June Secondary Market Report: Clear Signs of a Buyer's Market, Asset Purchase Demand Exceeds Listings by 75%

TechFlow Selected TechFlow Selected

June Secondary Market Report: Clear Signs of a Buyer's Market, Asset Purchase Demand Exceeds Listings by 75%

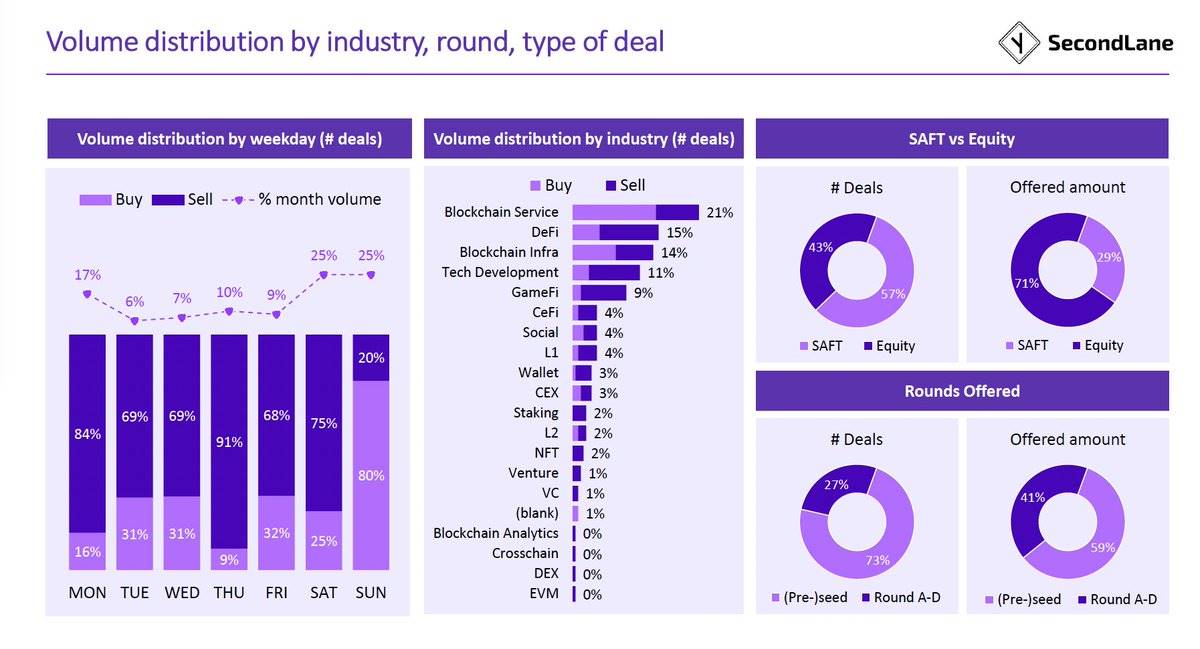

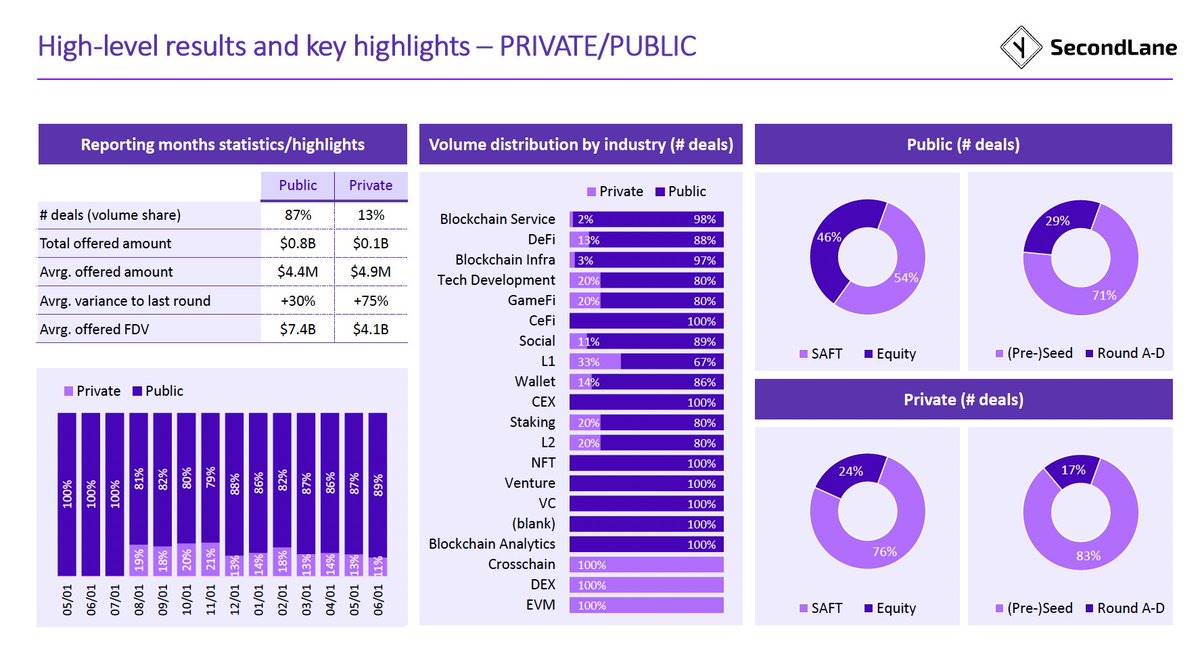

In June, 70% of transactions were concentrated in five sectors: blockchain services, DeFi, infrastructure, technical development, and GameFi.

Author: SecondLane

Compiled by: TechFlow

-

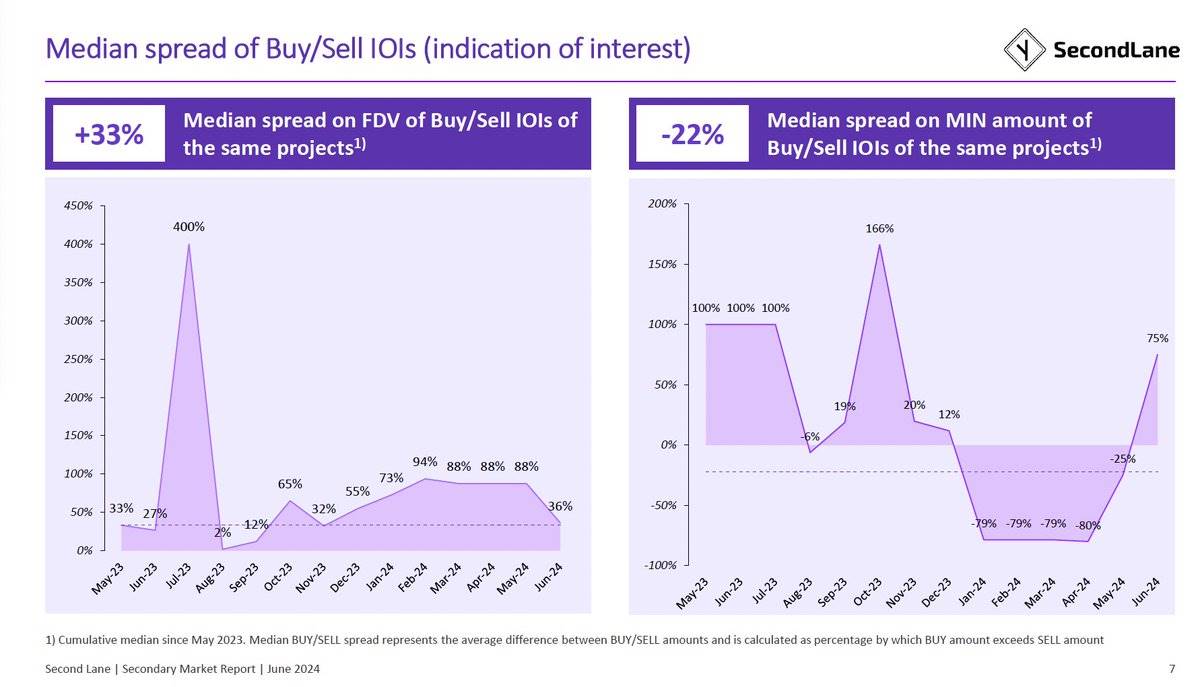

June marked the first month this year with a clear buyer's market, where buy requests outnumbered sell offers by 75%!

-

The valuation gap between bid and ask prices for the same asset dropped from 88% last month to 36%.

-

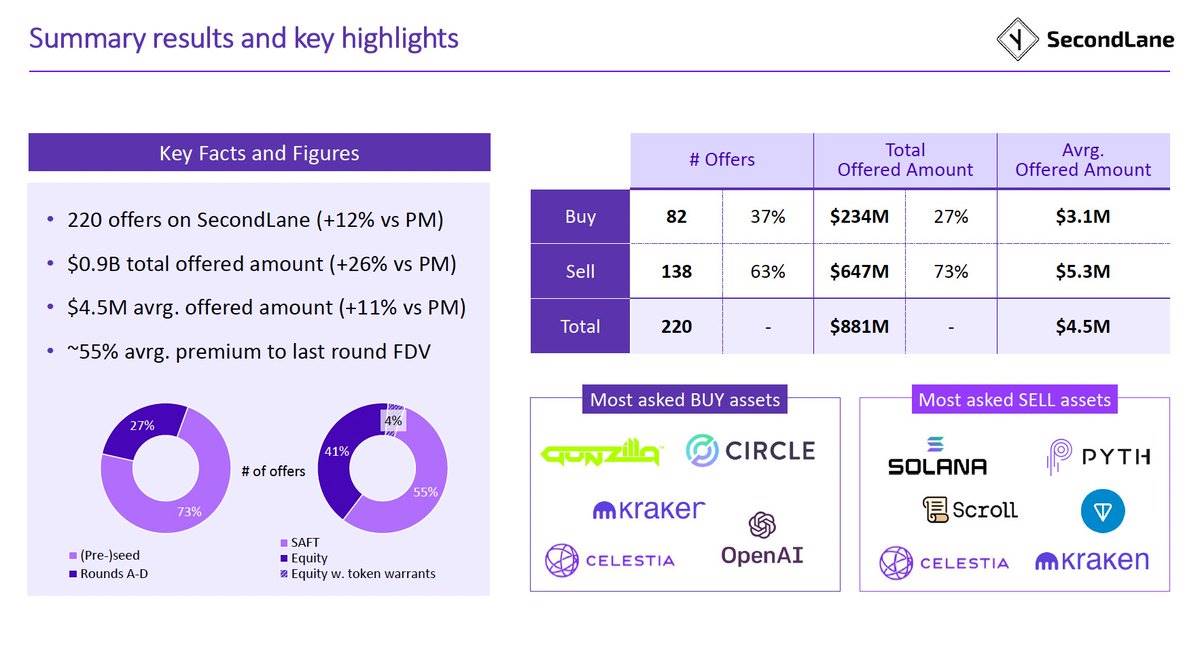

Total order book value in June 2024 reached $883 million.

-

Average offer size was $4.5 million, a significant increase from $3.9 million last month.

-

Average premium stood at 55% above the previous fully diluted valuation.

-

Key projects: Circle, Solana, Scroll, Kraken, Celestia, TON, Pyth, Gunzilla, OpenAI.

-

57% of transactions were SAFTs, 44% were equity deals.

-

73% of transactions were (early) seed rounds, 27% were Series A to D rounds.

-

70% of transactions concentrated in five sectors: blockchain services, DeFi, infrastructure, tech development, GameFi.

-

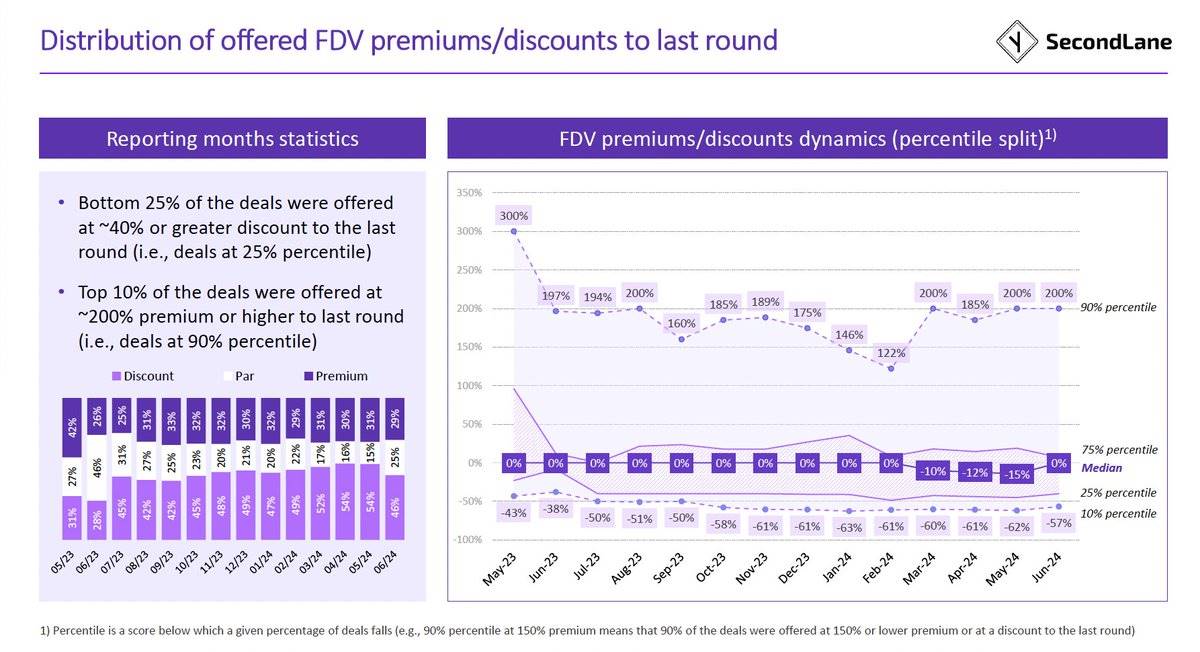

Transactions with premiums over the prior round decreased by 2%.

-

Transactions matching the prior round increased by 10%.

-

46% of transactions occurred at a discount in June, 25% at par, and 29% with a premium over the prior round.

-

The median discount across all June transactions was 15% below the prior round.

-

Top 10% of transactions offered premiums of 200% or more over the prior round.

-

Bottom 25% of transactions offered discounts of 40% or more compared to the prior round.

-

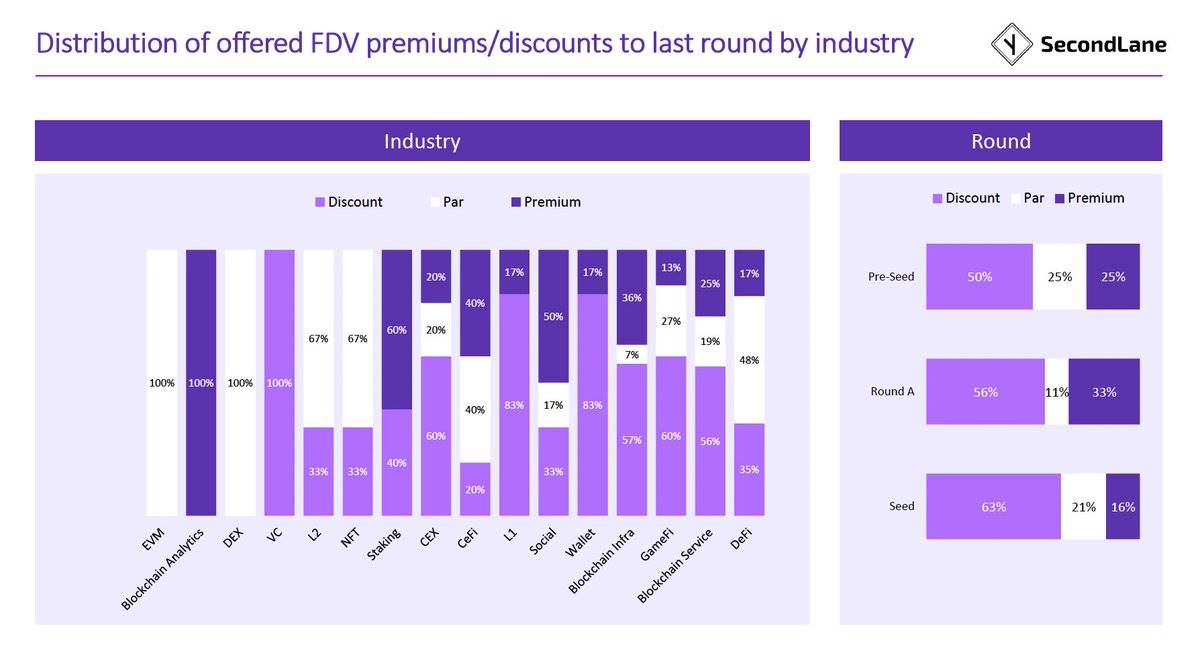

LP positions in VC funds, CEXs, L1s, wallets, GameFi, and blockchain infrastructure and services enjoyed the largest discounts.

(TechFlow note: In this article, "discount" refers to transactional discounts, meaning certain assets traded at prices lower than their previous funding round or market price. For example, some deals were transacted below the price of the last funding round—this is referred to as a "discount.")

-

Blockchain analytics and staking projects commanded the highest premiums.

-

Series A projects enjoyed the highest premiums, while seed round projects saw the largest discounts.

-

13% of transactions circulated without public exposure, at lower valuations (non-publicly quoted fully diluted valuation was $4.1 billion vs. $7.4 billion for publicly quoted).

-

Most private placements were SAFTs (76%), at the (early) seed stage (83%), targeting DEXes, EVMs, and cross-chain solutions.

-

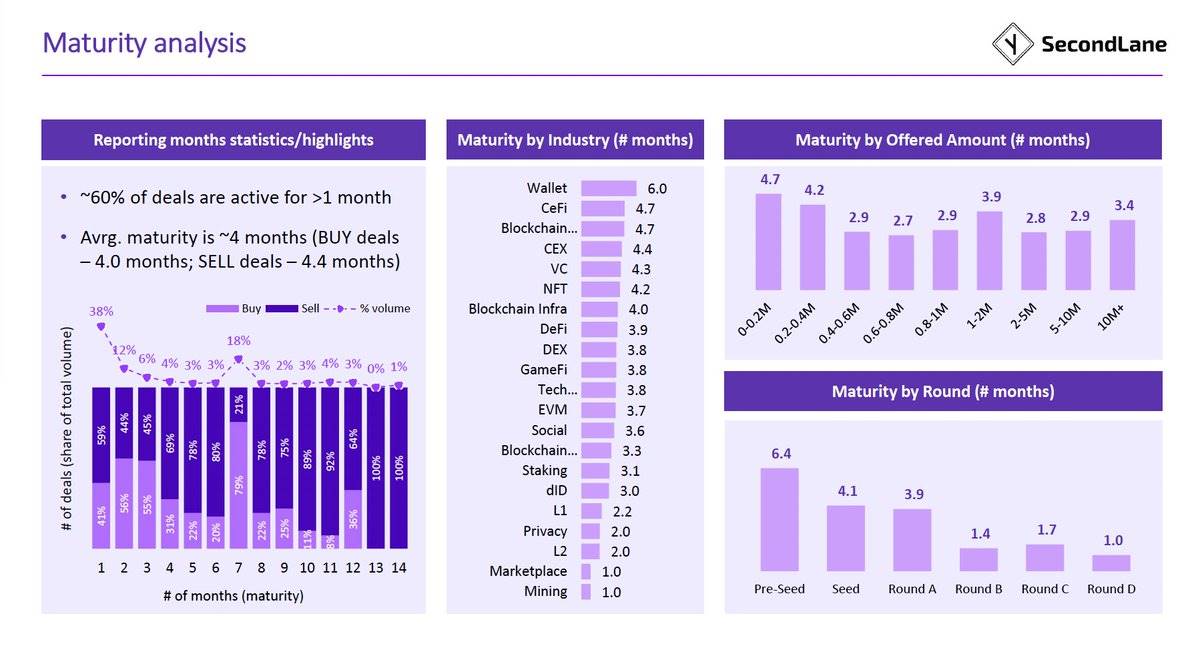

Average time-to-expiry increased to 4 months for buy requests and 4.4 months for sell offers until expiry or completion.

-

60% of transactions remained active for over one month.

-

Longest expiry times:

-

Early vs. late stages: Early seed rounds had 6.4 months; seed and Series A around 4 months; Series B, C, D over 1 month.

-

CeFi, wallets, CEX projects, VCs, NFTs, blockchain infrastructure.

-

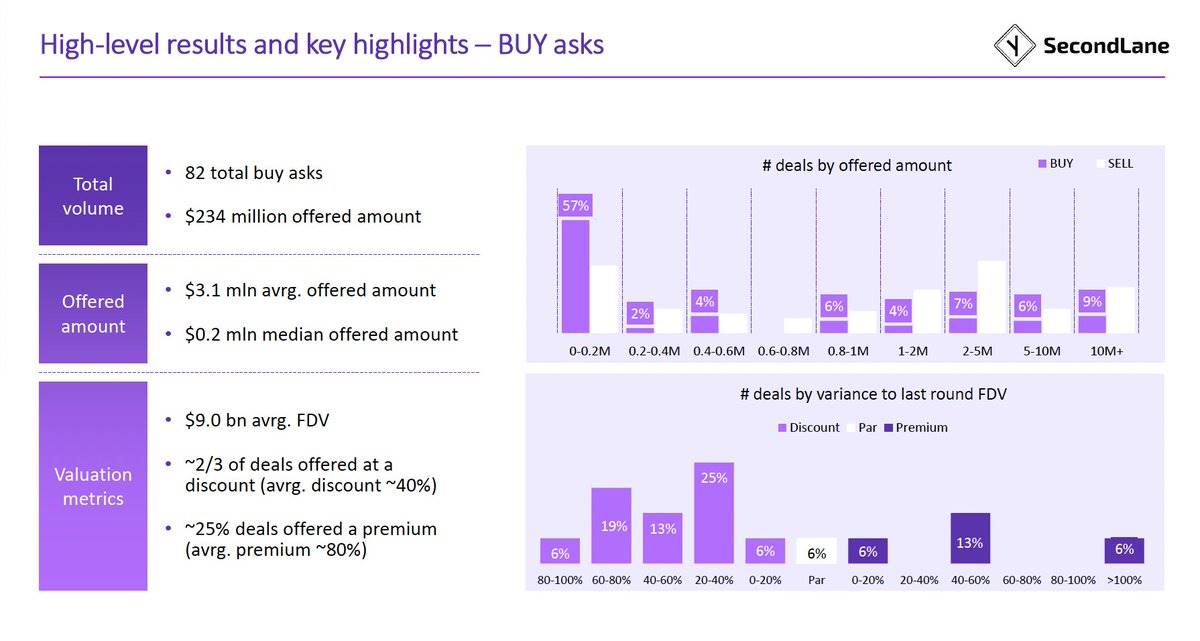

Median buy request was $200,000, with an average valuation of $9 billion.

-

Two-thirds of buy requests were made at a discount (average discount of 40% from prior or spot price); 6% at par; 25% demanded an average premium of over 80%.

-

Median sell offer was $2 million, with an average valuation of $6.5 billion.

-

40% of transactions occurred at a discount (average discount 45%); 32% at par; 29% demanded a premium (average over 270%).

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News