Despite a bleak market, how does Ton stand out?

TechFlow Selected TechFlow Selected

Despite a bleak market, how does Ton stand out?

Is the Summer of the TON ecosystem coming?

Author: Joyce

The overall market sentiment has recently been extremely pessimistic, especially in the altcoin market. Amid Bitcoin's instability, altcoins have plummeted across the board, with numerous projects seeing their values halved.

However, amid this bleak market environment, the Ton ecosystem has performed remarkably well. TON has risen 23% over the past thirty days, and the entire Ton ecosystem’s TVL (Total Value Locked) began surging from March this year, increasing more than sixfold within just four months. Projects within the ecosystem such as Notcoin have also seen explosive growth in both price and user numbers. Is summer finally arriving for the Ton ecosystem?

New Highlights of the Ton Ecosystem

Backed by Telegram’s 900 million active users, this is the biggest feature of the Ton ecosystem. However, it has long been criticized that there was not a close connection between Ton and Telegram—Telegram’s platform system did not provide much support to Ton, leaving Ton largely perceived as “air.”

But starting this year, things seem to have fundamentally changed.

From March to now, Ton’s TVL has grown from less than $23 million to $145 million today—an increase of over 6x. Meanwhile, TON’s price has also tripled during this period and remained resilient even through the recent small bear market. What are the key catalysts behind these gains?

Data source: DefiLlama

1) Using TON to settle Telegram’s advertising platform

Unlike social platforms like Facebook or WeChat, Telegram, despite its massive user base, has upheld a commitment to user privacy since inception and does not rely on user data for targeted ads.

As a result, Telegram lacks a precise user-targeting ad platform and has avoided the mainstream ad-based monetization model used by other social media giants. This led Telegram to remain unprofitable for years.

Only in the past two years did Telegram launch an ad platform independent of user profiling systems, along with a paid subscription service, forming its primary revenue streams.

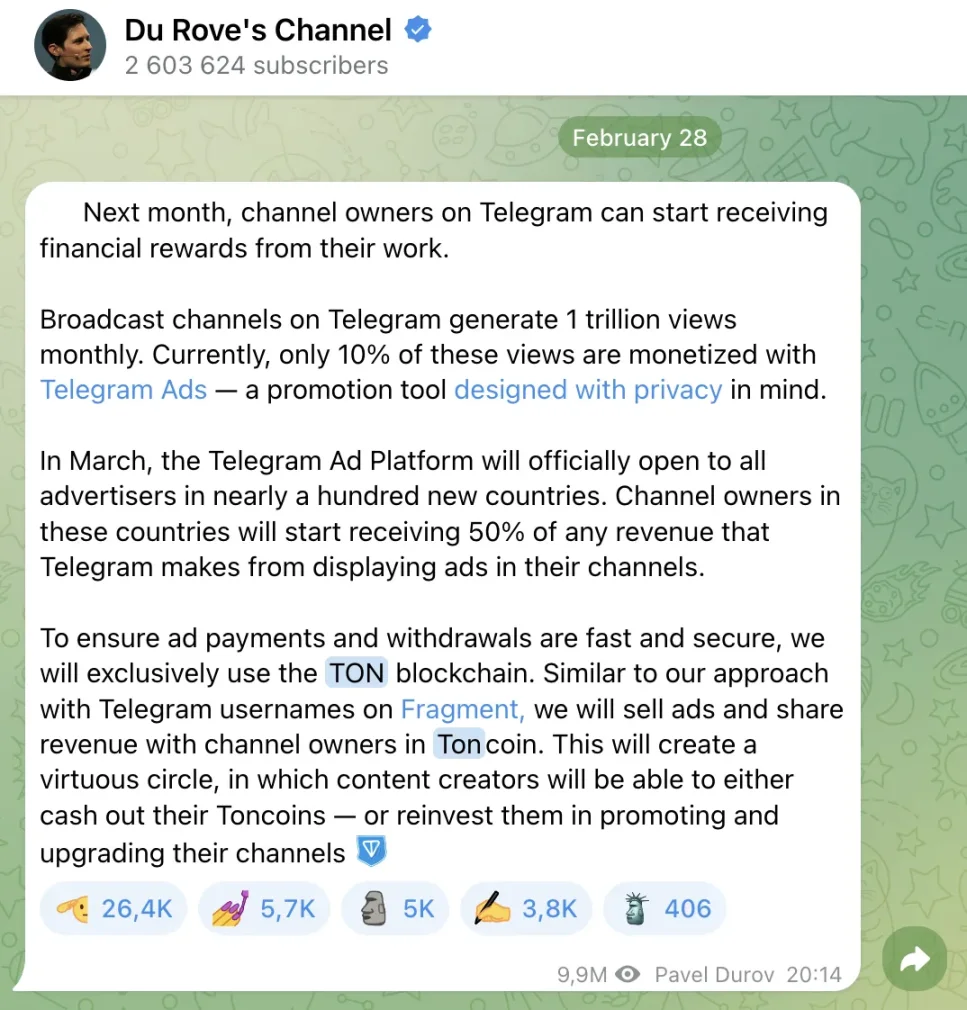

At the end of February this year, founder Pavel Durov announced via his Telegram channel that Telegram’s advertising platform—boasting over one trillion monthly views—would officially open to advertisers in nearly 100 countries starting in March. Channel owners will receive 50% of all ad revenue, settled entirely in TON.

Translation: Next month, channel owners on Telegram can begin receiving monetary rewards for their content. Broadcast channels on Telegram generate one trillion views per month. Currently, only 10% of these views are monetized through Telegram Ads—a privacy-focused promotional tool.

In March, Telegram Ads will fully open to all advertisers in nearly 100 new countries. Channel owners in these countries will start receiving 50% of the revenue generated from ads displayed in their channels.

To ensure fast and secure ad payments and withdrawals, we will exclusively use the TON blockchain. Similar to how we handled Telegram usernames on Fragment, we will sell ads via TON and share revenues with channel owners. This creates a virtuous cycle where content creators can either withdraw their TON earnings or reinvest them into promoting and upgrading their channels.

For TON, this marks a significant leap from being “air” to having real value.

Previously, TON was mainly used for on-chain smart contract transactions, staking, cross-chain swaps, and other protocol fees—similar to any typical public chain. Given that Ton had far fewer developers and users compared to major blockchains, TON’s utility and consumption were negligible. While TON could be used to purchase virtual goods like anonymous Telegram usernames, transaction volume had limited upside potential.

Using TON as the sole settlement asset for Telegram’s ad platform is a strategic move—it effectively leverages Telegram’s 900 million users for Ton, achieving deep integration between the Ton ecosystem and the Telegram platform. This instantly removes previous ceilings on both Ton’s ecosystem development and TON’s price potential.

Additionally, to prevent centralization risks due to Telegram accumulating excessive TON from ad revenue, Durov later stated that over 10% of the team’s TON holdings would be sold at a discount to long-term holders, with these tokens subject to 1–4 year lock-up periods.

For TON, this means Telegram is essentially using ad revenue to continuously buy back TON while distributing supply to long-term investors. By reducing circulating supply through vesting, this creates a powerful win-win scenario—effectively greater than the sum of its parts.

2) Launch of Ton Space

Ton Space launched in September 2023. Before that, the built-in Wallet in Telegram required KYC and was limited to payments. But Ton Space allows users to self-custody private keys—functionally identical to standard crypto wallets.

With Ton Space, users can seamlessly connect their Telegram accounts to apps in the Ton ecosystem—logging directly into DeFi, GameFi, NFT, and other Web3 services via their Telegram ID.

Imagine being able to shop directly on Pinduoduo or JD inside WeChat—similarly, Telegram’s 900 million active users can now trade tokens/NFTs, borrow/lend, or participate in GameFi projects right within Telegram, drastically lowering the barrier to Web3 participation.

Of course, this is also a game-changer for the Ton ecosystem—no other public chain enjoys such direct access to a user pool as large as Telegram’s.

3) Platform promotion of mini-apps

After establishing payment infrastructure, Telegram began actively promoting mini-apps—lightweight applications running natively within Telegram without requiring installation, similar to WeChat Mini Programs.

For example, Notcoin, which recently went viral, is an embedded mini-program allowing users to earn tokens simply by clicking within Telegram. Its integrated Web3 wallet significantly lowers entry barriers. With official traffic support from Telegram, it gained over 40 million users within months.

Currently, under official promotion, numerous Web3 mini-apps similar to Notcoin are emerging on Telegram. Compared to earlier GameFi booms driven by farming bots, Telegram’s platform enables mass participation in play-to-earn games without intermediaries—driving user growth directly.

Beyond this, Telegram and the Ton ecosystem have taken a series of collaborative steps. Since late 2023, Telegram appears to have firmly committed to a Web3 strategy, entering deep partnership mode with Ton.

These initiatives have led to breakout growth in both TON’s price and TVL, while also opening a high-ceiling revenue stream beyond ads and subscriptions for Telegram itself.

Clearly, this is a win-win situation.

Review of Key Projects in the Ton Ecosystem

There are currently 874 projects listed on Ton.app. While this pales in comparison to ecosystems like Ethereum, Solana, or Polygon, and only Notcoin has reached top-tier platforms so far, the number of Ton-based projects has grown nearly 60% over the past eight months, with TVL increasing dozens of times—clearly demonstrating strong momentum.

Here’s a brief overview of some of the most popular projects in the Ton ecosystem:

Notcoin

In Q1 this year, the Telegram developer community and Ton Foundation jointly released a report on Telegram ecosystem apps, featuring Notcoin as a highlighted case study.

As a “click-to-earn” game, Notcoin is the most popular Web3 app in the Telegram Apps Center and the most well-known project in the Ton ecosystem. It gained over 40 million users in just a few months. Despite criticism that its token NOT lacks utility within the game economy and is merely a memecoin, it still surged after listing on Binance.

Catizen

Catizen is the largest gaming platform in the Telegram ecosystem, with over 20 million total users, more than 500,000 paying users, and over 1.25 million on-chain users. It has ranked first in multiple seasons of the Ton Open League.

Hamster Kombat

Hamster Kombat is another play-to-earn game, gaining popularity recently due to anticipated airdrops. According to official data, it now has over 150 million active users—up 50% from last week—and ranks third in popularity within the Telegram Apps Center.

Gatto|Game

Gatto is a pet-raising game and one of the flagship projects showcased in the Ton Foundation’s Q1 2024 report. As of January 2024, Gatto reported 30,000 DAU, over one million pets created, and monthly revenue of $35,000.

Gamee

Gamee is a social gaming platform under Animoca Brands and one of the most popular game ecosystems on Telegram. Although its token price crashed early in 2024 due to a hacking incident, Gamee remains highly popular within the Telegram ecosystem.

PocketFi

PocketFi is a Telegram trading bot supporting cross-chain trades. It uses a click-to-earn model to attract users and, thanks to its simplicity and instant feedback, gained over 1.4 million users within three months of launch—achieving strong visibility in the Telegram Apps rankings.

Blum

Blum is a DEX in the Telegram ecosystem offering spot and basic derivatives trading. Though full features aren’t live yet, users can currently mine points through mini-games. It already has over ten million users.

Notably, Blum was founded by former Binance executives and has been selected for the Binance Labs accelerator program.

Yescoin

As the name suggests, Yescoin is a clone of Notcoin and currently very popular. It has surpassed 18 million users, with over 6 million subscribers on its official Telegram channel—exhibiting remarkable growth speed.

DeDust, Ston.fi

Both DeDust and Ston.fi are DEXes in the Telegram ecosystem. In the Apps Center rankings, they rank among the most popular apps outside the click-to-earn category.

On DefiLlama, they rank first and second in TVL at $320 million and $260 million respectively—making them the backbone of Ton’s total TVL of $634 million.

Ston.fi’s official Telegram channel has 680,000 followers, slightly outpacing DeDust in popularity.

Uxlink

Uxlink is the largest social infrastructure project in the Telegram ecosystem, leveraging friend networks for rapid viral growth within Telegram. Public registration data exceeds 10 million, making it a mega-scale social infrastructure player in the SocialFi space.

Uxlink has attracted investment from prominent firms including Genesis Group, Sequoia Capital, and GGV. Though not yet listed on major platforms, the future of such a large-scale SocialFi project is highly anticipated.

Conclusion

Judging from TON’s price performance, TVL growth, and ecosystem vitality, the Ton ecosystem truly stands out amid the current market downturn. However, beneath the surface of this apparent prosperity lie some non-negligible challenges.

For instance, according to Developer Report data, the Ton ecosystem has only 39 full-time developers and 175 total developers—far fewer than Ethereum’s 2,392 and 7,864, or even Solana’s 436 and 1,615.

Moreover, account theft has long plagued Telegram. With built-in Web3 wallets, phishing attacks and stolen credentials have become even more rampant—posing a critical challenge for Telegram’s Web3 ambitions, particularly for new users with limited security awareness. Combined with Ton’s relatively short operational history and lack of proven resilience against major security incidents, the ecosystem’s overall security remains a key test for future development.

That said, both developer shortages and security issues can gradually improve as the ecosystem matures. After all, the entire Web3 industry evolves through continuous iteration—building the plane while flying it.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News