CoinEx Research September 2024 Report: Fed Rate Cuts Drive Bitcoin Surge, Turning Recession Fears into Market Optimism

TechFlow Selected TechFlow Selected

CoinEx Research September 2024 Report: Fed Rate Cuts Drive Bitcoin Surge, Turning Recession Fears into Market Optimism

The key event this month was the Federal Reserve's 50-basis-point interest rate cut, which boosted market optimism and triggered a strong rebound in risk assets, including cryptocurrencies.

CoinEx Insight has released its comprehensive cryptocurrency market report for September 2024. The crypto market was driven by significant policy shifts and technological advancements. The key event this month was the Federal Reserve's 50-basis-point rate cut, which boosted market optimism and triggered a strong rebound in risk assets, including cryptocurrencies. This dovish stance was echoed by similar moves from the European Central Bank (ECB) and the Bank of England (BoE), reversing previous market declines, with Bitcoin leading the rally.

Bitcoin’s Bullish Breakout

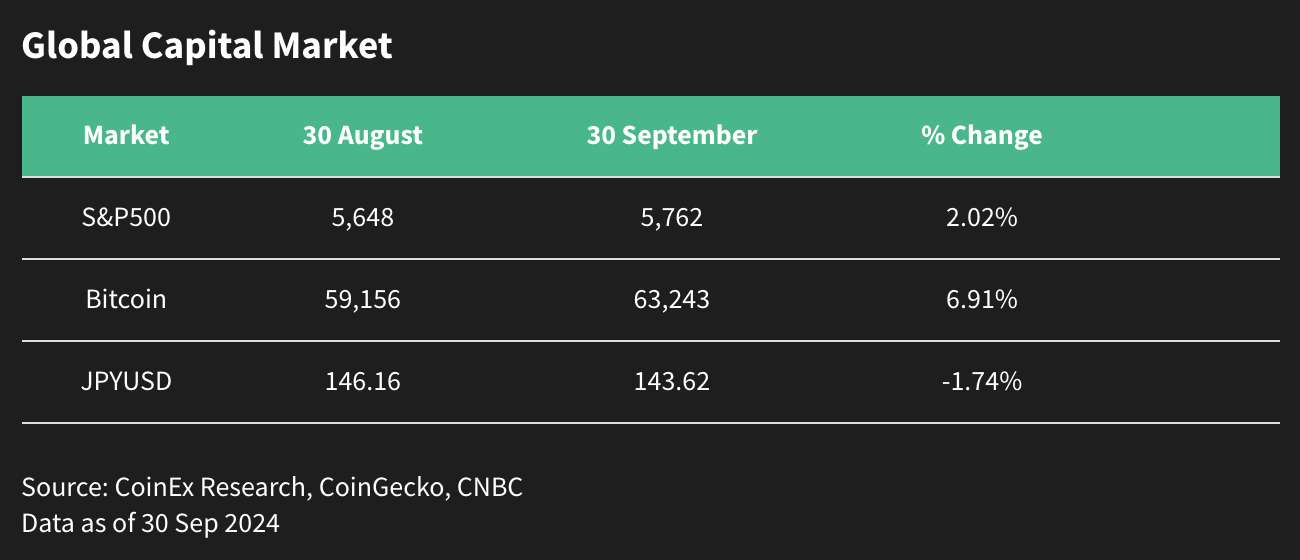

The month began with unstable Bitcoin trading prices, dipping as low as $52,700. However, following the Fed's rate cut announcement, Bitcoin surged from $58,000 to a recent high of $66,000, ultimately closing at $63,300—a gain of over 20%. This rebound was reflected across the broader cryptocurrency market. Bitcoin is now targeting the crucial $70,000 resistance level, and the macro outlook for the remainder of 2024 appears positive, especially as the impact of the Fed's policy continues to unfold.

Recession Risks

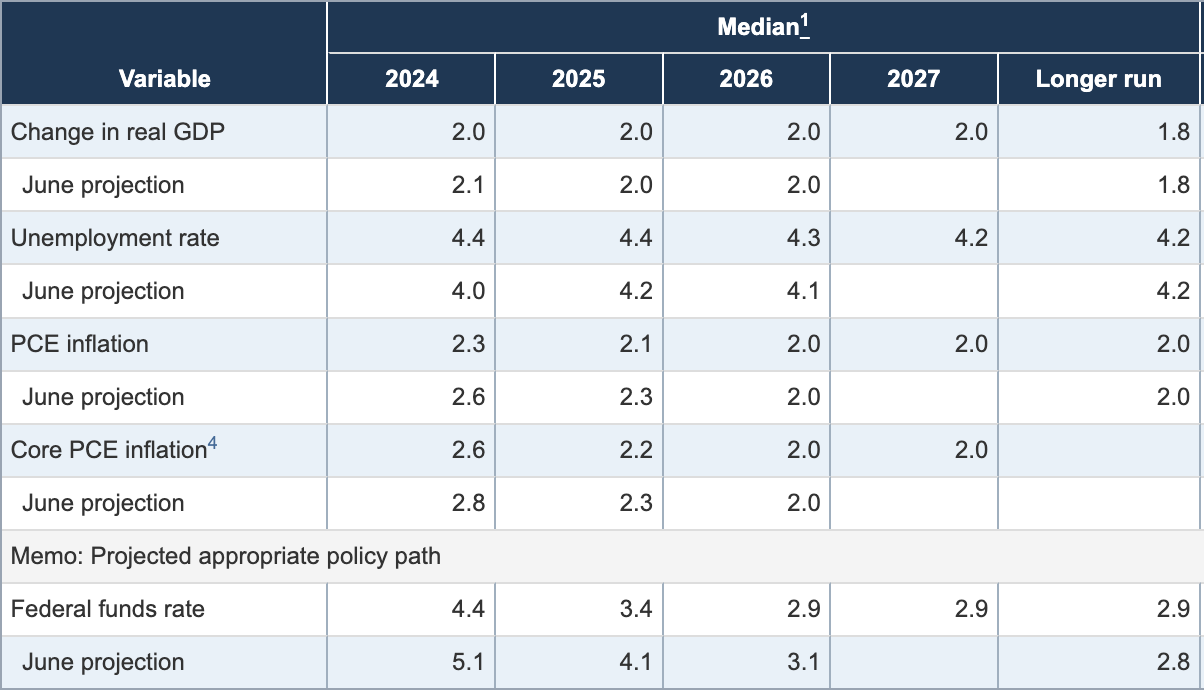

Global markets closely monitored central bank policies throughout September. The Fed's latest projections maintained GDP growth forecasts at 2% for both 2025 and 2026, signaling confidence in the economy's resilience amid ongoing policy adjustments. Meanwhile, inflation remains within manageable levels. However, with unemployment rates expected to rise, the Fed's actions reflect potential pressures building in the labor market.

Source: Federal Reserve, data as of September 18, 2024

USD/JPY – A Key Variable to Watch

Nonetheless, market participants are closely watching variables such as the USD/JPY exchange rate, which could affect global liquidity if the Bank of Japan continues raising interest rates.

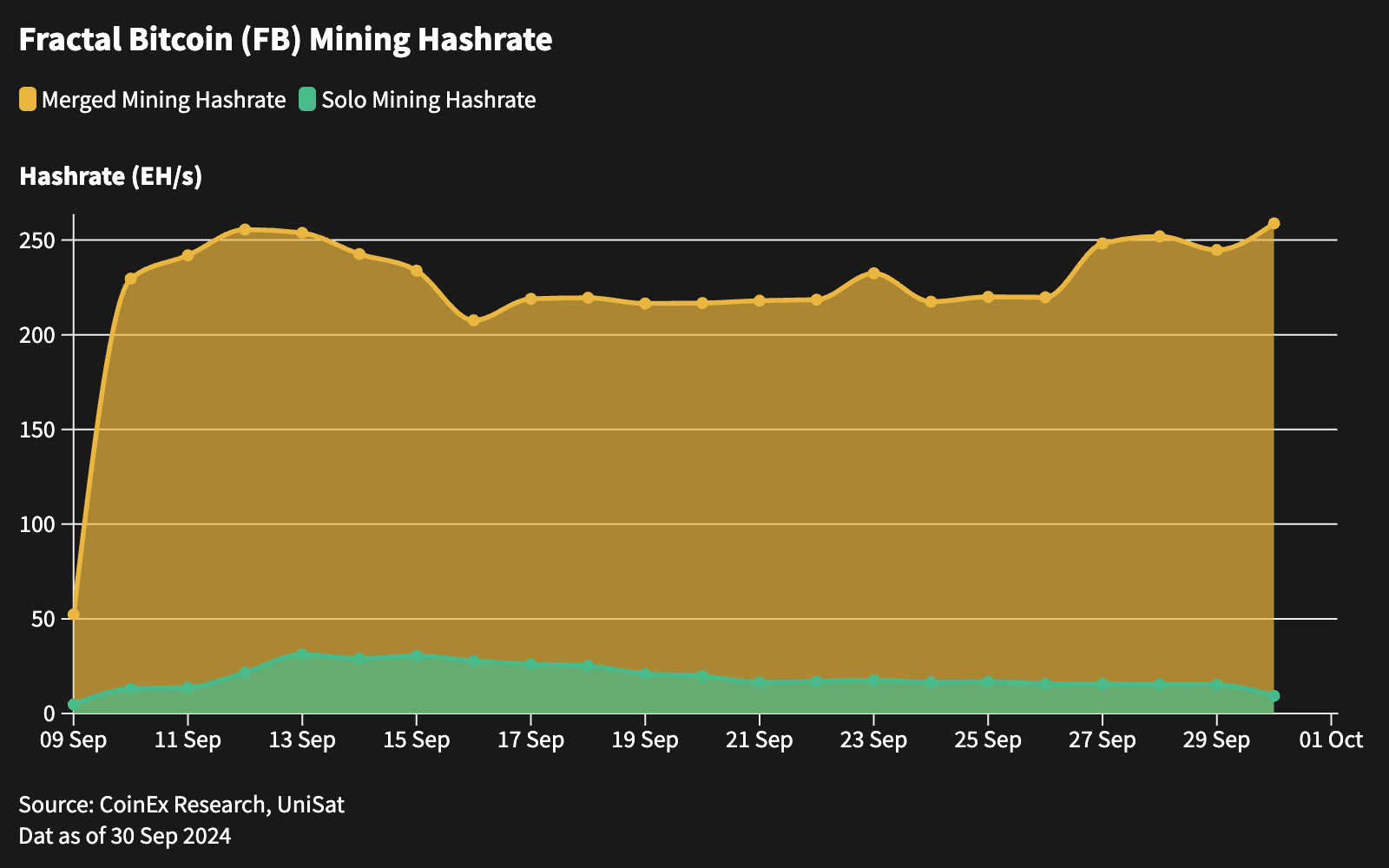

Technological Innovation: Fractal Bitcoin Mainnet

One of the most significant technological developments this month was the launch of the Fractal Bitcoin mainnet on September 9. Fractal Bitcoin is a Layer 2 solution that enhances Bitcoin's transaction efficiency while maintaining compatibility with the primary Bitcoin network. It enables scalability features such as the OP_CAT opcode, allowing developers to test new functionalities without disrupting the core system. This innovation has positioned Fractal Bitcoin among the top three proof-of-work chains by hash power and secured support from the ViaBTC mining pool, with CoinEx becoming the first exchange to list its native FB token.

To read CoinEx’s analysis of Fractal Bitcoin, see “Fractal Bitcoin: The Pioneering Network of Bitcoin - Analysis of Technical Innovation and Challenges”.

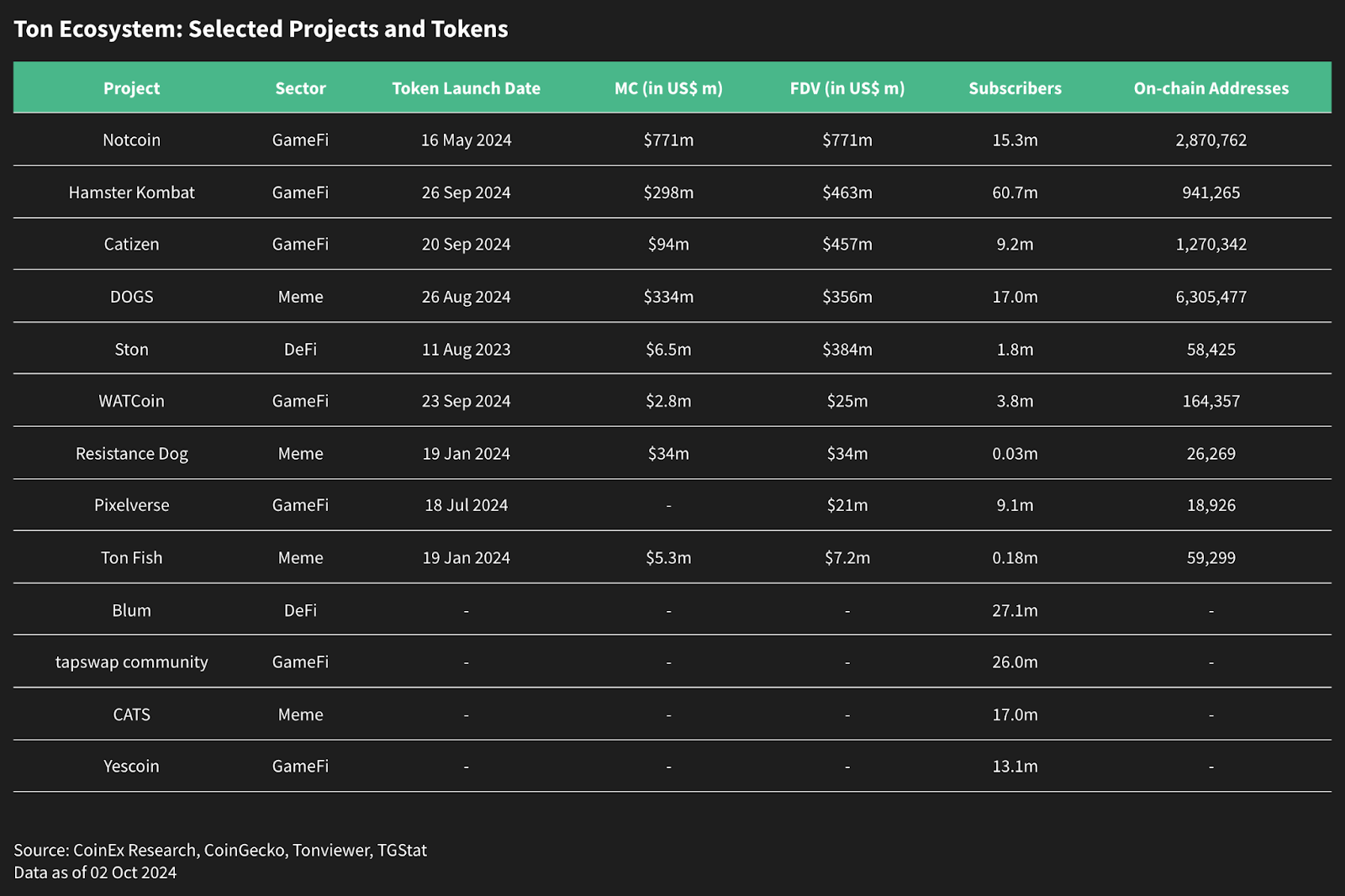

Ton Ecosystem Faces Challenges

Despite overall market optimism, the Ton blockchain faced setbacks with its new tokens CATI and HMSTR. Both tokens performed poorly after listing, declining by 55% and 35% respectively. Concerns about the sustainability of the “click-to-earn” model have emerged, as market saturation may limit the appeal of similar projects. The future of the Ton ecosystem will largely depend on its ability to deliver unique value propositions to sustain long-term growth.

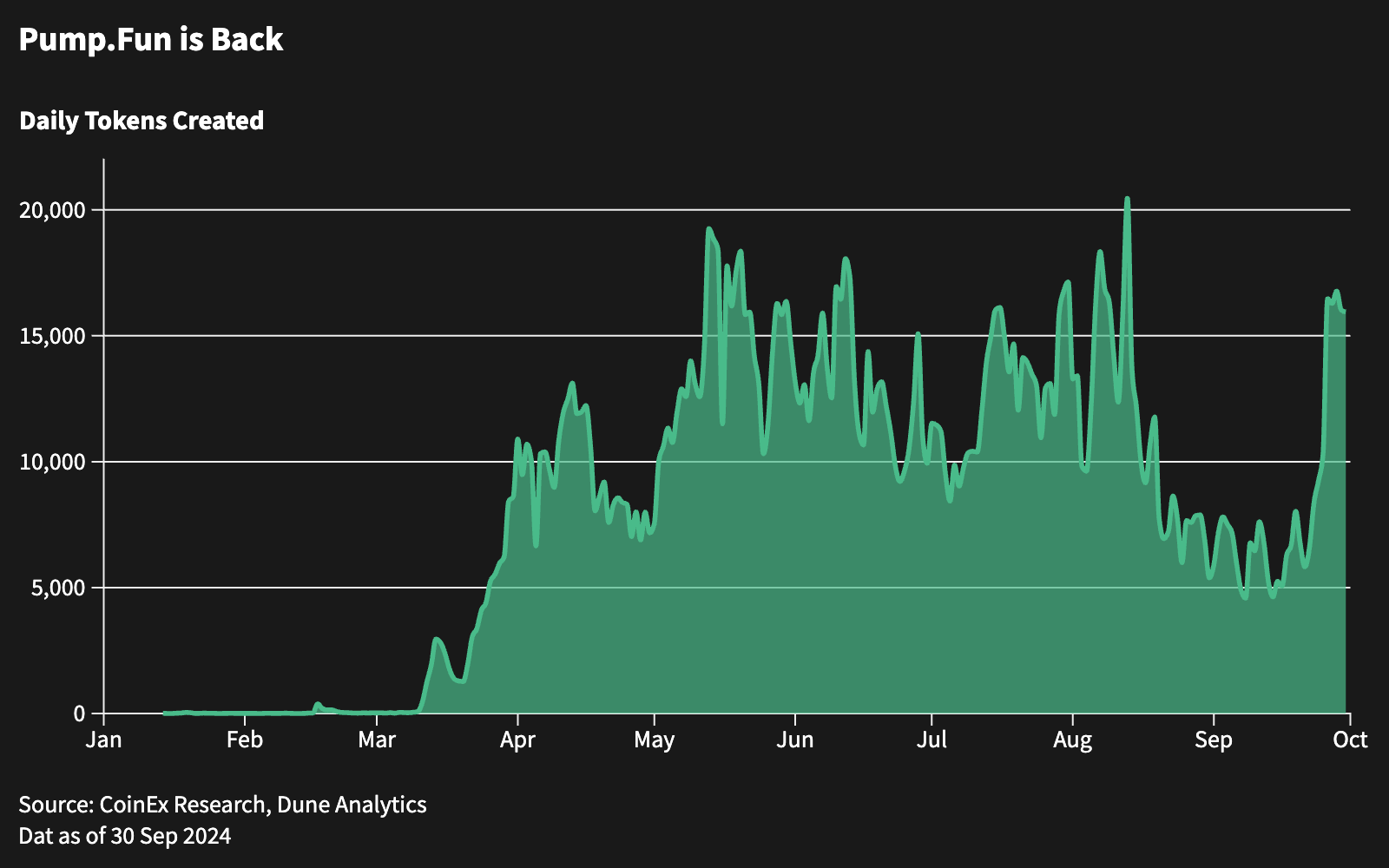

Meme Coin Surge Driven by Social Media

September also saw a resurgence in meme coins, fueled by viral social media trends. Animal-themed tokens such as Thailand's矮个子河马 Moo Deng, Penguin (PESTO), and Frog (OMOCI) sparked speculative interest, particularly on the Solana blockchain. Daily token creation levels on Pump.Fun have rebounded to highs seen earlier this year. While meme coins have drawn attention, their extreme volatility calls for caution, and investors are advised to remain prudent amid the frenzy.

Looking Ahead: Economic Data and Market Sentiment

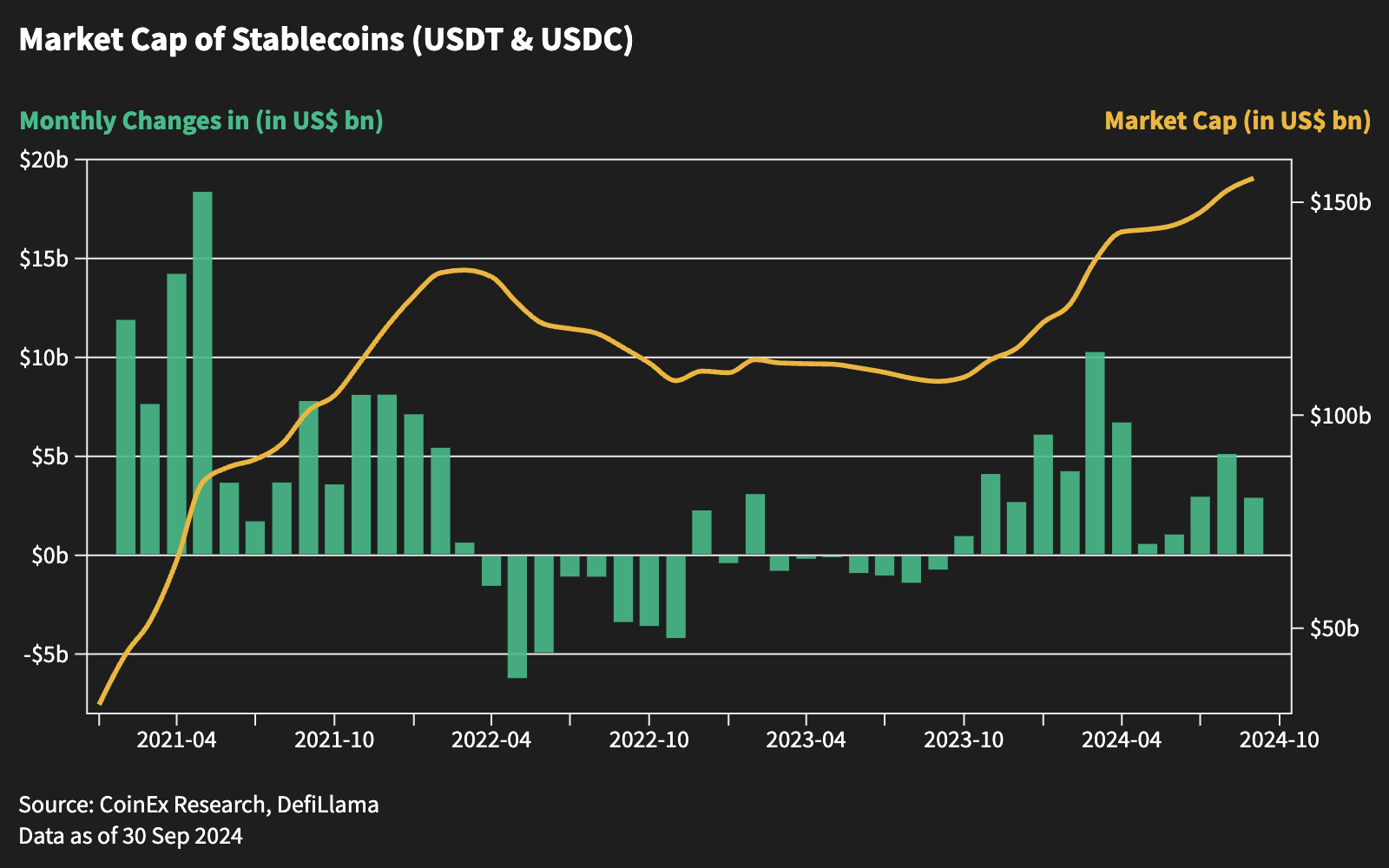

Despite a slowdown in stablecoin inflows, September ended with $2.9 billion, reflecting sustained investor confidence. As October unfolds, market participants will closely monitor economic data and the U.S. elections, which could drive the next wave of activity in the crypto space.

In summary, September 2024 was a pivotal month for cryptocurrencies, with macroeconomic policies, technological innovations, and speculative trends playing crucial roles in shaping market direction. With global monetary policies turning more accommodative and continued technological progress, the outlook remains optimistic heading into 2025.

About CoinEx

CoinEx, established in 2017, is a global cryptocurrency exchange dedicated to simplifying crypto trading. The platform offers a wide range of services including spot and futures trading, margin trading, swaps, automated market making (AMM), and wealth management solutions, serving over 10 million users across more than 200 countries and regions. Since its inception, CoinEx has adhered to a “user-first” service principle. Committed to fostering a fair, respectful, and secure crypto trading environment with genuine intent, CoinEx empowers individuals of all experience levels to easily enter the world of cryptocurrency through user-friendly products.

CoinEx Research is dedicated to delivering in-depth analysis and insights to help investors navigate the evolving cryptocurrency market and uncover future complexities and opportunities.

To learn more about CoinEx, visit: Website|Twitter|Telegram|LinkedIn|Facebook|Instagram|YouTube

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News