Positive Bitcoin and Ethereum ETF inflows align with strong U.S. economic growth

TechFlow Selected TechFlow Selected

Positive Bitcoin and Ethereum ETF inflows align with strong U.S. economic growth

Ethereum ETFs have attracted slightly more than a quarter of the funds that Bitcoin drew in the same phase.

Author: ECOINOMETRICS

Compiled by: TechFlow

Today’s content includes:

-

Bitcoin ETFs gaining momentum.

-

ETH vs BTC ETFs – comparing launch performance.

-

Strong U.S. economic growth.

Each topic comes with an explanation and a chart—let’s dive in.

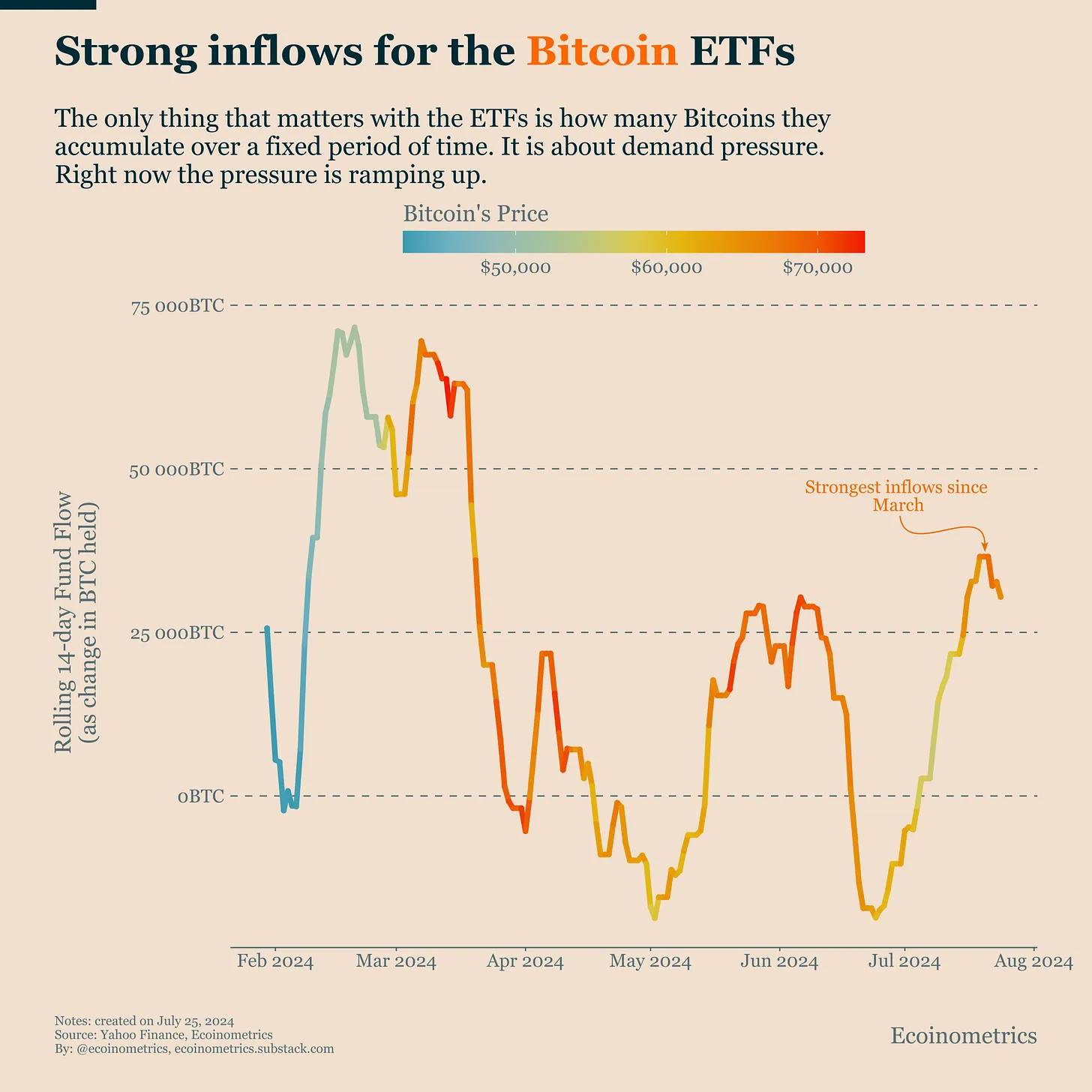

Bitcoin ETFs Gaining Momentum

Ignoring the stock market, it seems everyone had a decent week.

First up: Bitcoin ETFs.

Bitcoin ETFs just recorded their strongest capital inflows since March (measured by cumulative flow over a 14-day rolling window). If this trend continues, Bitcoin may finally break out of its current price range.

The more funds flow in over time, the greater the demand pressure on the liquid supply pool, increasing the likelihood of a BTC price surge.

(The chart shows strong inflows into BTC ETFs. What matters most for ETFs is how much Bitcoin they accumulate over fixed periods, reflecting demand pressure. Currently, that pressure is rising.)

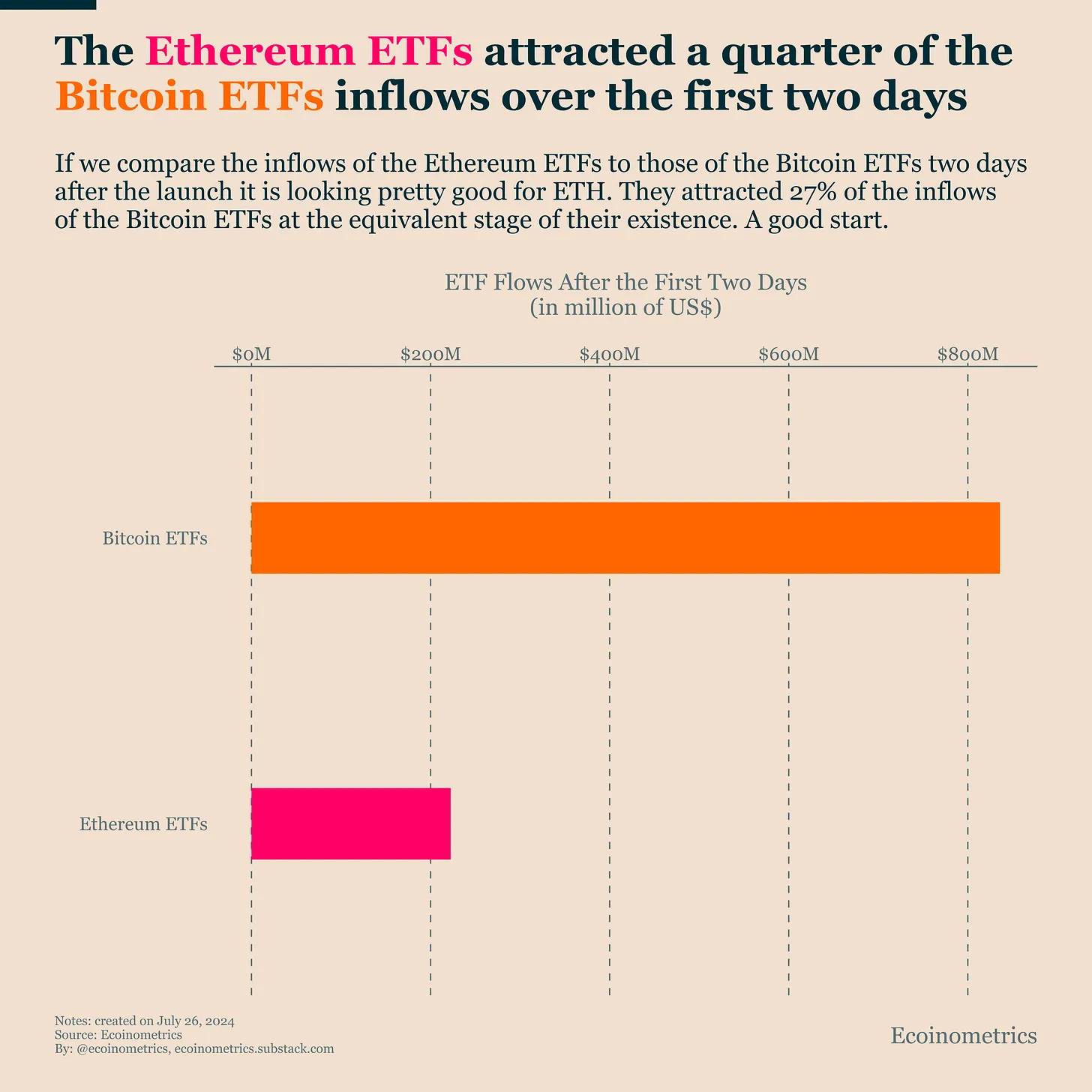

Ethereum ETFs vs BTC ETFs: Launch Performance Comparison

So far, spot Ethereum ETFs have performed quite well this week.

They’ve just launched and attracted what I consider solid initial inflows.

In the chart below, you can compare:

-

Net flows into Bitcoin ETFs during their first two days

-

Net flows into Ethereum ETFs during their first two days this week.

Ethereum ETFs managed to attract slightly more than a quarter of the capital that Bitcoin ETFs drew in during the same phase.

Considering (as I described here) Ethereum ETFs are inherently less attractive than Bitcoin ETFs, this is a pleasant surprise.

Let’s wait and see.

(The chart shows ETF inflows over the first two days. Ethereum ETFs attracted about one-quarter of the inflows seen in Bitcoin ETFs during their initial two days. Comparing ETH ETFs to BTC ETFs during their first two days post-launch, this is quite strong performance. ETH ETFs captured 27% of BTC’s inflow at a comparable stage—an encouraging start.)

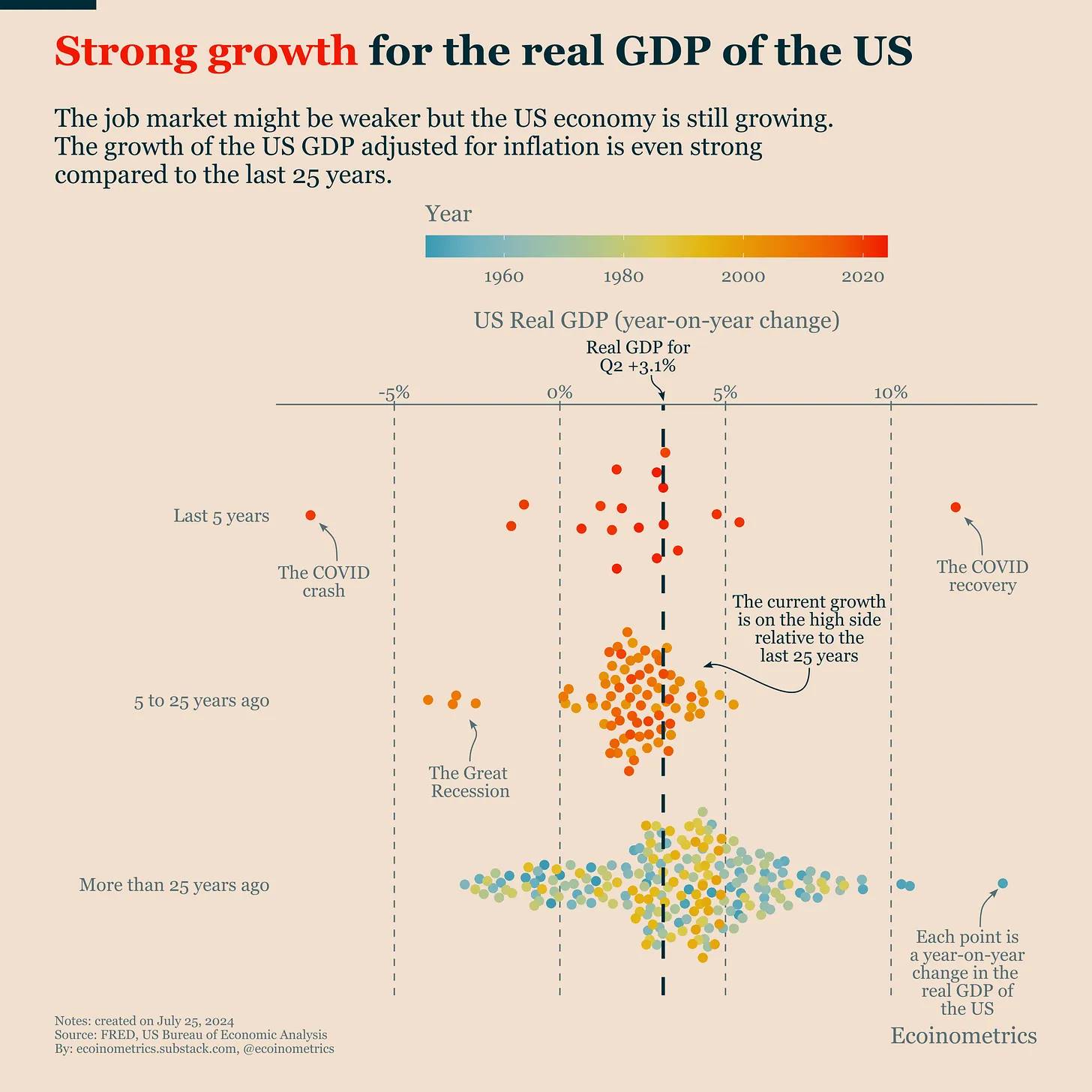

Strong U.S. Economic Growth

When I look at shifts in the job market, I often wonder if the U.S. is heading into recession.

But then I see that real U.S. GDP (inflation-adjusted) grew 3.1% year-over-year, and I think, "Hmm, okay, maybe it's not that simple."

It never is. Historically, it’s nearly impossible to predict next quarter’s GDP based on the prior quarter’s reading. So, a strong Q2 doesn’t guarantee smooth sailing for the rest of the year.

Still, we’re seeing another instance of “good news is bad news” in equities. As always, investors are focused on the Fed. Any data that could delay rate cuts tends to hurt risk assets.

Ultimately, monetary policy dominates financial markets. No point fighting it.

(The chart shows U.S. real GDP. U.S. real GDP is growing strongly. Despite softness in the labor market, the economy continues to expand. Inflation-adjusted U.S. GDP has performed well over the past 25 years.)

That’s all for today—hope you enjoyed it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News