Vitalik on DeFi Debate: The Communication Gap Between 1% Developers and 90% Traders

TechFlow Selected TechFlow Selected

Vitalik on DeFi Debate: The Communication Gap Between 1% Developers and 90% Traders

90% of people gamble on Meme tokens in PvP, 1% are elite hypocrites building castles in the air.

Author: ivangbi

Translation: TechFlow

This article is divided into three parts:

1. The importance of proper communication, including with regular users and partners. The introduction uses a general example to set the context for the topic.

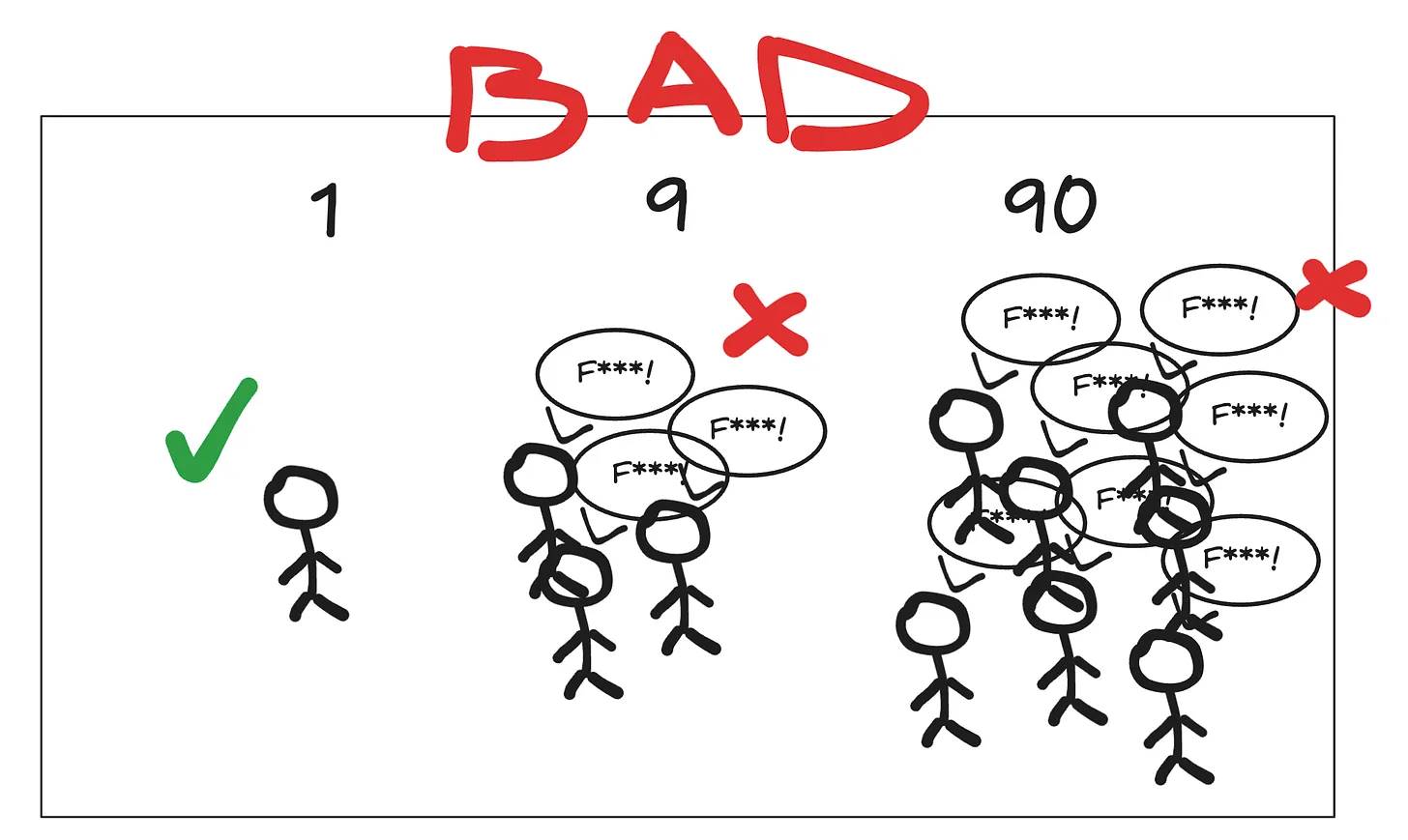

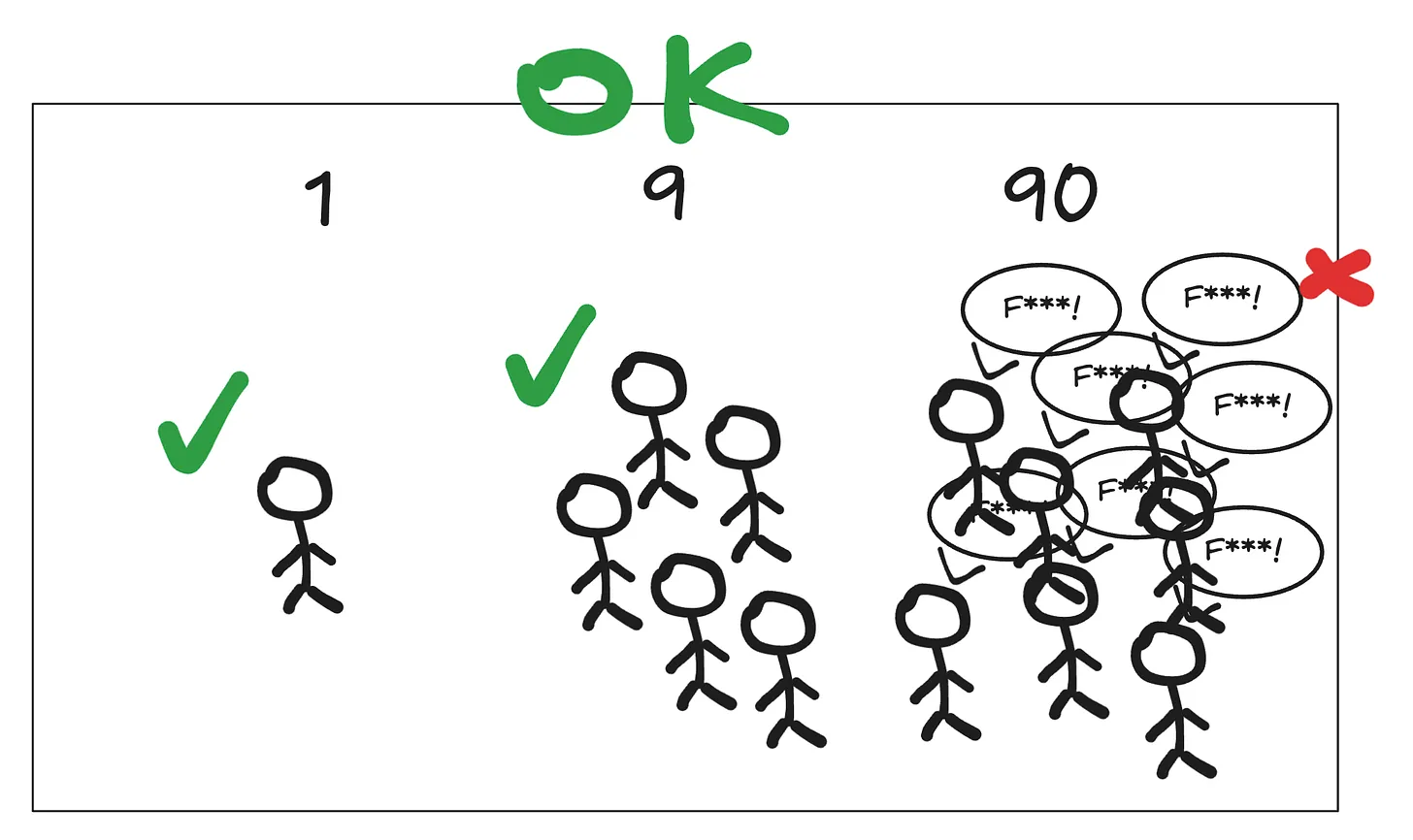

2. 1-9-90: The second part discusses the 1-9-90 guideline and my interpretation of it. This can be broadly applied to self-starting any community.

3. The difficulty of maintaining consistent communication in large groups, and the potential case where it may no longer be needed later on (today’s Ethereum). You can view the third part as a compelling overview of last week's debates within the Ethereum community, which are also part of the same issue. Whether 1-9-90 applies to Ethereum is one of the questions discussed in this section.

1. Introduction: Common Misunderstandings Between Developers and Token Holders

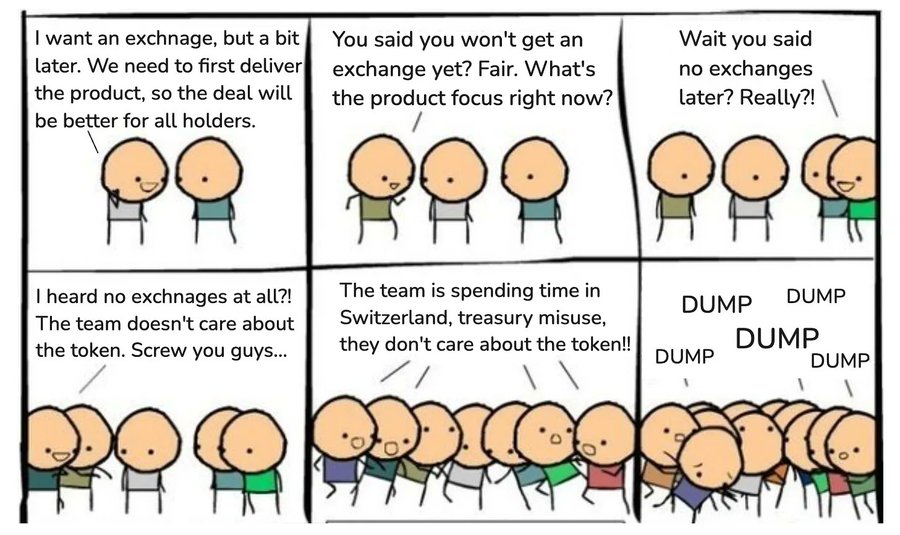

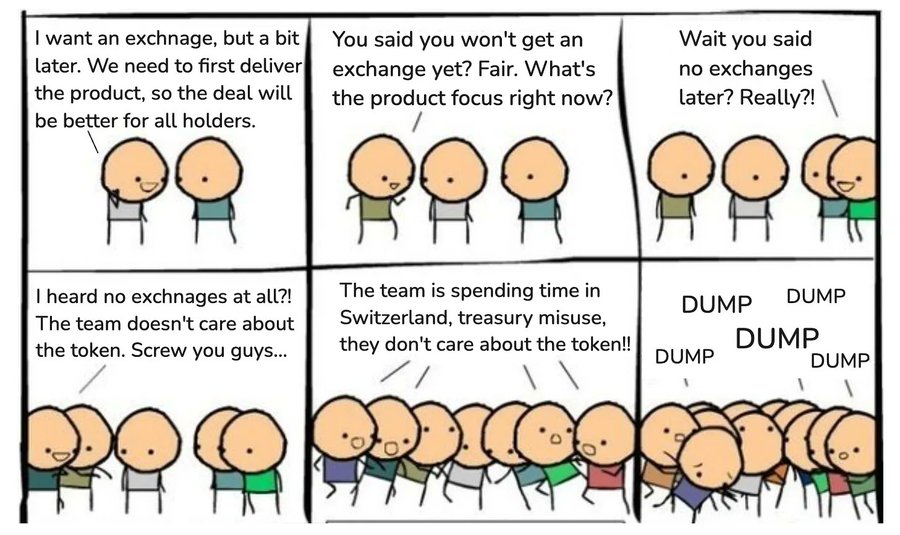

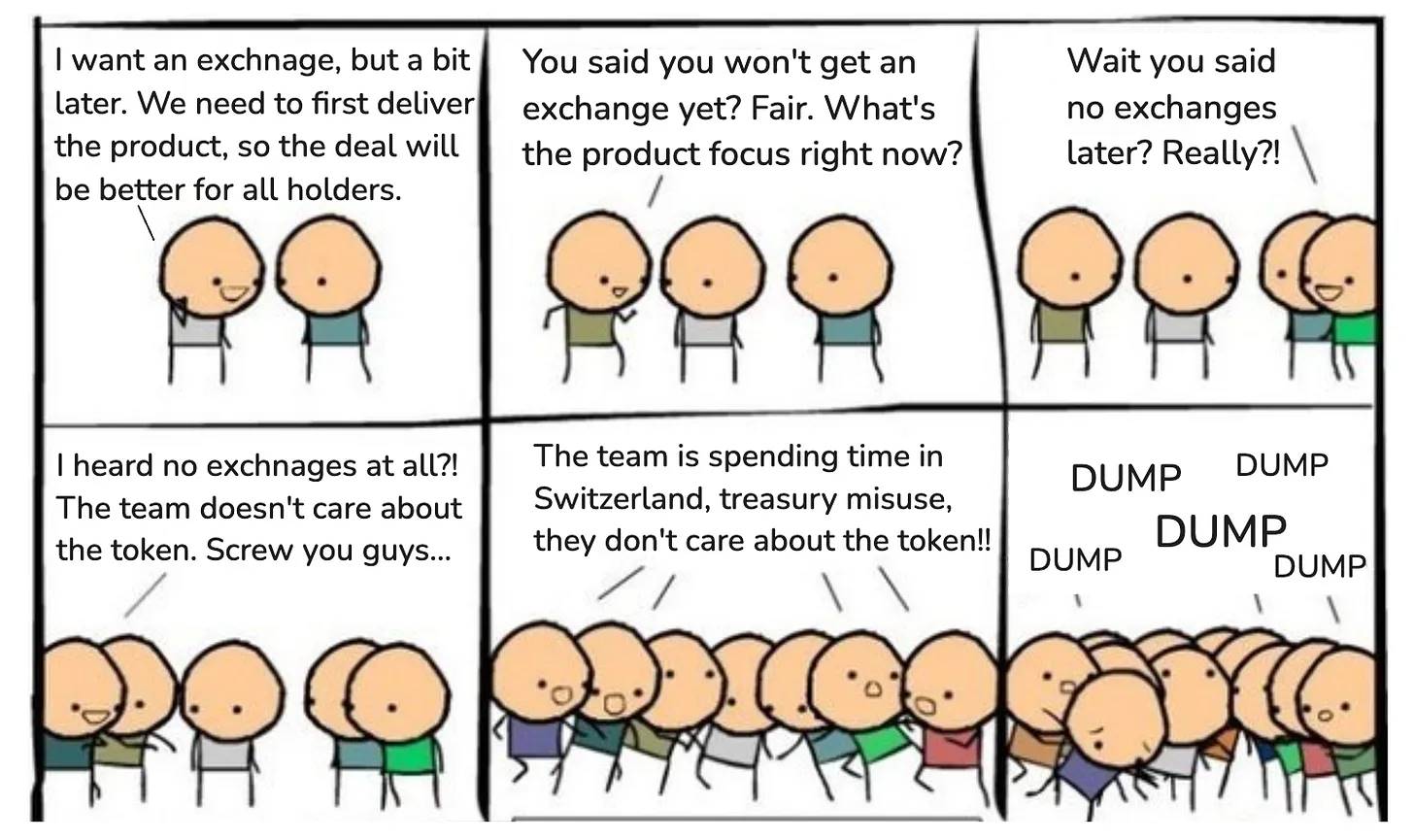

Token holder: "When will it get listed? When will it go live?"

Developer: "We’re focusing on the product now, not that."

Token holder: "You don’t care about the community at all—screw you!"

Developer: "You're just a short-term speculator, get lost!"

You’ve seen conversations like this before, right? This is exactly how chats unfold across Discord, Telegram, and Twitter for every project. I can assure you that in such exchanges, both sides feel frustrated. To developers, token holders appear as ordinary people demanding quick pumps and dumps. Meanwhile, to token holders, developers seem like elitist jerks building castles in the air.

Both perspectives are partly right—and partly wrong. They simply can't communicate. They speak different languages. Token holders only care about their asset’s value—but do you think developers don’t care? They do too. As for whether developers are incapable of handling business aspects—that’s another question we’ll leave aside for now.

P.S.: Note that I’m not glorifying either group, since both are simultaneously right and wrong. Favoring one side over the other is unwise—you need to see the middle ground.

1.2 Quick Response Strategy to Prevent Spread of Negative Emotions

-

Token holder: "When will it get listed? When will it go live?"

-

Response: "We can't publicly answer that yet, but of course it's an important question. You can join the discussion here. In the meantime, we’re launching some cool product updates—please share your thoughts in this thread!"

The token holder might not engage further, but they won’t stir up trouble either. Their immediate need for a response is satisfied, and they might even contribute their opinion. Win-win!

Experienced individuals understand they’ve received a somewhat superficial reply, so you must avoid sounding robotic. You need to guide people toward relevant and useful context so you don’t come off as talking down to children. Again, simple deflections might work once or twice—they’re temporary fixes until you have real answers. Repeated use of deflection eventually backfires. If accumulated anger reaches a peak, this strategy won’t work anymore. In such cases, you must give honest, detailed responses—or accept a temporary downturn.

In Web2, teams exist specifically to prevent FUD (fear, uncertainty, doubt) on social media. In restaurants, trained staff handle even the angriest or most intoxicated customers. Why would you expect things to be different here?

Conceptually, developers have no obligation to token holders (though morally, I believe they do—but that’s another topic). Yet equally, no one owes developers recognition or money.

So stop acting superior, both of you.

1.3 Structural Solution to the Root Problem

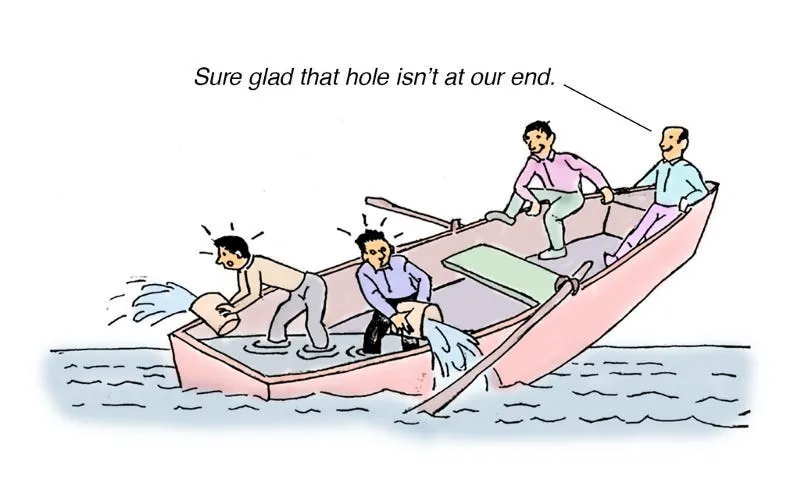

Their ultimate goal is somewhat aligned: token appreciation. However, their paths differ, and so do their timelines. Developers need high project value to ensure sufficient liquidity for exiting investments. Also, believe it or not, some developers genuinely want to build something cool! On the other hand, a holder just needs a $100k order depth to sell out. Thus, while incentives are often aligned, their time horizons differ. That much is obvious, I know.

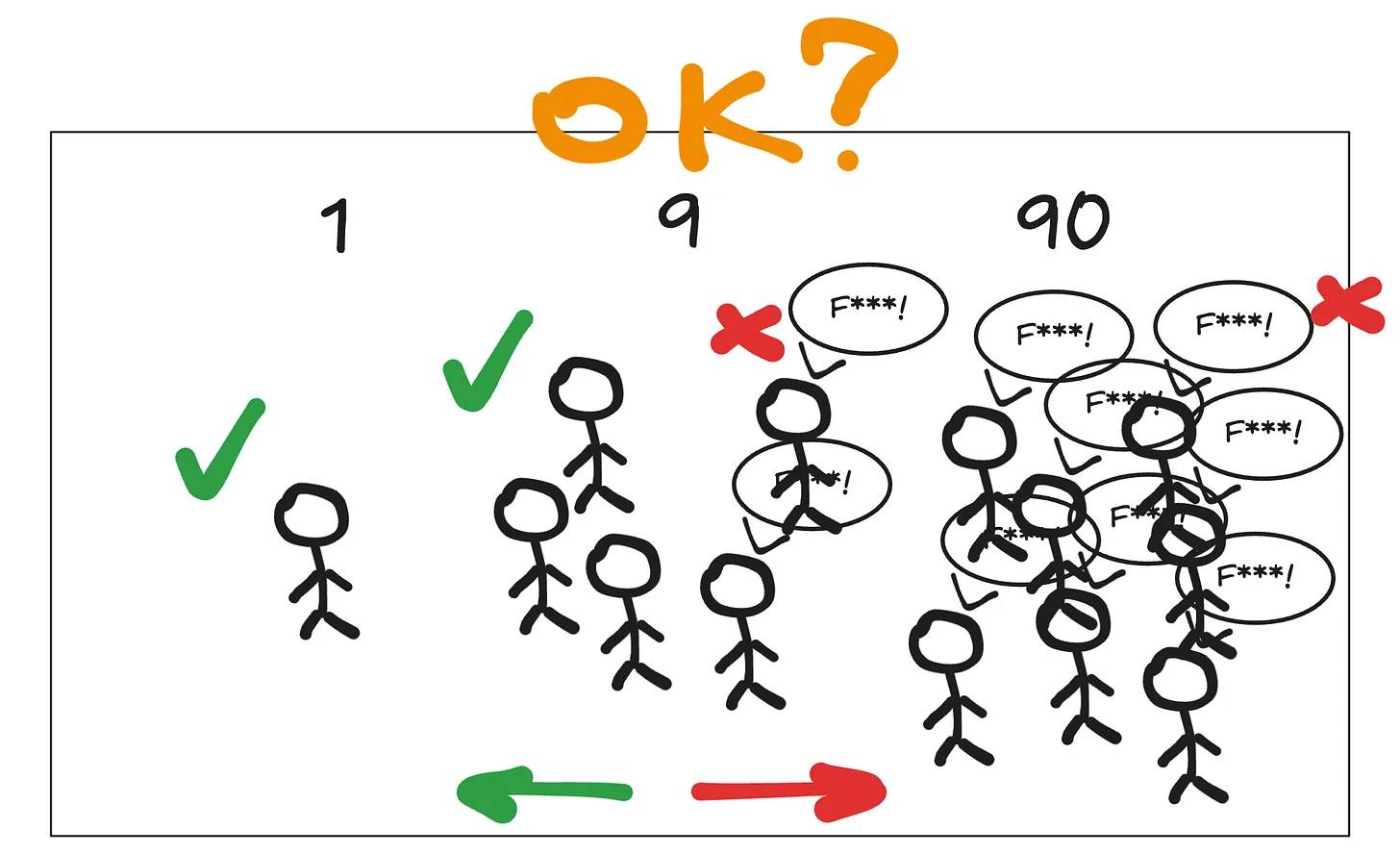

But the best way to achieve their goals is through collaboration. Developers need many holders; many holders need skilled developers to build. They cannot coexist if they try… otherwise, you end up with today’s market: 90% meme coin gambling PvP, 1% elite hypocrites building castles in the air while vacationing in Switzerland, right?!

P.S.: Indeed, there are cases where developers make false promises or holders turn extremely negative due to a red market. In such cases, neither side can help. You need unity—align vision with core supporters, raise your chin, and keep working. If you can deliver good results without dying, you’ll emerge stronger. Only under complete collapse does blunt honesty become effective.

So what exactly is 1-9-90, and how does it relate to all this? This concept isn’t original to me—it even has a Wikipedia page. I'm not sure my interpretation matches Wikipedia’s definition, but I've found it effective through years of practice. Everywhere.

2. 1-9-90 Community Building

To simplify understanding in the crypto context, think of it as:

-

1% are developers, builders, teams, and creators.

-

9% are writers, funds, researchers, and angel investors who actively follow the space and offer commentary—not actual team members, but not random newcomers either.

-

90% are random traders and speculators who never read documentation. They follow headlines, trade tokens, hold crypto—but don’t care about research. Just yellow-Tweet-loving speculators and traders. They aren’t stupid, just unwilling to “marry” any investment. Fundamentals usually don’t exist for them—they only want charts.

All these groups are important. In isolation, each slowly dies.

Speculation powers capital markets and investment, which in turn funds developers to build, thereby adding fundamentals to pure speculation, and so on. It operates like a living organism. Cut off a part, and it withers.

Don’t be arrogant!

2.2 Why 1-9-90 Works?

We can’t know everything or keep up with all developments. We may dislike generalized statistics and curated Netflix content, but we can’t live without them. If we allowed every decision to have unlimited options, our minds would explode—especially in startups. We want others to do the filtering work for us. Those who dig through piles of junk can find refined gems, but sometimes following the crowd is acceptable.

-

Why listen to what the 9% say? — Because funds, researchers, and angel investors are often seen as credible. They’ve existed for years, so they’re less likely to fall for cheap scam tactics. Or at least, that’s the hope. Therefore, for traders and speculators, it’s easier to simply pick assets backed by the most reliable supporter networks.

-

Why are the 9% willing to act as filters? — Because the better they filter, the more money they make. And they may attract better long-term followers. If you spot gems earlier, you gain better valuations and signal your ability as a gem hunter.

The 9% are the glue connecting the intensely focused 1% developers with the 90% of traders and holders who require simplified narratives. If I had to define the role of the 9%, I’d call it organic marketing and warm introductions—essentially seasoning early unknown projects with reputation and flavor.

2.3 What the 1-9-90 Stages Look Like

These three groups rarely align simultaneously—only during bull markets. The goal is to maintain alignment among two out of three, which is feasible. By definition, alignment between 1% and 90% is unlikely, because the 9% serve as the bridge delivering news to the 90%. So you must always start with 1% + 9%, then proceed from there.

An exception is 1% + 90%, when you're building something extremely easy to use for the 90%. Think meme coins, click games on Telegram, and similar phenomena. In these cases, the launch phase doesn’t require the 9%. However, after launch, sustainability requires some form of alignment—but not necessarily during the initial hype-driven phase.

This follows a typical venture model: team, angel investors, and community holders. A team (1%) starts a project, then (9%) amplifies it and raises visibility, followed by a wave of traders and holders (90%) joining based on the narrative.

1. The 1% developers begin with an idea and start building.

2. They consult friends, angel investors, capital allocators, researchers, etc.—those excited about the idea, forming the 9%.

Then, for various reasons, ideas embraced by many 1% and 9% participants eventually reach the 90%.

This is the standard recipe and direction for all companies. It doesn’t guarantee success, but it typically enables initial traction. If you already have a network, going from 0 to 1 is usually easy—because they’ll support you regardless of how you push forward.

A flawed example is Worldcoin, whose product and token strategy were bizarre (however intense and dystopian), yet many “9%” accepted and supported it solely due to the founder’s network.

2.4 Problems of Lacking the 9%

You generally shouldn’t take the ‘1% + 90%’ shortcut and ignore the 9% intermediary group. Because the 9% have a longer-term perspective than the average 90% user—they’re the foundation for stable project growth. If you end up with only a hype-driven community without cultivating the 9%, during any market turbulence, you may be left with only the 1%. That’s the problem with hype-reliant projects. It’s a decent launch tactic, but ultimately, you must find your 9% or convert your 90% into 9%. You can’t survive without advocates and supporters.

Remember how “fair launch” projects from 2020–2021 sold on secondary markets? Some launched without public sales, allocating only to contributors and/or DAOs. Weeks or months later, they needed funding to sustain operations and grow the brand or protocol, so they conducted OTC (over-the-counter) trades. Prices varied, but the overall model remained unchanged. Ultimately, though starting with 1+90, they had to work hard to find their 9%.

Another reason relates to perception. If I’m a researcher entering a chat and see only giveaways and airdrops—I immediately think “this is a scam.” And I’m usually right. It’s an overgeneralized time-saving heuristic, but it works. Therefore, you usually want to stay lean initially, create technical content to grow 1% + 9% first, then scale outward. Otherwise, you risk attracting 90%, creating noise that prevents attracting external 9% or converting your own 90% into 9%. Be careful!

This is especially dangerous for click-token projects and fast-launch IEO platforms. Fortunately for these founders, most such projects are built like scams anyway, so they don’t care about community building.

2.5 Real-Life Example: Ethereum Conferences

The clearest real-world example of 1+9 interaction is Ethereum conferences. Many developers attend, talk to funds and angels hunting for alpha, and new ideas emerge. These 9% players—funds and angels—may love wild dreams and creativity, but ultimately, they’re more eager to profit than the 1%, so they need to verify demand from the 90% for any given narrative—current or future.

1% + 9% can force-sell something to 90%, but it’s harder than expected. Doing so requires fundamentals and data to back claims—which isn’t always easy. You can view Celestia as a slightly forced niche example, valuation-wise. I’m not knocking it—they’re smart people—but pushing a new narrative to over $10B and sustaining it for months isn’t easy. The 90% knew nothing about DA—they certainly didn’t see it as a >$10B market.

Anyway, problems arise when the 9% become too self-absorbed. This happens when they only interact with the 1%, forgetting to validate reality with the 90%. Then you end up with isolated developer elitism—no one benefits. Staying grounded in reality matters, or everyone suffers.

Durable optimism and dreams are beautiful, but obsession isn’t.

2.6 Maintaining 1-9-90 Alignment After Launch

Nothing rises forever—you’ll face moments of broken alignment and shaken belief in the future, even with perfect 1+9. During those times, analyze why. Did the team stop working, or did the market just turn red? Are developers still working but building castles in the air even the 9% can’t grasp?

These are emotional checkpoints you must assess. If the team is working and the narrative holds, likely 1+9 remains aligned. So continuing to build during bear markets is fine. There’s nothing else you can do.

During crises, talk to partners, share new details, and reconfirm their biases when needed. No one fully trusts anything new at first, but time builds strength in brand and vision. Cultivate it first, then it happens naturally. This also applies to trading: when all tokens fall during a bear market and MATIC is the only one slightly rising, traders start calling it the “green safe haven across all markets.” Indeed!

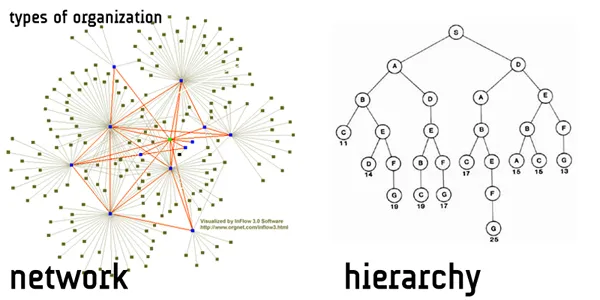

You must never let 9% and 90% become chaotic. That means developers face total alienation. Core teams must communicate with angels and researchers, and angels/researchers must know how to relay information to the 90%. By the way, this isn’t a pyramid—it’s just how information spreads among people. It’s a fact.

“Actions speak louder than words” and “the best tech wins” are both correct—until too much bad tech gets good marketing or good tech faces excessive negativity. Humans—and thus markets—are not rational.

2.7 Checks and Balances Among Groups

-

1%: May become complacent with success, overly elitist, and self-important. The more capital they accumulate, the farther they drift from reality checks, becoming overly optimistic and comfortable.

-

9%: Supposed to conduct research, but often only know fragments (like me). The issue is they focus too much on themselves, wasting founders’ time explaining things—otherwise, they spread incorrect narratives and ideas freely. They tend to talk a lot because, for many, expressing opinions is their job. Prone to fakeness.

-

90%: No issues! They take all risks with minimal resources. Of course, their patience and survivability are lowest—partly because when developers decide to run off with funds, they lack golden parachutes.

Now let’s apply this script to Ethereum… wait, maybe it’s already too late?!

3. Ethereum: Vitalik vs DeFi vs Ethereum Foundation

In recent days, controversy and frustration have surged within the Ethereum community. Not surprising—people are confused and don’t know how to express it. They’ve worked over three years since the last cycle, yet no new transaction volume or users are buying their assets, so everyone feels discouraged. It’s just a fact. I’m not offering causes or solutions—that’s for another article. Here I’m merely stating the current state.

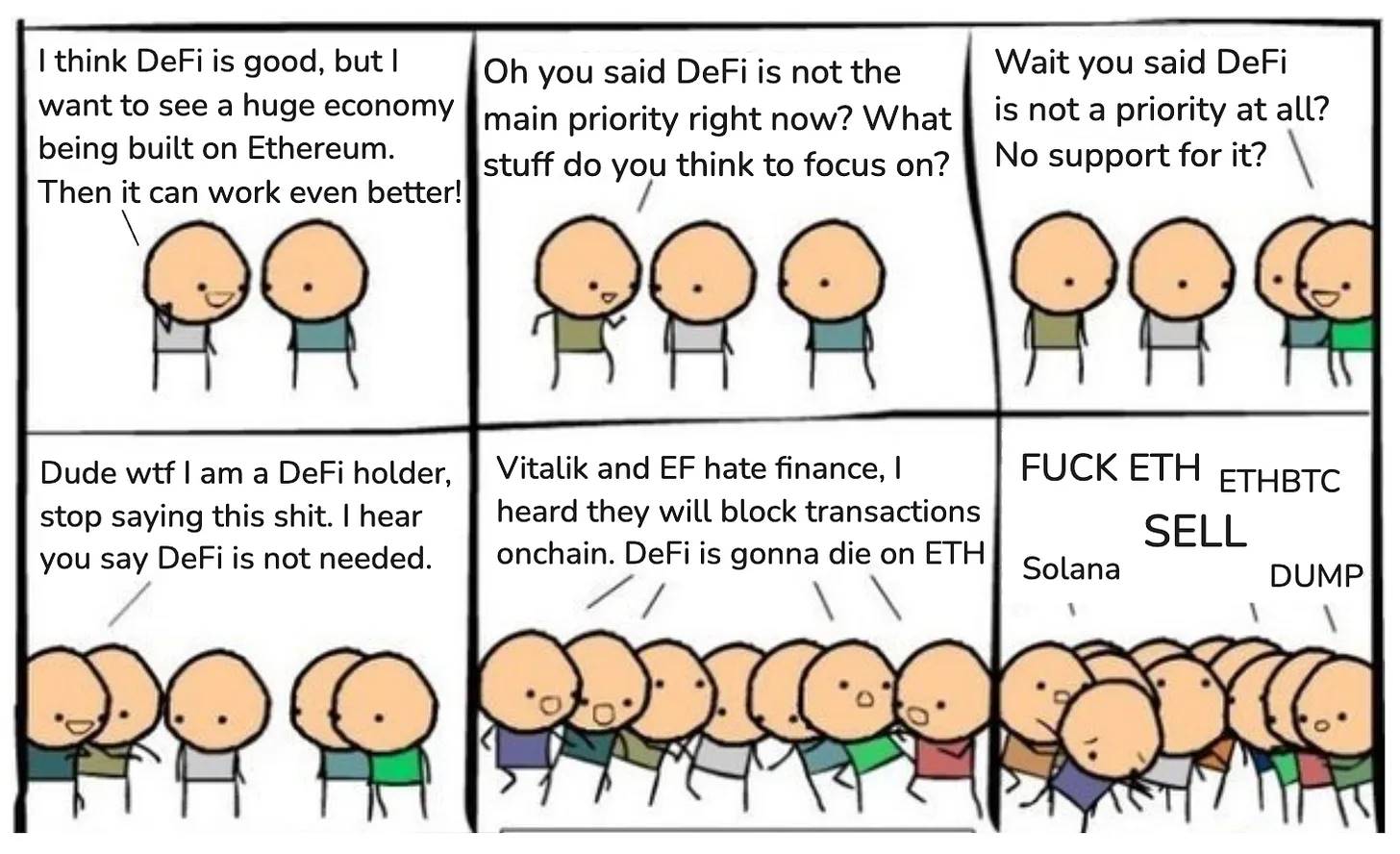

Amid the debate, some attempted rational discussion. For example:

-

Vitalik (1%) expressed concerns about DeFi. See this well-written tweet and the rest of the thread. He may focus too much on grand visions, but he was polite and provided context. He wants to inspire bigger thinking, motivating others beyond today’s limits—not constrained by what we have, but looking ahead. That’s what vision means. He doesn’t need to be always right—he doesn’t own Ethereum.

-

Ethereum Foundation (1%) stayed silent for years on selling, then Aya gave a slightly tone-deaf reply. Not because she said anything wrong, but because she “didn’t read the room”—EF is distant from everyday struggles. Still, see here for more detail: EF has done and continues transparency work.

-

DeFi founders (1-9%) felt confused, because despite being strong and indifferent to external validation, they still wanted some support—rather than constant dismissal of finance, which Vitalik previously joked about. Maybe he went too far, making people upset.

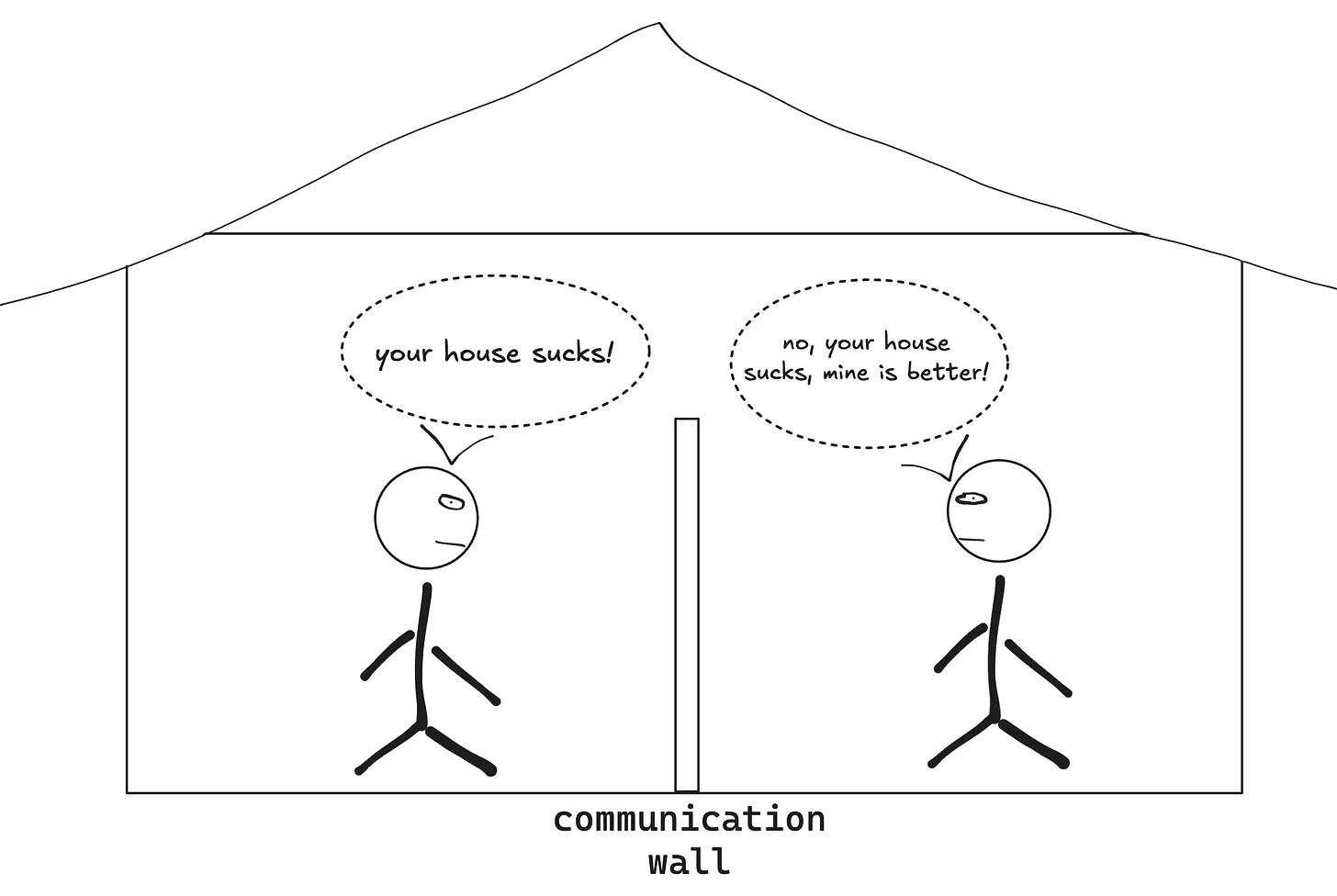

The communication barrier is what’s happening. The EF and core devs focus so much on the future that they sound indifferent to present issues. Though they do care, their thinking has moved ahead. This creates difficulty for the other side, who lack full context on their thought processes. You end up with: (see communication wall diagram below)

3.2 Is There a Structural Issue with 1, 9, or 90 Here?

As mentioned earlier, criticism is theoretically valid—but what’s the specific cause? Are developers marginalized, is the 9% unclear on what’s happening, or are the 90% merely complaining about price? This is what we need to explore.

First, examine the 1%.

Are developers actively working? Yes. Do they participate in public discussions? Certainly. Are different dev teams pursuing separate projects simultaneously? Yes. Are there events and hackathons to attract new developers? Also yes. Is there now a systematic effort to solve L2 fragmentation, especially after scalability improvements? Yes. So I believe the 1% group is fine.

Next, quickly check the 90%.

They clearly know ETH is a major asset and that markets may drop. Their confusion lies in why so many 9% also seem lost. Baseless panic could trigger real structural issues.

Finally, look at the 9%.

I personally think some former 9% have turned into hype-chasing traders. Nothing wrong with that—but we can no longer treat them as true 9%. They no longer research deeply, just follow headlines. Mistaking them for 9% may lead you to falsely perceive structural issues. To verify, ask developers. If they agree, then there might indeed be a problem.

Market turmoil turned some 9% into 90%. But the 1% keep working!

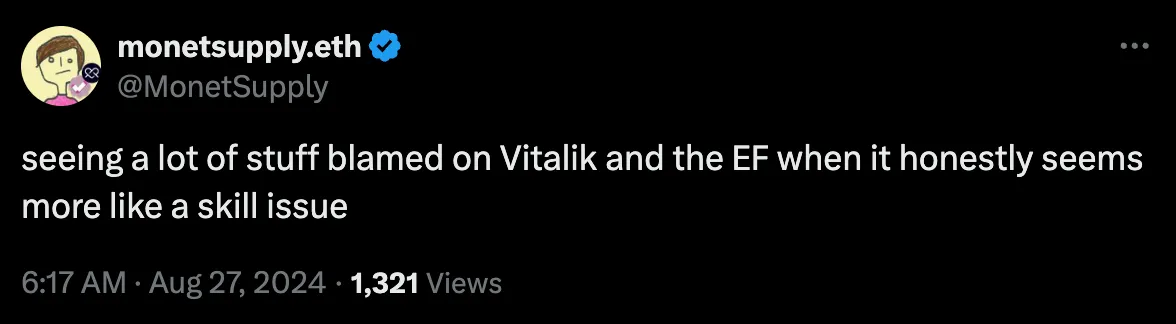

No disrespect, but if you study L2 and conclude “fragmentation is killing ETH, game over,” while ignoring all scalability research—that’s a skill issue.

3.3 Are Efforts Underway or Is the Problem Ignored?

Clearly, the 9%’s confusion is understandable. Ethereum is growing, with multi-year L2 roadmaps causing fragmentation along the way. When moving toward modularity, integration issues are normal. As long as the goal (scalability, larger platform) holds, it’s explainable.

Thus, I understand short-term bearish sentiment, but claiming “Ethereum is dead, no scalability work at all” is intellectual dishonesty. The 9% pushing this narrative are merely promoting alternatives and turning into 90%. Watch out for sensationalist Twitter users.

I’m not defending my assets—this article won’t sway anyone. I welcome acknowledging structural issues, but beyond “an EF member got advisory roles” and “EF sold some ETH—less than 0.1% of total supply”—I see no stronger arguments. You can do better.

But anyway, should the 9% still be nurtured as per the handbook?

I argue further: no longer necessary, nor possible.

3.4 Separation of Church and State. Forget Leadership? Forget the 9%.

Bitcoin and Ethereum on the left, all other chains on the right. So you can’t apply the same rules to both. Gradual decentralization, folks.

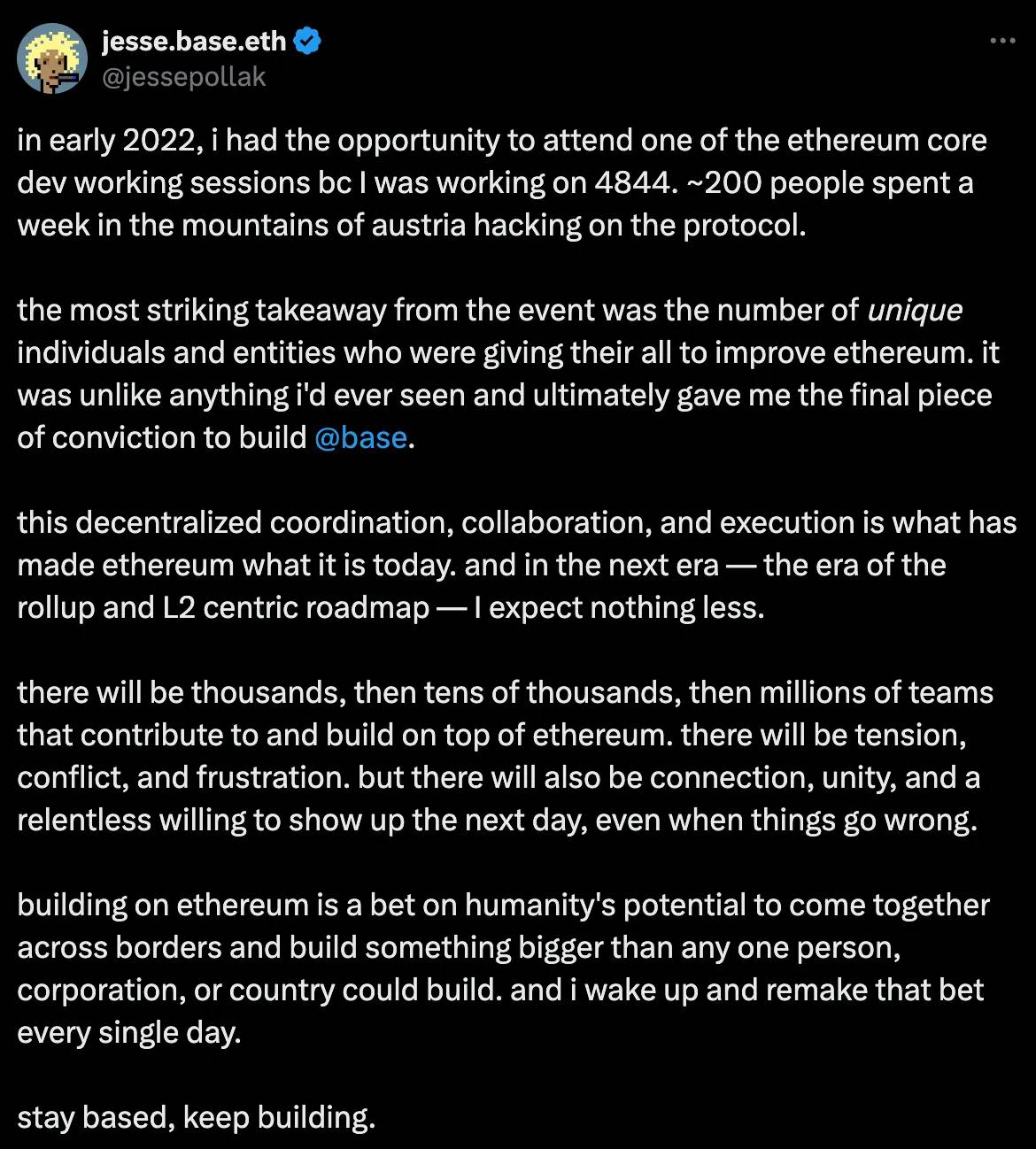

Ethereum has clearly entered the network stage. At this point, demanding “aligned roadmaps” misunderstands how things operate. It doesn’t mean macro-alignment attempts are useless, but they now happen organically. If you look at the first image, consider the main orange nodes as core Ethereum teams: clients, large funds with research arms, interconnected protocol ecosystems, etc. As long as they occasionally align, it’s fine. So ask yourself: if you don’t know what the orange ones are doing, you probably aren’t deeply involved. So it’s a skill issue, not an ecosystem issue. Don’t be arrogant.

(See tweet)

All these discussions, criticisms, etc., should happen. What’s different this time is too many formerly excellent participants turned radically aggressive, creating chaos—especially some fund GPs (you know who I mean). Most are pushing their own L1 gambling bets. If they believe other L1s are better and support them, fine. But doing so with fabricated arguments is intellectual suicide. Like this:

Yields come from borrowers, transaction fees, etc. True, this worries me. It’s like an Ouroboros: crypto token value lies in earning yield, which comes from people trading those tokens.

This isn’t the first time a large ecosystem faces this. Fragmentation, misaligned interests—yes, visible today. But instead of reverting to communism and centralized roadmaps, perhaps a better path is elevating this into a non-fragile state. Strip away fancy terms—none of it matters. DeFi, social, whatever—Vitalik’s views, EF’s stance, or any guru’s opinion—is irrelevant.

So what now?

1. Vitalik may be too elitist, chasing use cases that don’t exist or never will. People want more utility, and DeFi delivers that.

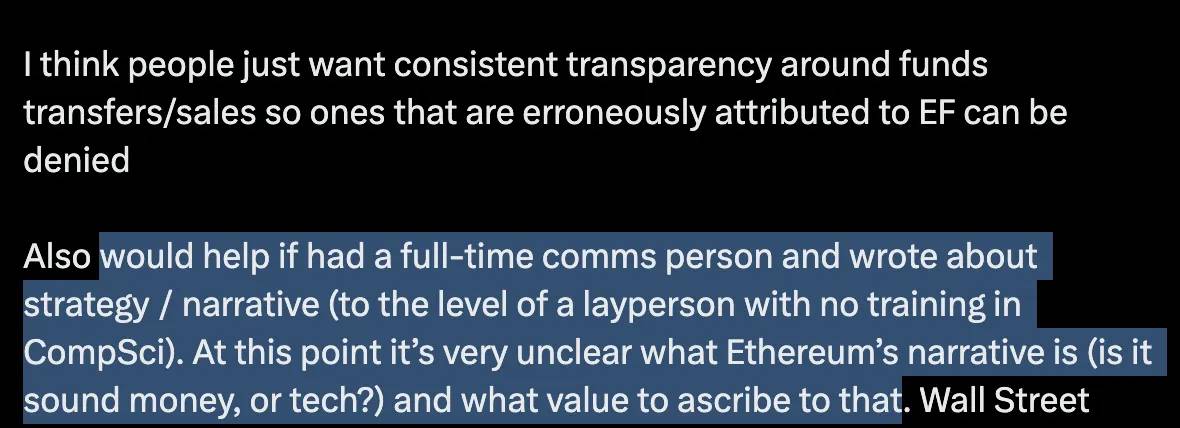

2. The Ethereum Foundation can be more transparent, sure.

3. Ethereum’s narrative has diversified, making it hard for the 9% to grasp a clear agenda, leading to confusion.

But the answer is: it doesn’t matter.

3.5 You Can’t—and Don’t Need To—Fully Align Anymore.

How many groups exist on Ethereum now? Client teams? Venture funds? Pump groups? — Answer: many. When was the last time you needed approval from the Ethereum Foundation (EF) or Vitalik’s blessing to build something unrelated to core protocols? — Never.

Diagram content:

I think people just want consistent transparency in fund transfers and sales to deny false attributions to EF.

Having a full-time communicator writing strategic narratives in reader-friendly language would help. So far, Ethereum’s narrative lacks clarity (is it sound money or tech?), and what value should we assign it? Wall Street.

I’m not attacking Evan—his tweets make sense and seem sincere. I just mean, while this request is reasonable in general, in Ethereum’s case, it can’t and shouldn’t be implemented. Still, this is my personal subjective view, possibly inaccurate.

EF could dissolve tomorrow, Vitalik could sail off on a yacht—doesn’t matter. Even if transparency is an issue, even if Vitalik is wrong—so what? Ethereum is now, or should be, at a stage where the core founding team no longer matters. Thus, attempts to frame this as some “Ethereum culture problem” fail. Culture is an open level playing field, not centralized viewpoints. Bitcoin faced similar trials—this is a real test of theoretical strength.

(See tweet)

Based on my experience and friends in crypto since 2017, no one ever got meaningful support or funding from Vitalik. He criticized ICOs in booms, DeFi in 2020—nothing wrong with that. He doesn’t need to be always right. He needed to be right in 2015, 2017, and after to build community and vision—but now, some have formed alliances against EF. That’s fine!

DeFi founders didn’t ask for his blessing or EF support. In fact, they built initially in opposition. Yet DeFi survived and grew—so why seek blessings now? One caveat: as long as core protocol changes don’t degrade DeFi usability, all is well. For example, gas costs for operations critical to DeFi. Essentially, sacrificing DeFi’s usability and growth for grand visions.

While I personally hope to see Ethereum applied beyond finance (which is already happening), significant work and support remain crucial for DeFi to grow rapidly. As I noted, DeFi can become the most empowering mainstream on-chain use case.

Well said. Letting winners continue may be the right technical focus for EF and Ethereum builders. Even if “it’s just finance.”

So alarmists can relax—don’t blow minor disputes into big issues.

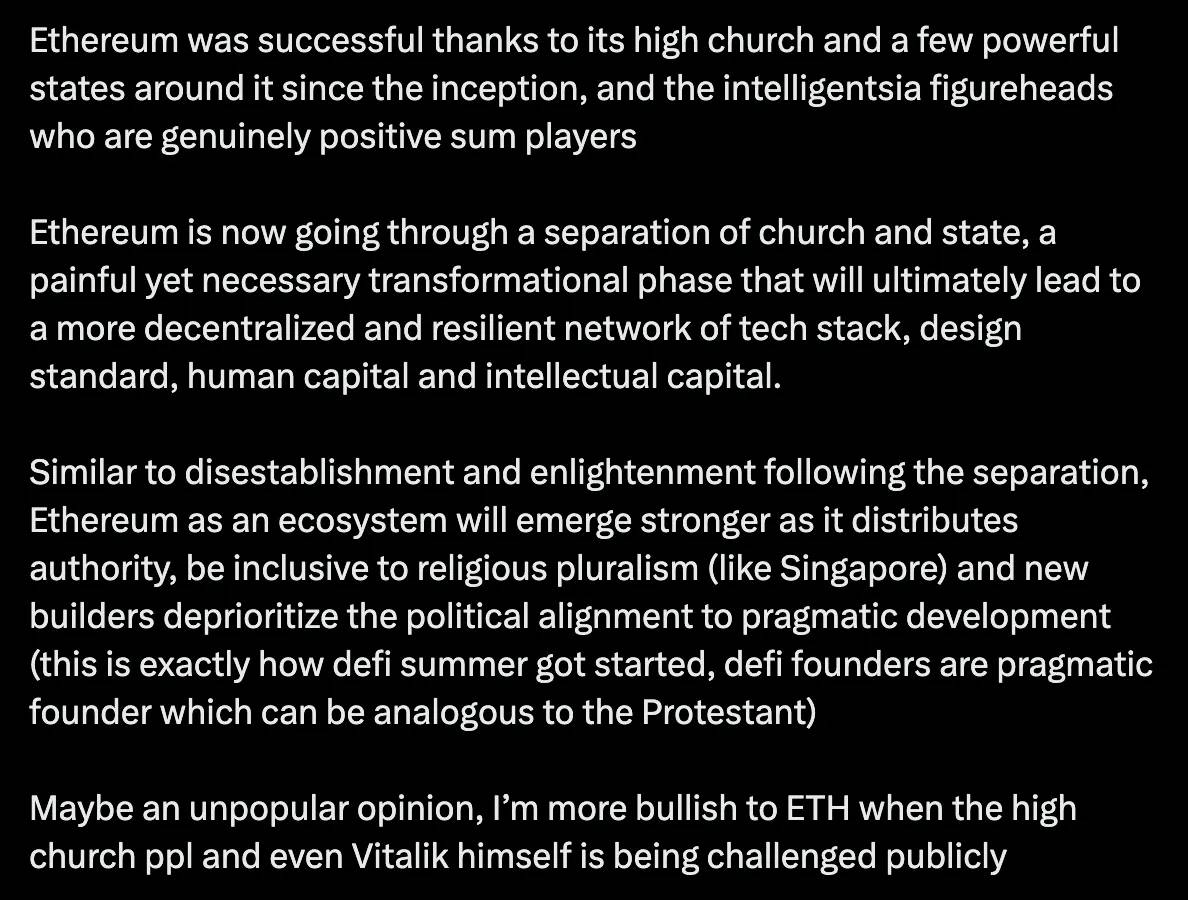

Ethereum succeeded thanks to strong institutional backing and active intellectual leaders around it since inception.

Ethereum is now undergoing separation of church and state—a difficult but necessary transition, ultimately leading to a more decentralized, resilient stack, design standards, human, and knowledge capital network.

Similar to post-religious separation and Enlightenment eras, Ethereum as an ecosystem grows stronger when embracing dispersed authority and religious diversity (like Singapore), while new builders deprioritize political alignment in favor of pragmatic development (exactly how DeFi summer started—DeFi founders were practical, akin to Protestants).

Maybe unpopular, but I’m more bullish on ETH when top figures, even Vitalik himself, face public challenges.

Another take on diversity of opinions and teams within large networks.

3.6 Other Considerations

-

No matter what Vitalik says, people will get angry. At some point, responding to angry Twitter users turns negative unless they offer reasonable critique. But if they nitpick every word out of resentment, let them. Still, reading the room helps. Vitalik does okay here, but not always.

-

Ethereum Foundation has done much on transparency, but could improve further. If they don’t, it’s fine—almost no one interacts with them directly. So it doesn’t create systemic issues they must face (the 9s forcing this narrative into a systemic issue). Maybe focus instead on fast-growing participants elsewhere in the ecosystem.

-

Other foundations spend far more than EF—some foundation heads run venture funds (e.g., Solana), or nearly buy meme coins (e.g., Avalanche). Again, pros and cons—I’m not saying “they do worse, so bad behavior is acceptable.” No, I’m saying other chains’ boosters should fix their own houses before shouting.

I hope you understand the importance of correct messaging and communication. These principles transcend raw technology, extending to general community building and your positioning with industry partners.

As for Ethereum, I hope I’ve convinced you that hand-holding is no longer needed. No more leadership. No more top-down centralized roadmaps. Let people fight, exploit each other, and support free markets.

Meanwhile, be careful whose voices you listen to. The 9% often turn into 90%. Exception: the 90% rarely lie about their intentions, while the 9% often spread false or misleading information, trying to profit through fake narratives.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News