September Crypto Market Outlook: The Cooling Solana Ecosystem Might Give Us a Buying Opportunity

TechFlow Selected TechFlow Selected

September Crypto Market Outlook: The Cooling Solana Ecosystem Might Give Us a Buying Opportunity

Must it fall whenever there's a meeting?

Author: Sleeping Heavily in the Rain

GM September outlook is here.

September remains a risky month for me—I won't consider making many trades (currently flat).

Waiting.

This piece aims to outline, from my personal perspective and in simpler, more precise language, the sectors and assets I’ll be closely watching this September.

TL;DR

1. Bullish on $BTC ecosystem—BTC staking, wBTC competitors ($T), inscriptions/runes ($SATS $ORDI), and $RUNE;

2. Bullish on DeFi’s Uniswap v4 $UNI—it's currently the most important catalyst in the DeFi ecosystem. ($COW is also making small moves);

3. Solana ecosystem cooling down may offer a buying opportunity. I think $JTO, $CLOUD, $DRIFT, $KMNO look promising—let’s see which one captures market attention;

4. Be cautious when considering RWA projects; $MPL and $CPOOL are two worth watching;

5. MakerDAO’s rebranding has created market speculation potential and could benefit $LQTY;

6. CZ’s release from prison is a strong positive signal for $BNB-related assets;

7. Pendle is moving closer toward BTCFi;

1/ BTC Ecosystem

The BTC ecosystem primarily revolves around three developments:

-

The surge of interest in $BTC staking triggered by Babylon—essentially another layer of abstraction;

-

Opportunities for alternatives amid growing skepticism toward wBTC: 1) Coinbase launching $cbBTC; 2) Former challenger Threshold’s $tBTC gaining significant traction; 3) Cross-chain adoption of Stack’s sBTC following the Nakamoto upgrade.

P.S. Competition among various wrapped BTC solutions will intensify. This might renew market interest in cross-chain protocols supporting native BTC, such as Thorchain $RUNE. Also, Threshold (operator of tBTC) has proposed merging with wBTC—but I find that unlikely.

-

Fractal Bitcoin, a Bitcoin scaling network, plans to launch its mainnet on September 9. The market appears receptive to this news, which is positive for the BRC20 ecosystem. Runes will likely receive indirect attention at that time.

(If I’ve missed anything, feel free to add.)

2/ DeFi

Lately, many are bullish on legacy DeFi projects like $AAVE (Aave’s recent fundamental data looks solid).

That said, while Aave has laid out extensive plans for future tokenomics, I believe implementation will take considerable time. Additionally, Aave intends to maintain GHO’s dollar peg through integration with BlackRock’s BUIDL.

Recently, I’m paying extra attention to $UNI. On August 15, Uniswap Labs announced a $2.35 million prize pool security competition for Uniswap v4, in collaboration with the Uniswap Foundation and Cantina—indicating v4 is imminent (previously expected in Q3).

The significance of Uniswap v4 has been widely analyzed—I won’t repeat it here. For reference: link.

I believe Uniswap v4’s launch is highly significant—the most crucial catalyst in DeFi right now (though oddly, little discussed in Chinese circles).

Worth noting: Cow Protocol seems aware of the threat posed by Uniswap v4 and is partnering with Wintermute to improve liquidity via CEX listings and on-chain enhancements.

3/ Solana

The most exciting part of the Solana ecosystem remains memecoins—keep an eye on what English-speaking KOLs are shilling. You can follow my List.

Next come the most profitable protocols in the Solana ecosystem: Jito $JTO / Raydium $RAY / Jupiter $JUP / Banana $BANANA

Other applications capturing market attention or liquidity: Drift $DRIFT / Kamino $KMNO / Sanctum $CLOUD

Here are some tokens I’ve added to my watchlist ⬇️

-

Jito — closely tied to Solana’s overall prosperity;

-

Sanctum — liquidity layer for LSTs; recent CEX involvement in $SOL staking benefits them;

More details here: link.

-

Kamino — liquidity layer on Solana, accounting for 28% of Solana’s total TVL;

-

Banana — the only Telegram bot (besides Bonk) listed on Binance.

One additional thought: As the market previously rejected VC-backed infrastructure tokens, memecoins became the new favorite. When sentiment gradually returns to rationality, fully diluted supply application tokens—and those generating substantial real revenue—may become the next speculative theme (not that memecoins are bad). Hopefully, this isn’t just wishful thinking.

4/ RWA (Please exercise caution with RWA-related assets)

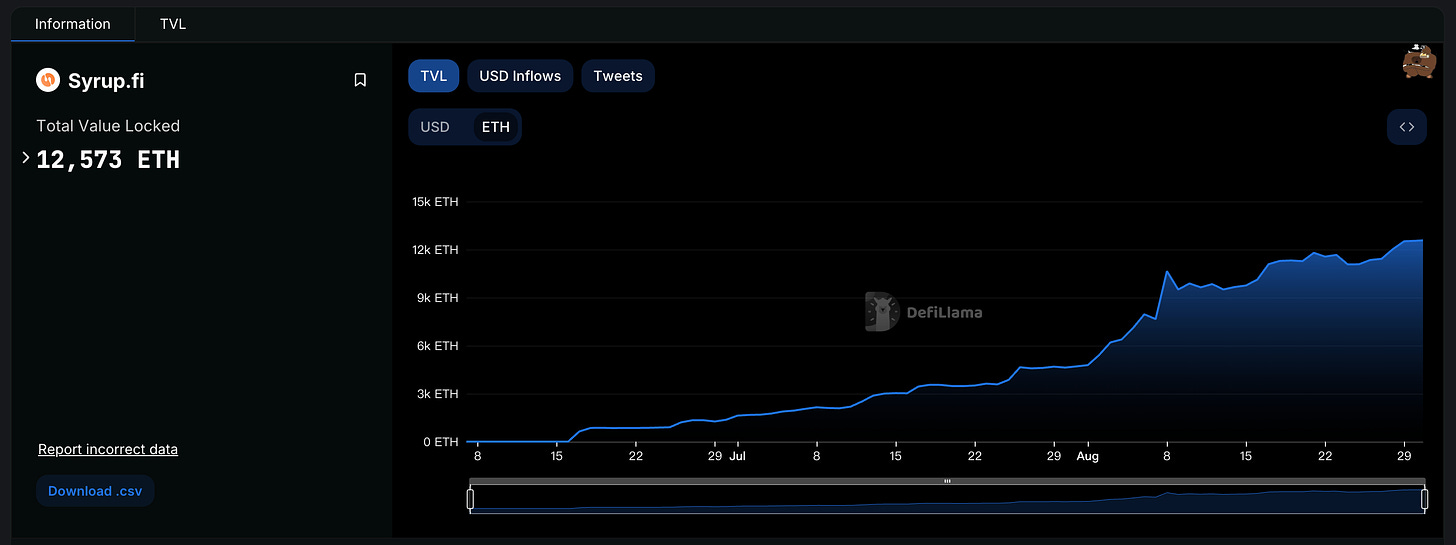

As mentioned in my August outlook, I’ve always liked Maple. Here’s an update on their latest progress:

1) Maple’s fundamental metrics are showing healthy growth;

2) Coming in Q4: $MPL will undergo a 1:100 split and rebrand to SYRUP, with lending revenue used to buy back SYRUP.

https://x.com/maplefinance/status/1828089885657534644

Another project worth watching is Clearpool—an institutional credit protocol.

Clearpool is launching Ozean, an RWA-yield-based Layer2 built on OP Stack: 1) Gas paid in stablecoin USDX; 2) Account abstraction implemented; 3) $CPOOL will govern both Ozean and Clearpool, earning Ozean sequencer revenue.

However, judging by price action, the market hasn’t embraced this yet.

https://x.com/ClearpoolFin/status/1825880491196821806

Investing in the RWA sector now feels like joining the Nationalist Army in 1949—please proceed with extreme caution before hitting that buy button.

5/ Stablecoins

No discussion about stablecoins is complete without mentioning MakerDAO’s rebranding. The split has pros and cons. “Sky” is simple and memorable; “USDS” is more straightforward than “DAI,” beneficial for attracting new users. Sky also opens up more use cases for USDS—for example, mining SubDAO tokens. On the downside, as @tmel0211 pointed out, “USDS includes blacklisting and freeze functionality,” sparking community controversy.

It’s also worth noting that MakerDAO has introduced additional incentives to encourage migration.

Join early and get boosted Sky Token Rewards.

From another angle: if DAI becomes less decentralized, then other truly decentralized stablecoins like $LQTY could benefit.

6/ Others

-

Sep 4: $MATIC → $POL rebrand;

-

Fantom’s new Layer1 Sonic testnet;

-

Arbitrum Stylus upgrade;

-

Sep 28: Potential release of CZ from prison;

-

Eigenlayer should have major project updates and EIGEN token transfers in Q3;

-

Eigenpie IDO (if you accumulated points earlier, don’t forget to participate—$3M FDV makes profit highly likely);

-

Berachain may launch mainnet in Q3;

-

A few other projects may conduct TGE (though due to current market weakness, timing might be delayed): Solv, Grass, DappOS, StakeStone, KelpDAO;

-

Singapore Token2049 (historically, prices drop after such events?)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News