Opinion: Rate cuts may not necessarily reduce the appeal of BlackRock's BUIDL

TechFlow Selected TechFlow Selected

Opinion: Rate cuts may not necessarily reduce the appeal of BlackRock's BUIDL

If real interest rates remain stable, the potential stimulative effect of a Fed rate cut could be weaker than expected, and Treasury bonds may still be attractive.

Author: Kaiko

Translation: 1912212.eth, Foresight News

Interest rate cuts are unlikely to reduce the appeal of tokenized Treasuries.

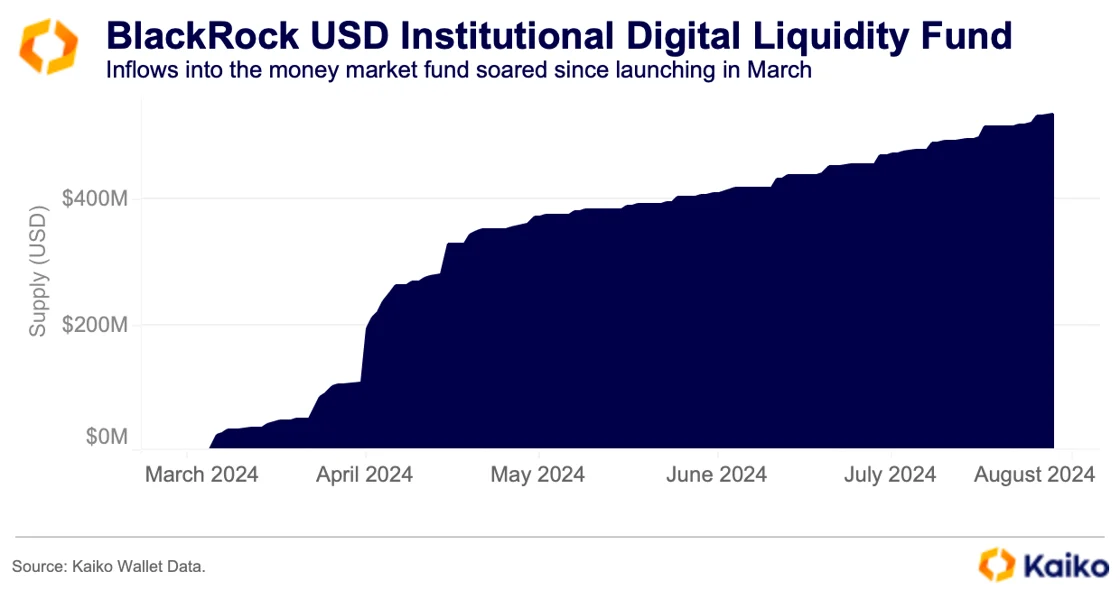

BlackRock's on-chain tokenized fund BUIDL (short for BlackRock USD Institutional Digital Liquidity Fund) is one of several funds launched over the past 18 months offering exposure to traditional debt instruments such as U.S. Treasuries, and has quickly become the largest on-chain fund by assets under management. Launched in March 2024 in partnership with Securitize, it has already attracted over $520 million in inflows.

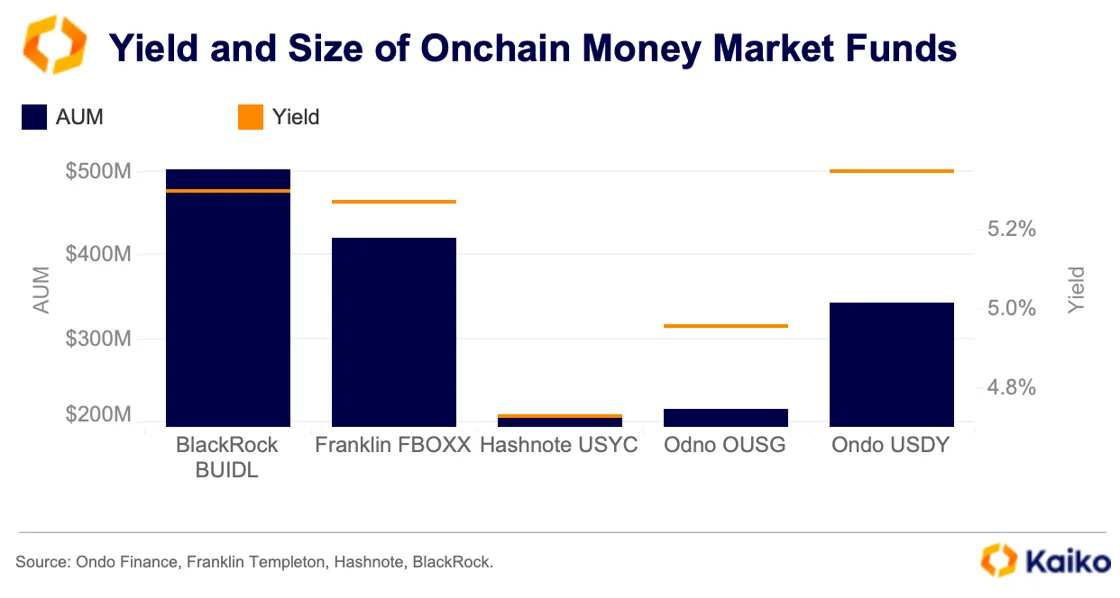

Most such funds invest in short-term U.S. debt instruments. Other top funds include Franklin Templeton’s FBOXX, Ondo Finance’s OUSG and USDY, and Hashnote’s USYC. Each offers yields comparable to the Federal Reserve's federal funds rate.

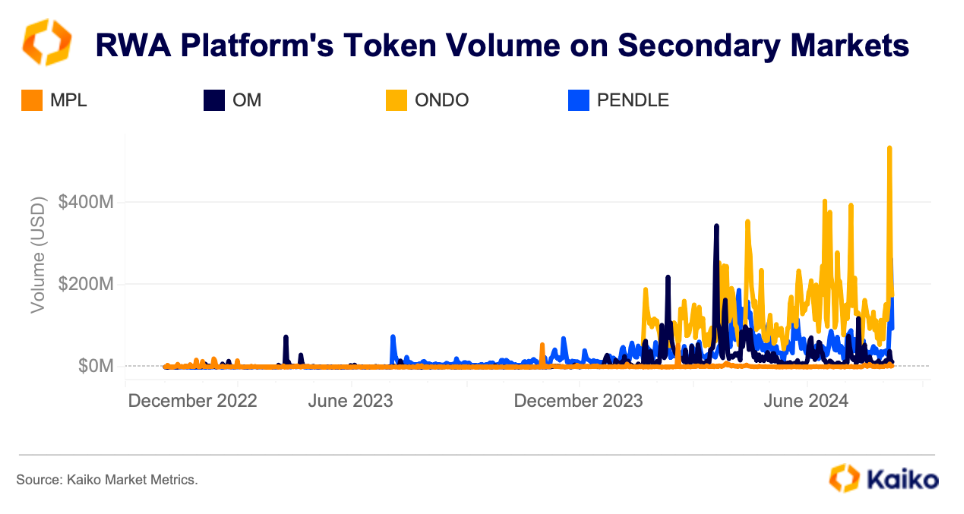

As interest in tokenized funds grows, so too have on-chain capital flows and secondary market activity for related tokens. Ondo Finance’s governance token ONDO saw the largest surge in trading volume, coinciding with the announcement of its collaboration with BlackRock’s BUIDL. With surging inflows into BUIDL and rising interest in on-chain funds, ONDO’s price hit an all-time high of $1.56 in June. However, enthusiasm has since cooled, and inflows may face headwinds amid shifting U.S. interest rate conditions.

Since the sell-off on August 5, market narratives have intensified around the idea that the Fed is "behind the curve" and needs to cut rates more aggressively to avoid a recession. Markets now expect 100 basis points of rate cuts this year.

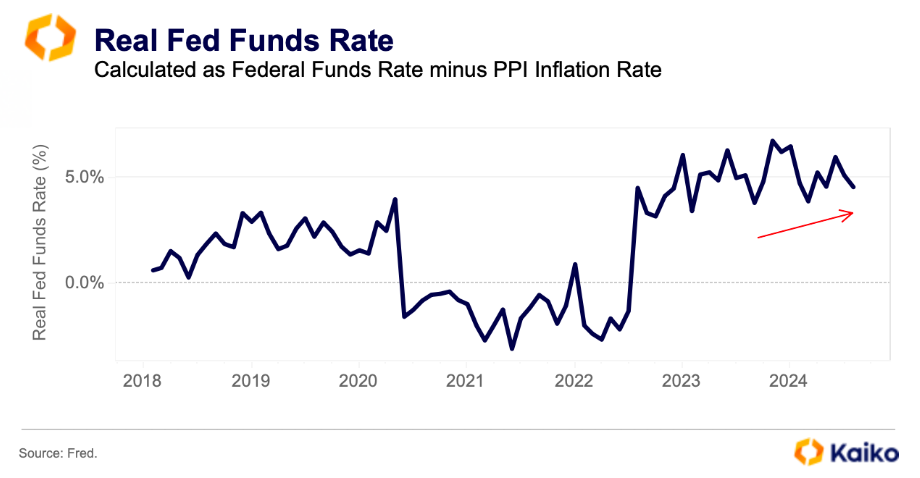

Last week’s U.S. inflation data came in below expectations, further solidifying expectations for a September rate cut. However, rate cuts do not necessarily imply looser monetary policy. If the Fed lowers nominal interest rates but inflation falls at the same pace or faster, real interest rates (nominal rates adjusted for inflation) could remain stable or even rise.

In fact, even with the Fed holding nominal rates steady, the real federal funds rate—adjusted for the Producer Price Index (PPI), a measure of firms’ pricing power—has slightly increased this year.

If real interest rates remain stable, the potential stimulative effect of Fed rate cuts could be weaker than anticipated. In such a scenario, Treasuries may remain attractive relative to risk assets, as investors may continue to favor liquidity and safety over risk-taking.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News