Solana Memecoin Market Analysis: Common Types of Memecoin

TechFlow Selected TechFlow Selected

Solana Memecoin Market Analysis: Common Types of Memecoin

Memecoin trading on the Solana blockchain is heating up, but with low cost and high risk—investors should proceed with caution.

Author: dt

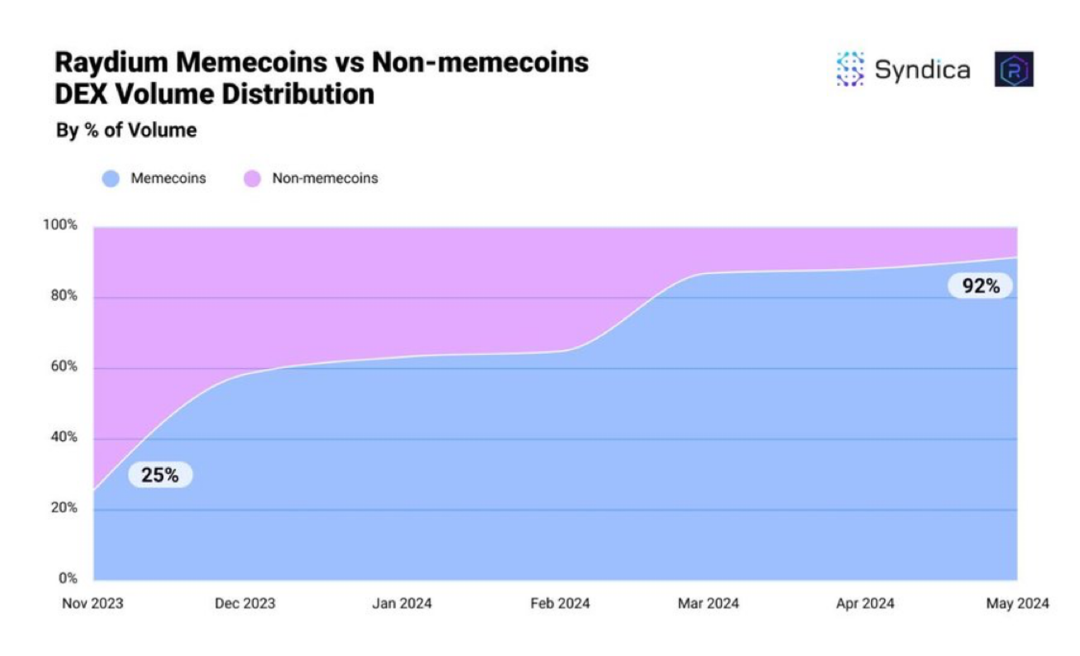

The cryptocurrency market remained sluggish this week, with most tokens continuing to decline. Even newly launched tokens from major projects like ZK Sync and LayerZero couldn't escape the downward spiral. The biggest opportunities and market focus remain on Memecoins, particularly those on Solana, which have gone into overdrive. Low transaction costs combined with Pump.fun's emergence have drastically lowered the barrier to token creation, turning Solana into the most active casino on-chain. According to data from node service provider Syndica, as high as 92% of trading volume on Raydium—the top DEX on Solana—is now driven by Memecoins.

This week’s Cryptosnap Dr.DODO explores several well-known Memecoins from the current bull run to help you understand different types of Memecoins.

Source: https://blog.syndica.io/deep-dive-solana-defi-may-2024/

Whale Coins

BOME / SLERF / MEW / MANEKI …

I categorize various large-liquidity-pool coins as Whale Coins. Their characteristics include large liquidity pools and extremely fast price surges—these are the assets with the highest potential for overnight wealth. They allow large position sizes and offer high multiples. However, they often reach high market caps quickly, making entry difficult. When participating in such projects, consider the following points:

-

Project Background: For example, BOME’s founder Darkfarms is a well-known artist in the crypto space, lowering the likelihood of a rug pull.

-

Liquidity Pool Locked or Burned: Large pools may not only be whale-driven but could also be one-time pump-and-dump scams designed to completely drain liquidity. In the case of SLERF, the team burned tens of millions in liquidity, which was precisely why there was such intense FOMO early on.

-

Trading Volume: Volume reflects market sentiment toward the project through concrete data, helping gauge its popularity.

-

Market Sentiment: This refers to broader market trends and macro conditions, useful for estimating a project’s potential peak.

In my view, Whale Coins tend to surge rapidly but usually only experience one major wave. Afterward, their behavior diverges from the typical small-capital, high-multiplier Memecoin investment logic. Due to their large pool size, small investments yield poor returns, so I don’t recommend re-entering after the initial move.

News-Driven Coins

GME / BODEN / TREMP / DJT / NCAT …

News-driven Memecoins often emerge around trending figures such as Elon Musk, Donald Trump, or Roaring Kitty—high-profile individuals whose every word sparks speculation. Corresponding Memecoins frequently appear on-chain. However, these coins are highly sensitive to news developments, causing sharp price swings. Therefore, tracking real-time news and reacting accordingly is key to successfully trading them. For instance, DJT (Trump coin) became the hottest topic on-chain this week due to rumors that Barron Trump was involved, attracting significant speculative interest thanks to its large liquidity pool. However, it sharply declined after prominent CTs like Zach XBT and GCR exposed insider information. Similarly, $GME surged wildly following Roaring Kitty’s comeback post but quickly crashed when his livestream failed to deliver meaningful content.

Community Coins

POPCAT / MICHI / SC

In my opinion, cat-and-dog-themed community tokens represent the highest-risk, highest-reward category of Memecoins. The reward potential is high because these tokens often have long accumulation phases allowing investors to acquire low-cost positions. However, due to relatively low uniqueness, many fail to gain traction. A visually appealing token image is important, but even more critical is the strength of the community. The key to evaluating such projects is joining their communities to assess whether there are enough enthusiastic members actively promoting the project. Additionally, monitor social media buzz—declining or stagnant chatter can signal weakening momentum and inform exit decisions.

Furthermore, I believe community-based Memecoins gradually build retail consensus and slowly push prices upward during favorable market conditions. But when sentiment turns negative, they tend to fall the fastest due to widespread, fragmented holdings.

Celebrity Coins

MOTHER / RNT / PAJAMES

Celebrity coins have become a recent trend on the SOL chain. Most celebrities aren’t interested in long-term token management, making many of these coins short-lived "one-pump" affairs. However, if a celebrity with massive external influence chooses to actively engage, the token holds significant potential. So far, $MOTHER stands out as the most successful example. Rapper Iggy Azalea leveraged her millions of fans to promote her token and consistently interacted with both crypto influencers (CTs) and community members, enabling sustained热度. In my view, participation in celebrity coins shouldn’t be rushed. Instead, observe for several days to determine whether the celebrity shows genuine intent to sustain involvement before joining—with higher odds of success.

Others

WEN / BONK / WIF …

Beyond the above categories, numerous other types of trending Memecoins exist. For example, $WEN launched by the Jupiter team, or $Bonk—rumored to be backed by the Solana Foundation to revitalize the ecosystem—achieved high valuations thanks to support from established teams. $Bonk started at a low point during Solana’s early recovery phase, resulting in high multiplication potential. In contrast, $WEN emerged during Solana’s peak FOMO period and had already priced in full expectations before launch, limiting its upside. Meanwhile, $WIF—the largest-cap Solana Memecoin and a bellwether for the entire sector—is the hardest to classify. It began as a community coin but later gained institutional backing, propelling it to become the strongest performer among Memecoins in this bull cycle.

Author’s View

Given that the Solana Memecoin market is currently undergoing a collapse phase, I do not recommend entering any trades at this moment. Instead, this is an ideal time to evaluate projects—especially community and celebrity coins. Dive deep into communities to see whether consensus remains strong despite falling prices, and assess whether leading celebrities continue to actively support their tokens.

I believe Memecoins are unsuitable for left-side trading strategies such as bottom-fishing or early accumulation. Memecoins lack fundamental value to support floor prices. Instead, they thrive on attention economics—price increases attract more attention, creating a self-reinforcing cycle. A better approach is to identify fundamentally sound candidates, add them to a watchlist, and wait for the next wave of momentum before entering.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News