Crypto Oasis in the Desert: Overview and Application Guide for Dubai VASP Licenses

TechFlow Selected TechFlow Selected

Crypto Oasis in the Desert: Overview and Application Guide for Dubai VASP Licenses

Any company wishing to conduct virtual asset activities in Dubai (excluding DIFC) or from Dubai must obtain a VASP license prior to commencing operations.

By ManQin Blockchain Legal Services

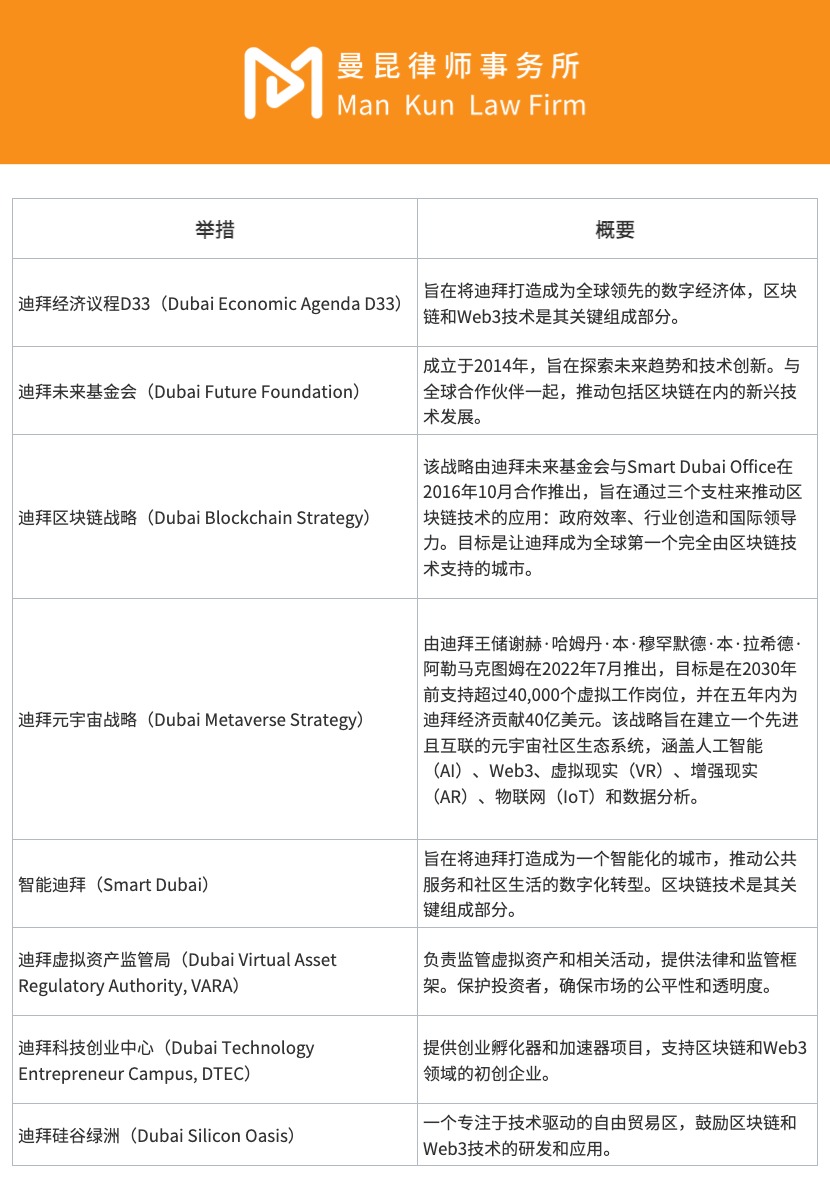

The Dubai government has long provided comprehensive support for the blockchain and Web3 industries, laying a solid foundation for digital opportunities through initiatives such as the Dubai Blockchain Strategy launched in 2016, the UAE Centre for the Fourth Industrial Revolution established in 2019 by the Dubai Future Foundation in collaboration with the World Economic Forum, and the Dubai Metaverse Strategy in 2022.

Ambitious government strategies and a world-class business-friendly environment underpin Dubai's appeal as a hub for digital innovation—especially for entrepreneurs and investors in the blockchain and Web3 sectors. Dubai’s Virtual Asset Service Provider (VASP) regime is renowned for its clear regulatory framework, high-level regulatory expertise, approachable regulatory posture, and balanced emphasis on encouraging innovation while mitigating risks. It continues to attract a steady stream of global blockchain and Web3 entrepreneurs and investors, with industry giants also flocking to establish their presence here.

Dubai Virtual Assets Regulatory Authority and Its Regulatory Framework

Under Law No. (4) of 2022 Regulating Virtual Assets in the Emirate of Dubai, the Virtual Assets Regulatory Authority (VARA) was established in March 2022 as the competent authority responsible for regulating virtual assets and virtual asset activities across all areas of the Emirate of Dubai—including special development zones and free zones, except the Dubai International Financial Centre (DIFC). VARA plays a central role in developing Dubai’s advanced legal framework to protect investors, establish international standards for virtual asset industry governance, and support the vision of a borderless economy.

Dubai’s regulatory framework for virtual assets consists of a comprehensive, top-down system of laws and regulations. At the legislative level, Law No. (4) of 2022 Regulating Virtual Assets in the Emirate of Dubai occupies the highest tier, while the Virtual Assets and Related Activities Regulations 2023 provide a detailed and specific regulatory framework covering licensing, anti-money laundering (AML) and countering the financing of terrorism (CFT), marketing regulation, and more, aiming to deliver regulatory certainty. This framework is built upon principles of economic sustainability and cross-border financial security. The UAE remains committed to safely harnessing these drivers, continuously updating its supervisory and regulatory approaches to address global money laundering (ML) and terrorist financing (TF) risks arising from the misuse of new technologies.

Part V of the Regulations, known as the VA Activities Rulebook, constitutes a complete and comprehensive compliance guide. It is divided into two parts: the Mandatory Rules Book, applicable to all VASPs, and the VA Activities and Other Rules Books, which contain specific conduct requirements tailored to each of the eight different VASP license types.

The Mandatory Rules Book serves as a universal compliance guideline and is critically important. The Corporate Rules Book outlines how VASPs must organize and manage their corporate structure, board, executives, and employees, and maintain appropriate internal controls and management systems. It also covers corporate governance requirements and ESG responsibilities. The Compliance and Risk Management Rules Book sets out general principles for regulatory compliance and implementation of compliance management systems, including the appointment of a compliance officer, record-keeping, and audit requirements. It further stipulates that VASPs must always comply with all applicable tax reporting obligations under relevant laws, regulations, rules, guidance, and national, international, and industry best practices, including the U.S. Foreign Account Tax Compliance Act (FATCA). The Technology and Information Rules Book governs technology governance, controls, and security—including cybersecurity obligations (as well as other legal and regulatory requirements)—and mandates compliance with personal data protection requirements and compliance programs. The Market Conduct Rules Book provides guidance on marketing, advertising, and promotional regulations and requirements.

VASP Licenses and Their Classification

VARA has identified eight distinct regulated virtual asset (VA) activities and classified the scope of regulation accordingly. Any Virtual Asset Service Provider (VASP) wishing to offer any of the following virtual asset activities—whether serving residents of the Emirate or, where permitted, global clients—must apply for and obtain a license from VARA before commencing operations within the Emirate of Dubai.

The Dubai Virtual Asset Service Provider (VASP) licenses include:

1. Virtual Asset Advisory Services

"Advisory services" refer to providing advice to clients on one or more actions or transactions related to any virtual asset, either at the client’s request or proactively initiated by the advising entity. These services aim to help clients understand and navigate the complexities of the virtual asset market by offering professional advice and strategic guidance to enable informed decision-making. Advisory services may include market analysis, risk assessment, investment strategy recommendations, and regulatory compliance guidance, ensuring clients’ operations in the virtual asset space are secure and lawful.

2. Virtual Asset Broker-Dealer Services

"Broker-dealer services" refer to any of the following:

[a] arranging orders for purchase and/or sale of virtual assets between two entities; [b] soliciting or accepting orders for virtual assets and receiving monetary or other virtual asset consideration for such orders; [c] facilitating the matching of virtual asset transactions between buyers and sellers; [d] acting as a dealer trading virtual assets for its own account; [e] using client assets to engage in market trading involving virtual assets; or [f] providing distribution, placement, or other issuance-related services to issuers of virtual assets. These services aim to provide clients with convenient access to virtual asset trading, ensuring smooth execution and secure asset management through professional brokerage services.

3. Virtual Asset Custody Services

"Custody services" refer to holding virtual assets on behalf of another entity and acting solely upon verified instructions issued by or on behalf of that entity. Note: Only VASPs that hold each client’s assets in separate VA wallets are eligible for a custody services license. Custody services provide a secure method of asset safekeeping, reducing the risk of theft or loss, and ensuring clients’ assets are strictly managed and protected at all times.

4. Virtual Asset Trading Services

"Trading services" refer to any of the following:

[a] exchanging, trading, or converting virtual assets and fiat currency; [b] exchanging, trading, or converting between one or more virtual assets; [c] matching orders between buyers and sellers and conducting exchanges, trades, or conversions of [i] virtual assets and fiat currency or [ii] one or more virtual assets; or [d] maintaining an order book to facilitate the fulfillment of the above activities [a], [b], or [c]. Trading services aim to provide diverse virtual asset trading options, meet varying client transaction needs, and enhance market liquidity and trading efficiency.

5. Virtual Asset Lending Services

"Lending services" refer to executing a contract whereby a virtual asset is transferred or loaned from one or more parties (lenders) to one or more parties (borrowers), with the borrower committing to return the virtual asset to itself or on behalf of others upon the lender’s request, within a specified period or at any time upon its conclusion. Lending services offer users a flexible capital management tool, meeting short- or long-term funding needs while safeguarding the interests and security of both lenders and borrowers.

6. Virtual Asset Management and Investment Services

"Virtual asset management and investment services" refer to acting on behalf of an entity as an agent or fiduciary, or otherwise being responsible for managing, administering, or disposing of that entity’s virtual assets. This includes but is not limited to:

[a] investment management services or other forms of virtual asset management; and [b] responsibility for "staking" virtual assets to earn fees or other value paid to validators and/or node operators on "proof-of-stake" distributed ledger technologies.

These services aim to help clients effectively manage and grow their virtual assets through professional investment strategies and management techniques to maximize returns.

7. Virtual Asset Transfer and Settlement Services

"Transfer and settlement services" include companies engaged in transmitting or transferring virtual assets from one entity to another, or from one entity to another VA wallet, address, or location. These services ensure secure and efficient transfer of virtual assets, reduce risks during the transfer process, and enhance customer experience.

8. Virtual Asset Issuance Category 1

"Issuance Category 1" refers to issuing fiat-referenced virtual assets (FRVAs), commonly known as "stablecoins." These virtual assets claim to maintain a stable value relative to one or more fiat currencies but do not have legal tender status in any jurisdiction. The issuance of stablecoins provides the market with a relatively stable medium of exchange, helping to reduce market volatility and improve transaction stability and predictability.

These VASP license types and corresponding service specifications provide detailed operational guidelines for virtual asset service providers, ensuring compliance with relevant regulatory requirements and protecting clients’ rights, interests, and asset security.

Below is an overview of the Dubai VASP licensing landscape.

VASPs may apply for authorization for multiple activities and consolidate them under a single overarching license, unless custody services are involved. VASPs authorized for multiple activities must fully satisfy the requirements for each activity and remain compliant at all times.

Virtual asset custody is the only regulated activity that must be separated from other virtual asset service license categories. In such cases, the custodian must be established as a separate legal entity with independent governance and non-affiliation, and must hold a standalone license.

Additionally, licensed VASPs are prohibited from engaging in proprietary trading or trading their group’s asset portfolios under their regulated activity license. To ensure fair and transparent market operations, a separate company must be established for proprietary trading. Clear separation between proprietary trading and group asset management is required to prevent potential conflicts of interest and ensure all clients trade in a fair and protected environment.

Application Process

Any company wishing to conduct virtual asset activities in Dubai (excluding the Dubai International Finance Centre, DIFC) or from Dubai has a legal obligation to obtain a license from VARA prior to commencing operations.

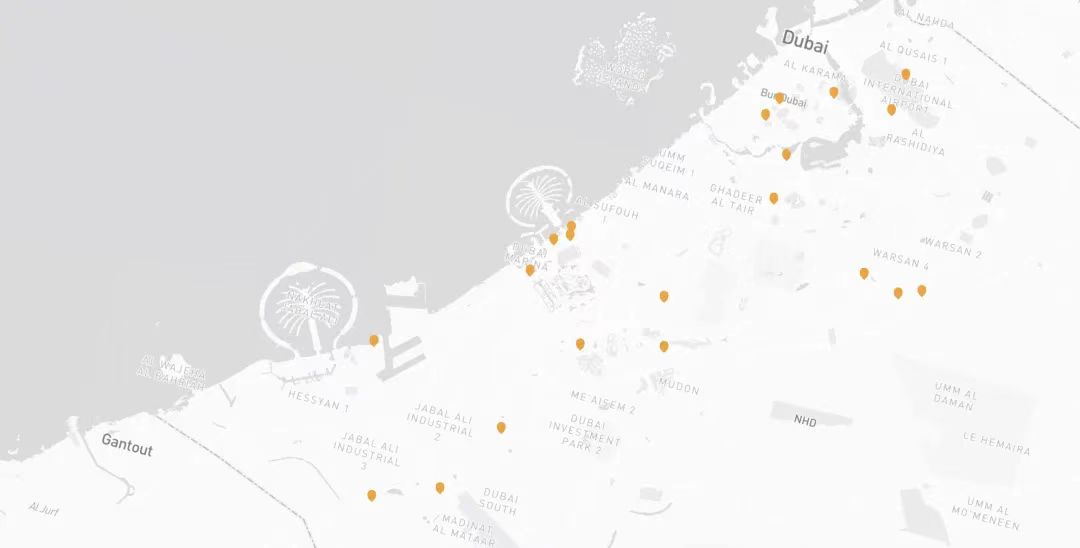

Mainland companies can submit applications through Dubai’s Department of Economy and Tourism (DET) or through any Dubai Free Zone (FZ) within the Emirate (excluding DIFC). Free zones are special economic areas offering tariff incentives and tax exemptions to investors, each governed by its own set of specialized regulations. Benefits of establishing a company in a free zone include 100% foreign ownership, 100% repatriation of capital and profits, and fast, streamlined company setup. Over 20 free zones currently operate in Dubai, most specializing in one or more particular sectors and providing business licenses typically covering trade, services, and industrial activities.

For newly established companies, the application process is as follows:

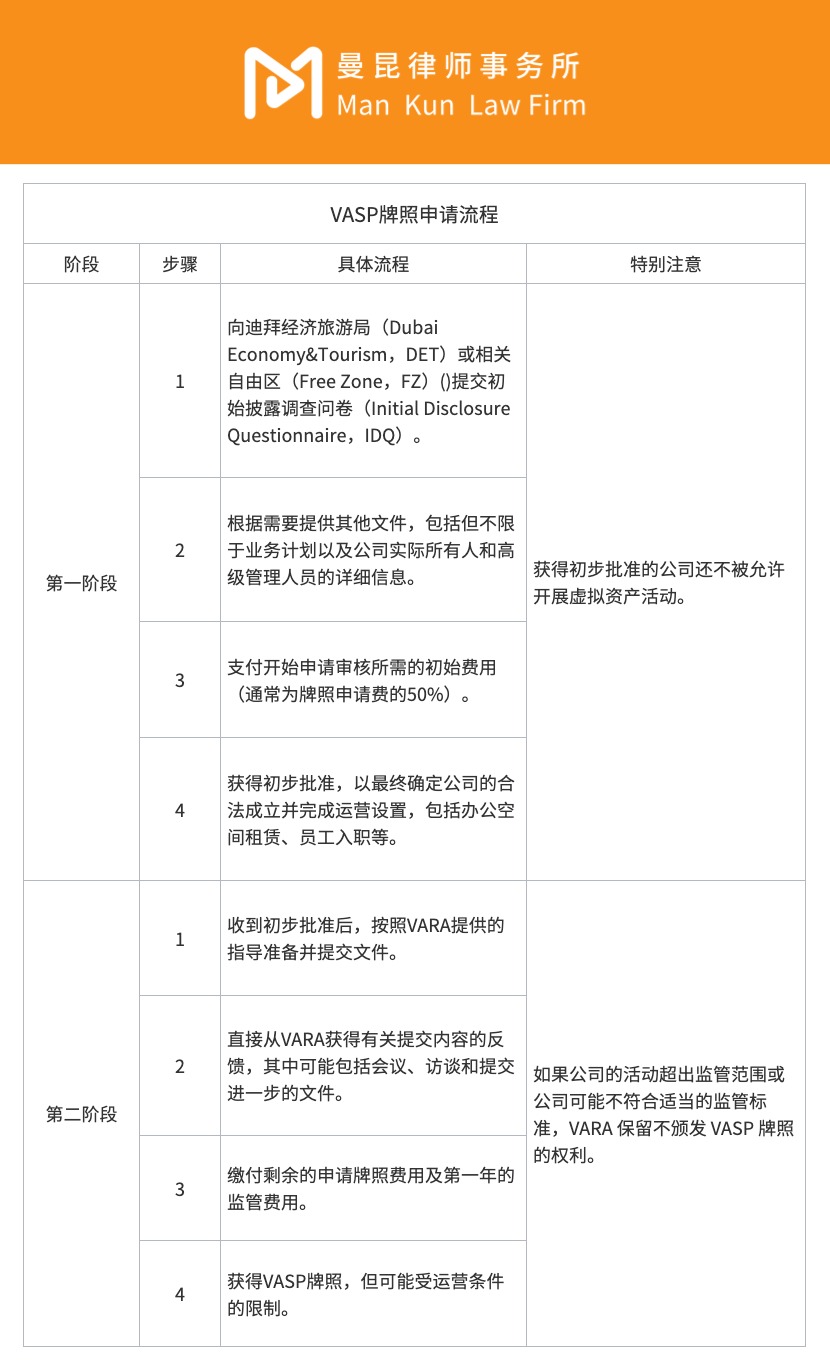

Phase One

-

Submit the Initial Disclosure Questionnaire (IDQ) to Dubai Economy & Tourism (DET) or the relevant Free Zone (FZ).

-

Provide additional documents as required, including but not limited to business plans and details of the company’s ultimate beneficial owners and senior management.

-

Pay the initial fee required to begin the application review (typically 50% of the total license application fee).

-

Receive preliminary approval to finalize the company’s legal incorporation and complete operational setup, including office space leasing and staff onboarding.

Note that even after receiving preliminary approval, companies are not yet permitted to conduct virtual asset activities during Phase One.

Phase Two

-

After receiving preliminary approval, prepare and submit documents in accordance with guidance provided by VARA.

-

Receive direct feedback from VARA on submissions, which may include meetings, interviews, and requests for additional documentation.

-

Pay the remaining license application fee and first-year regulatory fees.

-

Obtain the VASP license, possibly subject to operational conditions.

VARA reserves the right to withhold a VASP license if a company’s activities fall outside the regulatory scope or if the company fails to meet appropriate regulatory standards.

The VASP license application flowchart is shown below.

For companies that were already operating virtual asset businesses prior to February 2023 (legacy VA operators), VARA has invited all such entities to apply for the Dubai Legacy Program. This program enables organizations to transition seamlessly into VARA’s regulatory framework. VARA, in collaboration with the Department of Economy and Tourism and the Free Zone Council, has conducted various training sessions and outreach programs for this purpose.

As part of the regulatory process, VARA has required all existing legacy VA operators in Dubai to register by completing the Initial Disclosure Questionnaire (IDQ). VASPs who receive an Acknowledgement of Application Notice (AAN) may proceed to obtain either a Legacy Operating Permit (LOP) or a No Objection Certificate (NOC).

The Legacy Operating Permit (LOP) offers VASPs the opportunity to transition into the full virtual asset regulatory regime within a limited timeframe, provided they meet basic regulatory requirements. It also offers additional benefits, including up to a 50% discount on licensing fees and reduced capital requirements. Valid for 12 months, this permit gives VASPs sufficient time to develop and comply with full licensing and regulatory obligations.

Summary and Outlook

The establishment of the VASP regime represents a carefully considered strategic move by Dubai toward financial technology innovation. On one hand, it provides investors with a secure, transparent, and efficient market environment through strict compliance requirements and advanced risk management frameworks. On the other hand, as more compliant VASPs establish operations in Dubai, the city is poised to become a digital asset hub connecting East and West, facilitating the flow and integration of global financial resources.

The VASP regime is expected to act as a catalyst for financial technology innovation in Dubai, further advancing the development of blockchain, virtual assets, and other Web3 technologies. It also marks a valuable experiment by Dubai—driving technological and commercial innovation within a compliant framework. We look forward to Dubai ushering in a new era of a more open, inclusive, and mutually beneficial digital economy.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News