The Path to DeFi Growth: Building Human-Centric Communities Beats Chasing TVL

TechFlow Selected TechFlow Selected

The Path to DeFi Growth: Building Human-Centric Communities Beats Chasing TVL

While TVL is an important metric, the quality and quantity of protocol integrations often provide a better indication of future growth trends.

Author: James Glasscock

Translation: TechFlow

This article explores how DeFi thrives by relying on its most valuable asset—people—and examines key strategies and insights for driving sustainable community growth.

Successful DeFi protocols treat their communities as powerful growth levers. This article dives into the strategies, challenges, and lessons learned that shape their ecosystems. By focusing on incentives, metrics, contributions, and governance, we uncover subtle yet significant insights applicable to many projects. We share perspectives from mature protocols that have weathered challenges, evolved continuously, and remain at the forefront of DeFi’s future.

In writing this piece, we engaged in deep conversations with six core DeFi contributors who generously shared their insights. Mastery lies in details, and this article offers only preliminary observations. For those seeking deeper understanding, we encourage joining these communities and participating actively.

-

@DeFi_Made_Here – Instadapp Fluid, offering efficient lending services

-

@wagmiAlexander – Aerodrome and Velodrome, enabling trading and liquidity provision on Base and Optimism networks

-

@MattLosquadro – Synthetix, serving as a liquidity layer for on-chain derivatives

-

@omgcorn – Yearn, a decentralized automated yield aggregator

-

@amplice_eth – Gearbox Protocol, a leverage layer for DeFi

-

@kmets_ – Aladdin DAO, delivering flexible farming, leverage, and stability products through Concentrator, CLever, and f(x) Protocol

Our discussion focuses on projects with TVL between $70 million and $700 million during August 2024. As projects scale, their needs and opportunities evolve. In the future, we will explore the unique dynamics within larger protocol ecosystems.

Over the past few years, I’ve worked to help build the Reserve protocol ecosystem. During that time, our on-chain TVL grew from zero to over $200 million, especially throughout the bear market. However, the journey was far from smooth. Writing this article has given me the chance to reflect more broadly and share these experiences, hoping they may be helpful to you.

This article is ideal for:

-

Crypto project and community leaders looking to expand their toolkit and enhance community-driven growth.

-

Job seekers aiming to enter crypto and make meaningful contributions.

-

Community experience enthusiasts who want to create spaces where people naturally gather and collaborate.

The Essence of Community

Contribution is the heart and lifeblood of community. In the complex world of DeFi, where products are still experimental, initial value lies in depth of participation rather than breadth.

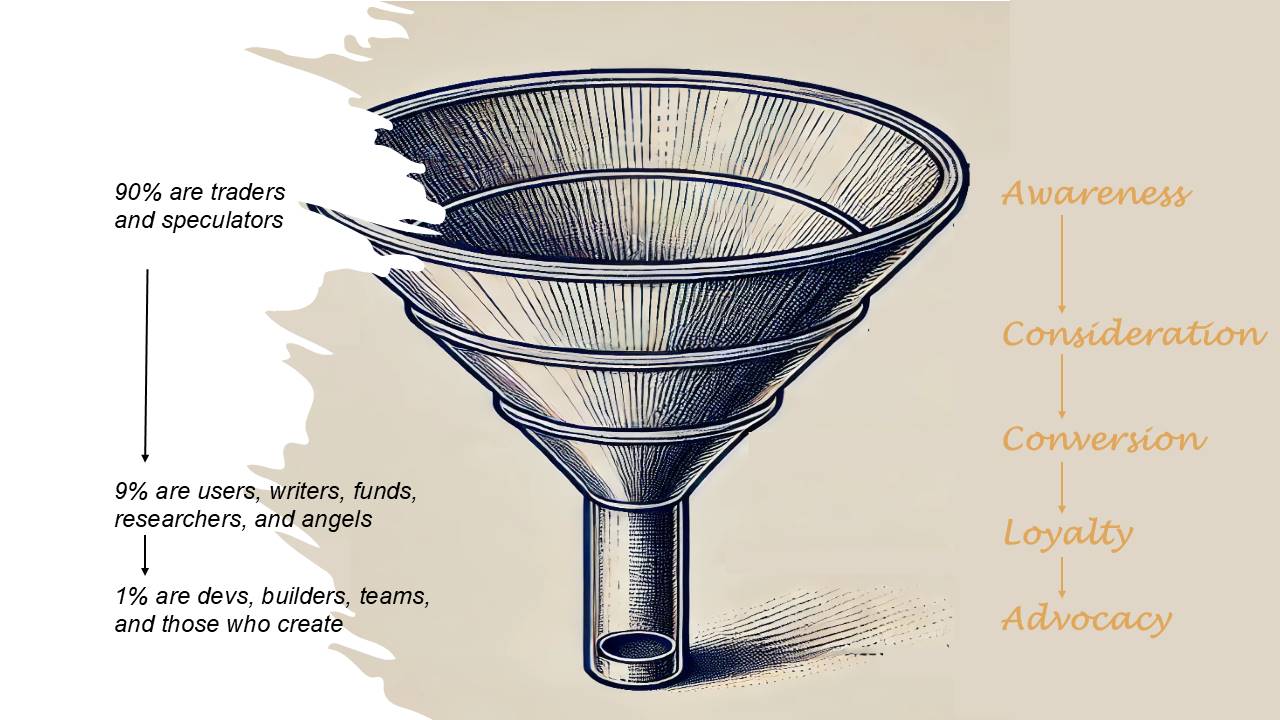

Borrowing from Gearbox co-founder @ivangbi_'s excellent article, "1-9-90 Community and Brand Building," communities can be divided into three tiers:

-

1% are developers, builders, and teams—the creators.

-

9% are users, authors, funds, researchers, and angel investors who follow the space closely and occasionally comment. They’re not part of the team but go beyond being casual newcomers.

-

90% are random traders and speculators who typically don’t read documentation. They follow headlines, buy and sell crypto, but don’t care about deep research. They’re not foolish—just unattached to any investment. Fundamentals usually don’t matter to them; price action does.

Using the funnel model analogy, 90% sit at the top, 9% in the middle, and 1% at the bottom.

We map the 1-9-90 model onto a standard marketing funnel, tracing the path from initial awareness to passionate advocacy.

Typically, community building starts with the 1% and 9%, then expands outward. For emerging DeFi platforms without product-market fit, combining technical education with hands-on exploration attracts only the curious and entrepreneurial. A small number of dedicated, high-quality contributors often outperform thousands of casual followers.

Key contributions include:

-

Developers: Build dashboards, collateral plugins, or new infrastructure.

-

Deployers/Integrators/Applications: Use code, assets, or incentives to compose and launch new products.

-

Liquidity Providers/Farmers: Deposit assets into pools or vaults to earn fees or yields.

-

Borrowers: Supply collateral and take out loans.

-

Leveraged Yield Seekers: Amplify returns via looping deposits and borrows, manually or with one-click tools.

-

Minters: Deposit collateral to mint leveraged tokens or stablecoins.

-

Token Stakers/Lockers: Lock governance tokens to gain higher voting power and rewards.

-

Governors: Propose ideas, elect councils, guide token emissions, and support protocol upgrades.

-

Traders: Execute spot or derivative swaps.

-

Researchers/Storytellers: Provide analysis and education across various media.

While not exhaustive, these individuals represent true “users,” not mere spectators or speculators. In many DeFi communities, this core group often makes up less than 10% of total members (the 1 and 9 in the 1-9-90 model). Many contributors are brought in through business development efforts, highlighting the close link between community building and BD. For ecosystem builders, the key is creating environments that identify and elevate these critical participants.

Analyzing Healthy Metrics

Low-priority metrics include engagement on X, YouTube views, Reddit posts, Discord activity, attendance at community calls, and feedback from token holders who don’t actually use the protocol. Focusing on these surface-level indicators can create illusions of engagement, ultimately leading to misleading conclusions.

As the saying goes, “If you want to make bad decisions, ask everyone.” Instead, if you want to make good ones, rely on data. The protocols surveyed in this article all view achieving sustained $1 billion in Total Value Locked (TVL) as their next major milestone. While TVL is undoubtedly the most popular metric, it has layers of complexity. Some portions of TVL may be purely utilitarian, making it essential to examine its composition. Key factors to consider include:

-

Liquidity and capital supply

-

Listed assets

-

Quality and quantity of integrated applications

-

Trading volume

-

Outstanding loans

-

Monthly Active Users (MAUs)

-

Revenue and/or profit

In our discussions with these projects, quality and quantity of integrations were highlighted as key drivers of community growth. Yet, the primary goal remains maintaining steady monthly active users—a more authentic measure of sustained engagement. Despite requiring significant investment and high switching costs, each high-quality integration adds compounding value. Every new integration opens channels for greater volume, drives MAU growth, and ultimately increases TVL, revenue, and even profits.

As @DeFi_Made_Here noted, “In early stages, the impact of 10 to 20 core users far exceeds that of thousands of average users. A small, focused team can generate initial momentum, scaling user numbers into the hundreds or more.”

Misconceptions and Motivations

There's a stark difference between superficial engagement and genuine community building.

Communities focused solely on hype or speculation often fail to convert participants into actual protocol users, ultimately leading to long-term failure. True community building requires deeper support and ongoing contribution, especially in the middle-to-lower stages of user engagement. Several projects pointed out that key community development often happens privately in high-signal Telegram groups dedicated to partnerships with other protocols. Projects often maintain hundreds of such groups, each focused on different protocol collaborators.

On incentives, balancing extrinsic and intrinsic motivation is crucial. Extrinsic incentive campaigns—like learn-to-earn tasks or low-barrier airdrops—often attract short-term, transactional participants. Once incentives end, these projects typically lose 90% or more of their users. Careful management through multiple touchpoints, long-term rewards, and attribution tracking can significantly improve retention.

Likewise, incentivized KOLs (Key Opinion Leaders) can help spread awareness, but selection must be cautious—many KOLs act like mercenaries, which often shows in the quality and authenticity of their efforts. In contrast, well-designed, enduring community content programs—such as the one at f(x) Protocol—defy this trend and thrive within tightly-knit communities.

Intrinsic motivators—such as a clear mission, unique product, transparency, and positive developer experience—are key to sustaining long-term engagement. Fully on-chain protocols directly create value for users through transparent incentives and strengthen network effects. Aerodrome excels here, ensuring all actions are tightly aligned with the protocol, free from off-chain intermediaries.

Some protocols noted that retroactive grants and rebates are powerful tools for aligning external rewards with intrinsically motivated contributions.

Coordinating Governance and Power Dynamics

There’s often a gap between the appearance of community governance and actual decision-making power. When a few entities dominate, community involvement becomes performative, raising concerns about a project’s true commitment to decentralization. This is a widespread issue, with potential solutions including token distribution methods—such as fair launches, adjusting governance voting schedules to align with on-chain incentives, or establishing official delegation programs. We’ll discuss some interesting approaches later in this article.

The Human Element in Community Building

Emerging systems depend on building a trustworthy brand, which begins with nurturing community. Announcements and tweets alone aren’t enough to cultivate a thriving community. Early users need personalized guidance and meaningful support.

Focus on one-on-one interactions with 10 to 20 individuals or projects with the highest potential to become long-term contributors. As these relationships deepen, scale naturally—from 20 to 40, then to 80, and so on.

Team members with strong social influence who can clearly explain the project in accessible language are invaluable marketing assets. While founders often fill this role, they don’t have to. As @wagmiAlexander said, consistent and clear communication is key: “Even though code is immutable, ultimately, people decide everything.”

Intentionally Designed Community Spaces

Design community spaces with clear intent. With limited resources, attracting speculators distracts from real growth factors, leading to inefficiency. Not only does this dilute community vitality, but it also diminishes the influence of genuine value creators. While speculators have a place, their sentiment fluctuates with unpredictable market shifts—only actual product usage is within your control. Over 90% of effort should focus on educating real users and gathering product feedback. Builders and innovators cannot thrive amid noise; uninformed discussions erode valuable network effects. As projects mature, encourage community-led space creation.

Beware of Venture Capital Hype

In a recent All-In Podcast episode, venture capitalist David Sacks observed: “One big shift in our industry is that in 2020 and 2021, we had a bubble. Because the federal government injected $10 trillion in liquidity into the economy during Covid, massive capital flooded into this space.” This wave of capital not only inflated markets but also swamped the VC industry with cash. As a result, entry barriers dropped, allowing inexperienced, opportunistic individuals to label themselves as VCs.

Announcing funding rounds or showcasing partnership logos doesn’t equate to real community engagement. Projects overly reliant on such PR may expose a lack of genuine user participation. Some VCs adopt a “spray and pray” strategy, prioritizing quick exits over long-term sustainability. Their focus is on fast financial returns, not the protocol’s enduring success.

In contrast, VCs who actively participate in governance, continue holding tokens after vesting, provide analysis, and foster ecosystem collaboration become vital allies. When dazzled by flashy funding announcements, pause and assess how past and present investors have helped drive real user growth. If you're announcing the news, remember: the most valuable potential contributors and partners will dig deep into the project—not just rely on press releases.

Lessons and Achievements in Governance

Governance matters, but in the early stages, builders and users are the foundation of TVL growth—and growing TVL, in turn, energizes governance. For example, three years ago at Yearn’s peak when TVL hit $1 billion, governance participation was 50 to 100 times higher than it is today. Governance typically sits at the bottom of the development funnel.

To illustrate differently, imagine a watering hole on the African savanna, where elephants, lions, antelopes, zebras, hippos, and crocodiles gather. Here, life flourishes under natural regulation. In this metaphor, water symbolizes TVL—without it, the number of “governors” dwindles.

Before participants can govern, they must first become active users or contributors. When TVL is low, engagement drops, power concentrates in few hands, weakening community cohesion and governance capacity. To build a strong community, focus on increasing TVL—governance strength will follow naturally. While this article won’t dive deeply into governance models, I’d like to highlight some promising approaches worth exploring.

Protocols like Velodrome and Aerodrome use fully on-chain methods, integrating governance and rewards through mechanisms like veTokenomics. These allow participants to vote on emissions and share in fees and rewards. Decentralized frontends can independently decide whether to include new protocol versions. This model replaces traditional DAO forums or Snapshot voting with a participant-driven “pull” system instead of an externally driven “push” system. Aerodrome has cultivated a community culture where everyone looks forward to weekly voting and reward days. Aladdin DAO’s f(x) Protocol follows a similar approach.

In DAOs, delegation of token voting is important. While there are valid criticisms, delegation allows small token holders who rarely participate to meaningfully engage. Synthetix succeeded with its representative councils, where SNX holders elect 4 to 8 members. The Spartan Council leads protocol changes, the Ambassador Council handles external partnership proposals, and the Treasury Council manages stipends and payments. Any community member can run for council seats, serving four-month terms with a monthly stipend of 2,000 SNX.

In early 2024, Pyth Network used a cunning strategy, airdropping PYTH tokens to seasoned Synthetix governance participants. Eligible recipients were those who had voted on proposals or made notable governance contributions. To claim these tokens, participants had to stake them within a specific timeframe, incentivizing deeper governance involvement. Unclaimed tokens reverted to the Synthetix treasury, ensuring only genuinely engaged participants—not speculators—benefited.

Unfortunately, none of the protocols I spoke with offered innovative approaches to governance communication or dashboards. Most still rely on traditional methods: submitting proposals on discussion forums, voting via Snapshot or Tally, and providing regular updates on 𝕏 and Discord. It seems we’re all navigating similar fragmented environments.

The Litmus Test of Governance. While governance is still nascent, I’d like to quote @MattLosquadro: “The biggest litmus test is whether project leads can be fully or partially rejected by the community through the governance process. This helps keep community members actively engaged.”

Surprises Along the Way

Despite abundant composable infrastructure, @omgcorn noted: “Interestingly, some protocols choose to build from scratch rather than reuse existing, battle-tested, audited code. Leveraging mature systems and their network effects should be the obvious choice—but perhaps this reflects how early we still are.” Additionally, choosing to build instead of buying might stem from new protocols needing to prove their token’s utility. As core innovations mature and stabilize, and understanding of network effects deepens, current hesitation may fade.

Success in community and TVL hinges on responsiveness and adaptability. Though DeFi innovation has recently slowed, breakthroughs like liquid staking tokens and points farming are surging. Take Pendle, for instance—a protocol that seized market timing perfectly, establishing itself almost as a blue-chip player. @amplice_eth emphasized: “It’s not just about innovative products, liquidity, or oracles—it’s about becoming a DeFi veteran who deeply understands market dynamics, seizes timing, and captures opportunity.”

“Aerodrome chose to focus on real token utility, system immutability, and decentralization, rather than catering to VCs or exit liquidity,” @wagmiAlexander said. By building a community rooted in transparency, openness, and utility, and consistently sharing progress updates, Aerodrome sparked strong productive energy. Its “Flight School” program exemplifies this commitment. Conversely, opaque operations benefiting only a select few, especially during bear markets, tend to erode community trust.

Yet, there exists a values-based meritocratic path that fosters value-driven subcommunities, welcoming anyone willing to earn their place. Almost every project has a subgroup contributing real value through capital, product feedback, governance, or narrative influence. Some groups are formal and public; others operate quietly behind the scenes, with a few key contributors informally fulfilling these roles.

Examples include Aladdin’s Community Boosters, Yearn’s Secret Cultists, Synthetix’s Representative Council, Club Gearbox DAO, and Aerodrome’s Pilots, Partners, and Sky Marshals. These subgroups cultivate deeper belonging, and their culture spreads to the broader community. To ensure the most loyal supporters join, some of these groups are private and require explicit alignment with project values before invitation.

Simply launching a product and expecting organic success is unrealistic. Early traction requires careful guidance and support for the first users to generate initial momentum. Great developer experience is critical, and fast, high-quality feedback from the community dramatically accelerates growth. Recognizing and acknowledging early contributors’ efforts is key to amplifying network effects.

Communities aren’t monolithic—they cluster across platforms like GitHub, Discord, governance forums, BD partner Telegram groups, Twitter/𝕏, Farcaster, YouTube, or Reddit. While each platform demands tailored engagement, resource constraints mean focusing and cutting non-essentials is equally important. You can’t do everything—better to excel in one or two places than be mediocre in five.

Talent Development Systems

Building the right team is one of the biggest challenges in scaling any project. Across conversations with various protocols, I noticed a common trend: talent in business, operations, data, and marketing rarely comes from outside the community. More often, they’ve already been actively contributing before formally joining. This works because it attracts people truly aligned with the project’s mission. These individuals deeply understand the project’s goals and can make immediate impact. @amplice_eth emphasized, “The people we want to hire already understand and believe in the product’s importance and uniqueness—that’s exactly what we look for.”

@wagmiAlexander, whose crypto journey began as a volunteer in the Solidly community and who previously worked in politics, shared a key insight: “In politics, full-time roles often go to those who showed up early, delivered results, and persisted. It’s less about resumes and titles, more about your contributions.”

If you can’t find skilled talent in your pool, it may mean you haven’t cultivated the right community. As @kmets_ put it, “Community is the talent pipeline.” Hiring from within reduces risks like onboarding bad actors. In remote-first DeFi environments, internal referrals are especially valuable.

However, finding engineering talent for DeFi protocols presents unique challenges. While hiring ready-to-work engineers is important, products must also be designed for new users, not just domain experts. In smaller DeFi communities, the software engineer talent pool may be limited. In such cases, stepping outside the community and using traditional web2 hiring methods becomes necessary.

As ecosystem TVL grows, stakeholders better integrate community engagement with hiring, strengthening network effects—a major advantage. This is especially evident in the largest DeFi protocols, L2s, and alternative L1s. Grant programs also offer vital opportunities to identify, test, and nurture new talent—preparing for even bigger challenges ahead, which we’ll explore in future articles.

Community plays a vital role in talent acquisition. Whether directly supplying technical talent or serving as social proof, it sparks interest and draws the right people to join the project.

Offline Events: Making Them Worth It

Event purposes vary—some see them as branding, others as user acquisition or consensus-building—all valid. Conferences like ETH Denver and Token2049 feature main-stage talks and hackathons alongside hundreds of side events, giving protocols chances for personalized, meaningful community interaction. Some protocols host regional meetups in cities like Berlin, Buenos Aires, or Lagos. For project leads, the key question is: Where should you invest your time and resources?

From discussions with multiple protocol leaders, event ROI varies widely. Some opt out entirely, believing replaceable-by-YouTube-video events offer little value. Others have learned to leverage local culture and environment to create fun, memorable experiences tightly aligned with their project’s core values.

For example, the Shielding Summit privacy event at EthCC Brussels gathered participants on a remote island to discuss privacy funding, policy, and tech. Some attendees wore masks, symbolically echoing the theme of anonymity. At Devconnect Istanbul’s Celestia Game Night, participants met casually while playing Super Smash Bros., sparking more authentic and engaging conversations than the usual “Where do you work?” Even cultural exchanges in Turkish hammams created irreplicable experiences.

While the Reserve ecosystem isn’t the focus here, I’d like to mention two standout consensus-building events. At ETH Denver, the ReGov event brought together veTokenomics enthusiasts to collaboratively extract signal from noise and refine governance design. Meanwhile, Monetarium in San Francisco—a three-day gathering focused on long-term stability and alternative monetary forms against global inflation—combined theme, participants, values, and location perfectly. Such unique offline experiences can generate impacts worth billions in just a few days.

Finding the right balance isn’t easy. Loud clubs and large venues may reduce deep conversation opportunities, while small dinners or impromptu gatherings often foster closer, more impactful discussions. Co-hosting events promotes idea exchange and shares logistical and financial burdens. Aligning events with business goals—especially product launches—increases their impact. Synchronizing gatherings with new feature rollouts turns events from parties into strategic growth engines.

The most impactful events are often relaxed and intimate. Small settings better enable deep dialogue, especially when bringing together engineers, artists, and other diverse roles. Hosting multiple small discussions instead of one large conference fosters more participatory and creative atmospheres. Of course, attendee selection is critical—whether as organizer or participant, nothing undermines an event more than misaligned attendees.

Expanding Internationally

Many projects mentioned in this article have global contributors and partners. Yet, their international reach primarily relies on differentiated products and English communication. While some attempt multilingual outreach, results are often underwhelming or distracting. Given limited resources, focusing on English remains the most effective strategy, covering the vast majority of the DeFi community.

That said, if expanding into other languages, French, Spanish, Portuguese, and Chinese are most frequently cited as key areas. Some projects find that even occasional local-language tweets can spark recognition and excitement in these communities. Of course, if your market strategy targets specific regions, tailoring communication to local audiences becomes essential.

Conclusion

In this article, I’ve shared insights from veteran developers behind protocols with $70 million to $700 million in TVL—projects that have stood the test of time in DeFi. While their approaches may not work for everyone, the 1-9-90 framework can serve as a valuable prioritization guide for community building.

It reminds us that a small number of high-level contributors are often more valuable than tens of thousands of fans or critics. Core members bound by shared intrinsic values (ideally on-chain) may require high upfront investment, but their contributions tend to have lasting impact.

Direct, personalized community engagement—20 carefully sent DMs—often produces faster results than a tweet to 20,000 followers. While hard to scale, this approach is indispensable in the early stages of building a vibrant, healthy community.

A strong community is not just a rich talent pool, especially for non-engineering roles. If your project isn’t drawing talent from its community, reconsider how to better align community building with hiring.

While TVL is important, the quality and quantity of protocol integrations often better predict future trajectory.

Core contributors openly and deeply sharing product features and strengths are among the most powerful ways to attract external attention and strengthen user loyalty.

In choosing community platforms, don’t try to be everywhere—sometimes less is more. Focus on cultivating presence where core users and active participants already thrive, and new opportunities will emerge organically. Deeply involved key figures create ripple effects that propel the entire ecosystem forward.

Governance participation rises as TVL grows. As long as you sustain user engagement and grow TVL, governors will naturally follow.

Event strategy should align with your goals—brand awareness, user acquisition, or consensus-building. Create unforgettable experiences, not content easily replaced by a YouTube video.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News