DeFi downturn, market eroded by L2s — where's the cure for ailing Ethereum?

TechFlow Selected TechFlow Selected

DeFi downturn, market eroded by L2s — where's the cure for ailing Ethereum?

While the current DeFi ecosystem is circular in nature, it has demonstrated the feasibility of on-chain financial systems.

Author: The Daily Bolt by Revelo Intel

Compiled by: TechFlow

In this newsletter, we explore Vitalik Buterin’s recent comments signaling a waning interest in DeFi, the underperformance of $ETH compared to $BTC and other competitors, and whether $ETH is facing an identity crisis—such as whether it should be seen as “ultrasound money” or if its value is being eroded by various Layer 2s. Year-to-date, $ETH has declined by 5%, highlighting these concerns. Supporters of ETH and others in the crypto space often disagree semantically about what constitutes Ethereum. Regardless of whether L2s are considered part of Ethereum, developments on L2s like Arbitrum and Base have not significantly benefited $ETH as an asset. In cryptocurrency, narratives are often validated through price, as it directly impacts profitability.

Vitalik's Waning Interest in DeFi

Vitalik Buterin’s recent remarks about DeFi have sparked intense discussion within the cryptocurrency and Ethereum communities. Vitalik argued that the current form of DeFi is unsustainable, likening it to an "ouroboros"—a snake eating its own tail. This highlights leadership challenges within the Ethereum ecosystem. Unlike competing blockchains with clear leaders, Ethereum faces unique difficulties due to its decentralized nature. When competing against other blockchains, it lacks a distinct market-facing spokesperson. While Vitalik is a thought leader with a real identity, he does not actively promote Ethereum in the way Do Kwon once did for Terra (perhaps for good reason), nor does he exert strong influence like Anatoly Yakovenko does on Solana—a chain outperforming $ETH and attracting significant retail investor attention.

Some community members view DeFi as a core component of Ethereum’s value and are concerned that key figures such as Vitalik and the Ethereum Foundation appear to offer little support (most team members merely held or sold $ETH during periods like DeFi Summer). Overall, those closer to Ethereum’s roadmap and technical implementation seem to prioritize other use cases—such as public goods funding, encrypted messaging, and quadratic voting—over the 24/7 “infinite casino” model.

Despite Vitalik Buterin’s skepticism toward DeFi, it’s important to note that the current DeFi ecosystem, while cyclical, has demonstrated the feasibility of on-chain financial systems. Infrastructure built for payments, swaps, lending, and derivatives shows potential in reducing counterparty risk, increasing transparency, and lowering transaction costs. Even though early applications were largely speculative, achievements in market efficiency and financial infrastructure should not be overlooked.

At the same time, on-chain DeFi appears to have reached a state of stagnation. Since Bancor and Uniswap, core swapping functionality has changed little. User experience hasn’t simplified—it’s become more complex. Users now must navigate new blockchains and Layer 2 technologies, understand cross-chain asset intricacies, manage different gas tokens, and handle multiple token representations. Real innovation may lie in intent-based architectures and solvers, which effectively centralize order flow among a few established market makers—contrary to the original vision of permissionless participation in market making. That said, relying on professionals does deliver better prices for users.

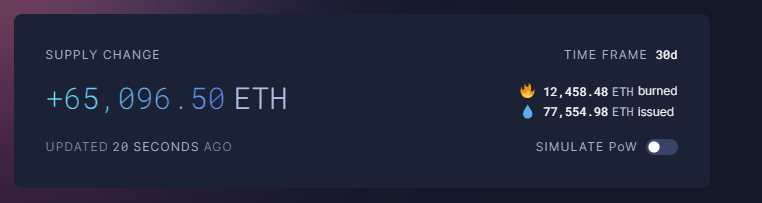

However, Ethereum’s identity crisis extends beyond Vitalik’s views on DeFi, touching on fundamental issues of value accrual and network economics. Over recent months, Ethereum’s gas fees have remained low—around 2–4 gwei—no longer producing the deflationary scenarios once projected on ultrasound.money. This has led to an increase in Ethereum’s supply, challenging the popular “ultrasound money” narrative from the last bull cycle. EIP-1559, introduced in August 2021, aimed to make Ethereum deflationary by burning transaction fees. However, in the current low-fee environment—and given the proliferation (possibly excessive and growing) of Layer 2 solutions—its effect has fallen short, resulting in net inflation rather than the intended deflation.

Ethereum’s focus on Layer-2 solutions and the upcoming EIP-4844 upgrade further complicate matters. Venture capitalist and Solana supporter Kyle Samani argues this strategy is flawed. He suggests Layer 2s may act like parasites, siphoning value away from Ethereum’s mainnet. Samani calls Ethereum’s decision to offload transaction execution and smart contract processing to Layer 2s “extremely bad.” He emphasizes that the primary value in blockchain networks comes from MEV (Miner Extractable Value, or validator profits from reordering transactions), and Ethereum risks forfeiting this advantage due to its Layer-2-centric roadmap. This idea was initially proposed by his Multicoin Capital partner Tushar Jain, who introduced an MEV-based valuation framework for blockchain assets about two years ago. Multiple Layer 2s fragment liquidity and user activity, creating poor user experiences—especially when contrasted with single-layer chains like Solana. Samani believes this fragmentation is a major reason behind Ethereum’s recent underperformance and poses a challenge to its future growth and adoption.

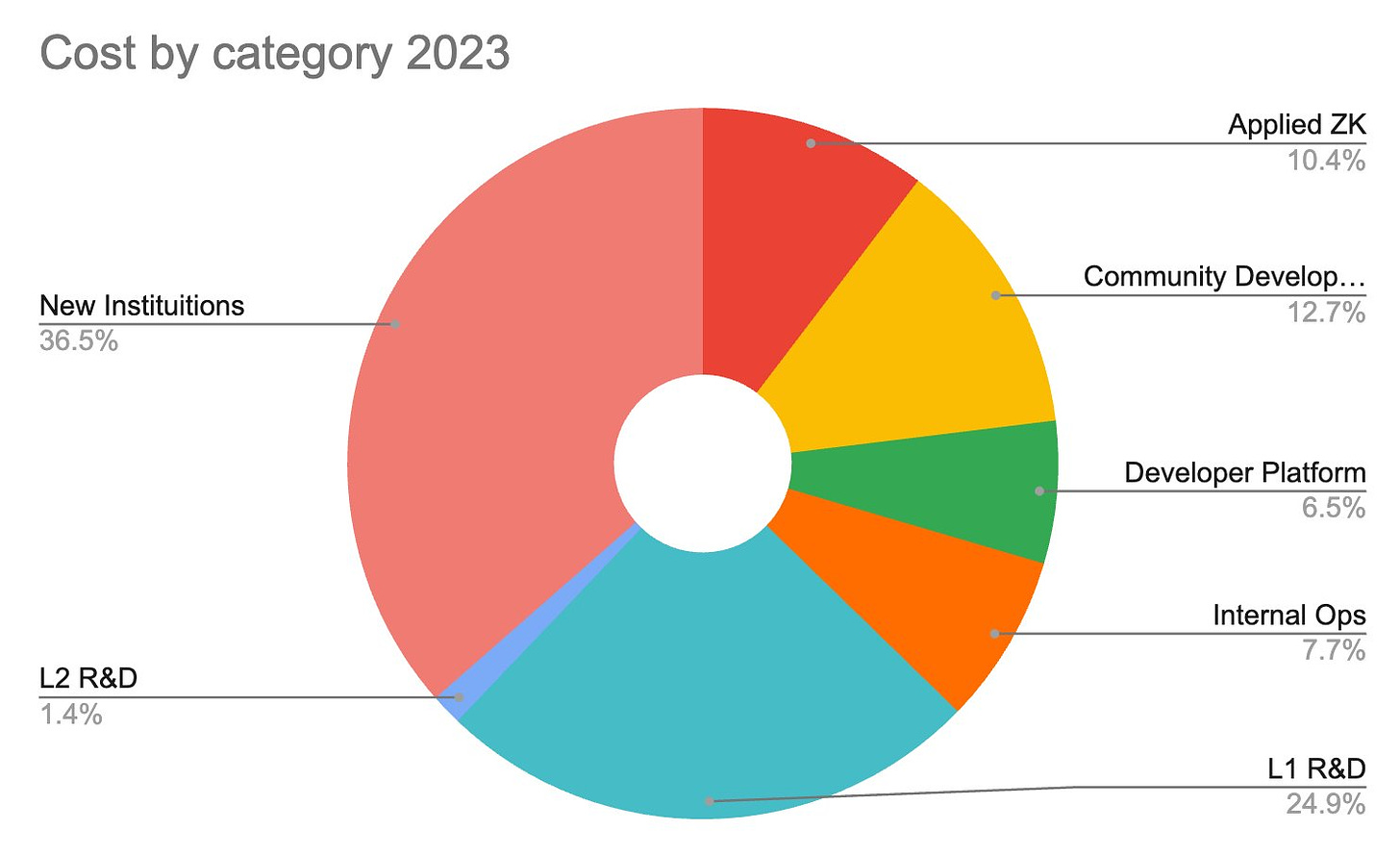

The revelation of the Ethereum Foundation’s annual budget—approximately $100 million—has intensified this debate. It has raised questions about resource allocation and transparency within the ecosystem. Supporters argue that Ethereum’s scale justifies such spending, but others question whether these funds are being used efficiently. The Foundation’s sale of large amounts of $ETH on exchanges like Kraken has drawn scrutiny, especially since selling during bear markets exacerbates downward price pressure.

Below is a breakdown of the Ethereum Foundation’s 2023 expenditures by category:

In a recent episode of the Steady Lads podcast, Justin Bram noted that decision-making power at the Ethereum Foundation largely rests with three individuals: Vitalik Buterin, another core member, and a hired regulatory expert. This structure raises concerns about transparency and accountability. As the crypto industry matures, there is growing demand for foundations and centralized entities to clearly explain how financial resources are allocated. This call for transparency also applies to governance structures, decision-making processes, and how they align with the platform’s overall goals.

Despite the challenges facing Ethereum and the broader DeFi ecosystem, a promising path forward is emerging. The critical question now is: What will drive the next wave of crypto adoption—potentially enabling 10x to 100x growth? While Vitalik’s concerns about DeFi’s sustainability are valid, they do not negate blockchain’s potential in finance. The answer may not lie in refining existing DeFi models or continuing speculative cycles, but in a more fundamental shift: tokenization of traditional financial assets, or RWAs (Real World Assets). This represents crypto’s largest untapped market, capable of bringing trillions of dollars in capital onto blockchains. By integrating vast quantities of “real-world” assets, this transformation could alleviate some of Vitalik’s concerns about DeFi’s circularity.

Consider the sheer size of traditional financial markets: BlackRock alone manages nearly five times the total market cap of the entire crypto industry. Tokenizing assets such as bank deposits, commercial paper, government bonds, mutual funds, money market funds, equities, and derivatives could unlock unprecedented capital inflows into the crypto ecosystem. These funds could integrate with DeFi infrastructure that already demonstrates utility in creating more transparent, accessible, and liquid markets. This potential aligns with Larry Fink’s views on Ethereum and could pave the way for a compelling future for the platform.

As Ethereum continues to mature, it stands at a pivotal juncture for innovation and widespread adoption. The ongoing debate over Ethereum’s future direction—whether to continue focusing on DeFi or expand into other application areas—will shape its technological evolution, market position, and regulatory approach. Although Vitalik remains skeptical of current DeFi models, his critiques may catalyze the ecosystem toward more sustainable and innovative solutions. Meanwhile, the vast potential of traditional asset tokenization could position Ethereum as a leader in on-chain financial markets.

While looking ahead, maintaining balance with the present is crucial. Financial derivatives emerged to manage risk and speculate on real underlying assets—commodities, commodity contracts, corporate shares, etc. Yet, crypto has almost jumped straight into derivatives without sufficient foundational assets. This isn’t entirely the industry’s fault, as regulatory barriers have hindered the tokenization of many important real-world assets (RWAs). Many top crypto assets essentially represent platforms for trading and speculation, where the traded assets themselves are highly speculative.

Crypto isn’t unique in this regard: How many of America’s most valuable companies pay dividends? Dividends were once a core incentive for going public, but today they’re often replaced by strategies akin to the “greater fool theory.” Even gold is inherently speculative—its practical use in semiconductors and devices is negligible relative to its market value. Thus, speculation plays a non-trivial role in markets, especially under inflationary fiat regimes. By any measure, $ETH’s recent price performance has been disappointing—not only within crypto but also compared to numerous large-cap U.S. equities over recent years.

Moreover, critics point out that an increasing number of protocols, particularly in the DePIN space, are choosing to build on Solana and other blockchains instead of Ethereum. While BlackRock has clearly signaled its intent to use Ethereum, it remains to be seen whether other traditional institutions will follow suit—and whether value generated on these platforms can effectively accrue back to $ETH.

Sometimes, criticism is exactly what protocols, companies, communities, or foundations need to spark progress. With potential regulatory easing and exciting new developments in RWA and DePIN, those hoping for a more “real” DeFi ecosystem may finally get their wish—hopefully sooner rather than later.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News