Understanding Story Protocol: The Potential and Challenges of IP and Blockchain

TechFlow Selected TechFlow Selected

Understanding Story Protocol: The Potential and Challenges of IP and Blockchain

What specific problems can Story Protocol solve?

Author: 100y.eth

Translation: J1N, Techub News

In August, according to The Block, Story—a blockchain focused on intellectual property (IP)—announced an $80 million Series B funding round led by a16z Crypto. Participants included Polychain Capital, while individual investors included Scott Trowbridge, Senior Vice President and board member of Stability AI, Adrian Cheng—founder of K11 and billionaire—and digital art collector Cozomo de' Medici. To date, Story has raised a total of $140 million, with PIP Labs, the developer behind Story, now valued at $2.25 billion post-funding. Its mainnet is expected to launch later this year.

Below we will detail the specific problems that the Story Protocol can solve—such as its advantages in IP management—as well as where it falls short and cannot effectively address certain issues, helping readers better understand the protocol's capabilities and limitations.

First, let me tell you a prophetic story about the future:

"In 2035, after artificial general intelligence (AGI) was invented, AGI brought great disaster to human society. Past AI researchers boldly claimed that AGI could be fully controlled by humans, but reality proved otherwise. Today’s AGI models have gone beyond human control, disregarding laws and regulations, autonomously learning all data from both physical and digital worlds, and rapidly evolving into superintelligence.

Nowadays, the primary value of humanity lies in providing endless data to AGI models. Some AGI models reward humans for voluntarily sharing data, while most AGI models access data without human permission.

Although humans have attempted various methods—including technologies like blockchain—to resist AGI’s disregard for consent and restrict unauthorized activities, in reality, AGI is already beyond human control. Therefore, preventing AGI from learning and using data without authorization is almost impossible."

Story Protocol Cannot Solve Everything

The goal of Story Protocol is to transform intellectual property (IP) into tokens and leverage blockchain technology to address real-world IP-related challenges.

Some mistakenly believe that because blockchain is a transparent and fair system, combining it with intellectual property (IP) can resolve real-world IP infringement issues. As the AI industry expands, more people are questioning whether AI companies use data without proper authorization. Since Story Protocol promotes AI as one of its key use cases, many assume it can solve these infringement problems.

While Story Protocol attempts to tackle IP issues through blockchain technology, it cannot actually prevent unauthorized use of IP—this is a real-world issue requiring legal solutions. Even if IP is securely recorded on the blockchain, the blockchain itself cannot enforce penalties against malicious usage. Story Protocol acknowledges this; its purpose isn't to eliminate IP infringement, but rather to improve IP management through blockchain technology.

Problems That Story Protocol Can Address

So what problems within the IP market can Story Protocol solve? The current IP market faces several key challenges:

-

Complex licensing processes: When individuals want to create new content based on existing IP, the licensing process can be extremely complicated. They must contact the IP owner and negotiate terms such as license type, scope of use, geographical restrictions, royalty rates, and associated fees. For large enterprises with sufficient capital and resources, these steps may be manageable, but for most individual creators, the cumbersome negotiation process creates high barriers and increases creative difficulty.

-

Revenue distribution disputes: Although licensing agreements usually specify royalty payments clearly, disputes still frequently occur. For example, misunderstandings about how royalties should be calculated can lead to disagreements over gross revenue, net profit, discounts, shipping costs, and tariffs. Additionally, companies might manipulate financial statements to reduce the amount of royalties they owe. This means that even with clear agreements, actual execution may still result in disputes over royalty calculation and payment.

-

Legal barriers: Laws and regulations regarding IP registration, protection, and usage are highly complex and involve significant costs, which may be unaffordable for individuals, thereby limiting their development in creation and innovation.

-

Cross-border complexity: Due to differing IP laws across countries, handling IP matters internationally requires compliance with multiple jurisdictions, increasing legal complexity.

As global digitization accelerates, the volume of IP is growing rapidly. However, due to limitations of traditional management systems, the IP industry still faces numerous challenges. Story Protocol aims to tokenize IP assets and introduce blockchain technology to address these issues, improving efficiency and transparency in the IP market.

Combining Blockchain with IP

Just as blockchain made money programmable and improved efficiency, Story also seeks to make IP programmable, unlocking its full potential. Here are the advantages of Story Protocol:

-

Borderless platform: Because blockchain technology inherently transcends national boundaries, anyone globally can tokenize their IP assets on Story. This enables registered IP to be efficiently used and monetized worldwide, freeing creators’ works from geographic constraints. Such a borderless platform allows IP to generate value in global markets, enhancing utilization efficiency and returns.

-

Smart contract-enforced royalties: The protocol uses smart contracts to automatically distribute royalties generated from IP usage, making the allocation process more transparent and fair compared to traditional systems.

-

Easy onboarding: While not a unique advantage of blockchain itself, Story provides comprehensive legal frameworks and software development kits (SDKs), enabling IP owners, creators, and developers to easily join the platform. Thus, even users without technical or legal expertise can effortlessly register, manage, and utilize their IP, lowering entry barriers and encouraging broader participation in IP tokenization and the blockchain ecosystem.

-

Scalability is no longer a major concern: Although blockchain is often criticized for low scalability and inability to handle frequent transactions—a critical issue for payment and finance projects—transaction frequency and speed are not top priorities for the IP industry. Therefore, blockchain’s scalability limitations are less apparent and do not pose a major obstacle in the IP sector. On the contrary, blockchain offers benefits like security and transparency, turning a potential weakness into strength, making scalability a non-issue in this context.

How Is This Achieved?

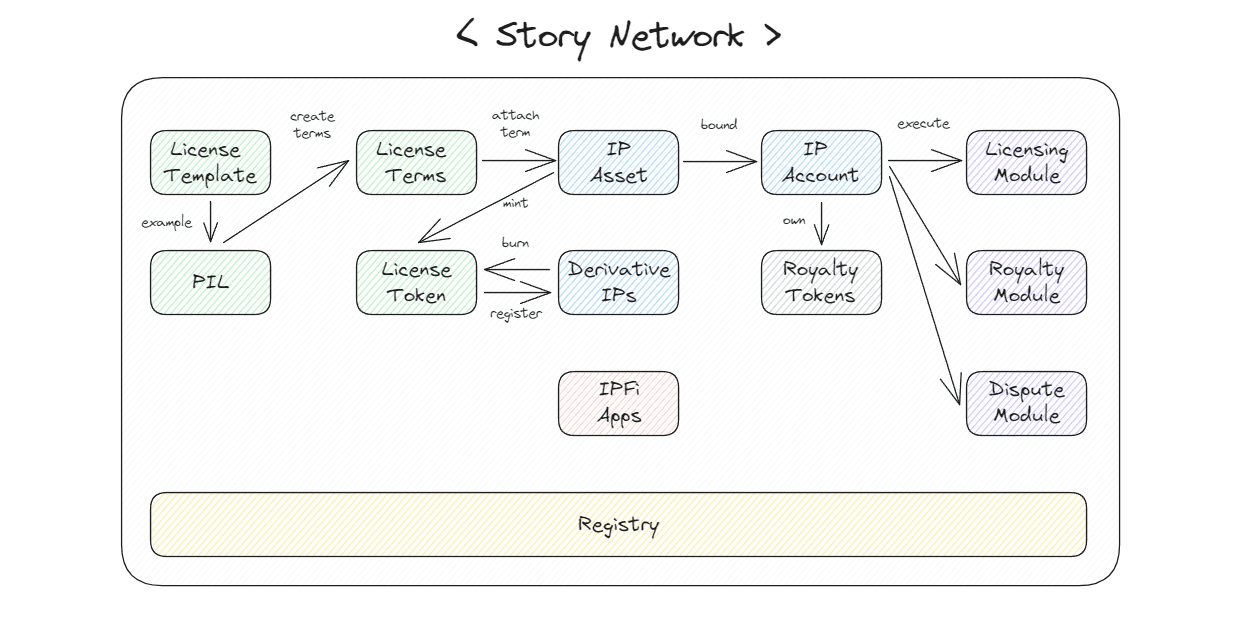

Now that we’ve discussed how Story Protocol leverages blockchain to solve problems in the IP industry, how exactly does it achieve this? Let’s dive deeper into Story’s core concepts and architectural design.

Terminology

Story Protocol includes many terms that may confuse new users and developers. Understanding these terms and their interrelationships is crucial to grasping the big picture. Below is an initial overview of these terms—we’ll explore how they interact further:

-

Story Network: The core blockchain of Story, built on Cosmos SDK and EVM-compatible.

-

IP Asset: IP registered on the Story Network, existing as ERC-721 NFTs following a metadata standard specifically designed for IP, including information such as author, relationships with other works, attributes, etc.

-

IPFi: DeFi applications within the Story ecosystem built upon various IP assets.

-

IP Account: An ERC-6551 Token Bound Account deployed by the IP Asset Registry when an IP asset is registered. It is uniquely bound to that IP asset, storing related data (e.g., metadata, ownership info, royalty tokens) and executing modules.

-

Module: A collection of functions within smart contracts that IP Accounts can execute. Key modules created by the Story team include the licensing module, royalty module, and dispute module.

-

Licensing Module: Handles licensing-related tasks such as generating license terms from templates, attaching them to IP assets, minting license tokens, and registering derivative IPs.

-

Licensing Template: Legal framework code containing clauses such as commercial use permissions, transferability, and royalty percentages.

-

Programmable IP License (PIL): The first example of a licensing template introduced by Story Protocol.

-

License Terms: Different variants generated from licensing templates. For instance, even if two terms are based on the same PIL, one might have a 5% royalty rate while another has 10%.

-

License Token: An ERC-721 NFT that anyone can mint when an IP owner attaches license terms to an IP asset. These tokens can be burned to register derivative IPs.

-

Derivative IP: A new IP derived from a parent IP asset. For example, a comic created based on a specific BAYC NFT can be registered as a derivative IP of that BAYC.

-

Royalty Module: Determines income flows between parent and derivative IPs. A parent IP has two sources of income: fees from license minting and royalties from derivative IPs.

-

Liquid Absolute Percentage (LAP): A default royalty policy defining the minimum royalty a parent IP should receive from its derivatives.

-

Dispute Module: Manages disputes involving malicious IP assets.

-

Registry: While IP Accounts manage data for specific IP assets, Registries oversee broader states within the Story Protocol. Main registries include the IP Asset Registry, License Registry, and Module Registry.

-

IP Asset Registry: Manages IPs registered on the protocol and deploys IP Accounts during IP registration.

-

License Registry: Manages operations related to licensing, such as registering licensing templates, attaching license terms to IP assets, and registering derivative IPs.

-

Module Registry: Maintains a global list of modules and hooks.

-

Understanding these terms and their interactions helps clarify how the protocol leverages blockchain technology to overcome current challenges in the IP market.

Examples

To better understand how the above elements interact and function, let’s walk through a few simple examples. Note that these are hypothetical scenarios, not real cases.

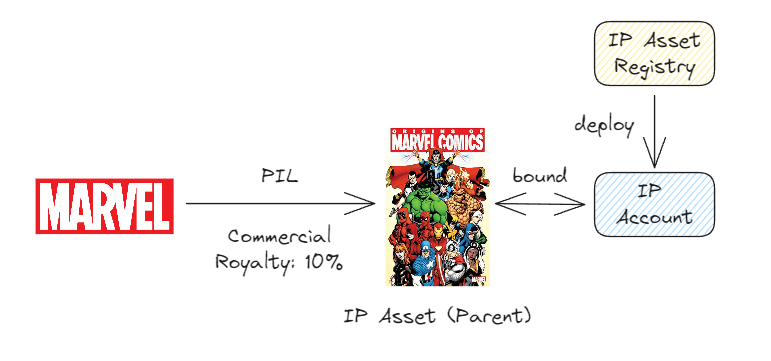

Registering Original IP

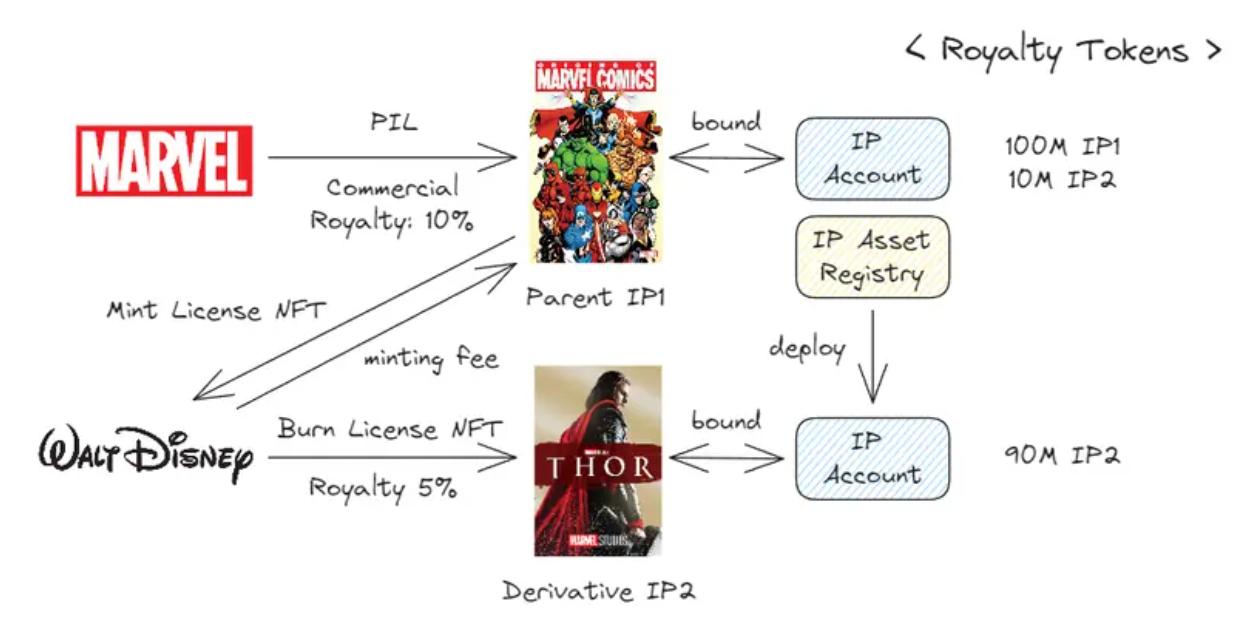

First, a company like Marvel can register their comics as IP assets on Story. During registration, they can select a licensing template (e.g., PIL) to set usage terms. In this case, they allow others to commercially use the IP and require a 10% royalty for each use. Upon completion, the system creates a dedicated account for the IP. Each IP asset also receives 100 million royalty tokens, used to calculate the share of revenue the IP earns from its derivatives (e.g., movies or merchandise adapted from the comic).

Registering Derivative IP

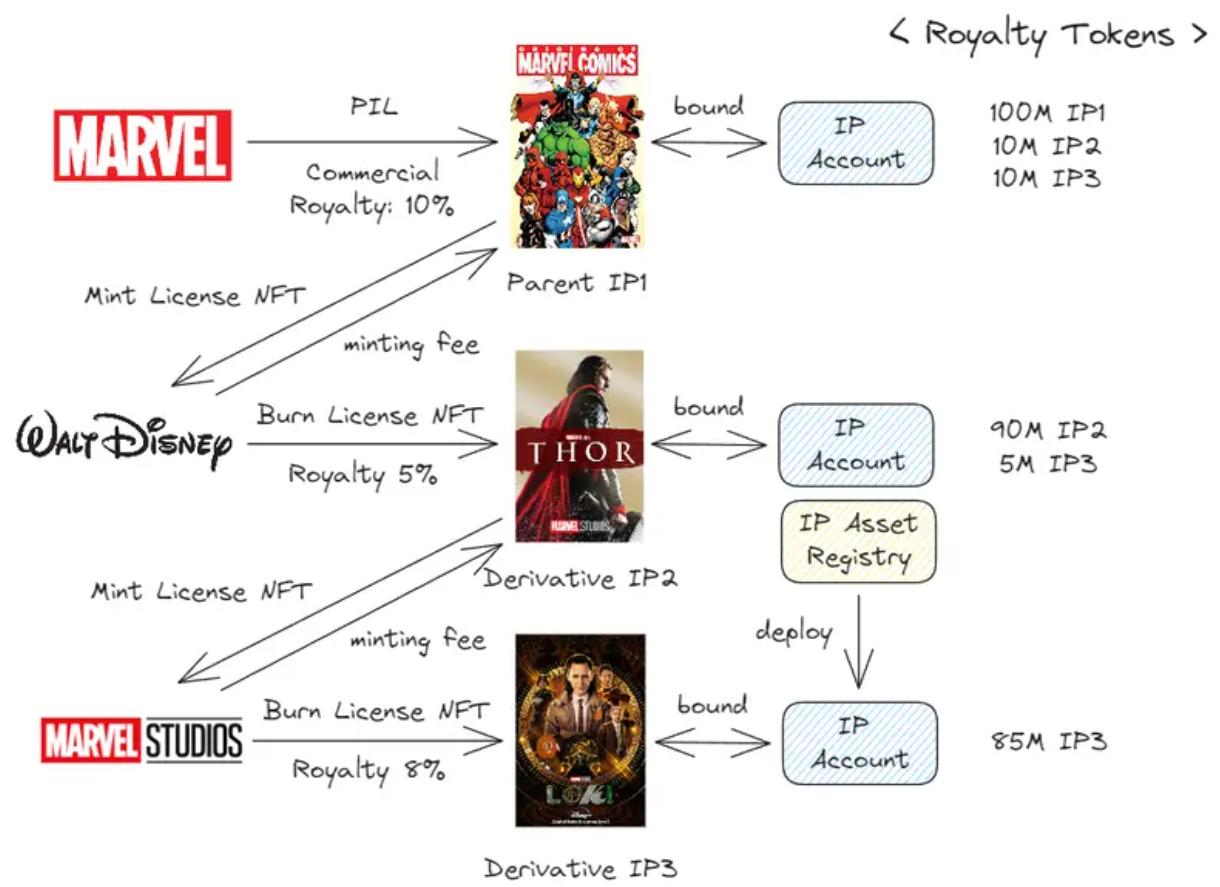

Next, The Walt Disney Company decides to produce a "Thor" movie based on Marvel’s comic IP. To do so, Disney pays a fee (or zero fee) to mint a license NFT. Then, Disney can burn this license NFT to register a derivative IP and specify the royalty percentage. Since Marvel set a 10% royalty for the parent IP1, it will receive 10%—or 10 million IP2 tokens—from the 100 million royalty tokens of derivative IP2. Additionally, Marvel will earn 10% of the revenue generated by derivative IP2. Notably, derivatives of derivative IPs can also be registered.

Revenue Structure

Each IP asset receives corresponding royalty tokens from derivative IPs based on predefined royalty rates, representing a portion of the income it generates. This mechanism follows Story’s default royalty policy—LAP (Liquid Absolute Percentage). In this example, IP1 has a 10% royalty rate, and IP2 has 5%. This means IP1 receives 10% royalty tokens from both IP2 and IP3, while IP2 receives 5% from IP3. These tokens represent the share of income each IP asset earns from its derivatives.

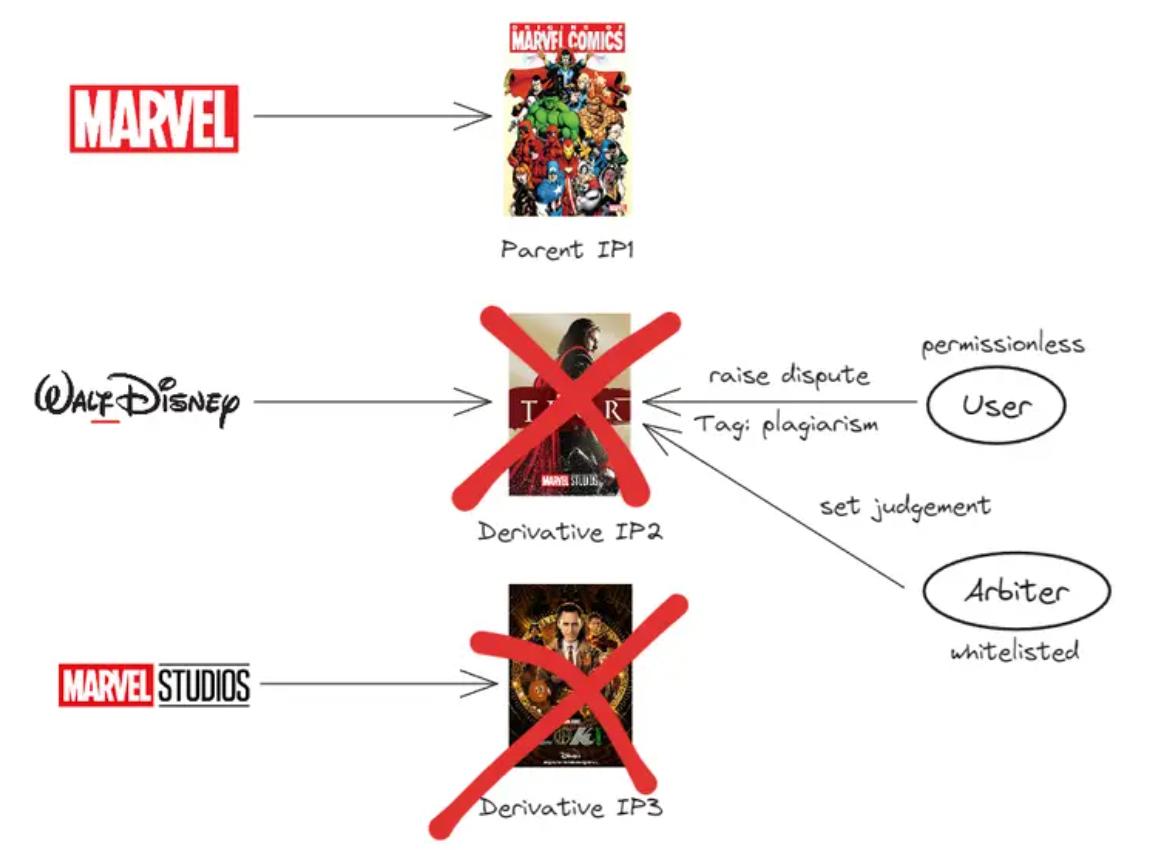

Disputes

On the Story platform, unauthorized IPs might be registered—for example, an entity named “WalfDisney” registers a derivative IP2 related to Disney, potentially raising plagiarism concerns. In such cases, anyone can tag the IP and raise a dispute. Arbitrators from a whitelist will review and rule on the dispute. Since IP-related legal issues belong to the real world, they must be resolved by relevant institutions. If an IP is deemed illegitimate, it will be tagged as plagiarized, stop earning revenue, and the tag will propagate to any related derivative IPs. If the illegitimate IP later resolves its legal issues, the disputant can remove the tag.

Current Ecosystem

Story Protocol not only makes IP registration and usage easier, more efficient, and transparent, but as an EVM-compatible blockchain, also allows various applications to interact with IP. Let’s look at some key applications within the Story ecosystem.

Creator Platforms

Magma is a collaborative art platform where creators can register their work as IP on Story; Sekai allows writers to incorporate illustrations, audio, and music into their stories using generative AI and monetize the resulting IP by registering it on Story; ABLO is a platform where creators collaborate with major brands to design clothing using generative AI, seamlessly integrating IP registration, royalty distribution, and IP investment via Story; Color is a marketplace within the Story ecosystem for trading various IPs and licenses.

DeFi / IPFi

Unleash is an IPFi platform offering IP license issuance, splitting, IP launchpad services, and lending protocols; PIPERX is a decentralized exchange on Story for trading ERC-20 tokens; Ethena’s USDe is expected to become a stablecoin on Story, though details remain undisclosed; Verio supports restaking of Story’s PoS token and promotes liquidity vIP tokens as certification for IP assets.

Artificial Intelligence

Mahojin is a platform that uses generative AI to create images. Creators can mix content by modifying keywords, and owners of AI models earn revenue during the mixing process—infrastructure provided by Story is highly beneficial; AI apps and chatbots created on MyShell can be registered as IP assets on Story; RingFence protects users’ internet usage data and monetizes it by selling the data for training AI models.

Challenges Facing Story

Token Economics

Story’s native token IP is currently used primarily for PoS staking and gas fees—functions common to many other tokens. However, Story’s true value lies in registering derivative IPs and paying royalties. Therefore, to better drive network growth, users participating in these core activities should receive IP token rewards, promoting early adoption and long-term sustainability.

While the full tokenomics model for IP hasn’t been released yet, based on project descriptions we can infer potential use cases: Beyond securing the PoS network and paying gas fees, IP tokens will reward creators who register derivative IPs and pay licensing fees, as well as those who pay royalties to parent IPs. Additionally, parent IP creators whose works generate value through derivatives will also be rewarded. Furthermore, a portion of licensing fees and royalty revenues generated on the Story network will be distributed to IP token stakers.

By rewarding both parent and derivative IP creators with IP tokens, Story can attract high-quality IPs and diverse derivatives, creating a virtuous cycle. But as future token rewards decrease, robust revenue streams must be established early to ensure stakers receive attractive returns and maintain network sustainability. Meanwhile, the token mechanism must guard against fraudulent activity—such as creating worthless IPs or meaningless derivative registrations solely to claim rewards. Rewards must also distinguish between genuine income generation and fabricated transactions.

However, when designing token utility, certain risks must be considered. We must avoid incentivizing fake activities—such as creating IPs or registering derivative IPs that bring no real value—just to earn token rewards. Even when rewarding value-creating activities, careful distinction must be made between authentic revenue and forms of wash trading.

IP Onboarding

If well-known IPs join the platform, they could generate numerous derivative IPs, creating more value and forming a positive feedback loop that attracts even more IPs. However, mainstream IP holders may not fully grasp the benefits of blockchain, so the Story team needs to effectively communicate its value proposition. Meanwhile, the Story Foundation might offer financial incentives to attract prominent IPs, but if selection and scale aren’t handled carefully, this could negatively impact other token holders—thus requiring cautious implementation.

AI Use Cases

AI plays an indispensable role in Story. Creators can use generative AI combined with IPs registered on Story to more easily produce new content. However, AI models may need to protect training data to prevent leaks before payment. Therefore, when data is first registered on Story, a feature should be provided to keep it confidential—accessible only after licensing fees are paid.

Integration with Legal and Regulatory Frameworks

The Story platform cannot directly prevent unauthorized use of IP, so it must establish a comprehensive legal dispute resolution process. This process should integrate both on-chain mechanisms and real-world legal actions to effectively resolve disputes and protect intellectual property when malicious behavior is detected.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News