Opinion: A bull market is like sex—the best part comes right before it ends.

TechFlow Selected TechFlow Selected

Opinion: A bull market is like sex—the best part comes right before it ends.

Warren Buffett said.

Author: Crypto, Distilled

Compiled by: TechFlow

The market's greatest trick is making everyone think it's already over before the real fun begins.

"Bull markets are like SEX—the best part comes right before they end." — Warren Buffett

Here are seven reasons why the most exciting phase has not yet begun.

The Market’s Greatest Trick

Before diving into these reasons, let's first understand the context.

The market’s greatest trick is convincing people it's already over before the fun even starts—driven by what's known as the "wall of worry."

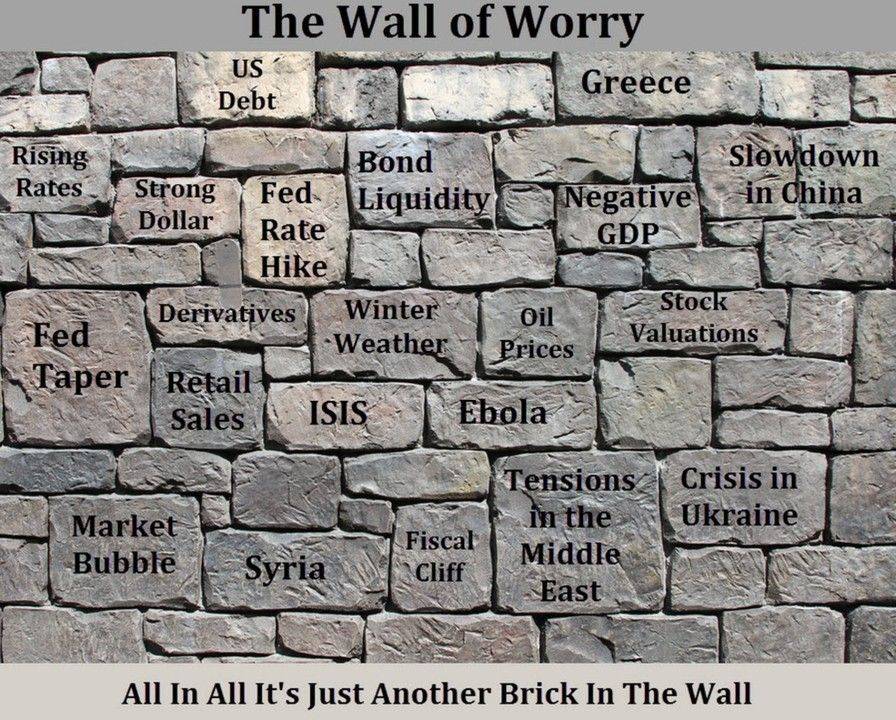

What Is the Wall of Worry?

During bull markets, prices rise along a wall built from worry and skepticism.

Each wave of negative news adds another brick to this wall. This ongoing struggle defines the nature of the bull run, with concern acting as fuel for price increases.

Building the Wall Higher

Moderate FUD (fear, uncertainty, doubt) is healthy during a bull market. It keeps some investors on the sidelines, creating potential buying power when skeptics finally turn into believers.

Despite $BTC approaching all-time highs, doubts remain about consumer crypto apps, global liquidity, $ETH ETFs, and altcoins.

The Greatest Opportunity

How do you profit from this? Stay calm amid uncertainty—panic narrows your vision.

Facing danger calmly allows us to assess the situation and spot hidden opportunities.

Now, let’s explore these seven reasons in detail.

-

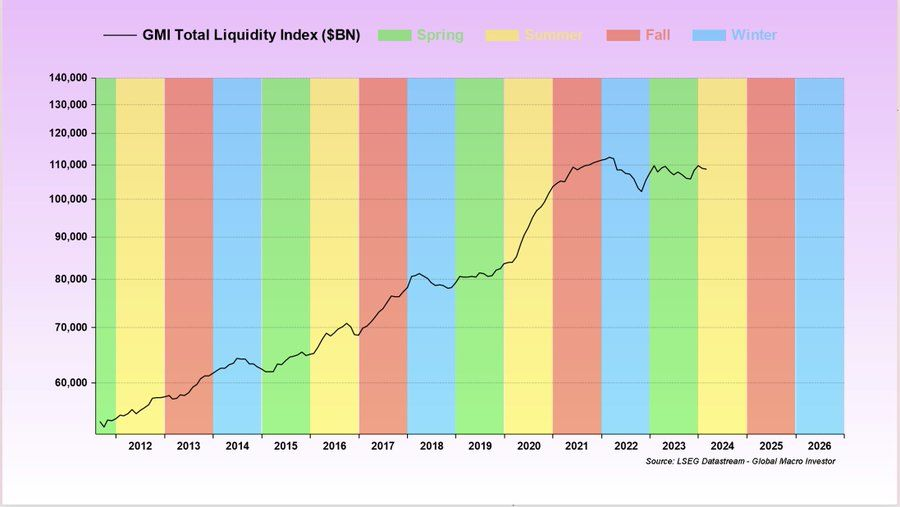

More Liquidity Is Coming

One major reason the cycle peak may not have arrived yet is liquidity.

With global macro policies expected to ease, liquidity is projected to surge in 2025.

Increased capital flows typically drive up cryptocurrency prices.

-

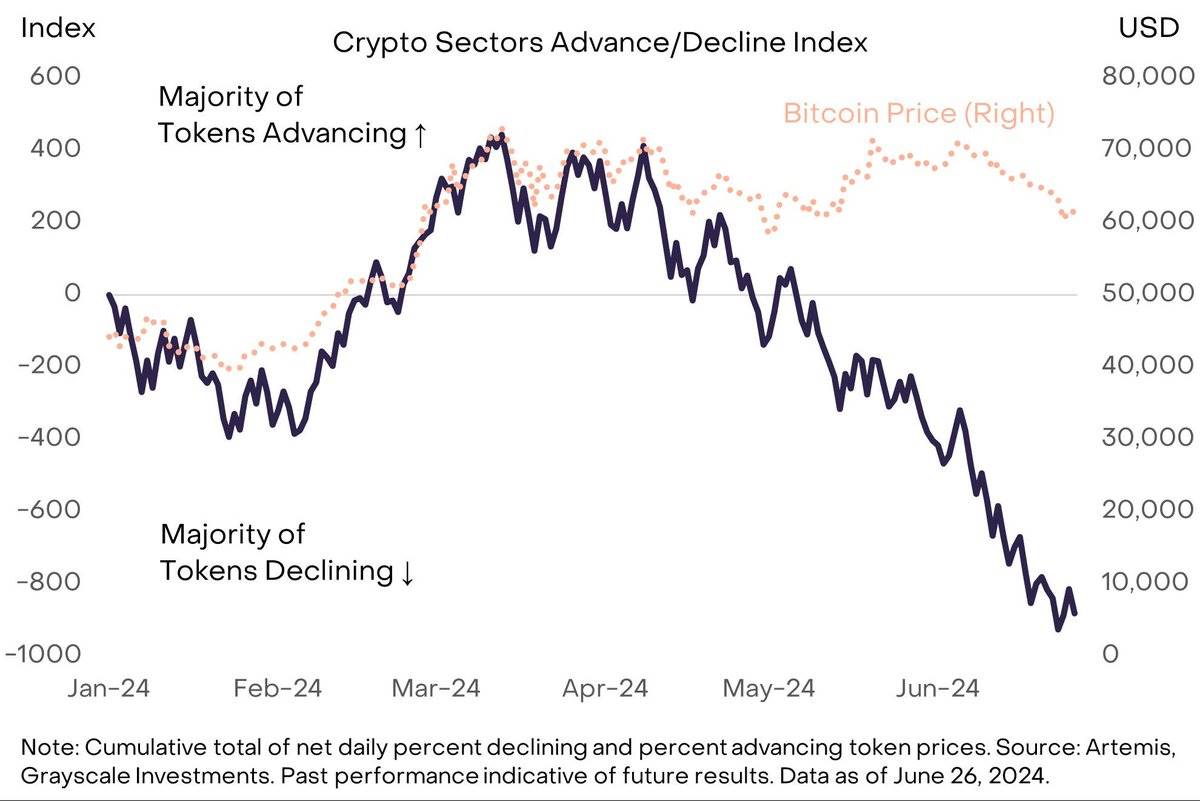

No Parabolic Blow-Off Yet

Past bull markets always ended with a clear parabolic surge.

History doesn’t repeat exactly, but it often rhymes—and so far, we haven't seen that kind of climax.

According to @Grayscale, only about 30% of altcoins have risen this year.

-

The "Banana Zone" Pattern

The "banana zone" refers to periods when asset prices skyrocket—an effect reliably observed in previous cycles.

This phenomenon is driven by the 4-year global liquidity cycle, which typically peaks in autumn.

Currently, we're still in the summer phase.

(Credit: @RaoulGMI)

-

Post-Halving Performance

Bitcoin’s historical post-halving performance suggests more upside remains.

Historical data shows that macro peaks usually occur around 200 days after the halving event.

Currently, the post-halving volatility is normal.

(Credit: @RaoulGMI)

-

The Four-Year Cycle Theory

The four-year cycle is like astrology for crypto—it might simply reflect the influence of global liquidity cycles and election seasons on markets.

If history repeats, a peak is expected around October 2025 (roughly 16–17 months from now).

(Credit: @BobLoukas)

Due to increasing "pre-shadows" in the crypto market, cycle signals appear earlier each time.

This makes it easy to mistakenly believe the cycle has ended, when in fact a new phase hasn't even started.

New phases typically bloom late in the cycle, fueled by experimentation and rising optimism.

(Translator’s note: The "premature shadow fallacy" refers to the tendency in crypto markets for early warning signs to appear increasingly sooner, leading people to wrongly assume the market cycle has ended. In reality, a new market phase has yet to begin. This phenomenon causes investors to miss out on later-stage opportunities because they prematurely believe the market has peaked or is about to decline.)

-

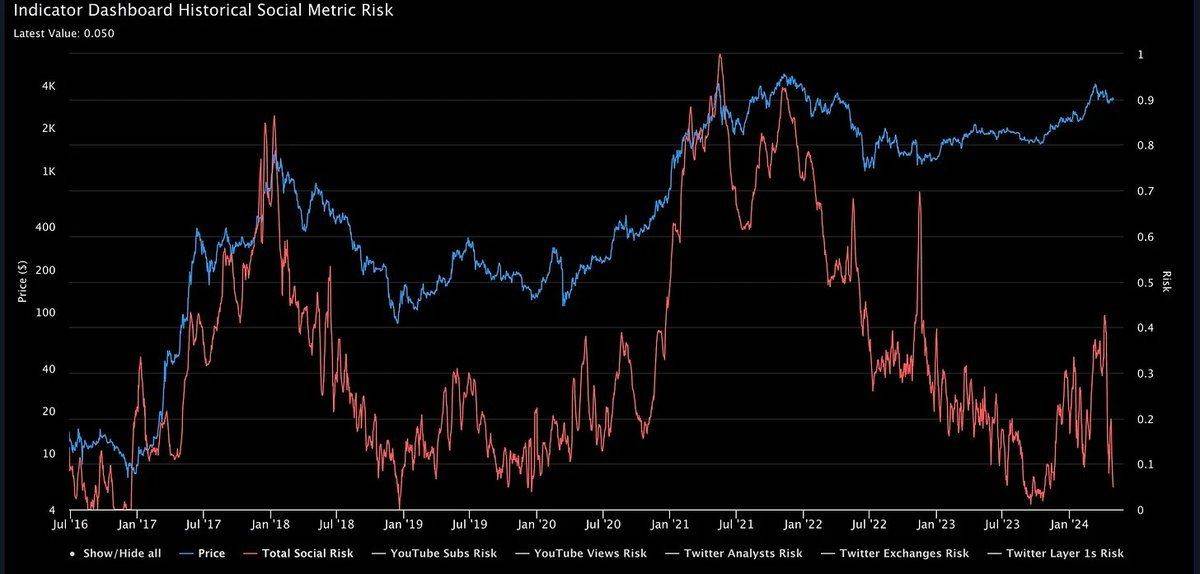

Extremely Low Social Risk

The most exciting—and dangerous—times in the market usually come with extreme euphoria.

In the first half of 2024, social risk in the market was extremely low—the market isn't overheating; it's unusually quiet.

Currently, retail investors show almost no interest in altcoins.

(Credit: @intocryptoverse)

Summary

-

The final stage of a bull market is usually the most explosive rally.

-

The wall of worry tricks people into thinking the bull run is already over.

-

Liquidity is expected to rise—could the banana zone be approaching?

-

The four-year cycle suggests a macro peak could occur in 2025.

Purely educational content, not financial advice.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News