Sui Ecosystem by the Numbers: Daily Active Addresses Surpass 470,000, DeFi TVL Exceeds $785 Million

TechFlow Selected TechFlow Selected

Sui Ecosystem by the Numbers: Daily Active Addresses Surpass 470,000, DeFi TVL Exceeds $785 Million

This article will introduce Sui's high-level user trends, covering its increasingly mature DeFi and consumer sectors, and provide a data-driven perspective on emerging protocols being built on the network.

Author: OurNetwork

Translation: TechFlow

Network Overview

Sui—a high-performance Layer 1 blockchain using the Move programming language—has raised a total of $396 million (the third-largest infrastructure project in our industry’s history, behind only ZK Sync ($458 million) and Avalanche ($716 million)).

The network has performed strongly in 2024—achieving a record high of 1.6 million weekly active addresses in May 2024. Since early Q2 2024, it has averaged over 400,000 active addresses. According to DeFiLlama, total value locked (TVL) has also surged 240% year-to-date, rising from $226 million to $789 million, with a net positive bridge inflow of $104.2 million (inflows: $631.3 million | outflows: $527.7 million).

In this report, we’ll walk you through high-level user trends on Sui, covering its maturing DeFi and consumer ecosystems, and provide a data-driven perspective on emerging protocols being built on the network.

Sui Special Edition

Wayne Cunningham | Website | Dashboard

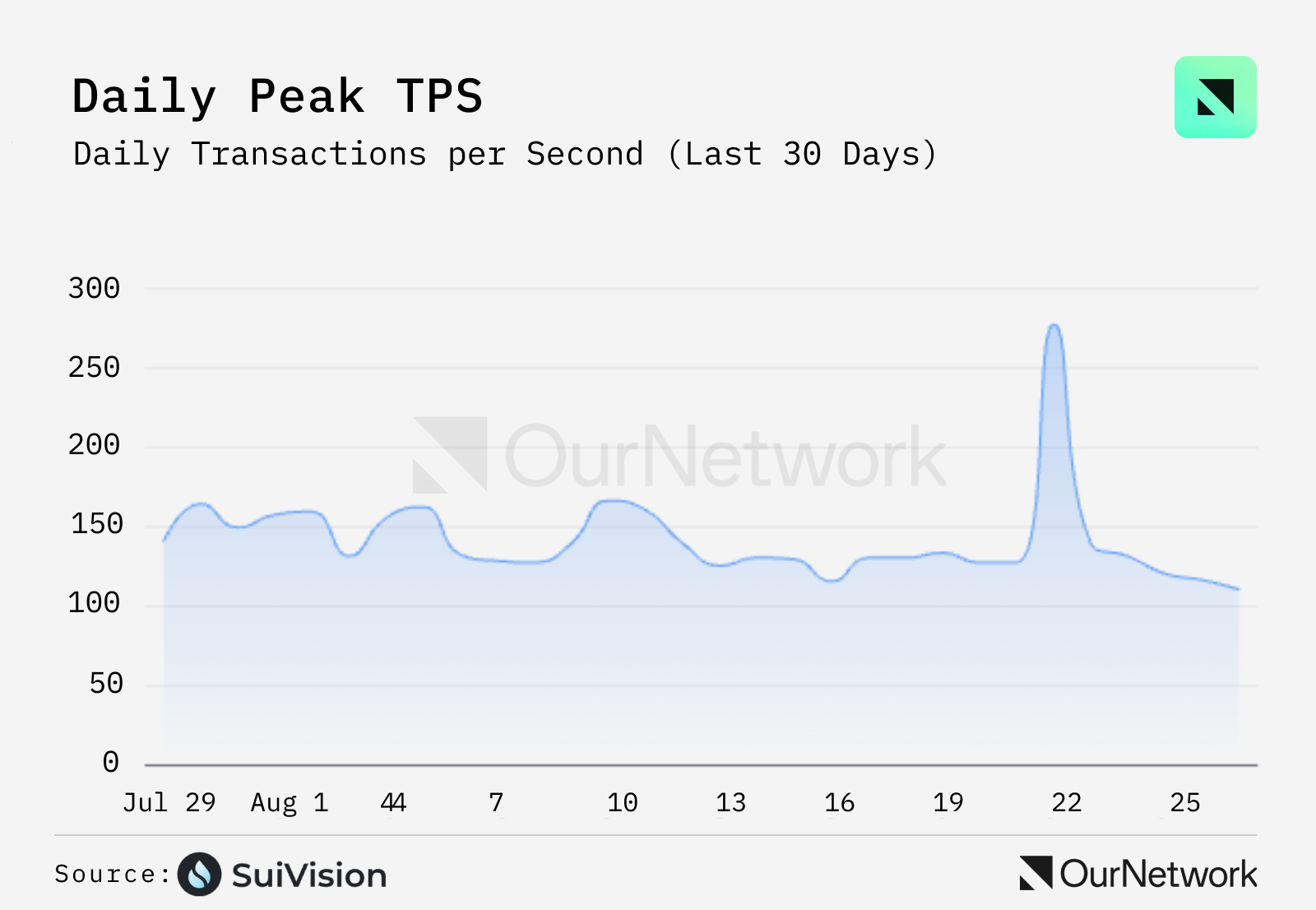

Sui tests show maximum transaction throughput of 297,000 TPS, averaging nearly 470,000 daily active addresses over three months

-

From May 20 to August 20, Sui averaged 472,600 daily active addresses over three months—an increase of 10x compared to prior periods. It peaked at 2.2 million in June, driven by popular applications within the ecosystem, surpassing Solana's peak of 2.09 million during the same period.

-

Sui is a Layer 1 blockchain designed for high-performance transactions (TPS)—early tests showed a maximum TPS of 297,000. This is partly due to Sui’s programmable transaction blocks, allowing up to 1,024 instructions per transaction. In December last year, interest in inscriptions pushed TPS close to 6,000. Notably, even during peak activity, fees remained stable.

-

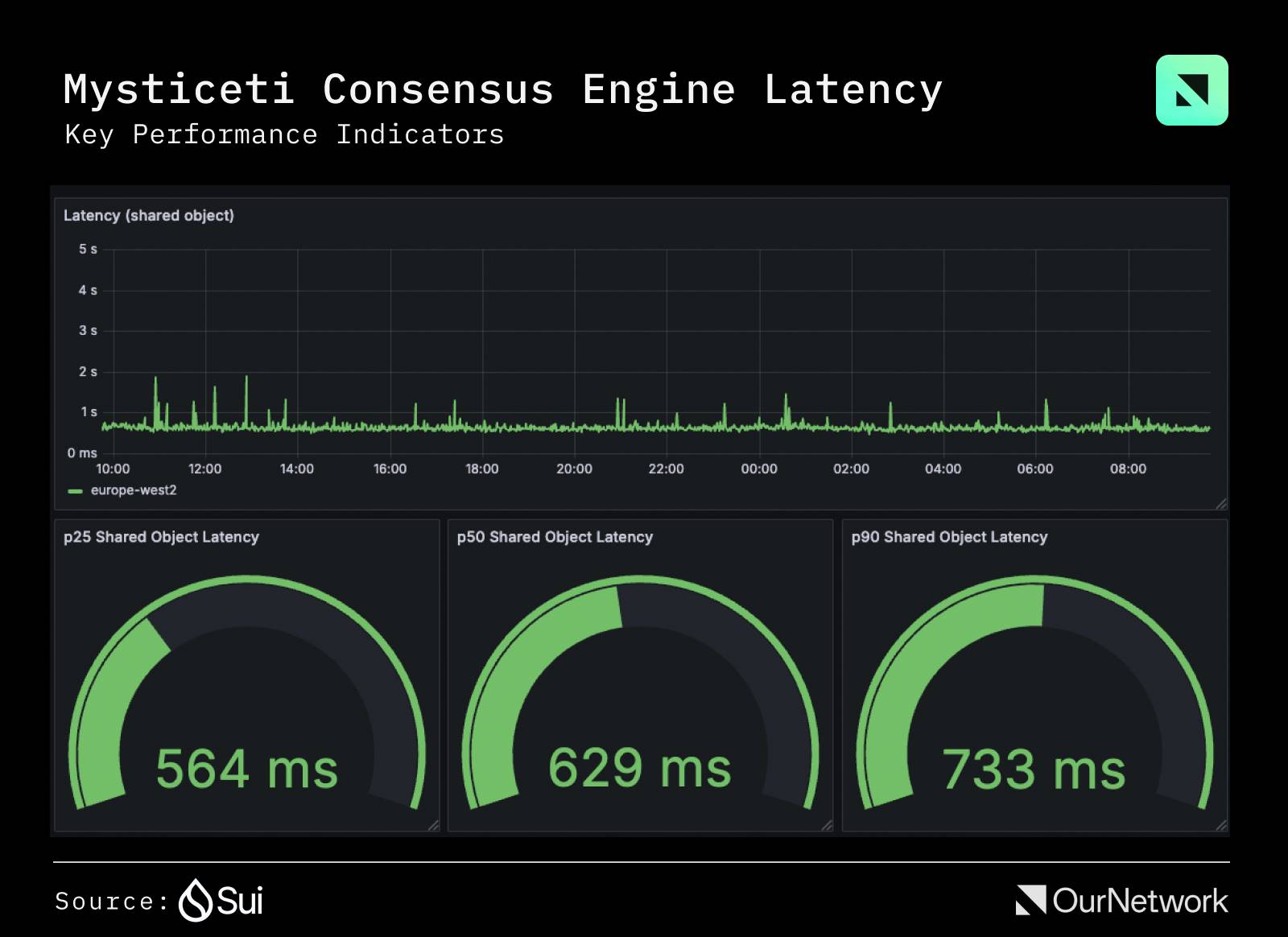

Sui’s new Mysticeti consensus engine delivers low latency, with early results showing a P50 latency of 629 milliseconds in Western Europe. This ultra-low latency ensures near-instant transaction finality, making Sui a powerful choice for high-performance applications.

Sui (internal data)

DeFi on Sui

Sui DeFi continues surge, TVL exceeds $785 million, net bridge inflows reach $260 million

-

Since mainnet launch, Sui’s DeFi ecosystem has grown steadily, continuing to demonstrate maturity and stability. Daily trading volume in 2024, especially since March, reflects increasing adoption, usage, and sustained engagement (averaging over $40 million in the past month), without sharp volatility or drawdowns. The steady rise in volume reflects growing market confidence in Sui’s DeFi infrastructure, attracting more liquidity, projects, and users to the platform.

-

Total Value Locked (TVL) on Sui surged over 1,500% during the last five months of 2023. It continued climbing into early 2024, peaking at over $880.7 million by the end of May. As of August 26, 2024, Sui’s TVL stands at $789 million, up 240% year-to-date.

-

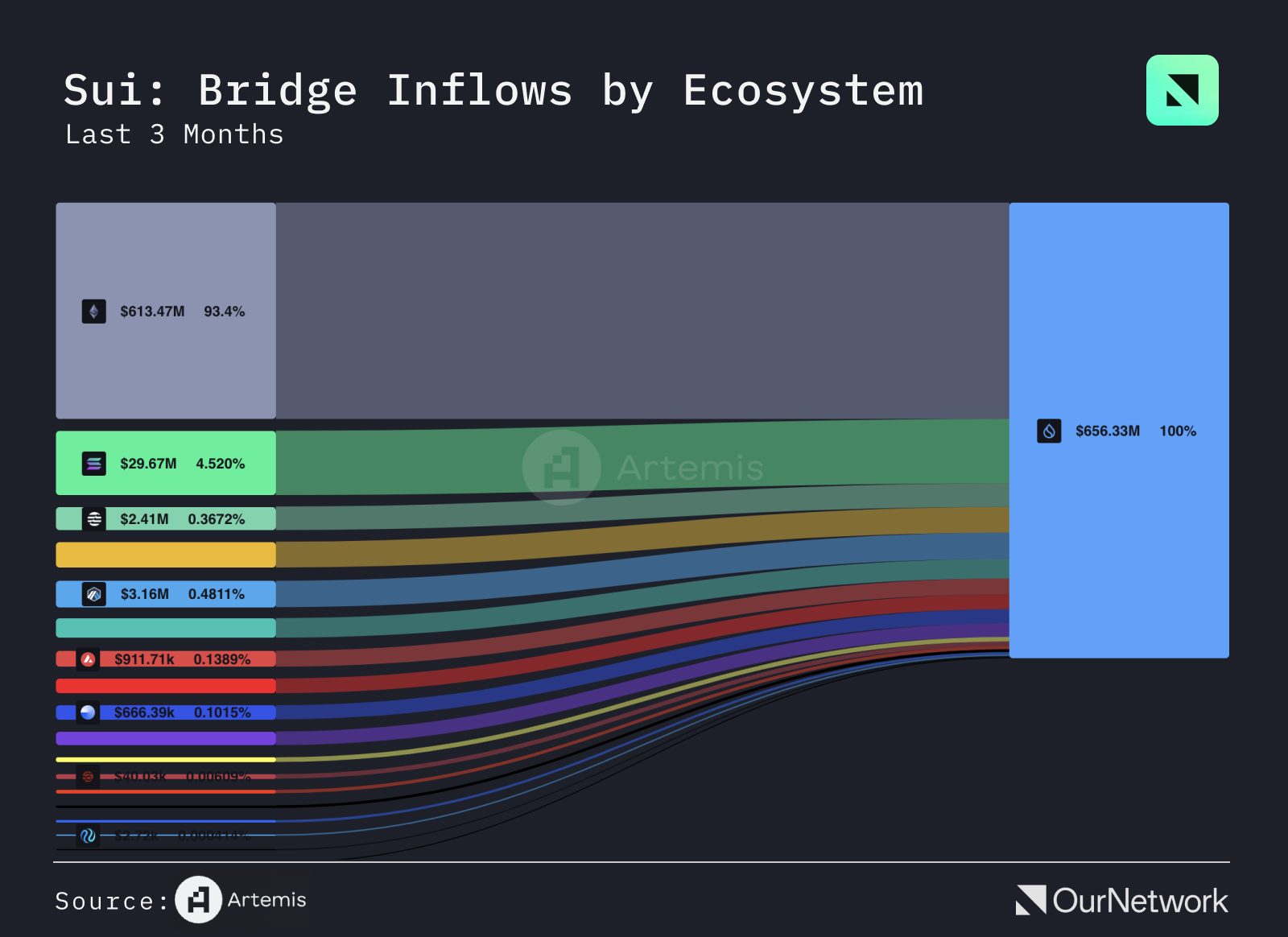

The total value bridged to Sui is also growing, with 92% coming from Ethereum, highlighting the blockchain’s role as a primary source of liquidity. Solana contributes 5.9%, while smaller chains like Aptos and Arbitrum contribute less than 1%. This growth reflects increased network activity and diversified inflows of assets and users, with net inflows exceeding $104 million so far in 2024.

NAVI

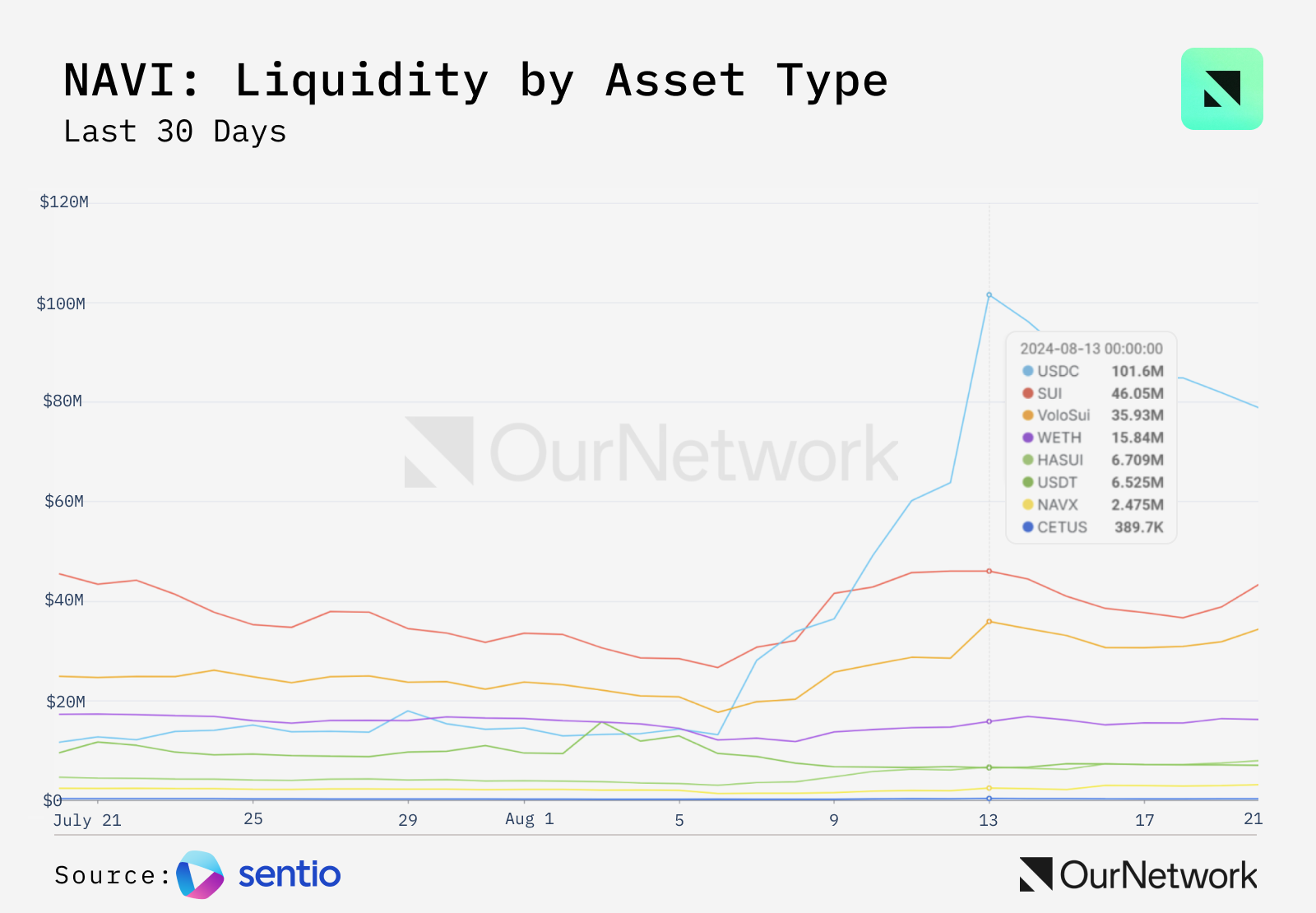

NAVI Protocol reaches $278 million in scale, over 850,000 unique users, USDC pool exceeds $100 million

-

As a one-stop liquidity protocol on Sui, NAVI Protocol has consistently led the lending DeFi category since launch. Focused on efficient capital utilization, NAVI supports borrowing and lending of major native assets, liquid staking tokens, and stablecoins. With the recent rollout of the NAVI Pro upgrade, the protocol surpassed its all-time high TVL, exceeding $250 million—accounting for over 50% of all lending TVL on Sui.

-

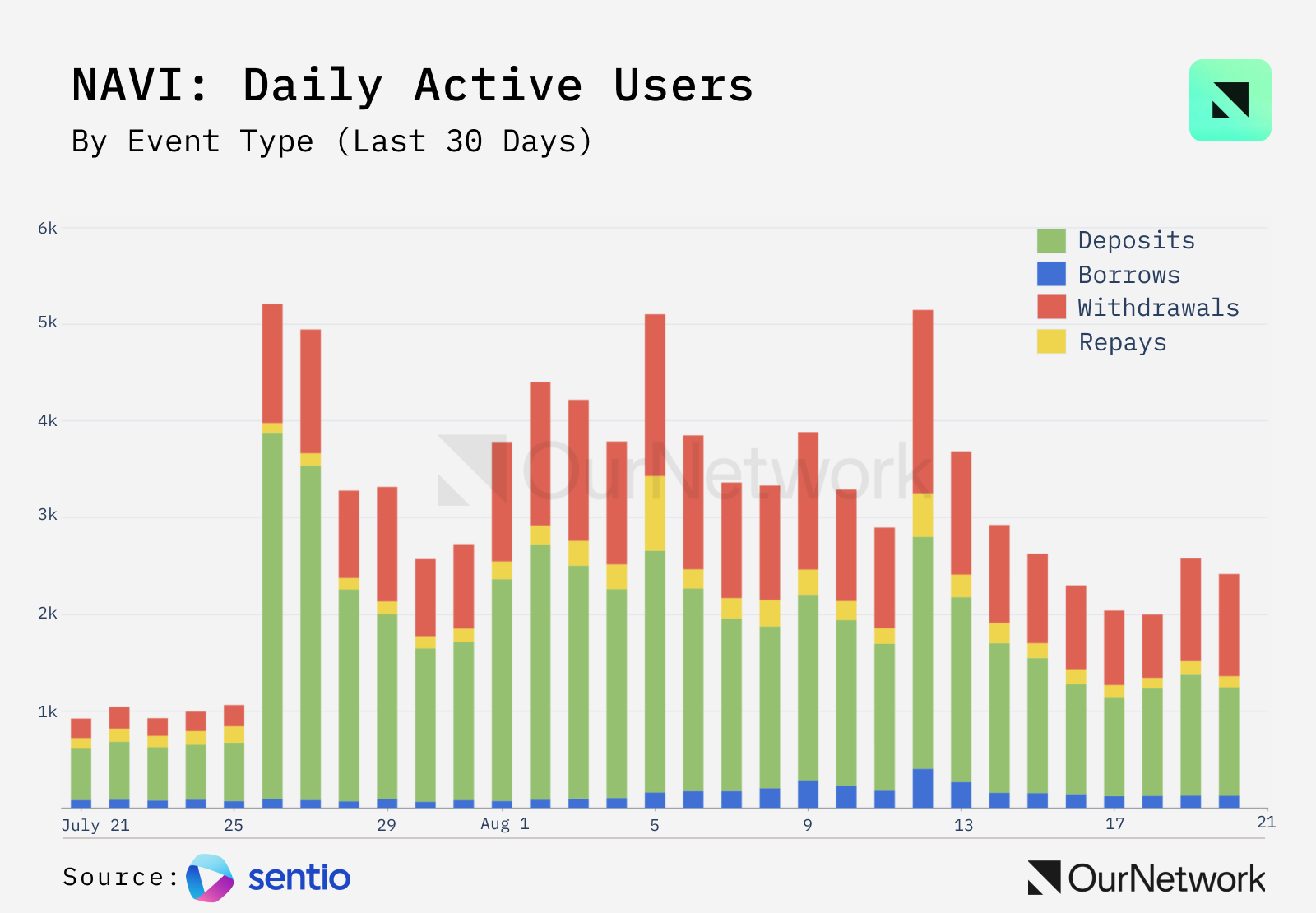

In addition, NAVI has attracted a highly active user base, ranking second only to the largest DEX on Sui. The protocol has maintained an average of 2,000 daily active users over the past 30 days, indicating sustained interest and trust.

-

Notably, in August, NAVI saw significant growth in asset supply following the launch of new liquidity incentives. Within less than a week, the protocol’s USDC TVL grew over 730%, eventually surpassing $100 million at its peak, pushing overall TVL to a new all-time high.

-

Transaction-level analysis: NAVI Protocol’s supply/lending incentives enable users to benefit from asset composability within its ecosystem. This transaction shows a user earning over $50,000 in rewards, showcasing the opportunities NAVI provides. It also demonstrates the flexibility of Move on Sui and how NAVI leverages it to deliver a smoother lending experience.

Bluefin

Bluefin, Sui’s leading decentralized exchange, surpasses $30 billion in trading volume

-

Bluefin is a decentralized orderbook DEX built for both professional and retail traders. Since launching on Sui, Bluefin has processed over $30 billion in trading volume, with over 33,000 users.

-

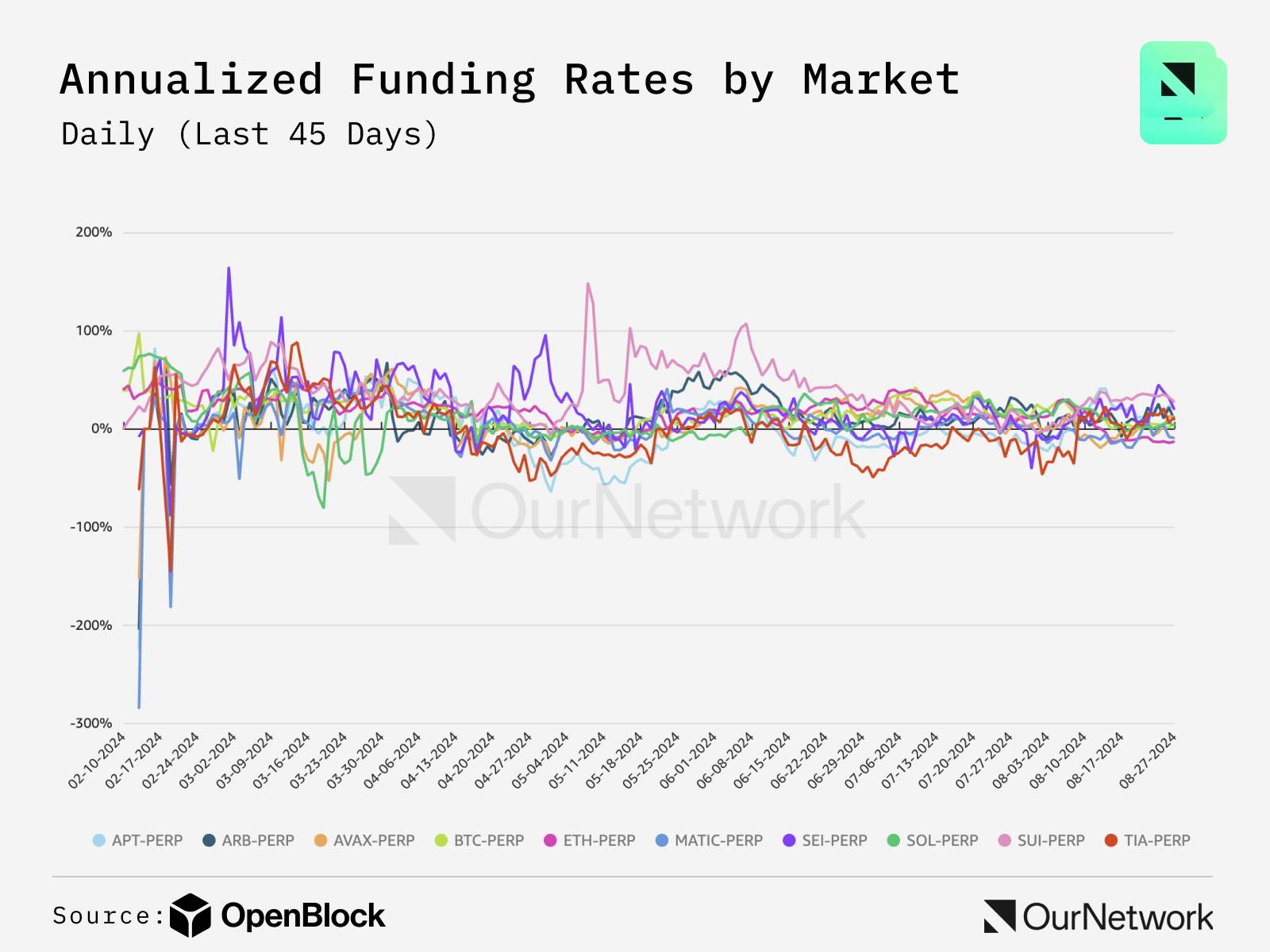

Funding rates are used to balance the difference between perpetual contracts and the spot price of the underlying asset. Bluefin maintains low annualized funding rates: 4.41% for BTC vs. Binance’s 4.33%; -11.71% for ETH vs. Binance’s 3.21%.

-

Bluefin’s liquidation process is designed to protect the platform and its users from systemic insolvency risks. The chart below shows the distribution of liquidations across trading markets on Bluefin.

-

Transaction-level analysis: This is the largest liquidation on Bluefin measured by PnL, with a loss of $72,670 on SUI-PERP.

Aftermath Finance

Aftermath’s TVL exceeds $50 million, trading volume surpasses $300 million

-

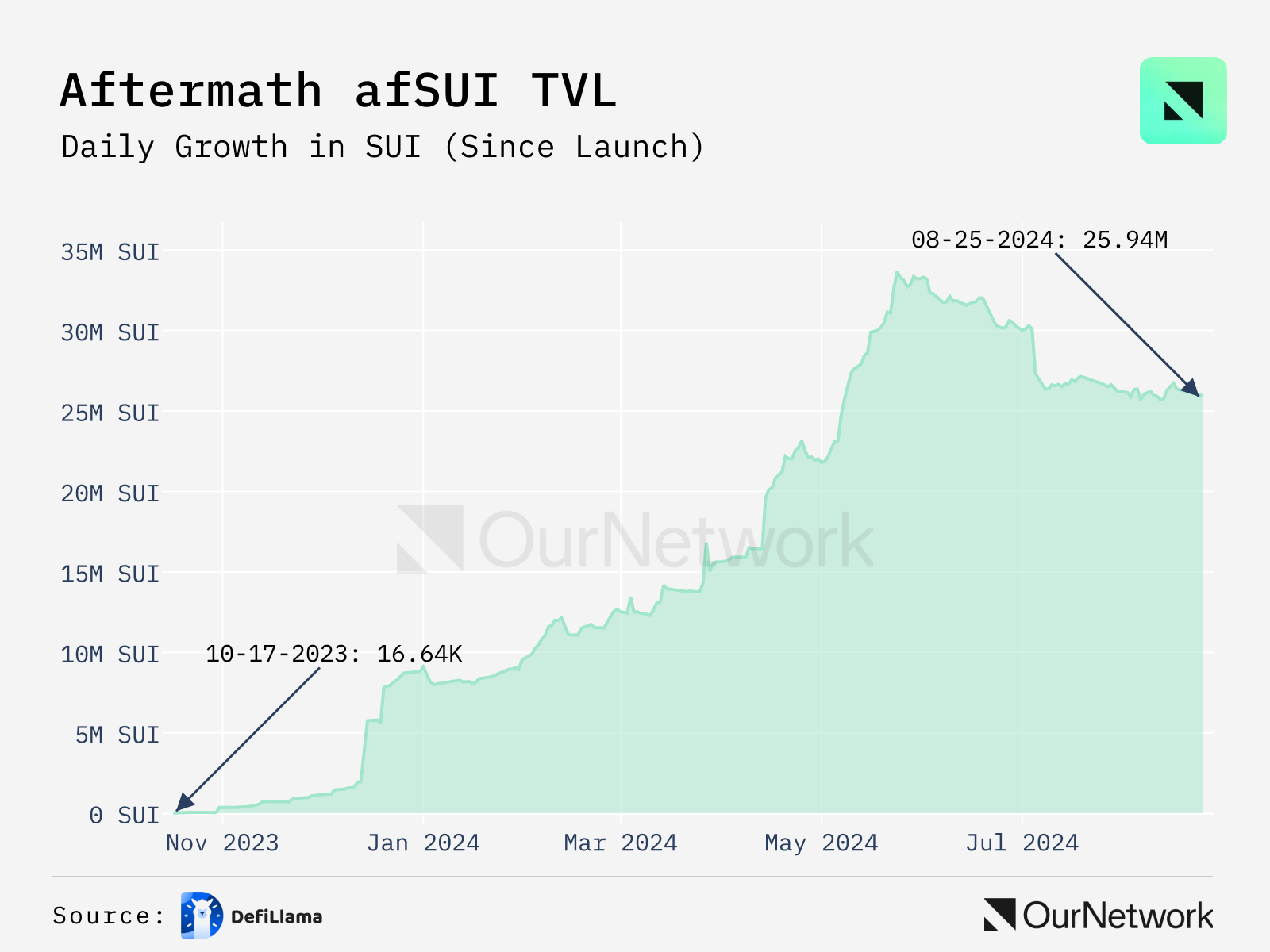

According to its documentation, Aftermath Finance is an “all-in-one DeFi platform for trading, investing, and earning yield.” To date, Aftermath has exceeded $300 million in trading volume, and its smart order router has recently seen improvements, including the introduction of a V2 routing algorithm, enhancing precision and speed.

-

The afSUI/SUI pool on Aftermath remains one of the most liquid pools on Sui, with TVL exceeding $20 million. A feature called Dynamic Gas allows afSUI to be used as a gas token on Aftermath, and other protocols have integrated afSUI into their strategies, including leveraged staking and collateral for lending.

-

Transaction-level analysis:

This is a relatively standard swap from SUI to USDC, but it illustrates the intermediate steps taken by Aftermath’s DEX aggregator routing algorithm to find the optimal swap path and maximize return amount.

DeepBook

Biff Buster | Website | Dashboard

DeepBook achieves milestone of 21 million transactions and 3,000 unique users over the past six months

-

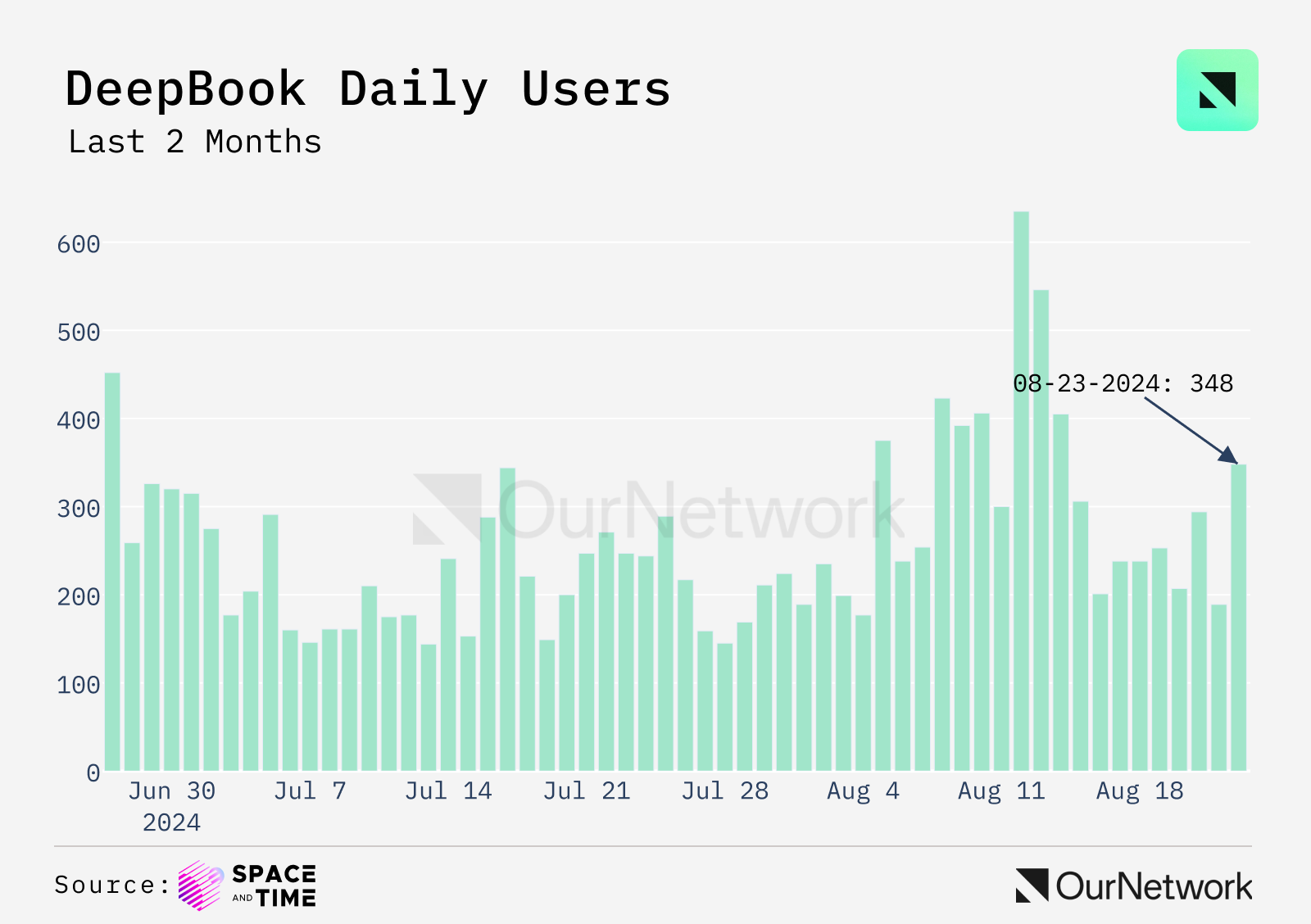

DeepBook is a centralized limit order book (CLOB) protocol on Sui, designed to bring high-frequency trading to blockchains. Since the V2 launch, average daily user activity doubled from May to June—from 120 users per day to over 250 users daily from July to August.

-

Over the past five months, earned fees have increased from 200 $SUI per day to 400 $SUI per day, reflecting significant revenue growth.

-

Transaction-level analysis: DeepBook aims to offer low-latency, low-cost trading for users leveraging its CLOB. For example, examining the average gas fee for limit orders, the average cost is approximately $0.005.

Consumer on Sui

Sui core primitives like zkLogin, sponsored transactions, and SuiNS drive consumer adoption

-

Sui’s core primitives and their applications continue to demonstrate value in reducing user friction and ultimately improving consumer experiences. zkLogin allows users to create Sui accounts via social logins (e.g., Google or Twitch) without revealing their on-chain activities to these providers. Popularity of zkLogin continues to grow alongside ongoing use of Programmable Transaction Blocks (PTBs) and wallet-integrated dApps (DAWs), reaching peaks as high as 225,000.

Sui (internal data)

-

Sponsored transactions allow developers to cover user gas fees, helping apps like Wave Wallet and FanTV attract users by eliminating the need to pre-purchase tokens. While the proportion varies, on certain days last quarter, 32.3% of Sui transactions were gas-free, enabling thousands of users to engage easily in on-chain activity.

Sui (internal data)

-

SuiNS is a decentralized protocol that gives users human-readable names, replacing default alphanumeric addresses. Currently, by querying SuiNS objects and aggregating wallets holding names, over 180,000 wallets already have names, improving efficiency and security in asset transfers.

Sui (internal data)

FanTV

Ozair Akhtar | Website | Dashboard

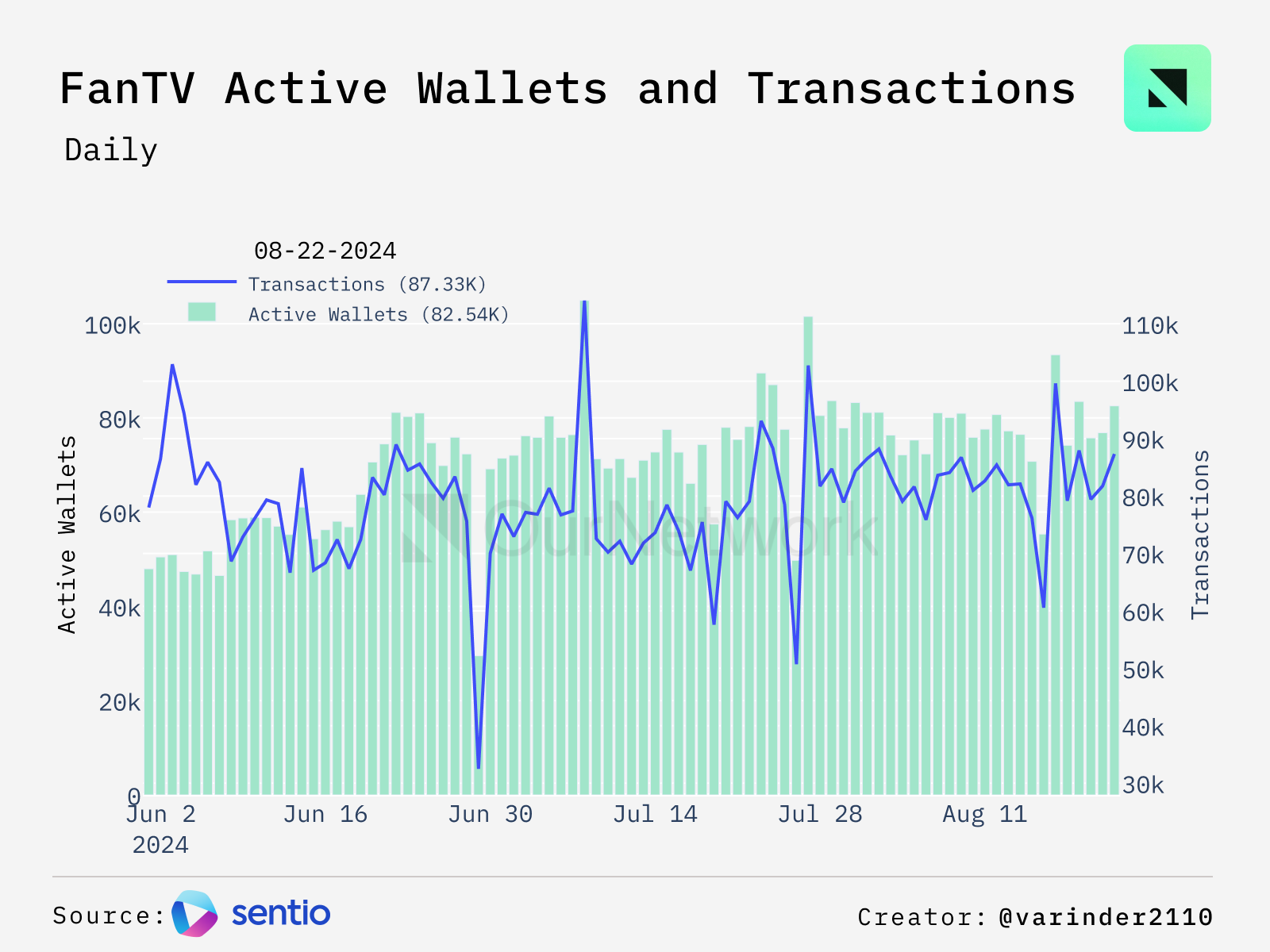

FanTV, SUI-based social streaming platform, surpasses 3.5 million registered users and 9 million transactions

-

FanTV is a social streaming platform powered by AI and Web3 technologies. It is currently the top-ranked social dApp on the Sui blockchain, with over 3.5 million registered user wallets and over 9 million transactions.

-

The platform’s rapid growth includes over 20,000 creators and 1 million monthly active users consuming 900,000 hours of content monthly. FanTV’s daily active wallets show healthy growth, up over 27% MoM (from 60,000 in June to 76,000 in July), reflecting a consistent upward trend.

-

Transaction-level analysis: FanTV transactions reflect high user engagement, where users earn tokens through “watch-to-earn” and “level-up rewards,” and creators earn via “live-to-earn.” Over 250 million tokens have been distributed to 3.5 million users, approaching 10 million historical transactions—these interactions showcase the dynamic growth and health of our platform. As the leading social dApp in the SUI ecosystem, FanTV’s success highlights its pivotal role in driving blockchain adoption and fostering a global creator community.

Wave Wallet

Wave Wallet | Website | Dashboard

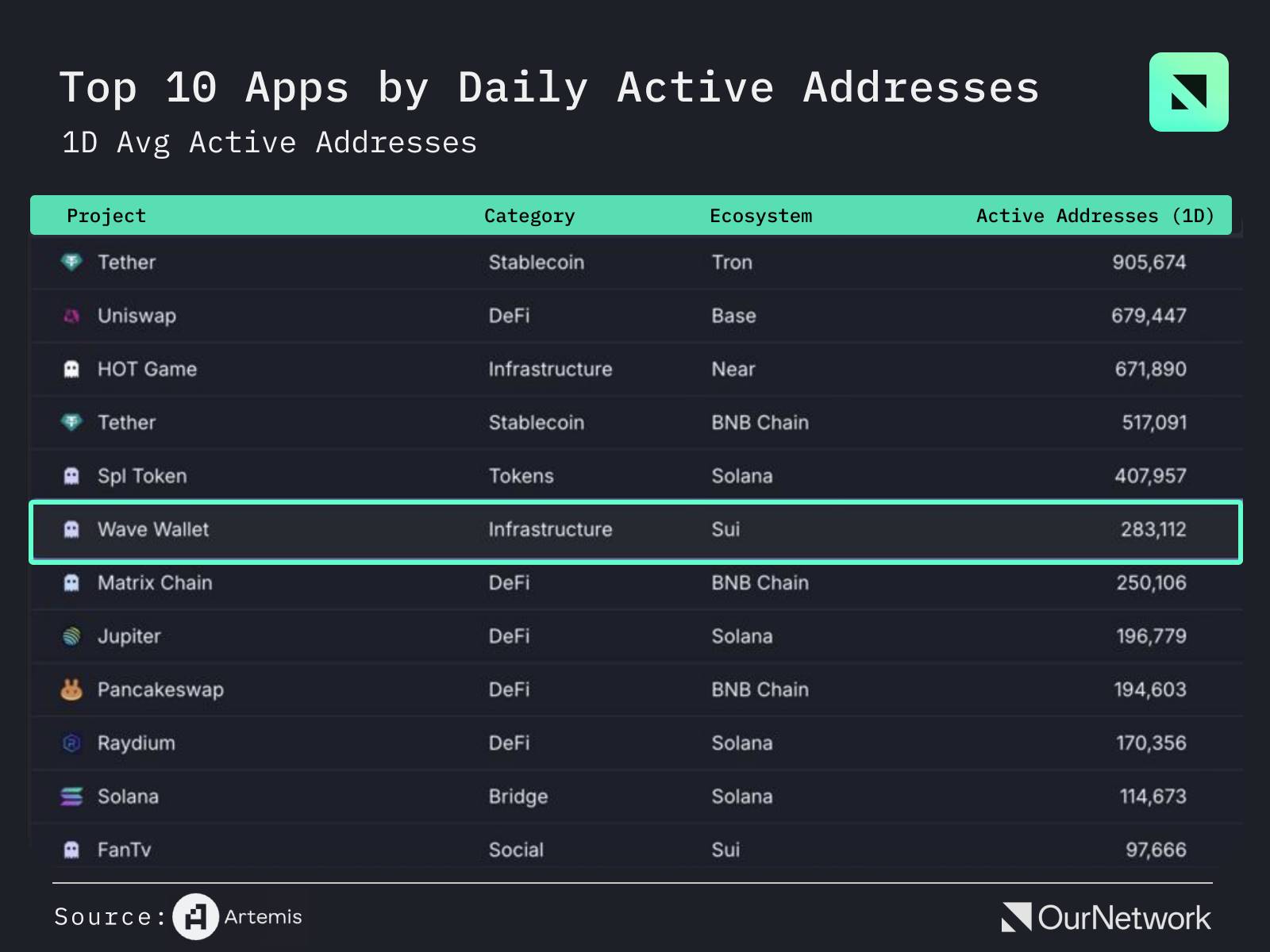

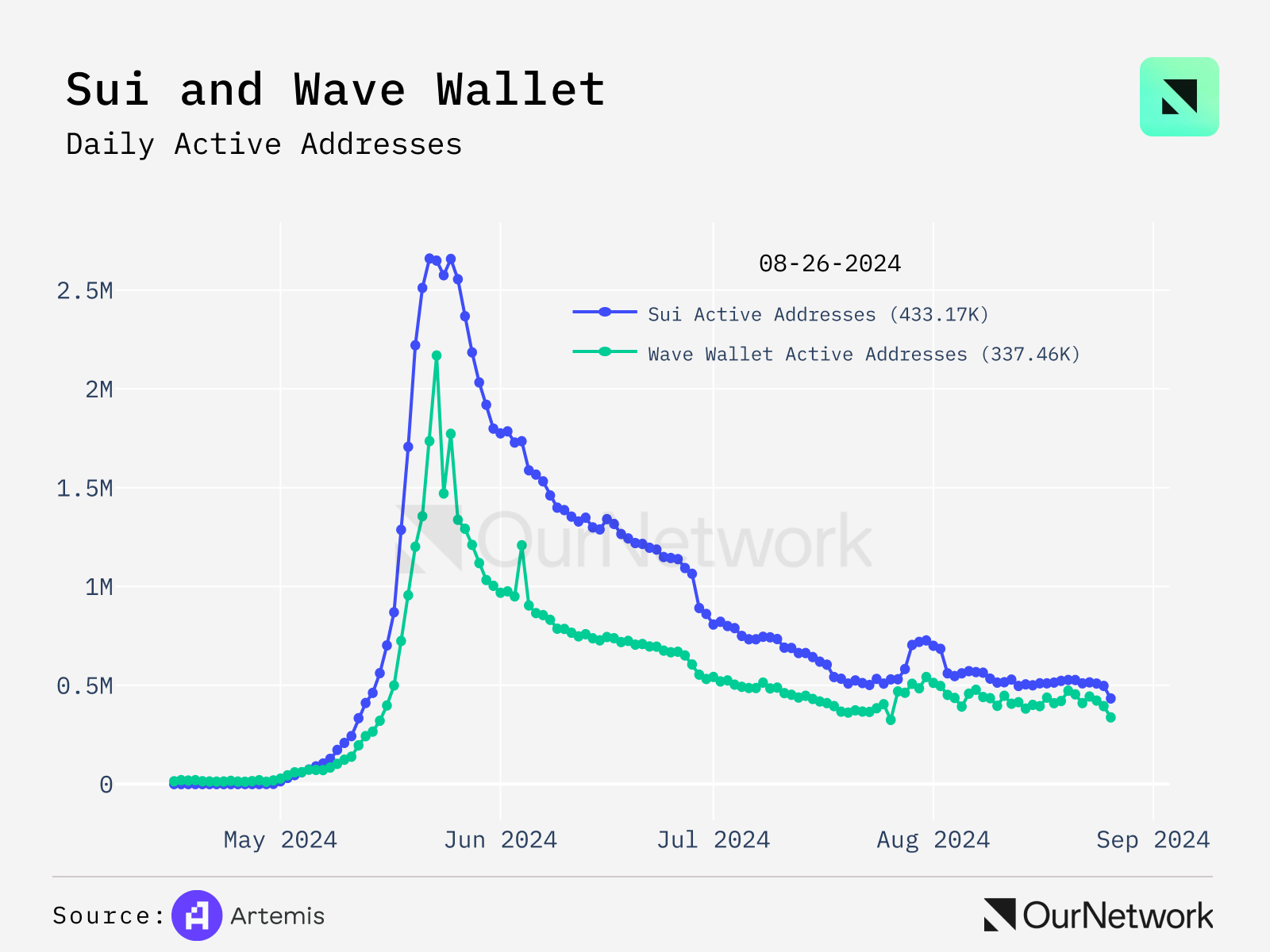

Wave Wallet surpasses 3 million users, processes over 250 million transactions, with over 280,000 daily active users.

-

Wave Wallet experienced explosive growth in early May, peaking at the end of May with over 1.3 million active wallets. While active wallet numbers have declined since then, Wave Wallet has consistently ranked among the top ten applications by active addresses across all apps tracked by Artemis.

-

Wave plays a critical role in the Sui ecosystem—it accounts for 80% of daily active addresses. This dominance has remained unchanged since Wave’s launch.

-

Wave Wallet handles 18% to 40% of all Sui transactions daily, serving as a key onboarding channel for new Sui users in both consumer and DeFi domains.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News