Sui: Solana's Potential Killer or Flash in the Pan? In-depth Analysis of Its Strengths and Weaknesses Across Five Dimensions

TechFlow Selected TechFlow Selected

Sui: Solana's Potential Killer or Flash in the Pan? In-depth Analysis of Its Strengths and Weaknesses Across Five Dimensions

Sui has a great user experience.

Author: Wajahat Mughal

Compiled by: TechFlow

I think we've all seen the "Sui evangelists" this week—some even calling it a Solana killer. But that's a bit overstated for now. The real question is whether there's genuine substance here or just another VC-backed coin pump?

In this thread, I'll share my thoughts on @SuiNetwork's technology, ecosystem, user experience, and token.

1. Technical Features

I'll keep this brief. Sui’s tech is impressive. Built on a Move-based codebase, its key features include:

-

Potential for 100k+ TPS (for single-type transactions, excluding shared object transactions)

-

0.33-second block production time + 500ms finality

-

Parallel processing

-

Optimized storage model

-

Object-based transaction model

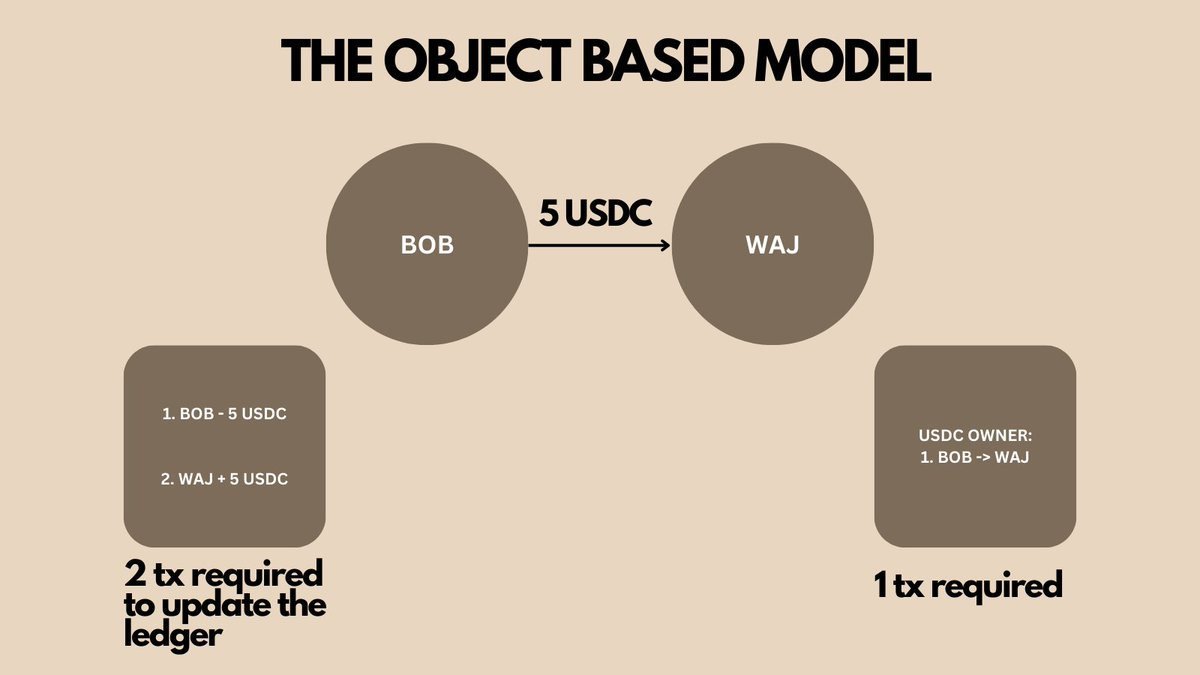

The most compelling part to me is the object-based model. I’ll highlight its efficiency in the diagram below.

2. Move Language

Second, the Move language includes security advantages over Solidity, especially in preventing re-entrancy attacks—a common issue in DeFi.

Move is said to be easier for non-crypto developers to learn and adopt. (I’m not entirely sure, as I’m not a developer.) Could this be the key to attracting more mainstream developers into crypto? Maybe—but I'm not fully convinced yet.

3. Sui Ecosystem

Sui’s recent price action has pushed it up the rankings into the top 12, though its market cap remains under $1 billion. Clearly, there’s still much work to do—but perhaps we should look deeper into the ecosystem.

DeFiLlama currently lists around 30 dApps on Sui, with 12 having TVL over $10 million. One thing I like is that these are mostly native dApps—better than many L2s today that simply copy-paste forks of AAVE and GMX everywhere.

While the Sui ecosystem is small, infrastructure is covered, and there are some derivatives—but not many. @navi_protocol, @CetusProtocol, and @TypusFinance are apps I’ve tried, and they’re decent. However, there’s nothing on Sui that I can’t already do on other chains. That’s a big problem for me.

Ultimately, if Sui wants to be truly significant, this isn't enough. I’d like to see $5–10 billion in TVL, over 100 ecosystem apps, and some unique dApps offering experiences unavailable elsewhere.

4. Sui User Experience

The experience is good.

The worst part is bridging funds or using cross-chain swaps, but once funds are in place, everything feels smooth, fast, simple, and clean. Sui’s native wallet handles direct staking well and even shows which airdrops I’m eligible for—very similar to Phantom on Solana.

Account abstraction is a focus for Sui, enabling several advanced features such as:

-

ZK-powered social logins

-

Sponsored transactions

-

Gas fees that don’t spike with network demand

-

Sui’s block explorer is also excellent—an aspect not every chain gets right.

5. Sui Token

This part is complicated. L1 investing today is nothing like it was in 2021. We now have double, triple, or even quadruple the number of “L1” tokens—and countless L2 tokens (though their value capture models differ).

With new chains like Berachain, Monad, and Hyperliquid emerging, this number will only grow.

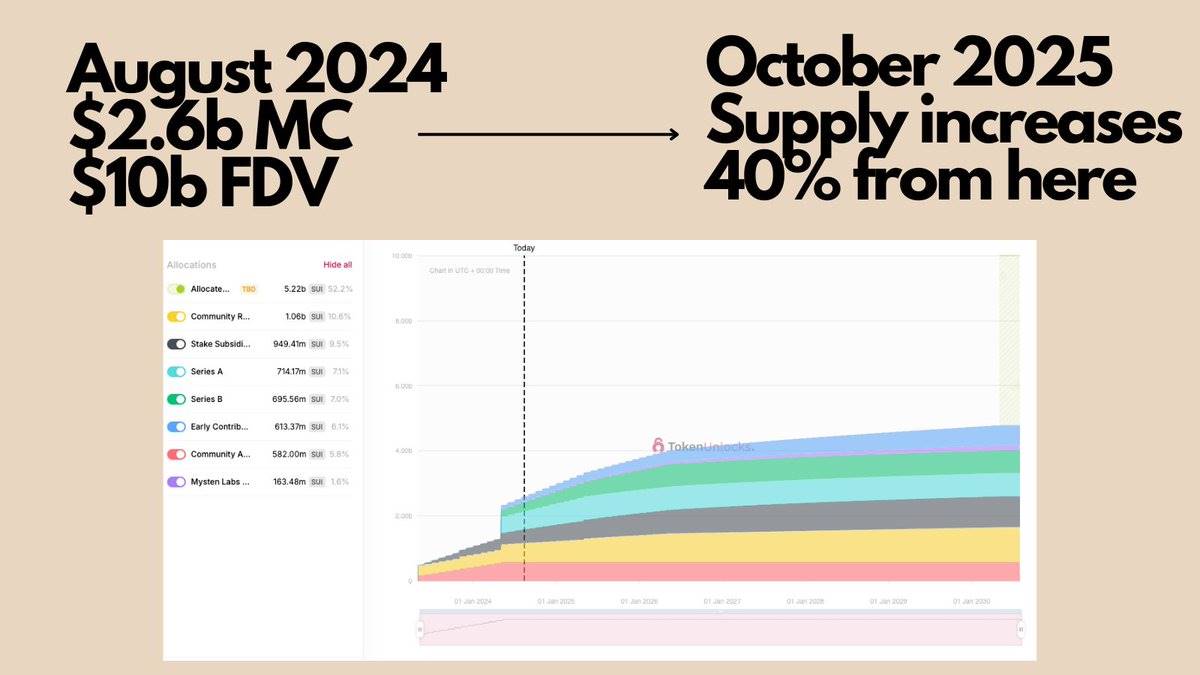

Sui’s market cap stands at $2.6 billion, with a fully diluted valuation (FDV) of $10 billion—decent at first glance, especially compared to:

-

TON: $16 billion

-

ADA: $12 billion

-

AVAX: $8 billion

-

ICP: $3 billion

My concern lies in VC unlocks. From now until October 2025, circulating supply will increase by 40%—about 900 million tokens, worth roughly $1 billion at current prices.

As Sui’s price rises, this inflation could represent billions in sell pressure. It’s something to consider—but doesn’t mean it can’t still be pumped. Notably, 50% of the supply belongs to Sui/Mysten Labs, and how they manage those tokens going forward remains unclear.

Overall Take

Honestly, I think Sui is better than some other L1s. There’s still room for improvement, especially in building a stronger ecosystem. Before I start comparing it to ETH or SOL, I need to see unique applications that don’t exist anywhere else. Still, there are many positive aspects to Sui, as outlined above.

Will it be a Solana killer? I don’t know.

I find the inflation interesting. I’m quite certain we’ll see VCs selling tokens—especially since B-round FDV was only $2 billion. That’s a 5x return at current prices.

What do you think? Is @SuiNetwork good or bad?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News