ArkStream Capital: Appchains Are Now a Trend — A Comprehensive Guide to Design Approaches and Projects to Watch

TechFlow Selected TechFlow Selected

ArkStream Capital: Appchains Are Now a Trend — A Comprehensive Guide to Design Approaches and Projects to Watch

Application-specific chains may address existing issues of liquidity fragmentation and interoperability through aggregation layers, superchains, or chain abstraction technologies.

Author: ArkStream Capital

Translation: TechFlow

Key Takeaways

1. The development of appchains is influenced by multiple factors, including infrastructure maturity, intensifying competition for blockspace, and growing demand for customized token economic models.

2. While decentralized applications (dApps) and appchains share similarities in business models, their respective advantages and limitations are evident. dApps may be more suitable when prioritizing ecosystem collaboration, whereas appchains offer greater autonomy and independence.

3. The progress of Cosmos and Polkadot has been jointly constrained by technical challenges, economic mechanism design, and high barriers to entry for appchains.

4. The core of appchain development lies in building application moats, leveraging low-cost transactions to enable high-frequency on-chain activities, and accumulating traffic and users. While technical support and enhancements are important, they serve more as auxiliary factors rather than core drivers.

5. In the future, appchains may address existing liquidity fragmentation and interoperability issues through aggregation layers, superchains, or chain abstraction technologies.

6. Although the market capitalization or fully diluted valuation of appchains may increase, the true key lies in the quality of the application itself and user experience.

The Inevitable Trend of Appchains

In 2023 and 2024, an increasing number of dApps have announced transitions into appchains. After analyzing the appchain landscape, we find these chains primarily concentrated in DeFi, gaming, social, and artificial intelligence sectors. We believe that the rise of appchains has become an inevitable trend, driven by the maturation of modular technology, widespread adoption of general-purpose Rollup Layer 2 networks, growing numbers of RaaS platforms with improved services, and increasing pressure on dApps regarding blockspace competition and demands for customized tokenomics.

However, we argue that a dApp’s upgrade to an appchain does not immediately translate into high infrastructure-level valuations, because dApps and appchains represent technological choices rather than decisive success factors. The strength of appchains lies in enabling higher-frequency on-chain transactions via low-cost fees, enhancing user experience through data accumulation, strengthening user stickiness, and thus achieving network effects. Therefore, the core of appchain development remains its unique application moat and traffic.

Tracing the Origins of Appchains

When discussing the origins of appchains, one cannot overlook the pioneering Cosmos project. Known for its modular and pluggable architecture, Cosmos separates the virtual machine from the consensus engine, allowing developers to choose VM frameworks and customize key consensus parameters such as validator count and TPS. This design enables various applications to exist as independent chains, showcasing unique advantages in flexibility and sovereignty. These innovations established Cosmos as a major contributor to appchain exploration and practice, laying a solid foundation for the field.

By reviewing the Cosmos appchain ecosystem on Mintscan, we observe many well-known and mature appchains—such as dYdX, Osmosis, Fetch AI, Band, and Stride—built on the Cosmos framework. However, overall growth of Cosmos-based appchains has not been sustained, and the number of new chains has not significantly increased. We believe this is mainly due to Cosmos granting excessive sovereignty to appchains, coupled with high setup and maintenance costs that previously undermined security before Atom 2.0's ICS solution was introduced.

Typically, building a Cosmos-based appchain requires a team familiar with the Cosmos SDK and Tendermint consensus engine, adding extra technical burden to teams primarily focused on application development. Moreover, even if a project can assemble sufficient technical personnel, most Cosmos-based chains involve airdropping tokens to attract initial validators and ensure network security, while high inflation rates incentivize validators to maintain security. However, this approach accelerates token devaluation, weakens network value, and makes it harder for appchains to gain market traction.

With the rollout of Atom 2.0’s ICS solution, the appchain concept will evolve into a permissionless consumer chain model, lowering the cost of securing consumer chains. However, this DAO-governed voting model may face inefficiencies similar to Polkadot’s parachain auction mechanism. Additionally, Cosmos’ shortcomings in chain activity, developer documentation resources, and community culture weaken its appeal to new appchains. For example, the Cosmos Hub halted block production earlier this year, and during the 2023 inscriptions boom, limited developer documentation further diminished its attractiveness. Combined with the cross-chain foundation’s "inner circle" policies, joining the ecosystem became increasingly difficult for new projects.

Catalysts for New-Generation Appchains

Early Cosmos appchains could be seen as chain-centric applications emphasizing chain sovereignty, whereas new appchains are more application-centric, focusing on app development. The emergence of these new chains is driven by several factors: the popularization of modular blockchain concepts, maturity and broad adoption of general-purpose Rollup Layer 2s, advances in interoperability and liquidity aggregation layers, and the rise of RaaS platforms.

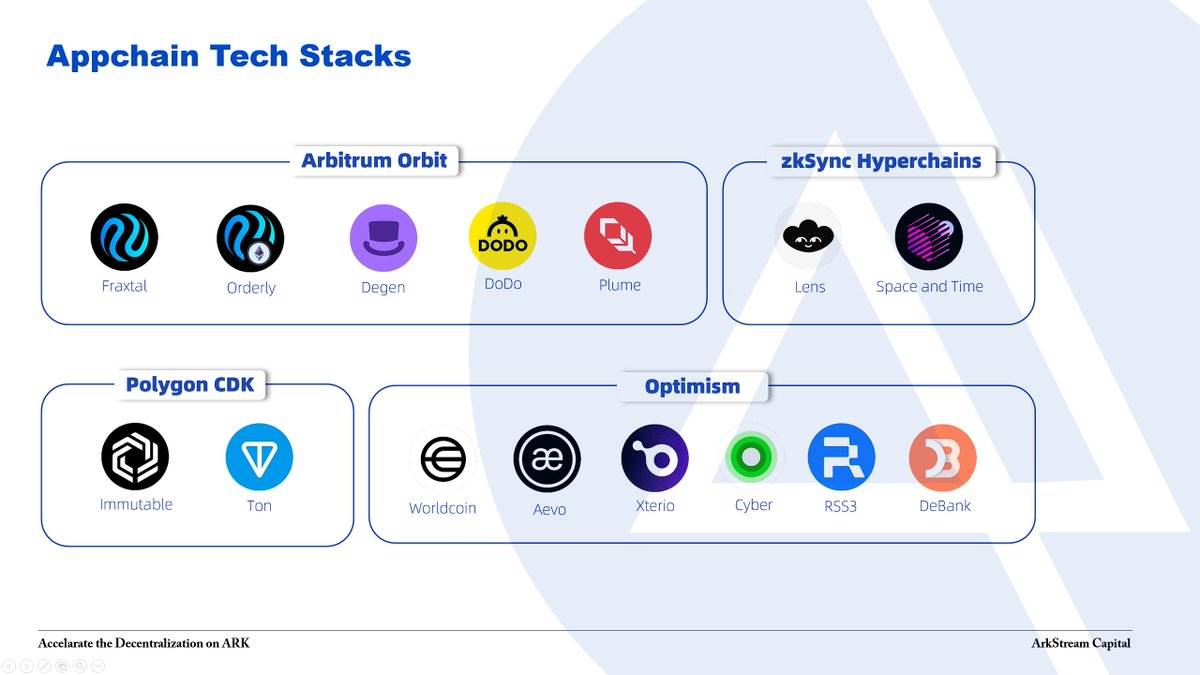

Optimism’s successful launch in 2022 marked the realization of modular blockchain theory, demonstrating how Rollups can efficiently scale Ethereum and encouraging broader exploration of Layer 2 solutions. Building on this, Optimism adopted ideas from Cosmos and introduced the OP Stack concept, widely adopted by projects like Worldcoin and Base, further capturing industry attention. Other Rollup solutions followed suit with similar offerings—Arbitrum Orbits, Polygon CDK, StarkWare Appchains, and zkSync Hyperchains. As a result, appchains have become a new way for dApps to implement business logic, shifting primary challenges toward technology selection, business design, and operational maintenance.

Implementing a Rollup solution typically involves selecting an appropriate execution framework, such as OP Stack or Arbitrum Orbits. The OP Stack is an evolving Rollup framework requiring continuous upgrades to support new Ethereum features—like Cancun’s Blob feature—and emerging capabilities such as alternative data availability. To simplify appchain development, the process generally follows these steps:

-

Technology Selection: Evaluate different frameworks’ features and advantages to select the most suitable one.

-

Demand Design: Design the appchain based on the chosen framework’s customization capabilities.

-

Operations and Maintenance: Complete deployment, testing, launch, and ongoing maintenance.

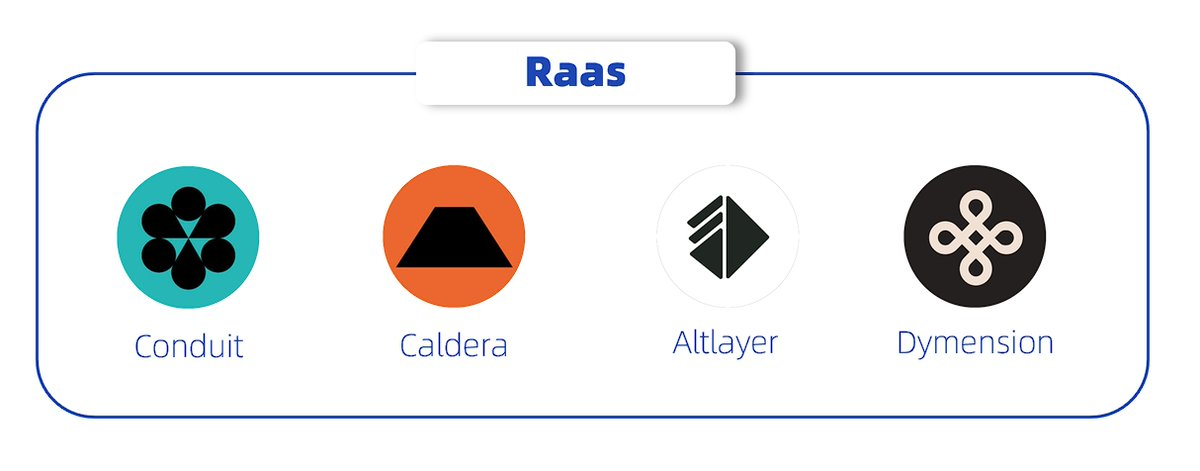

Selecting and implementing the right Rollup framework is no easy task—changes after launch can be even more complex. This is precisely why RaaS platforms like Altlayer, Caldera, and Conduit have emerged. Analogous to SaaS, these platforms specialize in Rollup solutions, helping dApps quickly evaluate and adopt different frameworks, streamline complex development steps, provide customizable core functionalities, and support post-launch maintenance and optimization.

Meanwhile, appchain infrastructure and related functions are rapidly advancing, introducing new protocols and features such as alternative data availability solutions from Celestia, EigenDA, and NearDA to reduce costs and boost throughput. RaaS platforms now also integrate support for custom gas tokens and native account abstraction. As Rollup-based appchains grow in popularity, liquidity fragmentation and interoperability issues have become increasingly apparent, spurring solutions like Optimism’s Superchain, Polygon’s AggLayer, Caldera’s Metalayer, and zkSync’s Elastic Chain—all aiming to improve interoperability and liquidity aggregation among appchains.

While these catalysts have lowered the entry barrier for appchains, challenges in primary and secondary markets are intensifying dApps’ search for breakout paths. According to data from CMC and Rootdata, among the top 100 projects in the secondary market, apart from meme tokens driven by community and culture, only a few pure application projects—such as Uniswap, LDO, Aave, Ondo, Jupiter, and Ethena—exist; most remain infrastructure-focused. This implicitly suggests that infrastructure holds a higher status than applications within the crypto industry.

In the primary market, funding amounts for applications are also far lower than those for infrastructure. We believe this is partly due to Web3 applications' UI/UX complexity falling short of Web2’s maturity and usability, along with a lack of genuine paradigm innovation in apps. Nonetheless, we believe the potential of appchains remains underexplored and may become a significant breakthrough for Web3 development. Currently, prominent appchain projects such as IMX, Cyberconnect, Project Galaxy, and Worldcoin are demonstrating the vast potential of appchains.

Pros and Cons of New-Gen Appchains

In technology and innovation, a “silver bullet” is often described as a perfect solution to all problems. Yet in reality, no single technology can solve everything at once. Similarly, new-gen appchains are not universal or perfect solutions. Below is our analysis of their strengths and weaknesses:

Advantages

-

Modular Design: Appchains typically adopt modular architectures, allowing developers to customize settlement mechanisms, data availability, and other infrastructure components according to specific needs.

-

Performance Optimization: Many new appchains introduce alternative data availability solutions to reduce costs and increase throughput.

-

Enhanced Value Capture: Features like custom gas tokens and account abstraction offer greater flexibility in app development and support more sophisticated business and token models.

Disadvantages

-

Liquidity Fragmentation: New appchains may suffer from fragmented liquidity, leading to inefficient resource allocation.

-

Interoperability and Composability Challenges: Appchains lose the convenience of composability and interoperability previously enjoyed on public chains, limiting their developmental potential.

-

Increased Complexity: Compared to traditional dApps, new appchains introduce higher complexity, especially in design and implementation, potentially requiring more technical resources and support.

Core Considerations When Choosing an Appchain

From a project team’s perspective, deciding whether to upgrade or iterate to an appchain should follow these principles:

1. Dependence on Existing Public Chain Features: If your application heavily relies on other dApps on a public chain—for example, for liquidity or product functionality—we recommend continuing with the existing dApp solution.

2. Need for Custom Functionality: If current protocols cannot support critical business requirements—such as account abstraction or specific onboarding mechanisms (e.g., revenue sharing)—and these functions are vital to operations, transitioning to an appchain should be considered.

3. Cost Sensitivity: If end-users are highly sensitive to blockspace resources, or if you aim to reduce losses such as MEV, an appchain may be preferable. Additionally, for applications involving high-frequency transactions, appchains offer higher resource efficiency and lower transaction costs.

Building Moats and Development Paths for Appchains

We believe an appchain’s moat always lies in its application business. Success hinges on deeply identifying market pain points and achieving strong product-market fit (PMF). Solely relying on narratives around chain infrastructure resembles “looking for nails with a hammer”—an ineffective strategy for building moats.

In today’s new wave of appchains, focus should be placed on building transparent, low-cost applications, identifying real market needs, solving product pain points, refining and securing products, and simultaneously accumulating large volumes of user data to develop cash-flow-positive business models. This creates strong user stickiness and network effects.

An overly aggressive approach may not suit appchains. At least until core products are refined and user growth metrics firmly established, the priority should remain on product development, with marketing taking a secondary role. Accumulating user data, cultivating user habits, and iterating product features do not happen overnight—thus, a steady and prudent approach is more appropriate. Appchains should first establish core, even irreplaceable, functionalities. On this foundation, they can expand into new features and product lines. Even if new features receive lukewarm responses, defensive strategies allow them to be abandoned. During upgrades and iterations, deep integrations with original app functionalities should be pursued repeatedly.

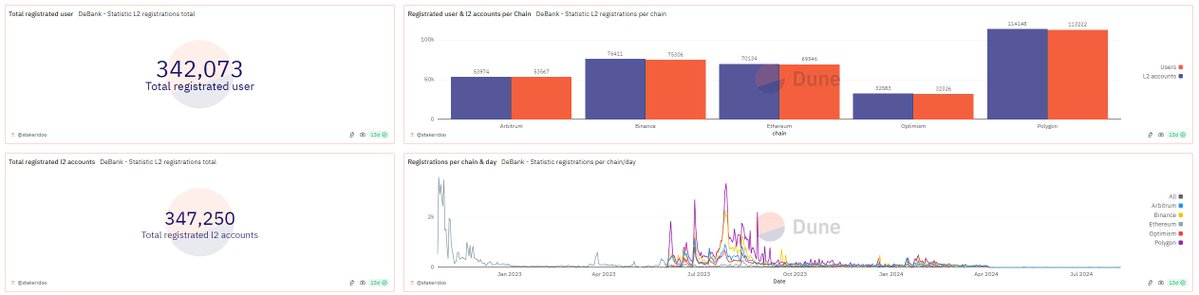

For instance, Debank, a well-known portfolio visualization and asset management platform, has long built tracking and monitoring systems for assets, transaction history, and dApp positions across ETH and EVM-based wallet addresses, iterating numerous features from this base. Though some lesser-known Debank features—like notifications, bookmarks, and greetings—have not weakened its core asset management capability, they still persist. Debank’s paid features also reflect attention to detail, offering diverse, granular pricing options and bundled package optimizations, providing thoughtful choices for users. These features collectively perform strongly and synergize well with Debank’s other product line, Rabby Wallet. Despite pushing forward Debank Chain based on OP Stack, users haven’t perceived significant differences—indicating that Debank’s appchain effectively established its core moat and offers valuable insights for other appchains’ development paths.

Designing Token Models for Appchains

When constructing token economic models for appchains, we advocate an “organic” approach. The core of this strategy is minimizing artificial intervention and avoiding reliance on short-term incentives. Our goal is to align token circulation and value growth with the expansion of the application itself and the growth of its user base. In this way, tokenomics can synchronize with the application’s long-term development and actual user needs, enabling sustainable growth.

In the early stages of an application, tokens can serve as effective tools to attract users and achieve “cold starts.” However, ensuring these initial users convert into long-term participants depends on designing an efficient and compelling mechanism. This mechanism must be grounded in clear product positioning, deep understanding of user needs and preferences, and comprehensive awareness of the commercial context. Furthermore, the core value of the token must be clearly defined so users can recognize its long-term potential and benefits. With such a strategy, tokens can not only attract users but also encourage sustained engagement and deeper product usage.

Growth in the number of token holders should align with user base expansion to ensure healthy token economy development. We should avoid overly aggressive token distribution strategies and instead focus on sustainable growth models. This requires careful consideration of current market liquidity and potential shifts, while ensuring the token model closely aligns with the application’s vision. Additionally, NFTs, as a novel form of reserve asset, can be innovatively integrated to provide diversified use cases, thereby enhancing token appeal and market competitiveness.

Learning from failure cases is crucial to avoiding mistakes when designing appchain token models.

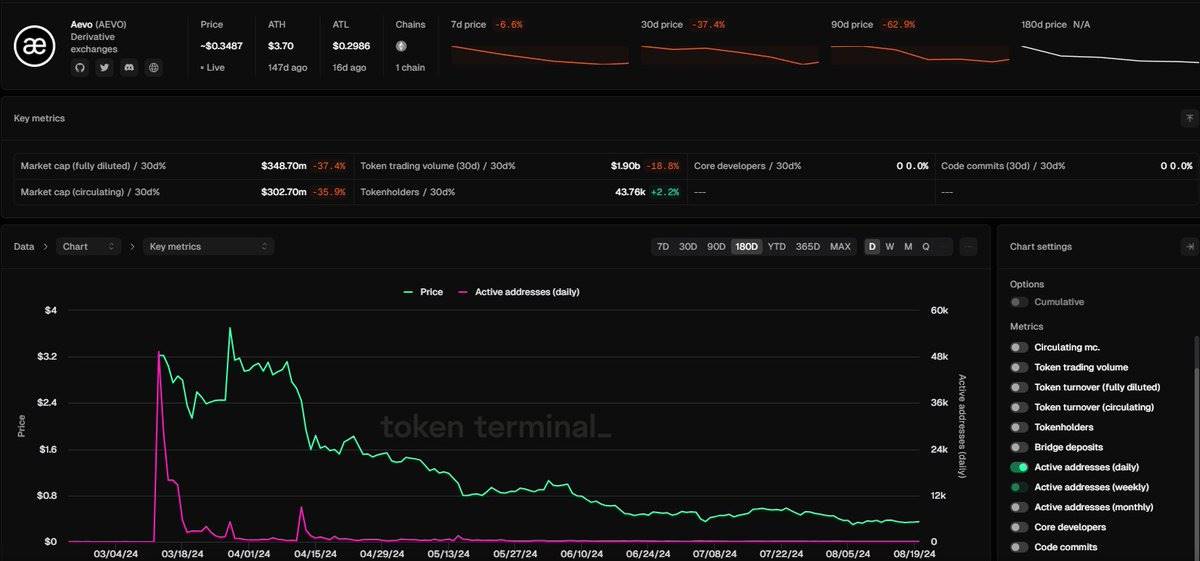

For example, Aevo is a newly listed token on Binance over the past six months. It did not suffer from insufficient liquidity. After attracting a large number of early users via airdrops, Aevo gained some foothold in pre-launch trading. Unfortunately, Aevo’s overly aggressive and unrestricted token design ultimately damaged its core growth metrics. Currently, Aevo shows stagnation in key indicators such as growth in token holders, daily trading activity, and fundamental market depth in pre-launch trading. Therefore, to build a token economy model that both attracts users and ensures long-term sustainability, we advocate an organic growth strategy rooted in intrinsic value and user demand, driving natural token appreciation alongside application expansion.

Overview of Notable Appchain Projects

Let us now examine some prominent appchain projects in the market and analyze their characteristics.

Cyber is a restaked Ethereum Layer 2 network aiming for mass adoption in the social domain. Its core features include native account abstraction, decentralized storage (CyberDB), and decentralized sequencing powered by the enshrined social graph protocol—CyberGraph and CyberAccount. Its flagship application, Link3, allows verified Web3 companies and professionals to create reusable on-chain data that can be integrated and utilized by other applications.

XAI is an EVM-compatible Layer 3 network purpose-built for gaming, developed by Offchain Labs using Arbitrum technology. XAI enables players to own and trade in-game items without needing a cryptocurrency wallet, while node operators participate in governance and earn rewards, creating open and authentic economic experiences for traditional gamers.

MyShell AI is an innovative platform for AI agent creators and serves as a consumer-facing AI layer connecting users, creators, and open-source AI researchers. Users can leverage MyShell’s proprietary text-to-speech technology and AutoPrompt tools to quickly customize agents with personalized voice styles and functions. For agent creators, the platform offers efficient creation tools, monetization options, and the ability to profit from their agents.

GM Network aims to lead in the consumer AIoT space. By combining advanced AltLayer technology, EigenDA, and OP Stack, it builds decentralized DePIN infrastructure. GM Network seeks to create a large-scale incentive and communication platform that bridges the virtual and physical worlds by integrating AI with DePIN/IoT technologies, thereby driving widespread consumer-side AI adoption.

Investment Analysis Framework

When conducting investment analysis, we apply the following framework to ensure comprehensive and in-depth evaluation of applications:

1. Industry Understanding and Market Positioning: Deep knowledge of crypto mechanisms and practices, identification of market pain points, and proposal of innovative application solutions.

2. Target User Base: Applications should target large and potentially expansive user bases, as this directly impacts their market cap ceiling.

3. Product Delivery and Iteration Speed: Compared to infrastructure, applications require strong product delivery capabilities and rapid iteration speed to ensure continuous functional optimization and innovation.

4. User Retention and Business Model: Applications must build strong user retention and achieve sustainable growth through GMV expansion and aligned business models.

By adhering to this framework, we can systematically assess a project’s overall strength and market potential, providing a solid foundation for investment decisions.

Outlook

We remain optimistic about the development of appchains. This optimism stems from their potential as central platforms for user activity, playing pivotal roles across diverse fields such as social networking and gaming. In the future, these appchains will not only deliver rich interactive experiences but also drive innovation and advancement in related industries through their unique technological advantages.

Notes

-

B2B and B2C application business models each have distinct characteristics, but their integration with appchains is similar. This article does not strictly differentiate between the two, instead focusing on how both leverage appchain technology to achieve business goals and growth.

-

The main difference between Layer 3 and Layer 2 appchains is that Layer 3 uses a specific Layer 2 as its settlement and data availability layer, meaning structurally there is little distinction from Layer 2.

-

Solana has not officially supported Layer 2 development; its focus remains on building a high-performance Solana public chain. For Layer 2 or appchains on Solana, integration resembles that of Ethereum, with differences mainly in execution frameworks and data availability layers.

-

Although the current Layer 2 landscape appears relatively quiet, the real issue lies in certain Layer 2s being overly reliant on anticipated airdrops to fuel on-chain activity, without adequately operating or maintaining their ecosystems. According to Defillama’s data, Layer 2 chains like Arbitrum and Base remain highly active.

-

Revenue-sharing models between appchains and RaaS platforms vary—ranging from fixed fees to allocations of sequencer revenue. Appchains of different scales can choose suitable revenue-sharing models based on their business circumstances.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News