Token Unlocks and Market Cap Traps: How to Avoid Getting Rekt?

TechFlow Selected TechFlow Selected

Token Unlocks and Market Cap Traps: How to Avoid Getting Rekt?

Before purchasing any token, please review the unlock schedule and token economics.

Author: Hanzo

Translation: TechFlow

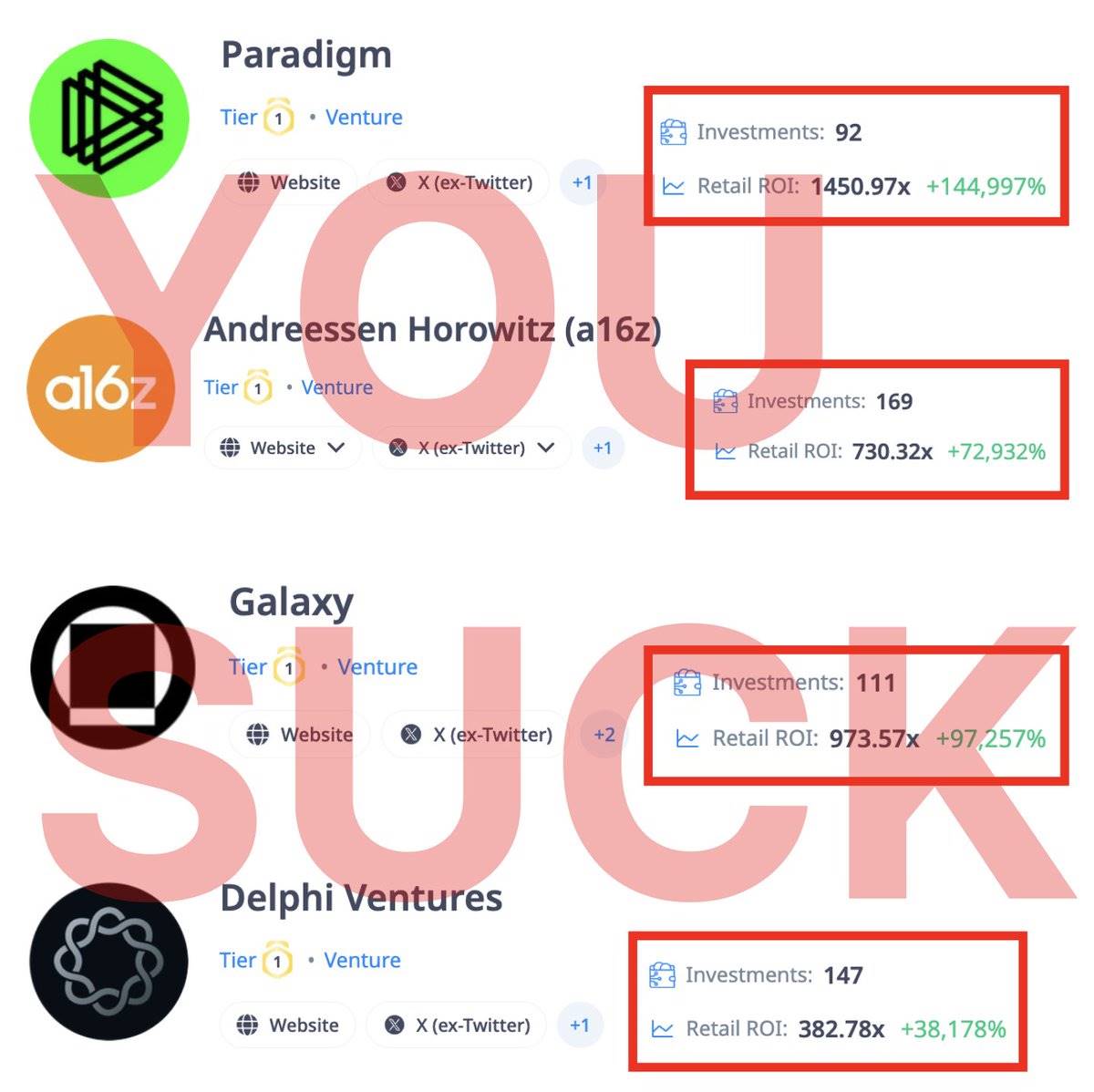

You've been scammed by VCs. Every dump you bought into was a venture capitalist cashing out for massive profits.

If I hadn't seen through their tricks, I would have lost nearly $300,000 in June!

Everyone evaluates tokens solely by price, forgetting about market cap and token unlocks.

This is a mistake.

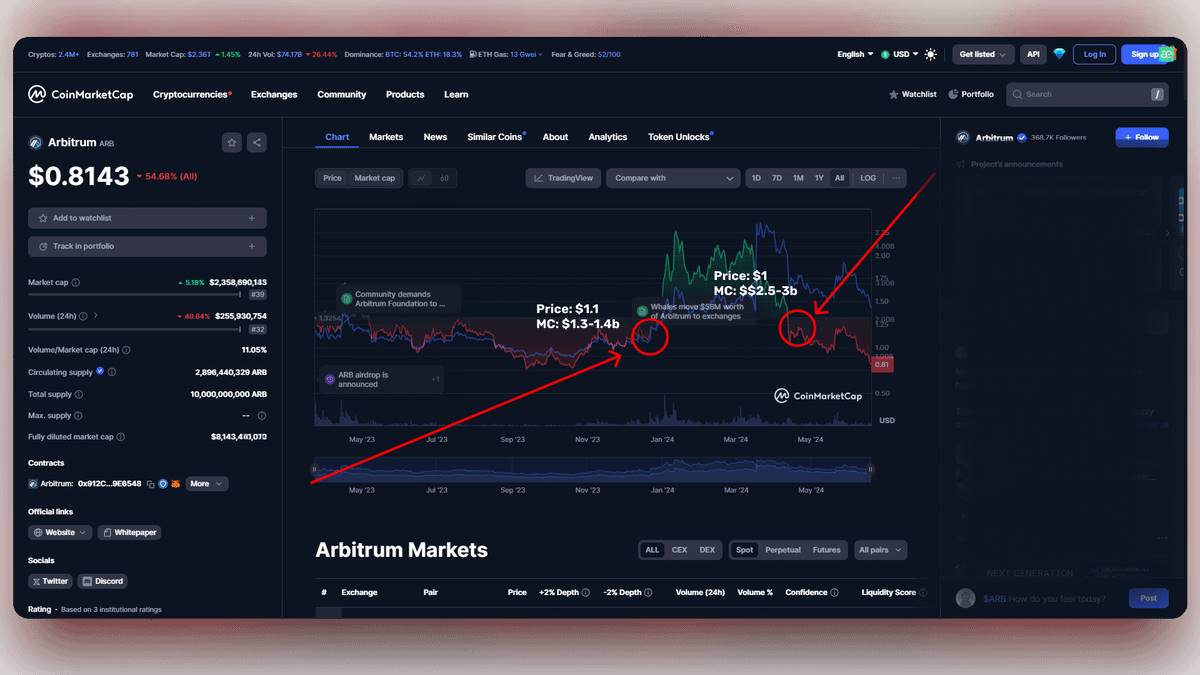

There are many examples: Arbitrum, Starknet, Zksync, etc.

In mid-December, $ARB was trading around $1.10, with a market cap of $1.3–1.4 billion. Then the price rose above $2, increasing the market cap accordingly. By April to May, the price had dropped back to $1, but Arbitrum's market cap remained at $2.5–3 billion—same as in December!

How did this happen?

As VCs unlocked their tokens, the price rose from $1 to $2.

Venture capitalists started selling, driving the price down—but people thought every dip was a great buying opportunity.

This pushed prices up again, more tokens unlocked, VCs sold, retail bought. That’s how it works.

Supporting a community is a complex task. This is why projects distribute airdrops themselves, manipulate prices, and play games with unlock schedules. Starknet is a perfect example—its price has gradually declined alongside its unlock schedule.

What can we learn from this?

-

Before buying any token, check the unlock schedule and tokenomics.

-

Examine the market cap (MCap) and its historical trends.

-

Analyze and logically assess whether buying a specific token is truly worthwhile.

In today's market, making consistent and substantial profits on regular altcoins is highly risky and difficult. Currently, memecoins are performing far better than standard tokens.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News