How to choose promising Meme coins through changes in TVL?

TechFlow Selected TechFlow Selected

How to choose promising Meme coins through changes in TVL?

The Memecoin TVL leverage theory suggests that major Memecoins or a basket of key Memecoins will serve as leveraged bets on on-chain TVL.

Author: CHARLES

Compiled by: TechFlow

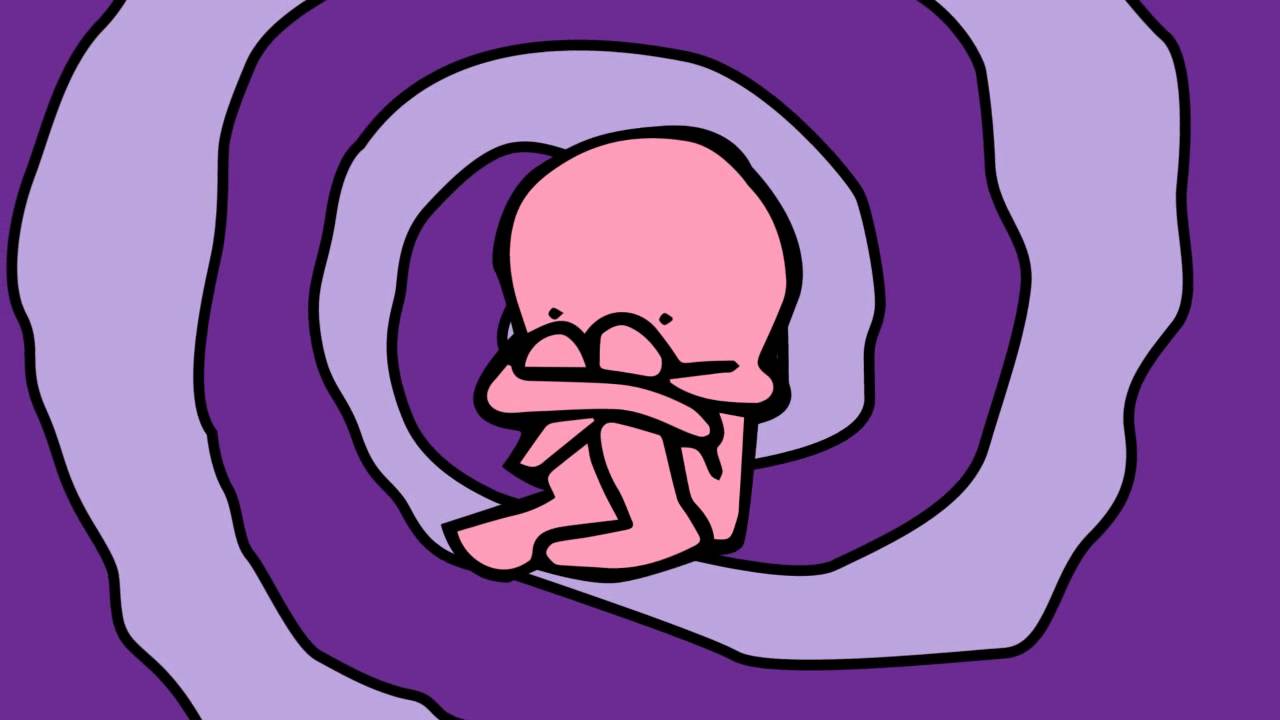

This cycle has been dubbed by some as the “memecoin cycle,” with others even calling it a “memecoin supercycle.” We’ve seen new memecoins like WIF surge from zero to multi-billion dollar market caps within months. We’ve also witnessed various products built around the memecoin phenomenon, such as the launch of pump.fun. Love it or hate it, memecoins are impossible to ignore.

Most active crypto participants have deeply felt that memecoins have performed exceptionally well in this cycle, outperforming every other sector by a wide margin. When we hear stories of traders achieving massive returns through memecoins, the inevitable question arises: “How did they identify that specific memecoin?” Of course, survivorship bias plays a role, but are there other forces at work?

Generally speaking, at HFAResearch we focus on fundamental-driven ideas from investment, trading, and mining perspectives. This makes covering the memecoin space difficult—like NFTs, memecoin investing logic tends to be fuzzier, more reliant on “vibes” and the meme itself, making fundamental analysis significantly harder. At least, that was our thinking before we discovered what we now call the “Memecoin TVL Leverage Thesis.”

The Memecoin TVL Leverage Thesis posits that major memecoins—or a basket of key memecoins—act as leveraged bets on on-chain TVL growth. Before listing historical examples, let’s first understand why this makes sense.

We know that as on-chain TVL increases, a certain proportion of capital flows into applications or “destinations” on that chain—say X% into money markets, Y% into primary decentralized exchanges (DEXs), etc. It’s therefore reasonable to assume that a portion of funds will seek the highest-beta way to bet on the chain’s success. How do they do it? By buying top-tier memecoins or a basket of leading memecoins. While this might seem obvious to some, we believe it offers a valuable—and potentially lower-risk—way to engage with memecoins, as it introduces a form of “fundamental” framework for assessing future memecoin performance (both upside and downside).

Let’s look at several historical examples where this dynamic played out:

Base

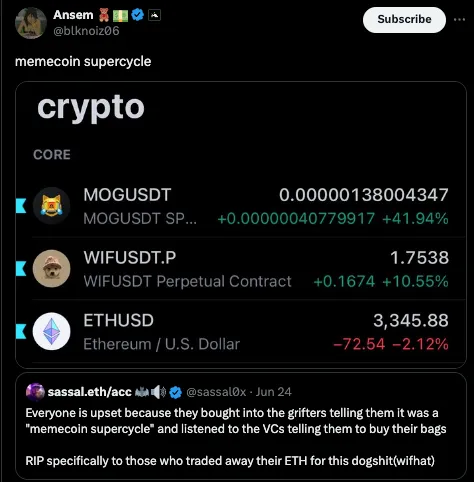

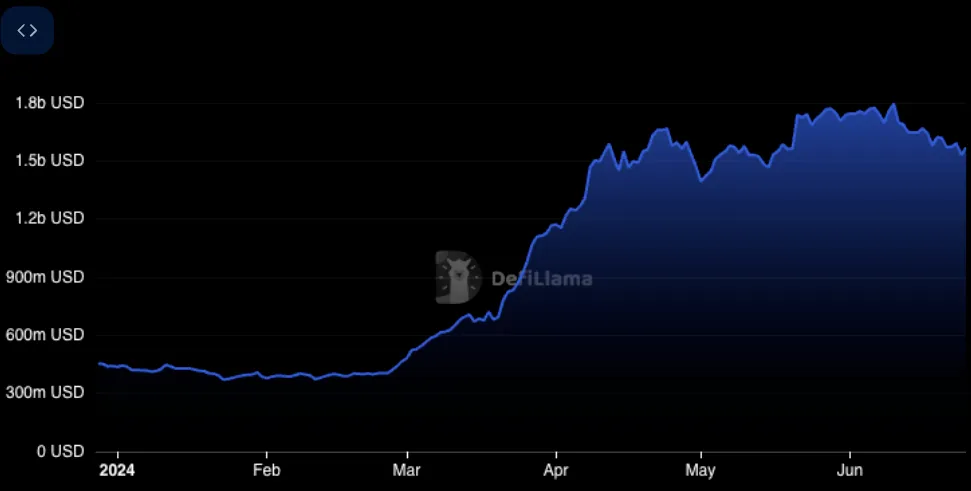

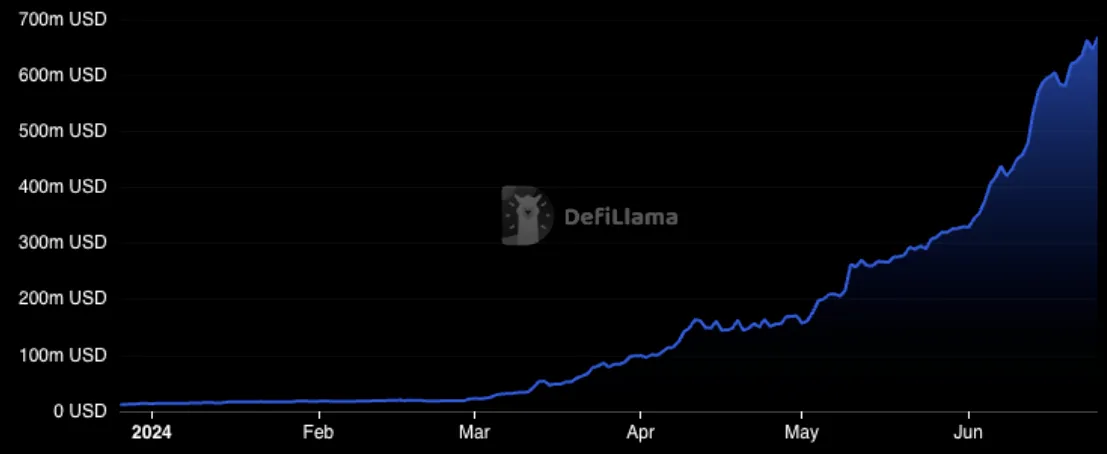

Base TVL

TOSHI's performance began tracking Base TVL growth starting in March

BRETT’s two parabolic rallies both occurred during periods of rising Base TVL

TON

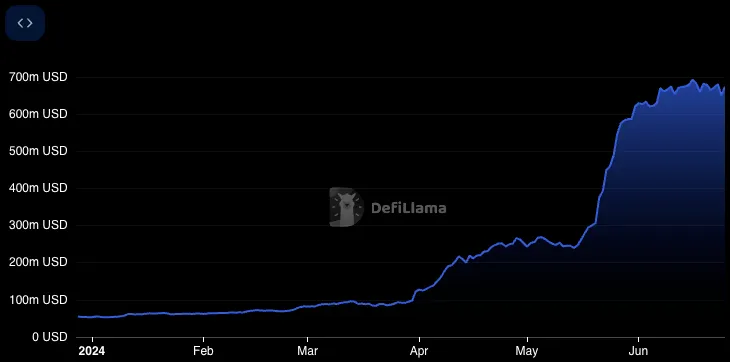

TON TVL

REDO is the dominant memecoin on the TON network

The above examples clearly show: TVL inflows = strong performance of leading memecoins. If you can predict TVL growth, you can position in the main memecoin(s) on that chain as a leveraged bet on your TVL forecast.

Critics of this strategy argue it inherently limits upside, as it requires identifying which memecoin is the most significant in order to correctly map TVL flows. That criticism holds merit—this approach certainly doesn’t allow you to sniper a memecoin at a $100k market cap and ride a 1000x move to $100M. However, it can be highly effective at identifying somewhat larger, slightly more mature memecoins and capturing meaningful gains from there. For instance, between late February and early April, Base experienced a parabolic run in TVL, and Toshi surged from a $40M market cap to over $300M—a nearly tenfold return in under two months with relatively little volatility.

Predicting TVL growth falls into two categories: long-term and short-term. Long-term forecasting involves projecting TVL flows over multiple months. We might point to Base leveraging Coinbase as a retail onboarding funnel as a reason for sustained TVL growth. We could examine TON’s almost incestuous relationship with Telegram to gauge the potential impact of bringing all 900 million Telegram monthly active users on-chain. We might cite Solana’s superior UX and mobile wallet ecosystem as reasons to believe TVL will follow. You get the idea—long-term TVL prediction requires analyzing deeper distribution fundamentals on the chain. Then, you identify the dominant memecoin(s) on that chain and place your bet accordingly.

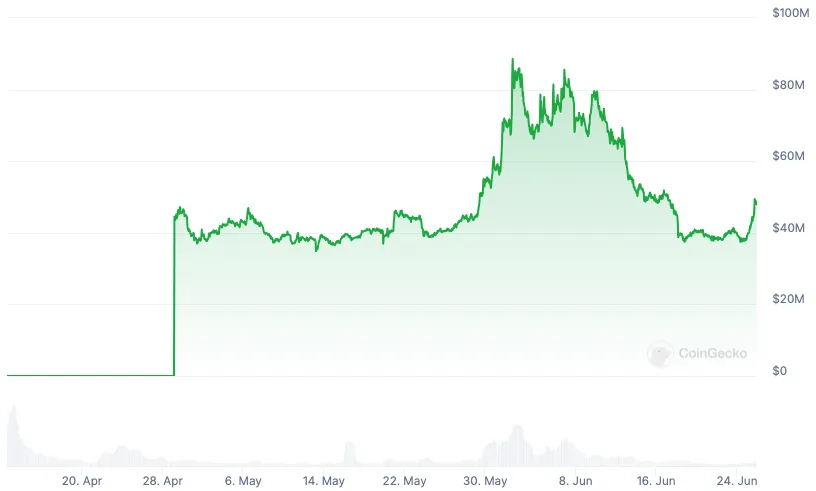

The short-term approach treats catalysts like points programs or airdrops as drivers of TVL growth. For example, $FOXY, as Linea’s premier memecoin, performed exceptionally well following the announcement of its Surge points program and the resulting TVL inflows:

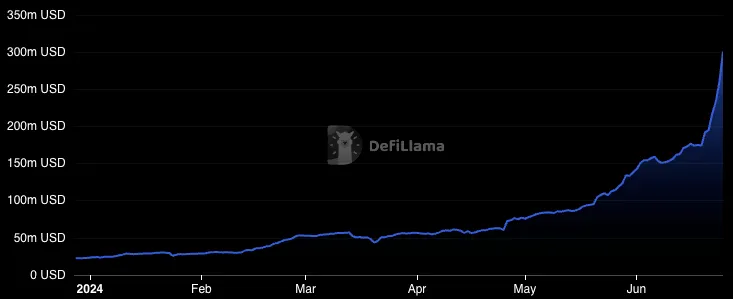

Linea TVL, Surge launched mid-May

$FOXY market cap

The short-term method demands more active market monitoring and an understanding of where capital may flow based on incentive programs. It’s similar to games some of us played last cycle—entering the number-two pool on the top DEX of a new chain to bet on TVL growth driven by incentives.

A more recent example is Scroll. After launching its latest points program, we’ve already seen explosive growth in its TVL. Could Scroll become the next ideal target for this short-term strategy?

We believe this approach offers a more systematic and lower-risk way to participate in the memecoin sector. Still, we’re relatively new to this space, so we’d love to hear your feedback!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News