Will the DeFi revival, institutional adoption, and new gameplay重现辉煌历史?

TechFlow Selected TechFlow Selected

Will the DeFi revival, institutional adoption, and new gameplay重现辉煌历史?

Overall, it seems that multiple factors are converging to signal a revival of DeFi.

Author: flow

Translation: TechFlow

The summer of 2020, known as "DeFi Summer," was an incredible period for the cryptocurrency industry. DeFi ceased to be just a theoretical concept and became something that actually worked in practice. During this time, we witnessed the rapid rise of multiple native DeFi protocols—including Uniswap's decentralized exchange (DEX), Aave's lending protocol, SkyEcosystem's algorithmic stablecoin, and many others.

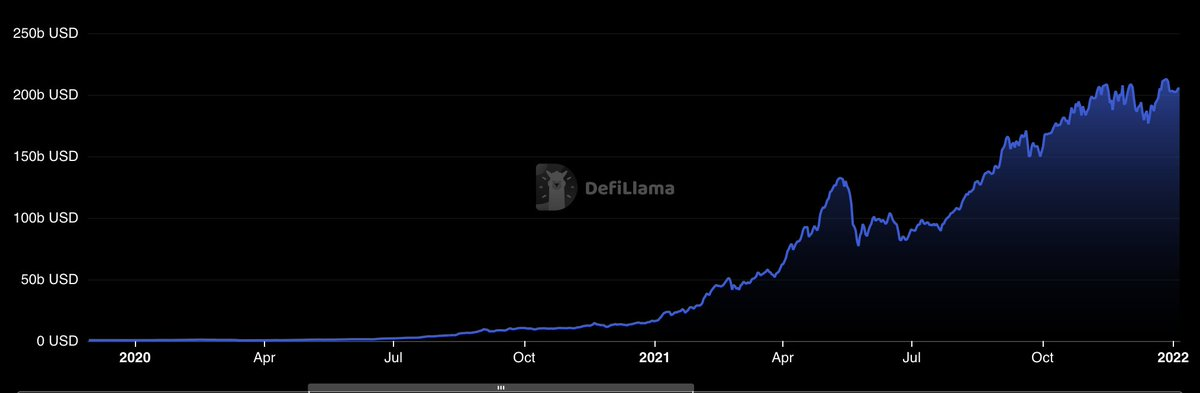

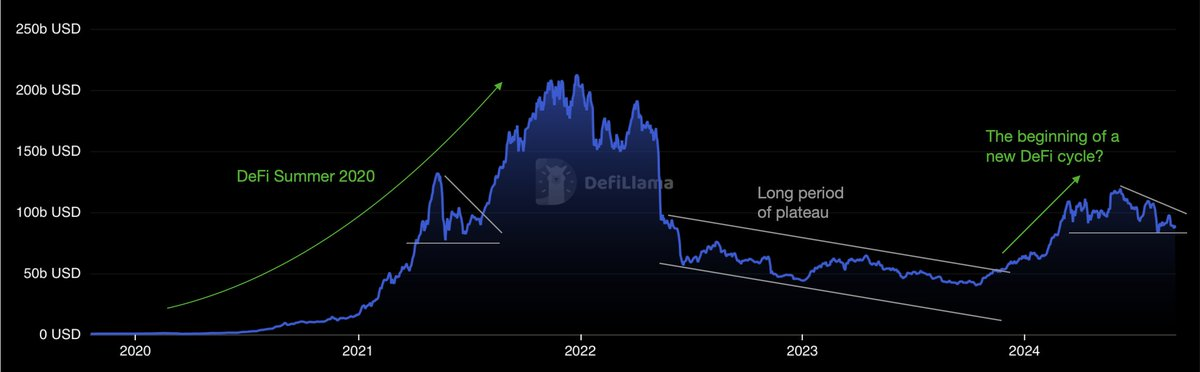

Following this, the total value locked (TVL) in decentralized finance (DeFi) applications surged dramatically. From approximately $600 million at the beginning of 2020, TVL rose to over $16 billion by year-end and peaked at more than $210 billion in December 2021. This growth coincided with a strong bull market within the DeFi sector.

Chart showing crypto TVL from 2020 to end of 2021

Source: DeFi Llama

We can identify two main catalysts behind "DeFi Summer":

-

Breakthrough advancements in DeFi protocols enabling scalability and offering clear use cases.

-

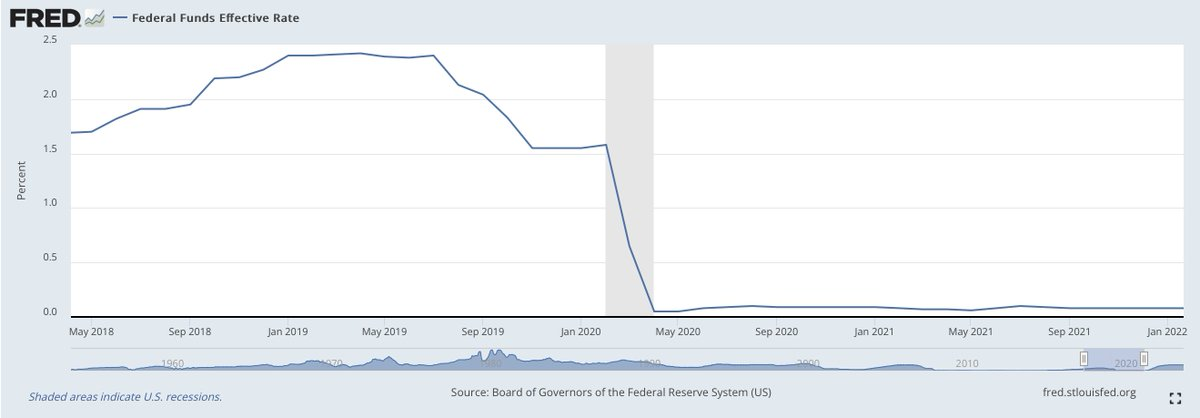

The beginning of the Federal Reserve's accommodative monetary policy cycle, during which interest rates were sharply cut to stimulate the economy. This led to abundant liquidity in the system and incentivized investors to seek more exotic yield opportunities, given the extremely low traditional risk-free rates. These conditions created a perfect environment for DeFi’s rapid expansion.

Federal Funds Rate chart from May 2018 to January 2022

Source: Fred St Louis

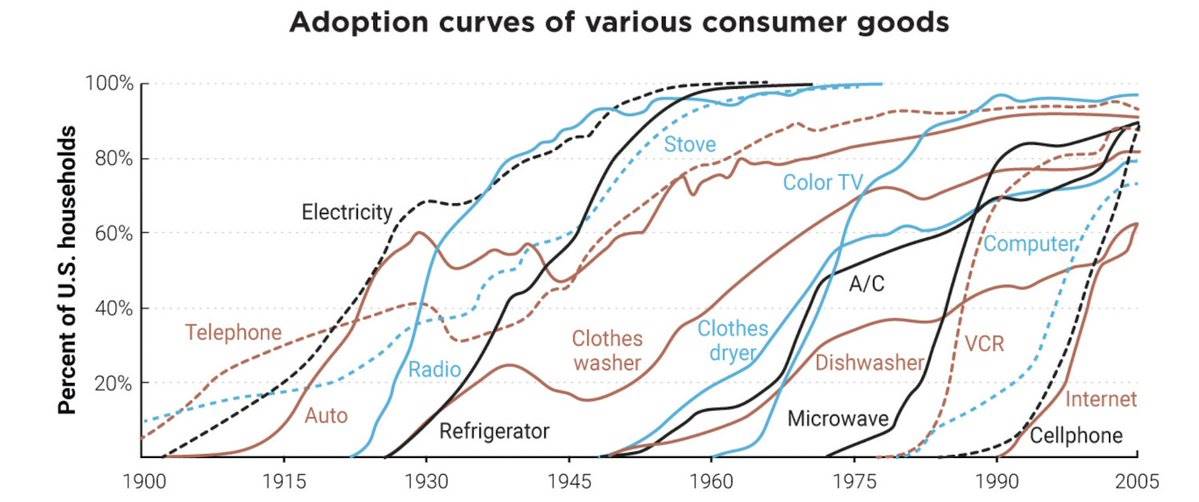

However, like many emerging disruptive technologies, DeFi adoption followed the typical S-curve pattern often referred to as the Gartner Hype Cycle.

Chart illustrating adoption trends over time across various consumer products

Source: The Bullish Case for Bitcoin

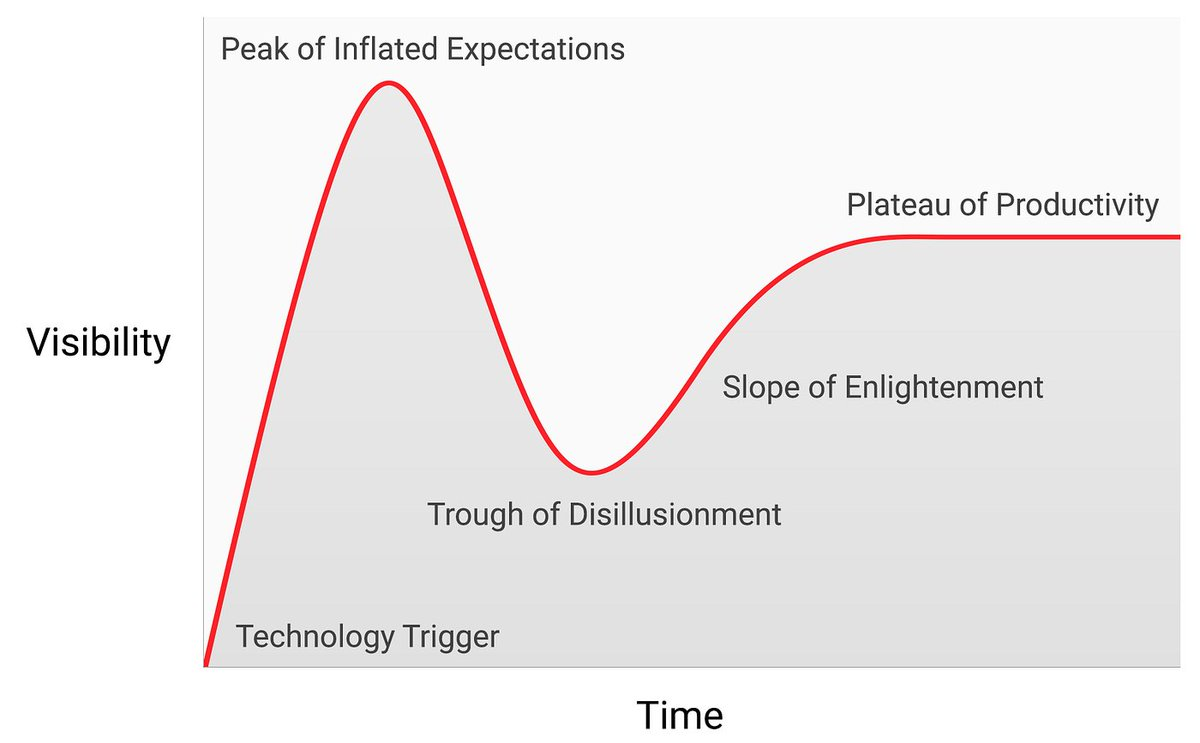

In general, it works like this: At the early stage of "DeFi Summer," early adopters had strong conviction about the transformative nature of the technology they were investing in. For DeFi, this belief stemmed from its potential to fundamentally reshape the current financial system. As more participants entered the market, enthusiasm reached its peak, with buying behavior increasingly driven by speculators more interested in quick profits than in the underlying technology. After this euphoric peak, prices declined, public interest in DeFi waned, and we entered a bear market followed by a prolonged plateau phase.

Gartner Hype Cycle chart

Source: Speculative Adoption Theory

It is important to clarify that this dull plateau phase is not the end of DeFi, but rather the beginning of its true journey toward mass adoption. During this time, developers continue building, and the number of committed believers in DeFi gradually increases. This lays a solid foundation for the next iteration of the Gartner Hype Cycle, potentially bringing even larger user bases and greater scale.

DeFi Revival

Currently, the outlook for a DeFi revival appears highly promising. Similar to the catalysts of the previous DeFi Summer, we now have: a new generation of more mature DeFi protocols under development; healthy and growing DeFi metrics; increasing institutional participation; and an ongoing accommodative monetary policy cycle from the Federal Reserve. Together, these factors create a fertile environment for another surge in DeFi activity.

To better understand this situation, let’s examine each component:

Toward DeFi 2.0

Over the years, DeFi protocols and applications have evolved significantly since the initial hype wave of 2020. Many of the issues and limitations of first-generation protocols have been addressed, leading to a more robust and mature ecosystem—what we now refer to as the DeFi 2.0 movement.

Key improvements include:

-

Better user experience

-

Cross-chain interoperability

-

Improved financial architecture

-

Enhanced scalability

-

Stronger on-chain governance

-

Improved security

-

Better risk management

Additionally, we’ve seen the emergence of multiple new use cases. DeFi is no longer limited to early-stage trading and lending. Emerging trends such as restaking, liquid staking, native yield, novel stablecoin solutions, and tokenization of real-world assets (RWA) are making the ecosystem more vibrant than ever. Even more exciting is the continuous development of new infrastructure. Recently, I’ve noticed on-chain credit default swaps (CDS) and fixed-rate/term loans being built atop existing lending frameworks.

Healthy and Growing DeFi Metrics

Since late 2023, DeFi activity has revived, accompanied by a wave of new DeFi protocols.

First, looking at total value locked (TVL) across the crypto ecosystem, we see momentum returning after a long consolidation period. From $41 billion in October 2023, TVL nearly tripled to reach a local high of $118 billion in June 2024, before pulling back to around $85 billion today. While still below the all-time high (ATH), this represents a significant upward trend. There is strong reason to believe this could be the first wave of a long-term rising TVL trajectory.

Chart showing the evolution of TVL in crypto

Source: DeFi Llama

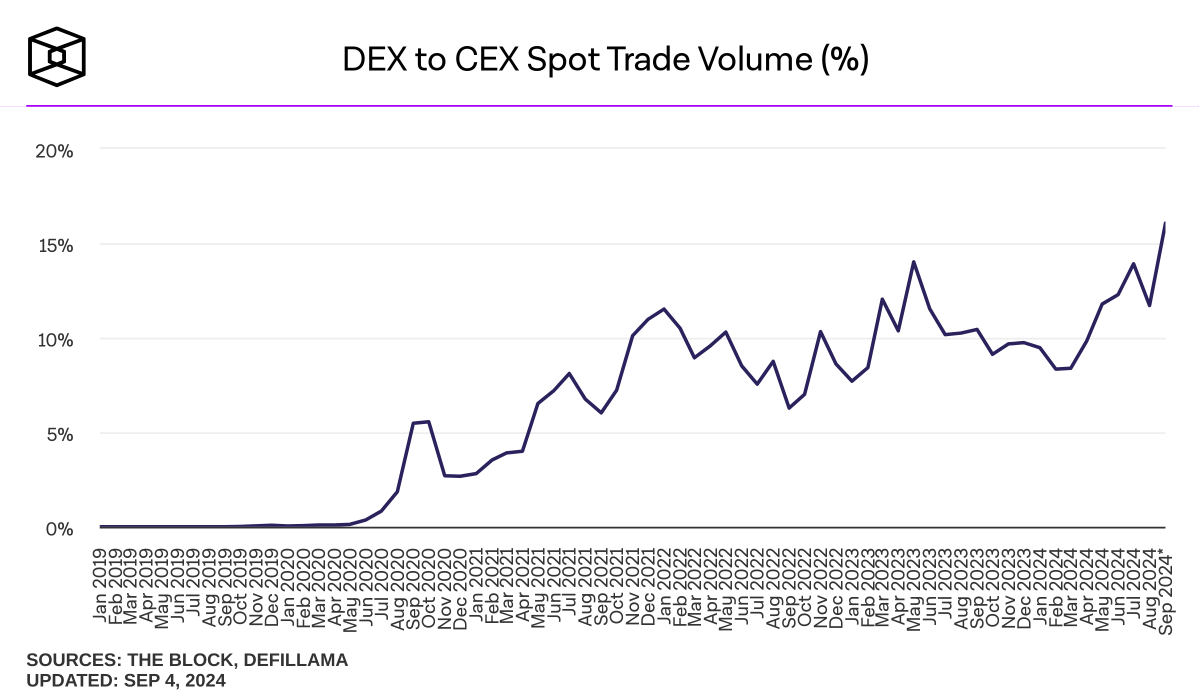

Another interesting metric is spot trading volume between decentralized exchanges (DEXs) and centralized exchanges (CEXs), which measures relative trading activity between the two. Again, we observe a positive long-term trend indicating that an increasing share of trading volume is shifting on-chain.

Chart showing DEX vs CEX spot trading volume

Source: The Block

Last but not least, DeFi’s share of attention within the broader crypto ecosystem has increased in recent months. In a competitive market where everyone fights for visibility, DeFi is once again capturing interest.

DeFi attention continues to rise.

If Trump wins, it’s hard to imagine which sector would benefit more.

Arrival of Institutional Participants

During "DeFi Summer," the first wave of DeFi users were primarily individuals trying to grasp this new technology. Now, a new wave of DeFi protocols is attracting major traditional financial institutions into the DeFi space.

In March this year, BlackRock, the world’s largest asset management firm, launched its first tokenized fund on the Ethereum blockchain—the BlackRock USD Institutional Digital Liquidity Fund (BUIDL)—allowing investors to earn U.S. Treasury yields directly on-chain. This marks BlackRock’s first DeFi initiative and has seen clear success, with assets under management exceeding $500 million.

BlackRock’s tokenized real-world asset fund $BUIDL surpassed the $500 million milestone within four months of launch, as the tokenized treasury market continues to expand.

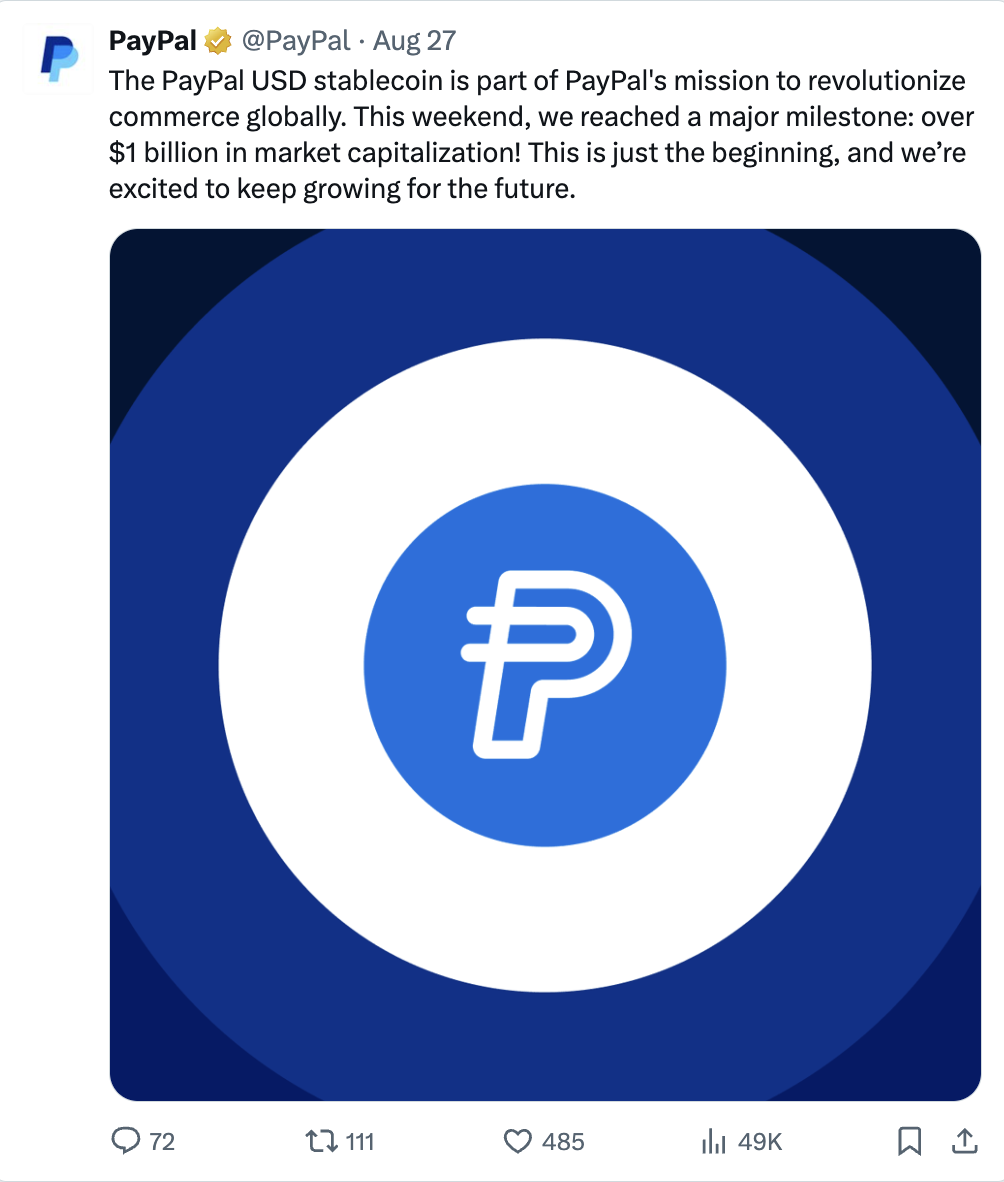

Another notable example of growing institutional interest is PayPal’s PYUSD stablecoin, which recently hit a key milestone: reaching a market cap of over $1 billion just one year after launch.

PayPal USD stablecoin is part of PayPal’s global mission to revolutionize commerce. This weekend, we achieved a major milestone: our market cap exceeded $1 billion! This is just the beginning, and we look forward to continued growth ahead.

These examples show that the broader financial industry is finally recognizing the value proposition of financial systems built on decentralized blockchain technology. As PayPal’s CTO put it: “If it reduces my overall costs while delivering benefits, why wouldn’t I embrace it?” As more institutions begin experimenting with this technology, we can view this as a powerful catalyst for advancing the DeFi sector.

Ongoing Fed Easing Cycle

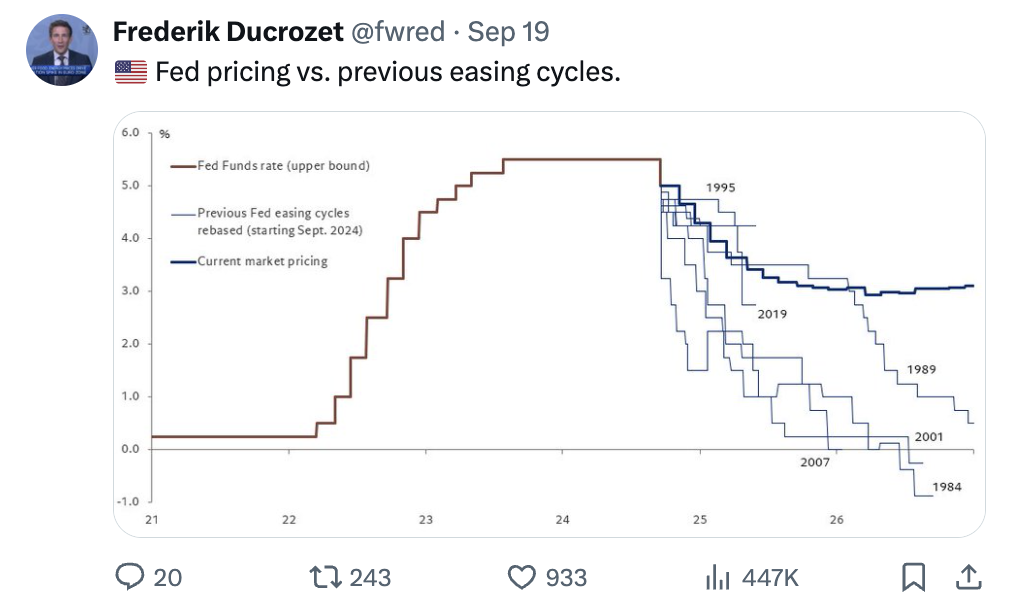

Beyond the points mentioned above, the current direction of U.S. monetary policy also serves as a potential catalyst for DeFi. In fact, we have just passed a critical economic turning point. The Fed made a 50-basis-point rate cut at its September FOMC meeting—the first such move since it began its post-pandemic inflation fight—strongly signaling the start of a new easing cycle. This is further supported by market expectations for the path of the Federal Funds Rate.

Frederik Ducrozet: Fed pricing compared to previous easing cycles.

The start of this new monetary easing cycle supports the DeFi bull case in two key ways:

-

This easing cycle will inevitably increase liquidity in the system. Liquidity is a crucial element in financial markets, and excess liquidity is beneficial as it means more capital available to enter markets. Thus, DeFi—and the broader crypto market—should benefit.

-

A decline in the Federal Funds Rate will relatively enhance the attractiveness of DeFi yields. Simply put, as traditional risk-free rates fall, investors will begin seeking alternative yield opportunities. This could lead to a rotation into DeFi, where attractive yields in stablecoins and other more exotic strategies are now safer and more reliable than they were years ago.

Will History Repeat Itself?

Overall, multiple factors appear to be converging, signaling a revival of DeFi.

On one hand, we are witnessing the emergence of several new DeFi infrastructures that are significantly more secure, scalable, and mature than those from a few years ago. DeFi has proven its resilience and established itself as one of the few areas in crypto with mature use cases and real-world applications.

On the other hand, the current macroeconomic environment is also supporting a DeFi resurgence. This mirrors the conditions of the previous DeFi Summer, and current DeFi metrics suggest we may be in the early stages of a much larger upward trend.

History doesn't repeat itself exactly, but it often rhymes.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News