Why has the price of Bitcoin not increased despite continuous inflows into Bitcoin ETFs?

TechFlow Selected TechFlow Selected

Why has the price of Bitcoin not increased despite continuous inflows into Bitcoin ETFs?

A possible answer? Cash and arbitrage trading.

Author: flow

Translation: TechFlow

Over the past three weeks, BTC ETFs have seen over $2.5 billion in net inflows. Yet during this period, the price dropped from $71,400 (May 20) to $67,400 (June 12). Why hasn’t the price risen despite $2.5 billion in new money flowing into ETFs?

On the surface, we’d expect this rebound in net inflows to be bullish for price. Surprisingly, that hasn’t been the case.

One possible explanation? Cash-and-carry arbitrage.

Let me explain.

ETF Flows

After a prolonged consolidation, fund inflows have recently resumed a strong upward trend—but without the accompanying price surge. Chart credit: @FarsideUK

Who Holds the ETFs?

When we examine the top 80 holders across various BTC ETFs, we find that most of these players are not simply "buy-and-hold" investors. Instead, we see many hedge funds on this list—entities with sophisticated and often complex trading strategies. Chart credit: @dunleavy89

CME Futures Market

Turning to the futures market, we observe that open interest in CME Bitcoin futures has simultaneously reached a record high near $11.5 billion.

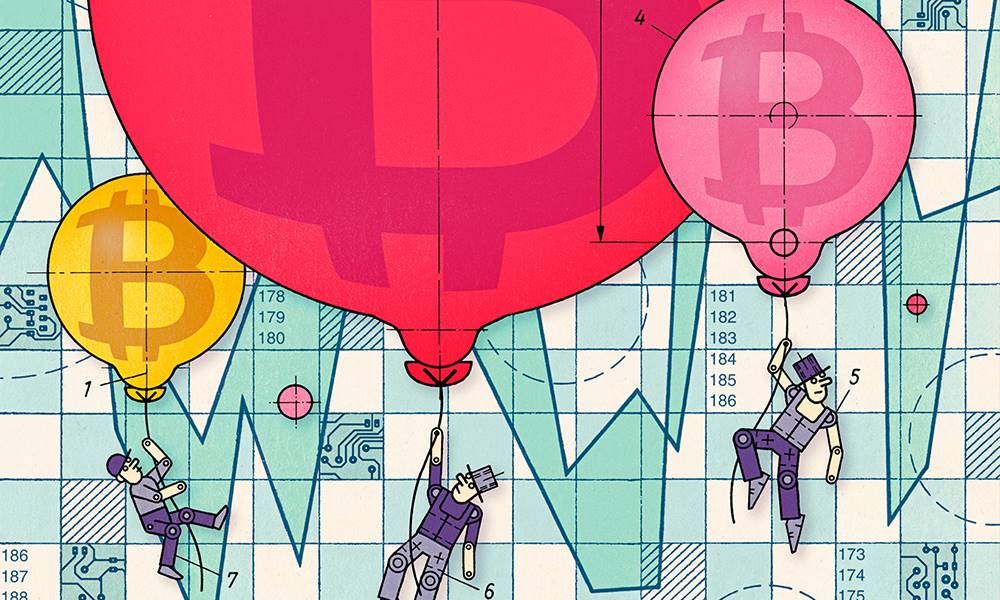

Digging deeper, we can analyze net positions in CME futures by trader category.

Here, we notice hedge funds have built increasingly large net short positions in Bitcoin futures—reaching $6.3 billion in net shorts just on CME Bitcoin futures.

What does this mean?

One interpretation is that an increasing number of sophisticated traders are engaging in cash-and-carry trades in BTC. This is an arbitrage strategy where traders exploit price differences between two similar securities.

In this case, it involves going long BTC via spot ETFs while simultaneously shorting an equal amount in futures contracts, capturing the basis spread between the two—creating a net-neutral position.

Thus, price risk is zero, profit potential is significant—and theoretically, the impact on price is neutral.

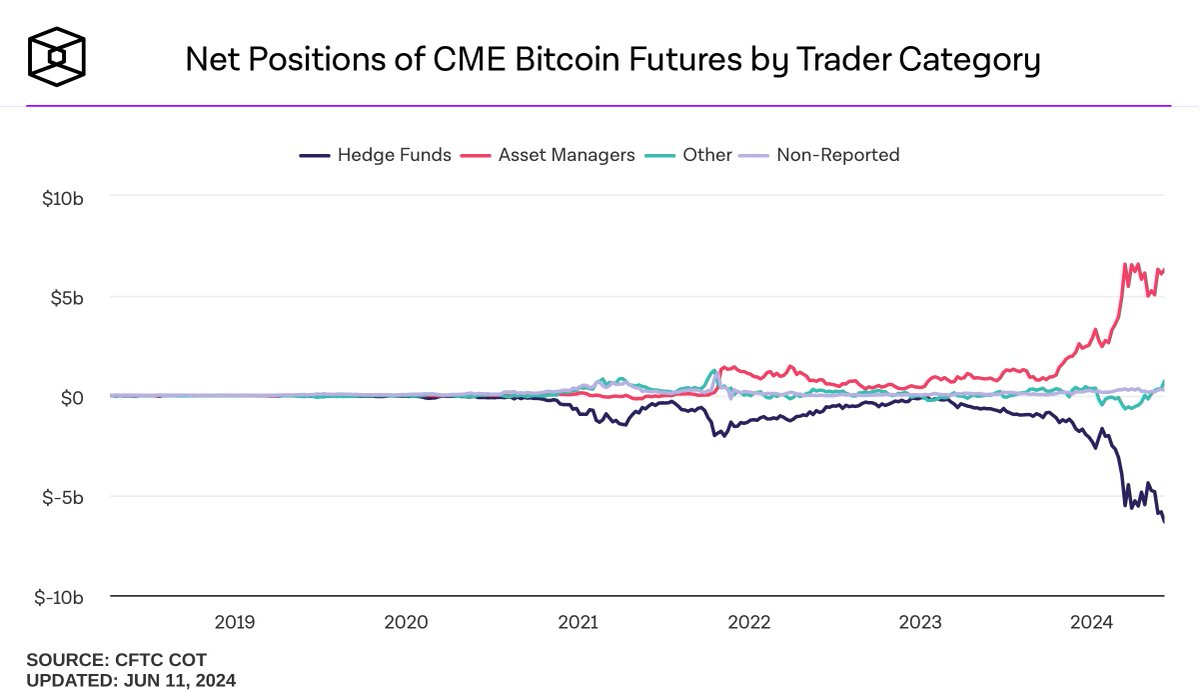

Now, the returns from this strategy are highly attractive, especially given the strong positive contango we’re seeing in the market (where futures prices are above spot prices). Chart credit: @JSeyff

Of course, we can’t be certain what’s driving the recent drawdown, but I believe cash-and-carry arbitrage offers a compelling explanation for the current dynamics. If true, it means much of the substantial new money flowing into spot ETFs is being used by arbitrageurs to build net-neutral positions—exerting no real upward pressure on price.

Unfortunately, this suggests there isn’t a large wave of new marginal buying entering the market, which could help explain the recent price action. That said, this is just one intriguing idea among many—and views do evolve as more data emerges.

What about you? How do you interpret this situation?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News