The Current State and Future Outlook of the DeFi Ecosystem on the TON Blockchain

TechFlow Selected TechFlow Selected

The Current State and Future Outlook of the DeFi Ecosystem on the TON Blockchain

Explore the current development and future opportunities of the DeFi ecosystem on Ton, and understand the key areas retail investors should focus on.

Author: dt, DODO Research

Editor: Lisa

This week’s market remains lackluster. In this edition of CryptoSnap, we continue discussing the on-chain ecosystem development of Ton. Dr. DODO will walk you through the current state of Ton DeFi, potential directions for future growth, and which areas retail investors should pay attention to!

Current State of Ton DeFi

Although DeFi hasn't been the dominant narrative in this cycle, its development remains a key indicator—and foundational element—of a thriving public chain ecosystem, and Ton is no exception.

As mentioned in the previous Cryptosnap, the basic DeFi applications on Ton—such as DEXs, lending, liquid staking, etc.—already exist at the first layer of DeFi Lego protocols, satisfying most retail users’ fundamental needs. However, there remain significant gaps for advanced DeFi users or whale farmers. Below are the five most critical areas where Ton's ecosystem still needs to grow:

-

Integration of mainstream assets BTC and ETH

-

More cross-chain bridge support

-

Oracles

-

Second-layer DeFi yield protocols

-

Memecoin infrastructure

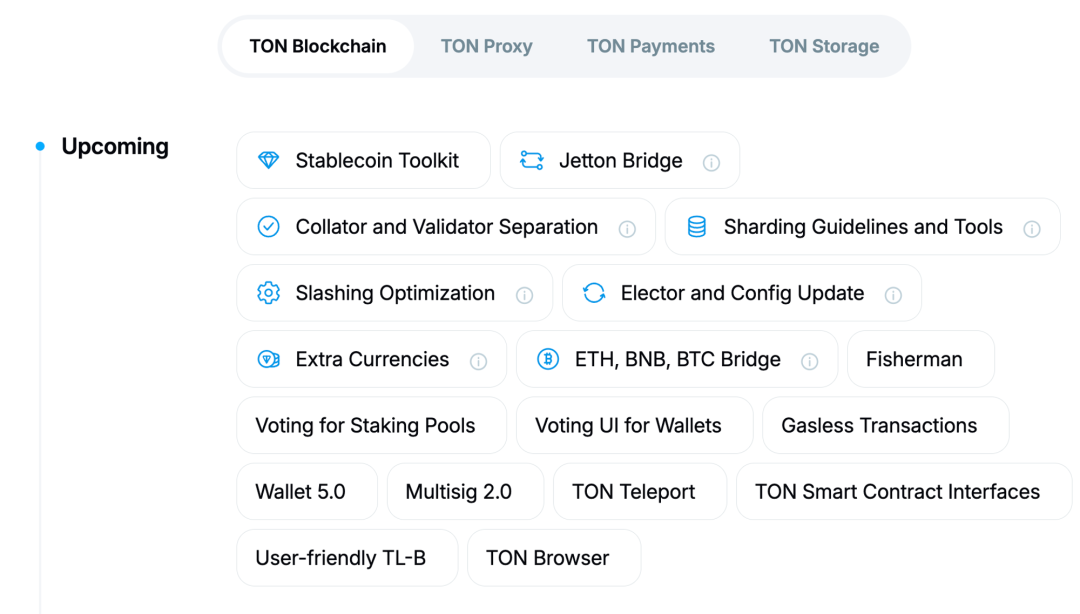

The first two points refer to the most basic requirements: cross-chain bridges and support for major external assets. The explosive growth of Ton’s TVL from $100M to $700M in Q2 2024 was primarily driven by native USDT integration. I believe the next breakthrough toward surpassing $1B TVL hinges on supporting other mainstream assets like BTC and ETH, along with more third-party bridges providing liquidity. This also aligns with the Ton Foundation’s roadmap goals for the upcoming quarter.

Source: https://ton.org/en/roadmap

The third point—oracles—determines whether more complex DeFi protocols can be implemented and is often a deciding factor for large players when evaluating participation. Currently, Redstone provides the primary oracle pricing solution in the Ton ecosystem. However, many whales still find Redstone insufficiently trustworthy. Integrating well-capitalized oracles such as Chainlink or Pyth could be pivotal for further TVL expansion.

The fourth point refers to second-layer DeFi yield protocols. While the foundational (first-layer) DeFi Lego components are already in place on Ton, higher-level yield-generating projects—such as stablecoin collateralization, wrapped interest-bearing assets, and yield strategy farms—remain scarce, especially those focused on high APR returns.

Finally, the last point reflects a major trend in this cycle: the mainstreaming of memecoins. In my view, Solana’s greatest success in this cycle wasn’t driven by DeFi apps, but rather by the explosive growth of memecoins, which in turn boosted DEX TVL. MemeFi is therefore another area worth heavy investment. Although several teams are already working in this space—such as TON Raffles, Ton UP, Thunder Finance—the real catalyst may require official coordination with venture capital to ignite a breakout moment, similar to how Solana’s $BONK and $WIF created wealth effects that sparked broader MemeFi adoption.

Mini APP

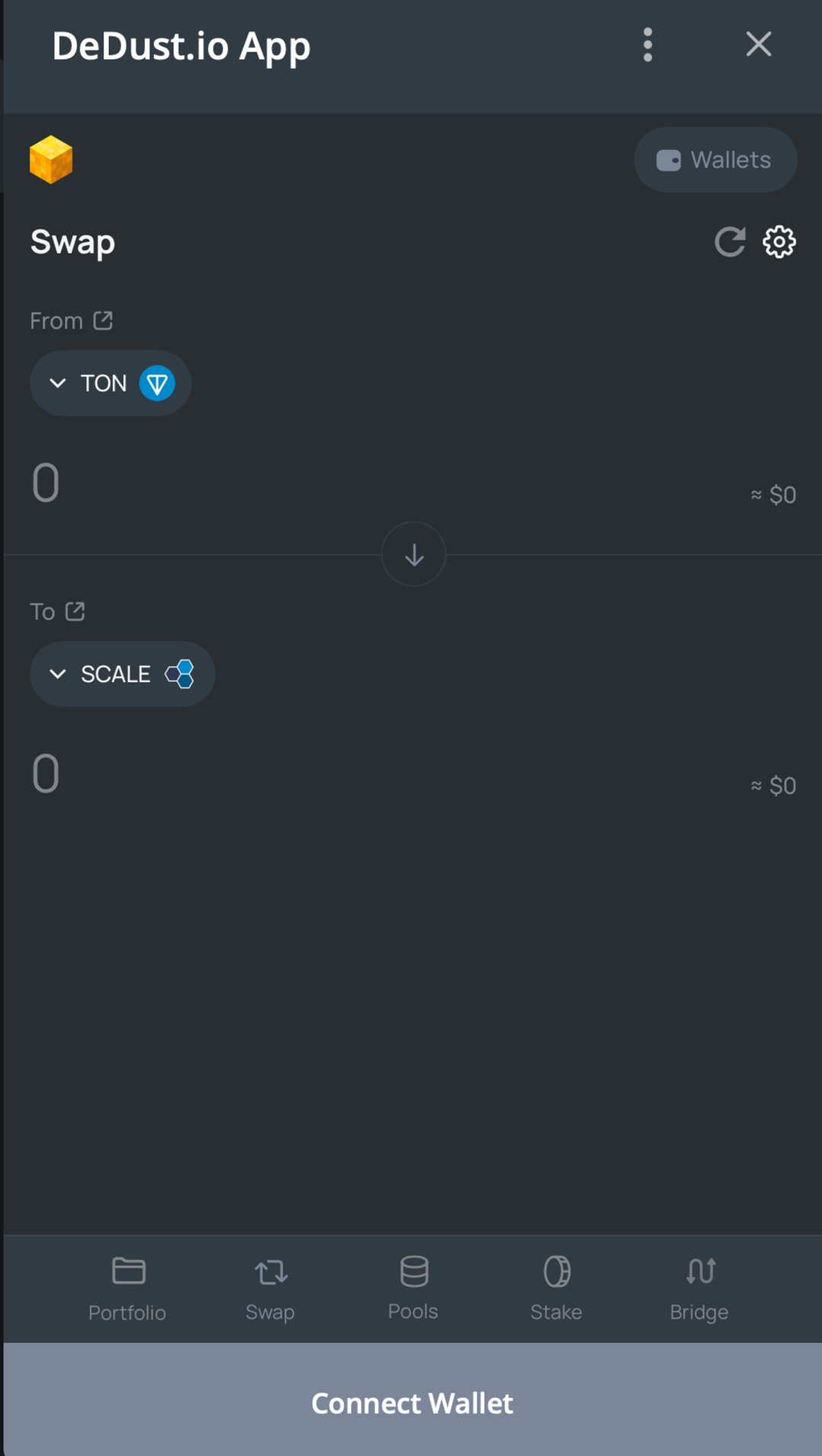

In my opinion, the standout feature of the Ton ecosystem is Telegram Mini Apps. While most current Ton Mini Apps are gaming-focused, nearly all leading DeFi applications on Ton now offer dual frontends: one standard web-based dApp interface and another via Telegram Mini App. This integration significantly narrows the gap between Ton’s DeFi services and Telegram’s massive user base, potentially capturing many new mobile users.

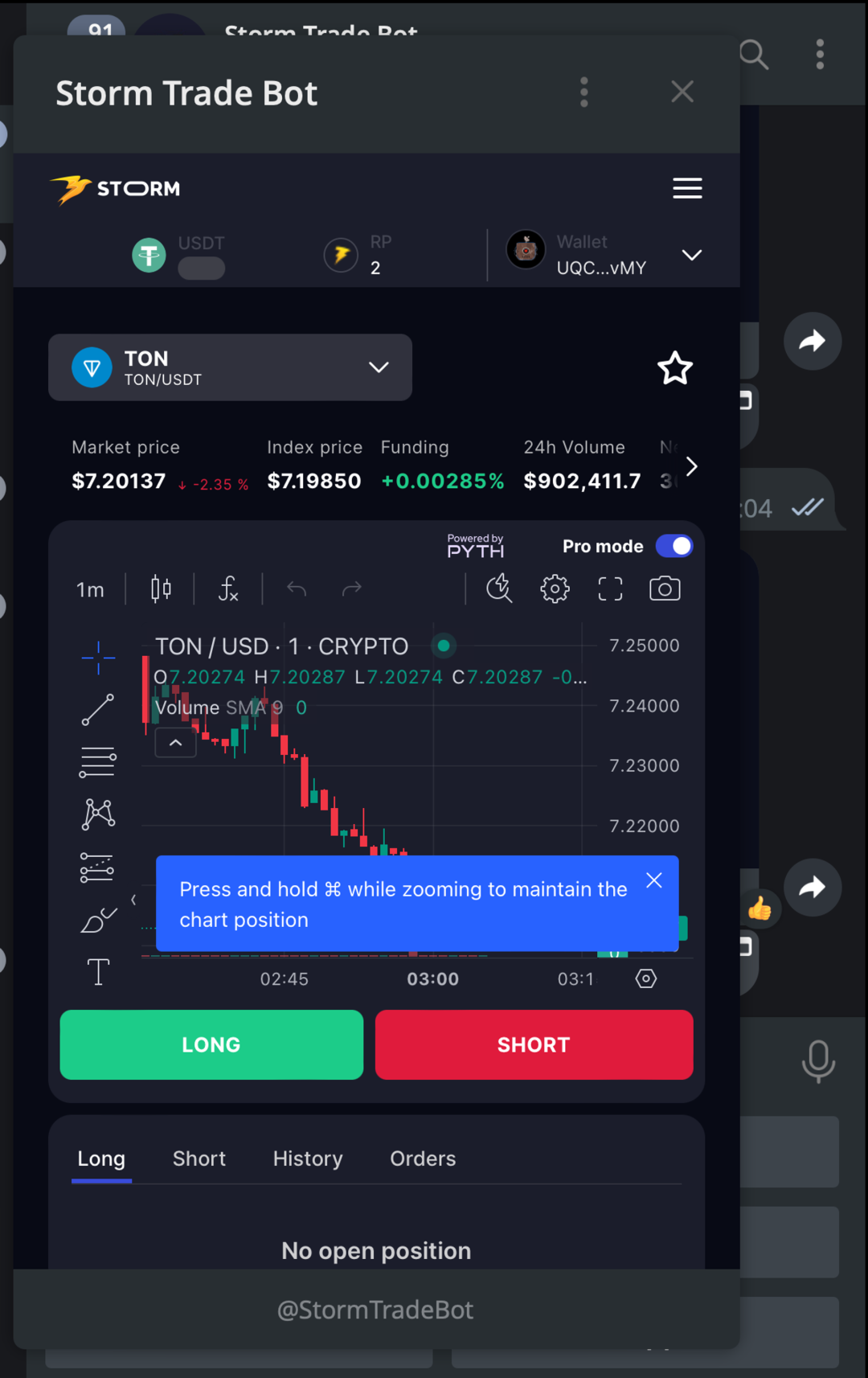

However, complex DeFi applications are generally unsuitable for mobile interfaces due to usability and security concerns. Mini Apps or Telegram chatbots are better suited for time-sensitive use cases like memecoin trading. Perhaps it will take the emergence of a “golden dog” memecoin on Ton to drive mass adoption of Mini Apps among retail traders.

Source: https://t.me/dedustBot

Source: https://t.me/StormTradeBot

The Open League Season 5

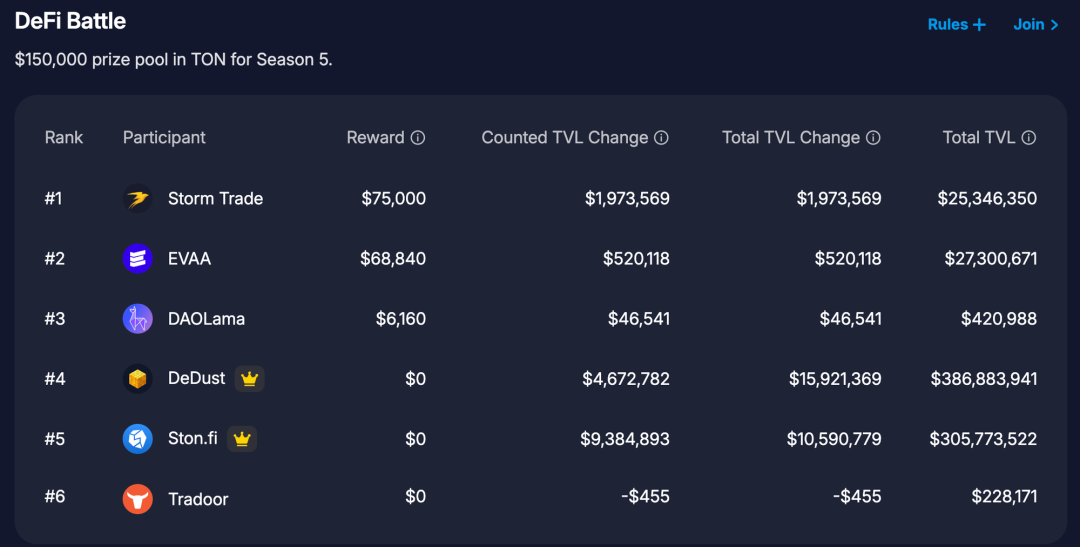

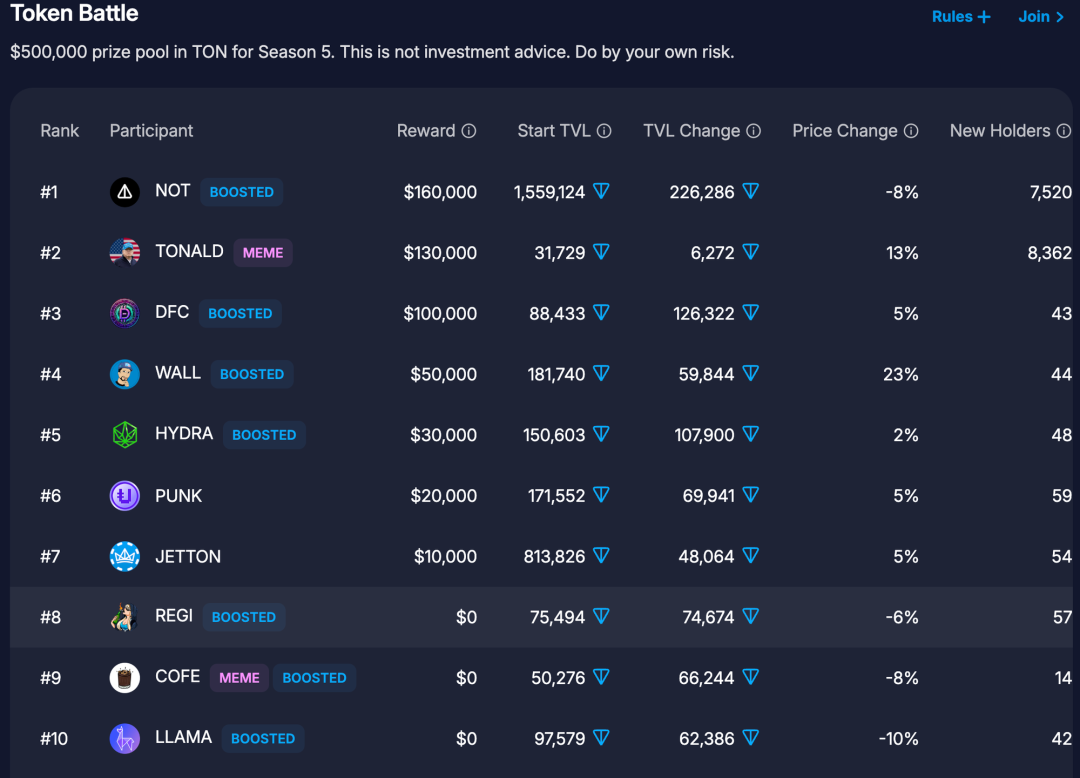

Lastly, let’s discuss The Open League Season 5, which recently launched. Frankly, I’m somewhat disappointed with the current state of Ton DeFi projects. Only six protocols are participating, identical to those in Season 4—with no new entrants. Among tokenized projects, only the NFT lending protocol DAOLama ($LLAMA) has managed to break into the top ten.

In terms of standings, Storm Trade—a derivatives-based perpetual contract protocol—has risen from third place last season to first, showing strong TVL growth. Conversely, Tradoor, another perpetual futures protocol, has regressed. EVAA, a lending protocol, ranks second; DAOLama, an NFT lending platform, takes third; while the two leading DEXs, DeDust and Ston.Fi, occupy fourth and fifth places respectively.

Source: https://ton.org/open-league

Source: https://ton.org/open-league

Author’s View

This article focuses on Ton’s DeFi development, which I believe still holds substantial room for growth. One challenge may stem from Ton’s use of a completely new programming language, increasing development barriers. So far, we haven’t seen strong backing from major VCs—unlike Multicoin and Jump Crypto’s early support for Solana—nor any standout developer figure emerging akin to Andre Cronje (AC) in Ethereum’s DeFi scene. That said, it’s still early, and Ton’s DeFi evolution remains highly worth watching.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News