4 Charts to Understand Bitcoin's Price Trend Amid U.S. Rate Cuts

TechFlow Selected TechFlow Selected

4 Charts to Understand Bitcoin's Price Trend Amid U.S. Rate Cuts

In addition to rate cut speculation, other factors contributing to the volatility of the crypto asset market include the upcoming U.S. election.

Source: beincrypto

Compiled by: Blockchain Knight

The BTC and crypto asset markets are undoubtedly in a challenging environment, with seasonal shifts in September making the situation even worse.

In a recent report, Kaiko researchers explored how potential U.S. interest rate cuts and other key economic events could impact BTC.

Four charts provided by analysts explain BTC's trajectory over the coming weeks.

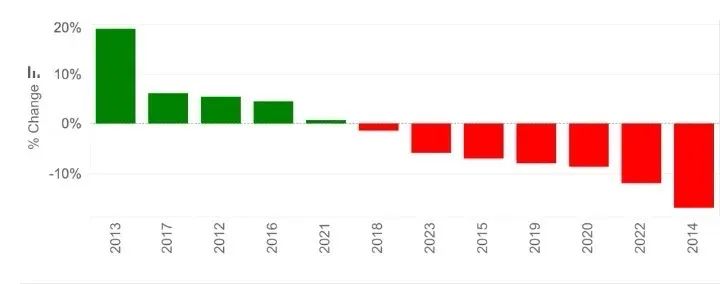

According to Be In Crypto, Q3 has historically been tough for BTC and the broader crypto market, with September often being the worst-performing month. Kaiko emphasized that BTC has declined in seven out of the past 12 Septembers.

In 2024, this pattern continues, with BTC falling 7.5% in August and down 6.3% so far in September.

To date, BTC is trading 20% below its all-time high near $73,500 reached over five months ago.

However, Kaiko Research also noted that upcoming U.S. rate cuts could boost risk assets like BTC. Alvin Kan, COO of Bitget Wallet, shares this view.

"At the Jackson Hole symposium, Federal Reserve Chair Jerome Powell hinted it might be time to adjust policy, sparking expectations of future rate cuts. The U.S. Dollar Index dropped sharply in response and is now fluctuating around 100," said Kan.

Kan added: "With rate cuts in September becoming a consensus expectation, the official start of rate-cut trades may improve overall market liquidity, providing momentum for crypto assets."

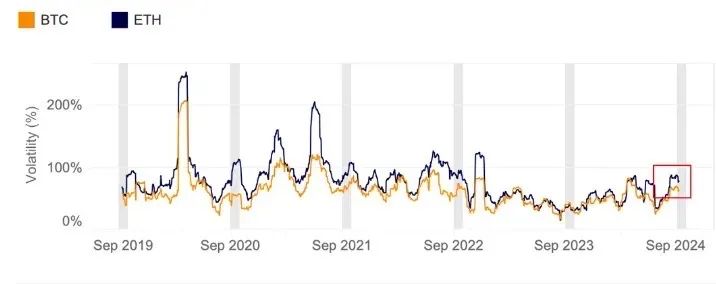

The report indicates that September will be a highly volatile month, with BTC’s 30-day historical volatility surging to 70%. This metric measures price fluctuations over the past 30 days, reflecting significant price swings during this period.

BTC's current volatility is nearly double last year's level and approaching the peak seen in March when BTC hit an all-time high above $73,000.

Ethereum has also experienced sharp volatility, exceeding both its March levels and BTC's, primarily driven by Ethereum-specific events such as Jump Trading's liquidation and the launch of Ethereum ETFs.

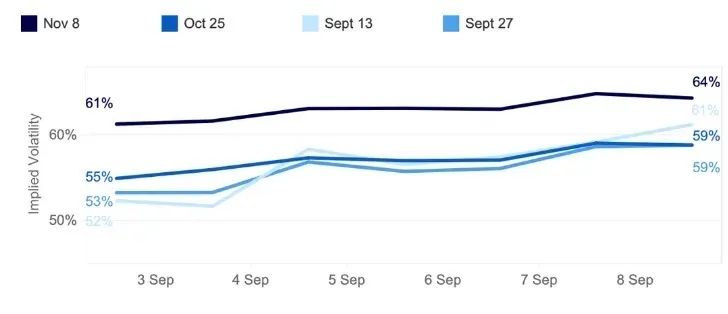

Since early September, BTC’s implied volatility (IV) has risen after declining in late August. The IV metric gauges the market’s expectation of future price volatility based on current options trading activity.

Higher IV values indicate that traders expect greater future price swings, though they do not signal the direction of those moves.

Notably, the largest increases have occurred in short-term options expiry dates, with the September 13 expiry jumping from 52% to 61%, surpassing end-of-month contracts.

For most people, when short-term implied volatility exceeds long-term volatility, it signals rising market stress—a phenomenon known as a "backwardation structure."

Risk managers typically see backwardation as a sign of increased uncertainty or market pressure. As such, they may interpret this as a warning to reduce portfolio risk—either by cutting exposure to unstable assets or hedging against potential downside.

Kaiko researchers noted: "Market expectations align with last week’s U.S. employment report, which dampened hopes for a 50-basis-point rate cut. However, upcoming U.S. CPI data could still sway market expectations."

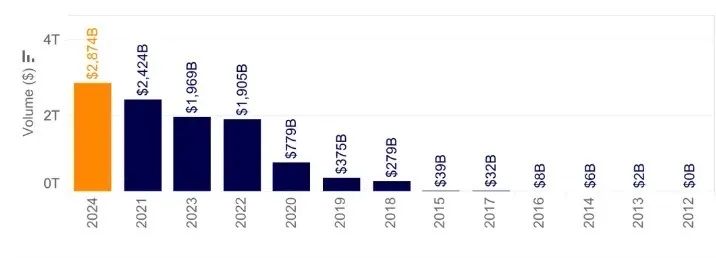

BTC trading volume charts also highlight current market volatility, showing increased trader participation. Cumulative volume is nearing a record $3 trillion, up nearly 20% in the first eight months of 2024 compared to the previous peak in 2021.

Traditionally, BTC investors view rate cuts as a positive market catalyst. However, concerns remain about how the market might interpret rate cuts larger than expected.

Markus Thielen, founder of 10X Research, warned that a 50-basis-point rate cut could be seen as a signal of urgency, potentially triggering a pullback in risk assets like BTC.

"While a 50-basis-point Fed rate cut might signal deeper economic concerns to the market, the Fed's primary goal is to mitigate economic risks, not manage market reactions," Thielen said in a note to clients.

Besides rate cut speculation, another factor contributing to crypto market volatility is the upcoming U.S. election.

Reports suggest that debates between Trump and Harris are expected to trigger market volatility, especially for BTC and Ethereum.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News