Meme Trading Guide: Set Strategies Based on Capital Size and Exit Promptly to Avoid Losing Hard-Earned Profits

TechFlow Selected TechFlow Selected

Meme Trading Guide: Set Strategies Based on Capital Size and Exit Promptly to Avoid Losing Hard-Earned Profits

Aim for 2-4x returns with a quick exit.

Author: INSIGHTFUL

Translation: TechFlow

Introduction

In this bull market, meme tokens continue to attract significant attention, with retail investors viewing them as their only chance for success in the current cycle. While potential returns are substantial, so too are the associated risks.

This article aims to help you establish trading rules and profit strategies to increase your chances of securing gains—rather than giving back all paper profits—instead of endlessly chasing the next 100x return.

Why Meme Tokens Are So Popular

Memes represent the most authentic and straightforward expression within crypto. Traditionally linked to retail traders, this cycle hasn’t seen a full retail comeback—yet memecoin attention has reached unprecedented levels early on.

Currently, the market is dominated by experienced crypto traders, many in their second or subsequent cycles. These participants typically:

-

Focus on maximizing profits.

-

Recognize that over 90% of "fundamental" projects are essentially memes with no real value and are destined to fail.

We've seen numerous examples where:

-

Memes have demonstrated remarkable wealth creation potential.

-

Multiple billion-dollar, venture-backed "fundamental" projects have slowly declined due to long vesting periods.

Given these factors, it's understandable why many opt for memes. They’ve proven to be powerful wealth generators without needing the false pretense of “innovative technology.”

The strong rebounds of PEPE and WIF after May’s correction highlight a shift in sentiment toward memes this cycle. Unlike in the past—when meme strength often signaled market tops and peak trader confidence—today’s memes show resilience during broader market pullbacks and periods of low confidence.

Large-cap memes like $PEPE and $WIF have almost become safe havens for users during uncertain times. The meme supercycle has clearly begun.

Risk Management: Position Sizing Relative to Portfolio

We break portfolios into four categories:

-

4 digits (1,000 to 9,000)

-

5 digits (10,000 to 100,000)

-

6 digits (100,000 to 900,000)

-

7 digits (1,000,000 to 9,000,000)

Trading with a Sub-Four-Digit Portfolio

The million-dollar question: “With limited capital, how can I succeed in shitcoins/memecoins?”

The honest answer is that the odds are very slim, especially for beginners. However, here are some principles to improve your chances:

-

Commit strongly: Allocate a significant portion of your portfolio to investments you have strong conviction in and solid reasoning for.

-

Exit quickly: Target 2–4x returns and exit promptly. Avoid holding too long when most of your capital is concentrated in one position.

-

Selective investing: Focus on logic and rationale, not charts and candlesticks. Allocate 20–25% of your funds per investment—enough risk to potentially break out of this stage.

-

Bull market opportunity: In strong bull markets with high risk appetite, narratives can power successful investments.

Step 1: Accept Reality

Understand that small amounts like $100 won’t make you rich overnight. Don’t rely solely on crypto to cover living expenses. Treat crypto as a side project—a skill you’re quietly mastering behind the scenes.

Step 2: Master a Niche

With limited capital, focus on improving trading skills rather than just making money. Accumulate capital until you’re skilled enough to identify opportunities. Choose a niche (e.g., swing trading, small-cap, mid-cap, large-cap) and dive deep. Practice via simulated trades and build capital through Web3 side gigs (e.g., web development, community management, graphic design).

Step 3: Begin Trading with Saved Capital

Once confident in your skills and with some capital saved, begin investing cautiously. On Ethereum, one ETH may be sufficient if you can spot opportunities accurately. Be selective, strictly manage profits, and cut losses quickly.

Step 4: Make Long-Term Investments

With a stable portfolio, allocate a meaningful portion to long-term holdings in projects you believe in. Hold until conviction fades. Even achieving 3–5x on a major part of your portfolio is highly rewarding. While small bets on high-risk projects may yield big wins, aim to follow rational principles.

Sub-Five-Digit Portfolio

If you have low five-digit capital, follow the same strategy as sub-four-digit portfolios but reduce position size per trade to 10–15%. Stay extremely selective. With this amount, you can comfortably engage in chart-based trading—buying at support and selling at resistance for major pumps. As you approach the upper end of five digits, focus more on technical analysis and closely monitor volume.

Sub-Six-Digit Portfolio

Maintaining and growing a six-digit portfolio is challenging. Your goal should be to protect gains and deploy capital into valuable opportunities. The journey to seven figures will be slow and requires commitment to a long-term process. If you get in early, consider investing in new major pump coins. Compare holder count/market cap against recently outperforming coins, and check whether most people on Twitter are already watching it.

Risk Management: How to Manage Trading Risk

-

Set stop-loss conditions for every trade:

-

Identify and mark key support levels on charts. Exit promptly if price hits those levels and move on.

-

Avoid letting assets go to zero. Exit quickly if the trade isn’t working.

-

Invalidation conditions may include slowing volume, breaking key support, or legitimate FUD.

-

Plan exits in advance:

-

Before entering any trade, determine in advance where you’ll exit if things don’t go as planned.

-

Depending on your goals and risk tolerance, consider setting stop-losses even on established coins. For new, volatile coins, you might adopt a “10x or bust” mentality.

-

Monitor hype and sentiment:

-

For meme tokens, track hype and market sentiment on Telegram and Twitter.

-

Assess overall market sentiment, particularly around major coins and their spin-offs. If a major coin drops, related ones may fall harder.

-

Evaluate utility coins:

-

For utility tokens, monitor team activity and ensure consistent updates are being delivered.

-

Look for catalysts not yet priced into the market.

Examples of Poor Risk Management:

-

Holding assets without taking profits, turning large paper gains into losses.

Here are some concrete examples:

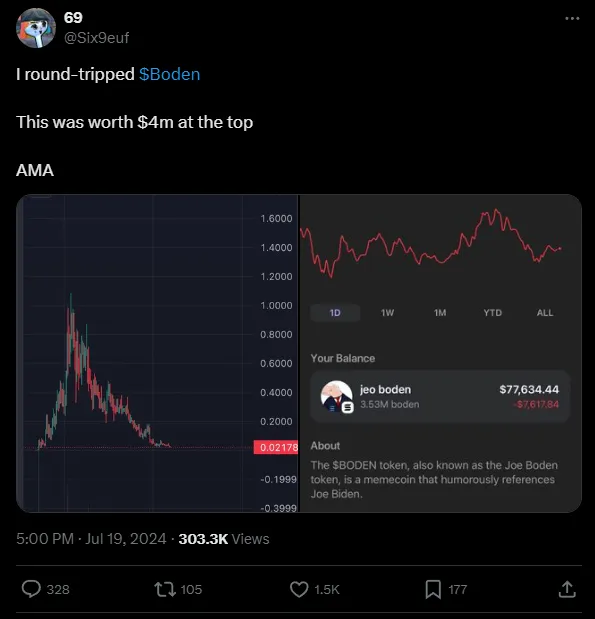

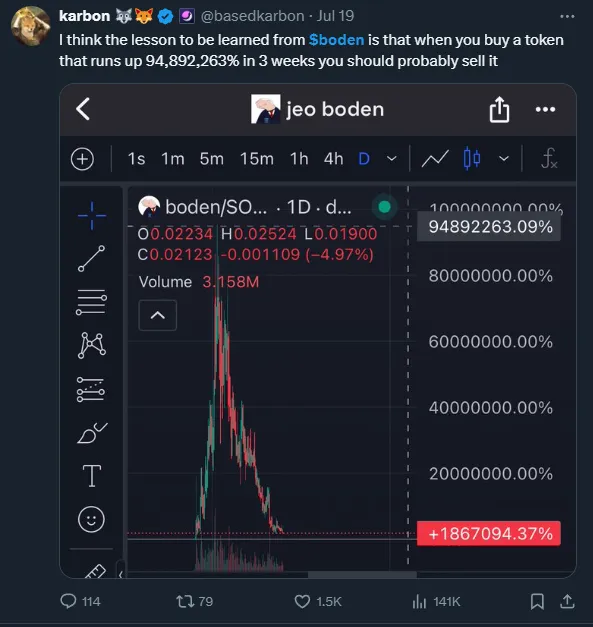

Lost $4 million in unrealized gains.

A whale sold $JUP for $BODEN at the top, losing 98%, turning $8 million into $85,000.

Zooming out helps gain a broader perspective.

Turned $9 into $40,000, then dropped back to around $1,600.

Elon Musk temporarily changed his Twitter profile picture to laser eyes. While a strong catalyst, when he changed it back, the price dropped sharply. Things change fast—often, if you haven’t taken profits ahead of time, you miss the optimal hedging window.

Psychological Framework and Self-Questioning

-

Reduce risk during extreme volatility:

-

Secure profits during sharp moves to lower overall exposure.

-

Ask yourself: Is the person talking about this coin known for pumping and dumping?

-

Identify why the coin is rising:

-

Determine the reason behind the rise. Is it pure speculation, or tied to developers from previously successful projects?

-

Recognize that peaks are often marked by widespread influencer hype or major events (e.g., Binance listing).

-

If you're excited and starting to take screenshots, that might be a sell signal.

-

Take profits incrementally:

-

Regular profit-taking is crucial. What matters is what you actually keep—not just paper gains.

-

Example strategy: Sell 25% at 3–4x to recover initial cost, then sell another 25% every 2–3x thereafter.

-

Keep 10–20% as a “moon bag” to stay invested and avoid regret after selling.

Useful Principles

-

Learn from mistakes:

-

Personal experience is the best teacher in trading. Lessons from losses are invaluable.

-

Advice about taking profits or checking contract addresses may not resonate until you’ve made the mistake yourself.

-

The pain from errors becomes a powerful future warning.

-

Value in simplicity:

-

Simple things are often overlooked because they don’t seem complex enough.

-

Observe the biggest movers during market rallies to identify the most watched sectors.

-

For example, consistently dollar-cost averaging into $MOG during June and July 2024 showed sustained outperformance.

-

Identify underperforming holdings during rallies to refine your focus.

-

Avoid overtrading:

-

Overtrading slowly erodes your portfolio. Constantly switching positions clouds mental clarity.

-

Stay disciplined: Do your research, build conviction, choose positions, and stick with them.

-

Learn to love selling:

-

Selling is psychologically harder than buying because of fear of missing massive gains.

-

Consistent profit-taking is usually more rewarding than chasing unlikely outsized returns.

-

Every day you hold a position, you’re actively choosing it over other potential opportunities.

-

Steady gains beat home runs:

-

Pursue multiple 3–5x returns instead of waiting for a 100x.

-

Scenario #1: Holding for 10–100x often means missing smaller, more reliable profits.

-

Scenario #2: Consistent 3–5x returns compound significantly over time.

-

Avoid re-entering profitable trades:

-

After achieving 2–4x, close the position and wait for a pullback before considering re-entry.

-

Post-victory excitement can lead to overconfidence and positive bias, increasing loss risk.

-

Removing a closed trade from your watchlist helps prevent emotional re-entry.

-

Be cautious of your emotions:

-

In crypto, the right decision often feels wrong. Selling during hype or buying during dips may feel contrarian—but it’s profitable.

-

Recognize that emotions like excitement and fear can mislead you; decisions should be based on rational analysis.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News