Arbitrum One's Third Anniversary: From 0 to $20 Billion TVL, Uncovering the Growth Story of an L2 Giant

TechFlow Selected TechFlow Selected

Arbitrum One's Third Anniversary: From 0 to $20 Billion TVL, Uncovering the Growth Story of an L2 Giant

While actively participating in the third anniversary celebration, let's take a look back at Arbitrum One's growth journey and review its successful strategies.

Author: TechFlow

Without experiencing a full bull-and-bear cycle, one cannot truly claim success in Web3.

Time verification is simply about extending the timeline, discarding false trends and seeing through to the true essence of demand — a principle particularly applicable in the highly competitive L2 space. The DeFi Summer of 2020 further exposed Ethereum's performance limitations, prompting the rise of L2 solutions as essential scalability upgrades for blockchain to support mass adoption.

Over the past four years, numerous L2 projects have emerged, with many disappearing during prolonged bear markets. Yet some have stood the test of time, steadily building expansive ecosystems. Among them, Arbitrum One stands out as a defining success story.

On August 31, 2024, Arbitrum One celebrates its third anniversary.

Three years of market cleansing, surviving two complete market cycles, Arbitrum One has evolved into an industry giant within the L2 and broader Web3 landscape:With TVL surpassing $14.75 billion — far ahead of other L2s — over 36 million unique addresses, and more than 2,000 ecosystem projects, it is widely regarded as the largest and most diverse L2 by volume and ecosystem depth.

To mark this milestone, the official Arbitrum Chinese community launched a series of celebratory events on September 4, including a Twitter giveaway and Chinese-language AMA. Participation offers not only exclusive merchandise but also opportunities to reflect on the journey so far and envision Arbitrum One’s next milestones alongside prominent industry leaders, top developers, and core contributors.

As we join in the third-anniversary festivities, let us revisit Arbitrum One’s growth trajectory and analyze its winning strategies.

Origins: Blockchain Struggles Under Load — Arbitrum One Arrives at the Right Time

Let us rewind to 2021, when Arbitrum One was born.

Prior to this, DeFi had been evolving rapidly while NFTs surged in popularity, increasing on-chain activity. As the birthplace of DeFi, Ethereum could process only around 15 transactions per second, leading to severe network congestion and high gas fees — catalyzing the search for alternatives.

On one hand, Ethereum began its long-awaited Ethereum 2.0 upgrade path;

On the other, new public chains and L2s began rising, aiming to scale blockchain performance and absorb spillover value from Ethereum.

Arbitrum One emerged precisely amid this backdrop.

Launched on August 31, 2021, Arbitrum One is an Ethereum L2 scaling solution built using Optimistic Rollup technology — among the first batch of Optimistic Rollup L2s to go live. In fact, Offchain Labs, the team behind Arbitrum, was also one of the earliest dedicated L2 research teams.

As early as 2018, Ed Felten — former White House tech official and Princeton computer science professor — along with two PhD students, Steven Goldfeder and Harry Kalodner, foresaw Ethereum’s future performance bottlenecks. They founded Offchain Labs to focus on L2 development. Between 2019 and 2022, Offchain Labs raised $120 million across multiple funding rounds, achieving a valuation exceeding $1.2 billion.

This strong technical foundation gave Arbitrum One significant advantages, exemplified by its multi-round interactive fraud proofs.

We know that L2s improve mainnet performance by offloading computation and storage from L1 to L2. However, data transferred between L1 and L2 must remain valid.

Building upon the standard Optimistic Rollup fraud proof mechanism, Arbitrum One introduced multi-round interactive fraud proofs.The process can be summarized as follows:

Validators on L2 submit compressed data to L1 while posting collateral. If any party disputes the validity of a rollup block’s transaction data, they can challenge it by also posting collateral. The validator and challenger then interact off-chain, using binary search to narrow down disputed steps until a single step remains, which is then verified on L1 — enabling efficient dispute resolution.

All steps are enforced by smart contracts, preventing either side from cheating. This ensures both data security and validity — inheriting Ethereum mainnet-level security — while enabling extremely low transaction fees ideal for DeFi and NFT applications.

In 2021, when Ethereum’s performance issues were widely criticized, Arbitrum One’s deep understanding of market pain points, three years of R&D in the L2 space, and first-mover advantage as an early Optimistic Rollup deployment made its launch perfectly timed — resulting in exceptional initial performance.

According to official social media, over 100 projects were deployed on Arbitrum One at launch, including major DeFi protocols like Uniswap, Sushiswap, and Curve — thanks to Arbitrum’s near-100% EVM compatibility, allowing seamless migration of Ethereum-based projects.

This thriving ecosystem quickly led to impressive on-chain activity:

In terms of TVL, according to L2 Beat, total L2 TVL was around $3 billion on September 14, 2021. Just two weeks after launch, Arbitrum One alone reached $2.2 billion — a seven-day growth rate of approximately 2411%.

Regarding addresses, arbiscan.io data shows Arbitrum One surpassed 100,000 unique addresses within half a month. On September 12, it recorded 267,608 on-chain transactions, demonstrating strong community engagement, all while maintaining significantly lower average gas fees compared to Ethereum.

From day one, whether measured by ecosystem maturity or on-chain activity, Arbitrum One had already secured its position as the leading L2. But as the saying goes: starting a business is hard; maintaining it is even harder. Over the next three years, facing increasingly diverse user demands and fiercer competition, sustaining this lead became a greater challenge than the initial “first-mover” success.

From this perspective, reviewing Arbitrum One’s achievements today — at this critical three-year milestone — carries even greater significance.

Growth: Reaching New Heights — Arbitrum One, the Undisputed L2 Leader with #1 TVL

For a long time, the community has viewed Arbitrum One as the earliest starter, highest achiever, and most mature ecosystem among Layer 2 networks.

This perception isn’t baseless — it’s backed by rich, concrete data. We typically assess chain scale and vitality using metrics such as TVL, unique addresses, daily active users (DAU), and daily transaction volume. Looking back at Arbitrum One’s growth over the past three years, it’s clear that it has consistently maintained its leadership in the L2 space.

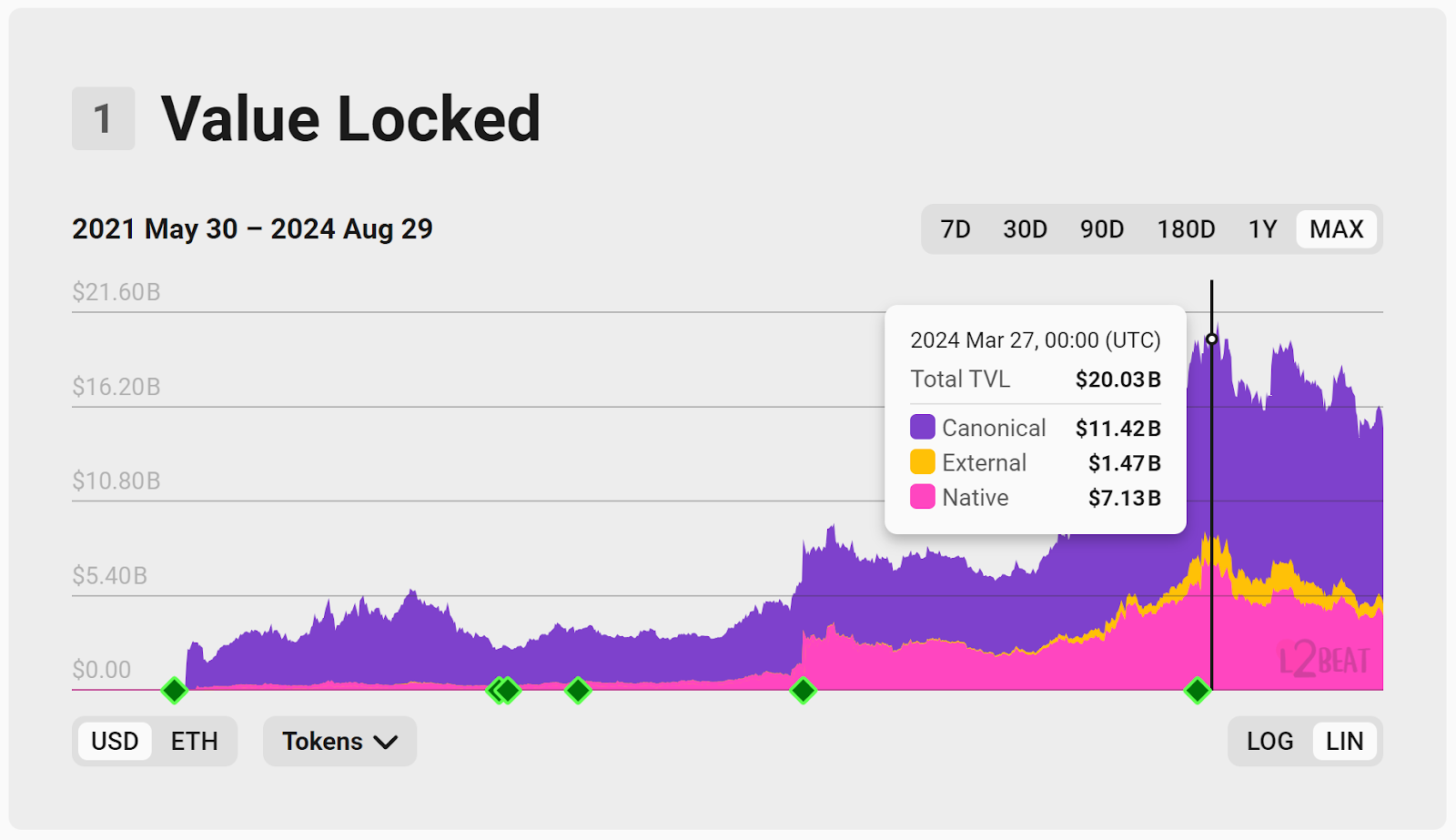

TVL reflects the amount of capital available within an ecosystem. Since inception, Arbitrum One’s TVL has remained firmly atop the L2 leaderboard:According to L2 Beat, on August 31, 2022 — its first anniversary — Arbitrum One’s TVL grew from nearly zero to $3.33 billion. By its second anniversary on August 31, 2023, TVL had doubled to $6.67 billion despite a deep bear market. On its third anniversary in 2024, TVL reached $14.77 billion, peaking above $20 billion in April — capturing roughly 65% of total L2 TVL. Even from a large base, Arbitrum One achieved over 450% growth entering the new cycle.

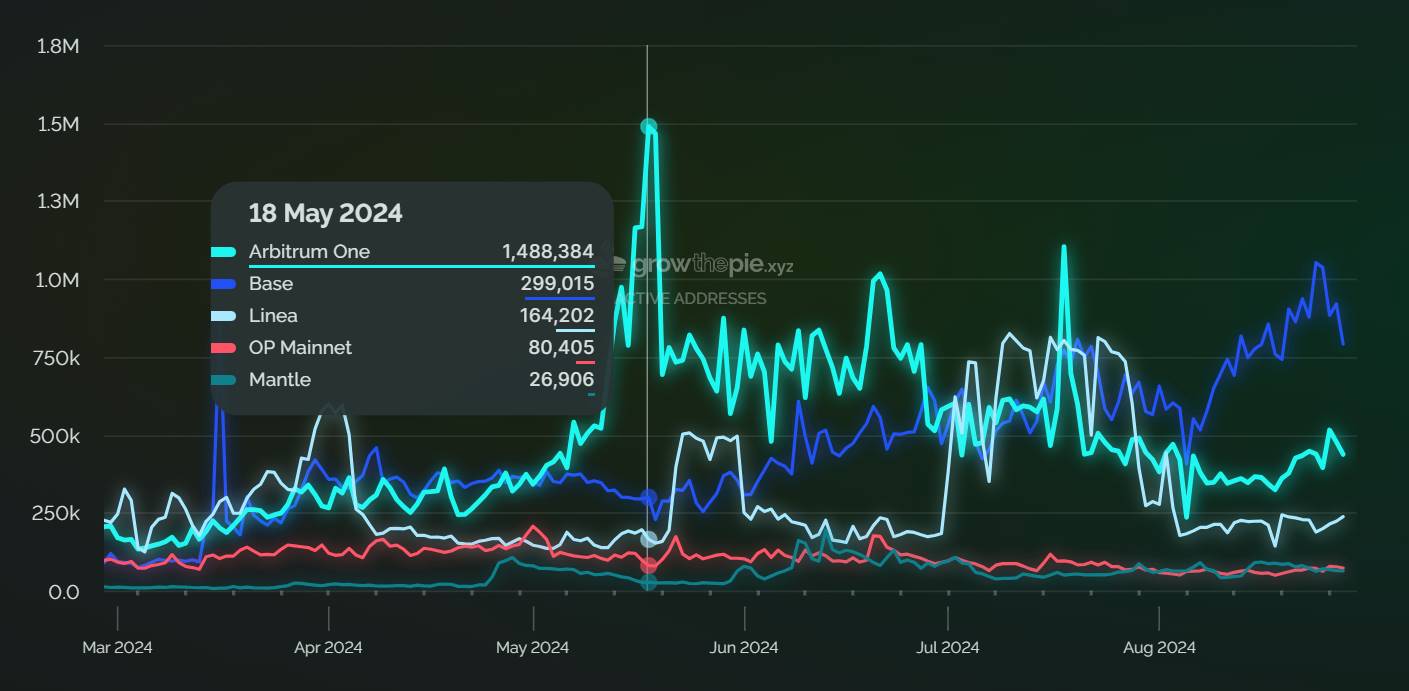

Address count is a key metric for measuring user adoption. Few L2s have crossed the 10-million-address threshold — Arbitrum One is one of them:As of August 28, 2024, arbiscan.io reports 37.47 million unique addresses on Arbitrum One. According to Growthepie, on May 18, 2024, Arbitrum One recorded 1.48 million daily active addresses — briefly surpassing Solana during its meme coin craze.

Additionally, Coin98 Analytics’ Q2 2024 L2 report shows Arbitrum One’s unique addresses grew from 19.88 million to 33.24 million — ranking third among 11 major L2s surveyed, with a quarterly increase of over 67%. By July 2024, unique addresses reached 35.77 million, up over 7% month-on-month — demonstrating sustained momentum.

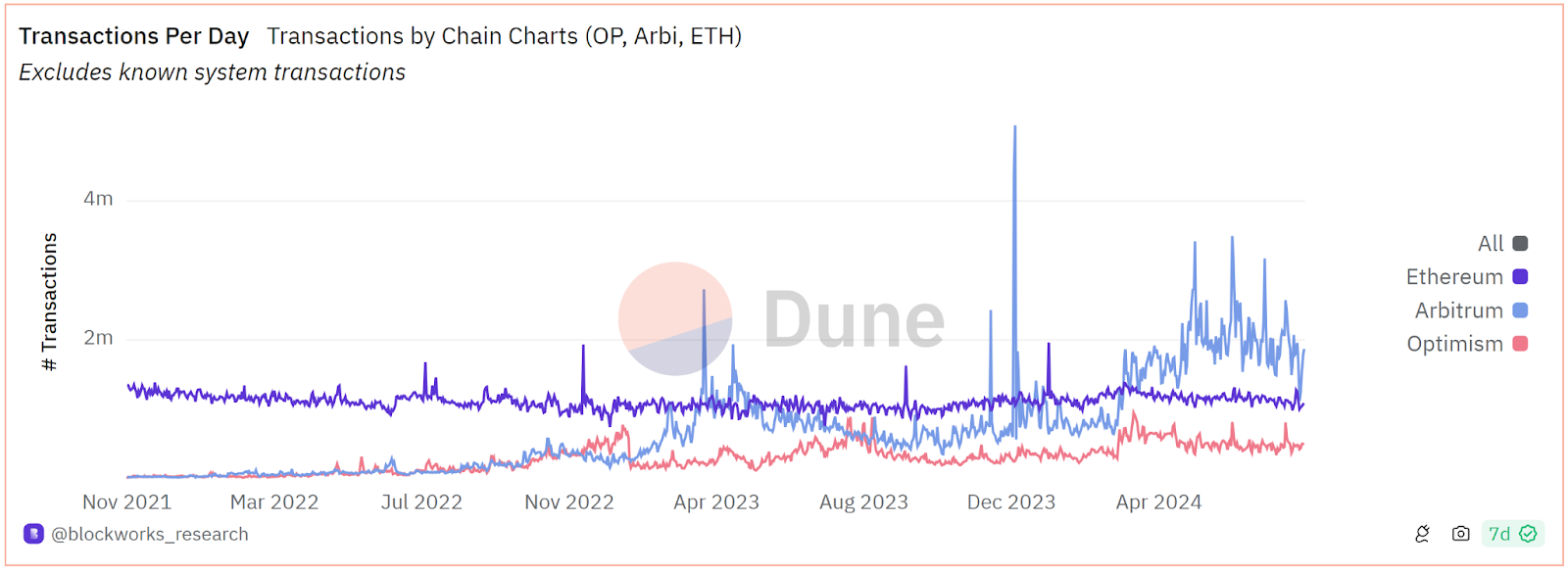

Transaction volume reflects both user activity and network performance under stress — areas where Arbitrum One continues to excel:To date, Arbitrum One has processed over 900 million transactions. According to Dune, on December 16, 2023, daily transaction volume hit a record high of 5.08 million. Currently averaging around 2 million daily transactions — second only to Base — compared to OP Mainnet’s ~500,000 and Ethereum’s typical ~1.1 million per day throughout 2024.

There’s a vivid analogy used within the Arbitrum community:

If the past three years of L2 competition were a series of exams, Arbitrum One would be the student who never ranked outside the top three — excelling both in individual subjects and overall strength. No one can deny its achievements in the L2 race.

Yet this raises another question:

In an industry accustomed to fleeting successes, what efforts have enabled Arbitrum One’s enduring dominance?

Analysis: Technology Upgrades + Ecosystem Incentives = A Thriving, All-Encompassing Arbitrum Ecosystem

Capital and users don’t flow in without reason — the fundamental driver is the ecosystem.

In the eyes of many community members: Arbitrum is Ethereum.This stems not only from the influx of major Ethereum-native projects but also from Arbitrum’s consistent innovation in launching standout native applications.

Unlike newer L2s that differentiate themselves through niche specialization, Arbitrum — as one of the earliest Optimistic Rollup deployments — embraces a "broad and comprehensive" approach. Through Arbitrum’s ecosystem portal, we see over 2,000 projects — rivaling Ethereum in richness and diversity.

Robust infrastructure is essential for sustainable ecosystem growth.As a fully EVM-compatible L2, Arbitrum benefits from Ethereum’s mature tooling while offering greater flexibility. Its infrastructure includes wallet integrations, cross-chain bridges, developer tools, and more. According to the portal, there are 60 bridging projects, 13 centralized exchanges, 76 wallets, 33 analytics tools, 13 oracles, and 79 developer tools — greatly enhancing usability.

DeFi forms the backbone of the ecosystem.The portal lists over 373 DeFi projects on Arbitrum, including 64 DEXs, 48 lending platforms, and 26 stablecoin projects — covering the core pillars of DeFi. Other categories include derivatives, perpetuals, DeFi utilities, liquidity management, yield aggregators, and restaking protocols.

Here we find established names like Uniswap, 1inch, Aave, Compound, Curve, DODO, and Sushiswap, as well as fast-growing native innovators such as GMX (perpetuals) and Camelot (DEX).

In 2024, Arbitrum continues to attract new DeFi entrants like Robinhood, Renzo, and coW Swap — significantly boosting TVL and on-chain activity.

As a 2021 mainnet launch, Arbitrum naturally rode the NFT wave:The portal shows over 74 NFT-related projects, including 15 marketplaces, 28 NFT collections, 12 tools, and 10 NFTFi platforms. Users can freely buy/sell NFTs and leverage them in DeFi activities like lending. Comprehensive support has attracted notable projects like OpenSea, NFTScan, and Azuki, which recently joined.

When discussing NFTs, gaming — deeply intertwined with NFTs — naturally follows:The portal lists over 76 gaming projects across GameFi, action, adventure, RPG, and casual genres. The most talked-about is Treasure DAO — supported by Offchain Labs.

Positioned as a “decentralized Nintendo,” Treasure DAO gained mainstream attention in late 2022 with the viral success of The Beacon. Within nine days, 34,394 genesis NFTs were purchased (each at 0.031 ETH). Other games include Bridgeworld and Smolverse, interconnected via the native MAGIC token and NFT trading platform Trove. With diverse gameplay and vibrant community, Treasure DAO is a cornerstone of Arbitrum’s gaming ecosystem.

Recognizing gaming as a key gateway for Web3 user acquisition, Arbitrum continues investing heavily here. Recent additions include Pirate Nation – Apex Chain, InfiniGods, and Avarik Saga — high-quality games enriching the ecosystem.

The scale effect created by Arbitrum’s thriving ecosystem provides a solid foundation for its continued leadership in the L2 space. Behind this success lies not only continuous platform optimization empowering developers but also relentless, holistic support for ecosystem projects over three years.

On the technical front, Arbitrum advances along two strategic axes: vertical and horizontal.

Vertical strategy refers to Arbitrum’s ongoing deepening of blockchain performance and developer experience — introducing technical upgrades and innovations to become the preferred platform for builders.

The Nitro upgrade is a prime example:In August 2022, Arbitrum One successfully upgraded to Nitro, enabling interactive fraud proofs via WASM-compiled code. This brought higher throughput, faster finality, and more efficient dispute resolution. Official data indicates L2 execution speed improved 20–50x, with lower transaction fees.

Another widely discussed innovation is AnyTrust:By introducing a Data Availability Committee (DAC) security model, AnyTrust achieves ultra-low operating costs and faster withdrawals while preserving Ethereum-level security.

At this year’s anniversary, Arbitrum Stylus will launch on both Arbitrum One and Nova mainnets:As an open-source SDK supporting multi-language app development, Stylus allows developers to use Rust, C, and C++ instead of being limited to Solidity — opening doors to Web2 and broader industry talent. As Arbitrum’s largest-ever execution layer upgrade, Stylus elevates both developer and user experiences.

Additional technical support includes the Atlas upgrade integrating blob transactions (reducing minimum base fee to 0.01 gwei), a suite of practical Arbitrum SDKs, comprehensive documentation, and responsive technical communities — lowering barriers and empowering developers.

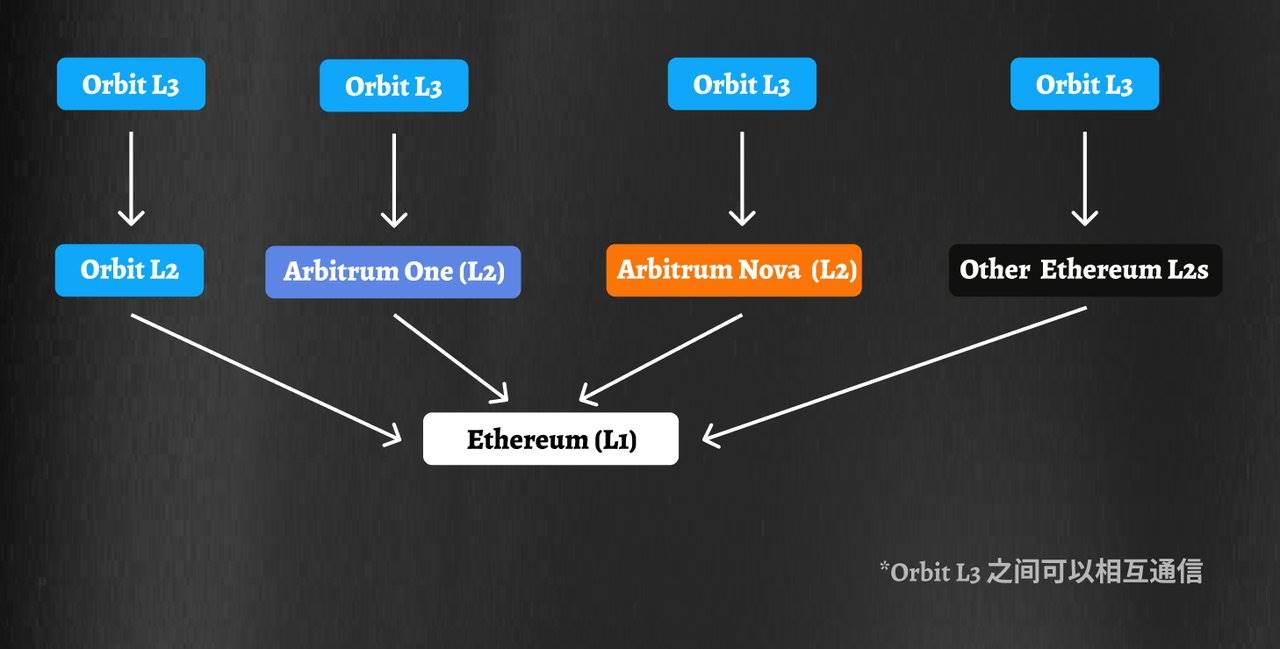

The horizontal strategy focuses on meeting diverse ecosystem needs. To accommodate different dApp requirements in speed, cost, and security, Arbitrum offers a multi-chain product suite and RaaS (Rollup-as-a-Service):

-

Arbitrum One: An L2 based on Arbitrum Rollup technology, inheriting Ethereum mainnet-level security — ideal for high-security applications like DeFi.

-

Arbitrum Nova: Built on AnyTrust, sacrificing some decentralization for drastically lower on-chain fees — ideal for high-frequency applications like GameFi.

-

Arbitrum Orbit: Enables permissionless creation of dedicated chains with customizable throughput, privacy, gas tokens, and governance — ideal for highly specialized use cases.

Each product excels in its domain, fostering vibrant sub-ecosystems: Arbitrum Nova hosts over 120 projects; since年初, Orbit has seen over 55 projects launch 17 mainnets, generating over 10 million transactions, with over 100 more in deployment. The flourishing of all three products accelerates the multi-chain era rooted in Ethereum and unlocks new possibilities for on-chain innovation.

Beyond technical support, ecosystem incentives are crucial catalysts for application growth. Arbitrum’s robust incentive programs have turned it into fertile ground for innovation.

For users:

Many still remember the massive Arbitrum Odyssey campaign in 2022. As an ecosystem exploration rewards program, participants completed tasks for NFTs and prizes. Amid anticipation of ARB token distribution, the event drew so many users that it caused transaction spikes and temporary outages — pushing Arbitrum to continuously optimize performance. Subsequent phases of Odyssey similarly attracted widespread participation.

Additionally, regular users can join the Ambassador Program, contributing via events, content creation, education, or tool development — earning generous rewards and broad community recognition.

For developers:

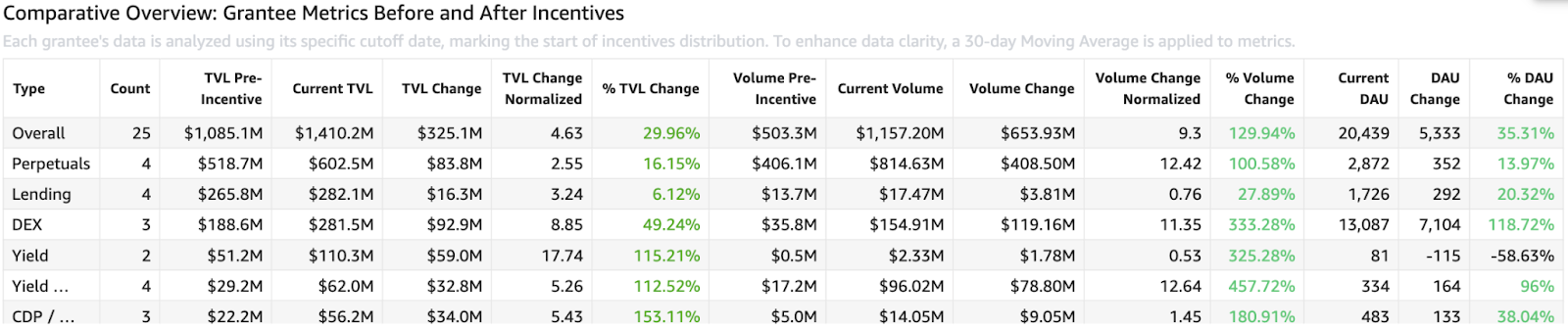

Starting November 2023, Arbitrum launched the Short-Term Incentive Program (STIP), distributing 50 million ARB tokens to top ecosystem protocols via community voting. Of 95 participating projects, 29 were selected — including Camelot, GMX, Galxe, and Pendle — ultimately disbursing 71.4 million ARB to 27 projects. On-chain data confirmed the impact: recipient protocols saw across-the-board growth in DAU, TVL, and transaction volume.

Building on STIP’s success, ArbitrumDAO launched the Long-Term Incentive Pilot Program (LTIPP) this year, allocating 25–45 million ARB to attract new users and liquidity while refining incentive mechanisms.

Meanwhile, Arbitrum runs a bug bounty program encouraging developers to participate in security audits. Bounties range from $1,000 to $2 million based on severity — continuously strengthening ecosystem security.

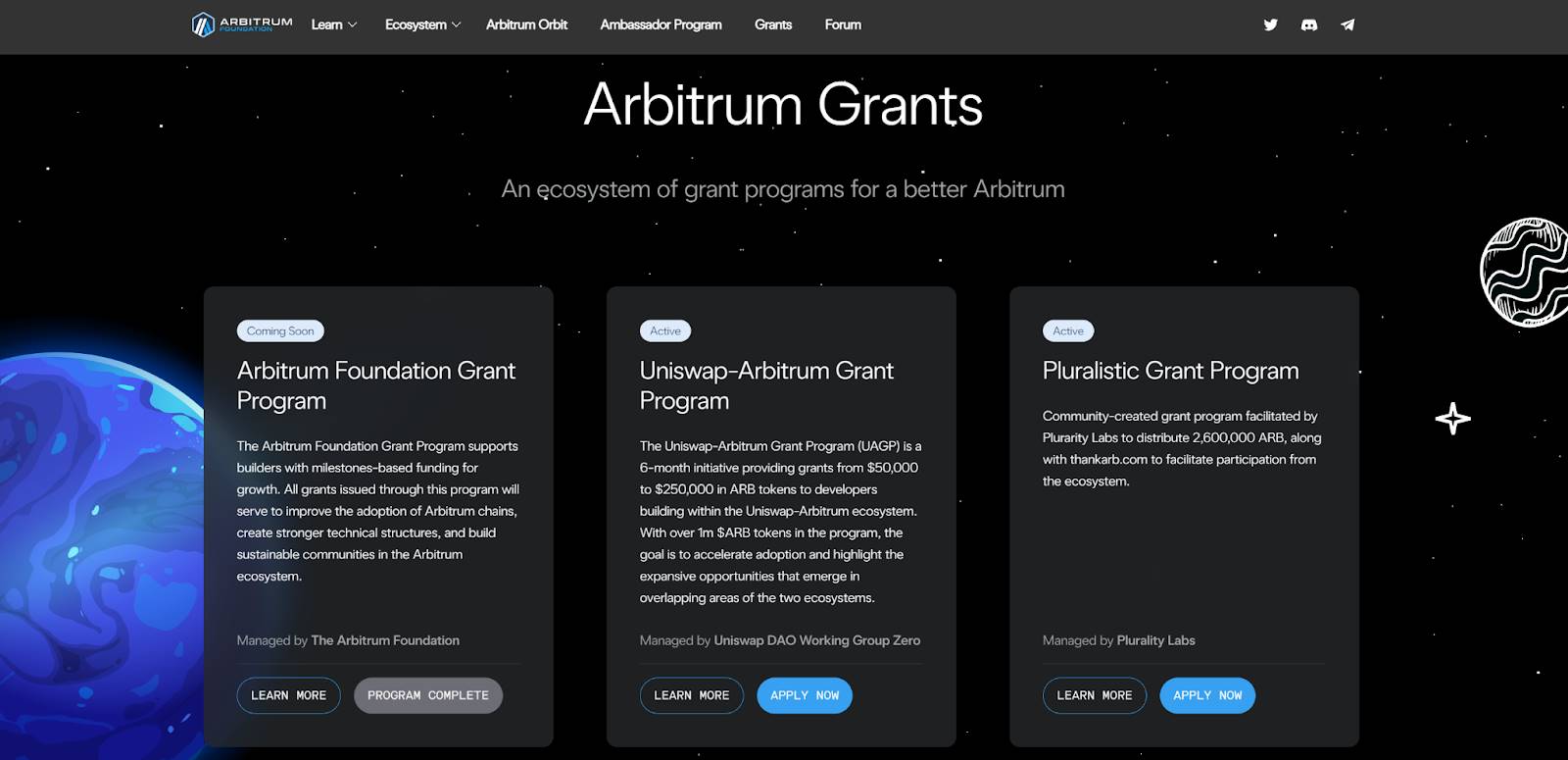

Additionally, the Arbitrum Foundation runs grant programs and hackathons. In June, ahead of Stylus’ release, it hosted the Stylus Blitz Hackathon on Arbitrum Sepolia testnet. The Foundation has completed three grant rounds, with the fourth即将 opening applications soon.

These diverse incentives attract vast developer participation. Generous funding, resources, and technical support enable creators to freely explore innovations — from finance to gaming and social platforms — fueling Arbitrum’s ecosystem expansion.

Outlook: Roadmap Progresses Steadily — Arbitrum One Poised for Future Growth

Of course, at this meaningful three-year milestone, reflecting on past achievements brings joy — but focusing on future strategy and growth potential is even more important.

On one hand, with zkSync announcing its token airdrop in June 2024, all four original “L2 horsemen” now have tokens. On the other, emerging L2s like Base, Blast, and Mantle intensify competition. As one of the original four, how can Arbitrum unlock a second growth curve and maintain its #1 TVL position?

Recent announcements suggest Arbitrum is well-prepared for these shifting dynamics.

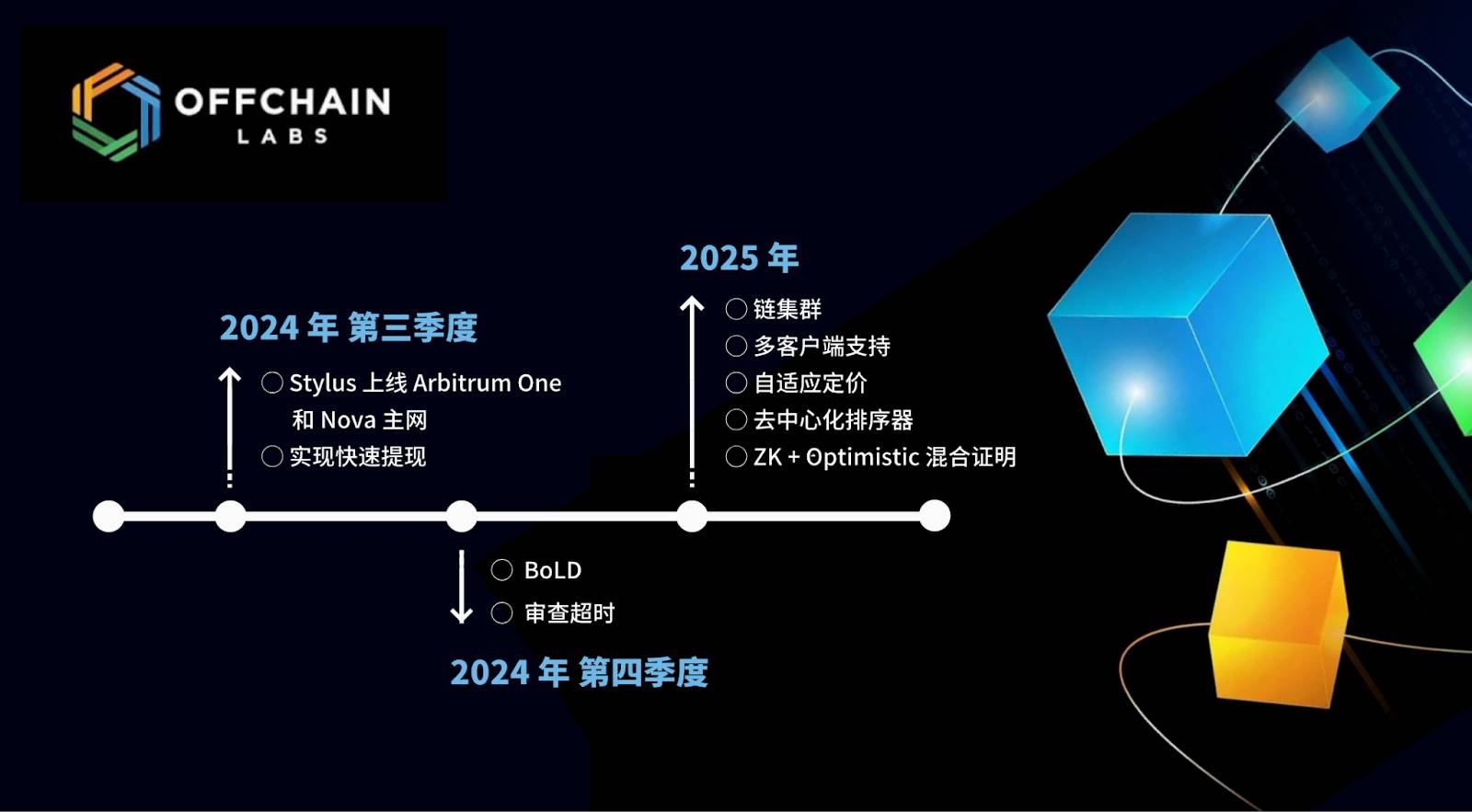

Technically, Offchain Labs recently unveiled its latest roadmap.Beyond the upcoming Stylus rollout on Arbitrum One and Nova mainnets, the plan details several key proposals:

Q3 2024: Offchain Labs will complete development of Arbitrum’s fast withdrawal feature;

H2 2024: Completion of the new Bounded Liquidity Delay (BoLD) validation protocol, enabling permissionless validation. BoLD will introduce censorship timeouts to mitigate negative impacts from repeated challenges or sequencer downtime — strengthening censorship resistance.

In 2025, priorities include multi-client support, adaptive pricing, chain clustering, and advancing decentralized sequencers. Research into hybrid ZK + Optimistic proofs will continue — further improving performance, efficiency, interoperability, scalability, and decentralization. These upgrades will undergo on-chain voting via ArbitrumDAO before phased implementation.

On the ecosystem front, H1 2024 brought multiple milestones: ApeCoin DAO chose Arbitrum to launch ApeChain; DuckChain leveraged Arbitrum Orbit to become TON’s first L2; and top projects like Azuki, Farcaster, and Robinhood joined the ecosystem.

These developments underscore Arbitrum’s enduring appeal and will serve as key drivers for continued leadership. Going forward, leveraging Arbitrum One, Nova, and Orbit, the ecosystem will pursue more partnerships and deepen efforts in ecosystem expansion, innovation stimulation, and user empowerment.

Celebration: Join the Community, Participate and Win Rewards

Finally, for most users, celebrating Arbitrum One’s third anniversary is best done through participation — rather than just reflection or forecasting.

To mark the occasion, the Arbitrum Chinese community has launched a series of events — the highlight being a special AMA on September 5 at 21:00.

Guests include @whizwang (Azuki ecosystem lead), @wiseoftheday (GMX core contributor), @legeishere (Chainlink China community manager), David (DuckChain founding member), and Leo (SNZ developer relations lead).

Additionally, like and retweet the event post and follow Arbitrum’s official Chinese Twitter — 10 lucky fans will win exclusive Arbitrum merchandise.

New and old friends gather to share stories, answer questions, and discuss Arbitrum’s future together.

Conclusion

Undeniably, the road ahead is challenging.

Looking at the L2 landscape: new contenders like Base and Mantle are rising, while some of the original “four horsemen” appear to be falling behind. This cycle, everyone can launch a chain — and many do — resulting in a “thousand-chain war.” Coupled with waning enthusiasm for infrastructure narratives, L2 competition has grown more unpredictable.

Yet for true L2 leaders like Arbitrum, their accumulated advantages aren’t easily challenged — especially because Arbitrum’s lead stems from rich, active ecosystems that drive real on-chain usage, a moat far harder to replicate.

As Arbitrum continues advancing in technology, user experience, and ecosystem development — executing milestone after milestone — we extend our best wishes and look forward to the innovations it will bring to the L2 space and the broader industry.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News