The Icarus Myth of the Crypto World: High FDV Triggers Project Self-Destruction

TechFlow Selected TechFlow Selected

The Icarus Myth of the Crypto World: High FDV Triggers Project Self-Destruction

FDV is not a meme.

Author: 0xLouisT

Translation: TechFlow

In Greek mythology, Icarus and his father Daedalus crafted wings from feathers and wax to escape the trap of King Minos. Daedalus warned his son: "Fly too low, and the sea will dampen your wings; fly too high, and the sun's heat will melt them."

But Icarus, intoxicated by the thrill of flight, soared higher and higher, forgetting his father’s warning. The sun’s heat melted the wax that held his wings together, and Icarus plunged into the sea. The moral of the story is that excessive hubris often leads to self-destruction.

In the current market cycle, I see striking parallels to the tale of Icarus. Just as Icarus was drawn by the exhilaration of flight, many crypto projects are lured by the temptation of high valuations. In both cases, unsustainable promises and inflated valuations lead to their downfall.

Why This FDV Frenzy?

What drives this trend of low circulating supply and high FDV? Several factors are at play:

-

Anchoring Effect: This cognitive bias influences decisions based on an initial reference point. If founders believe their project is worth $1 billion, they might launch with a $10 billion FDV, setting a psychological benchmark in the market. Even if the token drops 90%, it still returns to what founders perceive as fair value.

-

VC Valuations: The abundance of venture capital during 2021–2022 led to bloated private valuations. VCs paid increasingly high prices in each funding round, but public markets showed little appetite for these sky-high valuations. Since no project wants to launch its Token Generation Event (TGE) below its last private round valuation, they’re forced to seek ways to launch at even higher valuations.

-

Incentives & Treasury: A paper $10 billion FDV boosts a project’s treasury, enabling it to attract top talent, offer token-based incentives, fund ecosystem grants, and forge partnerships—fueling growth through significant paper value.

-

Supply Distribution: After ICOs and SEC enforcement actions, distributing tokens directly to communities has become more difficult. Airdrops and community incentives often fail to allocate a meaningful portion of tokens at launch—a major ongoing industry challenge.

-

OTC Sales & Hedging: High launch prices are achieved via discounted OTC sales or by hedging positions using perpetual contracts (perps), allowing teams and investors to cash out early—though large-scale execution remains challenging.

-

Perception of Success: It reflects our psychology. Higher valuations create an illusion of success, drawing people toward projects that appear successful—everyone wants to be part of the next big thing.

How Did This Start?

If you create Token A with a total supply of 1 billion and pair it with 1 USDC in a Uniswap pool, Token A has a nominal price of $1, giving it a $1 billion FDV. This valuation is entirely artificial; the actual value of the token is extremely limited.

The same applies to high-FDV tokens, where only a small fraction of the total supply is truly liquid. After initial airdrop sell-offs subside, most of the supply is held by market makers and whales who can influence pricing. Thus, a $1 billion FDV can be achieved with just tens of millions in capital.

Problems With High FDV

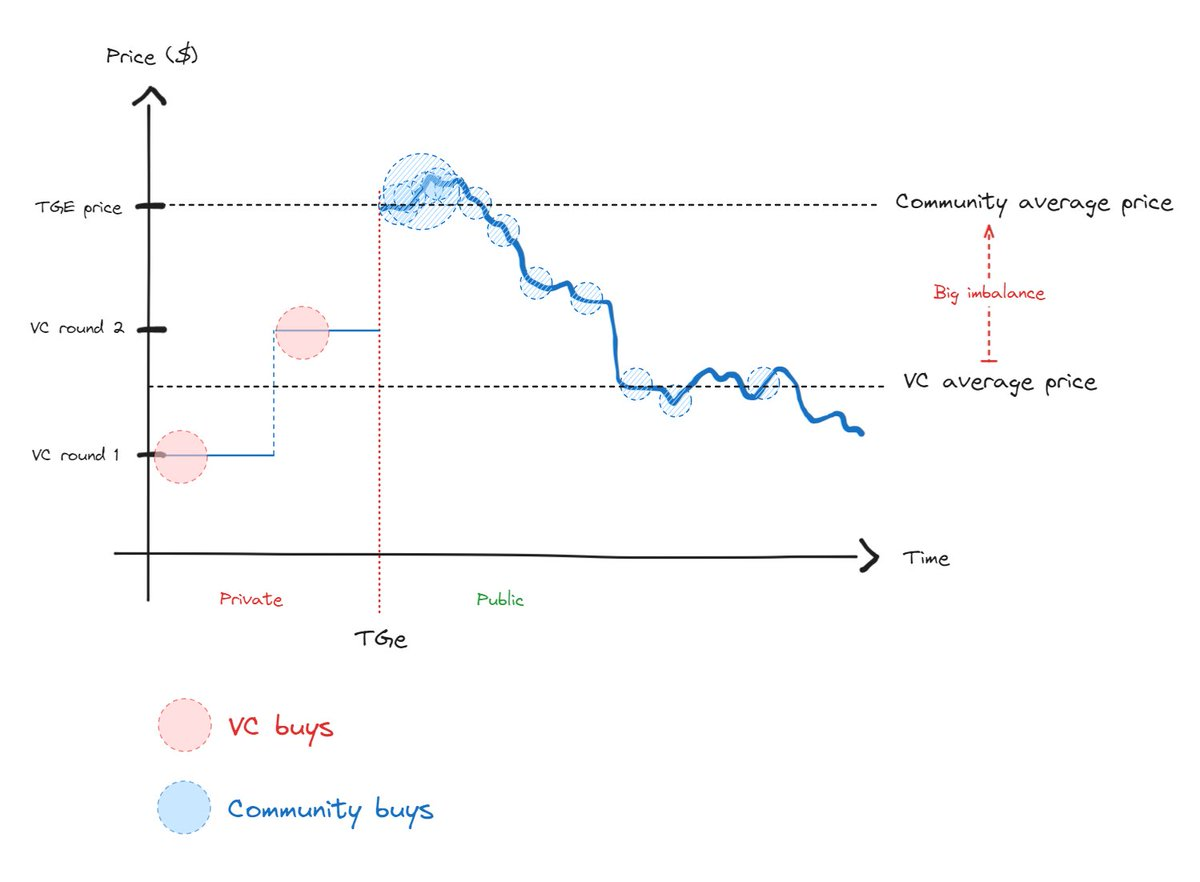

This high-FDV meta creates a significant imbalance in cost basis and supply distribution between TGE buyers and private investors (see image). This excessive misalignment intensifies ongoing tension between these two groups until the market price eventually reverts to a fair level.

TGE buyers are underwater immediately after purchase, while VCs are incentivized to sell once their holdings unlock. When community buyers recognize this pattern, they stop buying—which explains the recent sharp decline in interest in new tokens.

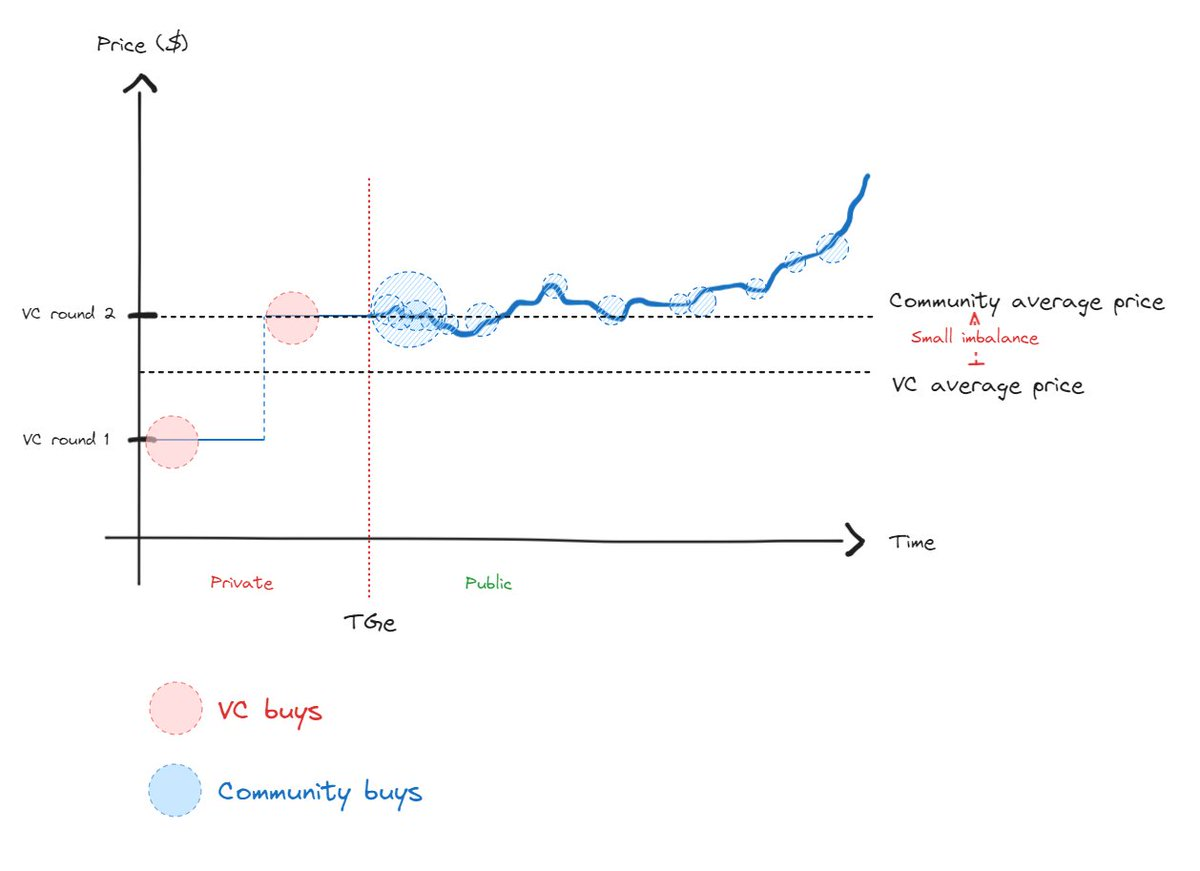

A healthier scenario would show far less disparity between community and VC pricing, enabling genuine price discovery (see below).

In an efficient market, price discovery is inevitable. While you can artificially manipulate price discovery in the short term, you only delay the convergence toward true value. However, market trajectories are interconnected, making a prolonged downtrend far more painful than reaching equilibrium directly.

Conclusion

An important nuance in the myth of Icarus is the warning not to fly too low. Just as Icarus was cautioned that flying too low could weaken his wings, underpricing a token launch may suppress growth potential. It can hinder partnerships, make talent retention difficult, and undermine overall success. Delaying token issuance until a project is mature enough is just as crucial as avoiding excessively high FDVs.

Key Takeaways

-

FDV Is Not a Meme: Avoid launching tokens at high FDVs. Like Icarus, attempting to manipulate the market through inflated valuations is likely to backfire in the long run. For liquidity participants, a high-FDV token is a red flag—they typically avoid or even short assets with inflationary risks.

-

Raise VC Funding Wisely: Raise funds only when necessary and aligned with your growth strategy. Choose venture partners you want to work with—not just those offering the highest valuation. Resist pressure to accept unsustainable valuations.

-

Avoid Premature Token Launches: Don’t launch a token simply because you achieved a high FDV in private rounds. Ensure clear signs of product-market fit and real market demand before conducting a token launch.

-

Token Distribution: This deserves a separate discussion, but for effective price discovery, maximize circulating supply at launch. Aim for 20% to 50% of total supply, rather than just 5%. However, current regulatory environments may make achieving such circulation targets difficult.

-

Engage Liquidity Providers: Liquidity providers are sophisticated investors who take on project risk post-TGE and therefore play a critical role in price discovery—more so than VCs.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News