Movement Bridge, powered by @LayerZero_Core, to bridge $MOVE onto Movement. Stake your $MOVE on Meridian to receive $stMOVE, then deposit $stMOVE into StableJack to earn leveraged yield and receive VT-stMOVE.

@meridian_money is our ecosystem’s DEX and liquid staking protocol, which has already raised $4 million and is becoming a cornerstone of our DeFi ecosystem.

@StableJack_xyz offers leveraged yield-bearing assets and also serves as a trading platform for yield and volatile markets.

🟡Strategy Two

Bridge glBTC (BTC LST) from BEVM to Movement. Deposit your glBTC into LayerBank and borrow FRAX. Then deposit the FRAX into Canopy, a yield aggregator. Canopy will automatically find the most profitable strategy to maximize your FRAX returns.

@BTClayer2 is a Bitcoin Layer 2 based on the "Super Bitcoin" mechanism, whose BTC LST is glBTC—usable on Movement.

@LayerBankFi is an omnichain lending protocol with hundreds of millions in TVL.

@fraxfinance is a censorship-resistant decentralized stablecoin pioneered by @samkazemian.

@canopyxyz is a composable Move-native yield aggregator.

🟡Strategy Three

Bridge LBTC (BTC LST) to Movement. Deposit your LBTC into Zeru Finance. After borrowing USDC, deposit it into Anzen to mint USDz—a privacy-credit-backed, yield-generating real-world asset (RWA).

@Lombard_Finance is a BTC LST that enables @babylonlabs_io users to earn staking rewards via LBTC while participating in DeFi.

@zerufinance is an omnichain credit infrastructure and money market with potential for uncollateralized lending.

@AnzenFinance pioneered USDz, enabling everyday users to access high yields through privacy-credit-backed, yield-generating RWAs.

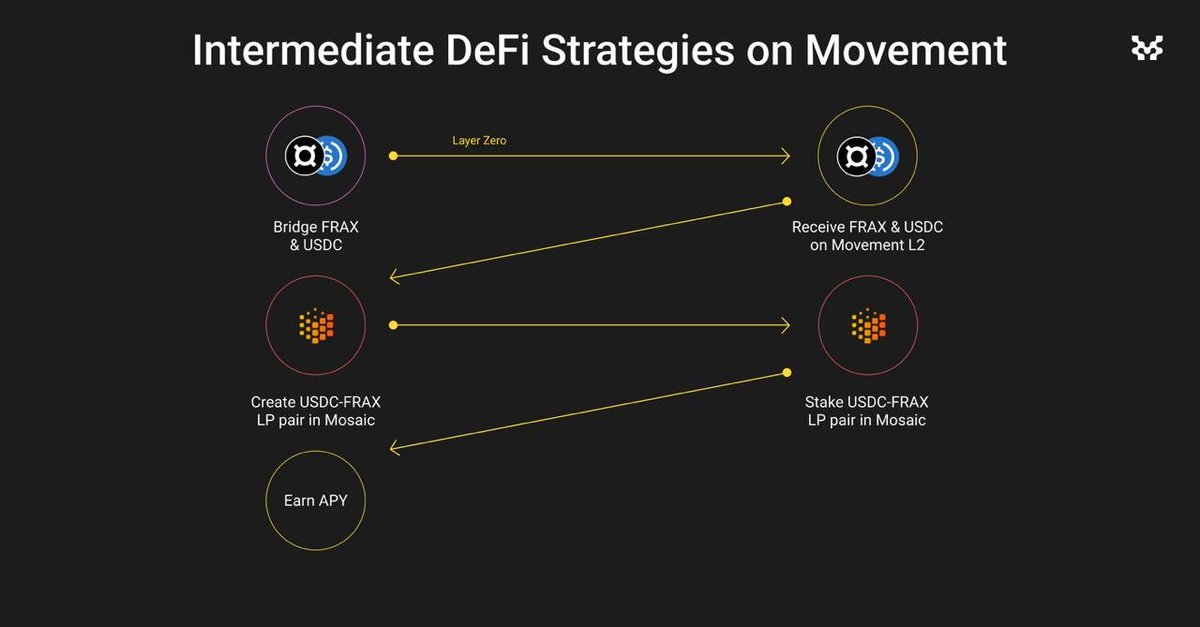

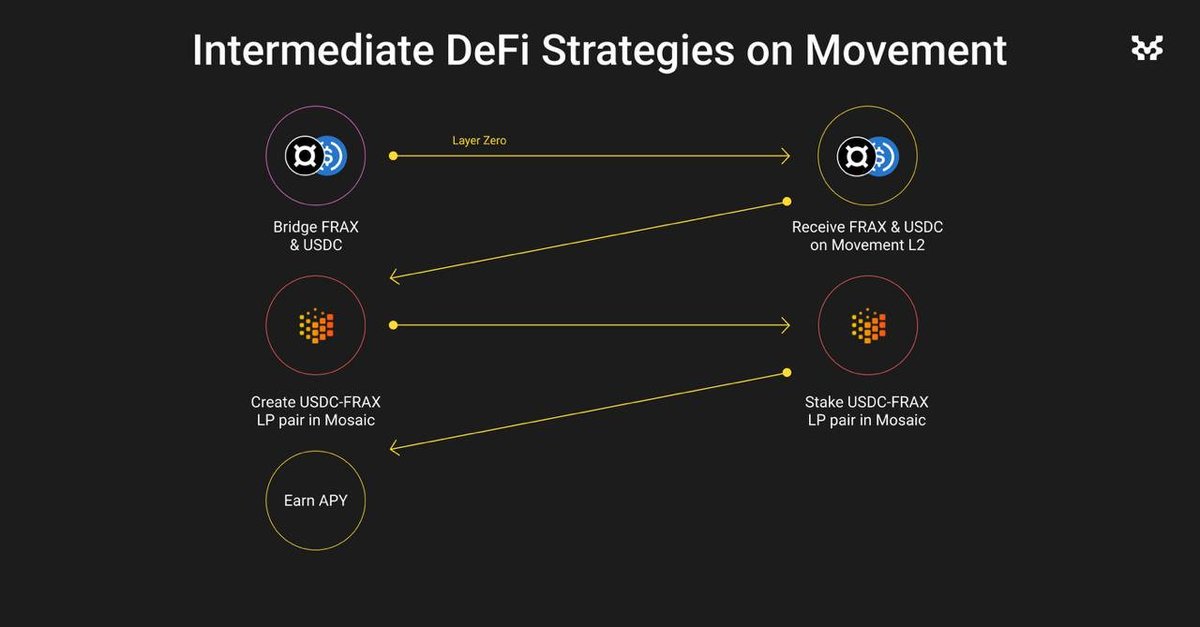

🟡Strategy Four

Bridge USDC and FRAX to Movement. Then provide them as a liquidity pair on Yuzuswap (DEX). By staking your USDC-FRAX LP tokens, you can earn trading fees and additional yield.

@YuzuDEX is a decentralized exchange built on the V2 AMM model, with more products coming soon. If you’ve never provided liquidity before, I recommend starting with stablecoins. Here’s a quick intro to being a liquidity provider from @Gemini:https://gemini.com/cryptopedia/liquidity-provider-amm-tokens…

We expect hundreds of millions in TVL during the first month of mainnet launch, including BTC LST, ETH LST/LRT, stablecoins, RWAs, and meme tokens. DeFi is the backbone of every respected blockchain, and Movement is no exception. Stay tuned—we’ll be releasing more video content introducing the advantages of DeFi!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News