From CoinList to a Leading Public Chain: Data-Driven Insights into Solana's Rise

TechFlow Selected TechFlow Selected

From CoinList to a Leading Public Chain: Data-Driven Insights into Solana's Rise

In 2024, Solana's on-chain activity grew by nearly 1900%, with monthly active addresses reaching 100 million.

Author: Builders

Translation: TechFlow

Solana made waves in the crypto space when it launched via CoinList in 2020, selling 8 million SOL tokens at $0.22 each. Prior to that, CoinList had collaborated with the Solana team for a year on the incentivized testnet Tour de Sol.

Today, the SOL token has appreciated nearly 820x, transforming Solana from a promising up-and-comer into the most popular blockchain ecosystem of 2024, capturing the attention of retail users, institutions, and developers alike.

To illustrate Solana’s dominance, let’s examine its recent growth metrics:

1. User Growth

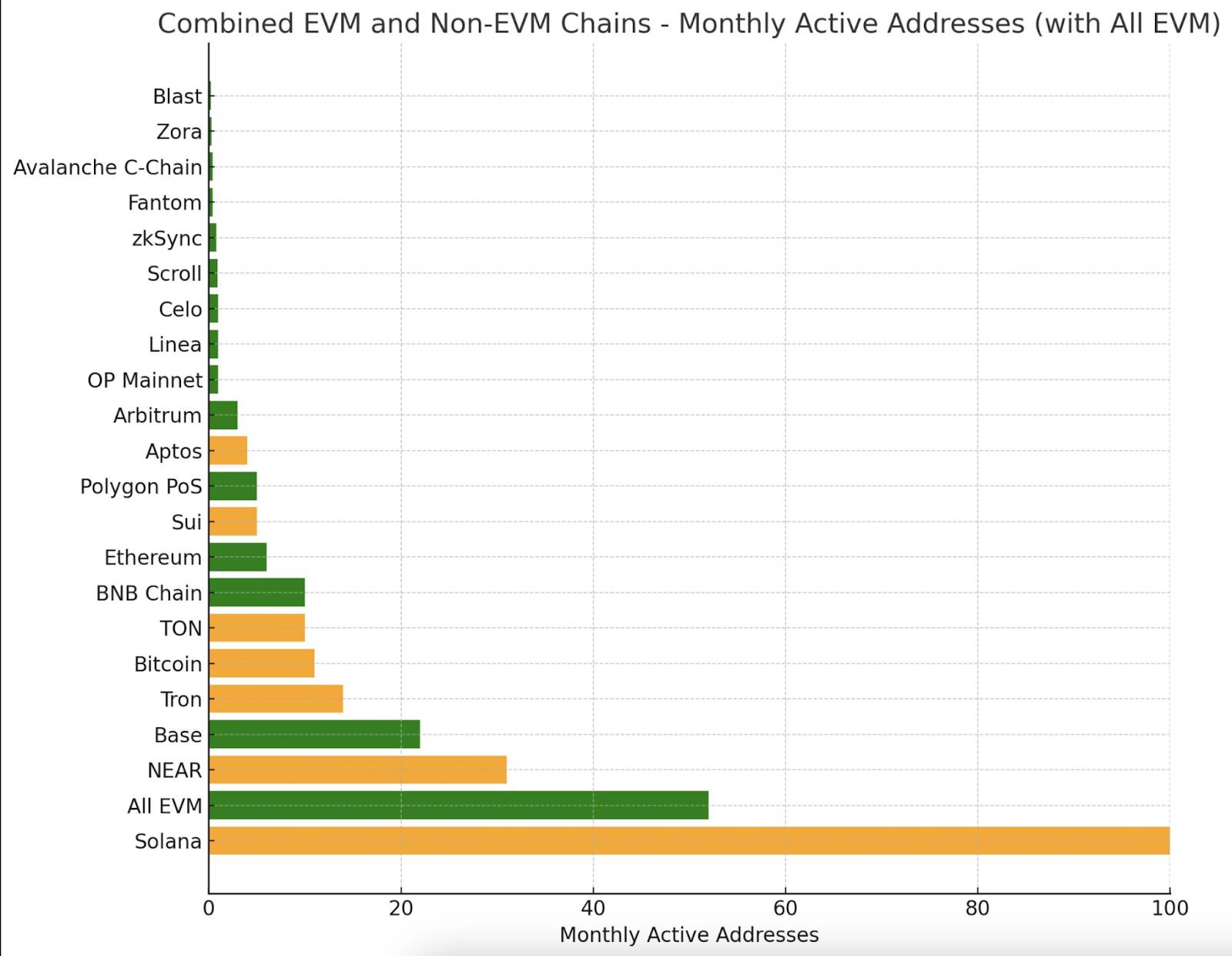

In 2024, on-chain activity on Solana surged by nearly 1900%, reaching 100 million monthly active addresses. In comparison, Base has 22 million monthly active addresses, while the combined total for all EVM chains stands at 52 million.

2. TVL & DEX Volume Surge

In October 2024, Solana's total value locked (TVL) reached a multi-month high of nearly $7 billion. The top five dApps by TVL are:

-

Jito ($247M TVL): Liquid staking

-

Kamino Finance ($172M TVL): Liquidity provider

-

Jupiter Exchange ($157M TVL): DEX

-

Raydium ($153M TVL): DEX and automated market maker

-

Marinade Finance ($964.08M TVL): Liquid staking

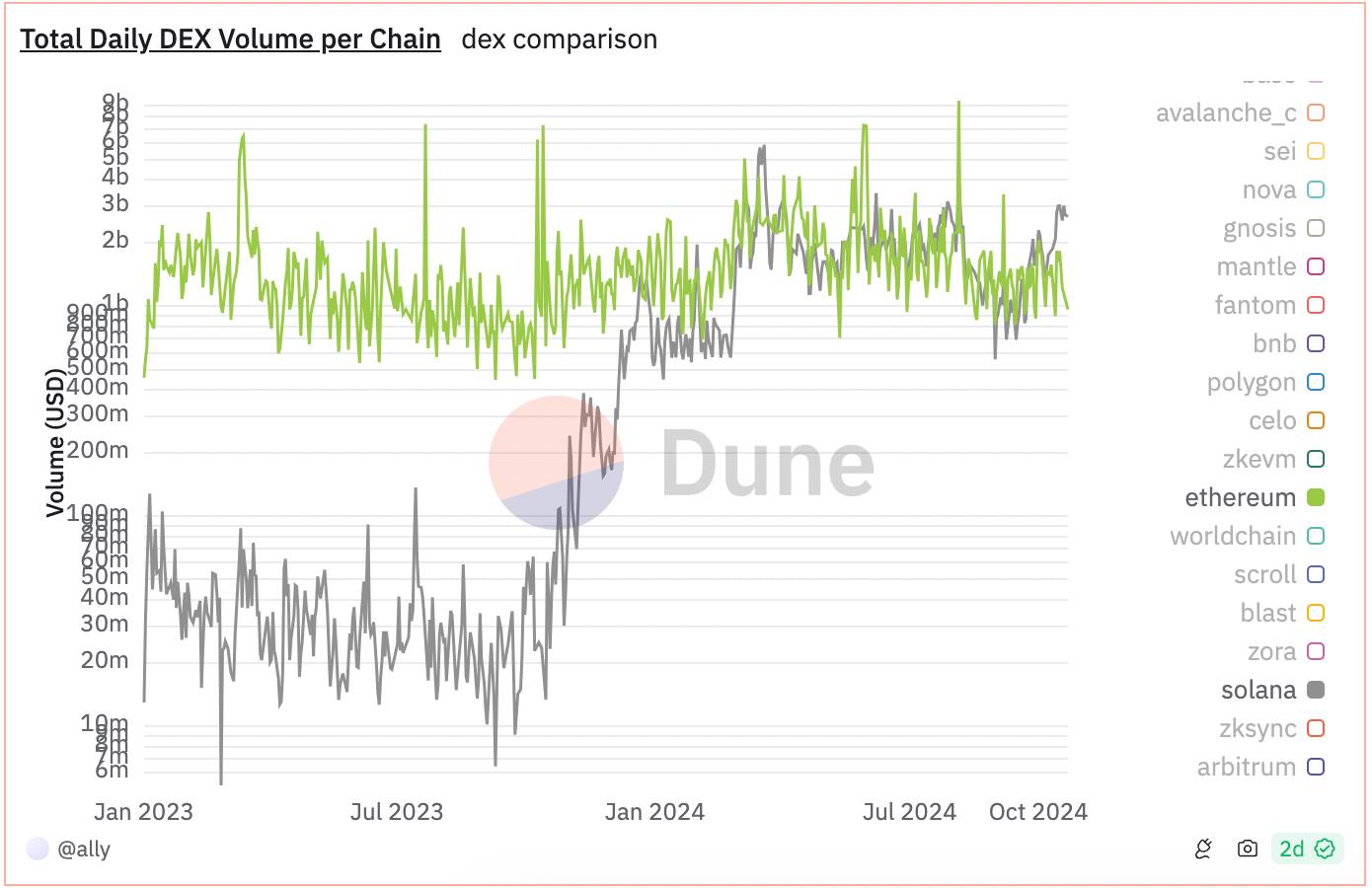

Meanwhile, daily DEX trading volume has been steadily increasing since August 2023, accelerating significantly at the start of 2024. At peak times, Solana’s DEX volume has matched or even exceeded Ethereum’s.

3. Rising Transaction Fees

Prior to December 2023, Solana’s share of monthly transaction fees never exceeded 1.5%. Since April 2024, however, Solana has consistently held over 10% of the fee market, peaking at 25% in July. Transaction fees directly reflect user engagement in valuable economic activity, their willingness to pay for execution, and validators’ ability to earn revenue.

4. Memecoin Mania

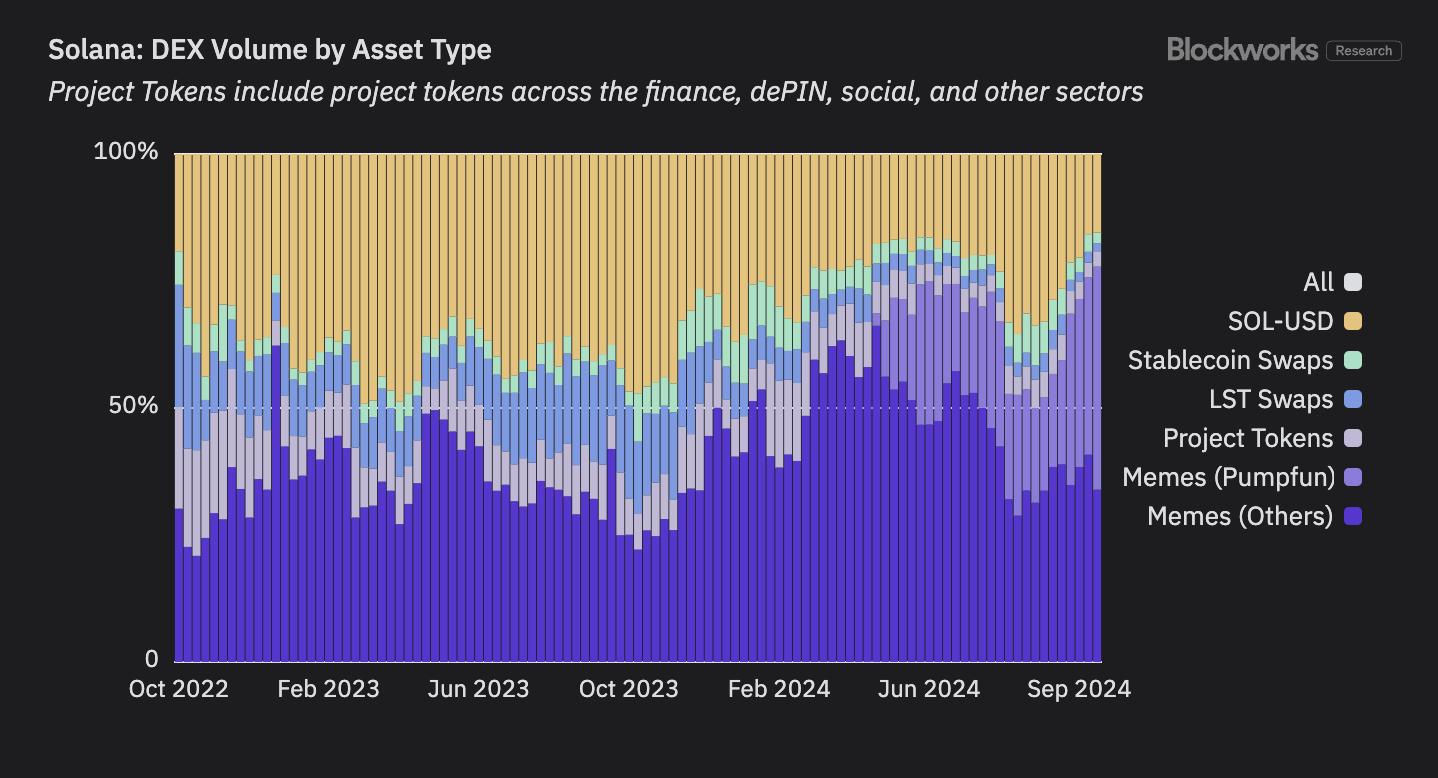

Solana has become the go-to chain for memecoins. For example, Popcat (POPCAT) and dogwifhat (WIF) surged by 12,882% and 1,108% respectively between January and September 2024. Developers choose Solana due to its high throughput, low-cost transactions, and a thriving community of memecoin traders. This surge in memecoin launches drove a 151% increase in network activity on Solana this year. Additionally, meme tokens accounted for 77.8% of recent Solana-based DEX trading volume.

5. Ecosystem Funding

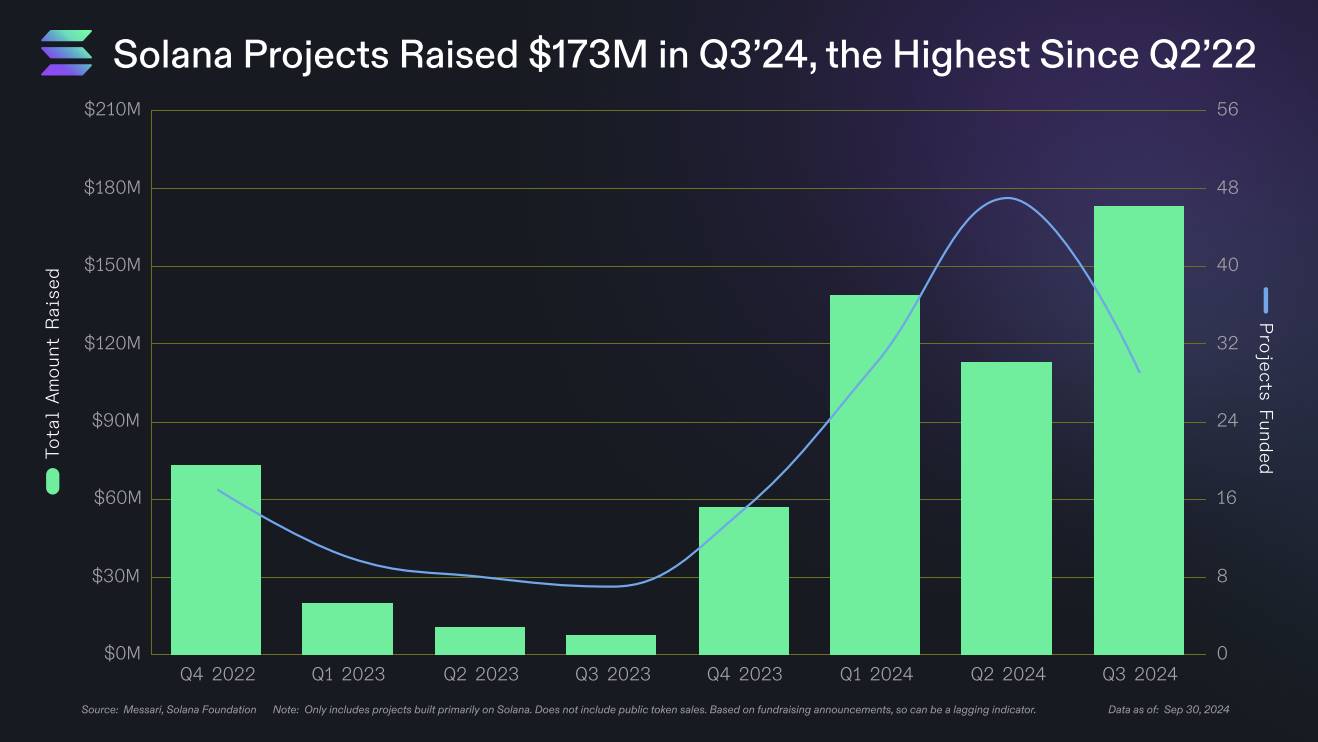

In Q3 2024, Solana-based projects raised $173 million, while Colosseum’s second hackathon saw a 36% increase in registrants compared to the first.

6. Accelerating Institutional Interest

Franklin Templeton, Securitize (BlackRock’s BUIDL tokenization partner), and Société Générale have all announced upcoming projects built on Solana. Meanwhile, firms like Jump Crypto and Multicoin Capital have increased their involvement in the Solana ecosystem, providing liquidity and bolstering long-term confidence.

7. Mobile dApps

To reach millions of users, dApps must meet users where they are—on mobile. Jupiter, DRiP, and PhotoFinish LIVE have announced mobile apps, while Solana Mobile’s Seeker and Jambo’s JamboPhone 2 aim to deliver crypto-native mobile devices.

8. DePIN Growth

Projects like Helium (over 1 million hotspots), Hivemapper (mapped over 7.5 million kilometers of roads), and Render Network are leveraging Solana’s infrastructure to demonstrate real-world applications beyond the EVM ecosystem, highlighting Solana’s role in decentralized physical infrastructure networks (DePIN).

Solana’s rise has sparked discussions about whether it could surpass Ethereum in market capitalization in the near future.

Can SOL overtake ETH? Time will tell. Stay tuned to CoinList for the next market moves.

Legal Disclaimer

This blog post is published by Amalgamated Token Services Inc., “CoinList,” or its subsidiaries. Use of this article and the CoinList website is subject to certain disclosures, limitations, and risks, available here.

The content herein should not be considered investment, legal, or technical advice; please consult your advisors. CoinList and its employees, executives, directors, and affiliates may hold interests in assets and/or projects mentioned in this blog post.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News