CoinEx: Only by fully leveraging its capabilities can an exchange help users escape the "FDV dilemma"

TechFlow Selected TechFlow Selected

CoinEx: Only by fully leveraging its capabilities can an exchange help users escape the "FDV dilemma"

CoinEx, established in December 2017, has always adhered to the brand philosophy of "user first," offering a variety of products and services including spot trading, perpetual contracts, margin trading, staking lending, and strategy trading.

On May 22, 2024, a major discussion initiated by CoinEx on X (CoinEx Global) titled "Ethereum ETF vs. High FDV Dilemma: Where Is the Market Heading?" captured the attention of cryptocurrency investors and quickly spread across various communities. Given the recent high levels of investor interest and discourse around topics such as "Ethereum ETF," "high FDV dilemma," "high market cap with low circulating supply," and "VC-backed projects," the event continues to gain momentum as of this publication.

During the CoinEx-led discussion, panelists unanimously agreed that market expectations for the approval of an Ethereum ETF are extremely high, though there remains uncertainty about when it will be approved—whether tomorrow or within the short term.

WoShy @bc1qWorkShy pointed out that the recent surge in Ether’s price reflects this anticipation, adding that historically, every decision made by the SEC regarding crypto assets has significantly impacted long-term cryptocurrency prices.

VIP3 @web3vip stated that former U.S. President Trump’s endorsement of cryptocurrencies serves as strong support for the crypto market, potentially amplifying its positive impact on Ether and other digital assets in the future.

On High FDV: Questions and Discussions

FDV, or Fully Diluted Valuation, refers to the total token value assuming full dilution, calculated by multiplying the current token price by the maximum supply. During bull markets, many investors treat high FDV as a key investment metric. However, one major point of contention in current debates is whether high FDV still holds practical relevance. Critics argue that since most VC-backed projects currently have circulating supplies amounting to only one-tenth—or even less—of their total supply, the fully diluted valuations are already inflated. Relying on high FDV as a basis for investment decisions could lead new investors into traps, making it a significant risk for market newcomers.

On the opposing side, some maintain that pricing is ultimately determined by market supply and demand dynamics and cannot be artificially controlled. The recent downturn exposed numerous VC projects whose prices were cut in half, primarily due to insufficient market liquidity. Moreover, as the industry evolves toward greater professionalism, the logic and standards for "price and value discovery" are also shifting. It's inappropriate to simply blame high FDV alone using rigid, outdated perspectives.

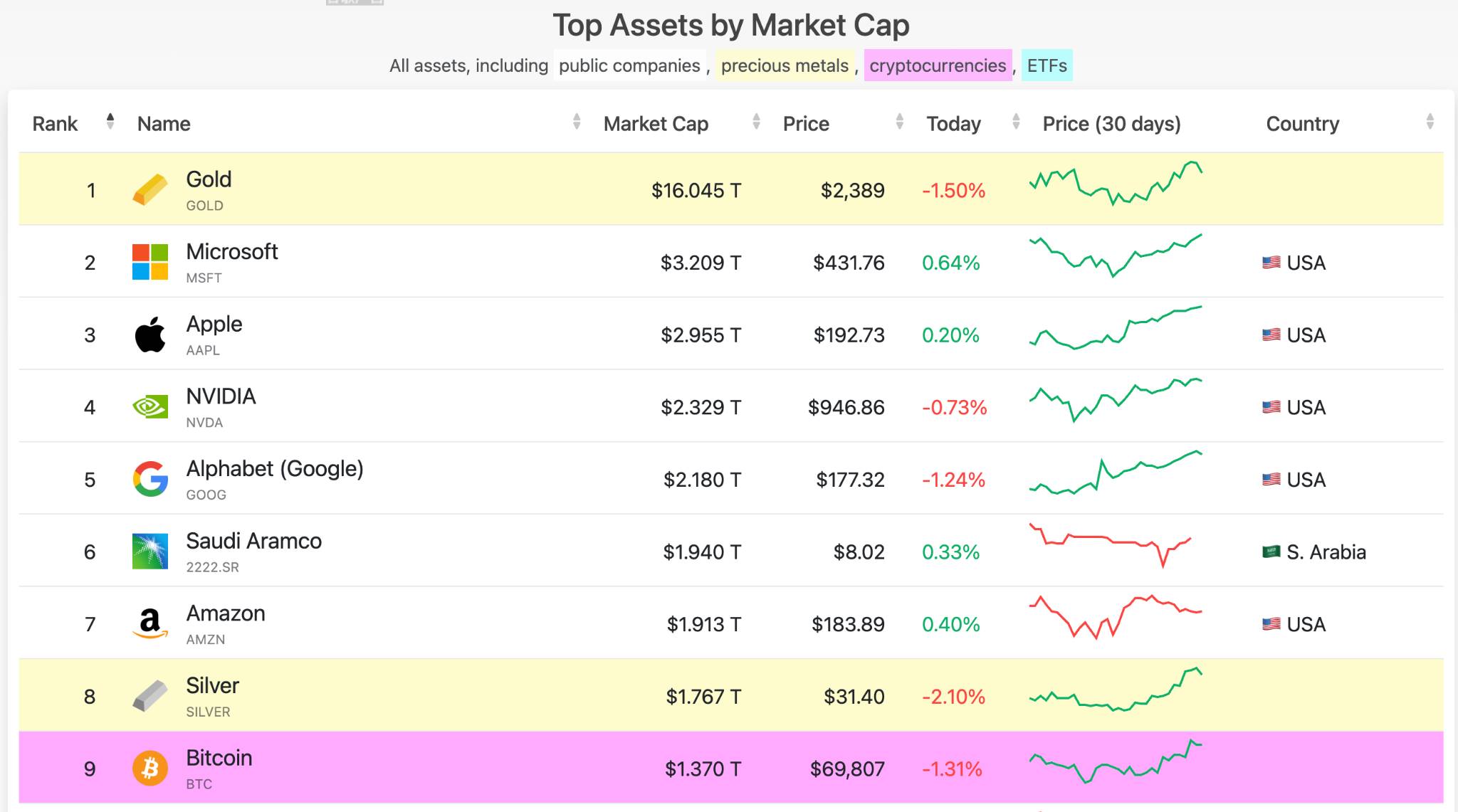

Indeed, growth is essential for the healthy development of the crypto industry. Thanks to persistent efforts by advocates and pioneers within and beyond the sector, the successful approval of Bitcoin ETFs brought sustained inflows, pushing the total market capitalization of global cryptocurrencies to $2.6 trillion. Bitcoin alone accounts for $1.37 trillion, ranking ninth among global assets (according to companiesmarketcap.com). The anticipated approval of Ethereum ETFs is expected to bring further influx—not just capital, but also new investors and users. Thus, avoiding the pitfalls of high FDV has become a pressing concern for both new entrants and seasoned participants in the space.

Escaping the High FDV Trap: The Key Lies in Exchange Project Selection

Undoubtedly, ETFs will drive new users and capital into the market, while the "high FDV dilemma" may result in capital outflows—a combination that, over time, undermines the normalization, scalability, and sustainable development of the cryptocurrency industry. To resolve the high FDV issue, we must understand why VC-backed projects tend to adopt a "low circulation, high valuation" model: under existing market demand, limited short-term liquidity allows lower circulating supply to support higher initial token pricing. Three key players are involved here: exchanges, new users, and VCs. Professional traders and investors, who possess well-developed investment frameworks, can be excluded from this discussion. VCs favor "low circulation, high FDV" structures primarily to secure stronger pricing power at launch, thereby maximizing FDV. Therefore, the key actor capable of protecting new users from the high FDV trap must be the exchange.

As a leading global cryptocurrency exchange committed to simplifying digital asset trading, CoinEx believes that continuously refining products and services, enhancing user experience, and consistently launching high-quality assets to meet diverse investment needs are crucial to serving more crypto users. In this process, project selection is paramount. Exchanges must play an active role to help more investors avoid the "high FDV trap." Over time, CoinEx has continuously optimized its project evaluation criteria, developing a listing mechanism centered on being “good, fast, and comprehensive,” with a focus on identifying innovative, high-growth potential projects with reasonable valuations—earning strong favor among investors, especially newcomers.

As guest TMJ noted during CoinEx’s X Space session: "The value of every quality project will eventually be recognized—it just takes time." The future of the digital asset industry awaits our collective vision.

About CoinEx

Founded in December 2017, CoinEx has always adhered to its brand philosophy of "users first," offering a wide range of products and services including spot trading, perpetual contracts, margin trading, staking, lending, and strategy trading. Driven by user-centric market insights, enriched with diverse functionalities and continuously refined service quality, CoinEx now supports over 1,000 cryptocurrencies and 1,500 trading pairs, serving more than 5 million users across over 200 countries and regions. Committed to providing intuitive, professional, and reliable crypto trading experiences, CoinEx safeguards users’ journeys in the world of digital assets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News