SUI Up 141% in a Week, Dubbed the "Solana Killer"—Is the Bullish Case Justified?

TechFlow Selected TechFlow Selected

SUI Up 141% in a Week, Dubbed the "Solana Killer"—Is the Bullish Case Justified?

TON might actually be the direct competitor Sui can truly be compared to.

Author: Frank, PANews

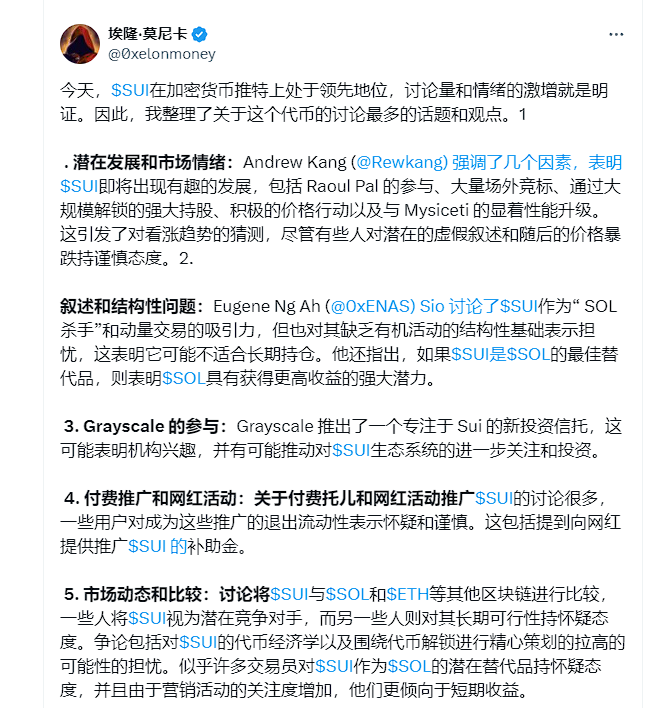

Sui has recently gained significant attention on social media, with many referring to it as the "Solana killer." Numerous analyses have been made regarding Sui's network performance and the price chart of its $SUI token, fostering a growing bullish sentiment. But does this claim hold water? How is Sui's ecosystem actually developing?

The Influential Bull Behind the Hype Is a Sui Foundation Director

The initial wave of bullish commentary originated from Raoul Pal, founder and CEO of Real Vision, who boasts over a million followers on X (formerly Twitter). On August 9, Pal posted multiple tweets comparing the price movements of $SUI against governance tokens of several major blockchains. He concluded: “From a price perspective, $SUI is starting to look very interesting. It’s still early and unproven, but it’s already showing breakout signs compared to most other tokens.”

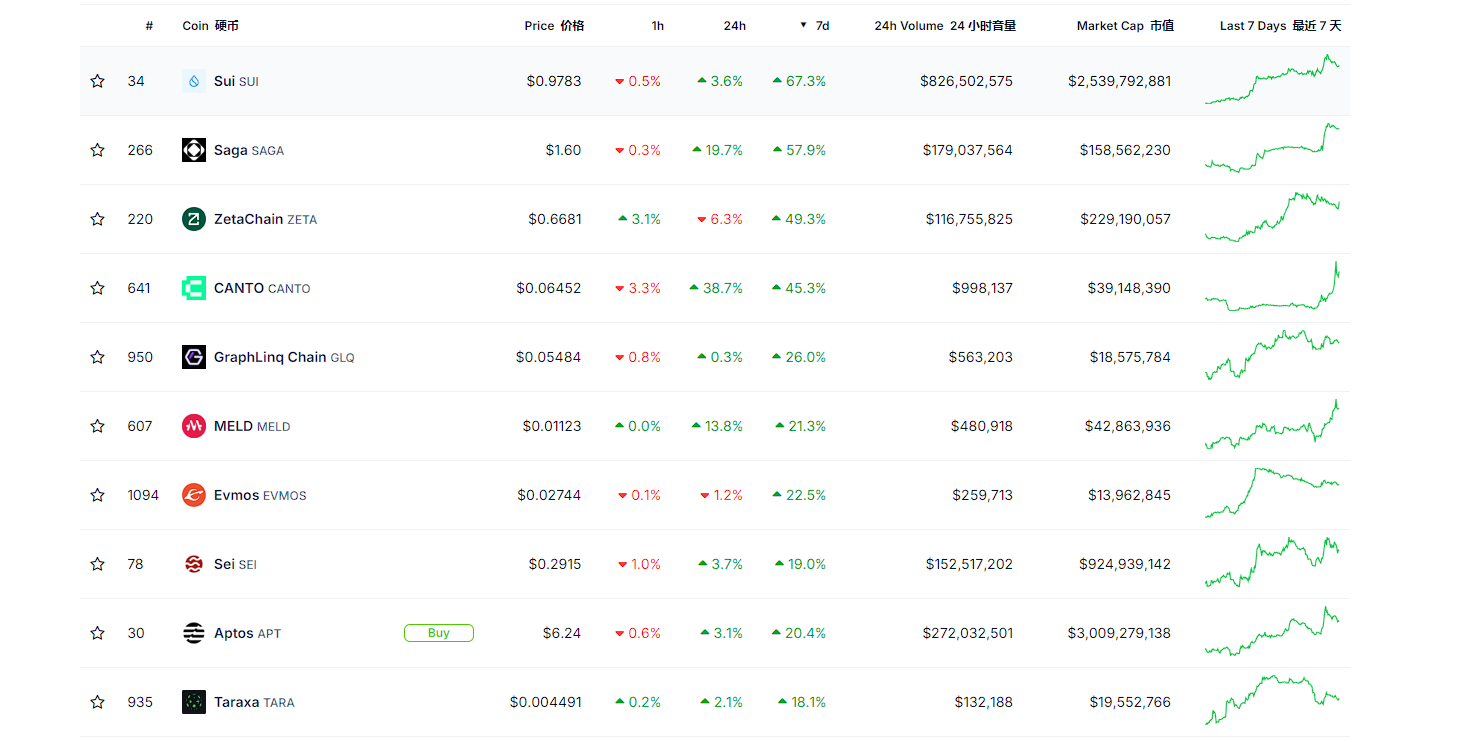

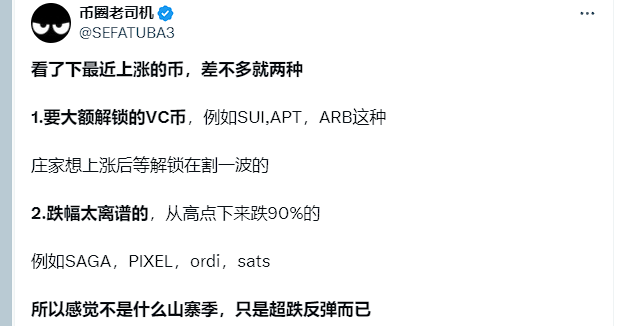

Indeed, SUI’s price performance has been impressive lately. After hitting a recent low of $0.4625 on August 5, the token surged, reaching a high of $1.1174 by August 12—a weekly gain exceeding 141%, the highest among major layer-1 tokens. However, this still falls far short of its all-time high of $2.18 reached in March. Since peaking at $2.18 on March 27, 2024, SUI steadily declined to a low of $0.46, marking a drop of over 78.8% within six months.

SUI’s strong rebound may be partly attributed to Grayscale’s endorsement. On August 7, Grayscale announced two new crypto investment products, including a trust for the SUI token. Rayhaneh Sharif-Askary, Head of Product and Research at Grayscale, stated: “We’re excited to add Bittensor and Sui to our product suite and believe Bittensor is central to decentralized AI development, while Sui is redefining smart contract blockchains.” Following this news, SUI’s price jumped 42% on August 8, marking its largest single-day increase recently.

Grayscale currently offers 18 crypto investment products, primarily covering mainstream layer-1 projects such as Solana and Litecoin.

Raoul Pal noted on X that he is actively seeking the next “SOL-type opportunity,” and considers SUI one of them. However, his endorsement has drawn scrutiny, as he openly disclosed being a director of the Sui Foundation—revealing a clear conflict of interest.

Andrew Kang, co-founder of Mechanism Capital, listed five reasons behind Sui’s recent rally: support from figures like Raoul Pal, strong OTC demand, resilient post-unlock holder behavior, lack of price correction, and the Mysticeti performance upgrade. Regarding claims that SUI could surpass Solana, Kang remarked: “I don’t think SUI’s market cap will match SOL’s, but it’s currently at 3.5% of SOL’s.”

Beyond influencer endorsements, Sui’s ecosystem has seen some developments. On August 9, SuiNS, Sui’s domain name service, announced a transition into a decentralized protocol governed by its NS token, with plans to airdrop 10% of tokens to the community. On August 13, CoinList launched a staking fund supporting five assets, including ETH, SOL, NEAR, SUI, and MINA.

Data Shows Sui Lags Behind Solana, Matches TON

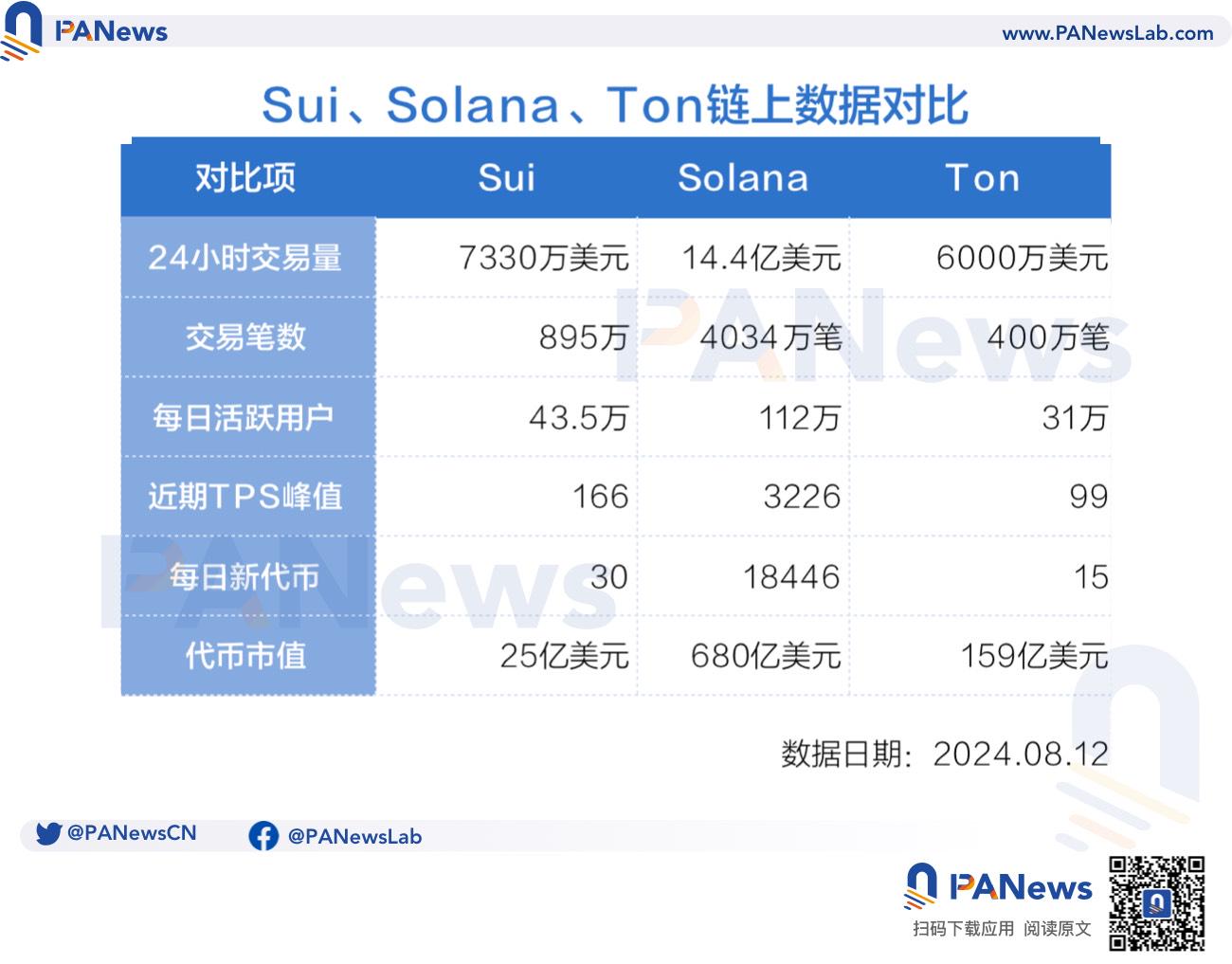

But has Sui’s ecosystem truly advanced rapidly, or is the bullish narrative mostly smoke and mirrors? PANews compared key metrics across Sui, Solana, and TON (data as of August 12).

In terms of transaction volume and count, SUI still lags significantly behind Solana—the 24-hour trading volume is only about 5% of Solana’s. Given TON’s strong recent ecosystem growth and secondary market performance (also dubbed a “Solana killer”), Sui’s overall data more closely resembles TON’s, even slightly outperforming in certain areas. However, there remains a stark difference in circulating market cap: SUI sits at $2.5 billion, while TON’s is approximately $15.9 billion—6.4 times higher. Catching up to TON’s valuation could represent SUI’s upside potential. That said, TON benefits from Telegram’s 900 million users, justifying a higher valuation premium over other blockchains.

Is a Major Token Unlock Being Framed as Good News?

Another argument used by bulls is SUI’s token unlock schedule. On August 1, 53.89 million SUI tokens were unlocked—about 2.56% of circulating supply, worth roughly $50.6 million. Supporters argue that despite the unlock, the market didn’t see massive selling pressure, indicating strength. Critics, however, point out that unlocks will continue monthly, suggesting this rally might simply be orchestrated hype ahead of larger sell-offs. Some users have also questioned whether the Sui Foundation has recently paid influencers to promote $SUI.

Notably, since August 5, SUI’s futures open interest has surged. Using Binance perpetual contracts as an example, open interest rose from 28.46 million on August 5 to 100 million by August 12. Meanwhile, funding rates have remained negative—indicating that a large number of short positions are paying fees to maintain their bearish bets.

On-chain data shows Sui has indeed made notable progress over the past six months. In May, leveraging a spam-resistant mechanism, daily transactions briefly exceeded 70 million—surpassing all other blockchains including Solana. Although transaction volume later dropped to around 7 million, it remains vastly higher than pre-May levels of under 100,000. Similarly, active addresses have grown substantially. However, overall scale still pales in comparison to Solana—especially in ecosystem activity indicators such as daily new token launches, where Sui averages only about 30, versus Solana’s ~20,000.

In summary, Sui is still far from being a true “Solana killer.” TON, rather than Solana, appears to be Sui’s more immediate competitive peer.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News