Will interest rate cuts truly be a market boon?

TechFlow Selected TechFlow Selected

Will interest rate cuts truly be a market boon?

The closer we get to an interest rate cut, the more severely funds tend to be withdrawn from risk markets.

Author: 0xTodd, Co-founder of Ebunker

Editor's note: On September 18, the Federal Reserve will hold its interest rate meeting. The long-awaited rate cut is finally about to begin. Rate cuts by the Fed are typically a major boost for risk assets, injecting substantial liquidity into markets. However, 0xTodd, co-founder of Ebunker, presents a contrarian view, arguing that the short-term effects of rate cuts may not benefit crypto asset investments in the near term. BlockBeats republishes the full article below:

I have an unverified hypothesis: Before rate cuts—especially as they draw nearer—capital is increasingly pulled out of risk markets.

Take now, for example. Regardless of nominal interest rates, medium- to long-term U.S. Treasury yields have already dropped from their peak of 4.5–5% down to 3.5–4%. If rate cuts are officially announced—or even a series of cuts begins—real yields will naturally fall further, reflected in rising bond prices.

(Possibly) some market participants think:

This might be the final window to accumulate U.S. Treasuries, locking in a 4% USD yield for 10 or even 30 years—an attractive rate.

To do so, these funds must rush to exit risk markets precisely during this time window (August–September), creating what feels like the darkest moment before dawn.

Rate cuts are a milestone event. Before they happen, there’s no urgency; everyone plans to squeeze out one last profit from risk markets. Only as the cut draws near does the mindset shift toward “rushing to catch the last bus.”

Therefore, rather than seeing the anticipated price-in effect and market rally, we may instead observe declining liquidity as we approach the rate cut.

By the time the rate cut is officially announced, the capital that intended to leave would have already exited. Those remaining are clearly the ones waiting for the party to begin.

P.S.: Of course, crypto investors likely differ significantly in risk appetite from U.S. Treasury investors, and their profiles may not align—so this remains an unproven idea.

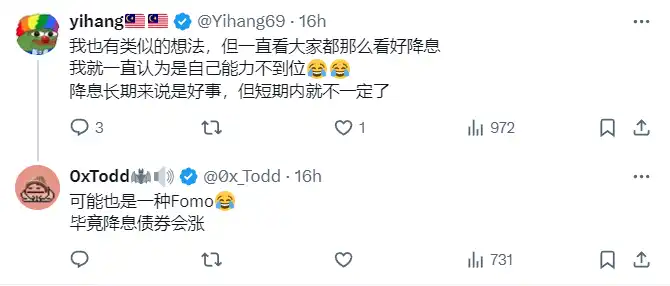

Comment from crypto investor yihang:

View from crypto KOL Dayu: Capital flows are one factor. Additionally, foreign exchange volatility could also matter. Moreover, it takes considerable time for tech stocks to align investment, valuation, and actual earnings—currently, AI seems mostly about chasing dreams.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News