Can Sui, now gaining momentum, replicate Solana's previous bull run? A comprehensive assessment.

TechFlow Selected TechFlow Selected

Can Sui, now gaining momentum, replicate Solana's previous bull run? A comprehensive assessment.

Judging from market performance, the price trends of the two indeed share similar experiences.

By Frank, PANews

Facebook-affiliated public blockchain Sui has recently drawn significant attention. The most discussed topic surrounding Sui on social media is that "the SUI token appears to be replicating Solana's 2021 price trajectory." Many believe the recent surge in SUI closely resembles Solana’s pre-rally phase before its last major bull run, leading some to speculate that Sui could become the next Solana.

Sui launched its mainnet in May 2023, while Solana’s mainnet went live in March 2020—there remains a considerable gap between their current data. However, when assessing growth potential, it makes sense to compare their performance during similar stages. This article compares Sui and Solana roughly one year after each network’s launch—Sui as of September 2024 and Solana around July 2021. While this comparison may seem like "marking the boat to find a lost sword," it still offers an objective reference point.

On-Chain Data: Sui Outperforms Solana in 2021

To enable clearer comparisons, Solana’s data is taken from approximately July 12, 2021, while Sui’s data reflects conditions as of September 24, 2024.

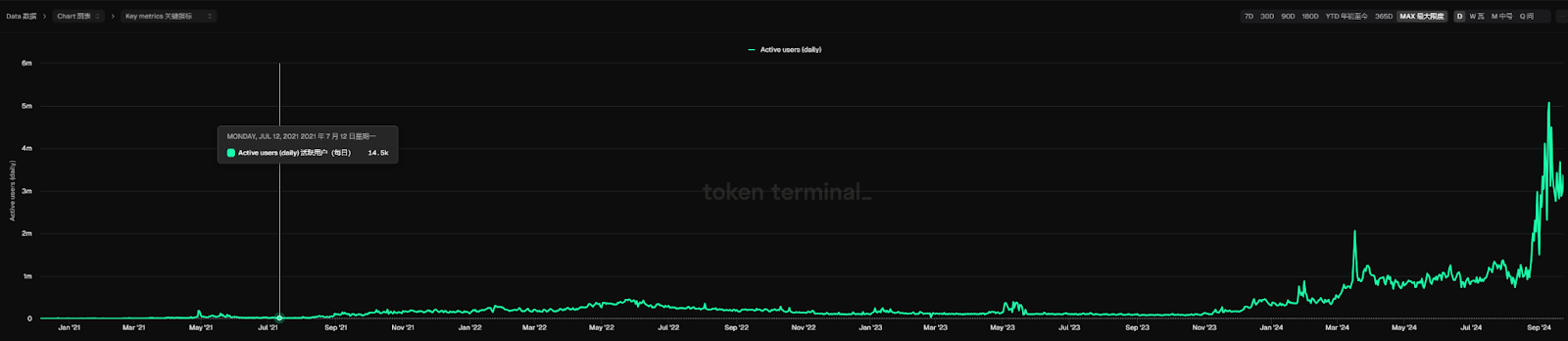

From an on-chain perspective, Sui currently outperforms Solana’s metrics from mid-2021. In fact, although Solana’s SOL token surged dramatically in 2021, its ecosystem data was not particularly impressive at the time. Daily active addresses (DAUs), for instance, remained in the tens of thousands throughout 2021, only surpassing 100,000 in 2022. Sui, by contrast, has seen explosive growth in DAUs. Before April 2024, Sui’s daily active addresses were comparable to Solana’s 2021 levels—averaging in the tens of thousands. However, following a spam-driven surge in April, Sui’s DAUs skyrocketed to over one million. Even during the market lull in August, DAUs stayed above 400,000, and have recently surged past one million again.

Sui Daily Active Addresses

Solana Daily Active Addresses

One frequently cited metric among Sui bulls is its peak TPS (transactions per second) reaching 297,000, compared to Solana’s peak of 65,000. However, in terms of average daily TPS, Sui still lags behind Solana’s level in July 2021.

Overall, Sui’s on-chain activity clearly exceeds Solana’s at a similar stage, lending credibility to the argument that Sui could become the next Solana.

Social Media Influence: Sui Lacks a “Star Spokesperson”

Ecosystem development is important, but in crypto, social media momentum often plays a decisive role in driving token prices. One key reason for Solana’s surge in 2021 was the public endorsement by FTX founder Sam Bankman-Fried (SBF). Dylan and Ian Macalinao, co-founders of Saber—one of Solana’s fastest-growing DeFi projects in 2021—explained their choice of Solana by saying: "We had been following SBF for a while and were already using FTX. That’s how we realized Solana was a strong blockchain."

Beyond SBF, venture capital firm A16z also played a crucial role in boosting market confidence in Solana through its investment. More on that later. Additionally, Solana gained high-profile endorsements from celebrities such as Mike Tyson, Michael Jordan, and Melania Trump in 2021. As a result, Solana became a true "influencer chain," with widespread online chatter about it becoming the "Ethereum killer"—a narrative strikingly similar to today’s hype around Sui being the next Solana. Andrew Kang, co-founder and partner at Mechanism Capital, commented: "It's not that I think SUI will reach SOL's market cap—it's currently only 3.5% of SOL's—but this sentiment echoes what .eth community members said before or during SOL’s outperformance."

In contrast, while numerous KOLs have voiced bullish sentiments on Sui, there is no single figure equivalent to SBF championing the project. Instead, support comes from a broad base of industry analysts and influencers promoting Sui across social platforms. For example, in September, David Zimmerman, analyst at K33 Research, stated that Sui, thanks to its technological advantages and upcoming native gaming console, could emerge as a strong competitor to Solana.

Capturing Market Trends: Solana Still Dominates the MEME Scene

Catching the right market wave is critical for any project’s success. In 2021, the dominant trends were NFTs and DeFi, both of which Solana capitalized on effectively. In the current cycle, however, MEME tokens are the biggest trend—and a major driver of on-chain activity. Until recently, Solana had a near-monopoly on this space. However, Sui is now showing signs of progress. Recently, the number of new tokens launched daily on Sui surpassed 300—a significant leap from the previous range of 30–50 before September 10. Still, this pales in comparison to Solana, which continues to generate around 10,000 new tokens per day. Unfortunately, historical data on Solana’s new token creation in 2021 is unavailable, making direct comparison impossible.

In terms of trading volume, on September 24, Sui recorded $95 million in 24-hour token trading volume, compared to Solana’s $1.1 billion. Solana continues to dominate the MEME trend, while Sui faces stiff competition from Base, Ethereum L2s, and TON.

Capital Backing: Shared Investor Lineage

Ultimately, capital support is a key driver of token valuation. Recently, Grayscale has emerged as a notable backer of Sui. On September 13, assets under management for the Grayscale Sui Trust exceeded $1 million. Additionally, on September 17, Jeremy Allaire, co-founder and CEO of Circle, announced that USDC and CCTP are now available on Sui Network.

Looking back at Solana in 2021, FTX did more than just provide social influence—it also offered substantial financial backing. It’s estimated that FTX and its affiliated investment arm, Alameda Research, invested over $100 million into various companies and projects within the Solana ecosystem. Furthermore, in June 2021, a16z injected $314 million into Solana. This close relationship with FTX provided Solana with abundant capital for marketing and price appreciation.

Sui has not announced any recent fundraising rounds (though unconfirmed reports suggest OTC sales occurred). Its last major funding round was a $300 million raise in 2022, led by FTX Ventures, with participation from a16z Crypto, Jump Crypto, Apollo, Binance Labs, Franklin Templeton, Coinbase Ventures, Circle Ventures, Lightspeed Venture Partners, Bixin Ventures, and A&T Capital. Notably, many of these investors were also early backers of Solana. However, in 2023, Mysten Labs—the company behind Sui—repurchased shares from FTX for $96 million.

Market Performance: Price Patterns Show Striking Similarities

Returning to the core of the current bullish narrative—the token market—SUI has seen a sharp rally recently. From August 5 to September 23, SUI surged 256% over 49 days, outperforming most other layer-1 blockchains.

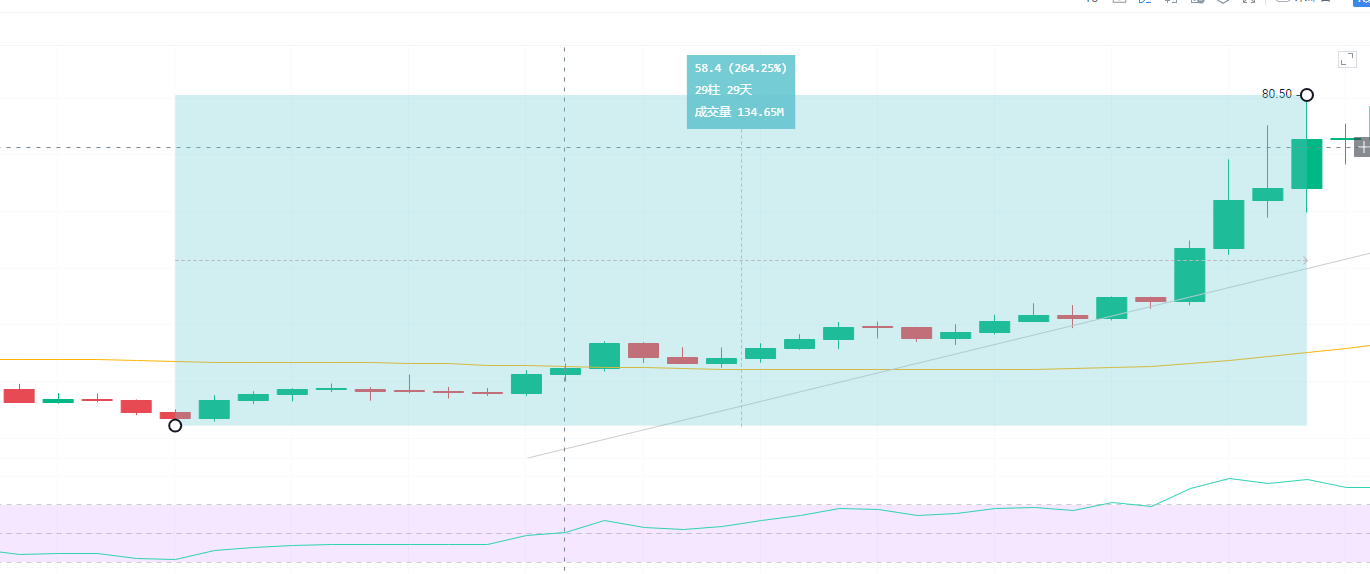

Solana Price Chart – July 2021

Back in 2021, SOL rose 264% over 29 days—from July 20 to August 18. The concentrated price surges in both tokens bear a striking resemblance.

SUI Price Chart – August to September 2024

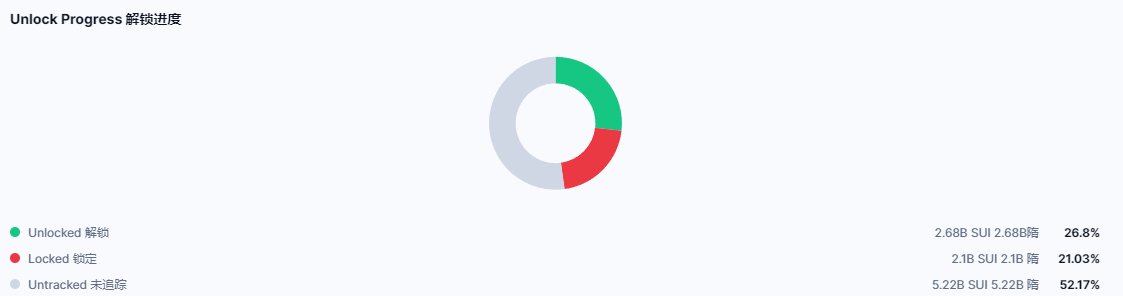

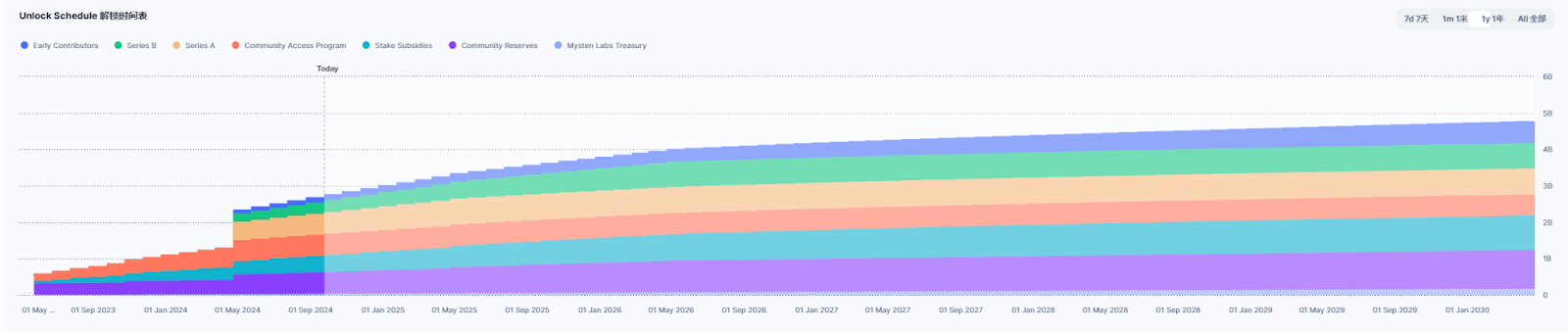

Currently, SUI’s circulating market cap stands at approximately $4.1 billion, while SOL reached $18.7 billion after its first major rally. SUI’s current circulating supply is 26.8%, with 21% of tokens still locked and set to unlock monthly. Even accounting for fully diluted valuation, SUI falls short of SOL’s post-rally market cap in 2021.

In terms of trading activity, SUI’s recent rally appears partly driven by strong demand in South Korea. Upbit, South Korea’s largest exchange, now accounts for about 7.21% of SUI’s total trading volume, making it the largest SUI trading venue after Binance, Coinbase, and OKX.

Overall, Sui and Solana in 2021 share many similarities: comparable social narratives, performance advantages, overlapping investor bases, and similar price action patterns. Perhaps Sui could become the next high-performance blockchain to capture market enthusiasm. However, several questions remain. First, unlike Solana in 2021, Sui does not enjoy a monopoly—today’s L1 and L2 landscape is crowded, so can performance alone still be a differentiator? Second, Sui’s data growth tends to be explosive followed by sharp declines—do these volatile swings truly reflect sustainable ecosystem health? Third, Sui has yet to produce breakout dApps with wealth-generation effects akin to Raydium or MagicEden during Solana’s prior bull run. Fourth, the ongoing token unlocks cannot be ignored. Of course, no one can predict the market with certainty. The above analysis should not be taken as investment advice—please proceed with caution.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News