Solana Ecosystem Explained: A Comprehensive Analysis from Funding History to Technical Mechanisms

TechFlow Selected TechFlow Selected

Solana Ecosystem Explained: A Comprehensive Analysis from Funding History to Technical Mechanisms

Solana has become the preferred choice for onboarding off-chain users, particularly in areas such as DePIN, mobile applications, and payments.

Author: Insight VC

Compilation: TechFlow

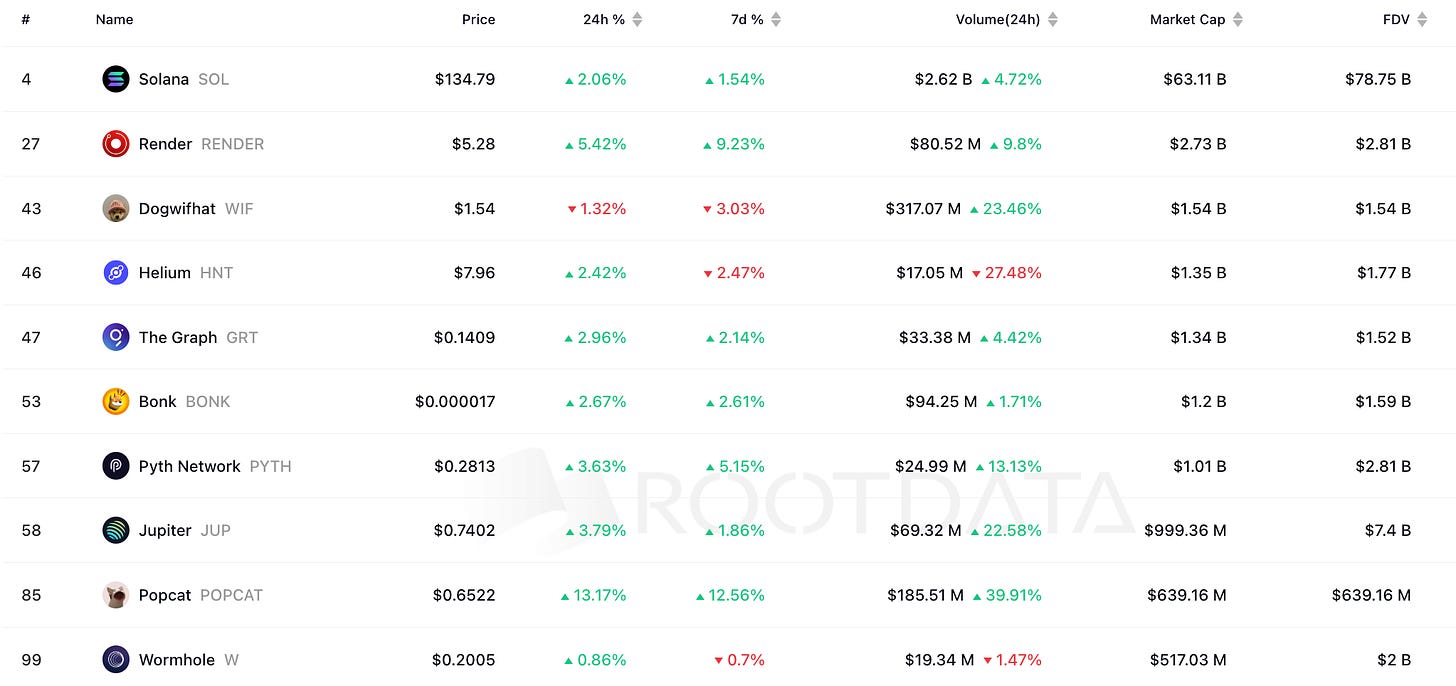

Solana has a market capitalization of approximately $63 billion, making it one of the leading blockchain platforms. It has become the go-to choice for onboarding users off-chain, particularly in areas such as decentralized physical infrastructure networks (DePIN), mobile applications, and payments. In previous newsletters, we highlighted DePIN projects built on Solana, including Helium and Hivemapper.

Over the past year, Solana has made significant progress, especially following Visa's announcement of plans to expand its stablecoin capabilities on the Solana blockchain, which triggered a surge in its native token. At the 2024 Consensus conference, PayPal Holdings, Inc. (NASDAQ: PYPL) revealed that PayPal USD (PYUSD) is now available on Solana, making PayPal’s stablecoin faster and more cost-effective to use (currently, PYUSD has a market cap of $827.83 million, with 58.3% on Solana and 41.7% on Ethereum).

Core Team:

-

Founder & CEO: Anatoly Yakovenko

-

Co-Founder: Raj Gokal

-

Co-Founder & CTO: Greg Fitzgerald

-

Co-Founder: Stephen Akridge

-

Co-Founder & Chief Scientist: Eric Williams

Solana Funding Insights - Total Raised: $359 Million

Funding Rounds:

-

Seed Round: Date: Q1 2018 | Amount Raised: $3.17M | Price: $0.04

-

Private Sale: Date: Q2 2018 | Amount Raised: $12.63M | Price: $0.20

-

Selected Investors: Jump Crypto, BlockTower Capital, Distributed Global, Reciprocal Ventures, etc.

-

Series A: Date: Q2 2019 | Amount Raised: $20M

-

Selected Investors: Multicoin Capital (lead), Distributed Global, Slow Ventures, RockawayX, NGC Ventures, Blockchange Ventures, etc.

-

Validator Round: Date: Q3 2019 | Amount Raised: $5.7M | Price: $0.225

-

Private & Pre-sale: Date: January 2, 2020 | Amount Raised: $2.29M | Price: $0.250

-

Strategic Round: Date: Q1 2020 | Amount Raised: $2.29M | Price: $0.25

-

ICO: Date: March 23, 2020 | Amount Raised: $1.76M | Price: $0.220 | Platform: CoinList

-

Token Generation Event (TGE) and Distribution: Date: April 10, 2020 | Listed Price: $0.67

-

Undisclosed Round: Date: June 9, 2021 | Amount Raised: $314M

-

Selected Investors: Andreessen Horowitz (a16z) (co-lead), Polychain Capital (co-lead), Multicoin Capital, CMS Holdings, Ryze Labs (BOCG Capital), Alameda Research, Jump Trading, etc.

Solana (SOL) Tokenomics (as of September 12, 2024)

-

Total SOL Supply: 584,294,896 SOL

-

Circulating Supply: 467,932,073 SOL (80.1%)

-

Non-Circulating Supply: 116,362,823 SOL (19.9%)

-

Market Cap: $63.3B (ranked #5 overall, 3.104% of total crypto market cap ($2.04T))

-

Total Supply Staked: 383,399,756.5 SOL (65.6% of total supply)

-

Locked Staked SOL: 48,163,740.1 SOL (12.6% of total staked)

-

Inflation: Current rate at 5.036%, decreasing by 15% annually until reaching a long-term rate of 1.5%

-

Supply Dynamics: Staked SOL includes both active and inactive assets; locked assets are temporarily frozen before specific dates, typically part of investments or grants from Solana Foundation and Solana Labs.

-

Transaction Fee Structure: 50% of transaction fees are burned, while the remainder is distributed as block rewards to validators.

Solana’s Inflation Mechanism

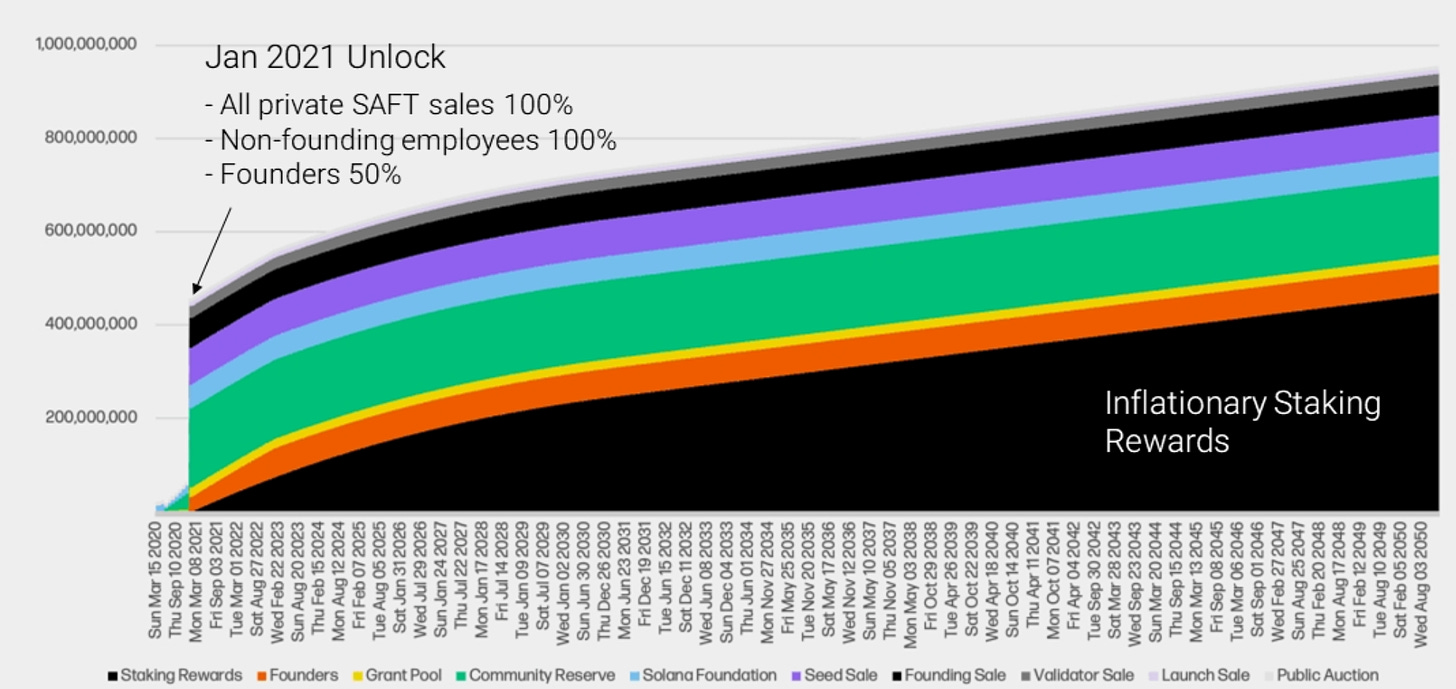

Token Issuance and Reduction Solana introduces SOL tokens through two primary mechanisms: the Genesis Block and protocol inflation (staking rewards). Conversely, SOL tokens are primarily removed from circulation via transaction fee burning. The inflation schedule is governed by three parameters: an initial inflation rate of 8%, a disinflation rate of -15%, and a long-term inflation rate of 1.5%. The current inflation rate is 5.07%, with Solana’s inflation beginning at epoch 150 in February 2021.

SOL Unlock Schedule (helius)

Impact Analysis on Network Participants

Proof-of-Stake (PoS) inflation transfers wealth from non-stakers to stakers, diluting the value of holdings for those not participating in staking while rewarding active participants. Solana maintains a high staking rate of 65%, a strong performance compared to other networks. To date, approximately 380 million SOL have been staked, with notable liquidity shifts observed across epochs.

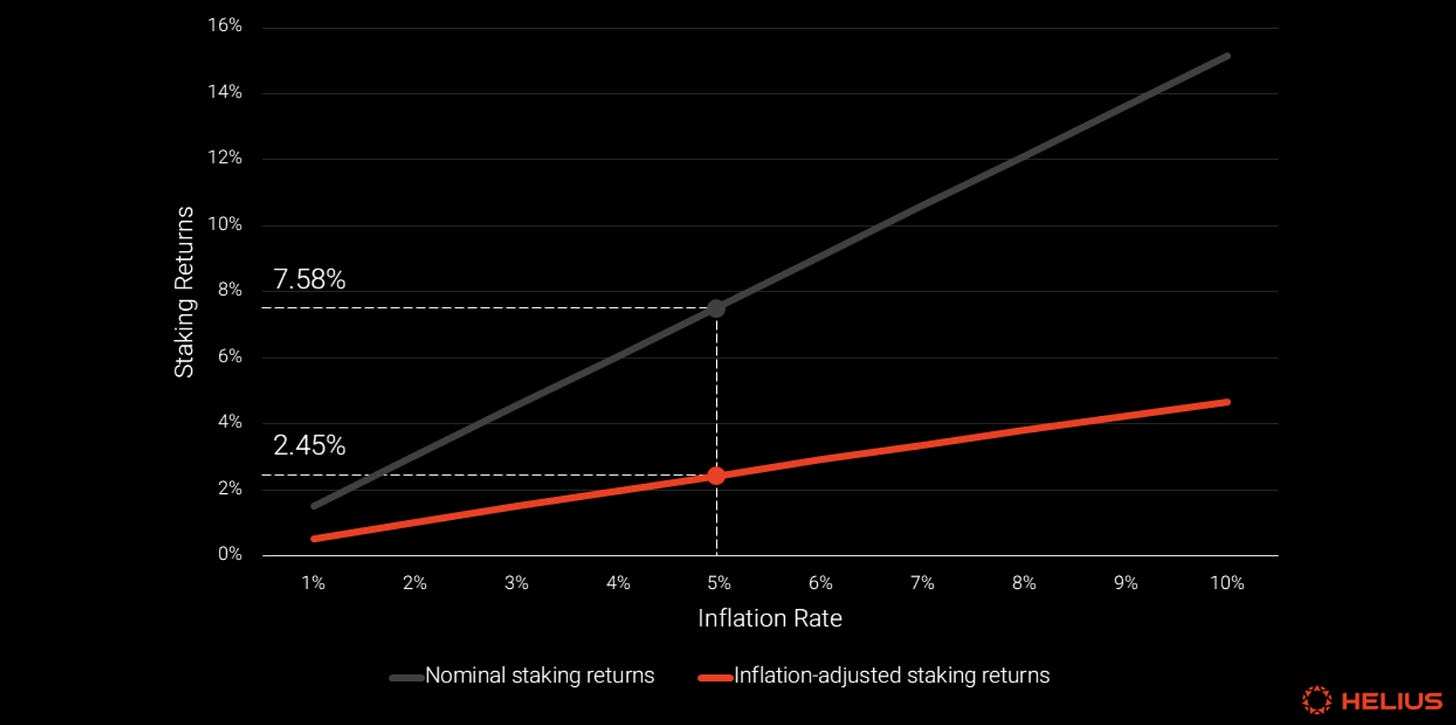

Relationship Between Staking Rewards and Inflation Rate

How Staking Yields Are Calculated

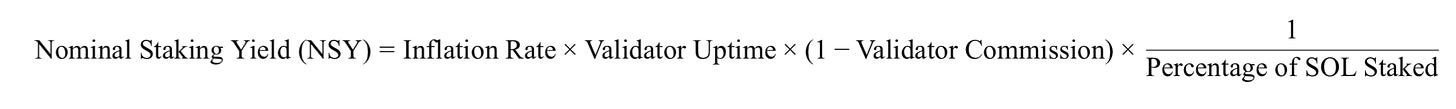

Staking yields are influenced by the inflation rate, validator uptime, commission rates charged by validators, and the percentage of SOL staked. The formula is:

Fee Burning and Deflationary Factors:

Transaction fee burning, slashing mechanisms, and other user-related losses contribute to deflationary pressure, though their impact is limited. Fee burning reached a peak of 7.8% of staking rewards in March 2024 but recently averages around 3.2%. After the implementation of SIMD-96, this effect will become negligible. While slashing is possible, it occurs infrequently and currently isn't a significant deflationary factor.

Tax and Market Impact:

In many jurisdictions, receiving inflation rewards may be considered a taxable event, potentially creating sell pressure as stakers need to liquidate portions to cover tax obligations. Additionally, PoS inflation may exert ongoing downward pressure on SOL’s price, affecting fair price comparisons and network economics.

Validator Revenue Dependence on Inflation:

Validators traditionally rely on inflation-based commissions, but recent growth in alternative revenue sources—such as Maximal Extractable Value (MEV) and block rewards—offers new sustainable income streams. However, the long-term sustainability of these alternative sources remains uncertain.

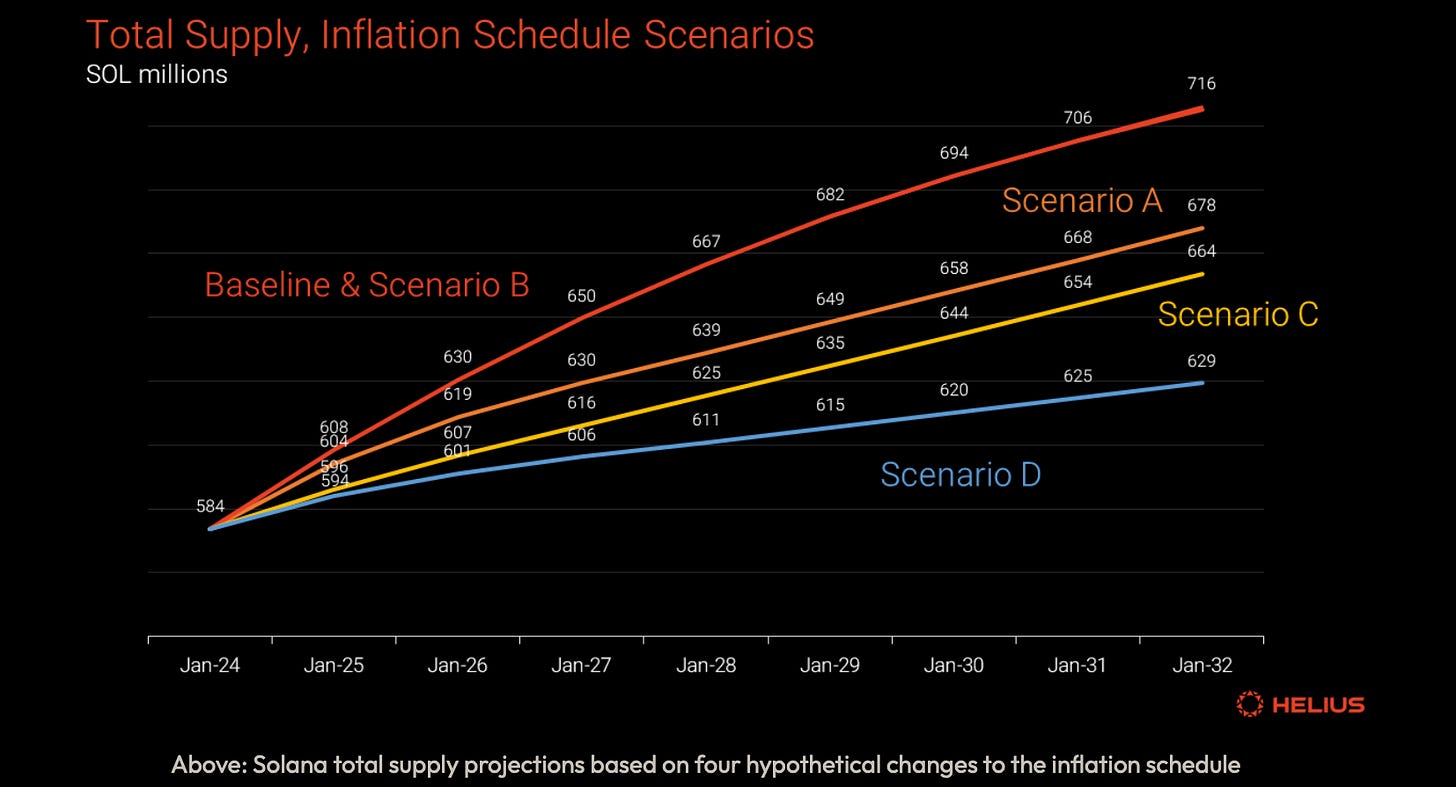

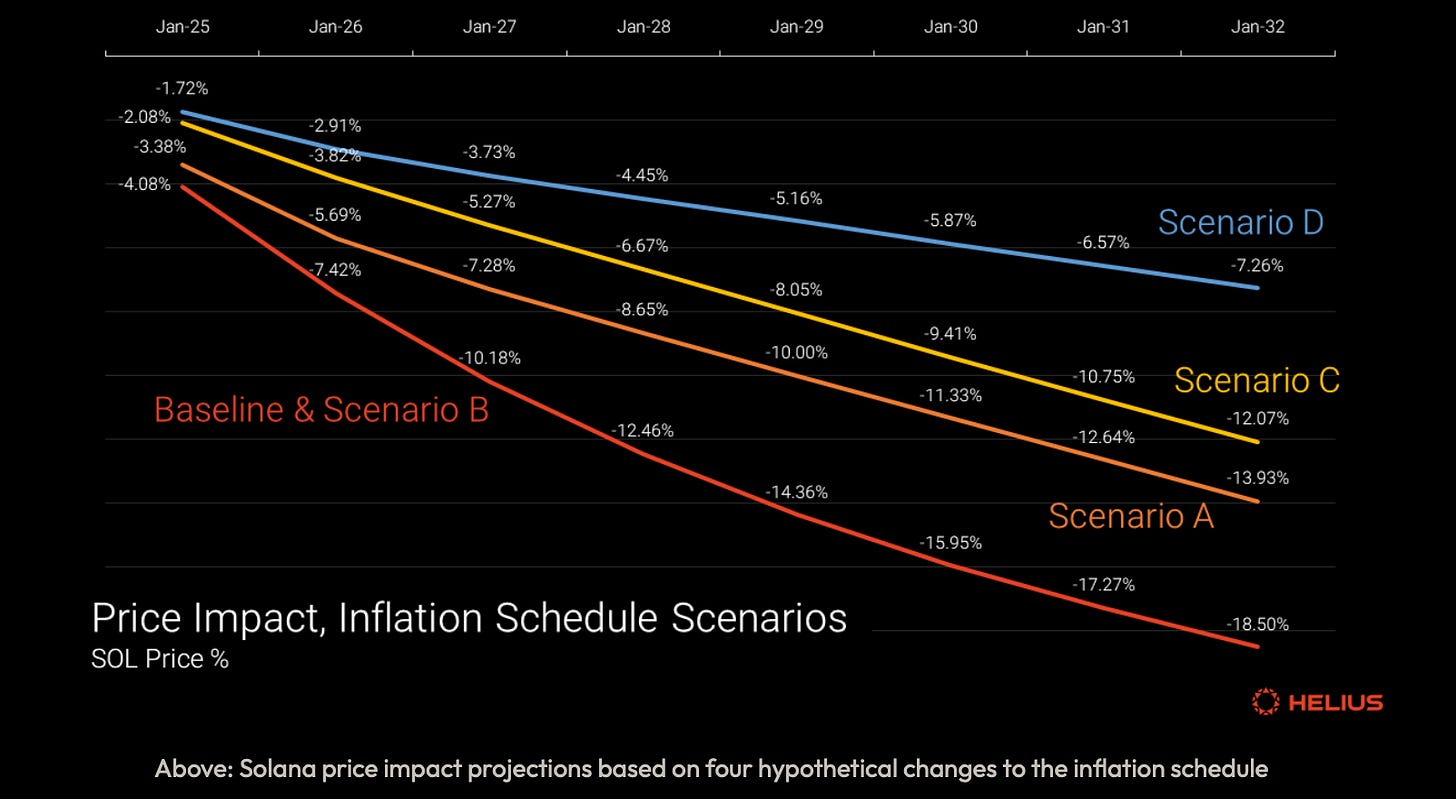

Inflation Parameters and Scenarios (from:Helius)

Solana’s inflation is currently set with an initial rate of 8%, a disinflation rate of -15%, and a long-term rate of 1.5%. As of September 2024, the current inflation rate is approximately 5%, with a total supply of 584 million SOL. Four scenarios are proposed to explore potential changes:

-

Scenario A: Double the disinflation rate from -15% to -30%.

-

Scenario B: Halve the long-term inflation rate from 1.5% to 0.75%.

-

Scenario C: Immediately halve the current inflation rate from 5% to 2.5%.

-

Scenario D: Halve the current inflation rate, double the disinflation rate, and halve the long-term inflation rate.

Impact on Supply and Price:

Over the next eight years:

-

Scenario A: Reduces total supply by 5.3% (down to 678 million SOL).

-

Scenario B: Minimal impact, reducing only 1 million SOL.

-

Scenario C: Reduces total supply by 7.3% (down to 664 million SOL).

-

Scenario D: Reduces total supply by 12.2% (down to 629 million SOL).

Assuming an initial SOL price of $150 and holding all other variables constant:

-

Baseline: Current inflation plan reduces price by 18.5%, down to $122.25.

-

Scenario A: Reduces price by 13.93%, down to $129.10.

-

Scenario C: Reduces price by 12.07%, down to $131.90.

-

Scenario D: Reduces price by 7.26%, down to $139.10.

Architecture and Design

Solana is a high-performance blockchain designed for speed, efficiency, and scalability. It supports thousands of transactions per second with low latency and extremely low transaction fees—block time is 400ms, with costs amounting to fractions of a cent. This report will explore Solana’s mechanisms and system architecture, emphasizing its ability to scale seamlessly and interact within a unified ecosystem.

Programming Languages

Solana primarily uses Rust for smart contract development due to its concurrency, memory safety, and control over low-level resources, ensuring code security and predictability. While Rust is the main language, Solana also supports all LLVM-compatible languages like C and C++, attracting a broader developer base. For client-side development, Solana provides SDKs in Java, C#, Python, Go, and Kotlin, enabling easy communication with the Solana network via JSON RPC API. This diverse language support enhances developer accessibility and flexibility.

Mechanisms and System Architecture

Solana’s architecture adopts a unified and composable ecosystem where all applications are integrated on a single blockchain. This design eliminates the need for bridges, separate chain IDs, or fragmented liquidity, improving user experience and simplifying interactions between applications. Blockchain performance leverages full hardware utilization, ensuring software scales alongside hardware advancements.

The Solana transaction process begins when users submit transactions to the blockchain leader, who bundles them into blocks and propagates them across the network for execution and confirmation by other validators. Core protocol changes are managed through Solana Improvement Documents (SIMDs), which undergo community review and voting.

Transaction Lifecycle

Transactions on Solana are the only way to alter the blockchain state. Each transaction, known as a “transaction message,” includes a header, account addresses, a recent block hash, and instructions. Transactions are atomic, ensuring all operations either succeed or fail together. This structure enables predefined optimization by requiring accounts to be listed upfront, facilitating conflict-free parallel processing of transactions.

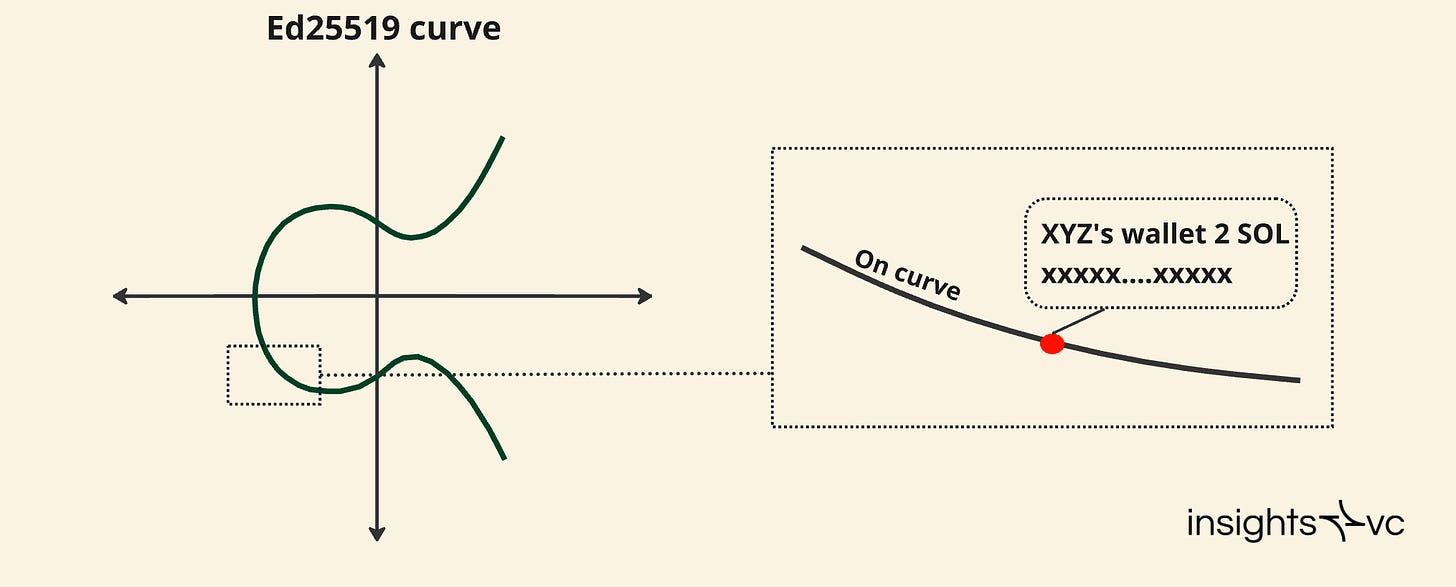

Security and Key Management

Solana uses Ed25519 elliptic curve cryptography to generate public-private key pairs, ensuring high security and efficient transaction signing. Wallets generate key pairs, with the public key serving as the account identifier on the blockchain and the private key used for authorization. Transactions are signed using the private key to ensure data integrity and authenticity, then verified using the public key.

Network Operations

Solana employs a leader-driven approach without a mempool, assigning specific validators as leaders to process transactions during fixed intervals (400ms). Validators are selected based on stake and rotate roles according to a predetermined schedule to enhance decentralization and security.

The network uses Stake-Weighted Quality of Service (SWQoS) to prioritize transactions from staked validators, mitigating spam and Sybil attacks. SWQoS reserves 80% of the leader’s processing capacity for transactions handled by staked validators, with the remainder allocated to non-staked nodes.

Scalability Enhancements

Recent scaling solutions such as SVM rollups and ZK compression are under development to further boost Solana’s performance, though still in early stages. The blockchain uses the QUIC network protocol to enable efficient, secure, and scalable transmission of transaction messages, meeting high-throughput demands.

Consensus and Block Production

Solana’s consensus mechanism uses continuous block construction, where leaders build and broadcast blocks in real-time during their time slot. This method reduces latency and optimizes transaction processing. Validators’ Transaction Processing Units (TPUs) manage block creation, executing transactions in parallel as much as possible to maximize throughput and efficiency.

Proof of History (PoH)

For detailed description of Proof of History, please refer to the Solana Whitepaper.

Proof of History (PoH) is a key feature of Solana, acting as a cryptographic clock that establishes verifiable order of events for network synchronization. Unlike Proof of Work consensus algorithms, PoH does not achieve consensus itself but provides a time reference for validators to sequence transactions and follow the leader’s timeline.

PoH works by continuously computing a SHA-256 hash chain, where each hash depends on the previous one. This sequence must be computed sequentially, creating a “micro proof-of-work.” Validators run PoH services to generate these hashes, which are difficult to produce but easy for others to verify. By embedding transaction data into the hash chain, PoH timestamps transactions, proving their order and preventing validators from manipulating block sequencing.

Mechanism and Functionality

Each Solana validator continuously runs a PoH service, hashing sequentially to maintain a cryptographically timestamped ledger. When the current leader processes new transactions, they are combined with the current PoH hash, updating the chain and embedding the transactions into the cryptographic timeline. This ensures the leader cannot manipulate the timing or order of transactions.

Within each 400ms block, the PoH stream includes about 800,000 hashes and time markers indicating elapsed time, spaced every 6.25ms. These time markers serve as evidence of activity and maintain the rhythm of network operations. Even when not acting as leader, validators keep the PoH clock running to stay synchronized with the rest of the network and adhere to the leader’s schedule.

Account Model

Solana’s state management relies on an account database called AccountsDB—a large key-value store where keys are account addresses and values are corresponding data. Solana accounts come in several types:

-

User Accounts: Represent users who hold private keys.

-

Data Accounts: Store state information such as token balances.

-

Program Accounts: Contain executable code for specific programs.

-

Native Program Accounts: Execute core network functions.

Solana differentiates code from state by keeping program accounts immutable while storing state in separate accounts. This separation enables efficient state management and unique optimizations tailored to Solana’s architecture.

Programs and State Management

Programs on Solana are written in languages like Rust to operate on data within accounts but do not store state internally. Instead, programs interact with Program Derived Addresses (PDAs)—special accounts controlled by programs that lack private keys. PDAs ensure only the relevant program can modify the state, enhancing security and control over state changes.

Rent and Account Management

To address state bloat, Solana implements a rent mechanism requiring accounts to maintain a minimum SOL balance. When no longer needed, accounts can be closed and the rent balance returned to the user. This encourages efficient use of account state and prevents unnecessary accounts from remaining open indefinitely.

Turbine: Data Propagation

Turbine is Solana’s data propagation protocol, inspired by BitTorrent. It breaks transaction data into small packets called “shreds,” which are then propagated across the network in a structured manner. Shreds are grouped into batches and broadcast via a Turbine tree, with validators organized in layers to forward shreds to other validators. This reduces the leader’s data load and improves the network’s ability to efficiently distribute blocks.

Consensus: Tower BFT

Solana uses Tower BFT, a customized Practical Byzantine Fault Tolerance (PBFT) implementation enhanced by PoH’s synchronized clock. This approach reduces communication overhead during consensus, as validators rely on the pre-determined transaction order provided by PoH rather than multiple rounds of messaging. Validators vote on blocks using credits earned for correct voting, and the system ensures validators remain on a chosen fork for a minimum duration, reducing the likelihood of forks.

Gossip and Archiving

Solana’s Gossip network acts as the control plane, broadcasting critical metadata to ensure nodes can communicate and synchronize states across the network. Archive nodes preserve the network’s history, with data stored on warehouse nodes to ensure availability of past transactions.

Economics and Jito

Solana’s economic model includes an inflation-based staking reward mechanism, where validators earn SOL by participating in consensus and producing blocks. Block rewards include transaction fees—partially burned and partially awarded to the block-producing validator. Liquid staking allows SOL holders to stake in pools, earning liquid staking tokens (LSTs) that are tradable or usable in applications while earning staking rewards.

The Jito client is widely adopted by Solana validators, enhancing economic incentives through an off-protocol block space auction system that allows transactions to be prioritized via tips beyond standard fees. This significantly increases validator rewards and drives widespread adoption of the Jito client across the Solana network.

Solana Virtual Machine (SVM)

The Solana Virtual Machine (SVM) is an innovative framework designed to manage Maximal Extractable Value (MEV) within the Solana blockchain. MEV involves extracting additional value by reordering, including, or excluding transactions. SVM provides technologies and protocols to detect, analyze, and manage MEV activities, improving efficiency, fairness, and security across the Solana ecosystem.

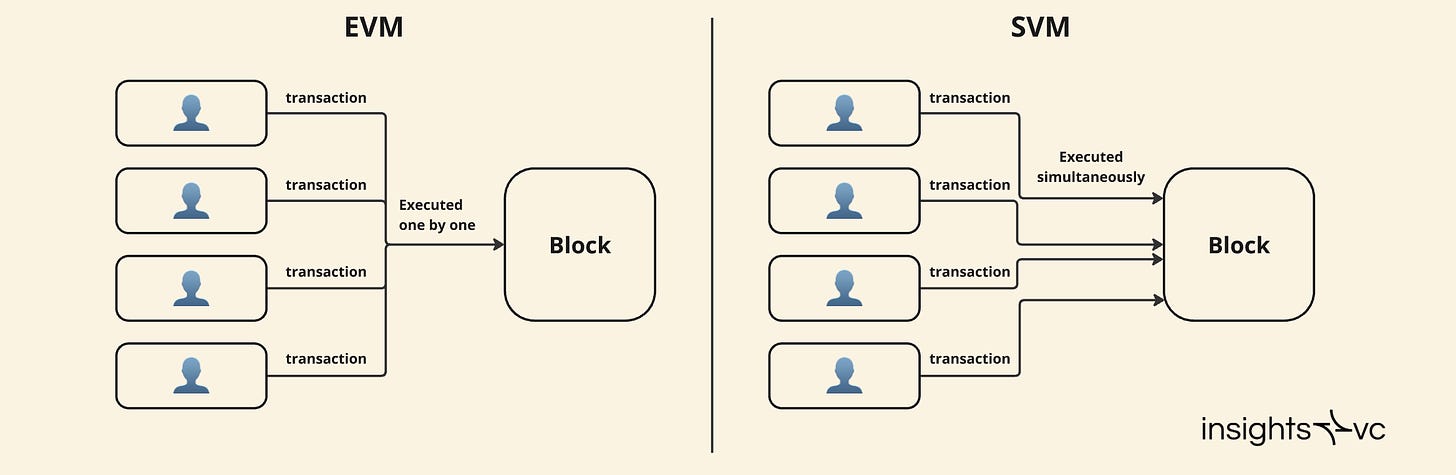

Ethereum Virtual Machine (EVM) vs. Solana Virtual Machine (SVM)

SVM differs from the Ethereum Virtual Machine (EVM) in smart contract execution and transaction processing. In SVM, each validator executes smart contracts independently, enabling high transaction throughput. In contrast, EVM requires nodes to reach consensus before execution, resulting in slower processing. Furthermore, Solana’s parallel processing model allows multiple transactions to execute simultaneously, whereas Ethereum’s sequential model processes one transaction at a time, making Solana faster and more efficient.

Purpose and Importance of SVM

SVM aims to address MEV issues through a structured approach, preventing manipulation in transaction ordering and block validation. This is crucial for maintaining the integrity of financial interactions on Solana, protecting users from harmful behaviors like front-running, and enhancing network credibility. Given Solana’s high transaction throughput, effective MEV management is essential to prevent rapid value extraction that could harm ordinary users.

Defining Solana Virtual Machine

The definition of SVM within the Solana ecosystem varies. Some view it as encompassing the complete transaction processing pipeline—including validator runtime and program execution—while others emphasize the low-level eBPF virtual machine responsible for program execution. Typically, SVM is seen as a comprehensive system involving the Bank component of Agave validators, which manages state within each slot. SVM processes transactions in batches, with each batch containing instructions targeting specific programs, leveraging caching mechanisms to optimize execution efficiency.

Opportunities with SVM

SVM’s decoupled and well-defined interfaces enable various applications beyond Solana validators, including:

-

Off-chain Services: Simulate Solana’s transaction processing off-chain for simulation and testing.

-

Light Clients: Enable fraud proofs for lightweight clients, improving scalability and security.

-

State Channels: Manage peer-to-peer connections based on SVM and post final results to the main chain.

-

Rollups: Serve as execution layer for rollups, enhancing scalability without adding full consensus protocol overhead.

-

Avalanche Subnets: Integrate with Avalanche modules for consensus and networking.

-

Extended SVM: Customizable SVM units for specific protocols, enhancing flexibility. SVM is now accessible via the solana-svm Rust crate, supporting diverse applications and driving innovation in the Solana ecosystem.

FTX

However, Solana faced challenges after the collapse of FTX, a major player closely tied to its ecosystem. FTX’s founder, Sam Bankman-Fried (SBF), was a prominent supporter of Solana, promoting projects like Serum DEX that were traditionally associated with the Ethereum ecosystem. Under SBF’s influence, FTX grew into one of the largest centralized exchanges, further boosting Solana’s visibility. Unfortunately, FTX’s misuse of corporate assets and customer deposits for high-risk investments led to its collapse, putting the Solana ecosystem linked to FTX at significant risk. On September 12, FTX/Alameda Research unstaked $24 million worth of $SOL, and Solscan data shows the wallet still holds over $1 billion in $SOL, including staked and locked tokens. Despite these challenges, a core developer community aligned with Solana’s vision has remained committed. Solana responded by focusing on enhancing network stability and creating a better environment for developers, addressing technical issues to rebuild community trust.

Selected Projects on Solana Blockchain

Solana Ecosystem (Top 10 projects by market cap)

-

Neon EVM: Neon EVM enables Ethereum-based applications to run on Solana, offering faster processing, lower costs, and leveraging Solana’s parallel processing capabilities.

-

Eclipse: An Ethereum Layer 2 solution leveraging Solana’s SVM, settling on Ethereum and using zero-knowledge proofs for security.

-

Nitro: A solution bridging Solana with Cosmos and IBC ecosystems, enhancing interoperability and access to liquidity.

-

Wormhole: A cross-chain bridge enabling seamless transfer of assets and information across multiple blockchains, including Solana.

-

Allbridge: A cross-chain bridge facilitating easy asset transfers between Solana and other blockchains, enhancing Solana’s interoperability.

-

LI.FI: A liquidity aggregation protocol integrating multiple bridge solutions and DEX aggregators for cross-network swaps.

DePIN

-

Helium: A decentralized wireless network leveraging Solana for scalability, supporting IoT devices and providing affordable connectivity solutions.

-

Hivemapper: A decentralized mapping network that rewards users with tokens for contributing real-time road images via dashcams.

-

Render Network & io.net: A distributed GPU computing network on Solana for 3D rendering and AI tasks, providing scalable and efficient computational power.

-

IoTeX: A Web3 infrastructure platform connecting smart devices and real-world data to the blockchain, improving data accuracy and practical utility.

-

Teleport: A decentralized ride-sharing service on Solana, offering drivers lower fees and higher earnings through blockchain protocols.

DeFi

-

Marinade Finance: A liquid staking platform on Solana allowing users to earn staking rewards via mSOL tokens while maintaining liquidity.

-

Jito: A protocol enhancing MEV profits through liquid staking, aiming for permissionless operations in the Solana ecosystem.

-

Sanctum: A liquidity-sharing scheme designed for liquid staking tokens on Solana, enabling seamless interaction and yield generation.

-

Drift Protocol: A decentralized exchange on Solana offering spot and perpetual contract trading with real-time price updates.

-

Jupiter: Solana’s primary DEX aggregator, offering efficient routing, limit orders, and perpetual contracts.

-

Zeta Markets: A decentralized derivatives trading protocol supporting options and futures.

-

marginfi: A decentralized lending protocol offering integrated financial services across multiple DeFi protocols.

-

Kamino: A DeFi platform supporting strategic financial activities including lending, liquidity provision, and asset management.

-

Parcl: A decentralized real estate investment platform tracking property prices using data sources.

Others (NFT & Memecoins etc.)

-

Magic Eden: The leading NFT marketplace on Solana, supporting multiple chains with a user-friendly interface and low fees.

-

Tensor: A marketplace tailored for professional NFT traders, featuring AMM integration and real-time data tools.

-

Metaplex: A platform providing tools for creating, selling, and managing digital assets, designed specifically for Solana.

-

DRiP: An NFT launchpad supporting emerging artists with affordable minting and free NFT art drops.

-

TipLink: A lightweight wallet enabling easy asset transfers via links or QR codes, accessible through Gmail and Solana accounts.

-

Solchat: A Solana-based communication protocol for on-chain messaging and P2P calls, expected to integrate with Solana’s mobile ecosystem.

-

Dialect: A decentralized messaging protocol allowing token-gated messaging.

-

Mad Lads: An xNFT collection created by Coral exploring NFTs as dApps, revitalizing the Solana community.

-

MonkeDAO: The first NFT DAO on Solana, originating from Solana Monkey Business, involved in various community-led initiatives.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News