Crypto Investment Research Methodology: Disassemble the Grand Narrative, Then Reassemble It

TechFlow Selected TechFlow Selected

Crypto Investment Research Methodology: Disassemble the Grand Narrative, Then Reassemble It

When you're confident in your analysis, it's time to rebuild the system from scratch using an integrated approach.

Author: Pavel Paramonov

Compiled by: TechFlow

How to Research and Understand Everything in Crypto?

Essentially, we need two key steps:

-

Analysis

-

Synthesis

Imagine you're playing with LEGO blocks—you usually assemble them into a whole. What we’re doing is the opposite process.

1.When you want to understand a topic, one of the best methods is breaking things down into smaller parts to understand how each part functions

From a scientific perspective, analysis is the detailed examination of the elements of the subject under study.

For example, suppose you want to learn how restaking works, particularly related to @eigenlayer. By spending 10 minutes on Google finding a description of EigenLayer, you can list the main components of restaking:

-

Actively Validated Services (AVS)

-

Operators

-

Restakers

-

Assets

Of course, you may find other components, but these are the primary ones.

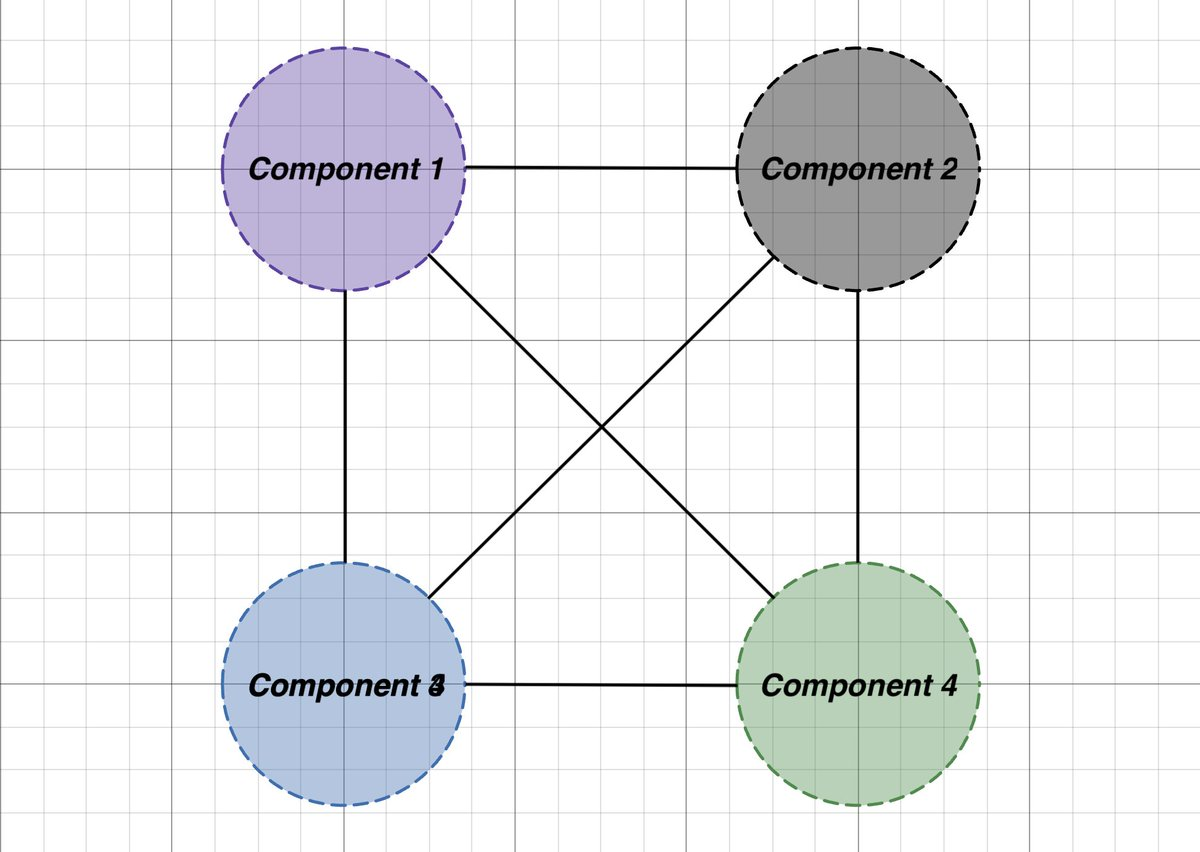

After dividing the structure into its main parts, it's important to identify the relationships between each component:

-

AVS is a system that requires its own distributed validation semantics to be verified.

-

Operators are entities that help run AVS software.

-

Restakers delegate their assets to operators.

-

Assets include native ETH or LST ETH.

With these four points, we can understand how each major component connects, giving us a general understanding of restaking.

2. Maintain skepticism—treat everything as unreasonable unless proven otherwise

It’s crucial to fully understand your research topic by asking yourself questions.

-

If every service could set up locally, why do we need AVS?

-

If restakers can choose which services to secure, why do we need operators?

-

What happens if a bad actor tries to cheat?

-

Why can restakers also deposit LST ETH? Isn’t there already too many wrappers?

-

Exactly how do assets protect the network?

-

Why can't I deposit stablecoins instead of only ETH?

The idea is to ask yourself as many questions as possible to clearly define each component’s function and limitations. This is also why new startups emerge—to solve problems in existing solutions.

This also explains why there are direct competitors rather than protocols built solely on top of @eigenlayer:

-

@symbioticfi supports any mix of tokens as collateral for restaking (not just ETH).

-

@nektarnetwork offers more modularity for operators and AVS.

-

@ExocoreNetwork enables restaking using multiple tokens across multiple chains.

By asking more specific questions related to the product’s core components, you can not only gain a deeper understanding of the product but also identify vulnerabilities and potential solutions to unresolved issues.

3. When you feel confident about your analysis, it’s time to rebuild the system from scratch using synthesis

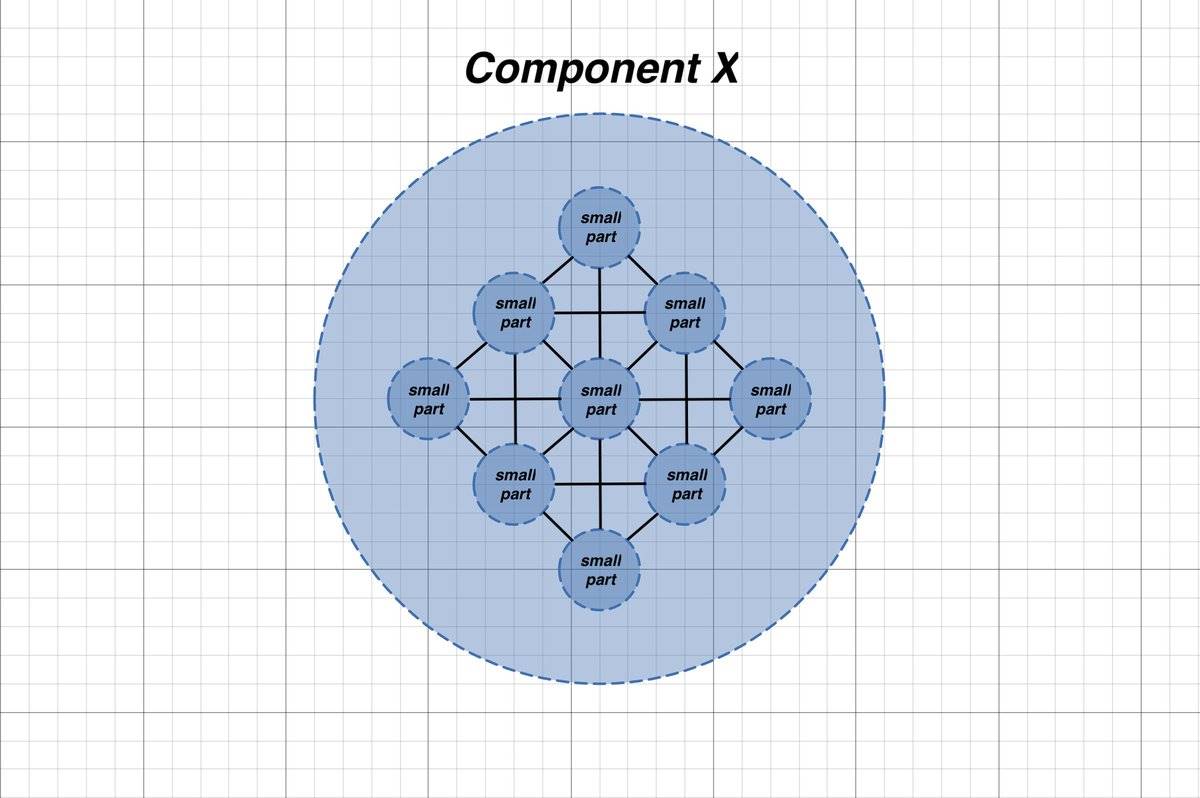

You’ve asked yourself many questions and likely broken down the main components into even smaller pieces.

For instance, when studying how operators connect with AVS, you might discover:

-

Slashing conditions

-

Cryptoeconomic security

-

EigenPod

-

Quorum

Now you have a conceptual understanding of how everything works. The next step is to reconstruct it from the ground up.

Scientifically speaking, "synthesis" refers to combining elements into a coherent whole—integrating all the knowledge you've acquired to reconstruct what you originally deconstructed.

As a child, I often disassembled computer parts to understand their characteristics and why they mattered.

This cultivated a valuable learning skill: If you want to understand something, take it apart—and then put it back together again.

Join the official TechFlow community

Telegram subscription group:

Official Twitter account:

English Twitter account:

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News