Trump vs. Harris: How Should U.S. Stock Investors Navigate the Election Season?

TechFlow Selected TechFlow Selected

Trump vs. Harris: How Should U.S. Stock Investors Navigate the Election Season?

Will the "Trump trade," fully embraced by Wall Street, face a new landscape?

By RockFlow

Key Takeaways

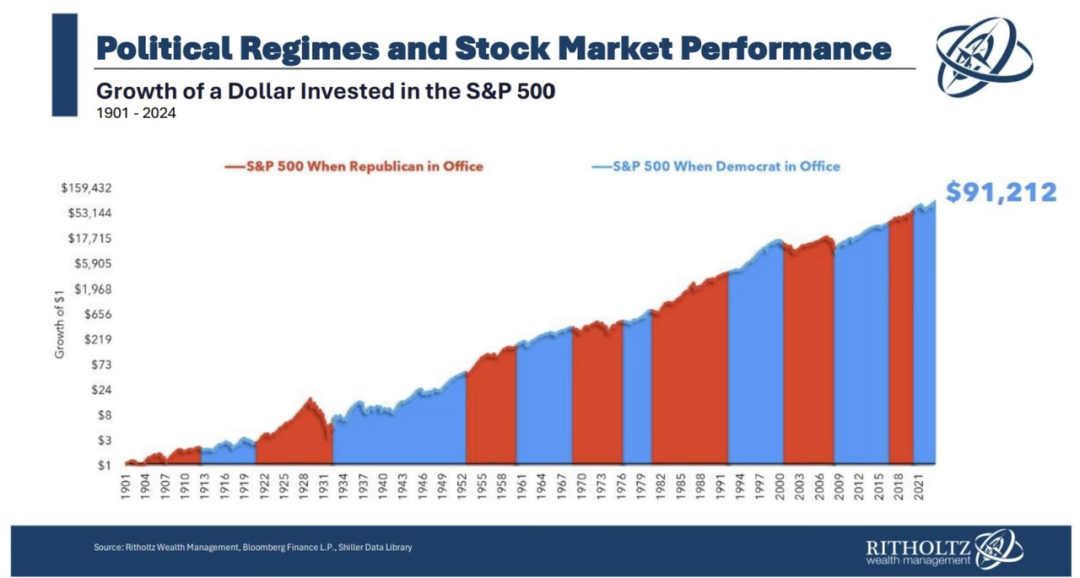

① Historical S&P 500 index data since 1901 shows that regardless of which political party occupies the White House, the index rises over the long term.

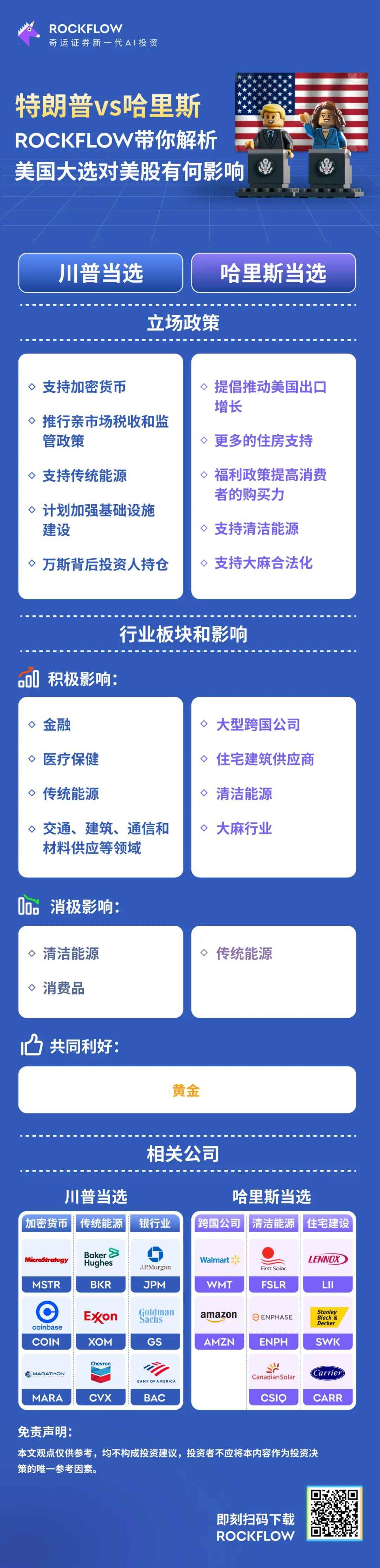

② The market generally believes that, given Trump's current stance, he supports cryptocurrencies, traditional energy, infrastructure development, and tax cuts; whereas if Harris takes office, she would favor welfare programs, healthcare, green energy, U.S. export growth, and housing support.

③ U.S. equity markets are now repricing the "Trump trade." For example, DJT, Trump’s social media company, has doubled since October; Phunware is up over 200% month-to-date; additionally, crypto-related stocks endorsed by Trump have rallied collectively, with Bitcoin rising more than 10% from its monthly low.

Following the Federal Reserve's recent announcement of its first interest rate cut since 2020, market attention is now turning to the next major event—the U.S. presidential election on November 5.

The chart below shows the historical performance of the S&P 500 index since 1901, with red indicating periods of Republican leadership and blue representing Democratic administrations. Historical data indicates that no matter which party holds the presidency, the index trends upward over the long run.

However, due to differing policy platforms between candidates, the outcome of the election will significantly impact various sectors of the U.S. stock market.

Recent polls show Harris and Trump locked in a tight race. In an ABC/Ipsos poll, Harris leads by four points, while Trump holds a slight edge in other surveys. This suggests that Harris’s support has declined since The New York Times’ early-October poll.

This dynamic explains why Goldman Sachs, JPMorgan Chase, and Deutsche Bank have recently issued statements signaling Wall Street’s growing bet on the “Trump trade.” A JPMorgan report on the 17th noted that hedge fund capital flows show strong preference for Republican-themed investments, while renewable energy—seen as a key beneficiary of a Democratic victory—has been heavily sold off in recent weeks.

The market broadly expects that, based on his current positions, Trump would support cryptocurrencies, traditional energy, infrastructure spending, and tax reductions. In contrast, a Harris administration would likely emphasize welfare expansion, healthcare reform, green energy initiatives, U.S. export growth, and housing assistance.

RockFlow has thoroughly analyzed the distinct policy stances of both candidates and their implications for relevant sectors, listing associated companies and investment targets to help investors identify opportunities arising from this pivotal event.

1. The Trump Trade

Recently, as Harris’s polling lead over Trump narrows, betting odds also indicate Trump has overtaken Harris. Markets are once again embracing the “Trump trade.”

Take DJT, Trump’s social media company: the stock has doubled since October. Phunware is up over 200% month-to-date. Moreover, crypto-related stocks publicly backed by Trump have rebounded collectively, with Bitcoin rising more than 10% from its monthly low.

RockFlow’s research team previously launched a “Trump portfolio,” compiling key investment targets linked to the “Trump trade,” including DJT (Trump’s media platform), PHUN (which developed campaign apps for Trump’s 2020 campaign), RUM (a video platform popular among Trump supporters), defense contractors Lockheed Martin and Raytheon Technologies (expected to benefit from increased military spending under Trump), CAT (likely to gain from Trump’s proposed tax cuts and infrastructure plans), and Tesla (Elon Musk being a staunch Trump supporter).

In addition, given Trump’s political stance and policy preferences, pharmaceutical stocks (such as Eli Lilly) and bank stocks (Goldman Sachs, JPMorgan Chase, etc.) may also benefit should he return to power.

Specifically, investors should focus on the following four sectors:

1) Trump supports cryptocurrencies, potentially benefiting MSTR, COIN, MARA

Trump attended the Bitcoin 2024 conference and shared his views on digital assets. He declared that if re-elected, he would work to make the U.S. the world’s “cryptocurrency hub” and a “Bitcoin superpower.” He pledged to promote Bitcoin mining and adoption under his administration to ensure American leadership in the global crypto industry. Trump also announced that the federal government would retain all of its approximately 210,000 Bitcoins—about 1% of total supply—making the U.S. the first country to include Bitcoin in its national strategic reserves, assigning it a status similar to gold.

2) Trump supports traditional energy, potentially benefiting BKR, XOM, CVX

This year, the Republican Party released an updated platform. On energy policy, it shifted from “supporting all tradable energy sources without subsidies” to “maximizing energy production, streamlining permitting, removing improper restrictions on oil, gas, and coal markets, achieving U.S. energy independence, opposing green policies, and eliminating EV subsidies.” Under Trump’s leadership, Republicans advocate stronger energy independence and show clearer support for traditional energy while suppressing new energy development.

3) Trump favors deregulation of financial institutions, potentially benefiting JPM, GS, BAC

Trump’s regulatory stance toward financial institutions, particularly banks, leans toward loosening constraints and reducing requirements related to capital and capital adequacy ratios. He argues that deregulation can release capital within the banking system, encouraging greater lending activity. Additionally, Trump’s proposed tax reforms could enhance profitability for financial firms.

4) Trump plans to expand infrastructure investment, potentially benefiting CAT

Trump’s proposed infrastructure initiative remains a market focal point. Aimed at large-scale public and private funding, the plan seeks comprehensive upgrades to America’s infrastructure. Increased investment in infrastructure is expected to benefit industries closely tied to construction, including transportation, building materials, communications, and supply chains.

2. The Harris Trade

In contrast to Trump, Kamala Harris emphasizes inclusive economic growth, sustainability, and addressing wealth inequality. If Harris wins, investors should pay close attention to the following potential beneficiaries:

1) Harris advocates boosting U.S. exports, potentially benefiting WMT, AMZN

Harris takes a more moderate and business-friendly stance on tariffs compared to Trump. She argues that Trump’s tariff policies increase consumer spending on gasoline and groceries, placing pressure on middle-class households. Instead, she promotes expanding U.S. exports. This approach could positively impact global trade, especially for large U.S. multinationals with extensive overseas operations and international revenues.

2) Harris calls for stronger housing support, potentially benefiting SWK

According to prior reports, Harris aims to build 3 million new homes over the next four years to address housing shortages and soaring prices. She also proposes eliminating tax incentives for Wall Street firms buying homes to curb rapid price increases. On the demand side, Harris plans to provide substantial down payment assistance and tax credits for first-time homebuyers to stimulate the market. These measures could positively impact residential construction suppliers.

3) Harris supports clean energy, potentially benefiting FSLR, ENPH, CSIQ

With Harris’s backing, the Biden administration successfully passed the landmark Inflation Reduction Act. She has also proposed allocating $20 billion to the EPA’s Greenhouse Gas Reduction Fund to accelerate clean energy deployment. Harris emphasizes strict regulation of oil companies and other polluters—she previously sued multiple fossil fuel firms, including one pipeline operator over oil spills and launched investigations into ExxonMobil for allegedly misleading the public on climate change. Her stance on advancing clean energy may be even more aggressive than Biden’s.

4) Harris supports marijuana legalization, potentially benefiting TLRY, CGC

The Democratic Party is pushing to legalize marijuana at the federal level, and Harris supports this effort. During a previous vice-presidential debate, she stated that the Biden-Harris administration is committed to “legalizing marijuana and clearing criminal records for those convicted of marijuana-related offenses.” Harris has openly criticized existing cannabis restrictions as “unreasonable” and called on the Drug Enforcement Administration (DEA) to reschedule marijuana. Therefore, if Harris wins, the cannabis industry could become one of the primary beneficiaries.

3. Conclusion

RockFlow’s research team believes the upcoming U.S. presidential election will create new investment opportunities in the U.S. stock market. Investors who anticipate a Trump victory may consider exposure to cryptocurrencies, traditional energy, and infrastructure sectors. Those expecting a Harris win may look to healthcare, green energy, and housing-support-related equities.

The stocks linked to the “Trump trade” and “Harris trade” will continue to spark intense discussion over the next two weeks. Only by deeply understanding each candidate’s policy agenda and the sector-specific impacts of their priorities can investors effectively navigate risks and capture market opportunities.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News