Latin America Cryptocurrency Market Overview: Growth Drivers, Institutional Recovery, and Innovation Pathways Amid Economic Turmoil

TechFlow Selected TechFlow Selected

Latin America Cryptocurrency Market Overview: Growth Drivers, Institutional Recovery, and Innovation Pathways Amid Economic Turmoil

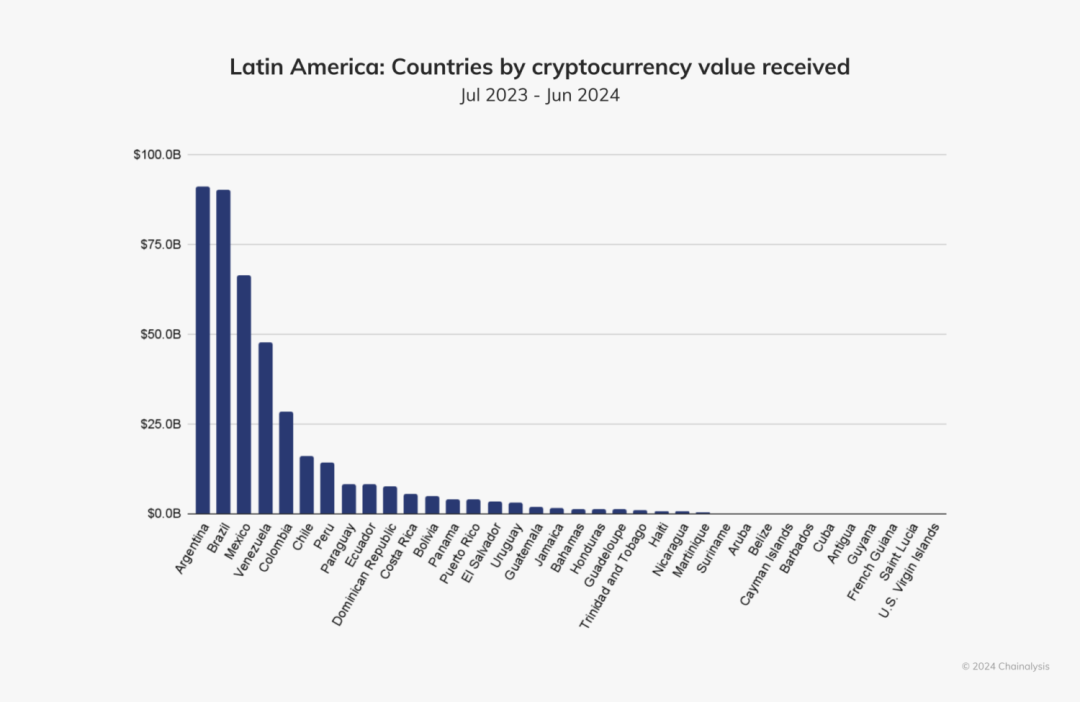

Argentina is the Latin American country with the highest value of cryptocurrency received, approximately $91.1 billion, slightly higher than Brazil's $90.3 billion.

Written by: Chainalysis

Translated by: Aiying Team

As Web3 and cryptocurrency technologies rapidly evolve, the global economic landscape is undergoing continuous transformation. Latin America has emerged as a region with significant growth potential amid unique challenges. Against this backdrop of globalization and decentralization, Aiying hopes that this Chainalysis report will spark deeper industry reflection and exploration of the Latin American market. Previously, we also published a similar report titled "Report: In-Depth Analysis of the 2024 Latin American Cryptocurrency Market — From El Salvador and Brazil's Legalization to Regional Innovation".

1. Overview of the Latin American Cryptocurrency Market

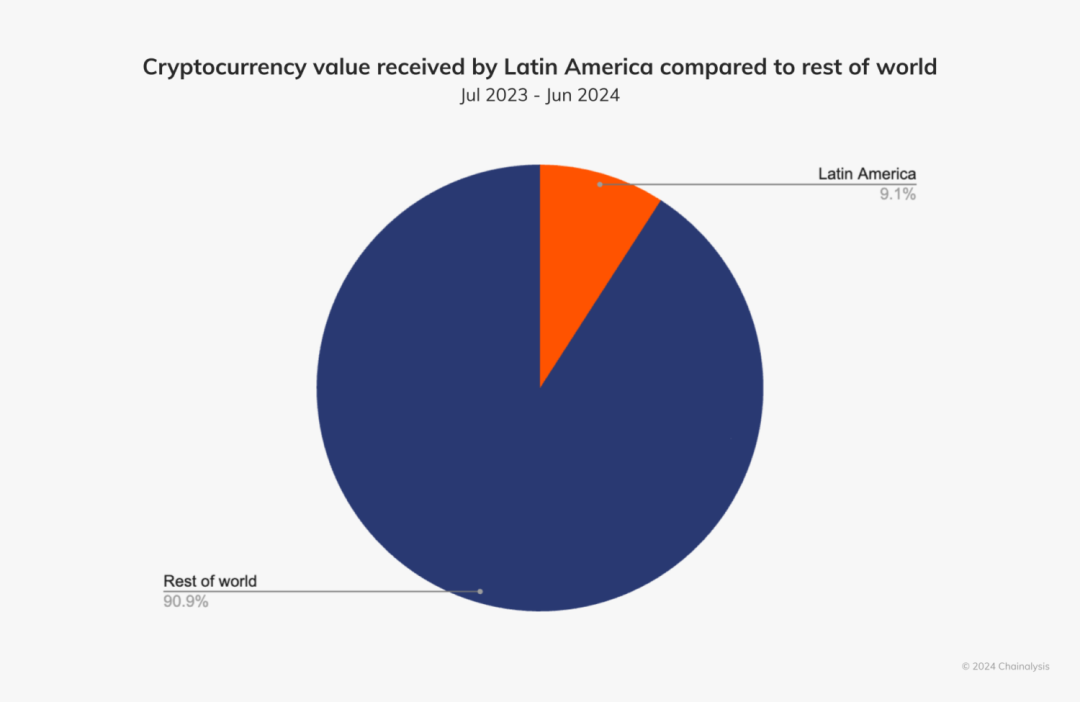

The report shows thatLatin America accounted for 9.1% of global cryptocurrency inflows between July 2023 and June 2024.

During this period, the region received approximately $415 billion in cryptocurrency—slightly more than East Asia.

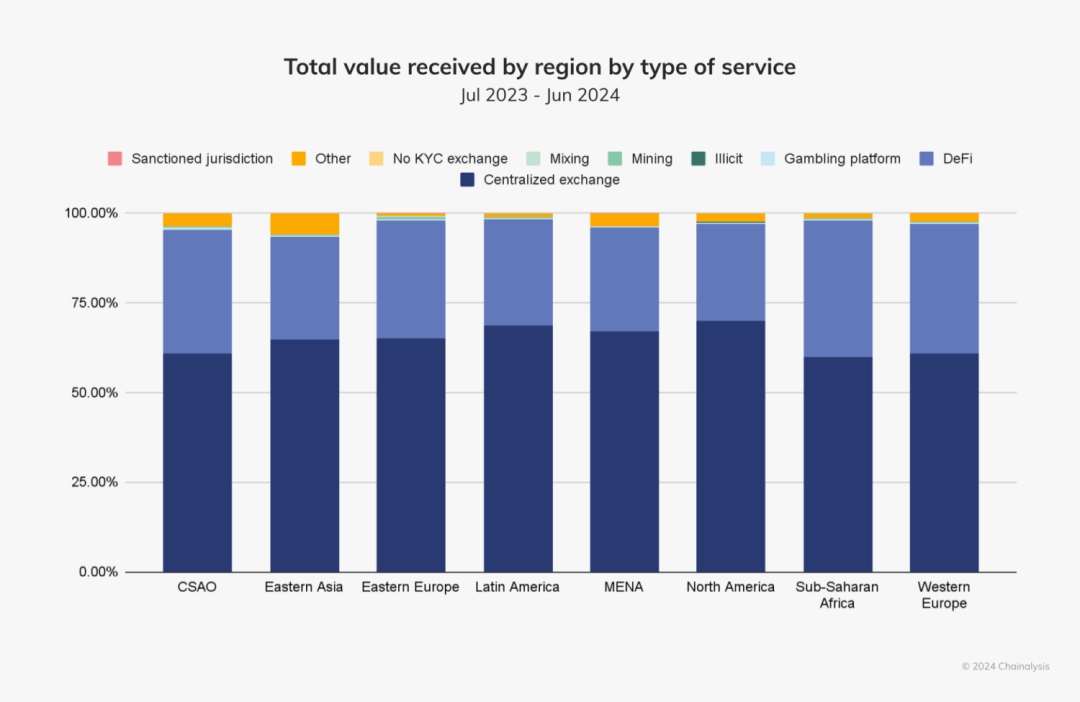

In Latin America, centralized exchanges (CEXs) are the most popular crypto services, handling 68.7% of transactions—slightly lower than CEX usage in North America.

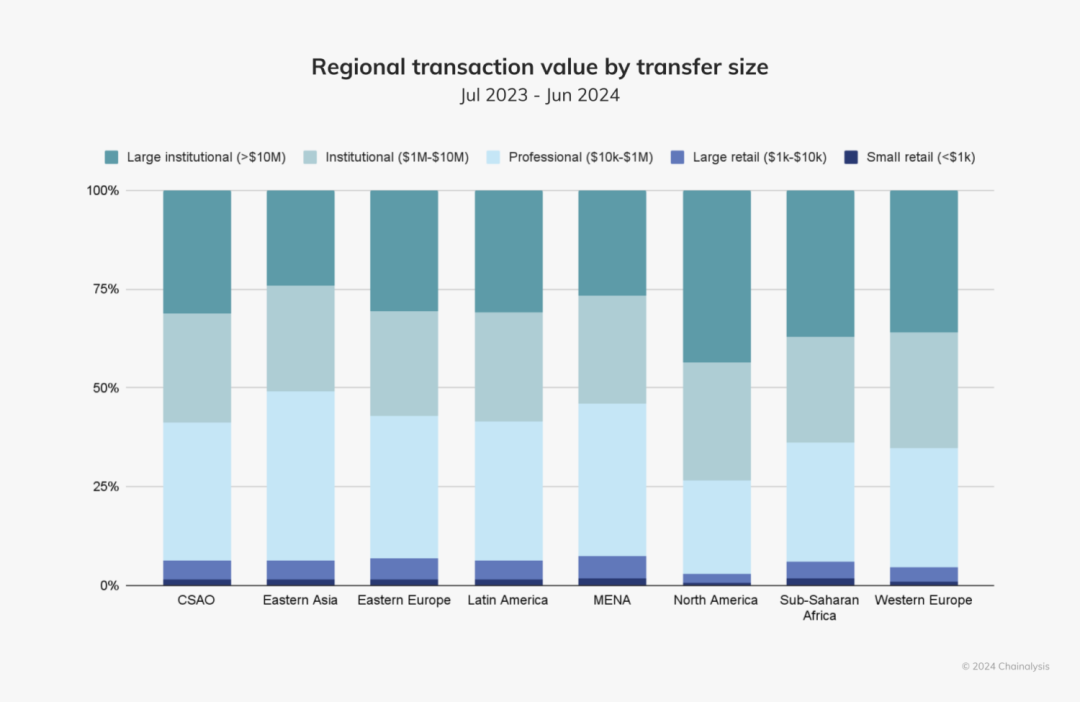

In terms of transaction volume, institutional and professional investors (entities transacting over $10,000) are driving crypto activity across Latin America.

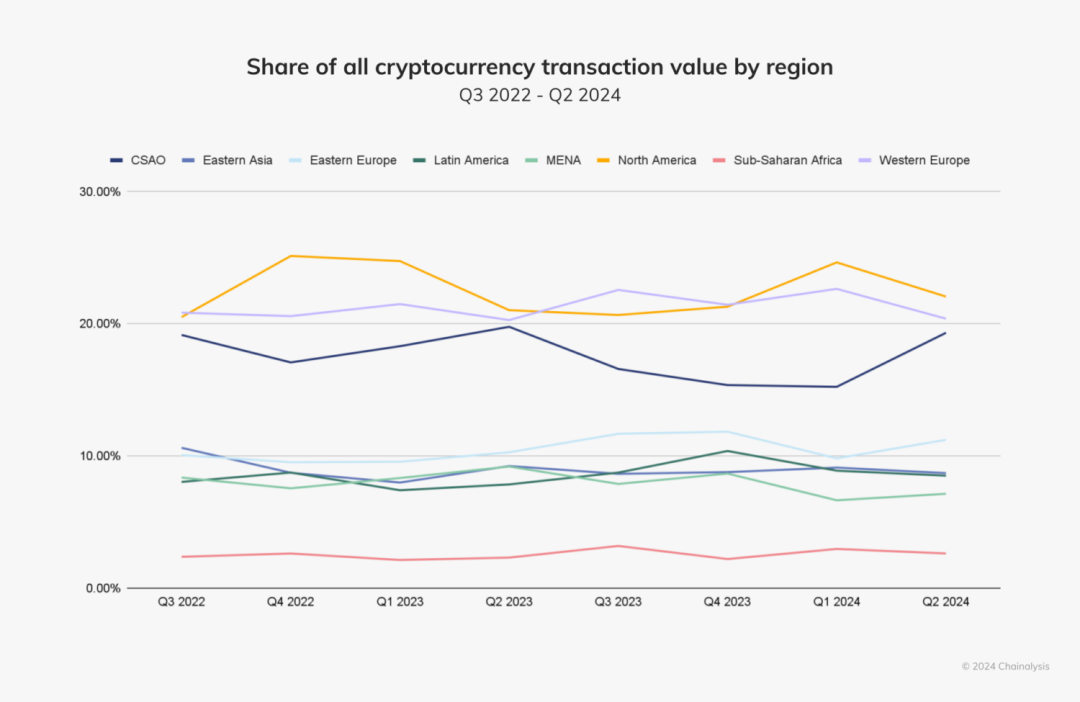

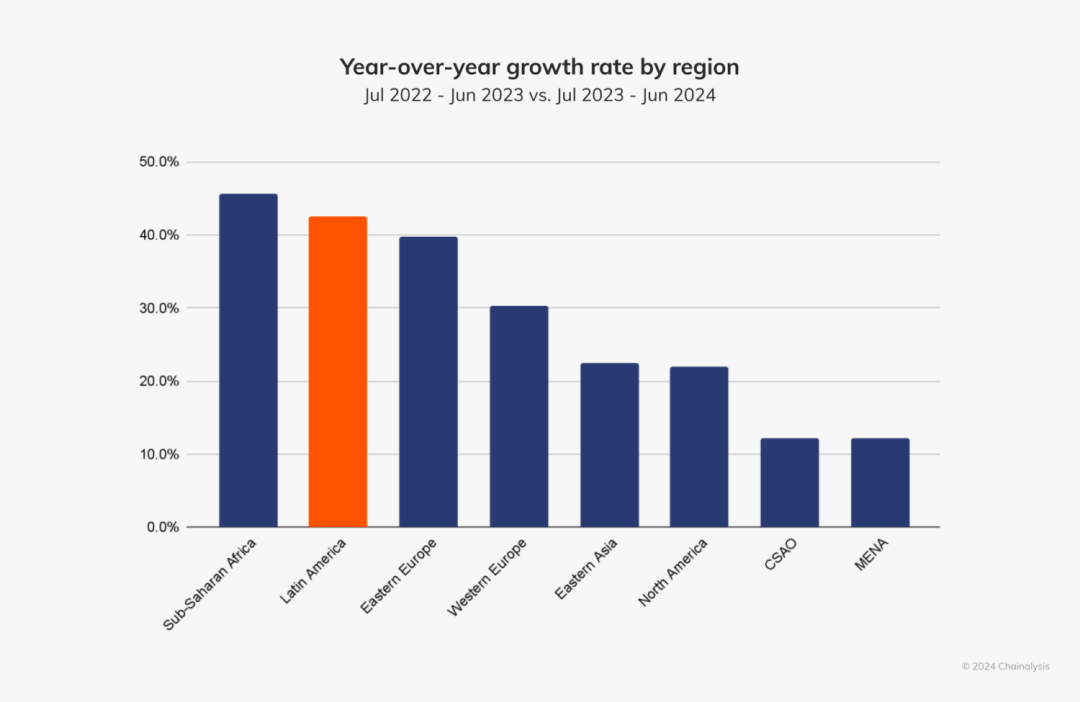

This year, Latin America ranks as the second-fastest growing region in the report, with a year-on-year growth rate of approximately 42.5%.

This growth is primarily driven by strong yet distinct cryptocurrency markets in countries such as Venezuela, Argentina, and Brazil. Argentina leads the region in cryptocurrency inflows at around $91.1 billion, slightly ahead of Brazil’s $90.3 billion.

In Chainalysis' Global Crypto Adoption Index, four Latin American countries rank within the top 20: Brazil (9th), Mexico (13th), Venezuela (14th), and Argentina (15th). As discussed later, stablecoin-based remittances are gaining increasing attention and adoption in these countries and across Latin America.

2. Institutional Crypto Activity Recovers in Brazil as Financial Giants Return to the Market

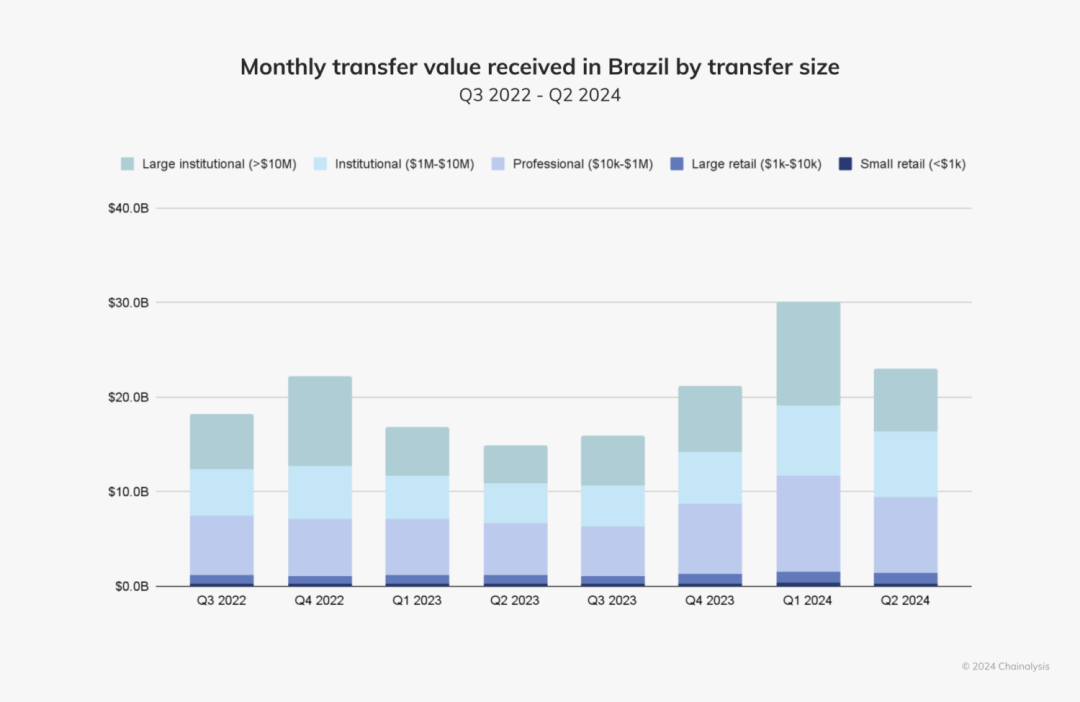

According to the report, Brazil’s crypto market experienced significant fluctuations over the past year, transitioning from a sluggish start in early 2023 to a strong rebound by mid-year, indicating renewed interest from institutional investors. The global crypto bear market in early 2023 led to a sharp decline in institutional trading volumes in Brazil. However, as market sentiment shifted, this trend reversed mid-year, with institutional activity quickly picking up.Data shows that large institutional transactions exceeding $1 million increased by 29.2% during the last two quarters of 2023, and the growth accelerated further to 48.4% between Q4 2023 and Q1 2024.

One key driver behind this recovery, according to the report, is portfolio diversification. André Portilho, Head of Digital Assets at investment bank BTG Pactual, noted: “As the market matures, investors are increasingly incorporating digital assets into their portfolios as an alternative investment with high return potential. Bitcoin and other cryptocurrencies are gradually being recognized as mature investment instruments, which is critical for attracting new capital flows.” Brazil’s crypto market recovery has also been propelled by improved regulatory conditions and the entry of U.S. institutions, particularly the launch of Bitcoin and Ethereum ETFs, which significantly boosted investor confidence.

Aaron Stanley, founder of the Brazil Crypto Report, observed from an industry-wide perspective: “Over the past year, Brazil’s crypto ecosystem has matured significantly. Major traditional financial institutions, including Itaú—the country’s largest bank—have launched cryptocurrency brokerage services, while other major banks are actively developing similar offerings. At the same time, leading global crypto exchanges such as OKX and Coinbase have expanded aggressively into Brazil, establishing local teams and offering customized services tailored to the Brazilian market. Additionally, the Central Bank of Brazil’s pilot project for its hybrid central bank digital currency (CBDC) and smart contract platform Drex has encouraged traditional financial institutions to adopt more proactive strategies in the digital asset space. All of this has undoubtedly contributed to greater adoption of cryptocurrencies among both institutional and retail investors.”

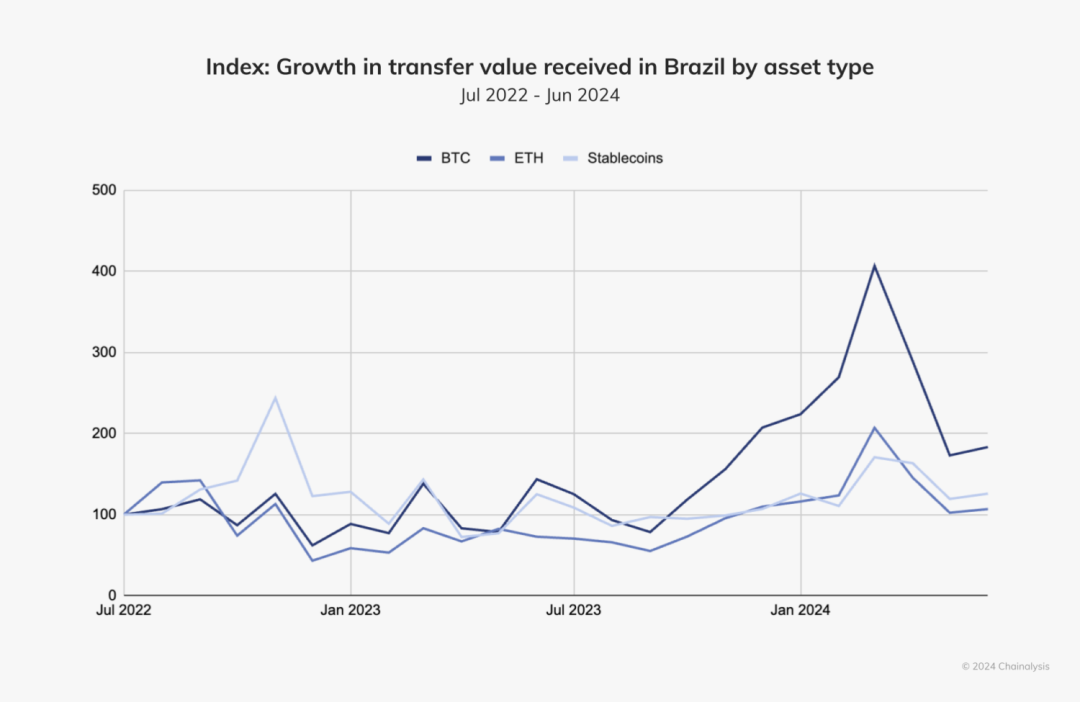

Against this backdrop, Brazilian crypto investors have shown particular interest in certain assets.Report data indicates a surge in Bitcoin trading volume between September 2023 and March 2024, likely directly linked to the U.S. Securities and Exchange Commission (SEC) approving spot Bitcoin ETFs in January 2024. During this period, Bitcoin’s price nearly doubled, significantly contributing to the rise in trading volume.

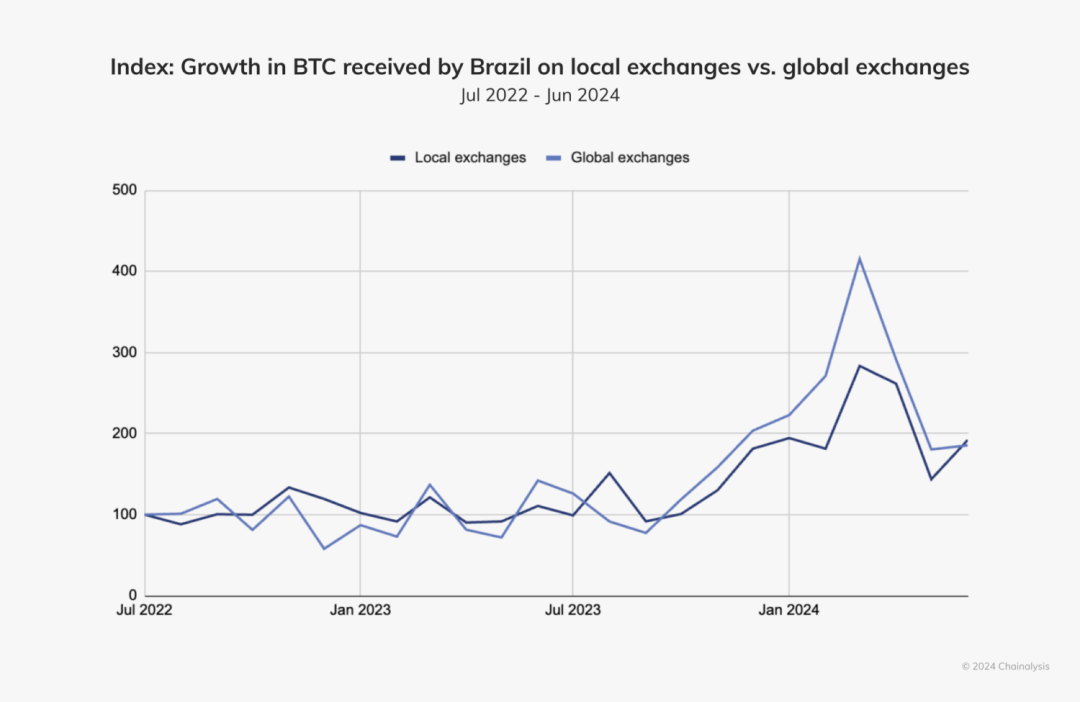

Furthermore, the report reveals that Brazilian investors’ Bitcoin trading volume on global exchanges far exceeds that on domestic platforms.

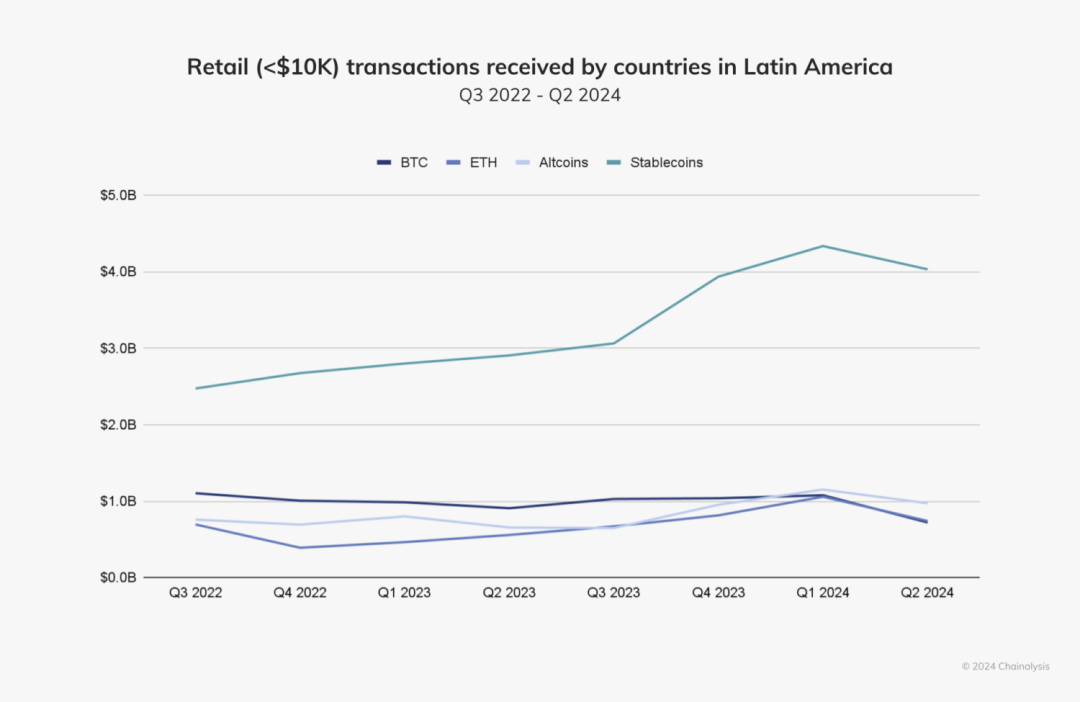

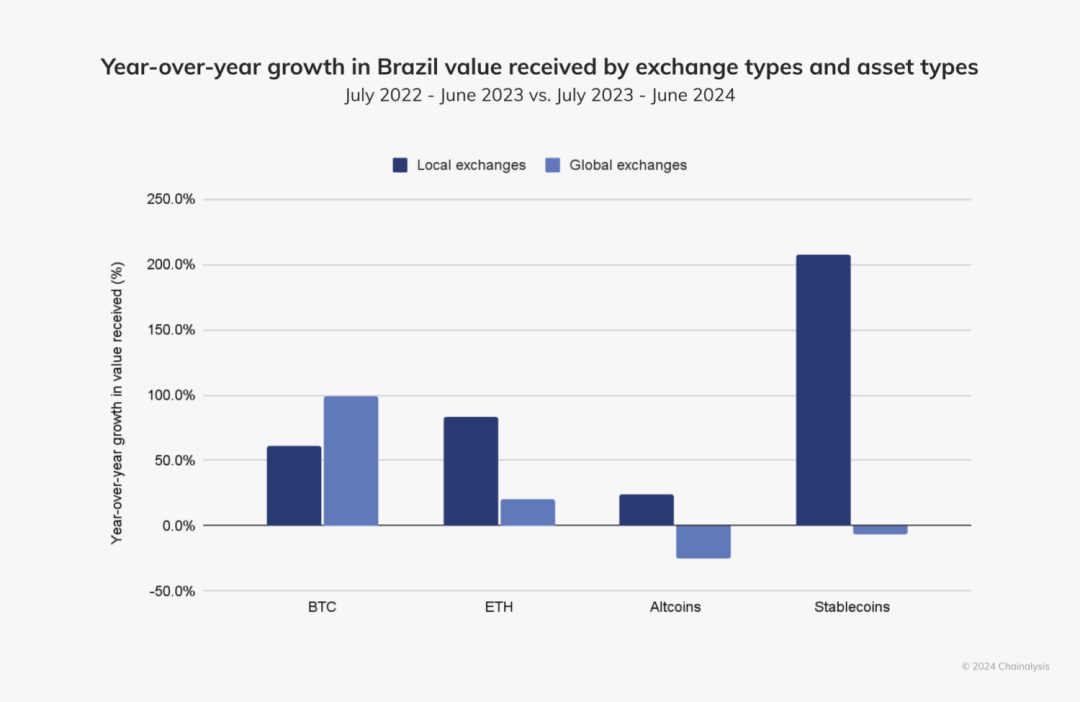

However, there is a clear difference in asset types traded on local exchanges.Data shows that stablecoin trading volume grew 207.7% year-on-year, far outpacing Bitcoin, Ethereum, and other altcoins. Stanley explained: “Many local exchanges and fintech companies offer dollar-pegged stablecoins to customers as a store of value. This strategy has attracted many users, but currently, stablecoins appear to be primarily used in B2B cross-border payments.”

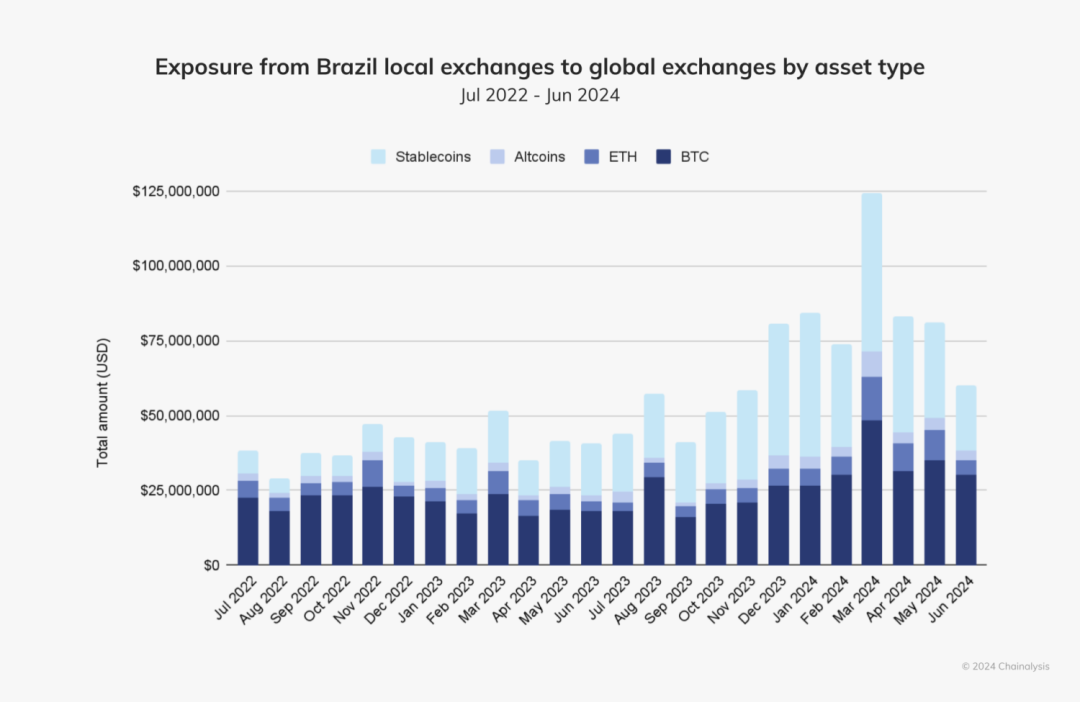

Stablecoins now account for about 70% of indirect flows from Brazilian local exchanges to global exchanges. The report notes that Brazil’s strong interest in stablecoins and other digital assets, along with broad acceptance of digital services, has drawn attention from major crypto firms like Circle. In May 2024, Circle announced its official entry into the Brazilian market. A Circle spokesperson said: “We chose to enter Brazil now because the regulatory environment is becoming clearer. The government is promoting innovation-friendly policies, and more business-friendly regulations may follow. We’re partnering with leading local companies to launch digital asset products, providing Brazilian users with instant, low-cost, 24/7 USDC services while expanding our local presence. Thanks to this strategic commitment, USDC user numbers have grown rapidly.”

Nonetheless, Brazil’s crypto market still faces significant challenges ahead. Aaron Stanley highlighted macroeconomic conditions as one of thebiggest obstacles: “Slowing economic growth, a sharply depreciating Brazilian real (BRL) against the U.S. dollar, rising tax concerns, and heavy debt burdens among middle-class households—all contribute to Brazilians having far less disposable income than expected.” Despite these challenges, regulators’ openness toward crypto lays the foundation for future growth. “Regulators see crypto technology as a tool to be effectively utilized rather than a threat to be suppressed. As long as a widely accepted regulatory framework can be established, Brazil’s crypto economy stands to experience steady growth in the coming years,” Stanley concluded.

3. Stablecoins Provide a Path to Stability Amid Argentina’s Long-Term Economic Turmoil

According to the report, Argentina’s decades-long battle with inflation and the depreciation of the Argentine peso (ARS) has led many citizens to seek alternative ways to protect their savings and secure a more stable economic future. The report highlights thatArgentina’s economic situation was particularly volatile in 2023. By the second half of the year, inflation had soared to around 143%, the peso’s value plummeted, and 40% of Argentines lived below the poverty line. In December 2023, newly elected President Javier Milei announced a 50% devaluation of the peso—a so-called “shock therapy”—while cutting energy and transportation subsidies.

To cope with the crisis, some Argentines turned to black markets to purchase foreign currencies, most commonly U.S. dollars (USD). This informal “blue dollar” is traded through unofficial parallel exchange rates via underground exchange offices known as “cuevas” spread across the country. Meanwhile, an increasing number of Argentines are turning to dollar-pegged stablecoins to safeguard their finances.

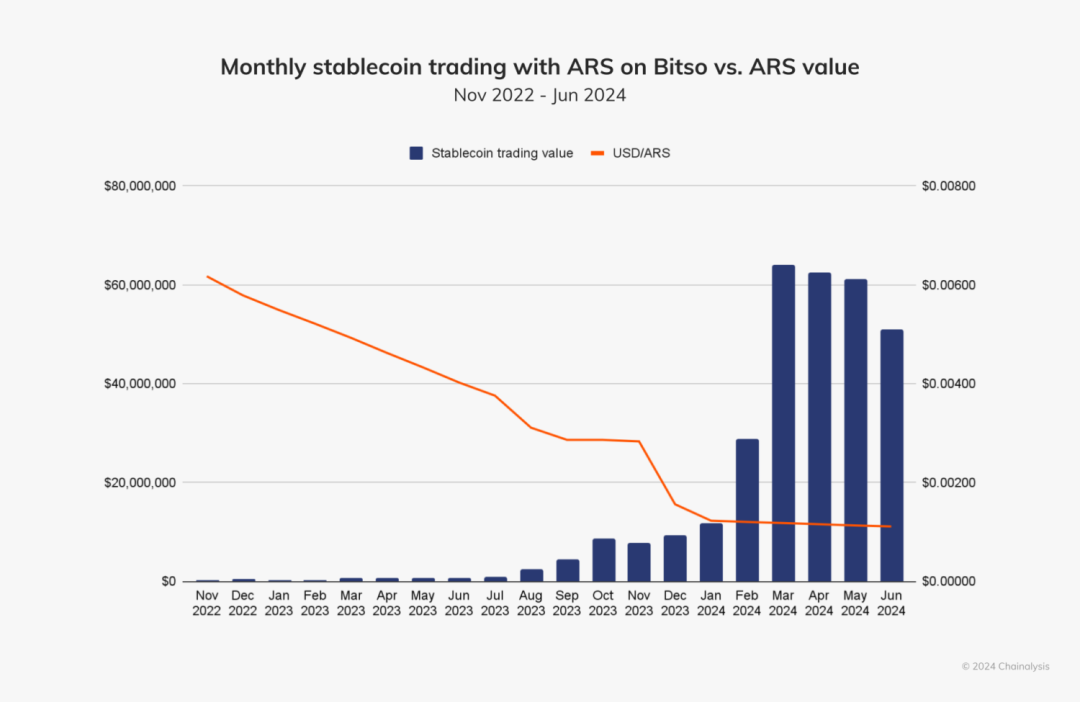

The report analyzedmonthly stablecoin trading volumes in ARS on Bitso, a leading Latin American exchange, and found that declining peso value consistently triggered increases in stablecoin trading volume. For example,when the peso fell below $0.004 in July 2023, stablecoin trading surged to over $1 million the following month. Similarly, when the peso dropped below $0.002 in December 2023—the month President Milei announced his policy—stablecoin trading exceeded $10 million the next month.

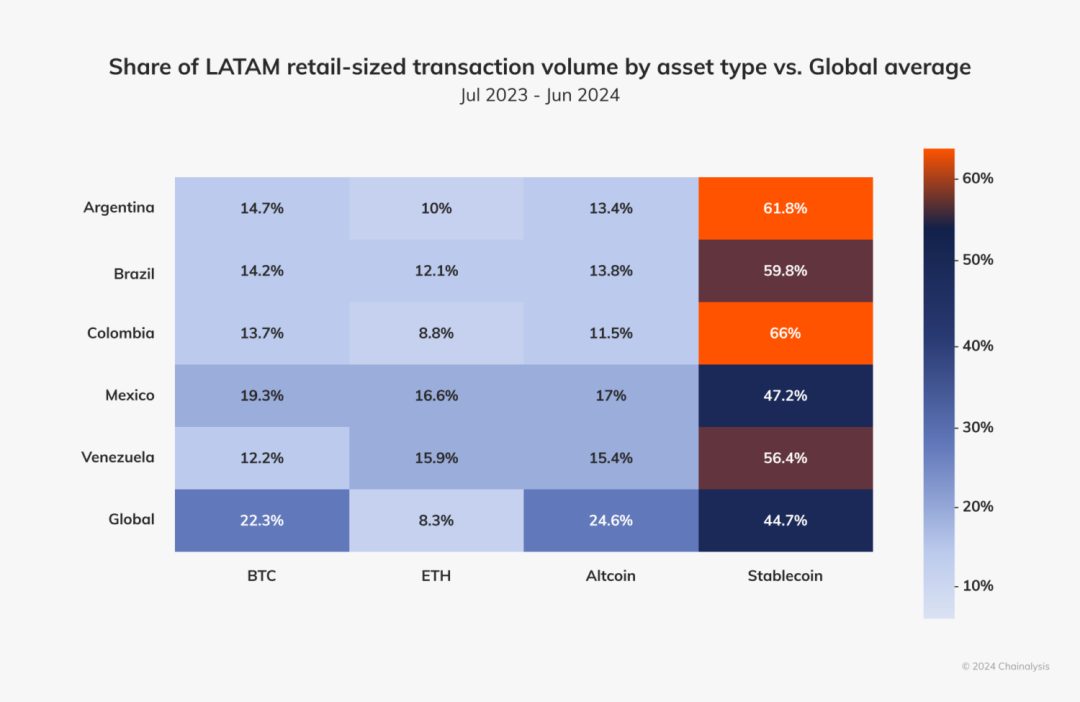

The report further notes thatArgentina leads Latin America in stablecoin adoption. Stablecoin trading accounts for 61.8% of Argentina’s total crypto trading volume, slightly above Brazil’s 59.8% and significantly higher than the global average of 44.7%.

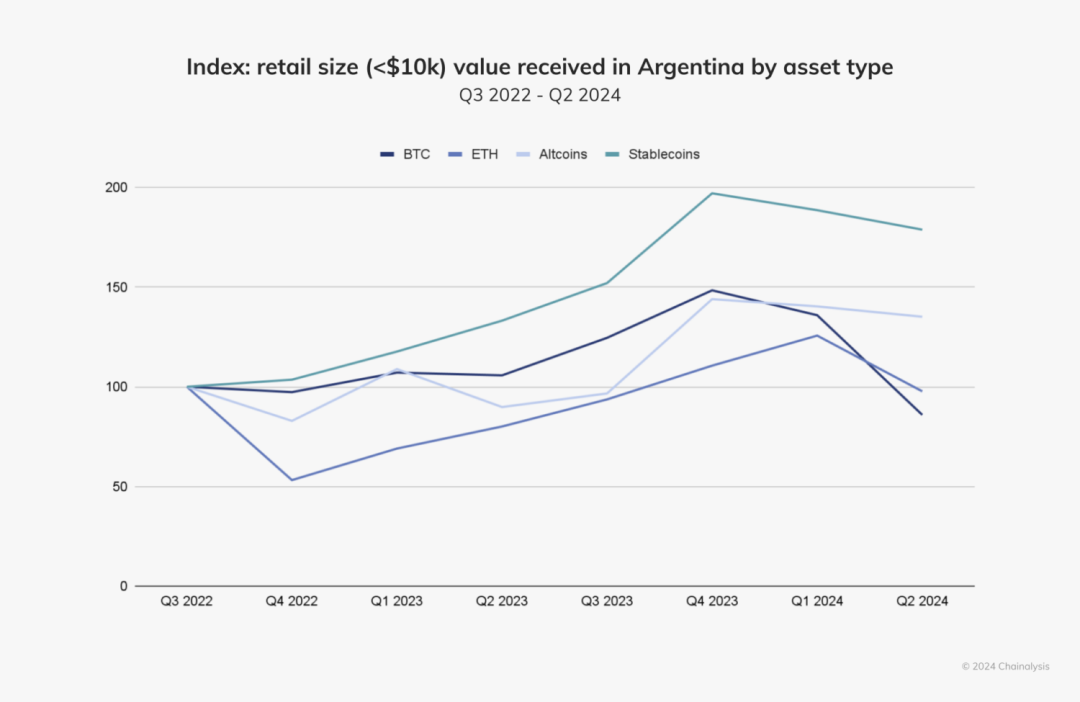

Additionally, the report shows that retail-level stablecoin transactions (those under $10,000) in Argentina grew faster than any other asset class, reinforcing the view that Argentines use stablecoins as a hedge against inflation and currency depreciation. Their growing interest underscores the role of crypto in unstable economies and how individuals can take control of their financial futures through crypto adoption, regardless of official monetary policies.

4. Strong Crypto Growth in Venezuela Despite Uncertainty Under the Maduro Regime

Despite ongoing turmoil under the Maduro regime creating uncertainty, cryptocurrency adoption in Venezuela remains robust. Venezuela’s relationship with crypto has been tumultuous—from the launch in 2018 to the abrupt termination in 2024 of the state-backed Petro (PTR), a stablecoin intended to be backed by Venezuela’s oil and mineral resources, to crackdowns on Bitcoin mining and blocks on access to mainstream crypto exchanges—all reflecting the complexity of the country’s crypto journey. At the same time,the Maduro regime has attempted to use cryptocurrencies to circumvent economic sanctions, with illicit oil trade intertwined with crypto transactions, ultimately leading to high-profile prosecutions by the U.S. Department of Justice. These crypto-related events reveal a broader dynamic:while the Maduro regime exploits crypto for corruption, ordinary Venezuelans turn to it as a means of achieving financial independence.

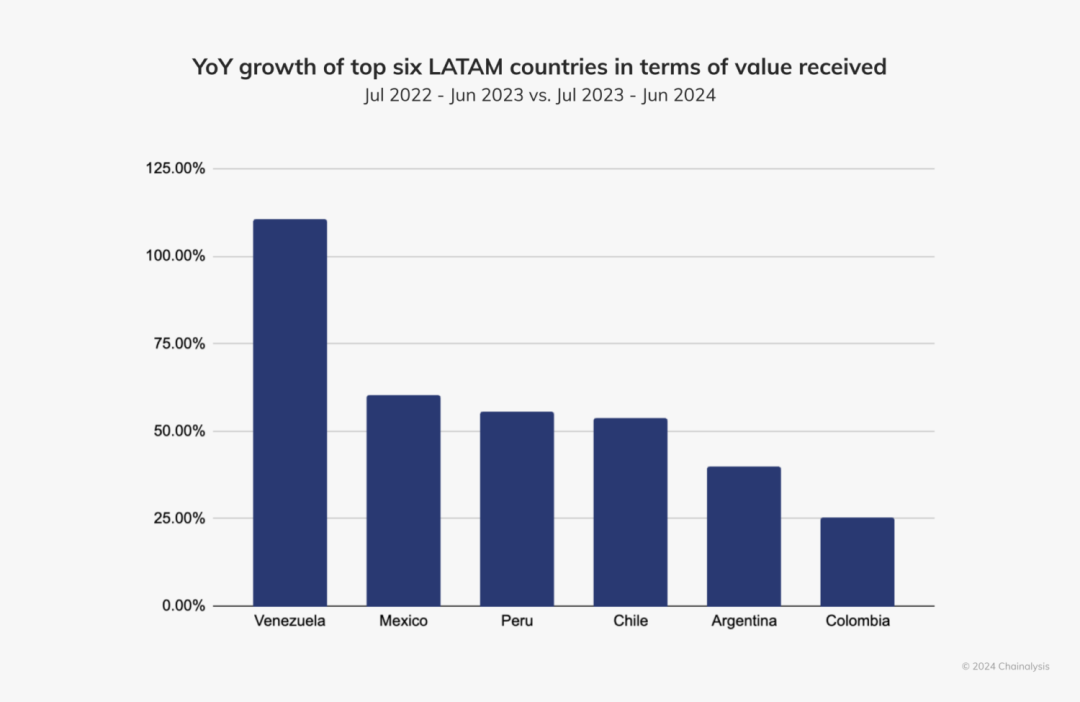

Despite instability, the Maduro regime has recently shown renewed interest in crypto, though no concrete plans have been announced. Regardless of how these political developments unfold,Venezuela remains one of the fastest-growing crypto markets in Latin America. The report shows Venezuela achieved a staggering 110% year-on-year growth rate—higher than any other country in the region.

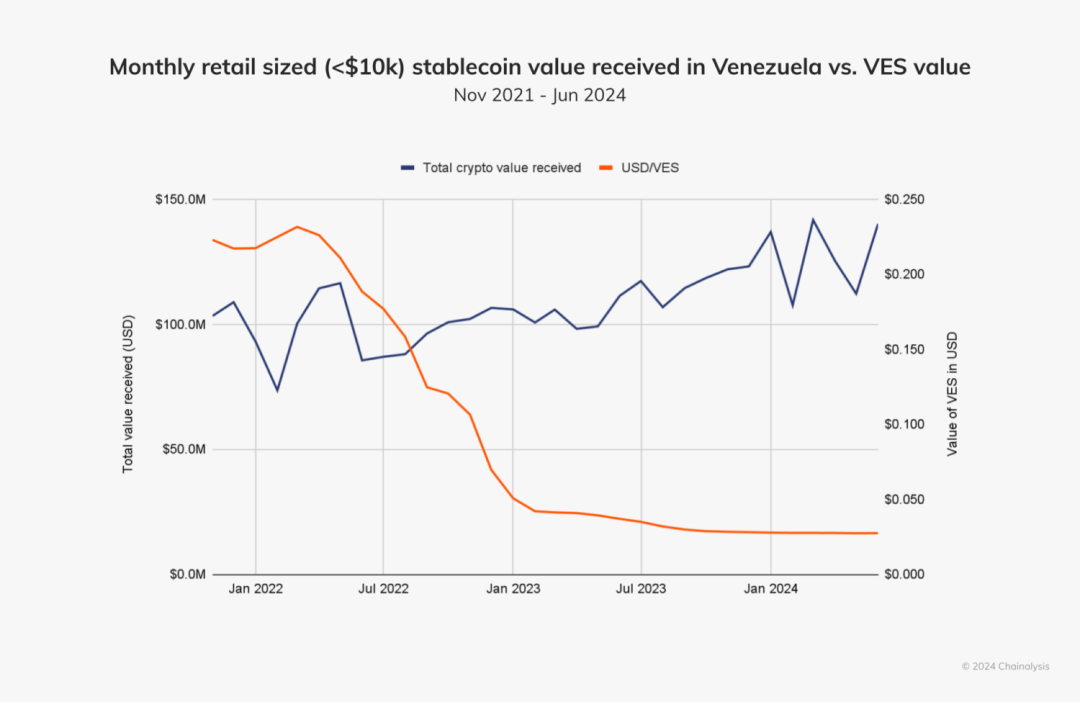

What’s driving this growth? First, the report notes that Venezuelans are drawn to crypto to cope with the bolívar’s (VES) steep depreciation. Data reveals a clear inverse relationship between the VES-to-USD exchange rate and the monthly value of incoming crypto. Multiple media reports confirm this,highlighting that everyday Venezuelans continue seeking stable stores of value to hedge against the impact of national economic crises.

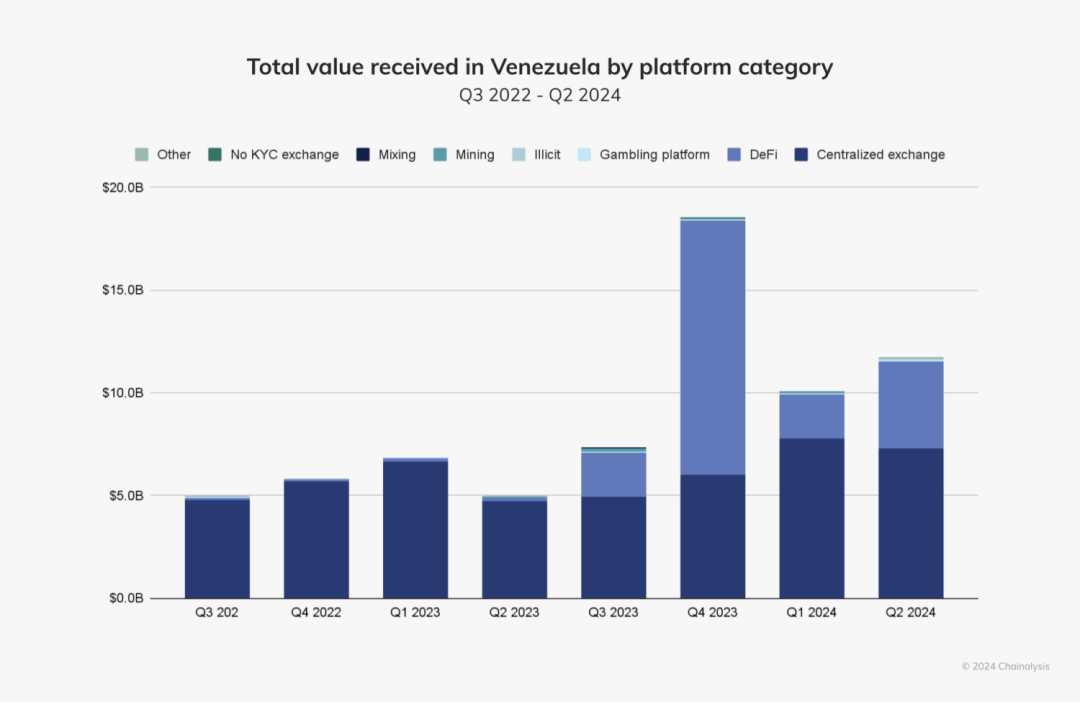

The report further points out thatDeFi (decentralized finance) represents another dimension of Venezuela’s crypto growth. Since 2022, centralized services have accounted for the majority of crypto inflows. However, interest in DeFi has gradually increased, especially notably since late 2023. While centralized platforms remain dominant, the growing share of DeFi is an area to watch—particularly if the Maduro regime explicitly supports crypto innovation, which could accelerate DeFi adoption even further.

5. Accelerating Crypto Activity Across the Caribbean Despite Lingering Post-FTX Uncertainty

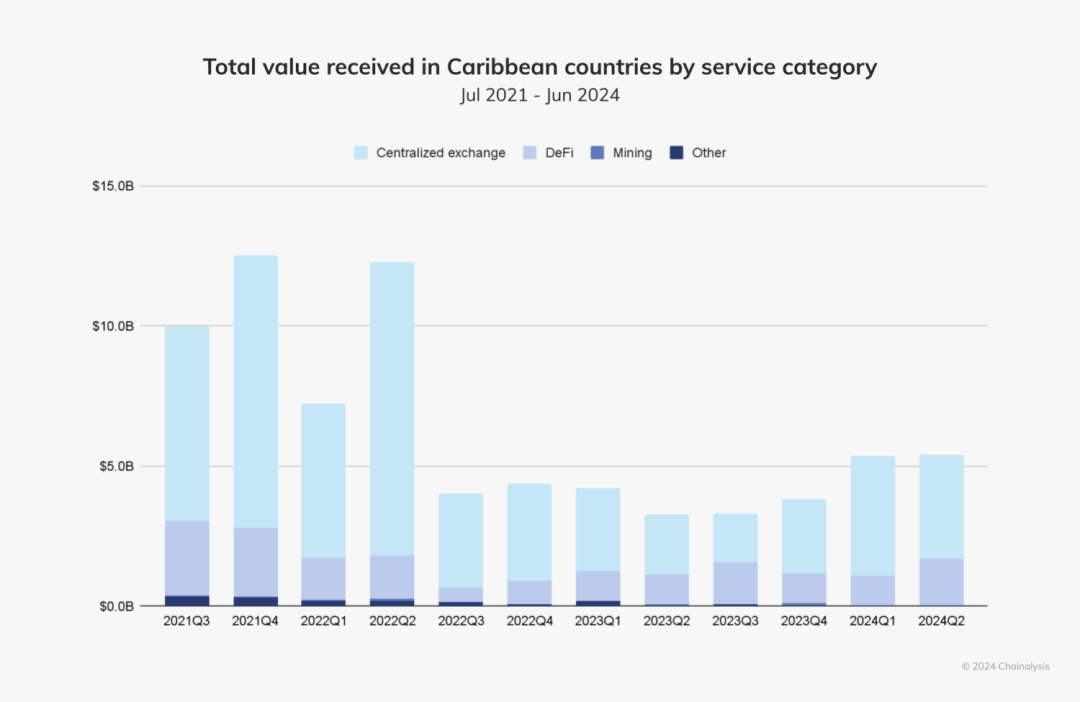

Since FTX’s collapse, the Caribbean’s crypto ecosystem has gone through a period of uncertainty and reduced activity, with declining user trust in crypto platforms. However, starting in late 2023, crypto activity in the Caribbean began to recover. Data shows users are returning to mainstream centralized exchanges (CEXs) such as Coinbase and Binance.

We spoke with David Templeman, a specialist financial investigator at the Cayman Islands Financial Investigations Agency, to better understand changes in Caribbean crypto activity. Templeman noted thatin the Cayman Islands, there has been a noticeable increase over the past year in overseas clients seeking to establish Web3 and blockchain-related legal entities—an upward trend not previously evident in earlier years. These projects typically involve Layer 1 or Layer 2 solutions and span diverse applications including artificial intelligence, cross-chain infrastructure, gaming, and data and cloud storage.

Templeman concluded: “A series of collapses—FTX, TerraUSD/Luna, Celsius Network, and Three Arrows Capital—put pressure on the entire industry, forcing it to learn from mistakes and build stronger oversight and protection mechanisms. In the Cayman Islands, blockchain and Web3 companies physically and legally based here have formed a strong community.” Clearly, crypto activity is thriving again in the Caribbean, solidifying the region’s position as a key hub for crypto adoption in the coming years.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News