Crypto x AI: Is It Still a Big Opportunity Now?

TechFlow Selected TechFlow Selected

Crypto x AI: Is It Still a Big Opportunity Now?

AI could be the best opportunity in the crypto space so far.

Author: Teng Yan

Translation: TechFlow

I often tell my friends that when we look back on the period from 2022 to 2024, we’ll realize it was a pivotal era of dramatic technological acceleration.

AI may well be the most transformative tech trend in our lifetimes—unless we happen to discover a miracle that extends human life by centuries.

This means AI is now red-hot, and everyone wants in.

In the first half of 2024 alone, AI startups attracted $35 billion in investment. And that’s just private funding—the internal investments made by big tech companies are even larger, as they buy GPUs en masse from NVIDIA, pushing the company’s market cap to an astonishing $3 trillion.

Yet amid this frenzy, one massive opportunity remains overlooked by many: crypto AI (or decentralized AI).

As early as 2019, a forward-looking comic strip hinted at this very idea.

History shows that every decade brings seemingly implausible or even foolish investment opportunities that ultimately prove visionary.

Social media was once dismissed as mere teenage entertainment with no viable business model. Yet today, Meta (formerly Facebook) stands among the world’s most influential companies, delivering over 1,000x returns to early investors.

The story of crypto AI is both urgent and compelling. When I explain it to others, most grasp it immediately.

At its core, AI concentrates power. Left unchecked, it risks consolidating control within a few monopolistic entities, which will inevitably use AI for profit and dominance. Thus, decentralized AI is critical to our future—and key to building a brighter, fairer society. I’ve written extensively about this philosophical imperative.

Yet skeptics argue that combining crypto with AI is merely buzzword hype, pointing out that in areas like entertainment, gaming, and social media, crypto has yet to deliver lasting impact or widespread adoption. I’ve even heard such concerns from sharp investors—it’s a valid point.

But I believe this time is different.

There are strong reasons why crypto AI will follow a fundamentally different path. This article lays out those reasons.

The scope turned out broader than I initially expected, so I’ve decided to split it into multiple parts.

In this three-part series, I’ll dive deep into the technical and investment landscape of crypto AI. I’ll highlight the most promising areas and share how I’m positioning myself to capture this emerging mega-trend.

Part One: Why Crypto AI Deserves Your Attention

Part Two: My Thoughts on AI Agents, Decentralized Training, Verifiable Inference, Data Networks (and Other Sub-Sectors of Crypto AI)

Part Three: Multiple Ways to Capture Value from This Opportunity

As AI grows more pervasive in the world, we need more cryptography to constrain it and establish pricing and protection mechanisms for our most precious and irreplaceable resource—time. — Preston Byrne

Standing at the Intersection of Technological Trends

As savvy investors and entrepreneurs, we always seek to ride waves of transformation.

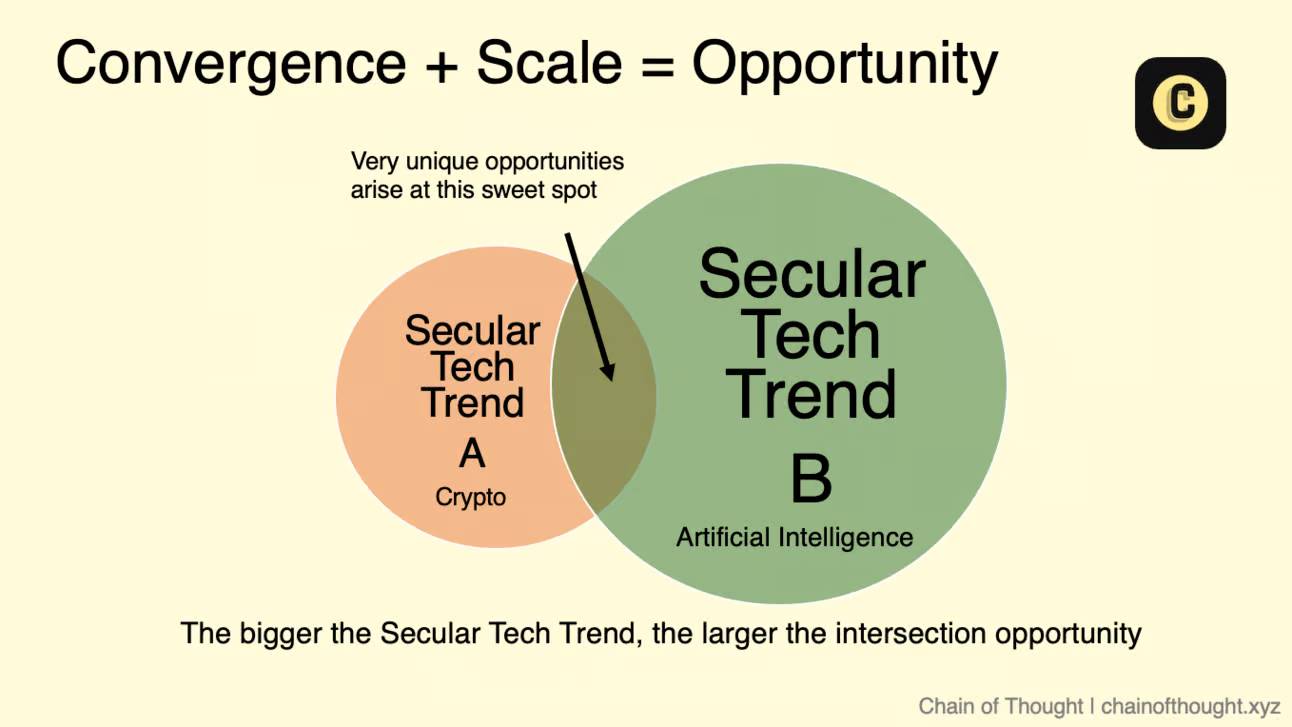

To catch the biggest waves, we must identify where major trends converge, then position ourselves there.

This means spotting profound behavioral shifts driven by technological progress—long-term tech trends capable of redefining entire industries.

Crypto is one such trend, reshaping how we think about and use money. Others include cloud computing, mobile technology, and clean energy.

But following a single tech trend isn’t enough. Countless others see the same trend and make similar bets. To truly stand out, we need to go beyond the obvious.

That’s why the early convergence of two major tech trends is so compelling.

This is where miracles happen.

Fusion + Scale = Opportunity

(1) The Power of Convergence

When two long-term trends intersect, they create fertile ground for innovation and value creation—often in overlooked places.

-

Multiple Growth Drivers: Companies at the intersection benefit from growth in each individual trend.

-

Reduced Competition: Deep expertise across multiple domains creates high barriers to entry, allowing unique positioning.

-

Cross-Pollination of Ideas: Fuels novel products and business models.

(2) The Power of Scale

Market size matters deeply in investing.

Consider Amazon in the early 2000s. Its success wasn’t just due to e-commerce, but also because it captured the nascent cloud computing wave through Amazon Web Services (AWS). AWS now generates billions annually and leads the rapidly expanding cloud infrastructure market.

The larger the long-term tech trend—measured by total addressable market or growth potential—the greater the opportunity at its intersection points, especially when entered early.

Big trends not only buffer against failure but massively amplify potential returns.

Crypto x Artificial Intelligence

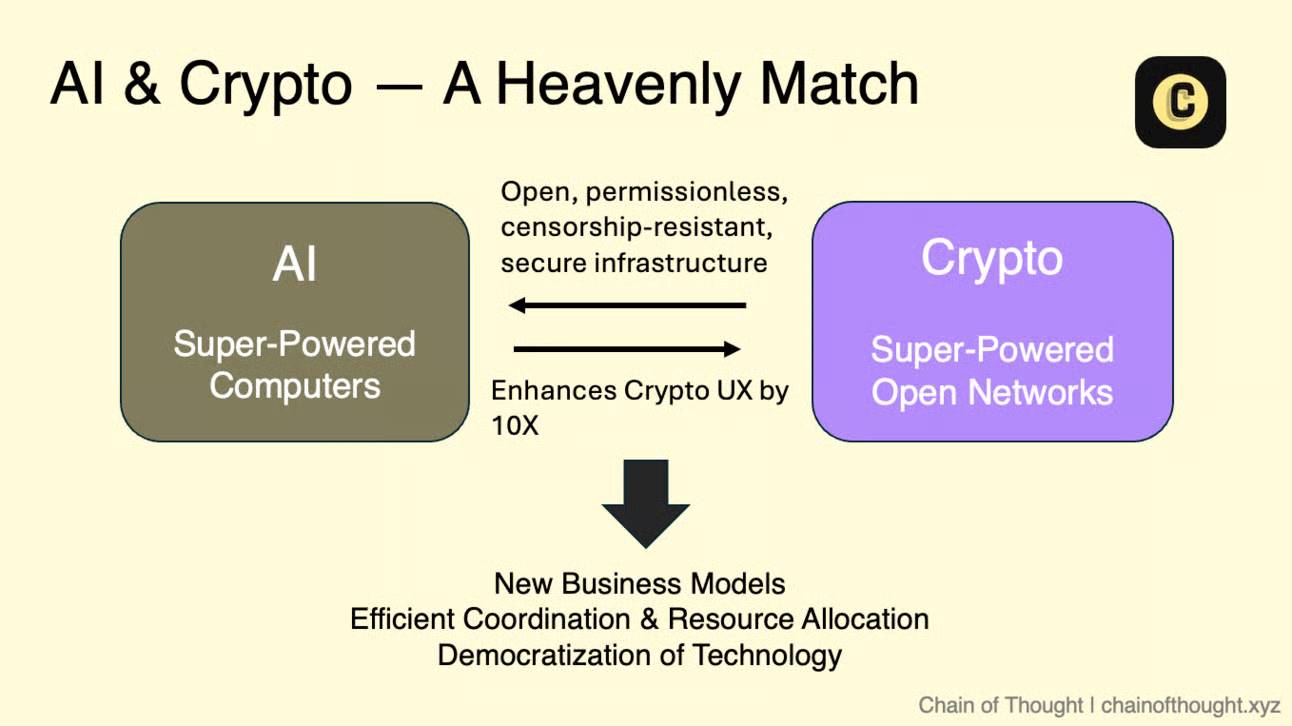

CPUs and GPUs have long powered computation. Now, they drive AI, turning the world into a supercomputer harnessing humanity’s collective intelligence and creativity.

Crypto enables open, decentralized networks—laying the foundation for the next-generation internet.

Together, these supercomputers and super-networks complement each other perfectly.

-

AI enhances the user experience of crypto. Users can interact with blockchains via natural language, without needing to learn wallet management, seed phrases, or transaction signing.

-

Crypto provides AI with trustless, permissionless, and secure infrastructure, ensuring openness and censorship resistance. It also serves as a powerful coordination layer for decentralized networks.

-

This fusion opens the door to entirely new business models.

The combination of crypto and AI will enable exponential growth, as both fields advance along independent trajectories.

The key is identifying what crypto enables AI to do that was previously impossible—that’s where the magic lies. Hint: distributed training, data networks, and private data. More on this in Part Two.

Lessons from History: The Cases of NFTs and DeFi

The floor price of Bored Ape Yacht Club NFTs soared. Yuga Labs raised $450 million in 2022 (source: Coingecko).

The rise and fall of NFTs offer crucial lessons.

NFTs briefly shone during speculative surges within the crypto community, but lacking support from another long-term tech trend, they struggled to scale. Entertainment and gaming—the primary use cases for NFTs—are complex, mature markets dominated by entrenched traditional players whose momentum isn't purely tech-driven.

As a result, NFTs failed to sustain their early momentum. While real applications exist, realizing their full potential will take much longer.

In contrast, DeFi exemplifies successful convergence of long-term trends.

DeFi merged fintech with crypto to revolutionize financial services, offering alternatives to traditional banking, lending, and asset management—meeting real-world financial needs. Today, stablecoins have reached an all-time high market cap of $170 billion and continue growing, while $82 billion is locked in DeFi protocols.

Tokens: Open-Source AI Needs Crypto

The closed nature of large language models at big tech firms hinders “AI democratization.” Every developer or user should be able to contribute algorithms and data to LLMs and share in future revenues. AI should be accessible to all, relevant to everyone, and collectively owned. — Catrina Wang (Portal Ventures)

When people ask me why AI needs crypto, my answer is simple: Tokens.

Traditional software scales almost at zero marginal cost. Once written, code can be deployed anywhere.

AI, however, is fundamentally different. It requires massive capital and ongoing marginal costs.

Training and deploying large-scale AI models demand enormous computational resources, making efficiency and access to infrastructure critical success factors.

Today, we live in a world dominated by centralized giants—OpenAI, Anthropic, Google. These companies possess abundant talent, hardware, and capital. But let’s be honest: corporate-owned AI always prioritizes profit maximization.

While Meta’s contributions to open-source AI are invaluable, who’s to say they won’t stop releasing cutting-edge models like Llama 3? Developing these systems costs hundreds of millions. If Zuck has a bad day, the project could be shut down.

Relying solely on ideals or goodwill to expect open-source efforts to compete with these giants is frankly unrealistic. We need new strategies.

In fact, outside top-tier AI research labs, vast untapped computing resources, research, and talent exist—universities, research centers, collaborative platforms like Hugging Face, and individual AI researchers. But currently, these resources are fragmented, lacking the coordination needed for breakthrough-scale progress.

This is where tokens shine.

As @long_solitude at Zee Prime noted, tokens embody crypto’s most powerful feature: permissionless capital formation.

Tokens enable things traditional financing cannot:

-

They provide bottom-up funding for experimental AI projects that might never get off the ground under traditional venture capital models.

-

They bootstrap decentralized networks by distributing ownership and value to contributors, transforming them into thriving, self-sustaining ecosystems. Bittensor is an early proof-of-concept example.

-

Through DePIN-style tokenomics, they unlock entirely new business models that drastically reduce costs—for instance, shifting huge upfront infrastructure costs from AI startups onto the network itself, or leveraging idle GPUs in homes worldwide to lower per-unit compute costs.

Tokens offer ordinary investors unprecedented access to the AI wave—an opportunity often underestimated.

Crypto excels at discovering new markets people are eager to trade. Consider NFTs and cultural assets, social tokens for creators, and viral memecoins.

I believe there’s immense, largely untapped demand from everyday investors to participate in early-stage AI projects.

As AI becomes more deeply embedded in daily life and empowers us to do things previously unimaginable, people are beginning to grasp its scale and reality. While speculation will run high, this is also about enabling everyone to join the greatest technological revolution of our lifetime—and giving everyone a shot at the next big opportunity.

Expect more surprising developments ahead.

So Why Now?

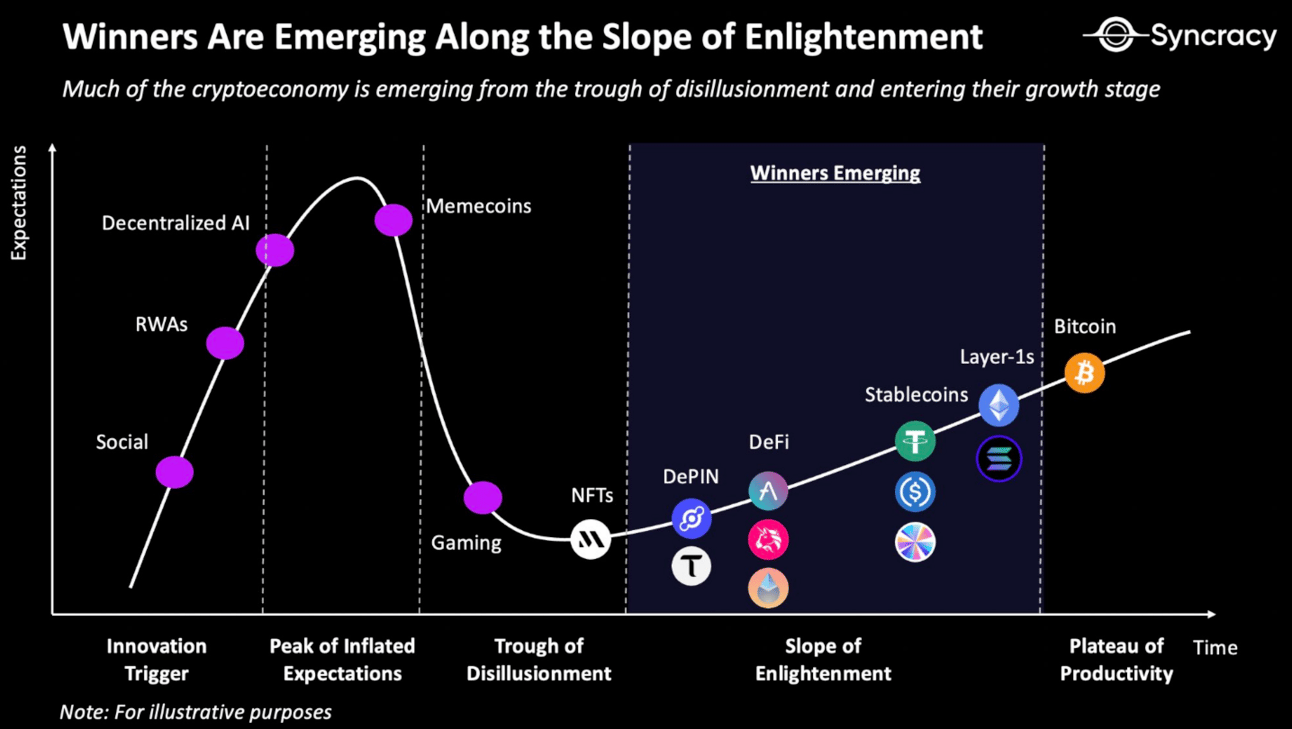

Source: Syncracy Capital

New technologies often follow a clear innovation cycle.

The Gartner Hype Cycle is one of the best-known frameworks, illustrating how innovations go through phases of hype, fall into the trough of disillusionment, and eventually reach practical adoption.

For investors, ideal entry points are either at the trigger of a new innovation—before the hype peak—or during the trough of disillusionment, when promising startups can be identified before maturity.

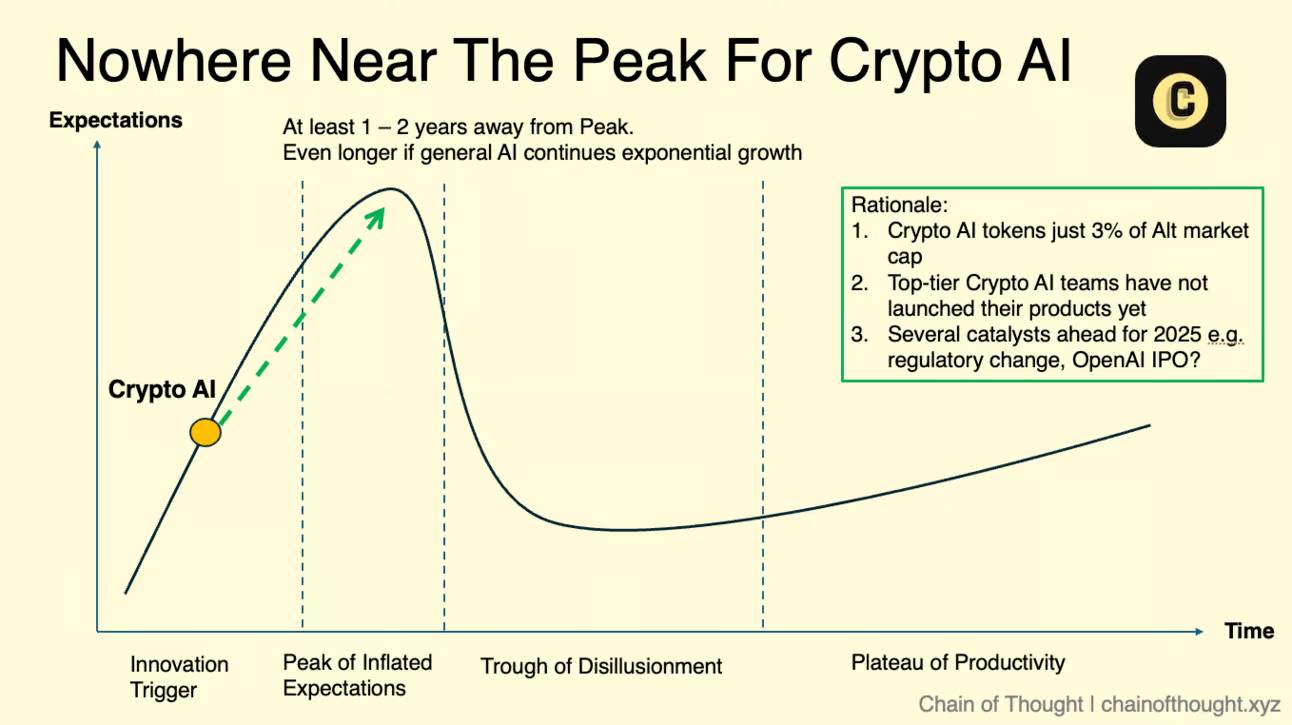

So here’s the million-dollar question: Where are we in the innovation cycle of Crypto AI?

I like using Syncracy Capital’s chart to illustrate current consensus.

It suggests decentralized AI is approaching or has already reached the peak of inflated expectations. Crypto AI has performed strongly this year, with several protocols reaching multi-billion dollar valuations.

But I disagree. I believe the peak of Crypto AI is far from here.

Current consensus vastly underestimates the field’s future potential. We haven’t even entered the mania phase yet. Ask around—how many people truly understand Bittensor as a Crypto AI indicator? I believe it may take another 1–2 years before we see the real peak.

Here’s why:

-

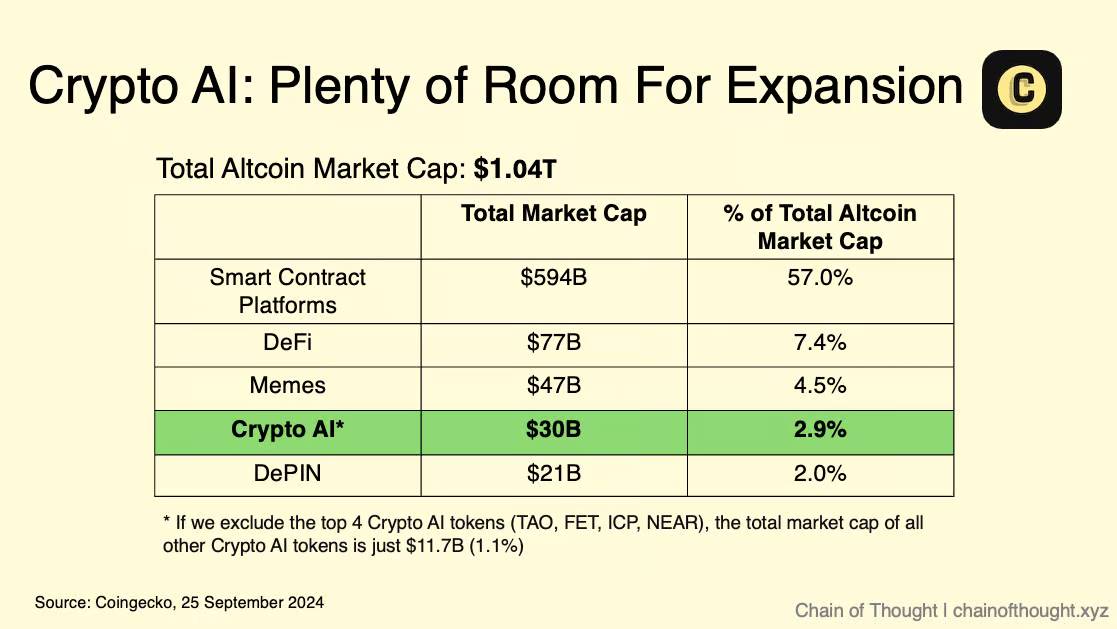

The total market cap of Crypto AI tokens is $30 billion, just 2.9% of the total altcoin market cap ($1.04 trillion).

Currently, only four major Crypto AI protocols—TAO, NEAR, FET, and ICP—have market caps between $5B and $10B.

Excluding these four, and noting that ICP and NEAR aren’t purely dedicated Crypto AI tokens, the total market cap of Crypto AI drops to just $11.7 billion—less than 25% of the memecoin market cap.

Only four other Crypto AI projects (RENDER, GRT, AKT, AIOZ) sit between $500M and $5B, with most below $100M–$200M.

Given the massive potential of this convergence trend, these valuations seem trivial. Crypto AI spans infrastructure and applications, including next-gen smart contract platforms designed for AI.

In comparison, the total market cap of current smart contract platforms nears $600 billion. There are 8 Layer 1 protocols above $10B, and 12 more between $1B and $10B.

How big could the Crypto AI market become? It’s too early to say precisely.

According to Bloomberg Intelligence, the generative AI market is projected to grow over 30% annually, reaching $1.3 trillion by 2032. If decentralized AI captures 10% of the overall AI market, and considering the typical 3x speculative premium in crypto markets, that implies a $390 billion market by 2032—13x today’s $30 billion.

I intuitively feel this forecast is too conservative and too distant to be actionable.

Alternatively, suppose that within the next 3 years (by 2027), Crypto AI captures 10% of the total altcoin market cap, as AI applications and smart contract platforms launch and gain momentum. If the altcoin market reaches $2.7 trillion (a 50% increase from its 2021 peak of $1.8 trillion), then Crypto AI would hit $270 billion—about 9x current levels. That implies $240 billion in latent value waiting to be unlocked.

But these figures are illustrative rather than predictive—too many variables remain. Still, they highlight the magnitude of the opportunity and provide a rational reference point when evaluating valuations.

-

Top-tier Crypto AI teams are just getting started

Many elite teams have been heads-down in R&D for 1–2 years and haven’t even launched their mainnets yet.

Some have already secured tens of millions in VC funding—projects like Sentient, Sahara, Vana, Story Protocol, Gensyn, Space and Time, Ritual, Nillion, and others. Over the next 12 months, we’ll see major mainnet launches and token releases—such as the AO Computer ecosystem, a project worth watching that I highlighted earlier this year.

-

AI is advancing rapidly

For example, OpenAI’s recently launched o1 model marks significant progress in reasoning capabilities. Scaling laws still hold, and Crypto AI will closely follow broader AI growth trends.

Still, the space is noisy—noisier than almost any other corner of crypto. Many startups and protocols, despite short-term traction, will inevitably fail.

Therefore, selectively identifying potential winners may be more effective than a broad, undisciplined approach.

Positive Catalysts in 2025

I expect multiple favorable catalysts to emerge in the coming year, driving industry development and market sentiment in Crypto AI.

-

Traditional Tech VCs Entering Crypto AI: While a16z is already involved, major funds like Sequoia, Lightspeed, and Accel have only dipped their toes. As they deepen their investments in decentralized AI, they’ll bring more capital and legitimacy to the space.

-

OpenAI IPO: OpenAI’s private valuation has reached $150 billion, with rising revenue. An IPO in 2025 could ignite retail enthusiasm for AI investing. Beyond NVIDIA and hardware, retail investors have few direct ways to gain AI exposure. This pent-up demand could spill into Crypto AI tokens, easily accessible on platforms like Coinbase.

-

A More Friendly U.S. Government: If the post-November 2024 election brings a more crypto-friendly administration, it could provide a massive boost to the Crypto AI sector—offering clearer regulation and encouraging broader adoption.

-

AI Breakthroughs: The pace of AI advancement shows no signs of slowing. In a recent blog post, Sam Altman shared his vision for a bright AI future. Progress in AI agents and distributed AI training will unlock new use cases and fuel further growth.

Risks in Crypto AI

While I’m optimistic about Crypto AI’s immense potential, I recognize nothing is guaranteed. My view could change if the following risks materialize:

-

Unfavorable Regulatory Environment: Hostile crypto regulations in major markets like the U.S. could stifle innovation, restrict capital flows, and push projects into gray zones. Tokens are central to decentralized networks—tight restrictions would undermine crypto’s core value proposition. This risk is lower if Trump wins, higher if Kamala becomes president.

-

AI Fails to Deliver: Despite current excitement and billions in investment, AI might fail to meet expectations. If progress stalls or hits roadblocks, the AI bubble could burst. I consider this unlikely.

-

No Large Market or Product-Market Fit (PMF): No matter how innovative, Crypto AI projects must achieve viable business models and product-market fit. If decentralized AI fails to integrate meaningful commercial applications, the industry could stagnate, becoming a niche segment.

-

Talent Shortage: Top ML scientists and engineers are scarce. If Crypto AI fails to attract enough elite talent who believe in an open, democratized AI future, innovation will slow, and competitiveness will erode.

Conclusion

Ironically, AI might be crypto’s best opportunity yet.

It paves the way for true mainstream applications and real-world use cases—something gaming, NFTs, and social apps have consistently failed to deliver.

We’re moving toward a future of decentralized AI powered by open, public networks. The most visionary founders and investors are already noticing.

In Crypto AI, the biggest challenge is that you can’t focus only on crypto. Doing so gives you a narrow, shallow understanding. You must keep up with the latest in machine learning, read Arxiv papers, and talk to founders who believe they’re building the next breakthrough in AI.

Honestly, I’ve never been more excited.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News