Gain or Harvest? Web3's Choice Amid Telegram's Traffic Surge

TechFlow Selected TechFlow Selected

Gain or Harvest? Web3's Choice Amid Telegram's Traffic Surge

Projects that have already gathered significant traffic on Telegram are now engaging in external collaborations, attempting to effectively direct this traffic toward products with genuine user demand.

Given the current volatility in the crypto industry, the lack of liquidity has become a persistent shadow looming over the sector. While crypto-related events continue to take place globally, industry participants have grown noticeably more hesitant and cautious. Pessimistic views are being voiced across different segments of the industry, ranging from comprehensive skepticism to frustration about the current market cycle. The absence of clear new sources of growth poses a significant challenge to confidence in the crypto space.

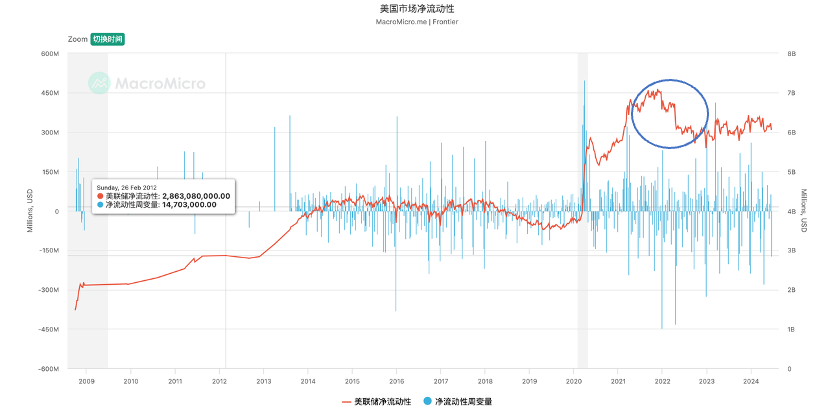

According to Hedy, Chief Researcher at OKLink Blockchain Research Institute, discussing market repositioning and liquidity issues in the crypto market, between 2022 and early 2023, seven consecutive interest rate hikes by the Federal Reserve led to a sharp decline in the U.S. market's net liquidity index, which has not recovered since. As a result, demand in the crypto market has significantly weakened.

*Chart from Macromicro.me

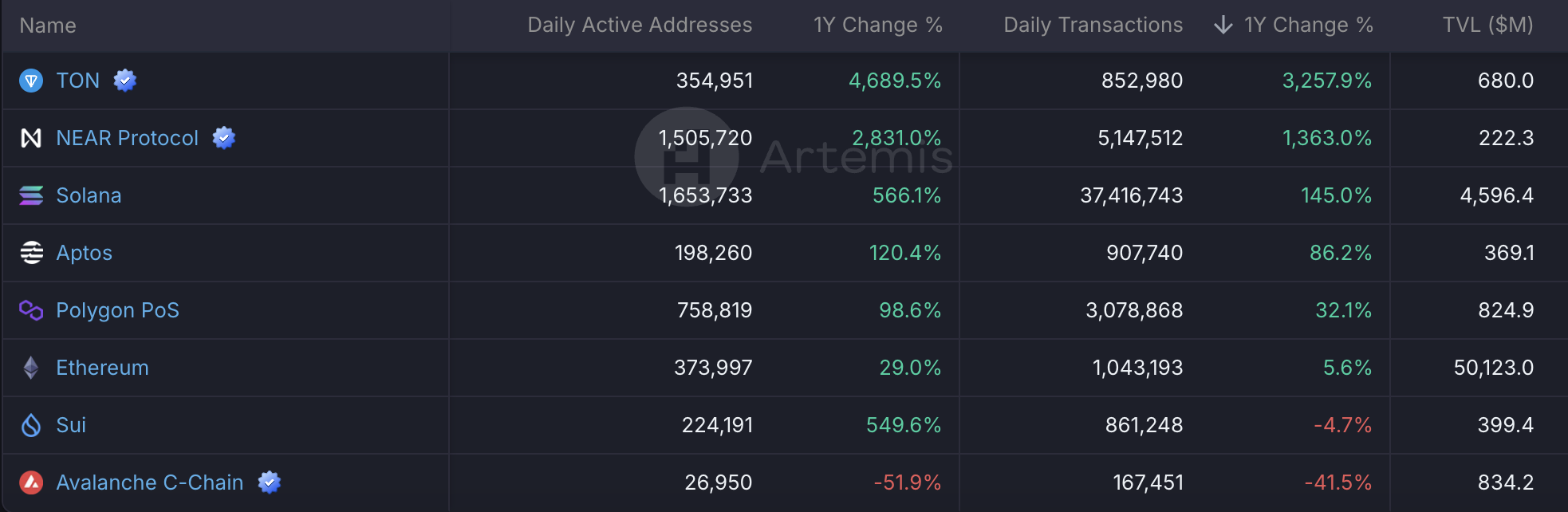

From OKG Research’s perspective, we observe that since the second half of 2023, the TON ecosystem (a deep collaboration partner on Telegram’s blockchain initiative) has demonstrated strong momentum. Efforts centered around building a Web3 ecosystem on Telegram have continued to generate substantial industry attention. On-chain data shows that in June 2024, TON surpassed Ethereum in daily active addresses, with both daily active addresses and daily transaction counts growing at an impressive rate, outperforming other major public blockchains.

*Charts Source: https://app.artemisanalytics.com/chains

Externally, a large number of Web3 mini-application projects依托on the Telegram platform have gathered on TON. These projects typically feature simple logic, ease of use, and viral characteristics, enabling rapid traffic diffusion and user acquisition within short periods. Several leading projects have already attracted tens of millions of users. While these projects succeed in capturing traffic, they also face considerable skepticism.

Against this backdrop, OKLink Blockchain Research Institute partnered with TOP (The Open Platform) to host an industry discussion titled Navigating Web3 Traffic Era, held on August 22 via Twitter Space (@OKGResearch). The event featured insights from key figures involved in the TON ecosystem, including JT, APAC BD Lead at TOP; Vivi, Research Lead at TON Foundation; Unai, independent researcher; Florence, CMO of Seed Combinator; Anton Umnov, Founder & CEO of Helika; and Semir Karaahmedov, Community Manager at Crust. The session was moderated by Hedy, Chief Researcher at OKLink Blockchain Research Institute, with participation from senior researcher Samuel, offering diverse perspectives on pressing questions facing the ecosystem.

@OKG Research

In the current crypto market environment, traffic and liquidity remain closely intertwined. With increasing focus on liquidity, “traffic-based business models” have drawn particular attention. The TON ecosystem built on Telegram may offer transformative changes distinct from mainstream crypto narratives.

From the perspective of industry practitioners such as speakers Florence, Anton Umnov, and Semir Karaahmedov, Telegram is currently seen as a promising frontier for crypto innovation. With a narrative built around its over 900 million users, even tapping into a small fraction of this user base could create significant ripple effects across the industry. As such, large-scale experimentation remains a top priority. From a promotion standpoint, gaming holds a natural first-mover advantage. Some leading games are already achieving sustainable profitability through in-app payments. Additionally, transaction-based applications have shown strong performance in driving native Web3 demand. However, TON as a Layer-1 blockchain still has considerable room for improvement—both in terms of technical development complexity and the inertia of Web3 developers’ mindsets, particularly regarding product-building strategies versus short-term monetization trade-offs.

From the viewpoint of speakers JT and Vivi, representing major ecosystem supporters like TOP and the TON Foundation, efforts go beyond just supporting ecosystem expansion—they are also continuously iterating on how to better monetize traffic on Telegram. Officially supported features such as various payment systems and in-channel advertising are ultimately anchored on the TON Blockchain. How to strategically integrate potential real-world applications with crypto payments will likely be viewed by official and institutional stakeholders as a key growth vector moving forward.

In the view of Samuel from OKLink Blockchain Research Institute, drawing a parallel with WeChat—an instant messaging app that built a robust ecosystem atop fiat payment infrastructure—it is precisely this kind of integrated system that truly enhances user stickiness and captures user time. How Telegram leverages its vast user base to deploy crypto payments effectively could become a pivotal factor in reshaping the current Web3 landscape.

Following traditional traffic monetization models, sectors like e-commerce and entertainment have given rise to some of the world’s largest internet companies. This same logic remains valid in Web3. As new users enter through viral campaigns or airdrop incentives, it reflects ongoing experimentation with Web3 applications. Only when application scenarios expand, drive user growth, and attract further capital investment can a virtuous cycle emerge. Projects that have already amassed massive traffic on Telegram are now seeking external partnerships to channel that traffic toward products addressing genuine user needs.

Notably, guest speaker Unai pointed out that due to the hype surrounding blockchain narratives, these projects often carry inflated valuations, requiring substantial fundraising before launch to ensure orderly exits later. Once the wealth effect fades, it becomes immediately clear who was truly building value—and who wasn’t.

Will the future see Web3 continuing to pay for short-term traffic spikes, layering speculative narratives onto existing industry anxieties? Or will sustained efforts close the gap in long-tail incremental adoption, making crypto applications an integral part of everyday life? The answer remains to be seen.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News