A New Era of DeFi: Innovative Approaches to Cryptocurrency Trading and Position Swapping

TechFlow Selected TechFlow Selected

A New Era of DeFi: Innovative Approaches to Cryptocurrency Trading and Position Swapping

This Bing Ventures research outlook explores the potential ongoing impact of DeFi technology in the future.

Author: Bing Ventures

I. Introduction

With technological advancements and market adaptation, DeFi has the potential to further transform traditional financial market structures, offering participants more efficient, secure, and transparent trading options. This report by Bing Ventures explores the ongoing impact of DeFi technologies in the future, particularly their potential contributions to enhancing market inclusivity, reducing transaction costs, and improving market efficiency—with a focus on case studies involving Pendle and premarket (Premarket) trading.

Pendle introduces traditional interest rate trading and financial derivatives onto the blockchain through tokenization, innovatively separating principal and yield into financial products such as PT (Principal Token) and YT (Yield Token). In doing so, Pendle not only provides flexible interest rate trading mechanisms but also enhances liquidity and efficiency within the DeFi market. By decoupling principal tokens from yield tokens, Pendle enables investors to independently manage assets based on their risk preferences and market outlooks.

In traditional stock markets, premarket trading is typically limited to large institutional investors and high-net-worth individuals. However, under the Web3 paradigm, premarket trading has been revolutionized—platforms like AEVO and Whales Market leverage smart contracts and decentralized exchanges to enable broader participation. This transformation increases market transparency and security while also improving capital utilization efficiency and overall market liquidity.

II. Pendle’s Innovative Practice: Transforming Interest Rate Trading

In traditional finance, interest rate trading remains one of the most important financial instruments, influencing monetary supply, market liquidity, and directly shaping the yield curve. In Web3, with the advancement of blockchain technology and the rise of the DeFi ecosystem, interest rate trading is undergoing a fundamental transformation. DeFi-based interest rate trading is no longer constrained by cumbersome procedures or geographical limitations imposed by traditional financial institutions. Instead, it operates via smart contracts on decentralized platforms, delivering faster and more flexible financial services to users.

In 2024, within this emerging DeFi interest rate trading landscape, Pendle stands out as a pioneering leader. Pendle tokenizes yield-bearing assets into SY tokens—for example, wrapping stETH into SY-stETH—and then splits the SY token into two components: PT (Principal Token) and YT (Yield Token), enabling flexible management and optimization of yield returns.

As the concept of restaking gains traction and synthetic stablecoins grow in scale, new opportunities emerge in the interest rate swap market, significantly expanding its potential size. Using Pendle as an example, we will explore these novel PT/YT use cases and examine their implications for the DeFi interest rate trading ecosystem and future development prospects.

The Market Potential of Interest Rate Trading

Taking Pendle—the current largest interest rate market—as an example, it briefly gained attention back in 2021 when few understood how Pendle's interest rate swaps could be applied in blockchain markets. Today in 2024, amid the explosion of LRT projects and the emergence of ETHENA, Pendle appears to have found its optimal path forward.

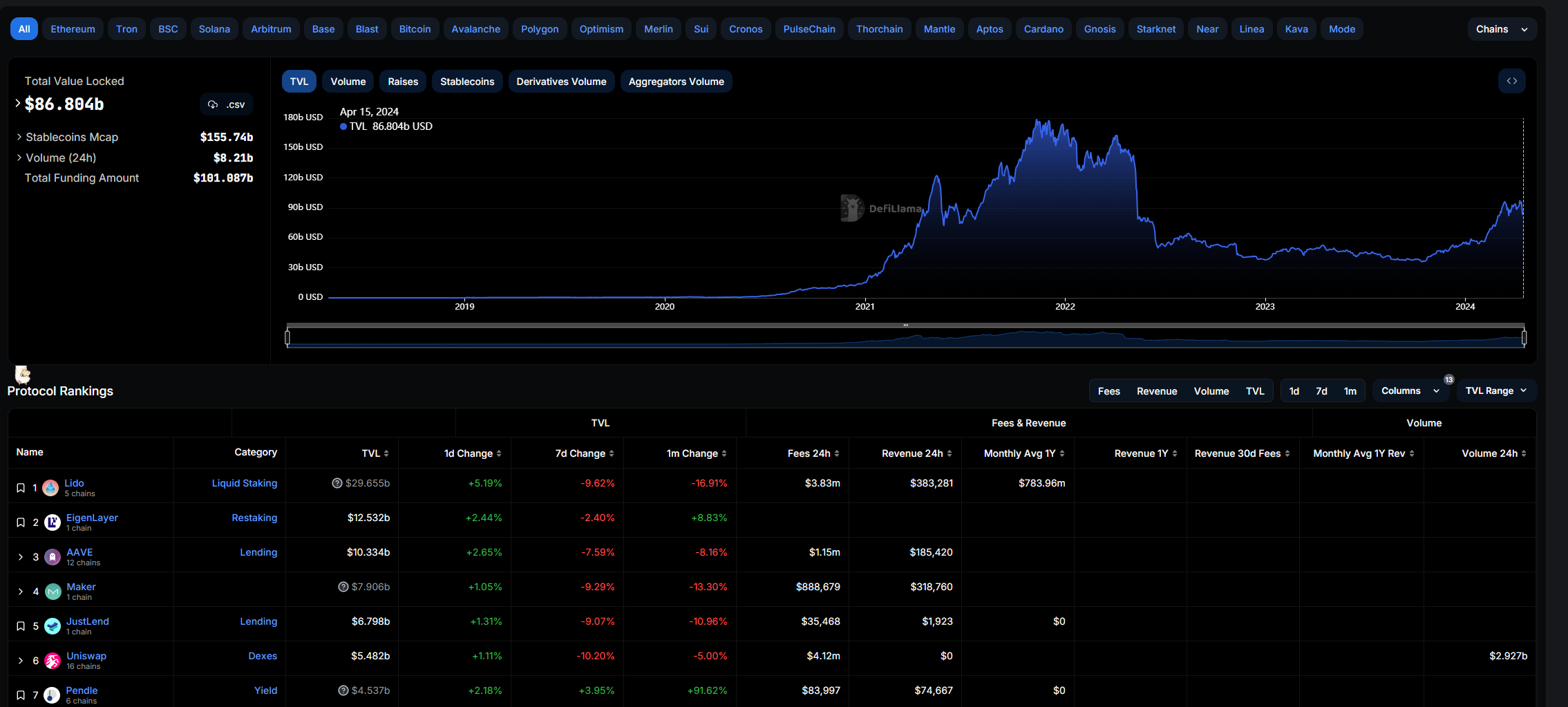

According to DefiLlama data, Pendle currently boasts a TVL of $86.884 billion, ranking 7th among DeFi protocols. Over the past month alone, Pendle’s TVL increased by 91.62%.

From an analysis of protocol-level products, most of the recent TVL growth stems from LRT protocol tokens and Ethena’s synthetic dollar. Pendle effectively integrates with these ecosystems, amplifying user yields. Behind this TVL surge lies the confluence of key bullish narratives: EigenLayer’s restaking points multiplier, innovative PT/YT strategies, and Ethena’s high returns.

Based on the above, the continued growth of Pendle’s interest rate market hinges critically on whether LRT and ETHENA can attract greater capital inflows moving forward.

New Use Cases for YT/PT

Previously, Pendle primarily served users holding yield-generating assets—for instance, those who had staked ETH on Lido to receive stETH—enabling them to achieve desired returns using PT/YT mechanics.

Now, new PT/YT strategies have emerged through synergies with Eigenlayer Points+ rewards and high-yield synthetic dollar protocols like Ethena:

1. Points Swapping: Both Eigenlayer and synthetic dollar protocol Ethena offerhigh-reward airdrop expectations. Staking assets (e.g., ETH) to earn points is central to qualifying for airdrops. Through Pendle, project teams distributing points can facilitate point swapping. Large investors provide liquidity based on reliable PT valuations, while smaller investors speculate on higher returns. This points-swapping mechanism has driven massive TVL growth for Pendle during this bull cycle.

a) For example, staking ETH on Eigenlayer earns eETH plus积分 rewards. Pendle splits eETH into PT (principal token) and YT (yield token). Purchasing YT means acquiring all future积分 rewards and potential airdrop benefits.

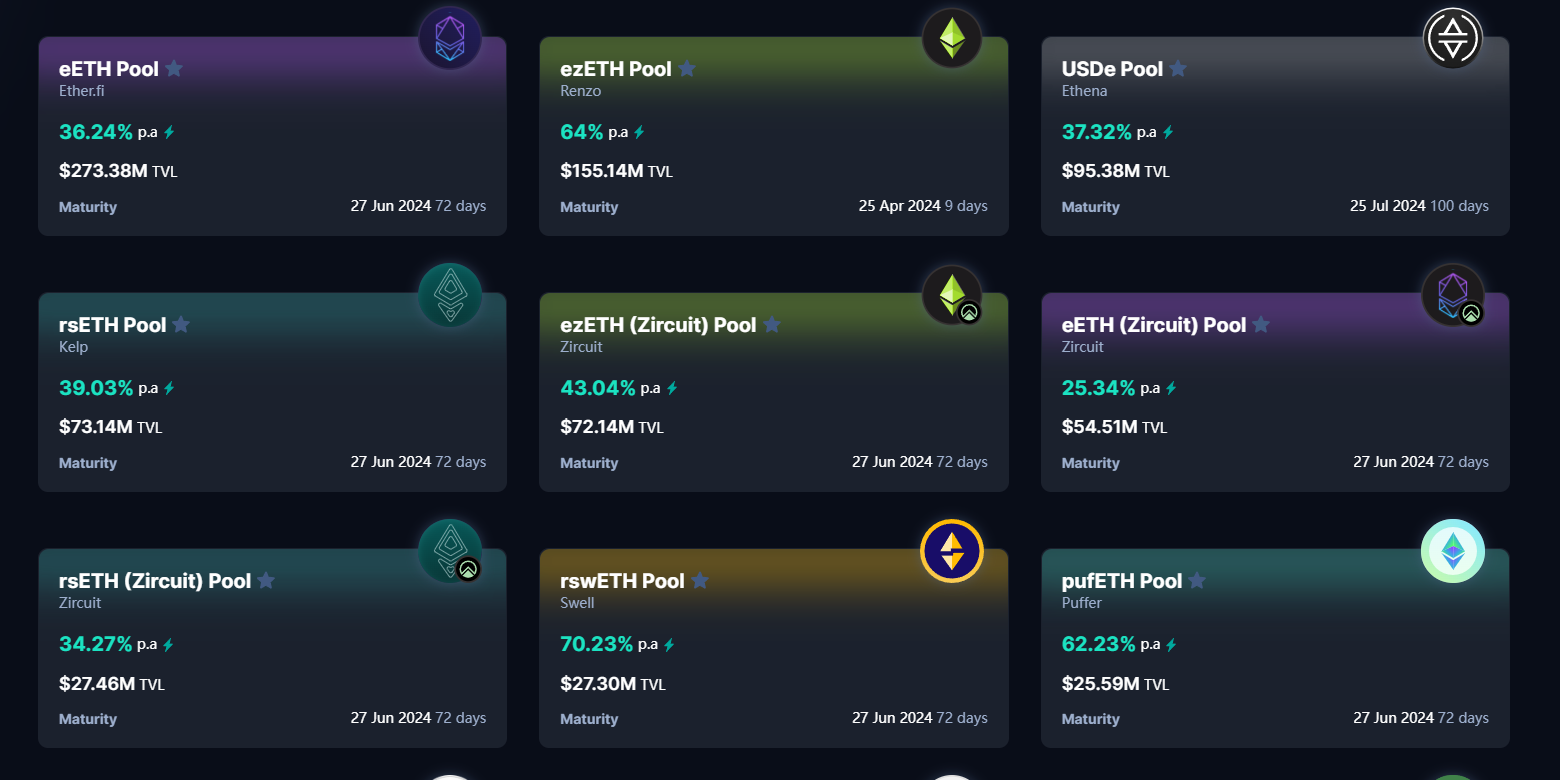

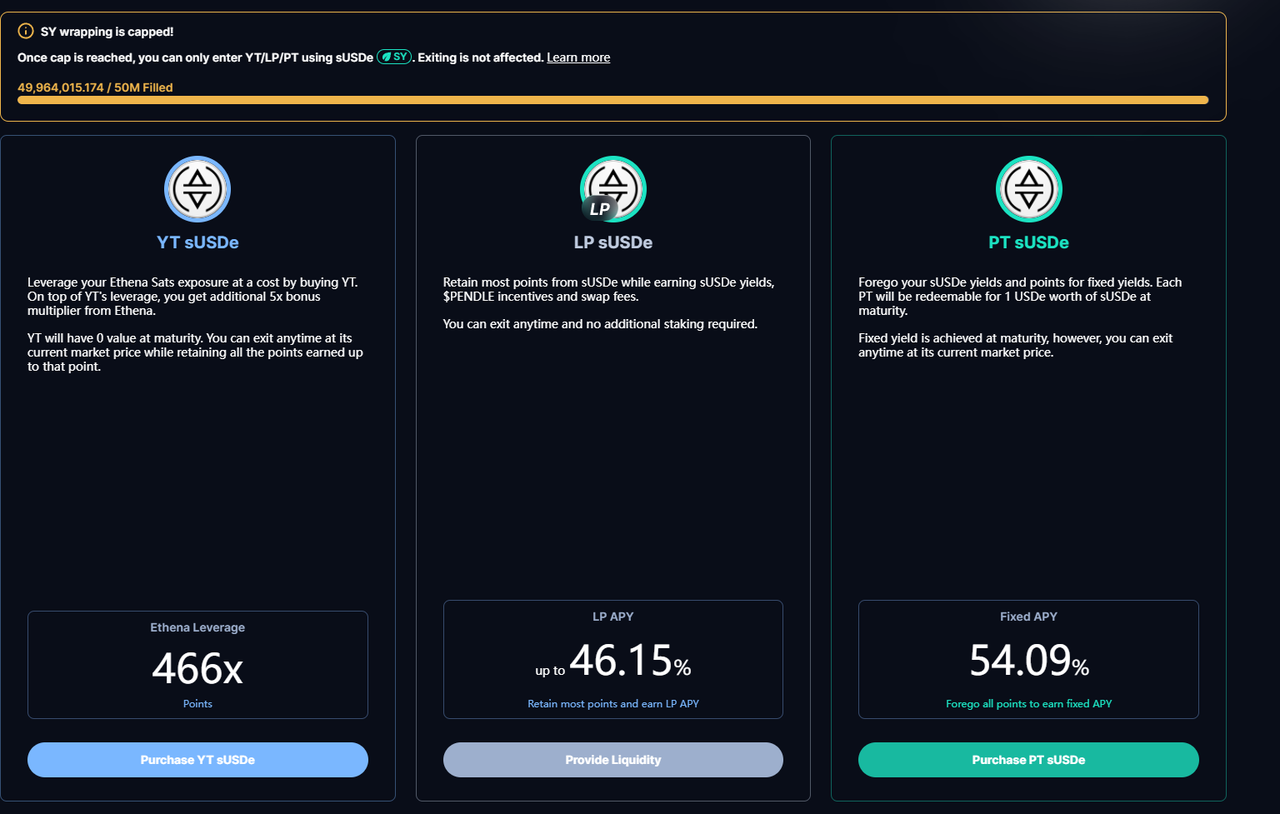

b) Taking Ethena’s current rates on Pendle as an example: when participating with sUSDe,

i) Converting sUSDe into YT-sUSDe grants access to 466x Pendle积分

ii) Converting sUSDe into LP-sUSDe offers a floating APY of 46.15% and retains eligibility for sUSDe积分

iii) Converting sUSDe into PT-sUSDe delivers a fixed APY of 54.09%

c) Large investors contribute liquidity based on stable PT pricing, while small investors bet on outsized gains. As Ethena scales, it will continue driving Pendle’s growth.

d) The integration between Ethena and Pendle can similarly benefit LRT protocols, giving users more yield-enhancing options. Meanwhile, the expansion of the restaking ecosystem will further fuel Pendle’s momentum.

2. Funding Fee Swaps: If synthetic stablecoin adoption continues growing during the bull market—say, increasing usage of ETHENA—there will be a surge in sUSDe supply. These sUSDe holdings can then be split via interest rate swap protocols into YT-sUSDe and PT-sUSDe. Traders can profit by predicting funding fee trends. For instance, anticipating a shift from bear to bull, traders might buy YT-sUSDe at low APY during bearish periods and later sell at a premium during bullish phases, creating additional speculative opportunities.

3. Diversified Strategies: Within PT/YT trading, investors with varying risk appetites can employ different investment strategies—such as bullish yield exposure, hedging, or discounted long positions—via Pendle.

a) If expecting rising yields, traders can buy YT to gain yield exposure. When yields increase, long-YT positions generate profits.

b) Conversely, if falling yields are expected, traders can hedge risk by selling YT and collecting upfront payments.

III. On-Chain Premarket Trading Platforms

“Premarket” typically refers to “pre-market trading” in traditional stock markets—trading activities conducted before official market opening hours. Such trades occur primarily on electronic systems rather than traditional exchanges. During premarket sessions, investors can buy and sell stocks, though trading volume tends to be lower and price volatility higher. The goal is often to capitalize on company news or events to secure better entry prices ahead of regular trading hours.

When applied to Web3, premarket trading allows investors to seek early opportunities in high-profile projects before their token generation event (TGE). These trades mainly involve confirmed airdrop tokens, transacted as shares or points.

Source: https://edition.cnn.com/markets/premarkets

Evolution of Premarket Trading in Web3

Source: https://www.racent.com/blog/man-in-the-middle-attack

-

In early off-exchange trading, social platforms like Discord, Telegram, and WeChat were commonly used for deal-making. Transactions were typically facilitated by a “middleman” who matched buyers and sellers, held deposits, and executed settlements upon completion, earning variable fees.

-

However, this model had significant flaws—the most common being malicious behavior by the middleman. Since all deals were brokered privately, actual bid/ask prices remained opaque, often deviating significantly from fair value. Additionally, there was risk of the middleman absconding with deposited collateral (“RUG pull”).

-

Once awareness grew about middleman risks, trusted KOLs and influencers began acting as intermediaries, leveraging their credibility. They would bring buyers, sellers, and themselves into shared group chats, ensuring greater price transparency. This became the dominant OTC method prior to the emergence of on-chain premarketplaces.

-

Despite improvements, this second phase still suffered from inefficiencies, human error, and residual counterparty risk—leading to the creation of two representative on-chain premarket platforms: AEVO and Whales Market.

Web3 Premarketplace Product Overview

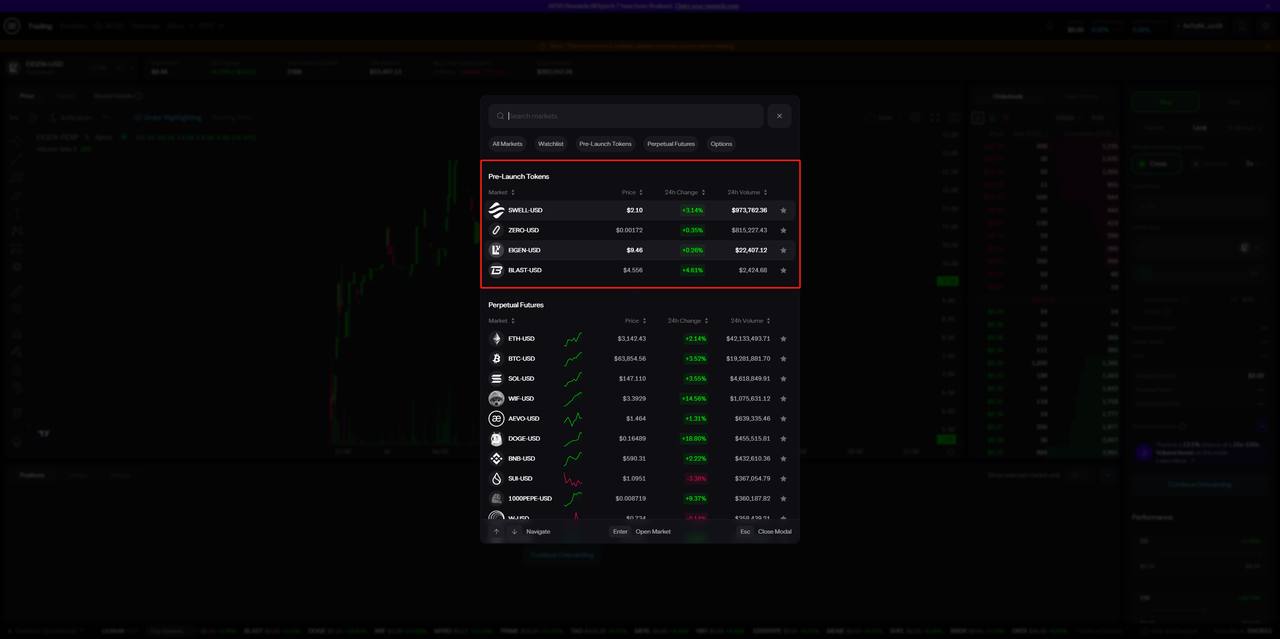

1. AEVO: AEVO is a decentralized options platform focused on options and perpetual futures trading, currently supporting Optimism, Arbitrum, and Ethereum. While historically known for perpetual trading, AEVO recently launched a Pre-Launch Tokens section allowing users to trade tokens before TGE.

a) Trading Process: Users select relevant tokens in the Pre-Launch Tokens section to engage in perpetual-style trading. Most tokens support 1–2x leverage, and operations mirror standard perpetual trading—allowing both long and short strategies.

b) Platform Data: As shown, the Restake protocol Swell’s token $SWELL is priced at $2.1 on AEVO, with 24-hour volume reaching $973,762—the highest in the Pre-Launch Tokens category.

c) Key Features:

i) Compared to traditional social media OTC methods, AEVO offers more formal, transparent, and secure trading.

ii) Supports 1–2x leveraged long or short positions for enhanced returns.

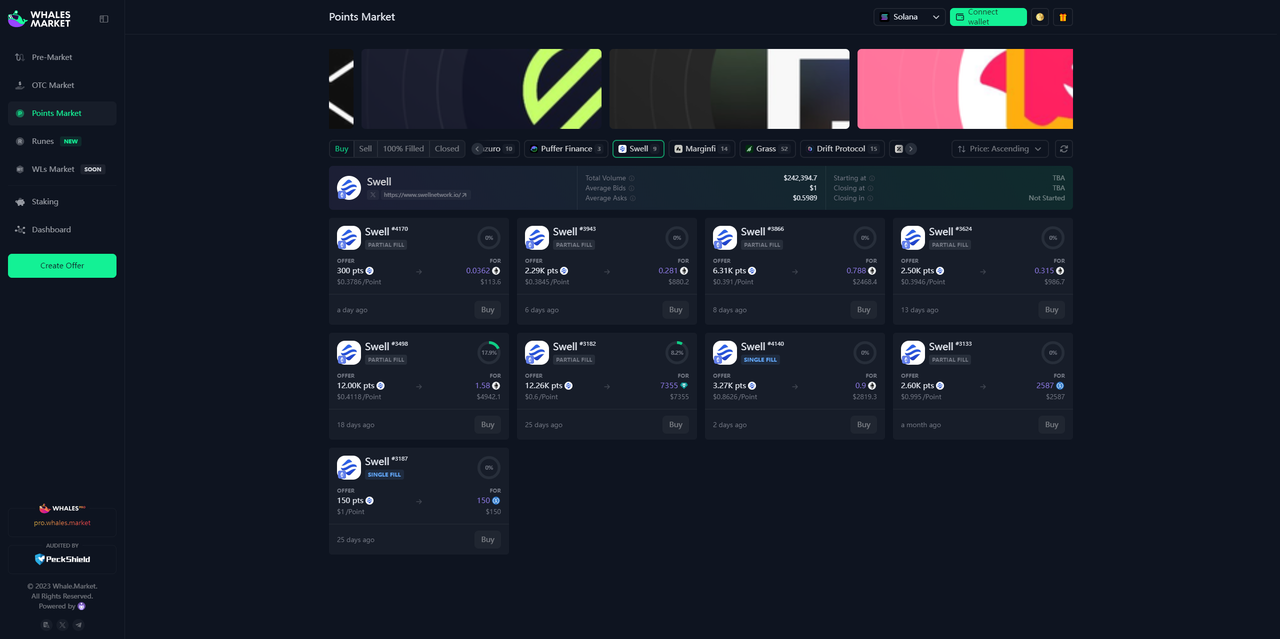

2. Whales.Market: Built on the Solana ecosystem, Whales.Market is an OTC trading platform that uses smart contracts to create a secure, trustless environment for trading pre-TGE allocations, tokens, and NFTs. Unlike AEVO, Whales.Market supports not just tokens but also Points and NFTs, with plans to add NFT whitelist trading.

a) Trading Process: Users browse available listings, clearly seeing quantity, unit price, and total cost. Buyers and sellers conduct peer-to-peer on-chain transactions, with funds held in smart contracts until successful settlement. Trade validation often requires manual review, streamlining processes, enhancing price transparency, and greatly reducing fraud-related losses.

b) Platform Data: Again using $SWELL, Whales Market recorded a Total Volume of $242,394 on the same day. However, Whales Market supports many more tradable assets than AEVO.

c) Platform Features:

i) Security: Transparent order matching via smart contracts ensures fund safety. ii) Asset Diversity: Supports multiple asset types including NFTs and protocol Points.

iii) Improved Experience: For large orders exceeding individual capacity, users can co-invest by purchasing partial shares with others.

Current Challenges

The evolution from risky, middleman-dependent OTC trading to platform-mediated, smart contract-based execution marks a critical step forward for the entire premarket ecosystem. Nevertheless, several pressing challenges remain.

Source: People Matters

-

Liquidity Crisis: Most Pre-Launch Tokens face insufficient liquidity. Even Swell, AEVO’s most traded token, sees less than $1M in daily volume. Low liquidity leads to extreme price volatility and prevents large “whale” investors from entering sizable positions. In theory, higher trading volumes lead to more accurate pricing.

-

Risks from Partial Centralization: Take Whales Market as an example: in a recent high-volume BTC NFT trade (“RuneStone”), centralized bottlenecks emerged. Due to the need for manual verification of NFT receipt, sufficient gas fees, and staggered airdrop timings, multiple users reported issues during settlement. These overlapping factors made trade completion difficult, highlighting lingering problems with centralized oversight.

-

High Risk of Premarket Trading: Numerous uncertainties exist—from seller reliability to platform integrity and shifting airdrop qualification rules—all potentially resulting in investor losses. Participants must meet a higher bar than in secondary markets, requiring expert-level valuation skills. Risks are substantial.

-

Inefficient Capital Usage: OTC trading often requires locking collateral to secure orders. Given that actual delivery may occur days or weeks later, capital remains idle during this period, severely limiting capital efficiency.

IV. Technological Convergence: Interaction Between DeFi and Traditional Markets

Despite repeated skepticism toward DeFi during previous bear markets, we believe the sector still holds immense possibilities and opportunities. With continuous innovation from protocols like Pendle, Ethena, and Eigenlayer, DeFi will further expand its boundaries, offering users more diversified services and flexible asset management tools. As innovation accelerates, we expect even more PT/YT-based strategies to emerge. The successful collaboration with LRT has already raised the ceiling for interest rate swap markets.

We look forward to seeing interest rate swapping applications proliferate—toward a future where “everything can be interest-swapped”—delivering innovative products and services to users. However, risks must not be overlooked. Behind the recursive yield stacking in LRT protocols lie systemic vulnerabilities: strong interdependencies and massive liquidity pools mean any hack or protocol failure could have catastrophic consequences. DeFi’s constantly evolving niche sectors represent fertile ground, and interest rate swapping is a precious seed within it—full of potential.

Pendle’s Innovative Practice

By introducing separated principal-and-yield financial products (PT and YT), Pendle offers investors new ways to flexibly manage and optimize yield returns during bull markets. This innovation enhances market liquidity and introduces a novel form of token turnover—automated via smart contracts. While enabling highly efficient trading mechanisms, this model demands greater expertise and risk management capabilities from participants. For example, misunderstanding the structure of PT/YT separation could lead investors to make uninformed decisions, increasing speculation and market instability.

On-Chain Premarket Trading Platforms

Through decentralized platforms like AEVO and Whales Market, premarket trading brings traditional stock market concepts into the Web3 world, enabling broader participation in high-demand project token trading. This approach improves accessibility and transparency while reducing intermediary risks inherent in traditional OTC trading. Although on-chain platforms mitigate counterparty fraud, new technical risks and operational errors persist. Smart contract bugs or user mistakes—especially in complex, high-value transactions—can still result in financial loss.

During this bull run, we’ve seen numerous projects launch tokens amid abundant market liquidity—a trend likely to continue. The pre-TGE trading window is now indispensable, and premarket strategies are becoming increasingly well-known. Looking ahead, we anticipate positive developments in premarket trading:

Source: RISMedia

-

Greater Degree of Decentralization: As platforms refine their governance rules, future premarketplaces may emphasize stronger decentralization—reducing manual intervention, accelerating trade execution, and enhancing autonomy.

-

Broadened Asset Coverage: Future premarkets may support a wider range of tradable assets, fostering diverse investment options. Just as Whales Market now includes protocol Points and NFTs, broader inclusion will enhance asset liquidity and trading activity.

-

Smarter Trading Experiences: Next-generation premarketplaces may integrate smart contracts with AI to deliver intelligent trading experiences—such as AI-driven price valuation, reduced entry barriers, and personalized trading recommendations—enhancing efficiency and user experience.

Building on current innovation trends in Pendle and premarket trading, several novel and creative use cases can be envisioned—each closely aligned with existing mechanisms and market structures:

1. Dynamic Interest Rate Swap Protocols

Pendle’s PT and YT framework could evolve into dynamic interest rate swap protocols, allowing users to adjust their swap terms dynamically based on market conditions. Such protocols could integrate real-time market data and AI forecasting models to automatically rebalance interest rates, helping users capture optimal yields amid market fluctuations.

-

Core Mechanism: Combine smart contracts with AI models to monitor market changes and auto-adjust interest rates.

-

Advantages: Increases flexibility in yield optimization and reduces manual adjustments.

-

Risk Management: Requires highly accurate prediction models and robust smart contract code to prevent errors and exploits.

2. Decentralized Cross-Platform Arbitrage Tools

Leveraging on-chain premarket platforms, developers can build decentralized cross-platform arbitrage tools. These tools would allow users to exploit price differences across DeFi platforms, using smart contracts to automatically detect and execute profitable trades, enabling risk-free arbitrage.

-

Core Mechanism: Smart contracts continuously monitor price discrepancies across multiple platforms and execute arbitrage trades autonomously.

-

Advantages: Enhances market efficiency, narrows price gaps, and creates risk-free profit opportunities.

-

Risk Management: Requires real-time data synchronization and ultra-low latency execution to avoid failed trades.

3. Smart Contract Insurance Mechanisms

Introduce insurance mechanisms into Pendle and premarket trading to protect users. When smart contracts fail or markets experience abnormal volatility, insurance protocols could automatically compensate affected users, safeguarding capital.

-

Core Mechanism: Define insurance conditions via smart contracts; automatic payouts triggered upon specific events.

-

Advantages: Boosts user confidence and encourages broader participation in DeFi.

-

Risk Management: Requires sufficient insurance reserves and clear payout criteria to prevent abuse or insolvency.

4. Multi-Layer Staking of Synthetic Assets

Building on Pendle’s PT/YT system, multi-layer staking mechanisms could be developed—allowing users to stake yield-bearing assets across multiple tiers, earning tier-specific returns and incentives. This structure would attract more capital into staking, boosting overall market liquidity.

-

Core Mechanism: Users stake assets at different levels, each associated with distinct rewards and risk profiles.

-

Advantages: Offers diversified investment choices appealing to various risk appetites.

-

Risk Management: Requires clear tier definitions and transparent reward calculations to avoid complexity-induced mismanagement.

These examples illustrate how new trading mechanisms in the cryptocurrency bull market enhance efficiency and transparency, while simultaneously introducing novel risks and challenges. The cases of Pendle and premarket trading demonstrate that the convergence of DeFi technology with traditional markets is driving financial product innovation—such as AI-integrated intelligent trading systems capable of delivering more personalized and efficient strategies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News