Opinion: Why am I skeptical about BTC-fi?

TechFlow Selected TechFlow Selected

Opinion: Why am I skeptical about BTC-fi?

From a philosophical perspective, there is little overlap between BTC holders and yield seekers.

Author: 0xLouisT

Translation: TechFlow

A commonly cited bullish narrative for Bitcoin among investors is the "digital gold" thesis—namely, that BTC will serve as a hedge against inflation. In traditional finance, gold acts as an inflation hedge because its value typically rises alongside inflation. Gold does not generate income; its returns come solely from price appreciation. In fact, due to storage and insurance costs, gold can even yield negative returns. Investors buy gold to preserve purchasing power, not to earn yield. There’s no free lunch: you can’t have both.

Turning to Bitcoin, a core belief shared by most BTCfi (BTC L2s, etc.) investors is that even if just 5% of circulating BTC flows into yield-generating protocols, the sector could expand 100-fold. Thus, most investors are betting on top-down growth: that this sector will grow faster than others.

While the BTCfi story is compelling, I believe Bitcoin resembles gold more than it does a yield-generating asset—at least according to the widely held view that positions BTC as a macro asset and an inflation hedge. Even the assumption that only 5% of BTC might enter the BTCfi ecosystem may be overly optimistic.

First conclusion: If this is the base case, some valuations may already be stretched.

Second conclusion: If you already accept that BTC is an inflation hedge, you may need to reevaluate your BTCfi thesis. You might be holding two conflicting views simultaneously. Philosophically, there is little overlap between BTC holders and yield seekers.

Counterarguments

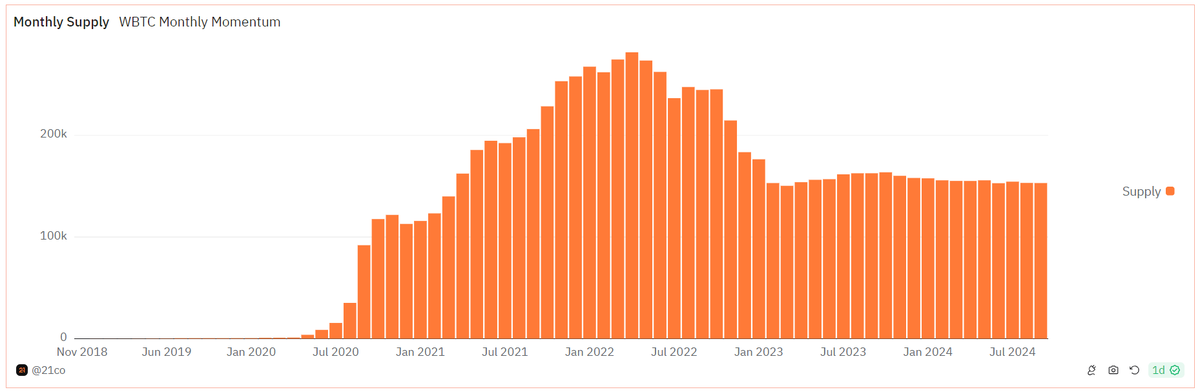

Although I remain skeptical of the BTCfi thesis, it's important to consider the opposing view. The supply of wBTC in the last cycle, along with the BTC holdings of Celsius, BlockFi, and Voyager, offer useful insight into the overlap between BTC holders and yield seekers. Currently, wBTC represents about 0.7% of Bitcoin’s total supply, while Celsius, BlockFi, and Voyager collectively held approximately $5 billion worth of BTC, or roughly 1.1% of total supply. Whether due to the decline of these platforms or stagnation in wBTC issuance (see below), these metrics do not reflect strong or growing demand for yield on BTC.

(Source: @tomwanhh)

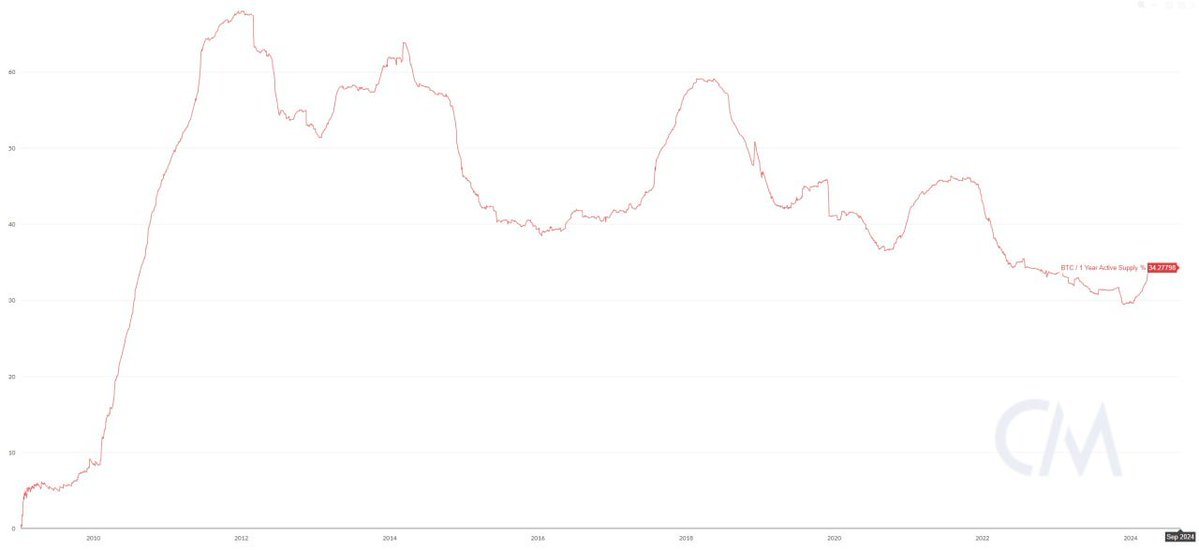

Finally, one might argue that because BTC is easier to store and trade than gold, it could generate greater demand for yield opportunities due to its higher liquidity. However, since 2012, Bitcoin’s active supply has been steadily declining.

In summary, at current valuations, I remain skeptical of the BTCfi thesis, as philosophically and economically, the overlap between BTC holders and yield seekers remains minimal.

Thanks to @f_s_y_y for assistance and data.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News