A Deep Dive into the Emerging Synthetic Dollar Stablecoin USDX: TVL Surpasses $180 Million, Powered by a Delta-Neutral Market-Making Protocol Supporting Multi-Asset Minting

TechFlow Selected TechFlow Selected

A Deep Dive into the Emerging Synthetic Dollar Stablecoin USDX: TVL Surpasses $180 Million, Powered by a Delta-Neutral Market-Making Protocol Supporting Multi-Asset Minting

This article will interpret and introduce the relevant features of USDX.

Introduction

As the crypto market experiences an overall recovery in 2024, the narratives across different sectors have diverged significantly from the previous bull run's emphasis on diversified crypto asset explosions.

The shift is evident—not merely focused on conceptual yield expectations anymore, crypto users are increasingly prioritizing real-time, tangible returns. The narrative within many sectors is quietly evolving, with new participants emerging around yield generation based on major crypto assets—such as USDe, Bouncebit, Solv, and USDX discussed here.

For a long time, the stablecoin ecosystem has remained one of the focal points both within the industry and the broader market. Among the top ten cryptocurrencies by market cap, USDT and USDC have evolved into widely accepted general-purpose stablecoins, with their valuations steadily increasing over the past two years.

Crypto investment inherently involves various risks, and mature stablecoin offerings continue to serve as effective tools for risk mitigation. Stablecoins themselves are also among the most efficient mediums of exchange in today’s market, collectively contributing to massive capital retention within the stablecoin sector.

Accordingly, the derivatives market built upon stablecoins has become one of today’s hottest sectors. Meanwhile, approximately $40 billion in delta-neutral positions are currently concentrated in BTC perpetual contracts. However, due to inherent network limitations and underdeveloped infrastructure, Bitcoin and other major networks struggle to offer strategies that truly hedge against price volatility while delivering investor returns. This creates opportunities for delta-neutral stablecoin-based solutions.

Several players already exist in this space, but recently launched distributed synthetic stablecoin project usdx.money has drawn notable attention.

Reportedly, USDX is a novel synthetic stablecoin that hedges exposure across multiple staked assets held by the protocol to maintain dollar peg stability and capture funding rate yields. Its total TVL has surpassed $180 million.

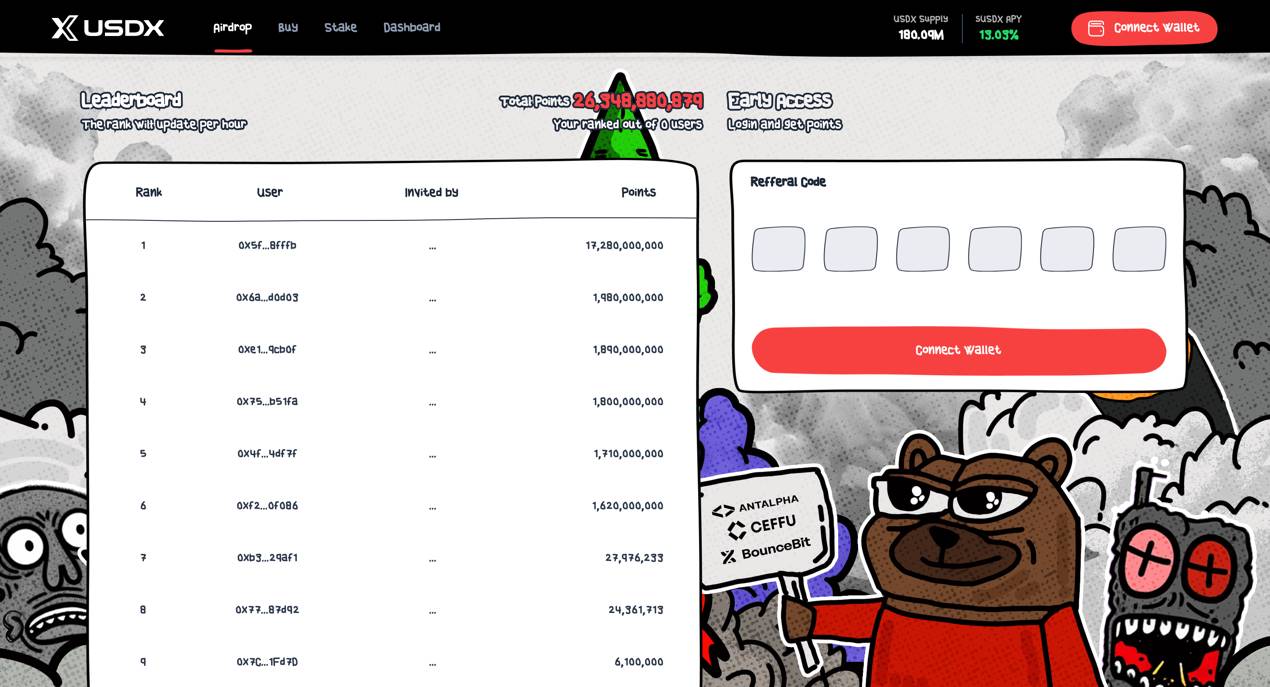

This article will analyze and introduce key features of USDX—a nascent stablecoin project with an unconventional appearance and meme-like viral potential. The project has completed its pre-launch phase and opened access to its DApp and points leaderboard. More market developments are expected ahead.

What Is USDX?

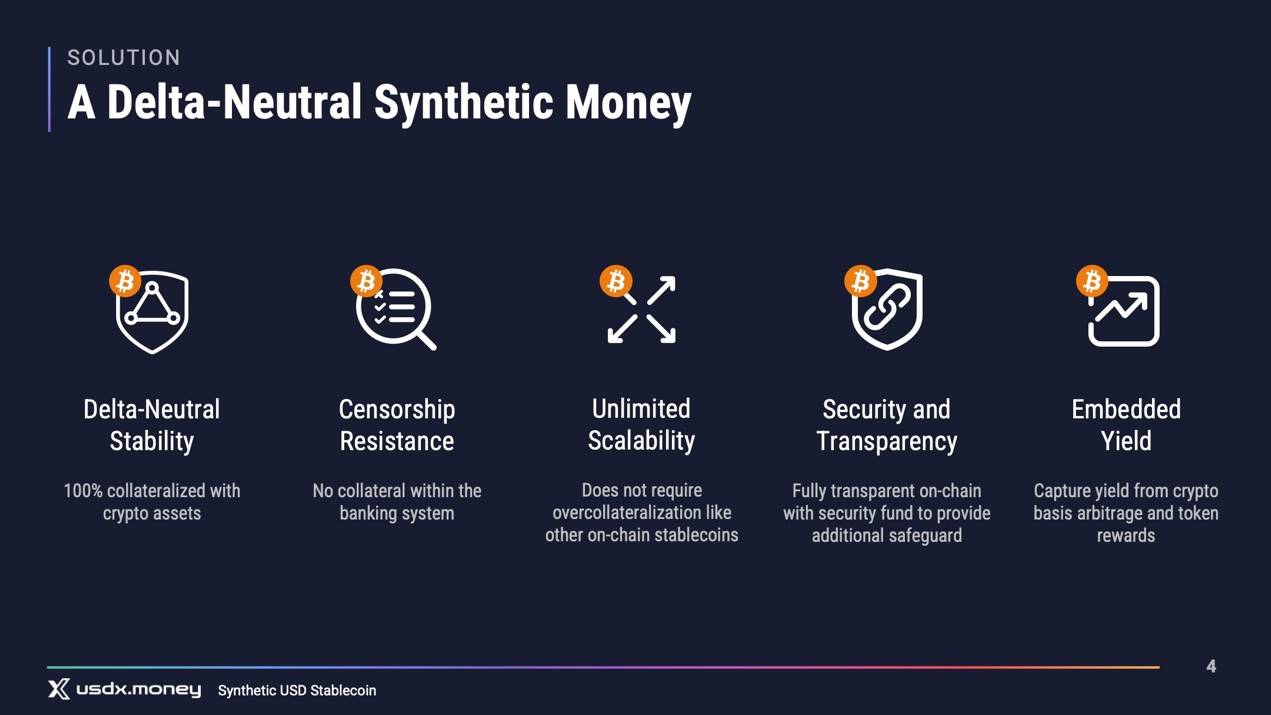

USDX is an emerging synthetic USD-pegged stablecoin protocol employing a multi-chain, multi-asset strategy, enabling higher aggregate yields compared to adjacent products. Rather than following common yield paths like re-staking or LSDs, USDX carves out a niche where users earn yield simply by holding stablecoins. Its risk profile differs from existing market offerings, allowing it to sidestep increasingly crowded yield strategies tied to dominant cryptocurrencies.

USDX provides a crypto-native stablecoin solution independent of traditional banking infrastructure, featuring censorship resistance, scalability, and high stability. Compared to current stablecoin projects anchored solely to BTC or other single mainstream assets, USDX aligns more closely with next-generation crypto savings concepts—offering a global, multi-asset-backed savings instrument.

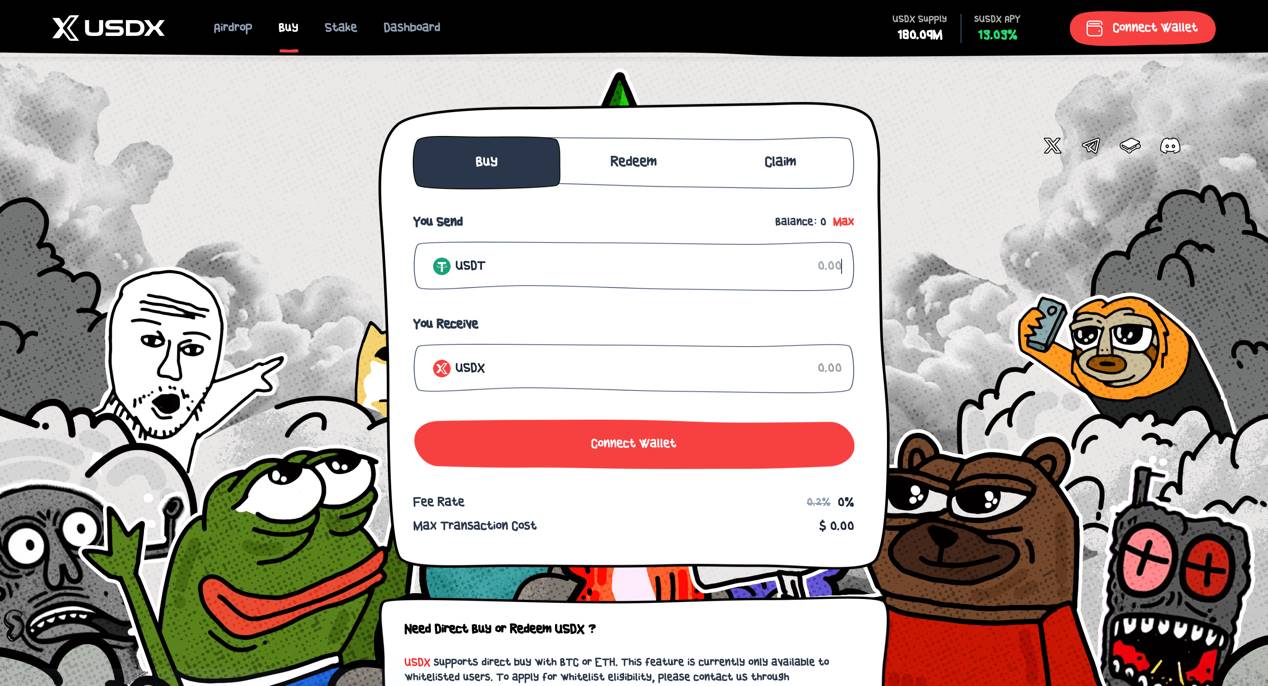

Currently, USDX offers full minting and redemption mechanisms, supports interactions with multiple stablecoins, and plans to integrate additional mainstream crypto assets in the future through over-collateralized minting models.

USDX maintains its dollar peg through delta-hedging derivative positions, neutralizing value fluctuations in the underlying collateral assets to ensure stability, while simultaneously generating denominated returns for USDX holders and ecosystem participants.

USDX Stability Mechanism

USDX employs an automated delta-neutral hedging strategy on target assets to maintain value stability under all market conditions, effectively mitigating risks arising from price volatility and ensuring consistent value for USDX.

"Delta" refers to the sensitivity (or rate of change) of a derivative’s value relative to movements in its underlying asset price—it is a crucial parameter for maintaining USDX’s value stability. Delta-neutral hedging balances potential price movement risks by establishing offsetting investment positions, thereby minimizing the impact of market volatility on portfolio value.

In the context of USDX, this means that if the price of the collateral asset fluctuates, the system automatically adjusts its hedge position to preserve USDX’s stable value.

This approach ensures USDX maintains relative stability regardless of market conditions, offering crypto users an effective risk-mitigation investment tool while unlocking the vast latent liquidity embedded in BTC and other crypto assets.

Delta-Neutral and Market Making Strategy

In USDX, "Delta" represents the sensitivity of derivative value to changes in the underlying asset price. When Delta equals zero, the portfolio is considered “delta-neutral,” meaning it is insensitive to price movements in the base asset—this is the foundational condition for USDX’s value stability.

Taking BTC as an example, USDX acquires a positive delta due to its underlying BTC holdings. To counterbalance this, the protocol shorts BTC perpetual contracts, bringing the overall delta back to neutral.

In other words, the delta-neutral strategy ensures the USD value of the protocol’s asset portfolio remains unaffected by market price swings, keeping USDX’s value stable—only briefly deviating when temporary discrepancies arise between spot and derivatives markets. Any gains from rising crypto prices are offset by losses in corresponding short perpetual positions, preserving USDX’s stability.

usdx.money conducts market-making activities across exchanges without using leverage, carefully matching the size of short perpetual positions to the underlying assets to maintain delta neutrality.

Maintaining delta neutrality is fundamentally the core market-making strategy used by usdx.money. This mechanism enables the protocol to generate sustainable returns over time.

Notably, maintaining delta-neutral positions is a well-established risk mitigation tactic widely used by institutional market makers—commonly practiced and highly mature in both traditional finance and crypto markets.

Learn more official details: usdx.money Docs

Protocol Arbitrage Mechanism

Since USDX requires minting via crypto assets, short-term market fluctuations create arbitrage opportunities for users.

Whenever USDX’s market price deviates from its $1 peg, users can exploit the minting and redemption functions to perform buy-low/sell-high arbitrage trades.

Certified or whitelisted users may mint or redeem USDX, profiting during periods of short-term price divergence. For instance, if USDX trades below $1 (e.g., $0.995) on external markets, a user can purchase 1 USDX for $0.995 and redeem it via the protocol for $1, earning a 0.5% profit.

Conversely, if USDX trades above $1 externally, users can deposit USDT into the protocol to mint USDX and sell the newly minted tokens at a premium, capturing arbitrage profits.

The persistent gap between USDX’s internal minting/redemption rates and its external trading price provides ongoing arbitrage opportunities.

Reward Token sUSDX

USDX holders can stake USDX to receive sUSDX and earn yield—an early native application of the USDX protocol built on the ERC4626 Token Vault standard, offering strong extensibility.

Staking rewards accumulate from funding rate and basis returns generated by the protocol’s delta-hedged derivative positions, along with incremental staking yields. As these funding and basis returns fluctuate over time, staking rewards are variable.

When no protocol earnings are transferred to the staking contract, the usdx.money insurance fund safeguards the underlying collateral, ensuring the security of users’ principal USDX assets.

Upon unstaking, users receive their original USDX principal plus a proportional share of accrued protocol earnings during their deposit period.

Essentially, sUSDX does not function as a governance token; rather, it serves as a utility token securing users’ entitlement to revenue sharing within the protocol.

Feature Summary

Overall, the USDX protocol exhibits the following characteristics:

1. Permissionless access via purchasing USDX with other stablecoins on AMM platforms.

2. Stable staking yield—the USDX tokens users stake are not reused elsewhere. The protocol employs a token vault model similar to Binance’s handling of WBETH.

3. On-demand minting and redemption—users can mint USDX by depositing approved crypto assets and redeem them anytime.

4. Clear arbitrage mechanics—with integrations across multiple AMMs, users can capitalize on price deviations using minting and redemption.

5. Delta-neutral market making—ensures sustainable protocol earnings and stable USDX valuation, supporting long-term health.

6. Secure and extensible staking contracts—built on the ERC4626 Token Vault standard for easy deployment of future use cases and robust collateral protection.

Additionally, USDX implements various measures to ensure the integrity and scalability of its deployed contracts, focusing on safeguarding user assets, achieving balanced governance, and maintaining overall protocol health.

Future Roadmap

Currently, USDX has been deployed on Ethereum, Arbitrum, and BNB Chain. It plans to expand into multiple external markets, including centralized and decentralized spot exchanges such as USDX/USDC pairs, and major AMMs like Uniswap and Curve.

Going forward, the protocol aims to integrate more use cases and cross-network ecosystems. Ultimately, the multi-asset-backed synthetic USD stablecoin USDX aspires to become one of the leading universal stablecoin protocols in the crypto market.

The protocol has launched a points-based referral system to source whitelist participants. Currently in its early stages, only whitelisted users can directly mint or purchase USDX—non-whitelisted users should stay tuned for updates.

Conclusion

Surveying the development of various sectors in today’s crypto landscape, the role of stablecoins as critical infrastructure will undoubtedly grow stronger. Demand for multi-asset synthetic stablecoins will become a vital component of foundational ecosystem development—precisely the niche USDX targets.

However, unlike solutions based on single dominant crypto assets, USDX’s multi-asset approach is pioneering. Combined with its distinctly meme-inspired visual identity, it may bring fresh dynamics to the market.

Compared to other over-collateralized or LSD-based stablecoin protocols, USDX places greater emphasis on user asset safety—both in risk contingency planning and yield model design—adopting a relatively conservative stance driven by its delta-neutral market-making strategy. Undoubtedly, this makes the protocol more user-friendly and secure.

If USDX and sUSDX gain broader adoption across diverse use cases and venture investment scenarios, this prudent stablecoin solution stands poised for significant growth.

After all, the anticipated rise of BTCFi presents a clearly defined demand outlook for stablecoins like USDX.

Visit for more information:

Website: https://usdx.money

Twitter: https://twitter.com/usdx_money

Telegram: https://t.me/USDX_Community

Discord: https://discord.gg/usdxmoney

Docs: https://docs.usdx.money

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News